Global Dialysis Market Analysis By Dialysis Type (Hemodialysis and Peritoneal Dialysis), By Product and Services (Equipment, Consumables, Dialysis Drugs, and Services), By End-User (Dialysis Centers and Hospitals, Home Care, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 101342

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

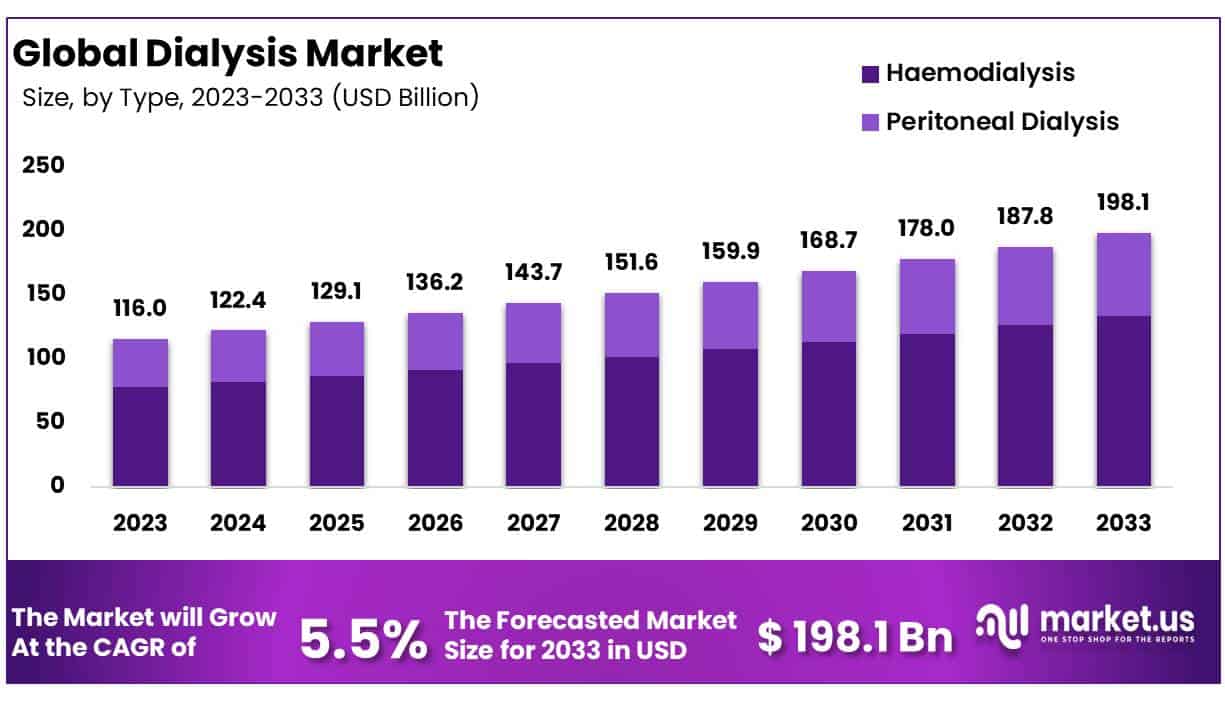

The Global Dialysis Market size is expected to be worth around USD 198.1 Billion by 2033 from USD 116.0 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

The dialysis market is undergoing significant transformation through advancements in technology and strategic financial investments, enhancing patient care and expanding service capabilities globally.

Technological innovations such as the THERANOVA dialyzer are pivotal, improving patients’ quality of life by filtering out larger molecules that contribute to chronic inflammation and symptoms. Another noteworthy advancement is the development of endovascular arteriovenous fistula creation technology, which enhances the durability and functionality of vascular access, a critical aspect in dialysis treatment.

In the regulatory landscape, the Centers for Medicare & Medicaid Services (CMS) in the United States plays a crucial role. The CMS oversees the End-Stage Renal Disease (ESRD) Prospective Payment System, ensuring that dialysis facilities adhere to strict safety and quality standards. For the 2024 calendar year, the CMS plans to distribute approximately $6.7 billion to over 7,900 ESRD facilities, supporting the implementation of new policies and ongoing operations, including pediatric dialysis and the introduction of new renal drugs.

Financially, the sector is witnessing substantial investments aimed at service expansion and the adoption of advanced technologies. For instance, the Asian Development Bank has invested $10 million to enhance renal care in India, focusing on the expansion of dialysis services due to increasing demand. Moreover, M42’s acquisition of Diaverum, one of the largest global providers of dialysis services, highlights a strategic move to broaden geographical reach and integrate technology-enhanced care solutions.

The global dialysis market is also influenced by import-export dynamics, affected by regulations and tariffs. Recent data from the U.S. Bureau of Labor Statistics indicates a 5.7% increase in overall import prices of nonmilitary goods and services related to dialysis as of early 2024. This reflects the impact of international trade costs on the dialysis sector, underlining the importance of economic conditions in market strategy and patient care access.

Adherence to health and safety standards is essential in dialysis facilities to prevent infections and ensure patient safety. The Centers for Disease Control and Prevention (CDC) recommends rigorous protocols for infection prevention, including regular hand hygiene and proper care of vascular access sites. Implementing these best practices is vital as dialysis patients are at a higher risk of infections, significantly more than the general population.

These developments collectively support the growth and enhancement of the dialysis services market, emphasizing the importance of continuous innovation and regulatory oversight.

Key Takeaways

- Dialysis Market size is expected to be worth around USD 198.1 Billion by 2033 from USD 116.0 Billion in 2023

- The market CAGR of 5.5% during the forecast period from 2024 to 2033.

- The hemodialysis segment dominates the market with a share of over 67.3%.

- The services segment held 41.3% largest market share in 2023, primarily due to the rise in service providers’ emphasis on providing high-quality care to patients.

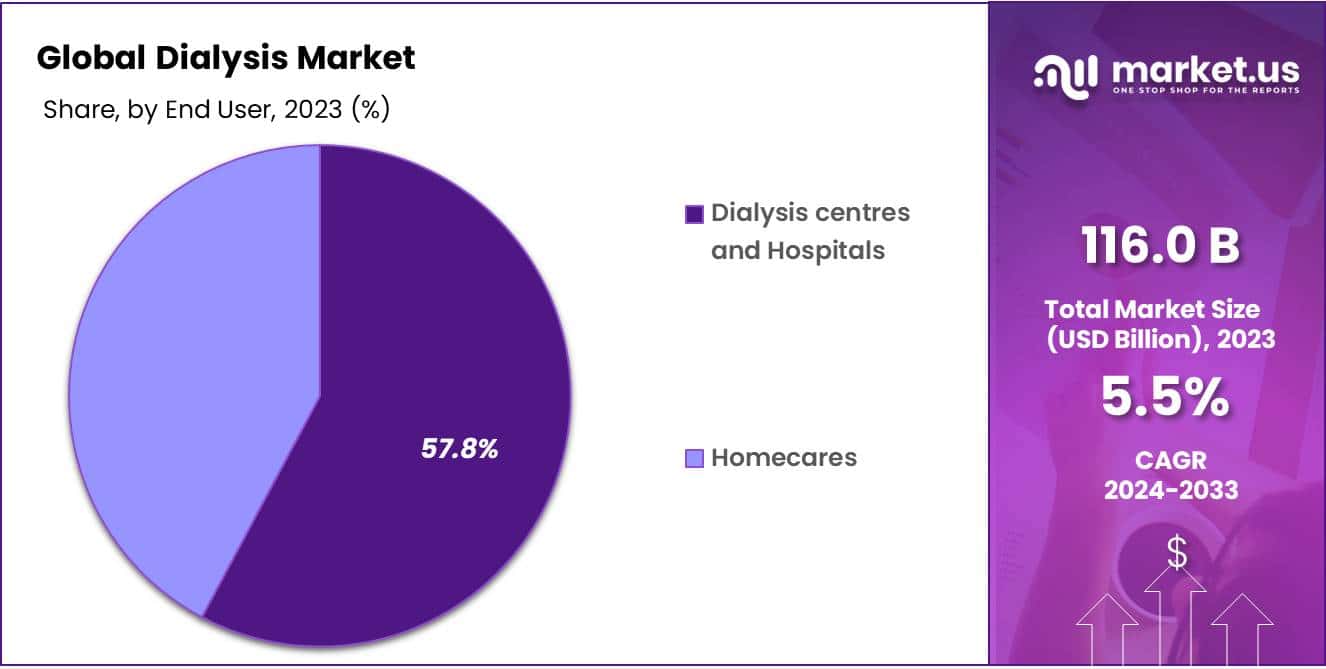

- Dialysis centers & hospitals dominated 57.8% market share in 2023, due to favorable reimbursement offered by renal facilities and hospitals for renal treatments.

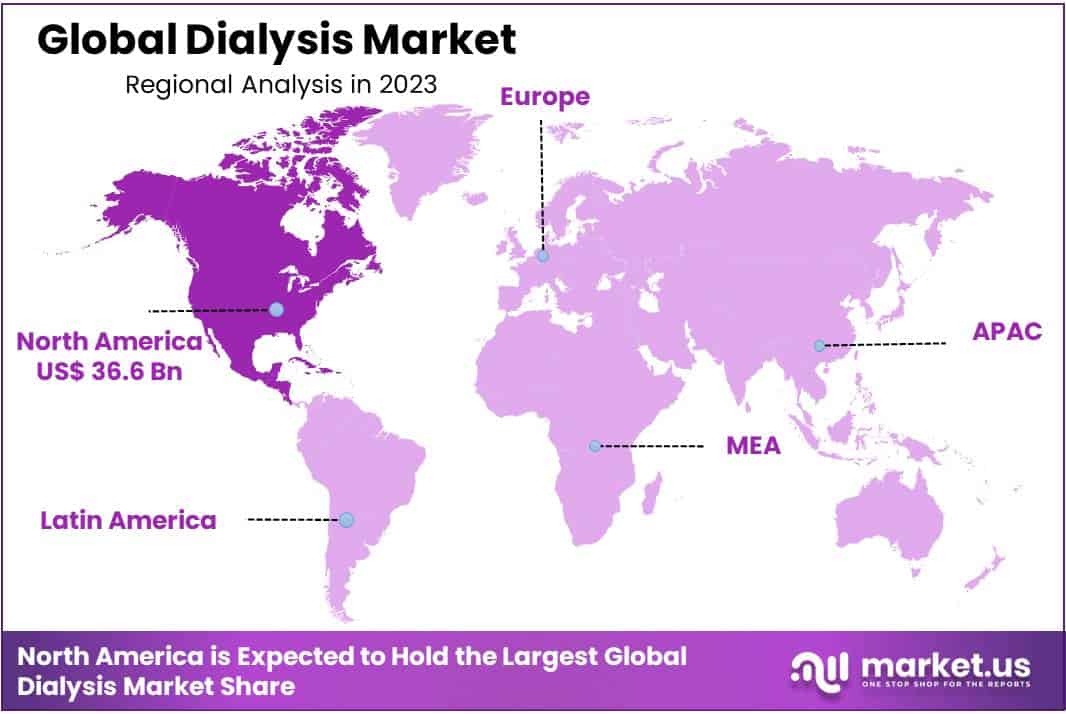

- North America is anticipated to hold 31.6% market share and USD 36.6 Billion market revenue.

Dialysis Type Analysis

In 2023, the hemodialysis segment dominated the dialysis market, accounting for approximately 67.3% of the total revenue. This can be attributed to several factors. Hemodialysis helps maintain a balance in the levels of salt, calcium, and potassium, which in turn, helps lower blood pressure. Additionally, the arteriovenous (AV) fistula is the most common vascular access for hemodialysis patients, making it a preferred choice. Furthermore, hemodialysis is less time-consuming compared to peritoneal dialysis.

However, the peritoneal dialysis segment is anticipated to be the fastest-growing over the forecast period. This is due to the efficient removal of toxic substances and the rising demand for home care among dialysis patients. Peritoneal dialysis is further subdivided into continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD).

The dialysis market is divided into two main types: hemodialysis and peritoneal dialysis. Hemodialysis is further segmented into conventional hemodialysis, nocturnal hemodialysis, and short-term hemodialysis. Peritoneal dialysis is divided into CAPD and APD.

The high growth of the hemodialysis segment can be attributed to its benefits in maintaining a balanced level of essential minerals and the convenience of the AV fistula. Nevertheless, the peritoneal dialysis segment is expected to witness the fastest growth due to its efficient toxin removal and the increasing preference for home-based care.

Product & Services Analysis

In 2023, the services segment held the largest market share in the global dialysis market, accounting for 41.3%. This can be attributed to the increasing emphasis on providing high-quality care to patients and the development of well-equipped renal care facilities for both chronic and acute care. Additionally, the demand for services is rising due to the improved, profit-oriented and patient-centered business models of service providers.

The products segment, which includes equipment, consumables, and dialysis drugs, is anticipated to experience healthy growth in the coming years. This is due to the increasing number of local and regional players in the market, aiming to meet the rising demand for advanced products and consumables.

The dialysis drugs segment is expected to grow more in the coming years. This is largely due to the high prevalence of anemia among dialysis patients, leading to the increased use of drugs like erythropoietin, iron, active vitamin D, phosphorus binders, B-complex vitamin, folic acid, topical creams, antihistamines, and vitamin E.

End-User Analysis

In 2023, the dialysis centers and hospitals segment dominated the global dialysis market, holding a 57.8% value share. This can be attributed to several factors.

Firstly, the favorable reimbursement policies offered by renal facilities and hospitals for dialysis treatments have made this setting a preferred choice for dialysis patients. Secondly, the expanding patient population with chronic kidney disease (CKD) and end-stage renal disease (ESRD) has driven the demand for dialysis services in these healthcare settings. Additionally, the rising healthcare spending by the population has further contributed to the growth of the dialysis centers and hospitals segment.

The dialysis market is segmented based on end-users, with the other two categories being home care and other end-users. However, the dialysis centers and hospitals segment has emerged as the dominant player, owing to the favorable reimbursement scenarios, the increasing CKD and ESRD patient pool, and the overall rise in healthcare expenditure.

This trend highlights the importance of well-equipped, hospital-based and dialysis center-based facilities in meeting the growing demand for dialysis services. As the market continues to evolve, the dialysis centers and hospitals segment is likely to maintain its leadership position in the foreseeable future.

Key Market Segments

By Dialysis Type

- Hemodialysis

- Peritoneal Dialysis

By Product & Services

- Equipment

- Consumables

- Dialysis Drugs

- Services

By End-User

- Dialysis Centers & Hospitals

- Home Care

- Other End-Users

Drivers

The increasing number of chronic kidney diseases is expected to increase the dialysis demand

End-stage renal disease (ESRD) and chronic kidney disease (CKD) represent one of the highest healthcare cost burdens globally. The primary driver of this market’s expansion is the increasing incidence of renal failure and other chronic kidney diseases. ESRD occurs when the kidneys permanently cease to function properly, requiring long-term renal therapy or a kidney transplant. The rising incidence of ESRD is contributing to the growing global cost of kidney diseases and is one of the primary factors driving the increasing revenue of dialysis services.

Furthermore, the market growth is expected to be fueled by the approval of new products and consumables by regulatory authorities, the participation of public authorities in the prevention and control of renal diseases, and the collaborative efforts of various organizations to provide effective renal services in developing regions.

Increased Accessibility to Hemodialysis Facilities to Fuel Market Expansion

The surge in chronic kidney disease (CKD) has led to a growing demand for accessible and efficient renal care facilities with shorter waiting times. The availability of highly skilled nephrologists in developed countries has resulted in an increase in the number of renal care facilities. Investors are also focusing on expanding renal treatment centers in emerging economies, such as China, India, and Mexico, to meet the rising demand for renal care in these regions. This is expected to drive the market’s revenue growth in the coming years, as the number of visits to these affordable care facilities continues to rise.

Restraints

The increasing number of patients choosing kidney transplantation limits the market growth

Kidney transplantation is an alternative treatment option for ESRD and stage III CKD patients, where a healthy kidney is transplanted from a donor. During the forecast period, the market growth is anticipated to be influenced by the improved treatment outcomes associated with kidney transplants and the procedure’s affordability due to favorable reimbursement policies. Patients with ESRD often prefer kidney transplantation over renal infusion therapy due to the long-term benefits of the procedure. Additionally, the COVID-19 pandemic in India has been linked to an increase in the cost of renal therapy, which could potentially hinder the expansion of the dialysis market.

Complications and risks associated with dialysis

While dialysis is a crucial treatment for ESRD and CKD patients, it is not without its complications and risks. Vascular access-related complications, such as bleeding, and cardiac diseases, including arrhythmic mechanisms or sudden cardiac arrest, are common issues faced by dialysis patients.

Additionally, low blood pressure, infection, nausea, hernia, hepatitis, and anemia account for the majority of dialysis-related deaths. Peritonitis, a common complication of peritoneal dialysis, can be caused by infections from catheters or contamination of the dialysate or tubing by pathogenic skin bacteria. These complications and risks associated with dialysis may limit the market’s growth as patients and healthcare providers seek alternative treatment options with fewer complications.

Opportunity

Emerging Opportunities in Asia Pacific and Rest of the World

The major players in the dialysis market are anticipated to capitalize on the emerging markets in Asia Pacific, such as India and China, as well as in Latin America, including Mexico and Brazil. These regions have some of the highest rates of treated end-stage renal disease (ESRD), particularly in countries like Taiwan and Malaysia.

To take advantage of these growth opportunities, companies are increasingly focused on strategic development agreements, partnerships, geographical expansions, and acquisitions. These initiatives aim to increase their market share and reach a larger customer base in these emerging economies.

Additionally, the development of home/nocturnal dialysis, the expansion of dialysis centers, and government funding for ESRD treatment are also contributing to the growth of dialysis procedures in developing nations. These factors are creating significant growth opportunities for the dialysis market in the Asia Pacific and the Rest of the World regions.

Trends

Rising incidence of CKD

One of the primary drivers is the rising incidence of chronic kidney diseases (CKD) worldwide. This increasing prevalence of CKD has led to a high demand for advanced dialysis solutions.

Another significant trend is the surge in new home dialysis product launches. These innovative solutions are making dialysis more accessible and convenient for patients, contributing to the market’s expansion.

Furthermore, the ongoing development of dialysis products and the rising healthcare expenditures in various regions are also supporting the market’s growth. This is particularly evident in the growing preference for peritoneal dialysis and the increasing use of home-based dialysis therapies, which are anticipated to bring numerous opportunities for market players in the coming years.

These trends, collectively, are creating a favorable environment for the dialysis market to thrive. The rising demand for effective renal care solutions, coupled with the advancements in dialysis technologies and the shift towards home-based treatments, are expected to drive the global dialysis market’s growth in the foreseeable future.

Regional Analysis

North America is anticipated to dominate the market, holding a 31.6% share and generating USD 36.6 Billion in revenue. This growth is driven by the high prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) in the United States and Canada, coupled with higher treatment rates in the region.

Europe is expected to be the second-largest market, with moderate long-term growth. The growing elderly population with renal conditions is the primary factor fueling the region’s rapid market expansion.

The Asia-Pacific region is also anticipated to experience significant growth, aided by public-sector funding initiatives to improve access to renal care. Meanwhile, the Latin American market, particularly in Brazil, is expanding due to the rising prevalence of chronic kidney disease among the elderly population.

Despite delayed diagnosis of CKD and ESRD, the Middle East and Africa region is expected to show slow to moderate growth, driven by rapid urbanization and increasing awareness of the severity of renal diseases.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

One of the largest providers in the renal disease space is Fresenius Medical Care AG & Co. KGaA. The company offers a comprehensive portfolio of products and services across the entire value chain, spanning both dialysis and non-dialysis solutions.

Fresenius Medical Care’s dialysis products segment provides a wide range of products for hemodialysis and peritoneal dialysis, which it designs, develops, and sells to over 150 countries through its extensive production network.

Other prominent players in the global dialysis market are also implementing various growth strategies, such as new product launches, capacity expansions, and technological advancements.

These strategic initiatives by key market participants are expected to be the driving force behind the anticipated growth of the dialysis market over the forecast period. The focus on innovation and expanding the reach of dialysis solutions is crucial in addressing the rising prevalence of chronic kidney diseases and end-stage renal disease globally.

Market Key Players

- B. Braun

- Baxter International Inc.

- Fresenius Medical Care AG & Co. KGaA

- Asahi Kasei Corporation

- Becton, Dickinson, and Company

- DaVita Inc.

- Medtronic plc

- Nipro Corporation

- NIKKISO CO., LTD.

- Satellite Healthcare Inc.

- Toray Industries, Inc.

- Other Key Players

Recent Developments

- In April 2024: DaVita Inc. secured a significant investment to expand its home dialysis program across the United States. The funding aims to increase accessibility and improve patient outcomes by providing advanced home dialysis equipment and support services.

- In January 2024: Fresenius Medical Care announced the acquisition of a regional dialysis provider in Latin America, expanding its presence in emerging markets. This strategic move is expected to enhance Fresenius’ service capabilities and reach in the region.

- In June 2023: Medtronic announced the launch of its new hemodialysis system featuring improved filtration technology. This product aims to enhance the efficiency and safety of dialysis treatments, reinforcing Medtronic’s position in the dialysis market.

Report Scope

Report Features Description Market Value (2023) USD 116.0 Billion Forecast Revenue (2033) USD 198.1 Billion CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Dialysis Type – Hemodialysis and Peritoneal Dialysis; By Product & Services – Equipment, Consumables, Dialysis Drugs, and Services; By End-User – Dialysis Centers & Hospitals, Home Care, and Other End-Users Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape B. Braun, Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Asahi Kasei Corporation, Becton, Dickinson and Company, DaVita Inc., Medtronic plc, Nipro Corporation, NIKKISO CO., LTD., Satellite Healthcare Inc., Toray Industries, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What does the Dialysis Market encompass?The Dialysis Market includes the medical devices, equipment, and services used for treating patients with kidney failure by artificially filtering waste and excess fluids from their blood.

How big is the Dialysis Market?The global Dialysis Market size was estimated at USD 116.0 Billion in 2023 and is expected to reach USD 198.1 Billion in 2033.

What is the Dialysis Market growth?The global Dialysis Market is expected to grow at a compound annual growth rate of 5.5%. From 2024 To 2033

Who are the key companies/players in the Dialysis Market?Some of the key players in the Dialysis Markets are B. Braun, Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Asahi Kasei Corporation, Becton, Dickinson and Company, DaVita Inc., Medtronic plc, Nipro Corporation, NIKKISO CO., LTD., Satellite Healthcare Inc., Toray Industries, Inc., Other Key Players.

What are the key types of dialysis treatments available?The two primary types of dialysis are hemodialysis and peritoneal dialysis. Hemodialysis uses a machine to filter blood externally, while peritoneal dialysis uses the patient's peritoneal membrane to perform filtration.

Which regions exhibit significant market growth?North America, particularly the United States, and Europe have a prominent presence in the Dialysis Market. Asia-Pacific is also witnessing substantial growth due to the increasing prevalence of kidney diseases.

How does the market address patient safety and treatment efficiency?The market focuses on improving patient safety through better dialysis machine design, infection control measures, and remote monitoring of patients. Efficiency is enhanced through automated systems and improved dialysate solutions.

What challenges does the Dialysis Market face?Challenges include the high cost of treatment, limited reimbursement in some regions, and the need for better access to dialysis services in developing countries.

-

-

- B. Braun

- Baxter International Inc.

- Fresenius Medical Care AG & Co. KGaA

- Asahi Kasei Corporation

- Becton, Dickinson, and Company

- DaVita Inc.

- Medtronic plc

- Nipro Corporation

- NIKKISO CO., LTD.

- Satellite Healthcare Inc.

- Toray Industries, Inc.

- Other Key Players