US Color Cosmetics Market Size, Share, Growth Analysis By Product (Face Color Cosmetics, Nail Color Cosmetics, Eye Color Cosmetics, Lip Color Cosmetics, Others), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Beauty Stores, Pharmacies & Drugstores, Online/E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147959

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

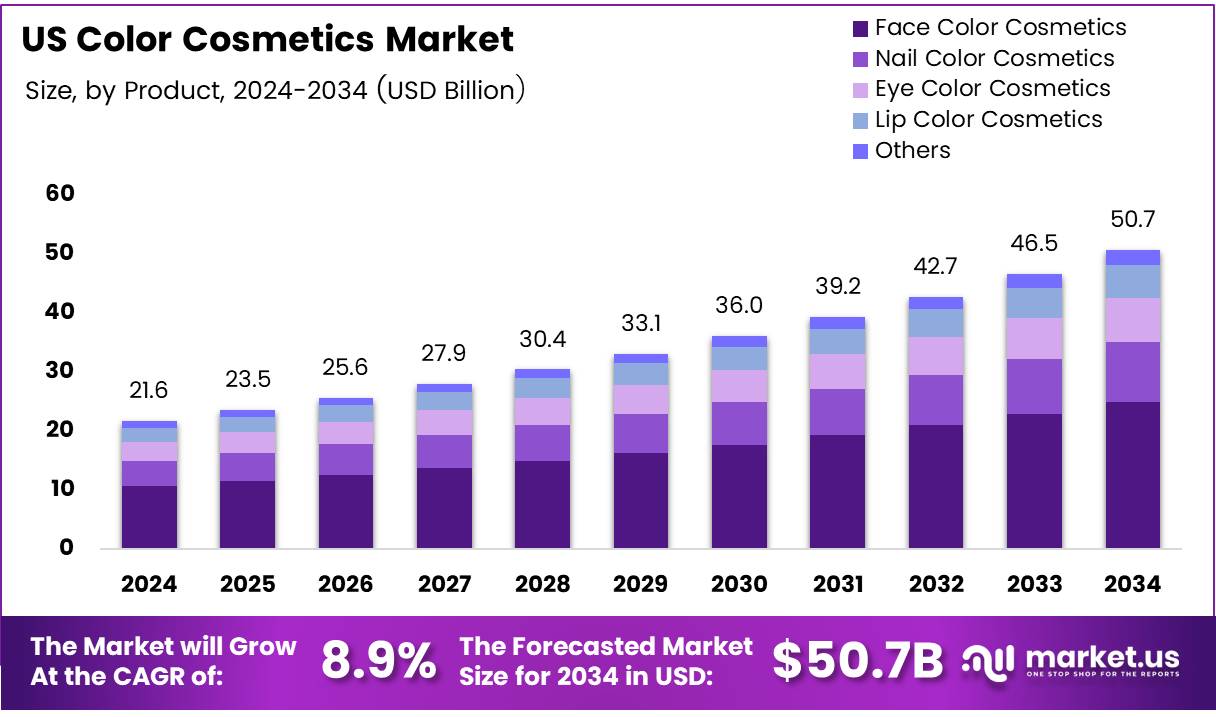

The US Color Cosmetics Market size is expected to be worth around USD 50.7 Billion by 2034, from USD 21.6 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034.

The U.S. Color Cosmetics Market refers to the segment of the beauty industry that includes products used for facial and body makeup—such as lipsticks, eyeliners, foundations, and blushes. These products are primarily used for enhancing appearance, expressing personality, and aligning with fashion trends.

The market has shown remarkable resilience and expansion. According to Forbes, the beauty industry generated $94.36 billion in cosmetics and beauty sales in 2023, demonstrating the sector’s strong consumer demand and economic significance. Color cosmetics continue to hold a major share of this figure.

From an analyst’s viewpoint, the market is evolving quickly due to innovation in textures, eco-friendly formulations, and inclusive shade ranges. Premiumization and digital-first marketing have allowed brands to target specific consumer groups, driving revenue. Growth is driven by Gen Z and millennial consumers looking for authenticity and diversity in makeup products.

Notably, branding strategies play a crucial role in color cosmetic success. According to Conceptsnc, 30% of brands use blue, another 30% opt for red, while 28% go with grey or black, and only 10% prefer yellow in their packaging. These color choices influence emotional engagement and purchasing decisions significantly.

There is a growing opportunity for indie and direct-to-consumer brands as consumers seek newness and uniqueness. Social commerce and influencer-led launches are making the market highly dynamic. Personalization and virtual try-ons are also reshaping consumer behavior and boosting conversion rates.

Government initiatives are becoming more noticeable. While not directly subsidizing cosmetics, agencies like the FDA regulate safety standards. These evolving compliance norms open space for brands that invest early in clean beauty and ingredient transparency to lead the market.

Consumer awareness of sustainable practices is pushing brands to invest in refillable packaging and cruelty-free formulas. With ESG goals tightening, companies focusing on green innovation are likely to gain favor with both regulators and shoppers.

In terms of investment, tech-integrated cosmetics and AI-based personalization tools are emerging hotspots. Venture capital is flowing into beauty-tech startups, highlighting a growing intersection between beauty and innovation that sustains long-term growth.

Key Takeaways

- US Color Cosmetics Market size is expected to reach USD 50.7 Billion by 2034, growing from USD 21.6 Billion in 2024 at a CAGR of 8.9%.

- Face Color Cosmetics held a dominant position in the By Product Analysis segment, capturing 40.2% of the market in 2024.

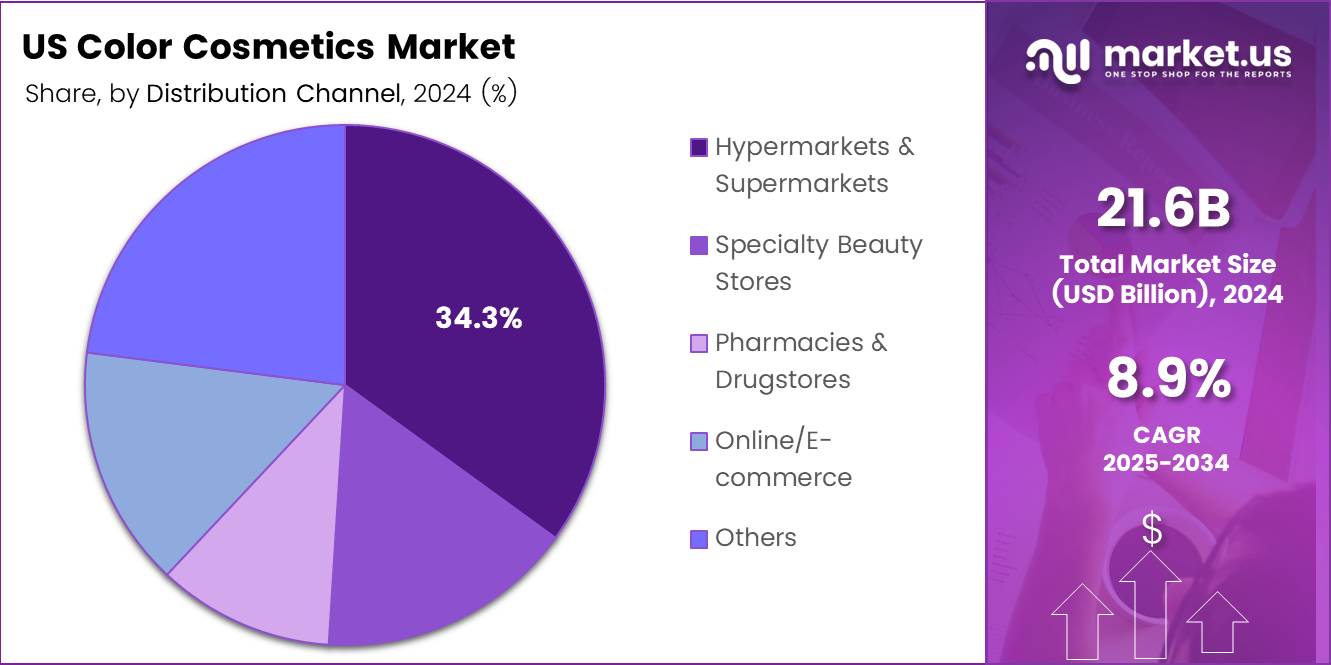

- Hypermarkets & Supermarkets dominated the By Distribution Channel Analysis segment with a 34.3% share in 2024.

Product Analysis

Face Color Cosmetics dominates the By Product Analysis segment of the US Color Cosmetics Market with a 40.2% share

In 2024, Face Color Cosmetics held a dominant market position in the By Product Analysis segment of the US Color Cosmetics Market, with a 40.2% share. This category includes products such as foundation, concealers, and blush.

These products are widely used for providing a base or enhancing facial features, leading to their substantial market share. Face Color Cosmetics are critical in the overall cosmetic routine, with their demand driven by the growing trend of personal grooming and beauty enhancement.

The increasing adoption of multifunctional face color products, including those offering skincare benefits, has also contributed to the growth of this segment. The popularity of long-lasting and full-coverage face cosmetics has further solidified its leading position in the market.

Distribution Channel Analysis

Hypermarkets & Supermarkets lead the By Distribution Channel Analysis segment of the US Color Cosmetics Market with a 34.3% share

In 2024, Hypermarkets & Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the US Color Cosmetics Market, with a 34.3% share.

These retail outlets serve as the primary point of purchase for a broad range of consumers, offering convenience and a wide variety of products under one roof. They cater to customers who prefer in-person shopping experiences and often feature promotions and discounts to attract shoppers.

This channel’s dominance can be attributed to the established consumer trust and the ability to provide competitive pricing, which drives volume sales.

Additionally, the large retail footprints of hypermarkets and supermarkets allow them to stock a wide variety of color cosmetics, appealing to diverse consumer needs. This, in turn, strengthens their position as the leading distribution channel for color cosmetics in the United States.

Key Market Segments

By Product

- Face Color Cosmetics

- Foundation

- Concealer

- Blush and Bronzer

- Powder

- Others

- Lip Color Cosmetics

- Lipstick

- Lip Liner

- Lip Gloss

- Lip Tint

- Others

- Eye Color Cosmetics

- Eye Shadow

- Eye Liner

- Mascara

- Eye Pencil

- False Eyelashes

- Others

- Nail Color Cosmetics

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Beauty Stores

- Pharmacies & Drugstores

- Online/E-commerce

- Others

Drivers

Rising Social Media Influence Boosts US Color Cosmetics Market

Social media platforms like TikTok and Instagram play a big role in how consumers discover and buy color cosmetics. Beauty influencers, makeup artists, and content creators share tutorials, reviews, and product recommendations that quickly go viral. This visibility increases awareness and creates demand, especially among younger consumers who are highly engaged online. As trends spread rapidly on social media, brands that collaborate with popular influencers often see immediate boosts in sales and engagement.

The expansion of inclusive shade ranges is another key factor driving market growth. Brands that provide a wide variety of shades to suit all skin tones attract a broader customer base and gain stronger loyalty.

Consumers today expect representation, and brands like Fenty Beauty have set a new standard by offering more inclusive product lines. This not only helps companies stand out but also supports long-term customer relationships.

Rising disposable income, particularly among millennials and Gen Z, also supports the premium segment of the market. With more spending power, these consumers are willing to invest in high-quality or luxury makeup products. This shift is encouraging brands to innovate with premium packaging, better formulations, and cleaner ingredients to meet evolving expectations. Altogether, these drivers—social media, inclusive products, and higher incomes—are fueling the ongoing growth of the US color cosmetics industry.

Restraints

Rising Ingredient Regulations Challenge US Color Cosmetics Market

One of the major challenges in the US color cosmetics market is the increasing regulation of ingredients. The Food and Drug Administration (FDA) has been tightening guidelines, and consumer demand for clean beauty is growing.

Brands now face more pressure to reformulate products without using controversial or banned substances. This increases production costs and limits the use of certain pigments or preservatives that were once common. As a result, some companies struggle to meet both compliance standards and consumer expectations at the same time.

Economic uncertainty is another significant restraint. With inflation and fears of a potential recession, many consumers are cutting back on non-essential spending. Luxury and high-end cosmetic items are often the first to be dropped from shopping lists when budgets are tight. This shift forces companies to adjust pricing strategies or expand their affordable product lines, which may affect profit margins. Overall, while the demand for color cosmetics remains, these restraints are likely to slow down short-term growth and make competition tougher for newer brands.

Growth Factors

Male Grooming Segment Expansion Presents New Market Opportunities

The growing acceptance of makeup among men is opening up new growth avenues in the US color cosmetics market. More male consumers are now exploring products like concealers, foundations, and brow enhancers as part of their grooming routines. This shift is breaking traditional gender norms and pushing brands to develop marketing campaigns and product lines that are inclusive and gender-neutral. Brands that cater to this emerging segment can tap into a fresh customer base and drive additional revenue.

Sustainability is another key opportunity. Consumers are becoming more environmentally conscious and prefer products that are refillable, recyclable, and cruelty-free. As a result, companies that adopt eco-friendly practices in packaging and formulation are likely to gain a competitive edge. This shift also encourages innovation in both product design and supply chains.

Lastly, the integration of augmented reality (AR) tools is revolutionizing how consumers shop for makeup online. Virtual try-on technology allows users to see how a product will look before buying, reducing returns and increasing customer satisfaction. Brands investing in AR not only enhance the shopping experience but also boost conversion rates. These opportunities—male grooming, sustainability, and AR—are set to drive future growth in the US color cosmetics market.

Emerging Trends

Celebrity & Influencer Brands Shape US Color Cosmetics Trends

Celebrity and influencer-owned beauty brands are having a strong impact on consumer choices in the US color cosmetics market. Labels like Fenty Beauty and Rare Beauty not only benefit from star power but also connect with audiences through authenticity and storytelling. These brands often launch with inclusive shade ranges and high-performance formulas, setting new standards and influencing what consumers expect from other beauty labels.

Another major trend is the rise of hybrid makeup-skincare products. Consumers are looking for cosmetics that do more than just enhance appearance—they want added skincare benefits like hydration, SPF protection, or anti-aging properties. This shift is driving innovation and pushing brands to create products that support both beauty and skin health.

Customization and personalization are also gaining momentum, especially among Gen Z. Young consumers want products that match their unique needs, whether it’s a foundation perfectly suited to their skin tone or a palette they can build themselves.

Digital tools and quizzes help brands offer tailored solutions, making customers feel more connected to the product. Overall, these trends highlight the evolving expectations of beauty consumers and offer valuable insights for brands aiming to stay competitive.

Key Players Analysis

In 2024, Fenty Beauty continues to be a dominant force in the US Color Cosmetics Market, known for its inclusive product range that appeals to a wide spectrum of skin tones. The brand has successfully tapped into the growing demand for diversity in beauty products, securing a loyal customer base and maintaining robust sales.

LVMH Moët Hennessy Louis Vuitton SE, a luxury conglomerate, has further solidified its position in the color cosmetics market with its strategic acquisition of Sephora and investments in high-end beauty lines. Their emphasis on luxury and exclusivity enables them to target premium segments, positioning their cosmetics portfolio as a leader in innovation and quality.

e.l.f. Beauty has seen remarkable growth due to its commitment to offering affordable, high-quality products. Its direct-to-consumer model, combined with a strong presence in drugstores, has enabled e.l.f. to rapidly expand its reach, making it a key player in the budget-friendly color cosmetics sector.

Huda Beauty has built a massive following thanks to its unique brand identity, influencer-driven marketing, and a wide variety of high-performance makeup products. Its strong social media presence and trendsetting products have allowed it to remain at the forefront of the US color cosmetics market, appealing to both luxury and middle-market consumers.

Top Key Players in the Market

- Fenty Beauty

- LVMH Moët Hennessy Louis Vuitton SE

- e.l.f. Beauty

- Huda Beauty

- The Estée Lauder Companies Inc.

- Coty Inc.

- Revlon

- Shiseido Americas

- L’Oréal USA

- Haus Labs by Lady Gaga

Recent Developments

- In January 2025, Daash secured $5.5 million in its second seed funding round to cater to the beauty industry’s increasing demand for AI-powered competitive insights. The funds will help Daash enhance its data analytics capabilities and expand its customer base.

- In March 2025, Mila Beaute raised Rs 18 crore in a pre-series A funding round led by Rukam Capital. The company plans to use Rs 5 crore of the funds to build a state-of-the-art manufacturing facility, strengthening its production capabilities.

- In September 2024, Pilgrim announced the leveraging of $9 million in Series B funding to boost its research and development efforts. The company also aims to expand its offline presence, further establishing its market footprint.

Report Scope

Report Features Description Market Value (2024) USD 21.6 Billion Forecast Revenue (2034) USD 50.7 Billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Face Color Cosmetics, Nail Color Cosmetics, Eye Color Cosmetics, Lip Color Cosmetics, Others), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Beauty Stores, Pharmacies & Drugstores, Online/E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fenty Beauty, LVMH Moët Hennessy Louis Vuitton SE, e.l.f. Beauty, Huda Beauty, The Estée Lauder Companies Inc., Coty Inc., Revlon, Shiseido Americas, L’Oréal USA, Haus Labs by Lady Gaga Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Color Cosmetics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

US Color Cosmetics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fenty Beauty

- LVMH Moët Hennessy Louis Vuitton SE

- e.l.f. Beauty

- Huda Beauty

- The Estée Lauder Companies Inc.

- Coty Inc.

- Revlon

- Shiseido Americas

- L’Oréal USA

- Haus Labs by Lady Gaga