US Pet Hard Goods Market Size, Share, Growth Analysis By Product (Pet Toys, Feeding Supplies, Training & Behavior Aids, Clothing & Apparel, Grooming Products & Tools, Pet Safety, Containment & Travel, Aquarium & Terrarium Supplies, Collars, Leashes & Harnesses, Bedding & Furniture, Cleaning & Waste Management), By Distribution Channel (Store-driven/Brick-and-Mortar, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150965

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

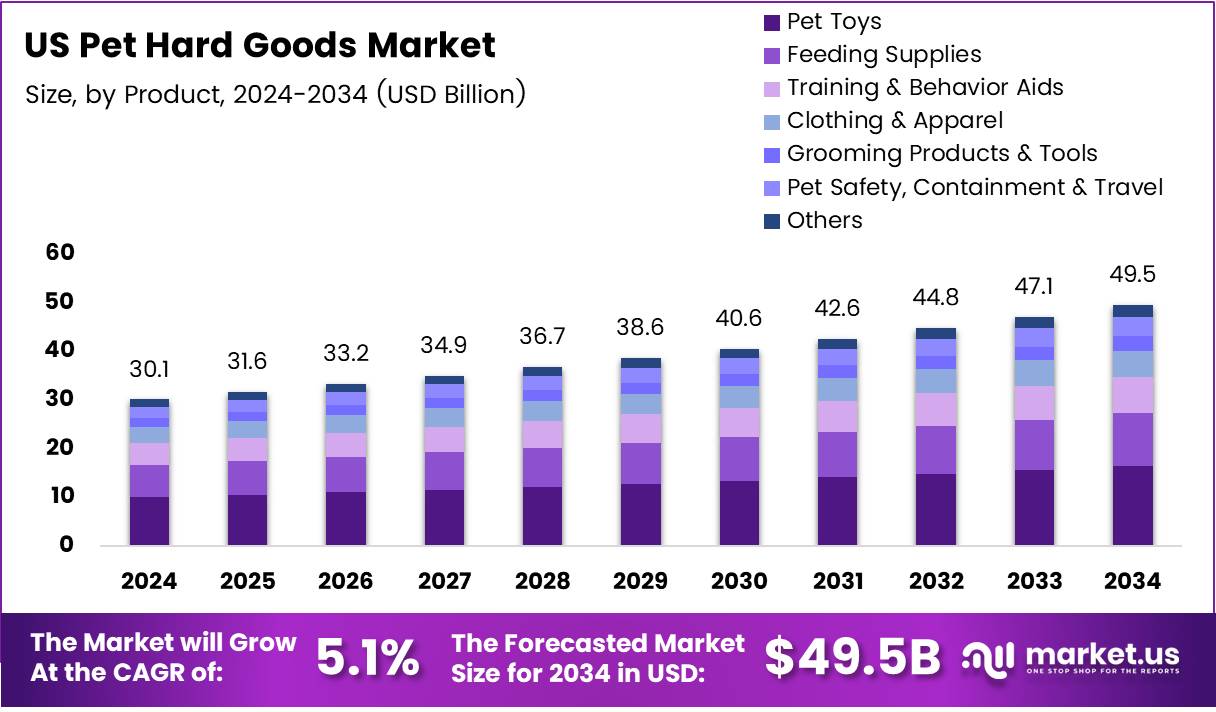

The US Pet Hard Goods Market size is expected to be worth around USD 49.5 Billion by 2034, from USD 30.1 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The U.S. Pet Hard Goods Market is showing strong momentum, driven by rising pet ownership and consumer demand for quality pet supplies. This segment includes durable items like collars, leashes, toys, crates, feeders, and beds. As more people treat pets like family, spending on pet accessories continues to increase.

U.S. consumers are embracing the premiumization trend, seeking stylish and functional hard goods for pets. As per the American Pet Products Association, nearly 94 million U.S. households own at least one pet. This rising base of pet owners is fueling market expansion and driving product innovation across hard goods categories.

The digital shift is also influencing market behavior. According to dodropshipping, 39.8% of all online pet stores are based in the United States, reflecting a robust e-commerce infrastructure. Pet retailers are capitalizing on digital platforms to offer convenience, product variety, and competitive pricing to customers nationwide.

In addition, grooming and hygiene products closely linked with hard goods are surging in popularity. According to industry report, the U.S. holds 56% of the global pet grooming market. This dominant share underscores the growing attention toward pet wellness, indirectly boosting demand for hard goods like brushes, grooming kits, and bathing tools.

Opportunities in the U.S. Pet Hard Goods Market are also emerging from the innovation side. Smart feeders, GPS collars, and ergonomic bedding are gaining traction. Consumer preferences for eco-friendly and sustainable products are creating niches for manufacturers and retailers willing to adapt their materials and practices.

Government regulations, particularly those focused on animal welfare, indirectly benefit the hard goods segment. Safety standards and product labeling requirements push brands to invest in quality, which enhances consumer trust. Although not heavily regulated, the segment aligns with broader pet industry guidelines ensuring product safety and reliability.

State-level funding and incentives for pet adoption and welfare facilities may also stimulate hard goods demand. Increased funding for shelters often translates into bulk purchases of crates, bedding, and feeding systems, opening up B2B supply chain opportunities in the hard goods market.

From a retail perspective, big-box stores and specialty pet chains continue to expand their shelf space for hard goods. However, online platforms remain a preferred shopping destination for millennials and Gen Z consumers. These demographics are not only digitally native but also spend generously on pet lifestyle products.

Key Takeaways

- The US Pet Hard Goods Market size is projected to reach USD 49.5 billion by 2034, growing at a CAGR of 5.1% from 2025 to 2034.

- In 2024, Pet Toys led the By Product Analysis segment with a 30.5% market share, driven by increased consumer spending on pet wellness and enrichment.

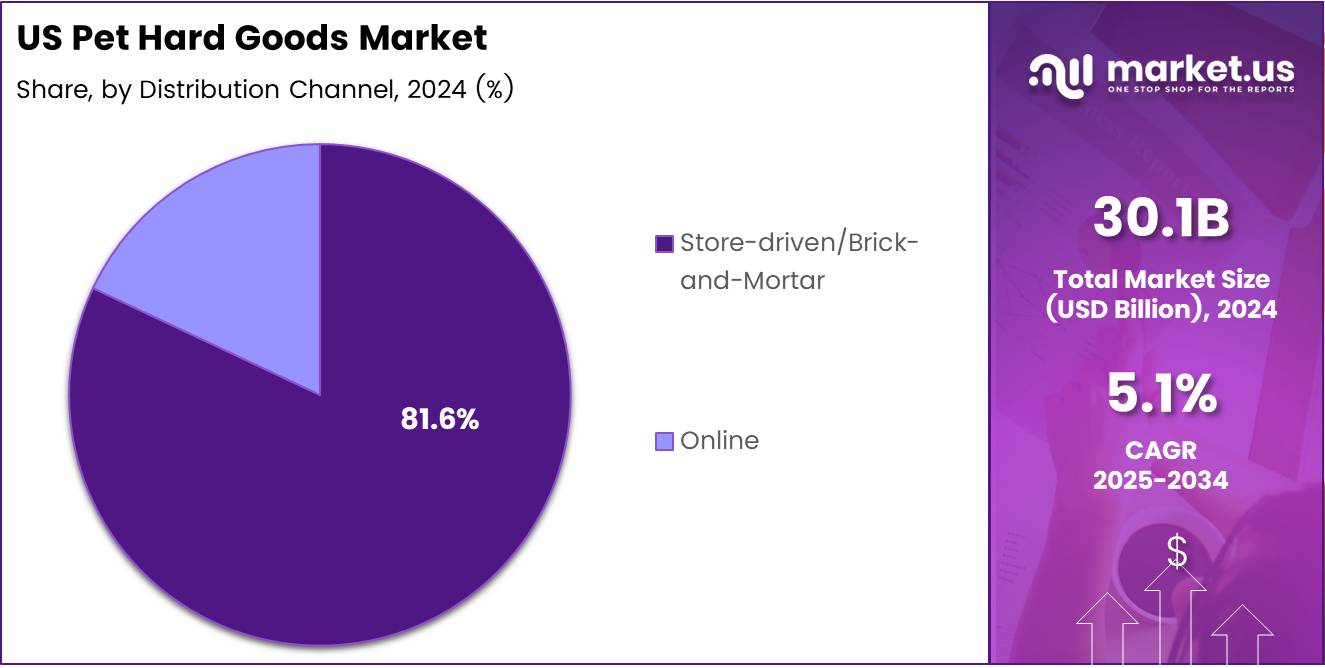

- In 2024, Store-driven/Brick-and-Mortar dominated the By Distribution Channel Analysis segment with an 81.6% market share, as physical retail remains the preferred choice for pet owners.

Product Analysis

Pet Toys lead the pack with 30.5% share due to rising pet engagement trends.

In 2024, Pet Toys held a dominant market position in the By Product Analysis segment of the US Pet Hard Goods Market, with a 30.5% share. This segment benefited significantly from increased consumer spending on interactive and mentally stimulating products for pets, reflecting a growing awareness of pet wellness and enrichment.

Feeding Supplies followed closely, driven by functionality and the growing focus on pet nutrition. Training & Behavior Aids also saw robust traction, as pet parents increasingly turn to tools that assist in behavior shaping, especially with rising pet adoption rates.

Clothing & Apparel and Grooming Products & Tools recorded stable growth, supported by premiumization and aesthetic trends. Consumers are spending more on appearance and hygiene-related goods, especially for dogs and cats.

Pet Safety, Containment & Travel solutions remained essential, with heightened interest in portable crates, car harnesses, and travel accessories. Aquarium & Terrarium Supplies catered to niche pet owners, while Collars, Leashes & Harnesses maintained steady sales due to consistent demand.

Bedding & Furniture and Cleaning & Waste Management rounded out the category, with durable and comfort-focused options enhancing pet owner satisfaction and driving repeat purchases.

Distribution Channel Analysis

Store-driven/Brick-and-Mortar dominates with 81.6% share owing to trust and tactile experience.

In 2024, Store-driven/Brick-and-Mortar held a dominant market position in the By Distribution Channel Analysis segment of the US Pet Hard Goods Market, with a commanding 81.6% share. Physical retail continues to be the preferred channel for many pet owners, primarily due to the opportunity to assess product quality firsthand and receive in-store advice.

Pet specialty chains and big-box retailers have capitalized on strong customer loyalty and well-established inventory systems, offering shoppers immediate product access and a wide range of goods. The tactile nature of pet hard goods—such as toys, bedding, and grooming tools—makes in-person evaluation especially valuable.

Online channels, while growing, remained secondary. Despite the convenience and broader product variety online, many consumers still favor brick-and-mortar locations for urgent needs and return ease. Additionally, physical stores are increasingly integrating digital tools to enhance shopper experience, further reinforcing their lead.

The dominance of store-driven channels highlights the importance of in-person retail relationships, strategic shelf placement, and experiential marketing in shaping consumer choices in the US Pet Hard Goods Market.

Key Market Segments

By Product

- Pet Toys

- Feeding Supplies

- Training & Behavior Aids

- Clothing & Apparel

- Grooming Products & Tools

- Pet Safety, Containment & Travel

- Aquarium & Terrarium Supplies

- Collars, Leashes & Harnesses

- Bedding & Furniture

- Cleaning & Waste Management

By Distribution Channel

- Store-driven/Brick-and-Mortar

- Online

Drivers

Rising Disposable Income of Pet Owners Drives Market Growth

The US pet hard goods market is expanding as more people own pets and treat them like family members. This trend has led to greater demand for high-quality pet products such as beds, crates, and grooming tools. Pet owners are willing to spend more to keep their pets comfortable and safe.

During the COVID-19 pandemic, pet adoption surged, further increasing the need for hard goods like carriers, feeding accessories, and toys. These items became essentials for new pet parents adjusting to life with animals.

Another key factor is the rise in disposable income. As Americans earn more, they allocate a part of their budget to their pets’ well-being. This allows them to invest in better and often more expensive pet supplies, pushing the market forward and encouraging brands to innovate and expand their product ranges.

Restraints

Increased Competition from International Players Limits Market Potential

The US pet hard goods market faces challenges due to rising competition from foreign manufacturers. International brands often offer similar products at lower prices, which can make it harder for domestic companies to maintain their market share.

In addition to price-based competition, there are increasing regulatory hurdles in the US related to product safety and material standards. Companies need to follow strict rules to ensure their products are safe for pets, which can delay product launches and raise production costs.

These factors create pressure on local manufacturers to balance quality with affordability. While consumer demand is high, overcoming these restraints is necessary for long-term market sustainability and growth.

Growth Factors

Expansion in Premium and Luxury Pet Products Offers Strong Growth Path

The growing interest in premium and luxury pet products is creating fresh opportunities in the US pet hard goods market. Pet owners are seeking higher-end items such as designer pet beds, customized feeding stations, and ergonomic crates that reflect their lifestyle and taste.

Eco-friendly and sustainable pet products are also gaining traction. Consumers are increasingly looking for biodegradable materials, recyclable packaging, and ethically made goods, which presents an opening for companies focused on green innovations.

Smart pet products are another exciting area. From automated feeders to GPS collars, technology is transforming how owners care for their pets. These advancements not only offer convenience but also improve pet safety and monitoring, leading to higher consumer interest and market growth potential.

Emerging Trends

Social Media Influence on Pet Product Trends Shapes Market Behavior

Social media is significantly influencing the US pet hard goods market, with viral trends driving demand for trendy and aesthetically pleasing products. Platforms like Instagram and TikTok have turned pets into online celebrities, making stylish pet gear a must-have.

Personalization is another trend on the rise. Consumers want customized collars, name-engraved bowls, and color-coordinated accessories to match their pet’s personality. This trend encourages niche brands and creative product offerings.

At the same time, tech-based pet care devices are gaining momentum. Smart water fountains, activity trackers, and interactive toys are becoming more common, as tech-savvy pet owners look for ways to monitor and engage their pets. These trends help shape consumer preferences and influence product development strategies.

Key US Pet Hard Goods Company Insights

In 2024, the US Pet Hard Goods Market continues to experience steady growth, driven by innovation and consumer focus on pet comfort and enrichment.

Among the notable players, KONG Company remains a dominant force due to its reputation for durable, enrichment-focused toys. Its ongoing investment in research-backed product development keeps it ahead in consumer trust and brand loyalty.

COLLAR Company has carved a niche by emphasizing high-tech and ergonomic pet accessories. Its expansion into smart pet devices and sustainability-driven products positions it well in a market leaning toward modernized pet care solutions.

Coastal Pet Products maintains strength through its wide-ranging, USA-manufactured product line, especially in collars, leashes, and grooming tools. The company’s consistent quality and affordability ensure it stays relevant in both mass and specialty retail.

BARK, Inc has effectively leveraged its DTC (direct-to-consumer) business model to foster a strong emotional connection with pet owners. Its personalized offerings and recurring subscription model drive customer engagement and recurring revenue streams, giving it a strategic edge in customer retention.

These players contribute significantly to shaping market trends in durability, personalization, and innovation. Their combined influence sets a competitive standard in the US pet hard goods industry, especially as consumers demand more functional, sustainable, and aesthetically appealing products for their pets.

The ongoing evolution of pet ownership, with pets increasingly considered family members, continues to drive innovation, and these companies are poised to benefit from this cultural and commercial shift.

Top Key Players in the Market

- KONG Company

- COLLAR Company

- Coastal Pet Products

- BARK, Inc

- Radio Systems Corporation (PetSafe)

- Chewy, Inc.

- Petmate (Doskocil Manufacturing)

- The Kyjen Company, LLC (Outward Hound)

- Central Garden & Pet Company

Recent Developments

- In March 2025, the U.S. pet food industry received a significant boost through a US$1.4 million USDA grant, aimed at supporting sustainable practices and innovation within the sector, enhancing food safety and manufacturing techniques.

- In March 2025, Dalma secured €20 million in funding to expand its pet insurance services, positioning itself as a key player in the growing pet insurance market, focused on providing comprehensive coverage for pet owners.

- In February 2024, Papa Pawsome raised US$400K in a seed round, led by Indian Angel Network (IAN), which will help the company expand its product line and improve its online presence in the pet care industry.

- In November 2024, General Mills announced its acquisition of Whitebridge Pet Brands’ North American Cat Food and Pet Treat Business, marking a significant strategic move to strengthen its position in the pet food market.

Report Scope

Report Features Description Market Value (2024) USD 30.1 Billion Forecast Revenue (2034) USD 49.5 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Pet Toys, Feeding Supplies, Training & Behavior Aids, Clothing & Apparel, Grooming Products & Tools, Pet Safety, Containment & Travel, Aquarium & Terrarium Supplies, Collars, Leashes & Harnesses, Bedding & Furniture, Cleaning & Waste Management), By Distribution Channel (Store-driven/Brick-and-Mortar, Online) Competitive Landscape KONG Company, COLLAR Company, Coastal Pet Products, BARK, Inc, Radio Systems Corporation (PetSafe), Chewy, Inc., Petmate (Doskocil Manufacturing), The Kyjen Company, LLC (Outward Hound), Central Garden & Pet Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- KONG Company

- COLLAR Company

- Coastal Pet Products

- BARK, Inc

- Radio Systems Corporation (PetSafe)

- Chewy, Inc.

- Petmate (Doskocil Manufacturing)

- The Kyjen Company, LLC (Outward Hound)

- Central Garden & Pet Company