US Telehealth Market Scope By Service Type (Teleconsultation, Remote Patient Monitoring (RPM), Store-and-Forward, Mobile Health Applications, Tele-ICU, and Others), By Deployment Mode (Cloud-Based, and On-Premises), By Application (Telepsychiatry, Teleradiology, Teledermatology, Teleneurology, Teledermatology, and Others) and By End User (Healthcare Providers, Patients, Payers, and Others), and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147994

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

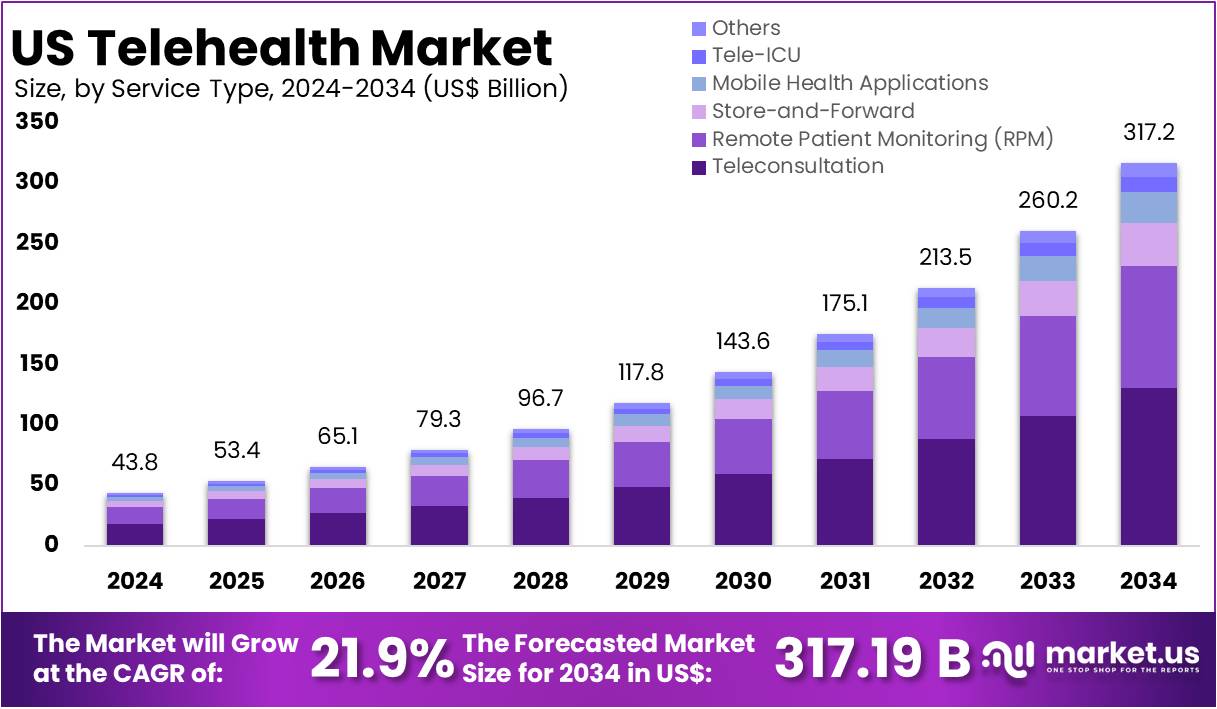

The US Telehealth Market Size is projected to reach USD 43.8 billion by 2024. The market is anticipated to grow at a CAGR of 21.9% between 2024 and 2034, reaching USD 317.2 billion by 2034.

Telehealth services include virtual consultations, remote monitoring, and digital health solutions that bridge the gap between healthcare providers and patients, especially in rural or underserved areas. The technology has revolutionized access to care by offering convenience, reducing in-person visits, and expanding reach for mental health, chronic disease management, and urgent care. According to the U.S. Department of Health and Human Services (HHS), telehealth visits surged by 63-fold during the COVID-19 pandemic, indicating a major shift in care delivery models.

Key market drivers include rising demand for remote patient monitoring, mental health support, and primary care services delivered through digital platforms. The aging U.S. population and increasing prevalence of chronic conditions such as diabetes and heart disease have boosted telehealth adoption.

Additionally, Medicare and Medicaid reimbursement reforms, along with the CARES Act’s provisions for telemedicine expansion, have significantly fueled the industry’s growth. However, the digital divide, licensure restrictions across states, and privacy/security concerns pose major challenges. Despite this, opportunities lie in integrating AI diagnostics, wearable medical devices, and expanding virtual behavioural health programs.

The U.S. dominates the global telehealth market due to advanced healthcare infrastructure, widespread broadband access, and supportive policy frameworks. States such as California, New York, and Texas are leading in telehealth adoption, supported by statewide parity laws and incentives. Federal funding for broadband expansion and interoperability standards for Electronic Health Records (EHRs) further bolster the market. In 2023, the FCC announced US$ 200 million in new investments for expanding telehealth infrastructure in rural areas under the COVID-19 Telehealth Program Phase II.

Key Takeaways

- The U.S. Telehealth market is expected to reach USD 43.78 billion by 2024 and grow significantly to USD 317.19 billion by 2034.

- A robust CAGR of 21.9% is projected between 2024 and 2034, indicating strong and sustained market expansion.

- Teleconsultation holds the largest share of 41.2%, driven by rising demand for remote consultations in both general and specialist healthcare.

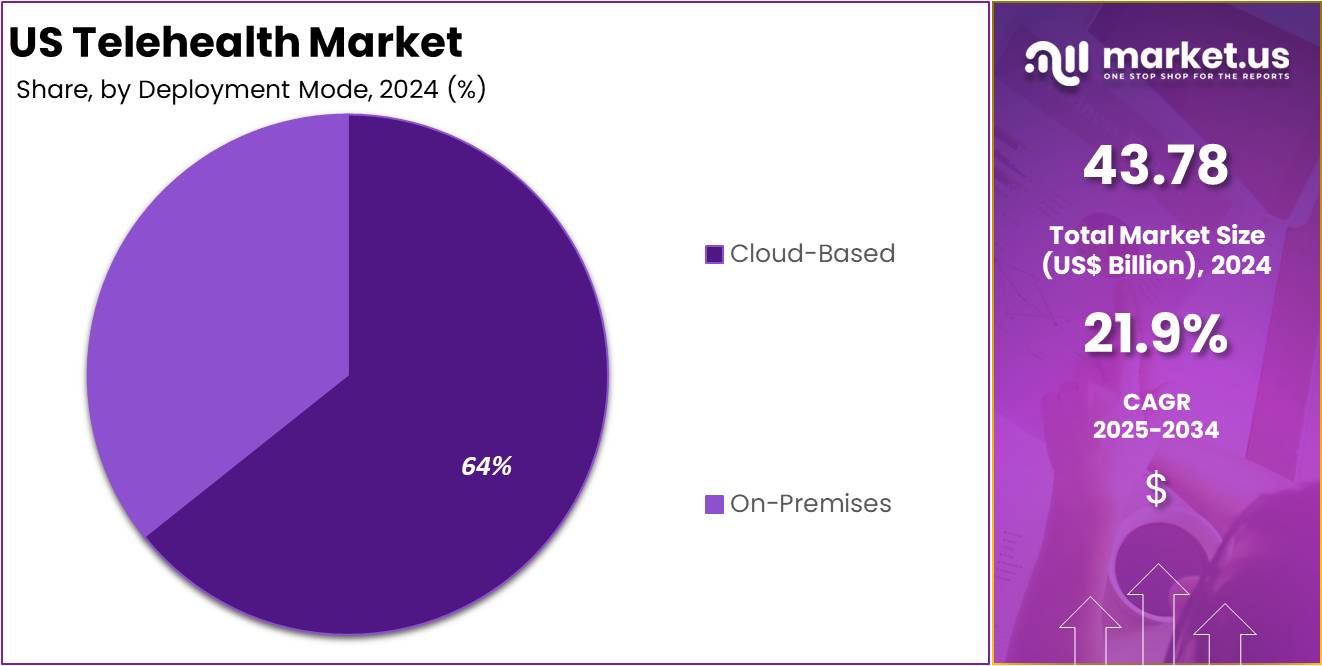

- Cloud-based deployment dominates with 64.3% market share due to its scalability, easy access, and secure data storage capabilities.

- Telepsychiatry leads the distribution segment with a 29.6% share, driven by increased demand for mental health support and service access.

- Healthcare providers account for the largest share at 45.6%, as they widely adopt telehealth to expand care delivery and lower costs.

Service Type Analysis

Teleconsultation is the dominant service type in the U.S. Telehealth Market covering 41.2% market share. It enables real-time, remote consultations between patients and healthcare providers via video calls, phone calls, or text-based communication. This service has gained significant traction due to its convenience and the ability to connect patients with doctors, particularly in rural or underserved areas. The growing trend of virtual care, driven by the COVID-19 pandemic, continues to fuel the adoption of teleconsultations.

Teleconsultations cater to a wide range of medical needs, including general healthcare, follow-up visits, mental health consultations, and urgent care, making it the most versatile and commonly used service in telehealth. In April 2025, ScienceSoft released research predicting that by the end of 2026, 30% of all U.S. medical visits will be conducted via telemedicine, with mental health leading adoption. The American Hospital Association is actively lobbying for permanent regulatory support for telehealth.

Deployment Mode Analysis

Cloud-based deployment leads the deployment mode segment in the U.S. Telehealth Market covering 64.3% market share. Cloud-based solutions offer the advantages of scalability, flexibility, and secure data storage, which are essential for delivering telehealth services across diverse healthcare settings. These solutions provide healthcare providers with the ability to access patient data in real-time from multiple locations, improving workflow efficiency and ensuring continuity of care.

The ease of integration with other healthcare systems and the reduced need for on-site infrastructure make cloud-based platforms particularly attractive for healthcare organizations of all sizes. As the adoption of telehealth grows, healthcare providers increasingly prefer cloud-based solutions for their cost-effectiveness and capacity for handling large volumes of patient data.

In April 2025, eClinicalWorks, a prominent provider of cloud-based electronic health records (EHR) for ambulatory care, introduced its AI-powered contact center solution, healow® Genie, at Maryland Endocrine practices. This strategic deployment is expected to enhance patient engagement by offering round-the-clock access to critical health information through multiple digital channels, including text messaging, voice calls, and chatbot interactions. The integration marks a significant advancement in patient communication and accessibility within specialty care settings.

Application Analysis

Telepsychiatry is the leading application in the U.S. Telehealth Market with 29.6% market share. This segment has gained dominance due to the increasing demand for mental health services, particularly following the COVID-19 pandemic. The shortage of mental health professionals and the growing recognition of the importance of mental health have contributed to the rise in telepsychiatry usage.

Virtual mental health consultations offer patients the convenience of accessing therapy, counseling, and psychiatric services from their homes. The widespread acceptance of telepsychiatry by both providers and patients, combined with increasing insurance coverage for telehealth services, is expected to drive continued growth in this application area. Additionally, telepsychiatry helps reduce barriers to care, such as geographic limitations, long wait times, and stigma associated with in-person visits.

In September 2024, Talkiatry, a leader in in-network psychiatric care, entered an exclusive partnership with BetterHelp, the top direct-to-consumer mental health therapy platform. Talkiatry now delivers in-network telepsychiatry services and medication management to BetterHelp’s business clients. Companies like BetterHelp and Talkspace have expanded their telepsychiatry platforms to include CBT, using AI-powered chatbots, self-guided modules, and video sessions to deliver therapy for conditions like PTSD, anxiety, and depression.

End User Analysis

Healthcare providers dominate the end-user segment in the U.S. Telehealth Market with 45.6% market share. Hospitals, clinics, private practices, and specialty care centers are the primary users of telehealth services. Telehealth allows these healthcare providers to expand their reach and deliver care more efficiently, especially in remote and underserved areas. With the growing demand for cost-effective care solutions and improved patient outcomes, healthcare providers are increasingly incorporating telehealth into their service offerings.

This is particularly evident in chronic disease management, remote patient monitoring, and post-surgical follow-up care. Additionally, telehealth solutions enable healthcare providers to increase patient engagement, enhance operational efficiency, and reduce the burden on in-person consultations, thus driving the overall growth of telehealth adoption.

Key Market Segments

By Service Type

- Teleconsultation

- Remote Patient Monitoring (RPM)

- Store-and-Forward

- Mobile Health Applications

- Tele-ICU

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Telepsychiatry

- Teleradiology

- Teledermatology

- Teleneurology

- Teledermatology

- Others

By End User

- Healthcare Providers

- Patients

- Payers

- Others

Drivers

Increasing Demand for Convenient and Accessible Healthcare

The growing demand for convenient, accessible healthcare is one of the key drivers of the U.S. Telehealth Market. Patients are increasingly seeking alternatives to traditional in-person consultations, driven by factors such as busy lifestyles, limited access to healthcare in rural or underserved areas, and the desire to minimize time spent in waiting rooms. Telehealth offers a solution by enabling remote consultations through video calls, phone consultations, and even text-based interactions.

The COVID-19 pandemic has accelerated the adoption of telehealth, as social distancing measures and lockdowns forced patients and healthcare providers to explore remote care options. Furthermore, telehealth enhances patient satisfaction by providing more flexible appointment times and reducing the need for travel, especially for non-emergency consultations or follow-up visits. This convenience, along with the improved efficiency of healthcare delivery, has led to widespread patient and provider acceptance.

As the demand for faster and more accessible healthcare continues to rise, telehealth services are expected to expand, further driving market growth. This trend is also supported by policy changes and the increasing reimbursement coverage for telehealth services, and new investments in the space, encouraging both healthcare providers and patients to embrace these solutions.

In January 2025, it was reported that Hone Health, a prominent telehealth clinic specializing in proactive and preventative longevity care, achieved a key milestone by surpassing 300,000 patient tests and treating over 55,000 individuals. The clinic also secured $33 million in Series A funding, bringing its total raised capital to $39 million. The funding round included backing from Tribe Capital, PIF, Republic Capital, Vibe VC, Humbition, Hanwha, Gaingels, Looking Glass Capital, FJ Labs, and Agent Capital. This financial boost is expected to facilitate Hone Health’s expansion into longevity-focused care services for both men and women, while emphasizing strict adherence to regulatory standards and patient safety protocols.

Restraints

Regulatory and Reimbursement Challenges

Despite the growth of the U.S. Telehealth Market, regulatory and reimbursement challenges remain significant barriers to widespread adoption. Telehealth services are subject to complex and varying regulations across states, particularly concerning licensing, data privacy, and reimbursement policies. For instance, each state has different rules regarding which healthcare providers are eligible to offer telehealth services and how they can be reimbursed.

Moreover, the temporary regulatory flexibilities introduced during the COVID-19 pandemic are still in flux, and there is uncertainty regarding the long-term future of these policies. Reimbursement for telehealth services has also been inconsistent, with many insurance plans offering limited coverage for virtual consultations compared to in-person visits.

While Medicare and Medicaid have expanded coverage for telehealth during the pandemic, private insurers vary in their policies, limiting the financial viability of telehealth services for some providers. These regulatory inconsistencies and reimbursement hurdles can discourage healthcare providers from investing in telehealth infrastructure and slow down market growth. For telehealth to achieve its full potential, these regulatory and reimbursement barriers need to be addressed with clear, uniform policies across all levels of government.

Opportunities

Expansion of Telehealth in Mental Health Care

An exciting opportunity in the U.S. Telehealth Market is the expansion of telehealth services in mental health care. The demand for mental health services has surged in recent years, particularly during and after the COVID-19 pandemic, which exacerbated mental health issues such as anxiety, depression, and stress. However, there is a significant shortage of mental health professionals in many parts of the U.S., especially in rural and underserved regions. Telepsychiatry and tele counseling have emerged as solutions to bridge this gap, providing patients with access to licensed mental health professionals via video calls, phone consultations, or even text-based platforms.

Telehealth has been shown to reduce the stigma associated with seeking mental health care, as patients can receive services from the comfort and privacy of their homes. Additionally, insurance coverage for mental health services is expanding, and telehealth is increasingly reimbursed, encouraging providers to adopt virtual care models. As demand for mental health services continues to grow, telehealth presents a significant opportunity to increase access to care, reduce wait times, and improve overall mental health outcomes. This segment is poised for rapid growth, offering considerable expansion potential for telehealth companies focusing on mental health services.

In March 2025, Medicare has extended many telehealth flexibilities for mental health services, including expanded coverage for audio-only sessions and permanent additions of some mental health evaluations to the telehealth services list. Providers must use updated CPT codes (e.g., 90791, 90834) with appropriate modifiers to ensure reimbursement.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions, such as inflation, unemployment, and healthcare spending, play a vital role in shaping the demand for telehealth services. During economic downturns, patients may seek more cost-effective healthcare solutions, driving the adoption of telehealth as a more affordable alternative to in-person visits. Additionally, as healthcare providers seek to reduce operational costs, telehealth can offer a more efficient and budget-friendly model. However, economic instability may also result in reduced consumer spending, making some patients hesitant to invest in telehealth services or forcing healthcare providers to cut back on their telehealth infrastructure.

Geopolitical tensions, such as international trade disputes or regulatory changes, can impact the U.S. Telehealth Market in various ways. For instance, geopolitical conflicts or sanctions may disrupt the global supply chain of telehealth technologies, delaying equipment or software deployments. On the other hand, international collaborations, such as telehealth agreements with other countries, can open new markets for U.S. telehealth companies, promoting growth and expansion. Furthermore, global healthcare policies and regulations, including data protection laws, can influence how telehealth services are delivered, especially in terms of cross-border patient care.

Latest Trends

Integration of AI and Machine Learning in Telehealth

One of the emerging trends in the U.S. Telehealth Market is the integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance healthcare delivery. AI and ML are being increasingly adopted to improve the efficiency, accuracy, and personalization of telehealth services. AI-driven tools can help healthcare providers analyze patient data, assist with diagnoses, and recommend treatment options, significantly reducing the workload on healthcare professionals and enhancing the quality of care.

For example, AI algorithms can analyze medical images for conditions such as dermatological issues or identify early signs of diseases like cancer. Machine learning models can also assist with remote patient monitoring, enabling healthcare providers to predict potential health issues based on patients’ health data. Moreover, AI-powered chatbots are being used for initial patient consultations, symptom assessments, and follow-up care, allowing for faster response times and better patient engagement. The use of AI and ML in telehealth can improve decision-making processes, reduce medical errors, and provide more tailored healthcare experiences, making this technological integration a major trend shaping the future of the telehealth industry.

As these technologies advance, the capabilities and applications of telehealth services are expected to expand, offering greater convenience and more precise care to patients. In 2025, Teladoc Health expanded its telehealth offerings to include AI-driven mental health and chronic condition management, while Amwell integrated AI chatbots for patient triage and streamlined virtual consultations. Babylon Health continues to use AI for symptom checking and preventive care recommendations.

Key Players Analysis

Leading companies in the market are Teladoc Health, Inc., Amwell, MDLive, Doctor on Demand, Lemonaid Health, HealthTap, American Well (Amwell), Babylon Health, 24/7 MedCare, Cureatr, SOC Telemed, One Medical, InTouch Health, Everlywell, and Others.

Teladoc Health is a pioneer in virtual healthcare, offering a comprehensive range of services including primary care, mental health, dermatology, and chronic condition management. The company operates in over 130 countries and serves approximately 80 million people globally, with 56 million paid members in the U.S. Amwell connects patients with doctors over secure video.

The company collaborates with over 55 health plans and 240 of the nation’s largest health systems, encompassing more than 2,000 hospitals. In 2020, over 40,000 providers were using the Amwell Platform. MDLIVE is a virtual clinic offering 24/7 access to board-certified doctors and mental health professionals via phone or video. The company provides services across various medical and behavioral health needs.

Top Key Players in the US Telehealth Market

- Teladoc Health, Inc.

- Amwell

- MDLive

- Doctor on Demand

- Lemonaid Health

- HealthTap

- American Well (Amwell)

- Babylon Health

- 24/7 MedCare

- Cureatr

- SOC Telemed

- One Medical

- InTouch Health

- Everlywell

- Others

Recent Developments

- In April 2025, Teladoc Health, the global leader in virtual care, announced the acquisition of UpLift, a tech-enabled provider of virtual mental health therapy, psychiatry, and medication management services. This acquisition aligns with Teladoc’s strategy to strengthen its leadership in virtual mental health, particularly by enabling consumers within its BetterHelp segment to access mental health benefits coverage. UpLift serves the health plan market and has partnerships covering more than 100 million lives, along with a network of over 1,500 mental health professionals, key capabilities, and a skilled team.

- In January 2025, Amwell®, a global leader in digital care, has announced the sale of its Amwell Psychiatric Care (APC) business to Avel eCare, a national leader in clinician-to-clinician telehealth services.

Report Scope

Report Features Description Market Value (2024) US$ 43.8 billion Forecast Revenue (2034) US$ 317.2 billion CAGR (2025-2034) 21.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Teleconsultation, Remote Patient Monitoring (RPM), Store-and-Forward, Mobile Health Applications, Tele-ICU, and Others), By Deployment Mode (Cloud-Based, and On-Premises), By Application (Telepsychiatry, Teleradiology, Teledermatology, Teleneurology, Teledermatology, and Others) and By End User (Healthcare Providers, Patients, Payers, and Others) Competitive Landscape Teladoc Health, Inc., Amwell, MDLive, Doctor on Demand, Lemonaid Health, HealthTap, American Well (Amwell), Babylon Health, 24/7 MedCare, Cureatr, SOC Telemed, One Medical, InTouch Health, Everlywell, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teladoc Health, Inc.

- Amwell

- MDLive

- Doctor on Demand

- Lemonaid Health

- HealthTap

- American Well (Amwell)

- Babylon Health

- 24/7 MedCare

- Cureatr

- SOC Telemed

- One Medical

- InTouch Health

- Everlywell

- Others