Global US Respiratory Disposable Devices Market By Product (Nasal Canula and Tubing, Resuscitator, Mouthpiece & Oxygen Masks, Disposable Liners & Canisters, Others) By Patient Group (Neonatal & Pediatric, Adult, Geriatric) By End-User (Hospitals, Nursing Homes & Clinics, Others) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2023

- Report ID: 68632

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

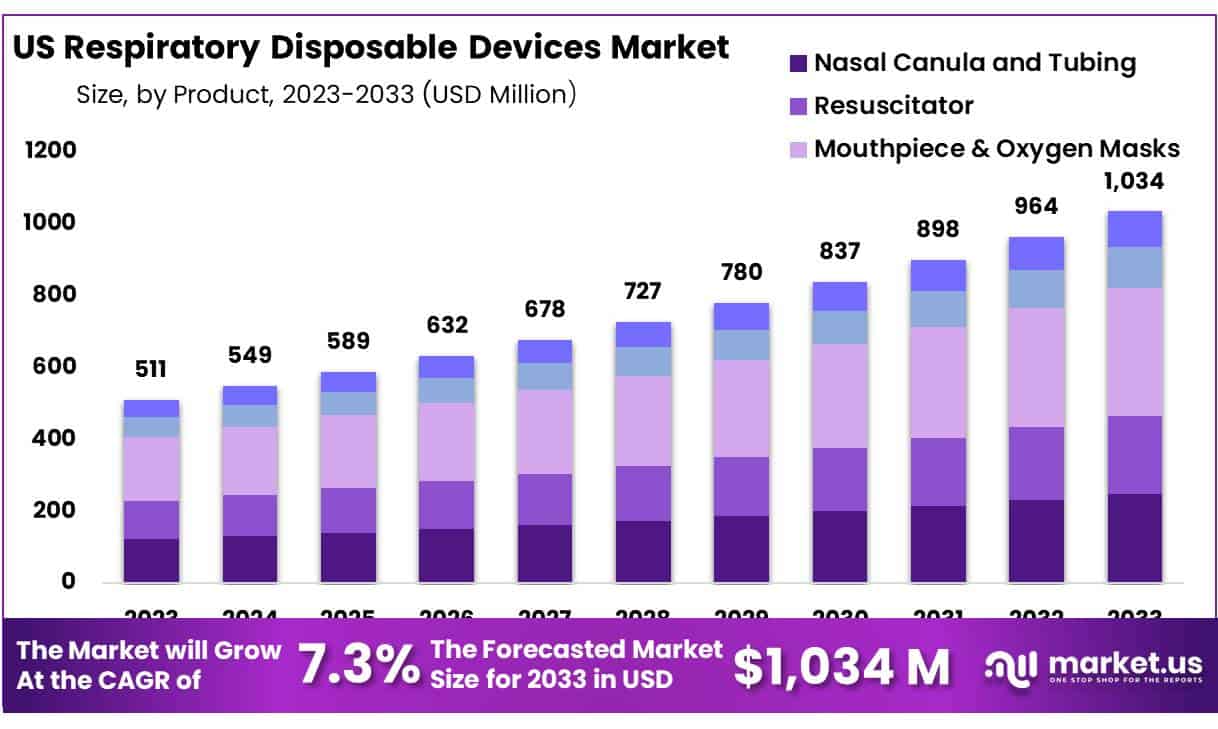

The Global US Respiratory Disposable Devices Market size is expected to be worth around USD 1,034 Million by 2033 from USD 511 Million in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

The human respiratory system is composed of two lungs contained within the thorax, or chest cavity. The primary function of the lungs is gas exchange with the blood. This provides a continuous source of oxygen to body tissues and helps to eliminate carbon dioxide, which is produced as a waste product of cellular metabolism.

Respiratory devices supply respiratory gas mechanically to patients suffering from various respiratory disorders. The respiratory gas contains oxygen and conveyed into the lung. Respiratory smart medical devices generally fall into categories designed to measure volume, flow, pressure, or gas concentration. Most respiratory devices are composed of one or more simpler components. There are different types of respiratory disposable device commercially available, including face masks, tubes, filters, and others.

Some benefits of the respiratory disposable device are simple and easy to use, highly protective, cost-effective, as well as easy to maintain, and helps to the elimination of risk of cross-contamination associated with the usage of reusable respiratory devices. These devices offer enhanced care to patients suffering from various acute and chronic respiratory diseases

In addition, increasing incidences of accidents, rising prevalence of chronic diseases, and other ailments is a major factor expected to boost the market for the target market. According to WHO’s Global Status Report: In 2022, the annual road traffic deaths had reached an estimated 1.35 million, and 93% of the world’s fatalities on the roads occur in low- and middle-income countries, even though these countries have approximately 60% of the world’s vehicles. Another report by WHO states that by 2020, chronic diseases will account for almost three-quarters of all deaths worldwide

Increasing prevalence of respiratory diseases such as asthma, COPD, pulmonary fibrosis, and others is a key factor expected to drive the growth of US respiratory disposable devices market over the forecast period

Nonetheless, rapidly increasing levels of air pollution and dust, pollen, and others are expected to boost the demand for disposable or single-use respiratory devices such as nasal filters, nasal mask cushion, face masks, nasal cannula, and others at home health care. As well as rising demand and usage rate of non-invasive respiratory care devices coupled with higher healthcare expenditure. These are expected to create a lucrative opportunity for the major players as well as for new entrants operating in the US respiratory disposable device market.

Key Takeaways

- Market Size: US Respiratory Disposable Devices Market size is expected to be worth around USD 1,034 Million by 2033 from USD 511 Million in 2023, growing at a CAGR of 7.3%

- Product Analysis: Mouthpieces and oxygen masks take up 34.5% market share.

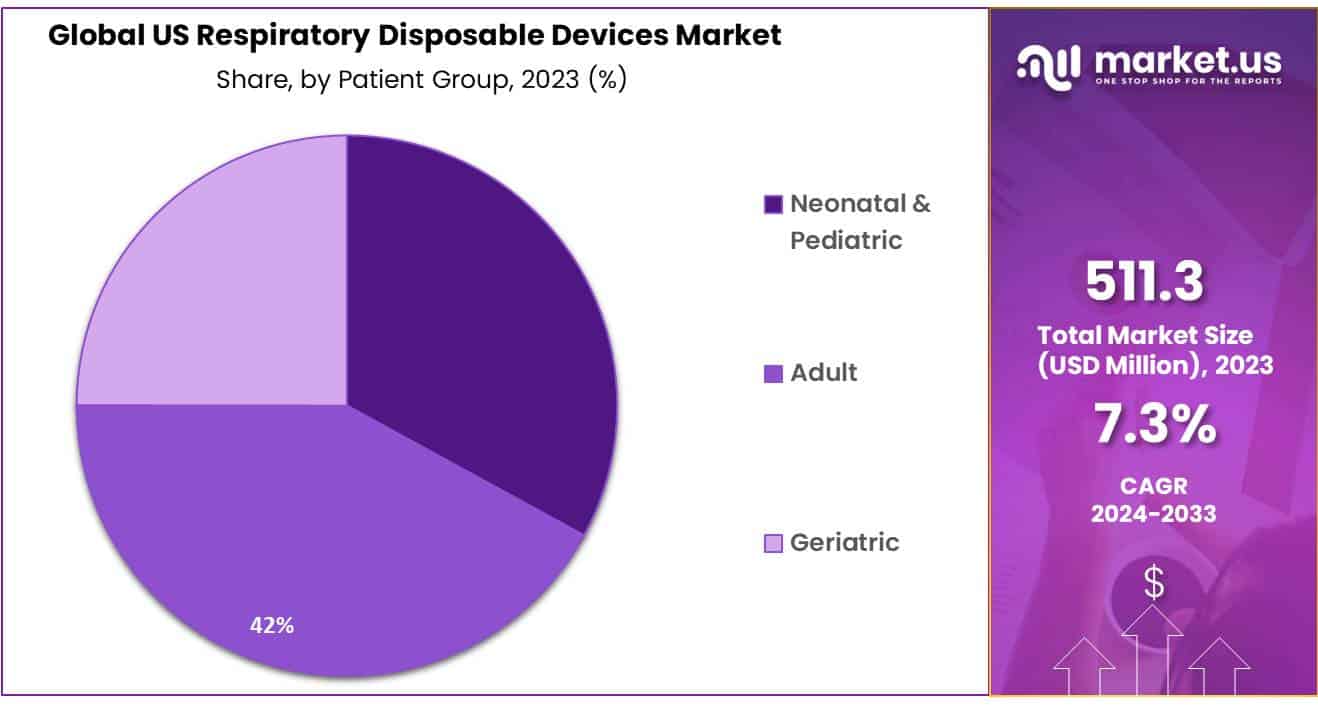

- Patient Group Analysis: Adults account for 42.1% of market share in terms of patient groups in terms of Respiratory Disposable Devices in the U.S.

- End-Use Analysis: Hospitals, as the predominant end-users, dominate the market with a 43.6% share.

- Rising Respiratory Diseases: An aging population and increasing prevalence of chronic respiratory diseases like asthma and COPD are creating long-term demand for respiratory disposable devices used in treatment and management.

- Technological Advancements: Development of new disposable devices with improved functionality and comfort, such as lighter masks or more efficient nebulizers, is expected to drive market growth.

- Focus on Convenience: Disposable devices offer convenience and ease of use compared to reusable alternatives. This trend is likely to benefit the market, especially for home healthcare applications.

- Regulatory Landscape: Regulations governing safety and efficacy of disposable devices can impact market growth. Staying updated on these regulations is crucial for companies in this market.

Product Analysis

The U.S. Respiratory Disposable Devices Market is driven by key products that address various respiratory care needs. Mouthpieces and oxygen masks take up 34.5% of this market, reflecting their role as oxygen therapy devices that facilitate patient breathing. They’re essential in various medical settings due to their direct impact on patient wellbeing; hence their high demand.

Nasal cannulas and tubing play an integral part in this market, providing less intrusive means to deliver continuous oxygen therapy to long-term oxygen therapy patients. Resuscitators provide emergency and critical care patients who cannot breathe independently with manual ventilation solutions, making up another crucial segment of this market.

Disposable liners and canisters used in medical suction devices to collect bodily fluids, mucus, and respiratory secretions play an essential role in maintaining hygiene and avoiding cross-contamination in healthcare settings. Together these products represent the heart of the U.S. Respiratory Disposable Devices Market as essential products that reflect innovation within respiratory care.

Patient Group Analysis

Adults account for 42.1% of market share in terms of patient groups in terms of Respiratory Disposable Devices in the U.S. This shows their heavy reliance on disposable respiratory devices like masks, tubes and nebulizers due to chronic respiratory conditions like COPD, asthma and acute respiratory infections which are widespread among this age group.

Neonatal and pediatric devices represent an integral part of the market. Tailored specifically to infants and children, these devices help address congenital conditions, early-onset asthma attacks, respiratory syncytial virus (RSV), while also meeting this demographic’s unique respiratory needs with precision and care.

Geriatric patients represent another key segment, necessitating specialized respiratory disposable devices to manage age-related respiratory conditions effectively. An increasing elderly population susceptible to chronic respiratory conditions drives continuous demand in this sector – spurring market expansion as healthcare providers address their needs efficiently.

End-User Analysis

In the U.S. Respiratory Disposable Devices Market, end-users play a critical role in shaping the industry landscape. Hospitals, as the predominant end-users, dominate the market with a 43.6% share. This significant proportion reflects the extensive use of respiratory disposable devices in hospital settings, where the demand for such products is consistently high due to the wide range of respiratory ailments treated, from emergency care to routine procedures.

Nursing homes and clinics also constitute essential segments of this market. In these settings, respiratory disposable devices are vital for managing chronic respiratory diseases, providing emergency respiratory care, and offering routine respiratory support for elderly residents and outpatients. The emphasis on quality care and infection control drives the steady demand in these facilities.

Key Market Segments

By Product

- Nasal Canula and Tubing

- Resuscitator

- Mouthpiece & Oxygen Masks

- Disposable Liners & Canisters

- Others

By Patient Group

- Neonatal & Pediatric

- Adult

- Geriatric

By End-User

- Hospitals

- Nursing Homes & Clinics

- Others

Driver

Rising Prevalence of Respiratory Diseases

According to estimates by the Centers for Disease Control and Prevention (CDC), more than 16 million Americans live with COPD while 25 million have asthma. Furthermore, annual flu epidemics result in 45 million illnesses annually, creating significant demand for respiratory disposable devices.

Restraint

Tighter Regulation Requirements for Solar Facilities

Industry analyses may reveal that FDA approval processes for new medical devices often take three to seven years and cost manufacturers millions in both direct and indirect expenses, negatively affecting market dynamics and innovation rates.

Opportunity

Technology Advancements and product innovations present opportunities.

Market research could indicate a compound annual growth rate (CAGR) of 7-10% for technologically advanced respiratory devices, signalling strong industry opportunities for companies that innovate while emphasizing smart inhalers and connected devices as key trends.

Trend

Home Healthcare adoption on the rise

Industry forecasts project that the home healthcare equipment market will experience compound annual compound growth of around 8% between 2017-2060, with respiratory disposable devices making up a large share. Demand will likely be driven by America’s rapidly aging population which is projected to double by 2060 – increasing demand for in-home respiratory care solutions.

Regional Analysis

The Northeast, with its high population density and substantial healthcare infrastructure, shows strong demand for respiratory disposable devices. States like New York, Massachusetts, and Pennsylvania, known for their significant healthcare systems and high rates of respiratory ailments, contribute notably to the regional market’s size. In the Midwest, states such as Illinois, Michigan, and Ohio feature prominent healthcare systems and a sizable aging population, driving the demand for respiratory disposables. The region’s focus on healthcare quality and access to medical services supports the steady market growth here.

The South holds a significant market share, attributed to its large, diverse population and increasing healthcare expenditure. States like Texas, Florida, and Georgia face high incidences of chronic respiratory conditions, necessitating a robust supply of respiratory disposable devices in hospitals and home care settings. The West, encompassing states like California, Washington, and Colorado, demonstrates a growing market due to its progressive healthcare policies, high awareness of respiratory health, and substantial investment in healthcare infrastructure. The region’s emphasis on technology and innovation also propels the adoption of advanced respiratory disposable devices.

Market Player Analysis

This report presents key developments in the US Respiratory Disposable Devices market, outlining both organic and inorganic growth strategies. Many companies are employing organic tactics such as product launches, approvals, patents, events and acquisitions as growth strategies; acquisitions partnerships collaborations have enabled an expansion in business operations and customer bases for market players in Respiratory Disposable Devices sector allowing for lucrative growth prospects due to rising global demand for these devices.

Additionally, this report presents detailed profiles of key companies along with SWOT analyses and market strategies in the Respiratory Disposable Devices market. Furthermore, the report highlights major industry players by providing details such as company profiles, offerings, financial data from past three years, as well as developments over last five years.

Market Key Players

- Becton

- Dickinson and Company Medline Industries Inc.

- Teleflex Incorporated

- Armstrong Medical Industries Inc.

- Westmed Inc.

- Dynarex Corporation

- Respironics Inc.

- ResMed Inc.

- Invacare Corporation

- Allied Healthcare Products Inc

Recent Developments

- ResMed (October 2023): Announced the launch of their new AirMini travel CPAP machine, a portable device for sleep apnea treatment. This could be significant for the disposable filters and masks used in CPAP therapy.

- Teleflex (Late 2023): Industry rumors suggest Teleflex might be in acquisition talks with other medical device companies. If true, this could impact their disposable respiratory device offerings depending on the target company.

- Becton Dickinson (BD) (Unconfirmed – But ongoing development): BD is a major player in medical devices, and while they might not announce everything publicly, they are likely continuously developing new products. They have a strong presence in the medication delivery space, so keep an eye out for advancements in nebulizers or inhaler technology in their future announcements.

- Allied Healthcare Products (Early 2024): Considering the ongoing focus on hygiene during the pandemic, Allied, a distributor of medical supplies, might be expanding its offerings of disposable face masks or other respiratory hygiene products.

Report Scope

Report Features Description Market Value (2023) USD 511 Million Forecast Revenue (2033) USD 1,034 Million CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Nasal Canula and Tubing, Resuscitator, Mouthpiece & Oxygen Masks, Disposable Liners & Canisters, Others) By Patient Group (Neonatal & Pediatric, Adult, Geriatric) By End-User (Hospitals, Nursing Homes & Clinics, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Becton, Dickinson and Company Medline Industries Inc., Teleflex Incorporated, Armstrong Medical Industries Inc., Westmed Inc., Dynarex Corporation, Respironics Inc., ResMed Inc., Invacare Corporation, Allied Healthcare Products Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are respiratory disposable devices?Respiratory disposable devices are single-use medical products designed to assist with respiratory functions, including oxygen delivery, airway management, and ventilation support.

How big is the US Respiratory Disposable Devices Market?The global US Respiratory Disposable Devices Market size was estimated at USD 511 Million in 2023 and is expected to reach USD 1,034 Million in 2033.

What is the US Respiratory Disposable Devices Market growth?The global US Respiratory Disposable Devices Market is expected to grow at a compound annual growth rate of 7.3%. From 2024 To 2033

Who are the key companies/players in the US Respiratory Disposable Devices Market?Some of the key players in the US Respiratory Disposable Devices Markets are Becton, Dickinson and Company Medline Industries Inc., Teleflex Incorporated, Armstrong Medical Industries Inc., Westmed Inc., Dynarex Corporation, Respironics Inc., ResMed Inc., Invacare Corporation, Allied Healthcare Products Inc.

What types of respiratory disposable devices are available?There is a wide range of respiratory disposable devices available, including oxygen masks, nasal cannulas, endotracheal tubes, tracheostomy tubes, CPAP masks, nebulizer masks, and breathing circuits.

Why are respiratory disposable devices important?Respiratory disposable devices play a crucial role in healthcare settings by providing safe and hygienic solutions for patients requiring respiratory support. They help prevent the spread of infections and ensure effective treatment delivery.

How are respiratory disposable devices disposed of?Respiratory disposable devices are designed for single-use and should be disposed of according to medical waste disposal guidelines to prevent contamination and ensure environmental safety.

US Respiratory Disposable Devices MarketPublished date: March 2023add_shopping_cartBuy Now get_appDownload Sample

US Respiratory Disposable Devices MarketPublished date: March 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton

- Dickinson and Company Medline Industries Inc.

- Teleflex Incorporated

- Armstrong Medical Industries Inc.

- Westmed Inc.

- Dynarex Corporation

- Respironics Inc.

- ResMed Inc.

- Invacare Corporation

- Allied Healthcare Products Inc