U.S. Cosmetic Packaging Market Size, Share, Growth Analysis By Material Type (Plastics, Glass, Metal, Paper and Paperboard), By Product Type (Bottles and Jars, Tubes and Sticks, Folding Cartons, Corrugated Transit Boxes, Flexible Sachets and Pouches, Others), By Dispensing Mechanism (Pump-based, Dropper/Pipette, Spray/Mist, Stick/Twist-up, Jar/Scoop), By Cosmetic Type (Skin Care, Color Cosmetics, Perfumes and Fragrances, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158086

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

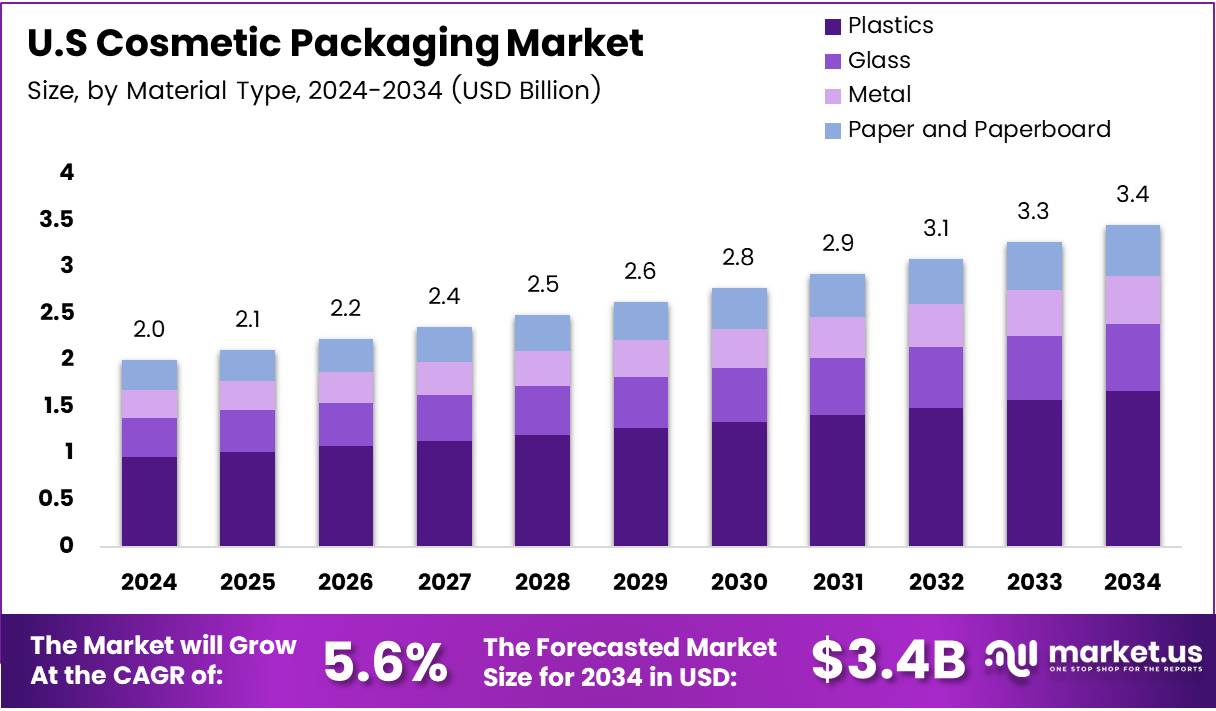

The U.S Cosmetic Packaging Market size is expected to be worth around USD 3.4 Billion by 2034, from USD 2.0 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The U.S. cosmetic packaging market represents an essential part of the country’s beauty and personal care industry. It includes primary packaging such as bottles, jars, and tubes, as well as secondary formats like cartons and boxes. These solutions safeguard formulations, build brand identity, and support regulatory compliance across an evolving consumer-driven market.

Driven by shifting consumer behaviors, the market has steadily grown with higher demand for sustainable and innovative designs. Brands are investing in eco-friendly materials, refillable systems, and smart packaging. This is creating opportunities for packaging firms to differentiate themselves and align with consumer values while strengthening partnerships with cosmetic manufacturers.

Additionally, government regulations around labeling, safety, and recyclability continue to shape market strategies. Federal agencies encourage sustainable manufacturing practices, while states like California promote extended producer responsibility. Such policies drive companies to adopt circular solutions and invest in biodegradable or recyclable cosmetic packaging materials to remain competitive and compliant.

E-commerce has also become a major growth driver, reshaping packaging needs. Beauty products increasingly require durable, ship-ready formats that prevent leakage and damage during transportation. This digital shift is encouraging manufacturers to re-engineer lightweight and protective packaging structures while balancing environmental sustainability and premium aesthetics.

Furthermore, brand investments in customization and design innovation remain strong. Influencer-driven sales and subscription boxes push companies to adopt creative and eye-catching packaging. This personalization trend positions packaging not just as a protective layer but as a marketing tool that enhances consumer experience and brand loyalty in a competitive environment.

According to the U.S. Bureau of Economic Analysis (BEA), consumer spending on personal care reached $387.5 billion in 2023 (PCE), highlighting a robust foundation for both primary and secondary cosmetic packaging demand. Additionally, the U.S. Census Bureau reported e-commerce’s retail share at 16.3% in Q2 2025, up from 16.1% a year earlier, reinforcing opportunities for ship-ready solutions.

Key Takeaways

- The U.S. Cosmetic Packaging Market is projected to reach USD 3.4 Billion by 2034, up from USD 2.0 Billion in 2024, with a CAGR of 5.6%.

- In 2024, Plastics led the market by material type with a 48.3% share, driven by versatility and cost-efficiency.

- Bottles and Jars dominated by product type with a 38.1% share, reflecting their wide use in skincare, haircare, and liquid cosmetics.

- Pump-based dispensing mechanisms held the lead with a 42.9% share, supported by demand for hygienic and precise application.

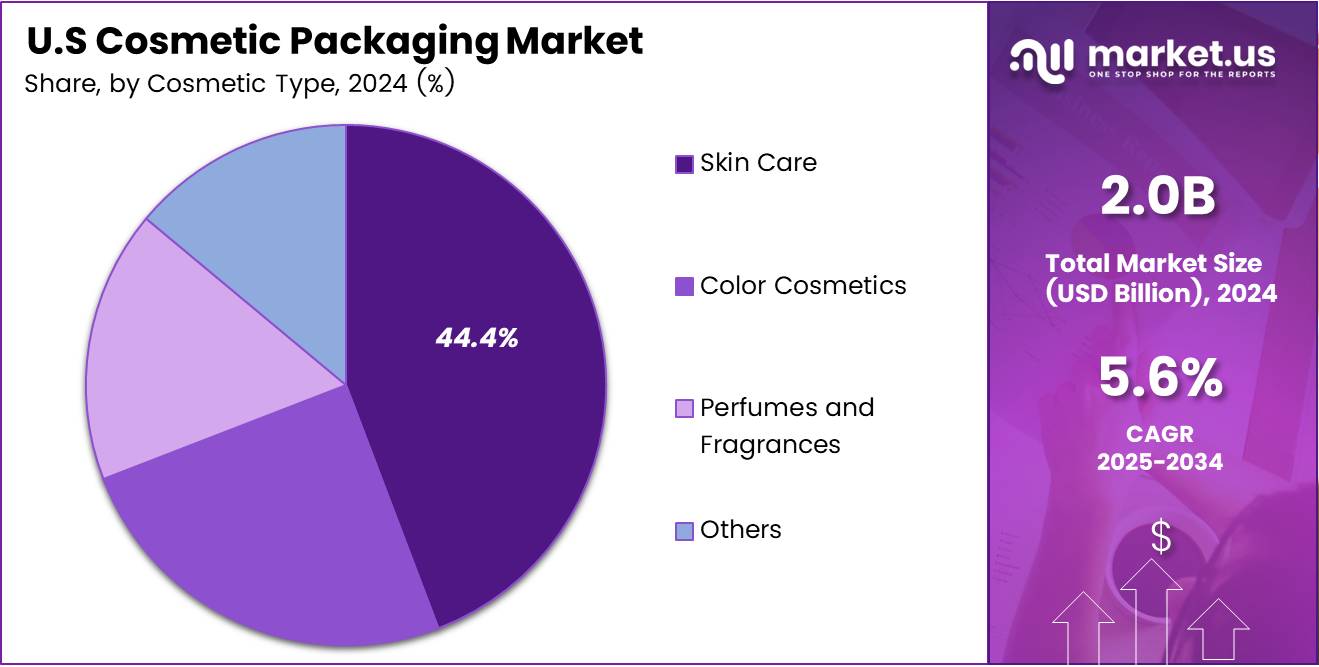

- Skin Care accounted for the largest cosmetic type share at 44.4%, fueled by rising focus on anti-aging and preventive beauty care.

Material Type Analysis

Plastics dominate with 48.3% due to their versatility and cost-effectiveness in cosmetic packaging applications.

In 2024, Plastics held a dominant market position in By Material Type Analysis segment of U.S Cosmetic Packaging Market, with a 48.3% share. This substantial market leadership reflects the material’s exceptional versatility, lightweight properties, and cost-effective manufacturing capabilities that align perfectly with diverse cosmetic packaging requirements.

Glass emerges as the second-most preferred material choice, particularly favored for premium cosmetic products where brand perception and product integrity are paramount. The material’s recyclability and premium aesthetic appeal continue to drive adoption among luxury beauty brands.

Metal packaging solutions maintain a specialized niche, offering superior barrier protection and extended shelf life for specific cosmetic formulations. Paper and Paperboard materials are gaining traction as sustainable alternatives, driven by increasing consumer environmental consciousness and regulatory pressures toward eco-friendly packaging solutions in the beauty industry.

Product Type Analysis

Bottles and Jars dominate with 38.1% due to their widespread application across multiple cosmetic categories.

In 2024, Bottles and Jars held a dominant market position in By Product Type Analysis segment of U.S Cosmetic Packaging Market, with a 38.1% share. This leadership position stems from their universal applicability across skincare, haircare, and liquid cosmetic products, offering reliable containment and user-friendly dispensing mechanisms.

Tubes and Sticks represent the second-largest segment, particularly popular for lip products, concealers, and cream-based cosmetics where precise application and portability are essential. Their squeeze-dispensing mechanism ensures controlled product usage and minimal waste.

Folding Cartons serve as essential secondary packaging, providing brand messaging space and product protection during retail display. Corrugated Transit Boxes ensure safe transportation and logistics efficiency. Flexible Sachets and Pouches are experiencing growth in sample packaging and travel-sized products, while the Others category encompasses specialized packaging solutions for niche cosmetic applications.

Dispensing Mechanism Analysis

Pump-based mechanisms dominate with 42.9% due to their precise dispensing control and hygienic application benefits.

In 2024, Pump-based held a dominant market position in By Dispensing Mechanism Analysis segment of U.S Cosmetic Packaging Market, with a 42.9% share. This commanding market presence reflects consumer preference for controlled, hygienic, and precise product dispensing, particularly crucial for liquid foundations, serums, and skincare products.

Dropper/Pipette mechanisms cater to high-value skincare products where precise dosage control is essential, such as facial oils and concentrated treatments. These mechanisms prevent contamination and ensure accurate application quantities.

Spray/Mist dispensers serve the fragrance and setting spray segments effectively, providing even distribution and user convenience. Stick/Twist-up mechanisms dominate the lip care and solid cosmetic categories, offering portability and easy application. Jar/Scoop dispensing remains popular for cream-based products where consumers prefer direct access and application control, particularly in premium skincare and makeup products.

Cosmetic Type Analysis

Skin Care dominates with 44.4% due to increasing consumer focus on skincare routines and wellness trends.

In 2024, Skin Care held a dominant market position in By Cosmetic Type Analysis segment of U.S Cosmetic Packaging Market, with a 44.4% share. This substantial market leadership reflects the growing consumer emphasis on comprehensive skincare regimens, anti-aging solutions, and preventive beauty care practices that require specialized packaging solutions.

Color Cosmetics represents a significant market segment, encompassing foundations, lipsticks, eyeshadows, and makeup products that demand innovative packaging designs for functionality and aesthetic appeal. The segment continues to evolve with trends toward customizable and refillable packaging solutions.

Perfumes and Fragrances maintain their specialized packaging requirements, focusing on brand differentiation and product preservation through sophisticated bottle designs and premium materials. The Others category includes emerging cosmetic segments such as men’s grooming products, organic beauty lines, and specialized treatment products that require unique packaging innovations to meet specific consumer and regulatory requirements.

Key Market Segments

By Material Type

- Plastics

- Polyethyler

- Polypropy

- Polyethyle

- Others

- Glass

- Metal

- Paper and Paperboard

By Product Type

- Bottles and Jars

- Tubes and Sticks

- Folding Cartons

- Corrugated Transit Boxes

- Flexible Sachets and Pouches

- Others

By Dispensing Mechanism

- Pump-based

- Dropper/Pipette

- Spray/Mist

- Stick/Twist-up

- Jar/Scoop

By Cosmetic Type

- Skin Care

- Facial Care

- Body Care

- Hair Care

- Color Cosmetics

- Perfumes and Fragrances

- Others

Drivers

Rising Demand for Premium Beauty Products Drives Market Growth

The U.S. cosmetic packaging market is experiencing strong growth driven by several key factors. Premium and luxury cosmetic brands are increasingly popular among American consumers, creating higher demand for sophisticated packaging solutions. These high-end products require elegant and durable packaging that reflects their quality and brand image.

The boom in online beauty shopping has created new packaging requirements. E-commerce sales need protective packaging that can withstand shipping while maintaining visual appeal when customers receive their orders. This dual need for durability and attractiveness is pushing packaging innovation forward.

Sustainability has become a major concern for beauty consumers. More shoppers are looking for brands that use eco-friendly, recyclable packaging materials. This shift is forcing cosmetic companies to rethink their packaging strategies and adopt greener alternatives.

The growing trend toward portable beauty products is also influencing packaging design. Consumers want travel-sized and on-the-go cosmetics that fit their busy lifestyles. This demand is driving innovation in compact, leak-proof, and user-friendly packaging formats that maintain product integrity while being convenient to use anywhere.

Restraints

Regulatory Compliance Challenges Restraint Market Expansion

The U.S. cosmetic packaging market faces several significant challenges that limit growth potential. The Food and Drug Administration (FDA) has strict rules about cosmetic packaging and labeling requirements. Companies must ensure their packaging meets all regulatory standards, which can be complex and costly to navigate, especially for smaller beauty brands.

Raw material price volatility creates ongoing challenges for packaging manufacturers. When prices for plastics, glass, and other packaging materials fluctuate unpredictably, it becomes difficult for companies to maintain consistent production costs and profit margins. This uncertainty affects pricing strategies and long-term planning.

Supply chain disruptions have become a persistent problem in recent years. When packaging materials or components are delayed or unavailable, it can halt entire production lines. These disruptions force companies to find alternative suppliers quickly or face product launch delays, which can significantly impact revenue and market competitiveness.

These restraints require cosmetic companies to build more resilient business models with flexible supplier networks and compliance expertise to successfully navigate the challenging regulatory and operational landscape.

Growth Factors

Expansion of Sustainable Packaging Solutions Creates Growth Opportunities

The U.S. cosmetic packaging market presents numerous exciting growth opportunities for forward-thinking companies. Refillable and reusable packaging systems are gaining momentum as consumers become more environmentally conscious. Brands that offer refill programs can build stronger customer loyalty while reducing environmental impact and long-term packaging costs.

Smart packaging technology represents a major opportunity for differentiation. Features like QR codes for authenticity verification and product tracking help combat counterfeiting while providing valuable consumer data. These technologies also enable brands to create interactive experiences that engage customers beyond the initial purchase.

The personalization trend is creating new market segments, particularly among independent and direct-to-consumer beauty brands. Custom packaging with individual names, colors, or designs allows smaller brands to compete with major corporations by offering unique, personal experiences that resonate with modern consumers.

Men’s grooming products are experiencing unprecedented growth, creating demand for entirely new packaging categories. This segment requires masculine design aesthetics and functional formats that appeal to male consumers, opening up fresh opportunities for packaging innovation and market expansion.

Emerging Trends

Minimalist Design Trends Shape Market Direction

Current trends in the U.S. cosmetic packaging market reflect changing consumer preferences and technological advancement. Clean, minimalist packaging designs are becoming increasingly popular as consumers gravitate toward simple, elegant aesthetics. This trend toward less-is-more design philosophy emphasizes quality over flashiness and appeals to environmentally conscious buyers.

Biodegradable materials are transforming packaging options across the industry. Paper-based alternatives and eco-friendly plastics are replacing traditional materials as brands respond to consumer demand for sustainable products. This shift represents both an environmental imperative and a marketing advantage for early adopters.

Interactive technology integration is revolutionizing how consumers engage with products. QR codes and augmented reality features allow brands to provide additional product information, tutorials, and personalized experiences directly through packaging. This technology bridges physical and digital marketing channels effectively.

Premium glass packaging is experiencing renewed popularity, particularly for high-end skincare and fragrance products. Glass conveys luxury and quality while being infinitely recyclable, making it attractive to both premium brands and environmentally conscious consumers seeking sophisticated packaging solutions.

Key U.S Cosmetic Packaging Company Insights

The U.S. cosmetic packaging market in 2024 is being shaped by the strategies of major global packaging leaders that continue to drive innovation, sustainability, and customization in beauty solutions. These players are enhancing value by focusing on lightweight materials, eco-friendly options, and e-commerce-ready formats.

Amcor plc has reinforced its presence in cosmetic packaging through a strong emphasis on recyclable and flexible solutions. The company is actively developing lightweight formats tailored for personal care brands, responding to U.S. consumer demand for sustainability without compromising on aesthetics.

AptarGroup Inc. remains a frontrunner with its dispensing and closure technologies for cosmetics and skincare. In 2024, its investments in airless packaging systems align with rising U.S. e-commerce trends, offering improved product protection during shipping and extended shelf life for sensitive formulations.

Gerresheimer AG is strengthening its footprint with premium glass and plastic cosmetic containers. The company is responding to demand from U.S. luxury beauty brands for high-quality, recyclable materials, ensuring that functionality and elegance remain central to packaging strategies across skincare and fragrance categories.

Silgan Holdings Inc. continues to deliver robust rigid plastic packaging solutions to cosmetic and personal care players. Its focus on lightweight, cost-effective designs has made it an attractive choice for mass-market U.S. brands that require both affordability and durability in packaging formats.

Together, these companies are setting the tone for competitive differentiation in 2024, with sustainability, e-commerce readiness, and product integrity driving their market relevance.

Top Key Players in the Market

- Amcor plc

- AptarGroup Inc.

- Gerresheimer AG

- Silgan Holdings Inc.

- Albéa Group

- WestRock Company

- HCT Group

- Quadpack

- Huhtamaki Oyj

- World Wide Packaging LLC

- WWP Beauty

Recent Developments

- In Aug 2025, Debut raised US$20 million to speed up its AI-driven ingredient discovery platform for skin longevity, aiming to bring novel formulations into beauty science. The funding will strengthen R&D pipelines and accelerate partnerships with skincare and wellness brands.

- In Oct 2024, Earthodic secured fresh funding to expand its bio-based coating technology across the US, targeting sustainable alternatives to petroleum-based coatings. The investment supports scaling production and meeting rising demand for eco-friendly packaging solutions.

- In May 2024, natural skincare brand Three Ships Beauty raised C$3.5 million to boost its US expansion, focusing on retail distribution and product development. The funding helps the brand strengthen its presence in clean beauty while scaling its manufacturing capabilities.

- In May 2025, Wonderskin raised US$50 million to expand its retail footprint and drive product development initiatives. The investment is expected to support innovation in high-performance beauty products and accelerate the brand’s global growth strategy.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Billion Forecast Revenue (2034) USD 3.4 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Plastics, Glass, Metal, Paper and Paperboard), By Product Type (Bottles and Jars, Tubes and Sticks, Folding Cartons, Corrugated Transit Boxes, Flexible Sachets and Pouches, Others), By Dispensing Mechanism (Pump-based, Dropper/Pipette, Spray/Mist, Stick/Twist-up, Jar/Scoop), By Cosmetic Type (Skin Care, Color Cosmetics, Perfumes and Fragrances, Others) Competitive Landscape Amcor plc, AptarGroup Inc., Gerresheimer AG, Silgan Holdings Inc., Albéa Group, WestRock Company, HCT Group, Quadpack, Huhtamaki Oyj, World Wide Packaging LLC, WWP Beauty Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Cosmetic Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

U.S. Cosmetic Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- AptarGroup Inc.

- Gerresheimer AG

- Silgan Holdings Inc.

- Albéa Group

- WestRock Company

- HCT Group

- Quadpack

- Huhtamaki Oyj

- World Wide Packaging LLC

- WWP Beauty