Global Ultra-High-Speed Wi-Fi Market By Speed (1GB, 1.1-10GB, and Above 10GB), By End-Use Industry (Military, IT & Telecom, Entertainment & Media, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Dec. 2024

- Report ID: 102868

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

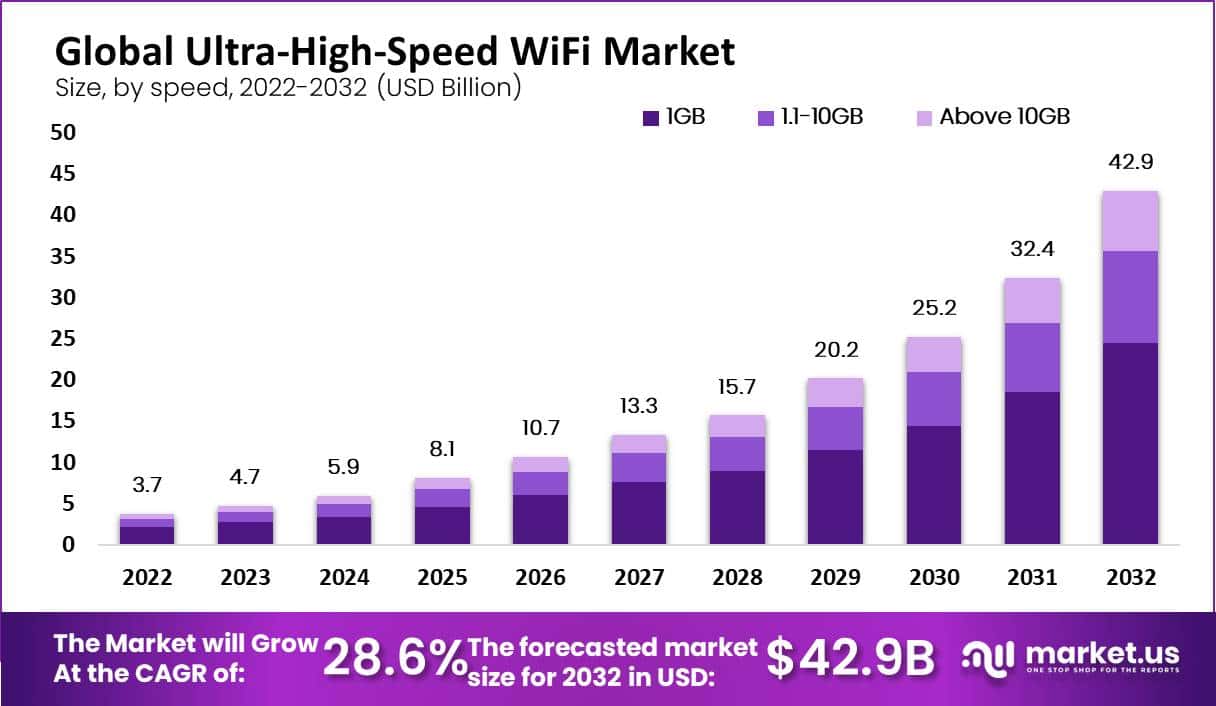

In 2022, the global ultra-high-speed WiFi market was valued at USD 3.7 billion and will reach US$ 42.9 billion by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 28.6%.

The global ultra-high-speed WiFi market refers to wireless internet connectivity that provides the highest speed data transfer rates. Ultra-high-speed Wi-Fi technology supplies internet connectivity with speeds of up to a few gigabits per second and is used in different applications like gaming, video streaming, online education, teleconferencing an also other bandwidth-intensive applications.

The demand for ultra-high-speed Wi-Fi technology is maximizing globally owing to the rising need for faster internet connectivity, maximizing adoption of smart devices as well as the rising popularity of high bandwidth applications.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth: The ultra-high-speed WiFi market soared from USD 3.7 billion in 2022 to a projected USD 42.9 billion by 2032, representing a staggering 28.6% CAGR.

- Definition: Ultra-high-speed Wi-Fi technology enables data transfer rates of several gigabits per second, catering to applications like gaming, video streaming and online education.

- Trends: The adoption of 5G technology impacts the ultra-high-speed Wi-Fi market, while the growing focus on security drives demand for secure networks capable of warding off cyber threats.

- Opportunity: Rising cloud-based service adoption and the growing demand for remote work and online education offer opportunities for businesses to provide tailored ultra-high-speed Wi-Fi services for remote workers and students.

- Driving Factors: The 1GB segment boasts 57% revenue share, driven by increasing demand for high-speed internet, improvements to 5G and Wi-Fi 6 technologies, and the advent of cloud services and IoT adoption.

- Restraints: Challenges include prohibitive costs of Wi-Fi 6 network implementation, limited high-speed internet infrastructure availability, and pandemic-induced delays affecting high-speed data transfer.

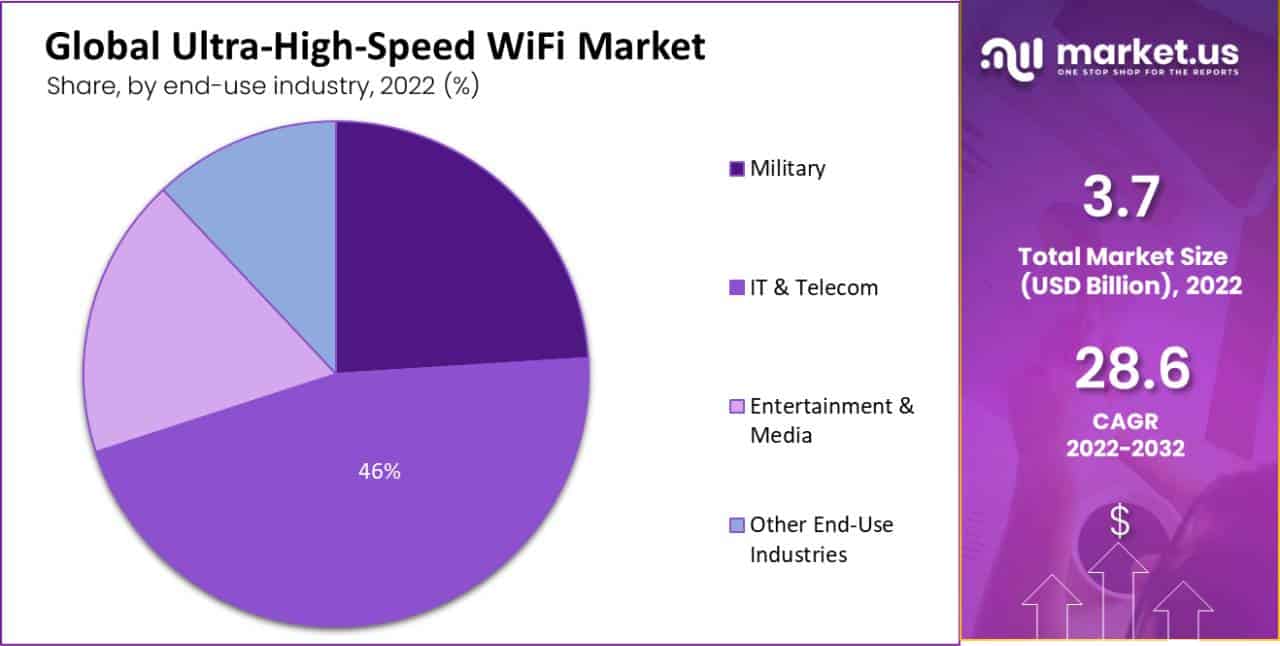

- Market Segments: The 1GB segment caters to residential and small business users, while the IT & Telecom sector holds the largest revenue share (46%), followed by entertainment, media, and military sectors.

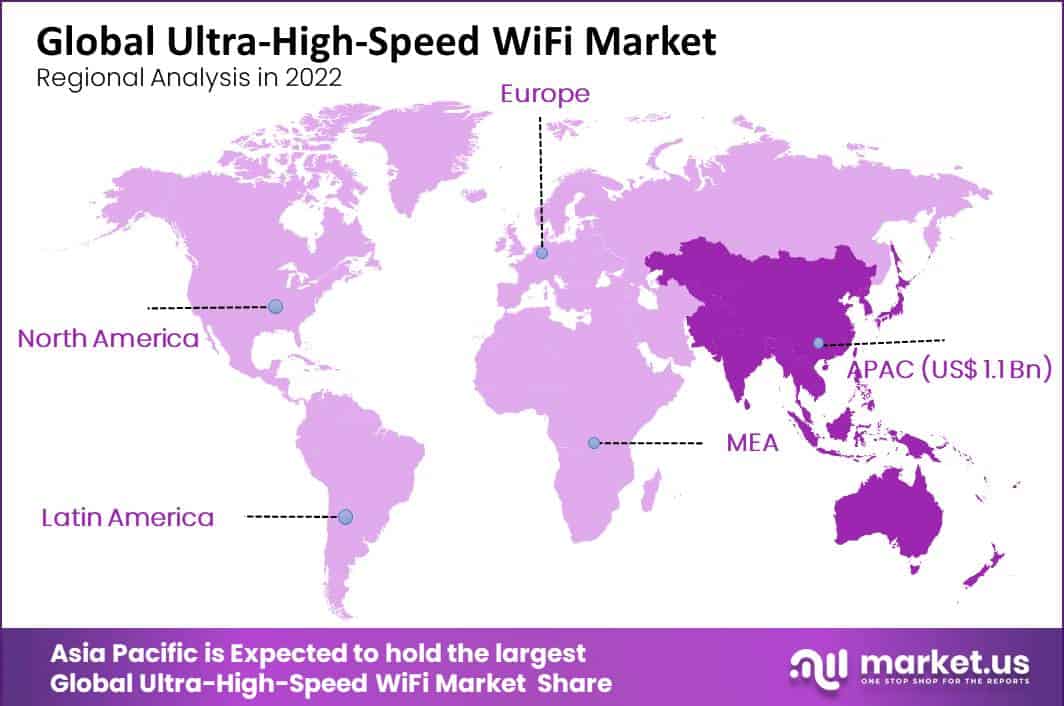

- Regional Analysis: Asia Pacific leads with 29% market share, followed by North America and Europe, while the Middle East & Africa market gains traction due to increased demand for internet services and smart home applications.

- Key Players: Market leaders include Huawei Technologies, Ericsson, Nokia Corporation, Cisco Systems, Qualcomm Technologies, and others, contributing to the competitive industry landscape.

Drivers

The global ultra-high-speed WiFi market is starting to be driven by a few factors that are contributing to its growth. Firstly, there is a maximizing demand for high-speed internet connection as more devices or applications need faster speeds. This demand has been spurred on by improvements in technology like the advancement of 5G networks, Wi-Fi 6, or mesh networking. They have made it possible to achieve faster as well as most reliable Wi-Fi speeds.

Moreover, the maximizing adoption of cloud-based services like video streaming, gaming, or online collaboration, has made the need for ultra-high-speed Wi-Fi to support these services. The maximization of the Internet of Things and the proliferation of IoT devices has also made the need for ultra-high-speed Wi-Fi networks to operate the most beige amounts of data generated by these devices.

The COVID-19 pandemic has also accelerated the trend of remote work or distance learning, increasing the demand for ultra-high-speed Wi-Fi to support these activities. Finally, increasing investment in Wi-Fi infrastructure by governments as well as private organizations is helping to provide faster & more reliable internet connectivity to consumers and also businesses.

Restraints

The global ultra-high-speed WiFi market faces a few restraints that may hinder its growth & development. The price of implementing or maintaining ultra-high-speed Wi-Fi 6 networks can be prohibitively expensive for a few businesses like consumers, particularly in developing countries. This limits the market potential or adoption of ultra-high-speed Wi-Fi technologies.

The availability and also accessibility of high-speed internet infrastructure like fiber optic cables, can also limit the increase of the ultra-high-speed Wi-Fi market. Without robust & reliable internet infrastructure, it is difficult to achieve the high data transfer rates as well as the lowest latency that ultra-high-speed Wi-Fi promises.

Speed Analysis

The 1GB Segment is Dominant in the Ultra-high-speed WiFi Market.

Based on type, the market for global ultra-high-speed Wi-Fi is segmented into 1 GB, 1.1-10GB, and above 10 GB. The 1GB segment is the most lucrative in the global ultra-high-speed Wi-Fi market, with a projected CAGR of 28.6%. The total revenue share of 1GB type ultra-high-speed Wi-Fi was 57% in the global ultra-high-speed Wi-Fi market in 2022.

The 1GB segment is Wi-Fi solutions that offer speeds of up to 1 Gigabit per second. This type of Wi-Fi is suitable for residential users, small businesses as well as lowest density environments. 1.1-10GB, the segment includes Wi-Fi solutions that offer speeds ranging from 1 to 10 Gbps. This type of Wi-Fi is suitable for medium to large businesses, high-density environments an also applications that require high bandwidth like video streaming & online gaming.

By End-Use Industry

The IT & Telecom Segment is Dominant in Ultra-high-speed WiFi Market

Based on end-user, the market is segmented into military, it & telecom, entertainment & media, and other end-user industries. Among these end-users, the IT & Telecom fragment is estimated to be the most lucrative fragment in the global ultra-high-speed Wi-Fi market, with the largest revenue share of 46%.

The military segment is expected to significantly account for the rise of the ultra-high-speed Wi-Fi market, given the need for secure & reliable communication networks in military operations. The entertainment & media segment is another significant end-user of ultra-high-speed Wi-Fi, with the maximizing adoption of video streaming services and also online gaming. Other end-user industries like healthcare as well as education, are also expected to drive the demand for ultra-high-speed Wi-Fi in the coming years.

Note: Actual Numbers Might Vary In Final Report

Key Market Segments

Based on Speed

- 1GB

- 1-10GB

- >10GB

Based on End-User Industry

- Military

- IT & Telecom

- Entertainment & Media

- Other End-Use Industries

Opportunity

Opportunity is the maximizing demand for high-speed internet connectivity owing to the proliferation of internet-connected devices like smartphones, tablets, laptops as well as IoT devices. As the number of connected devices continues to grow, the demand for faster & more reliable Wi-Fi networks will also rise. This presents an opportunity for businesses to spend money on other things that offer ultra-high-speed Wi-Fi services to meet the maximum demand.

Exceptional opportunity lies in the rising adoption of cloud-based services or applications, which require fast or reliable internet connectivity. Meanwhile, the increasing need for remote work as well as online education owing to the COVID-19 pandemic has highlighted the importance of reliable or fast internet connectivity. This has led to a maximized demand for ultra-high-speed Wi-Fi networks that can support remote work an also online education. This presents an opportunity for businesses to offer ultra-high-speed Wi-Fi services that cater to the needs of remote workers & students.

Trends

The adoption of 5G technology is now maximizing or it is expected to have a significant impact on the ultra-high-speed Wi-Fi market. With 5G users will have access to faster & more reliable internet connectivity and which may lead to a decrease in demand for ultra-high-speed Wi-Fi in a few markets.

As the number of connected devices, and also data transmitted over Wi-Fi networks increases, there is a rising focus on security. This has led to a raised demand for secure ultra-high-speed Wi-Fi networks that can protect against cyber threats.

Regional Analysis

Asia Pacific is forecast to be the most profitable market in the global ultra-high-speed Wi-Fi Market, with a share of 29%. Asia-Pacific has seen a meteoric maximization in the demand for ultra-high-speed Wi-Fi owing to smartphone adoption and online gaming/streaming activity.

North America, on the other hand, already boasts an established market for such services owing to its high internet penetration rate. The US is the major market for ultra-high-speed WiFi owing to the rapid adoption of technology & infrastructure development. Europe also enjoys high internet penetration rates as well as increasing demand for IoT devices.

The Middle East & Africa are rapidly upcoming major markets for ultra-high-speed Wi-Fi owing to the increasing demand for internet services and the proliferation of smart homes and buildings. UAE, Saudi Arabia, and South Africa are the primary hubs in this region for this technology.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Global Ultra-high-speed WiFi market is a highly competitive & fragmented industry, with some players operating in the market. Recent key players in the market include Huawei Technologies, Ericsson, Nokia Corporation, Cisco Systems, Qualcomm Technologies, Arris International, Extreme Networks, HPE Aruba as well as Aerohive.

Market Key Players

Listed below are some of the most prominent Ultra-high-speed Wi-Fi industry players.

- Charter Communications

- Comcast

- Midcontinent Communications

- Altice

- Cox Communications

- Insight Communications

- Verizon

- SureWest Broadband

- ATandT

- ChinaMobile

- Changcheng

- China Unicom

- ASAHI Net Inc.

- KT Corp

- LGU

- SKBroadband

- Spectrum

- Other Key Players

Recent Developments

- In June 2021, the global satellite operator SES introduced that it was partnering with Microsoft to launch Azure Orbital, a ground station service that will enable satellite operators to communicate with their spacecraft & process their data in the cloud.

- In August 2021, Nokia announced that it had partnered with Charter Communications to provide 10Gbps broadband services to its customers. The service will use Nokia’s XGS-PON technology to deliver ultra-high-speed internet to Charter’s subscribers.

Report Scope

Report Features Description Market Value (2022) USD 3.7 Bn Forecast Revenue (2032) USD 42.9 Bn CAGR (2023-2032) 28.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Speed-1GB, 1.1-10GB, and Above 10GB; By End-Use Industry-Military, IT & Telecom, Entertainment & Media, and Other End-User Industries Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Charter Communications, Comcast, Midcontinent Communications, Altice, Cox Communications, Insight Communications, Verizon, SureWest Broadband, ATandT, ChinaMobile, Changcheng, China, Unicom, ASAHI Net Inc., KT Corp, LGU, SKBroadband, Spectrum, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global ultra-high-speed Wi-Fi market?The global ultra-high-speed Wi-Fi market was valued at USD 3.7 billion in 2022.

How can ultra-high-speed Wi-Fi market be defined?Ultra-high-speed Wi-Fi market refers to wireless internet connectivity that provides the highest speed data transfer rates.

What are some applications of ultra-high-speed Wi-Fi?Ultra-high-speed Wi-Fi is used in various applications such as gaming, video streaming, online education, teleconferencing, and other bandwidth-intensive applications.

What are the different speed segments in the ultra-high-speed Wi-Fi market?The ultra-high-speed Wi-Fi market is segmented based on speed into 1GB, 1.1-10GB, and above 10GB.

What are some notable trends in the ultra-high-speed Wi-Fi market?The adoption of 5G technology and the growing focus on security for Wi-Fi networks are among the notable trends in the ultra-high-speed Wi-Fi market.

Which segment dominates the ultra-high-speed Wi-Fi market in terms of speed?The 1GB segment is the most lucrative in the global ultra-high-speed Wi-Fi market, with a projected CAGR of 28.6%.

What factors are driving the growth of the ultra-high-speed Wi-Fi market?The increasing demand for high-speed internet connection, adoption of cloud-based services, proliferation of IoT devices, remote work, and investment in Wi-Fi infrastructure are driving the growth of the ultra-high-speed Wi-Fi market.

What opportunities are there in the ultra-high-speed Wi-Fi market?The increasing demand for high-speed internet connectivity, rising adoption of cloud-based services, and the need for reliable internet connectivity for remote work and online education present opportunities in the ultra-high-speed Wi-Fi market.

How is the adoption of 5G technology impacting the ultra-high-speed Wi-Fi market?The adoption of 5G technology may lead to a decrease in demand for ultra-high-speed Wi-Fi in some markets as it provides faster and more reliable internet connectivity.

Which region is projected to be the most profitable market for ultra-high-speed Wi-Fi?Asia Pacific is forecast to be the most profitable market for ultra-high-speed Wi-Fi, followed by North America and Europe.

Ultra-High-Speed WiFi MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Ultra-High-Speed WiFi MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Charter Communications

- Comcast

- Midcontinent Communications

- Altice

- Cox Communications

- Insight Communications

- Verizon

- SureWest Broadband

- ATandT

- ChinaMobile

- Changcheng

- China Unicom

- ASAHI Net Inc.

- KT Corp

- LGU

- SKBroadband

- Spectrum