Global Upcycled Food Products Market Size, Share, And Industry Analysis Report By Source (Food Waste, Agricultural by Products, Brewery and Distillery Waste), By Type (Food and Beverages, Personal Care Products, Household Products, Pet Food, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169093

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

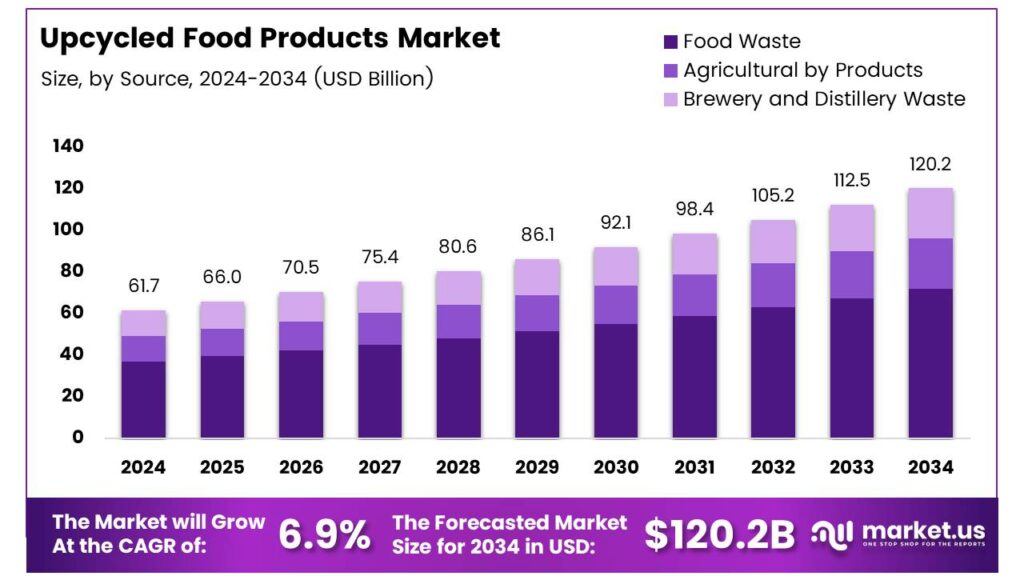

The Global Upcycled Food Products Market size is expected to be worth around USD 120.2 billion by 2034, from USD 61.7 billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The upcycled food products concept refers to food and ingredients made from by-products that otherwise leave the human food chain. Instead of discarding surplus pulp, grains, peels, or trimmings, producers convert them into safe, nutritious foods. Consequently, upcycled foods improve resource efficiency, protect farm value, and strengthen sustainable food systems.

Certification and verification strengthen trust and transactions. The Upcycled Food Association, its certification program has prevented 840 million pounds or over 381 million kilograms of food waste annually. This transparency reassures buyers, supports regulatory compliance, and accelerates corporate commitments, positioning the market as both commercially scalable and environmentally impactful.

- Economic inefficiencies further emphasize opportunity. Global food waste costs approximately USD 1 trillion annually, while 28% of agricultural land produces food never eaten. Through auditable supply chains, upcycled food recovers lost value, preserves nutrients, and enables farmers to extract higher returns from existing farmland resources. Environmental data highlights the market’s strategic significance. Food loss and waste contribute 8% of human-caused greenhouse gas emissions globally.

The Upcycled Food Products Market represents the commercial expansion of this waste-reduction philosophy across packaged foods, ingredients, beverages, and functional nutrition. As sustainability purchasing becomes mainstream, manufacturers increasingly integrate upcycled ingredients into core portfolios. Therefore, the market aligns closely with circular economy, clean-label food, and responsible sourcing strategies.

Key Takeaways

- The Global Upcycled Food Products Market is projected to grow from USD 61.7 billion in 2024 to USD 120.2 billion by 2034 at a 6.9% CAGR.

- Food Waste is the leading source segment, holding a dominant share of 58.2% due to high availability and efficient recovery potential.

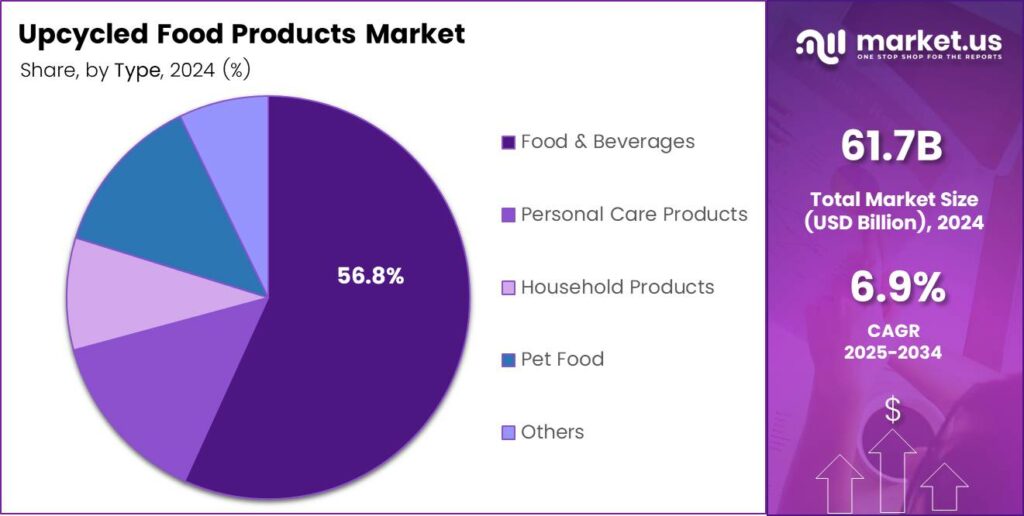

- Food and Beverages dominate the type segment with a market share of 56.8%, driven by strong consumer adoption.

- Offline Distribution remains the primary sales channel, accounting for 69.3% of total market share.

- North America leads the global market with a share of 37.2%, valued at USD 22.9 billion in 2024.

By Source Analysis

Food Waste dominates with 58.2% share due to scalable recovery opportunities and strong sustainability alignment.

In 2024, Food Waste held a dominant market position in the By Source Analysis segment of the Upcycled Food Products Market, with a 58.2% share. This segment benefits from large volumes of discarded produce, grains, and processed food residues. Moreover, structured collection systems enable efficient conversion into value-added ingredients.

Agricultural by Products represent a steadily emerging source, supported by crop residues such as husks, peels, and bran. Consequently, processors increasingly integrate these materials into food formulations. Transitioning away from disposal, agricultural by-products provide reliability, traceability, and consistent quality for upcycled production models.

Brewery and Distillery Waste continues to gain traction due to nutrient-rich spent grains and fermentation residues. Subsequently, food innovators repurpose these inputs into flours, snacks, and nutrition products. This source aligns well with circular economy goals, especially in regions with dense brewing and distillation activity.

By Type Analysis

Food and Beverages leads with 56.8% share driven by direct consumer adoption and functional positioning.

In 2024, Food and Beverages held a dominant market position in the By Type Analysis segment of the Upcycled Food Products Market, with a 56.8% share. This category benefits from strong retail visibility, clean-label positioning, and compatibility with sustainability-focused consumption trends across urban markets.

Personal Care Products leverage upcycled ingredients such as fruit extracts and plant residues for natural formulations. Gradually, brands adopt these inputs to enhance eco-credentials. As a result, upcycled sourcing supports differentiation while maintaining ingredient performance and compliance requirements.

Household Products integrate upcycled materials in cleaners and lifestyle goods, emphasizing waste reduction narratives. Meanwhile, Pet Food applications use nutrient-dense by-products to improve formulation efficiency. Others include niche uses where innovation pilots support future commercial expansion.

By Distribution Channel Analysis

Offline dominates with 69.3% share supported by retail trust and physical product discovery.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Upcycled Food Products Market, with a 69.3% share. Supermarkets and specialty stores drive visibility, allowing consumers to physically evaluate sustainability claims and ingredient transparency.

Online distribution plays a complementary role by enabling brand storytelling and direct-to-consumer engagement. Increasingly, digital platforms help educate shoppers about upcycling benefits. Although smaller in share, online channels support innovation testing and targeted marketing strategies for emerging upcycled brands.

Key Market Segments

By Source

- Food Waste

- Agricultural by Products

- Brewery and Distillery Waste

By Type

- Food and Beverages

- Personal Care Products

- Household Products

- Pet Food

- Others

By Distribution Channel

- Online

- Offline

Emerging Trends

Clean-Label Positioning and Story-Driven Branding Shape Market Trends

One key trend in the upcycled food products market is clean-label positioning. Brands are keeping ingredient lists short and simple, while clearly explaining the origin of upcycled inputs. Transparency builds trust and aligns with modern consumer expectations. Story-driven branding is gaining importance. Companies share the journey of how unused food becomes a new product.

- This educational approach helps consumers connect emotionally with sustainability goals and supports repeat purchases. The Food and Agriculture Organization of the United Nations (FAO), around one-third of all food produced for human consumption worldwide is lost or wasted each year, amounting to roughly 1.3 billion tonnes.

Digital retail channels are further shaping trends. Online platforms allow brands to explain product benefits in detail, which is helpful for new concepts like upcycled food. Social media storytelling also boosts visibility and engagement. Upcycled ingredients are now used in protein powders, flour blends, snacks, sauces, and beverages. This expansion shows that upcycling is moving from niche to mainstream food categories.

Drivers

Rising Focus on Food Waste Reduction and Resource Efficiency Drives Market Growth

The upcycled food products market is strongly driven by the growing focus on reducing food waste across the global food system. Large volumes of food are lost during farming, processing, and distribution, creating economic and environmental pressure. Upcycled foods convert these unused ingredients into safe, valuable products, helping industries improve material efficiency.

- Many shoppers now prefer products that clearly support environmental goals. Upcycled food products match this mindset by showing how waste can be reused instead of discarded. This message is simple, visible, and easy for brands to communicate. UNEP and FAO estimates, food loss and waste contribute between 8% and 10% of global greenhouse-gas emissions — a share larger than many entire industries.

Government policies also support this growth. Several regions promote circular economy models and food waste diversion strategies. These policies encourage food producers to recover by-products and redirect them into new food items. Upcycled food fits well within regulatory goals.

Restraints

Complex Supply Chains and Quality Consistency Limit Market Expansion

One major restraint in the upcycled food products market is supply inconsistency. Food waste streams vary by season, location, and processing activity. This makes it difficult for manufacturers to secure steady input volumes throughout the year. By-products often differ in moisture, nutrition, and contamination risk. Extra processing, testing, and sorting are needed to meet food safety rules.

- Regulatory clarity is also limited in some regions. Definitions around “upcycled” ingredients are still evolving, causing uncertainty for labeling and approvals. The United Nations Environment Programme (UNEP) estimates that 13.2% of food is lost between harvest and retail, while another 19% is wasted at the retail, food-service, and household level.

Consumer trust can act as a restraint as well. Some buyers still associate upcycled foods with waste rather than value. Companies must invest heavily in education and transparency to overcome this perception gap. Without clear messaging, adoption can remain slow in certain markets.

Growth Factors

Expansion of Sustainable Food Brands Opens New Growth Opportunities

The market presents strong growth opportunities as more food brands adopt sustainability-driven portfolios. Startups and established companies are launching products that highlight waste reduction, creating space for innovation in snacks, bakery, beverages, and ingredients.

Food service and institutional buyers also offer opportunity. Hotels, cafeterias, and corporate dining programs actively look for visible sustainability actions. Upcycled foods allow them to reduce waste while improving public image. Technology improvements create further opportunity. Better drying, fermentation, and preservation methods help stabilize by-products and extend shelf life.

Partnerships across the value chain are increasing. Farmers, processors, and food brands are collaborating to secure by-product streams and develop new formulations. Such partnerships reduce risk and improve supply reliability, supporting long-term market growth.

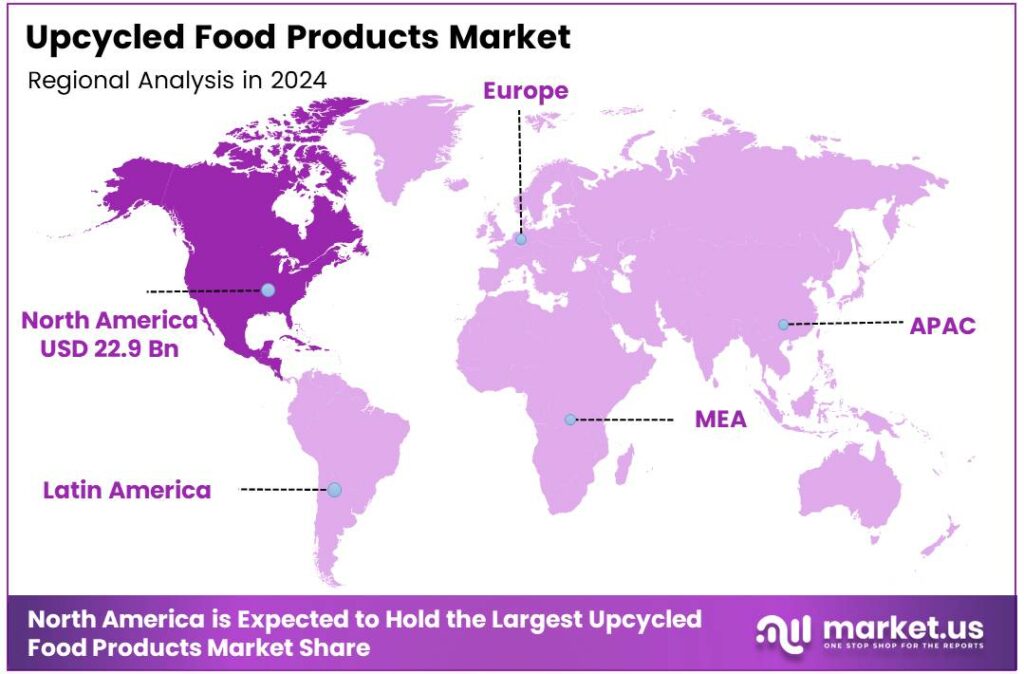

Regional Analysis

North America Dominates the Upcycled Food Products Market with a Market Share of 37.2%, Valued at USD 22.9 Billion

North America leads the upcycled food products market due to strong consumer awareness around food waste reduction and sustainable consumption. In 2024, the region accounted for a 37.2% market share, with the market valued at USD 22.9 billion, reflecting its advanced sustainability ecosystem. Supportive regulations, clear labeling frameworks, and growing retailer acceptance continue to strengthen regional demand.

Europe represents a mature and regulation-driven market for upcycled food products, supported by strict food waste reduction policies and circular economy goals. Strong alignment with sustainability standards encourages food manufacturers to repurpose surplus raw materials into value-added products. Consumer preference for eco-labeled and traceable foods further supports market expansion.

Asia Pacific is emerging as a high-potential region, driven by rising urbanization and increasing food loss across supply chains. Growing awareness of sustainable diets is encouraging manufacturers to invest in waste-to-value food processing. Expanding middle-class consumption also supports diversified product launches using rescued ingredients. Government-led food security initiatives further create favorable conditions for market development.

The Middle East and Africa market is gradually developing as food security and resource efficiency gain policy attention. High dependency on food imports encourages initiatives focused on minimizing waste and improving value extraction. Emerging sustainability programs support the adoption of upcycled ingredients across packaged foods. However, market expansion remains nascent, supported mainly by pilot projects and awareness-building efforts.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Abokichi positions itself as a creative front-runner in the upcycled food space by turning overlooked ingredients into premium pantry products. The company’s focus on flavor-forward innovations and clear storytelling around food waste reduction helps it connect with urban, sustainability-conscious consumers. As it scales, disciplined distribution partnerships and brand education will be critical to defend its niche positioning.

Superfrau brings a beverage-led approach, transforming surplus or side-stream ingredients into functional drinks with a wellness angle. By combining upcycling with gut-health and energy narratives, it taps into multiple high-growth consumer trends at once. However, it must carefully manage pricing, logistics, and shelf placement to remain competitive against larger functional beverage brands.

The Spare Food Co. acts as a category evangelist, building products and narratives that reframe “waste” as a premium, climate-positive resource. Its strategy of collaborating across the value chain—from foodservice partners to ingredient suppliers—helps unlock scalable access to side streams. The key success factor will be converting these partnerships into repeatable, profitable models that can withstand volatility in supply.

Alice and Ambre Inc. adds a more lifestyle- and design-driven dimension to upcycled food, emphasizing branding, packaging, and consumer experience. By making sustainability feel aspirational rather than sacrificial, the company strengthens willingness to pay and encourages trial among mainstream shoppers. Going forward, disciplined innovation management and channel selection will determine whether its strong brand identity can translate into sustained, global growth.

Top Key Players in the Market

- Abokichi

- Superfrau

- The Spare Food Co.

- Alice and Ambre Inc.

- Riff Cold Brewed

- Diana’s Bananas, LLC.

- Blue Stripes LLC.

- ReGrained

Recent Developments

- In 2024, Abokichi made its popular OKAZU Ginger Miso flavor a permanent offering, responding to customer demand after limited releases. This builds on their upcycled approach by incorporating surplus ginger and miso byproducts into the versatile condiment.

- In 2024, Superfrau was selected as one of two winners in a Nestlé Health Science and Tufts University startup challenge, recognizing its innovative use of upcycled whey for functional beverages. This partnership could accelerate scaling and distribution.

Report Scope

Report Features Description Market Value (2024) USD 61.7 billion Forecast Revenue (2034) USD 120.2 billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Food Waste, Agricultural by Products, Brewery and Distillery Waste), By Type (Food and Beverages, Personal Care Products, Household Products, Pet Food, Others), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Abokichi, Superfrau, The Spare Food Co., Alice and Ambre Inc., Riff Cold Brewed, Diana’s Bananas, LLC., Blue Stripes LLC., ReGrained Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Upcycled Food Products MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Upcycled Food Products MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abokichi

- Superfrau

- The Spare Food Co.

- Alice and Ambre Inc.

- Riff Cold Brewed

- Diana's Bananas, LLC.

- Blue Stripes LLC.

- ReGrained