U.S. Flexible Packaging Market Size, Share, Growth Analysis By Recycling Method (Mechanical Recycling, Chemical Recycling), By Packaging Type (Pouches, Bags, Wraps, Films, Sachets, Laminates, Others), By Material Type (Plastic, Polyethylene, Polypropylene, Polyethylene Terephthalate, Paper, Biopolymers, Aluminum Foil, Others), By End-Use (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Household Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158093

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

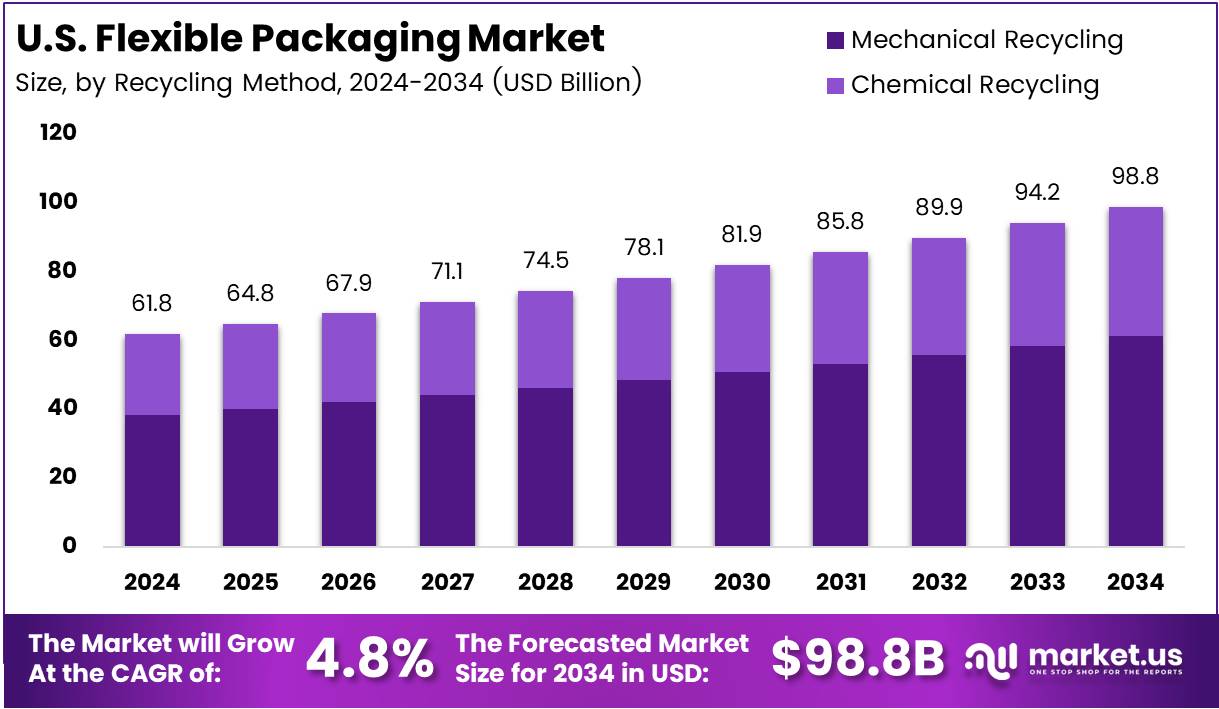

The U.S. Flexible Packaging Market size is expected to be worth around USD 98.8 Billion by 2034, from USD 61.8 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The U.S. Flexible Packaging Market represents one of the most dynamic areas in the packaging industry, driven by consumer demand for convenience and sustainability. In 2024, the market stood as a significant part of the packaging sector, supported by its adaptability, lightweight properties, and reduced material usage compared to rigid packaging alternatives.

Growth in this market is largely fueled by shifting consumer lifestyles and rising e-commerce penetration. Consumers increasingly prefer resealable pouches, stand-up bags, and lightweight films that enhance shelf life and reduce transportation costs. The ability of flexible packaging to lower energy consumption in production also adds to its competitiveness across industries, particularly in food and beverage.

Opportunities are emerging from sustainability trends, as companies innovate bio-based films, compostable pouches, and recyclable laminates. Government incentives promoting sustainable materials, alongside rising consumer willingness to adopt eco-friendly products, provide strong momentum. Flexible packaging producers are also investing in digital printing technologies, offering customized, small-batch production for diverse product categories.

Government investment and regulatory measures are also shaping the market’s direction. Agencies such as the Environmental Protection Agency (EPA) continue to encourage the reduction of single-use plastics, which accelerates innovation in flexible packaging. Federal and state-level recycling infrastructure funding creates new opportunities for circular packaging solutions to gain commercial adoption.

At the same time, regulations on food safety and labeling standards influence material selection and design. Compliance requirements push manufacturers to adopt barrier films with advanced protection while maintaining sustainability commitments. This dual pressure of regulation and innovation positions flexible packaging as a resilient, adaptable solution in a highly competitive landscape.

Key Takeaways

- The U.S. Flexible Packaging Market is projected to reach USD 98.8 Billion by 2034, rising from USD 61.8 Billion in 2024, at a CAGR of 4.8%.

- In 2024, Mechanical Recycling dominated the recycling method segment with a 67.9% share, supported by mature infrastructure and cost efficiency.

- Pouches held the leading packaging type share in 2024 with 31.8%, reflecting consumer demand for lightweight and convenient formats.

- By material type, Plastic captured a 34.4% share in 2024, driven by versatility, affordability, and strong protective performance.

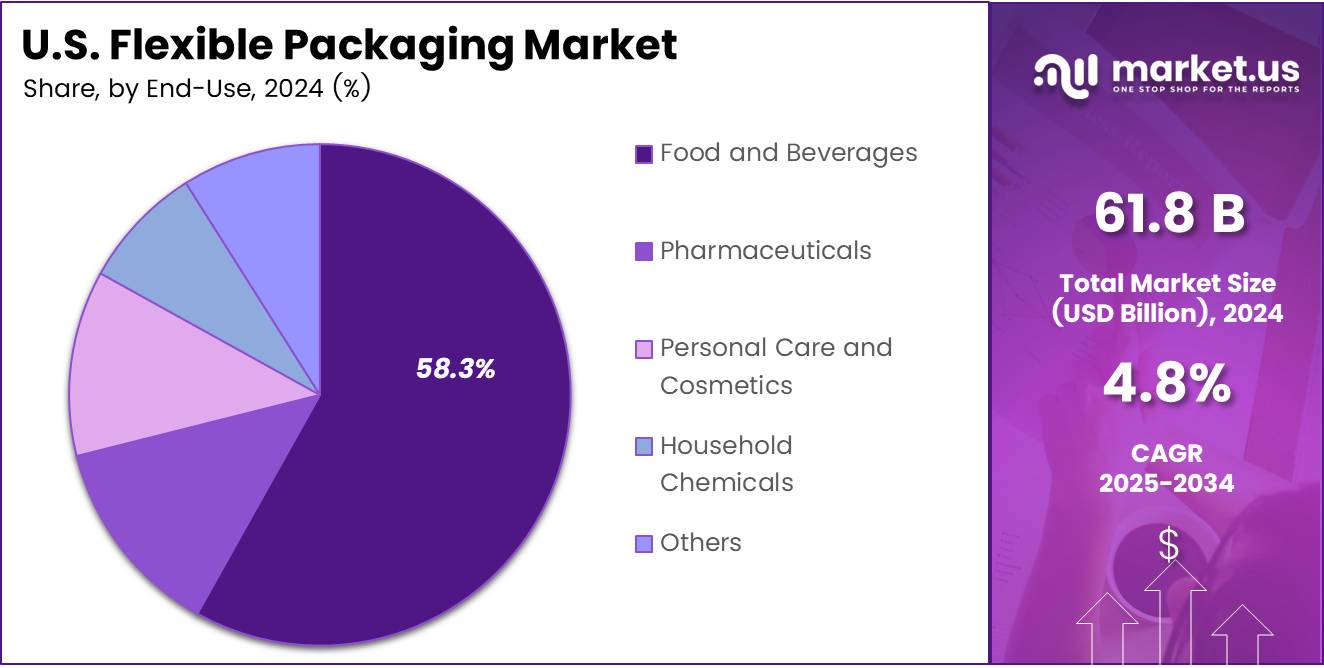

- The Food and Beverages sector led end-use in 2024 with a commanding 58.3% share, highlighting extensive packaging requirements across categories.

Recycling Method Analysis

Mechanical Recycling dominates with 67.9% due to its cost-effectiveness and established infrastructure.

In 2024, Mechanical Recycling held a dominant market position in By U.S. Recycling Method Analysis segment of U.S. Flexible Packaging Market, with a 67.9% share. This overwhelming market leadership stems from the technology’s mature infrastructure and cost advantages over alternative recycling methods.

Mechanical Recycling’s dominance is attributed to its widespread adoption across packaging manufacturers and waste management facilities. The process involves shredding, washing, and melting plastic waste to create new packaging materials, making it the most economically viable option for large-scale operations.

Chemical Recycling represents the secondary segment in this analysis, though specific market share data indicates significant room for growth. While Chemical Recycling offers superior quality output and can handle contaminated materials, higher operational costs and limited infrastructure currently restrict its market penetration compared to mechanical alternatives.

Packaging Type Analysis

Pouches dominate with 31.8% due to their versatility and consumer convenience.

In 2024, Pouches held a dominant market position in By Packaging Type Analysis segment of U.S. Flexible Packaging Market, with a 31.8% share. This leadership position reflects the growing consumer preference for convenient, lightweight packaging solutions across multiple industries.

The Pouches segment benefits from excellent barrier properties, reduced material usage compared to rigid packaging, and enhanced shelf appeal. Their popularity spans food products, personal care items, and household chemicals, making them the most versatile packaging format in the flexible packaging portfolio.

Other significant segments include Bags, Wraps, Films, Sachets, Laminates, and Others, each serving specific market niches. While Pouches maintain market leadership, the diverse range of packaging types demonstrates the industry’s ability to meet varied consumer and industrial requirements through specialized flexible packaging solutions.

Material Type Analysis

Plastic dominates with 34.4% due to its superior barrier properties and manufacturing flexibility.

In 2024, Plastic held a dominant market position in By Material Type Analysis segment of U.S. Flexible Packaging Market, with a 34.4% share. This market leadership is driven by plastic’s exceptional versatility, cost-effectiveness, and superior protective qualities for packaged goods.

Within the plastic category, key subcategories include Polyethylene (PE), Polypropylene (PP), and Polyethylene Terephthalate (PET), each offering distinct advantages for specific applications. PE provides excellent moisture resistance, PP offers superior heat resistance, while PET delivers outstanding clarity and strength characteristics.

Alternative materials including Paper, Biopolymers, Aluminum Foil, and Others represent growing segments as sustainability concerns drive innovation. However, plastic maintains its dominant position due to established supply chains, proven performance characteristics, and competitive pricing that continues to meet diverse packaging requirements across industries.

End-Use Analysis

Food and Beverages dominate with 58.3% due to extensive packaging requirements and consumer demand.

In 2024, Food and Beverages held a dominant market position in By End-Use Analysis segment of U.S. Flexible Packaging Market, with a 58.3% share. This substantial market dominance reflects the sector’s extensive packaging needs, from fresh produce to processed foods and beverage containers.

The Food and Beverages segment drives flexible packaging innovation through demands for extended shelf life, portion control, and convenient consumption formats. Growing consumer preferences for on-the-go eating, single-serve portions, and sustainable packaging solutions continue to fuel this segment’s expansion.

Secondary end-use segments include Pharmaceuticals, Personal Care and Cosmetics, Household Chemicals, and Others. While these sectors represent smaller market shares individually, they contribute to the overall growth through specialized packaging requirements, regulatory compliance needs, and premium product positioning that demands advanced flexible packaging solutions.

Key Market Segments

By Recycling Method

- Mechanical Recycling

- Chemical Recycling

By Packaging Type

- Pouches

- Bags

- Wraps

- Films

- Sachets

- Laminates

- Others

By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Paper

- Biopolymers

- Aluminum Foil

- Others

By End-Use

- Food and Beverages

- Pharmaceuticals

- Personal Care and Cosmetics

- Household Chemicals

- Others

Drivers

Rising Consumer Demand for Convenient and Cost-Effective Packaging Solutions Drives Market Growth

The U.S. flexible packaging market is experiencing strong growth due to companies seeking lightweight packaging alternatives that significantly reduce transportation costs. These materials weigh much less than traditional rigid packaging, allowing businesses to ship more products while spending less on fuel and logistics. This cost advantage becomes especially important as shipping expenses continue to rise across the country.

Consumer preferences are shifting toward packaging that offers convenience and functionality. People want containers they can easily reseal to keep products fresh longer. Flexible packaging meets this demand by providing zip-lock features, spouts, and tear-off sections that make daily use simpler and more practical.

The rapid expansion of e-commerce has created new packaging requirements. Online retailers need materials that can protect products during shipping while remaining flexible enough to fit various box sizes. Flexible packaging provides the durability needed for long-distance shipping while adapting to different product shapes and sizes.

Environmental concerns are pushing companies toward sustainable packaging solutions. Modern flexible materials can be made from recyclable components, helping businesses meet their environmental goals. These eco-friendly options appeal to consumers who increasingly choose brands based on their environmental impact, creating a competitive advantage for companies using sustainable flexible packaging.

Restraints

Regulatory Challenges and Material Limitations Create Market Barriers

Government regulations on plastic usage present significant challenges for the flexible packaging industry. New laws targeting single-use materials force companies to redesign their packaging or face penalties. These regulations vary by state, creating compliance complexities for manufacturers operating across multiple markets.

Raw material price volatility creates ongoing financial pressure for packaging producers. The cost of petroleum-based materials fluctuates unpredictably, making it difficult for companies to maintain stable pricing. This uncertainty affects profit margins and forces businesses to frequently adjust their pricing strategies.

Flexible packaging cannot always match the protective qualities of rigid containers. Some products require stronger barrier protection against moisture, oxygen, or light that flexible materials struggle to provide. This limitation forces companies to choose between cost savings and product protection, sometimes resulting in shorter shelf life or quality issues.

Recycling infrastructure for complex multilayer flexible packaging remains inadequate across most U.S. regions. These materials often combine different plastics that cannot be separated easily, leading to waste management problems. Limited recycling options create environmental concerns and potential regulatory issues for companies using these packaging types.

Growth Factors

Innovation in Sustainable Materials and Smart Technologies Creates New Market Opportunities

The development of bio-based and compostable packaging materials represents a major growth opportunity. Companies are investing in plant-based alternatives that break down naturally, appealing to environmentally conscious consumers. These innovations help businesses meet sustainability goals while potentially avoiding future regulatory restrictions on traditional plastics.

Smart packaging technologies are opening new revenue streams for flexible packaging manufacturers. These systems can include sensors that track temperature, freshness, or location during shipping. Such capabilities provide valuable data to both manufacturers and consumers while creating premium product categories with higher profit margins.

The food and beverage industry continues expanding its use of flexible packaging to extend product shelf life. Advanced barrier films can keep foods fresh longer than traditional packaging, reducing waste and improving customer satisfaction. This trend is particularly strong in organic and premium food segments where freshness is crucial.

Healthcare applications for flexible packaging are growing rapidly, especially for sterile medical devices and pharmaceuticals. These products require specialized packaging that maintains sterility while remaining easy to open in medical settings. The aging U.S. population and increased healthcare spending drive continued growth in this high-value market segment.

Emerging Trends

Industry Shift Toward Recyclable Materials and Customization Drives Market Evolution

Manufacturers are increasingly adopting mono-material flexible packaging designs that use single plastic types instead of complex multilayer combinations. This approach makes recycling much easier and more cost-effective, addressing environmental concerns while simplifying waste management. The trend helps companies meet sustainability goals without sacrificing packaging performance.

Digital printing technology is revolutionizing how companies approach packaging design and production. This method allows for small-batch customization and rapid design changes without expensive tooling modifications. Brands can now create personalized packaging for specific markets or seasons, improving customer engagement and reducing inventory risks.

Stand-up pouches are becoming increasingly popular on retail shelves due to their space efficiency and consumer appeal. These packages take up less shelf space than traditional containers while providing excellent product visibility. Retailers prefer them because they can display more products in the same area, while consumers appreciate their convenience and modern appearance.

Collaborative partnerships between brands and recycling companies are creating circular economy models for flexible packaging. These arrangements ensure that used packaging gets properly processed and turned into new materials. Such partnerships help companies demonstrate environmental responsibility while potentially reducing raw material costs through recycled content usage.

Key U.S. Flexible Packaging Company Insights

Mondi maintained a strong presence in the U.S. flexible packaging market in 2024 through its innovation in sustainable materials. The company’s focus on recyclable and paper-based flexible formats positioned it to benefit from shifting consumer preferences and evolving regulatory frameworks demanding reduced plastic use. Its portfolio expansion enhanced customer adoption across retail and food sectors.

DS Smith emphasized circular economy principles, driving packaging solutions that maximize recyclability and efficiency. In 2024, its investment in fiber-based flexible alternatives supported growth in food service and e-commerce packaging. The company’s integration of lightweight and eco-efficient solutions strengthened its competitive position, aligning with consumer and industry sustainability goals.

Amcor continued to dominate through its scale, technological expertise, and global manufacturing network. The company’s investments in high-performance flexible packaging, including barrier films and resealable solutions, supported diverse applications from healthcare to beverages. In 2024, its strategic push toward bio-based polymers and recyclable films enabled it to meet rising U.S. regulatory and consumer demand for sustainability.

Constantia Flexibles reinforced its role with a focus on premium and sustainable flexible packaging for food, pharmaceutical, and personal care markets. In 2024, the company leveraged its expertise in aluminum-based packaging and mono-material solutions to expand in the U.S. Its balance between performance and recyclability positioned it as a preferred partner for brands transitioning to eco-friendly packaging.

This combination of sustainability leadership, technological innovation, and customer-focused solutions allowed these four players to remain key contributors to U.S. flexible packaging market growth in 2024.

Top Key Players in the Market

- Mondi

- DS Smith

- Amcor

- Constantia Flexibles

- Sealed Air

- Crown Holdings

- WINPAK LTD

- Bemis Company, Inc.

- Coveris Holdings S.A.

- TC Transcontinental

Recent Developments

- In Jul 2025, TedPack LLC announced the acquisition of Fairview International LLC, strengthening its global presence in flexible packaging solutions and expanding its customer base across North America and Europe. The move is expected to enhance TedPack’s production capacity and broaden its product portfolio in premium packaging formats.

- In Jun 2024, Eagle Flexible Packaging acquired a state-of-the-art SOMA Optima2 Wide Web Flexographic Printing Press, aimed at increasing efficiency and improving print quality. This investment highlights the company’s commitment to adopting advanced technologies to meet rising demand for sustainable and high-quality flexible packaging solutions.

- In Apr 2025, TOPPAN Holdings completed the acquisition of Sonoco’s TFP business, strengthening its advanced materials segment. The acquisition is anticipated to accelerate innovation in functional films and broaden market opportunities, particularly in electronics, healthcare, and sustainable packaging sectors.

Report Scope

Report Features Description Market Value (2024) USD 61.8 Billion Forecast Revenue (2034) USD 98.8 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Recycling Method (Mechanical Recycling, Chemical Recycling), By Packaging Type (Pouches, Bags, Wraps, Films, Sachets, Laminates, Others), By Material Type (Plastic, Polyethylene, Polypropylene, Polyethylene Terephthalate, Paper, Biopolymers, Aluminum Foil, Others), By End-Use (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Household Chemicals, Others) Competitive Landscape Mondi, DS Smith, Amcor, Constantia Flexibles, Sealed Air, Crown Holdings, WINPAK LTD, Bemis Company, Inc., Coveris Holdings S.A., TC Transcontinental Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Flexible Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

U.S. Flexible Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mondi

- DS Smith

- Amcor

- Constantia Flexibles

- Sealed Air

- Crown Holdings

- WINPAK LTD

- Bemis Company, Inc.

- Coveris Holdings S.A.

- TC Transcontinental