UK Pet Grooming Products Market Size, Share, Growth Analysis By Type (Shampoo & Conditioner, Shear & Trimming Tools, Comb & Brush, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149820

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Size & Trends

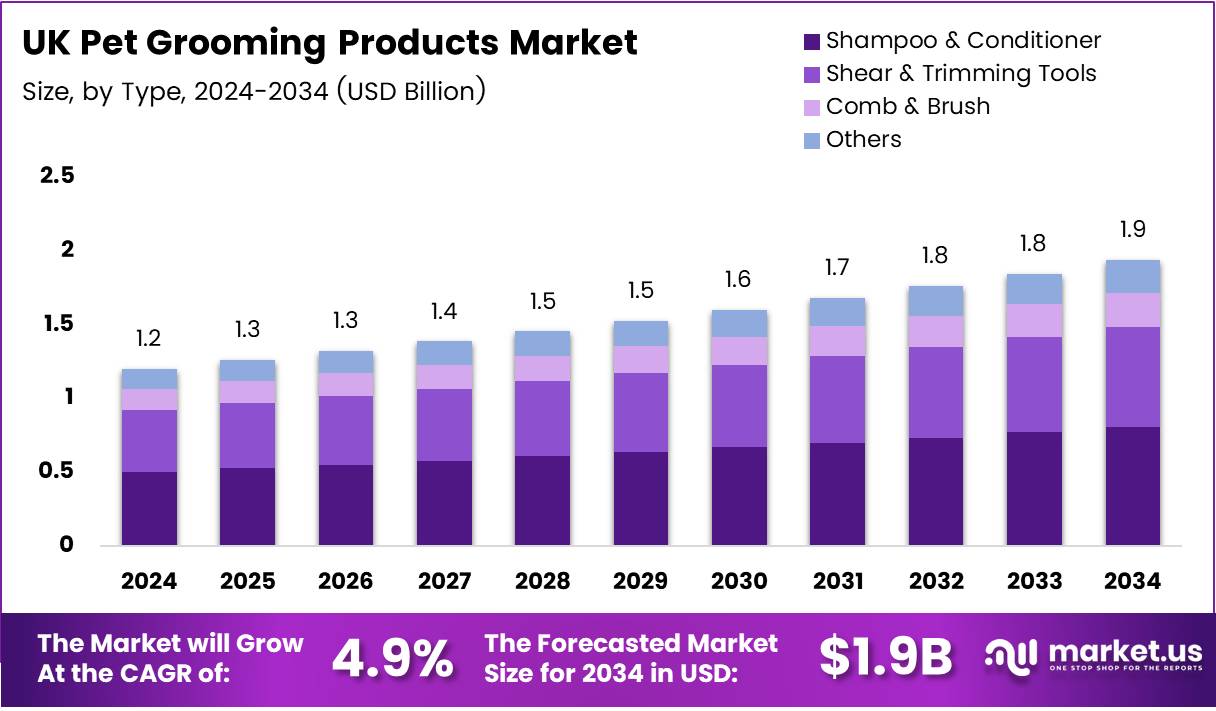

UK Pet Grooming Products Market size is expected to be worth around USD 1.9 by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. This growth is primarily driven by increasing pet ownership, rising awareness of pet health and hygiene, and the growing demand for premium grooming products.

Key Takeaways

- The UK Pet Grooming Products Market is projected to reach USD 1.9 billion by 2034.

- The market was valued at USD 1.2 billion in 2024.

- The market is expected to grow at a CAGR of 4.9% from 2025 to 2034.

- In 2024, Shampoo & Conditioner dominated the By Type segment with a 55.6% market share.

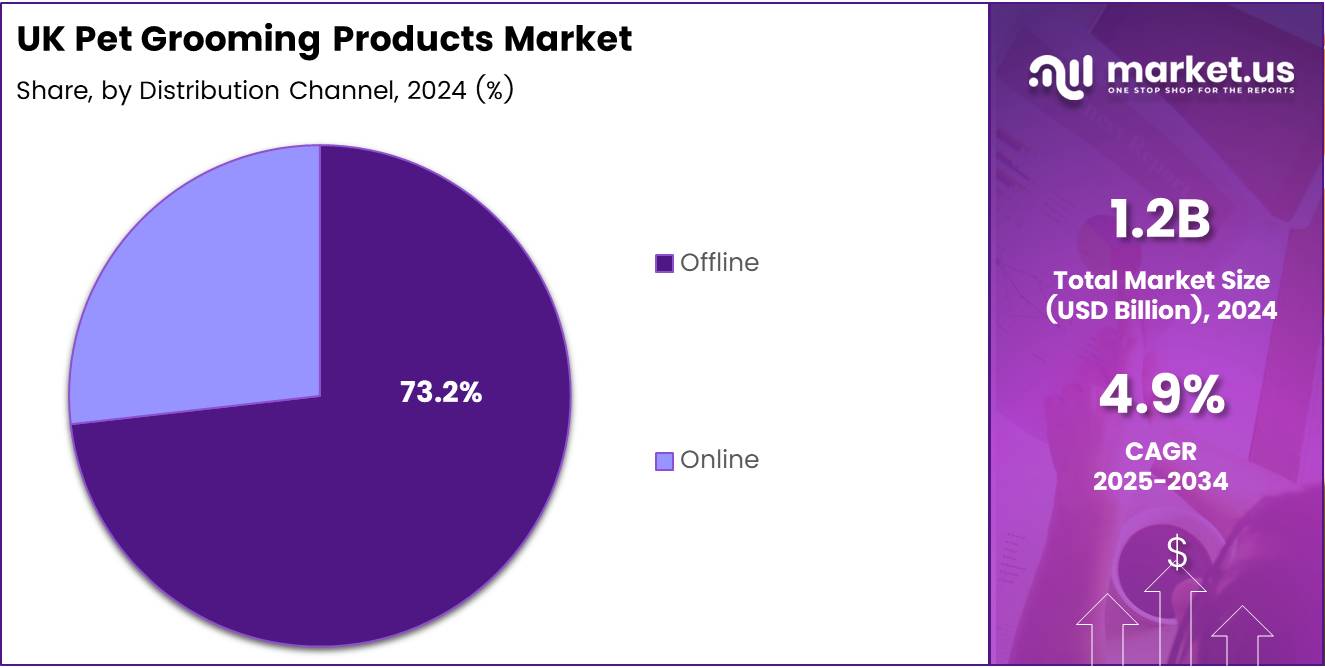

- The Offline distribution channel led the market in 2024, holding a 73.2% share.

Report Overview

The UK pet grooming products market has emerged as a key segment within the broader pet care industry, driven by rising pet humanization trends and increasing expenditure on pet wellness. Pet owners are showing strong preference for quality grooming products to maintain hygiene, manage shedding, and ensure their pets’ appearance remains well-kept. The market includes shampoos, conditioners, clippers, brushes, and skin care solutions designed for pets, with innovation focused on organic, hypoallergenic, and breed-specific products.

In the UK, pet grooming is no longer a luxury—it’s viewed as an essential care routine, especially among dog owners. According to Hepper, dog owners spend around £130 a year—just over £10 a month—on professional grooming, indicating a consistent demand for both services and related products. This reflects not only a willingness to spend but also a growing awareness of pet health and hygiene.

Pet ownership statistics underline the huge consumer base supporting the grooming market. According to Hepper, the UK is home to 11.1 million cats, 10.2 million dogs, and 1 million rabbits. This widespread ownership opens the door for continuous sales of grooming items tailored to various pet types, breeds, and coat conditions.

Spending habits further confirm market strength. As stated by industry report, annual spending in the UK reaches GBP 10 billion (USD 12.4 billion) on dogs and GBP 8 billion (USD 9.9 billion) on cats. A portion of this is dedicated to grooming essentials, from daily use brushes to premium grooming kits and professional treatments.

Consumer sentiment plays a pivotal role in shaping this market. A survey by GlobalPetIndustry, involving 2,000 UK dog owners, found that 88% believe their pets deserve the same care as humans, while 48% prioritize pet needs over other household members. These attitudes translate into growing demand for advanced grooming products and services.

The UK government has supported the pet care sector through regulatory oversight to ensure product safety and animal welfare. While no direct investments in grooming have been highlighted, increasing focus on animal health aligns with growth in regulated grooming product manufacturing and import.

Simultaneously, pet grooming startups and online pet stores are capitalizing on digital retail trends. Local entrepreneurs are introducing D2C grooming brands, capitalizing on opportunities in premium, eco-conscious, and allergen-free pet grooming products, aligning with evolving consumer preferences.

This market continues to benefit from urbanization, rising disposable income, and a cultural shift that considers pets as family members. The combination of economic factors, emotional attachment to pets, and retail innovation ensures that the UK pet grooming products market is well-positioned for sustained growth.

Type Analysis

Shampoo & Conditioner dominates with 55.6% due to its routine use in pet hygiene and grooming routines.

In 2024, Shampoo & Conditioner held a dominant market position in the By Type Analysis segment of the UK Pet Grooming Products Market, with a 55.6% share. This category leads the market due to the growing emphasis on pet hygiene, odor control, and coat maintenance. Pet owners increasingly prefer specialized shampoos tailored to skin sensitivity, breed-specific needs, and dermatological conditions, driving repeat purchases and brand loyalty.

Shear & Trimming Tools also contribute significantly to the segment, as grooming routines increasingly include at-home hair trimming and styling. These tools cater to both casual users and professional groomers seeking precise grooming outcomes.

Comb & Brush products serve an essential role in daily grooming habits, helping reduce shedding, prevent matting, and enhance coat shine. As pet care awareness rises, their demand steadily follows suit.

The Others category includes niche items such as paw balms, ear cleaners, and detanglers. Though smaller in share, this group benefits from the rising interest in holistic and all-round pet care, especially among premium consumers. Each product type reflects an evolving grooming culture driven by humanization trends in pet ownership.

Distribution Channel Analysis

Offline channel dominates with 73.2% due to high trust in physical pet retail and personalized in-store experience.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the UK Pet Grooming Products Market, with a 73.2% share. Consumers continue to favor brick-and-mortar pet stores, supermarkets, and veterinary clinics, primarily due to the assurance of product quality and immediate availability. The opportunity to receive grooming advice from store staff further enhances the offline value proposition.

Physical retail locations also enable sensory evaluation, particularly important for items like shampoos and brushes, where scent, texture, or size matter. Many customers also prefer to combine grooming product purchases with other essential errands, adding to the convenience factor.

The Online segment is gradually expanding, especially among tech-savvy urban pet owners seeking convenience and wider selection. E-commerce platforms offer bundled deals, subscription grooming kits, and access to niche brands. However, despite this growth, the offline dominance continues to be underpinned by customer trust, tactile product assessment, and the role of in-person service in the grooming journey.

Key Market Segments

By Type

- Shampoo & Conditioner

- Shear & Trimming Tools

- Comb & Brush

- Others

By Distribution Channel

- Offline

- Online

Drivers

Growing Popularity of Premium and Organic Pet Grooming Solutions Fuels Market Expansion

The demand for high-quality pet grooming products is rising, especially those made with natural, organic, and chemical-free ingredients. Pet owners in the UK are becoming more aware of the skin sensitivities and allergies pets may face, which is leading them to choose safer, premium options. This shift supports the steady growth of brands offering eco-friendly shampoos, conditioners, and grooming wipes.

Single-person households are increasing across the UK, and many of these individuals are adopting pets for companionship. With fewer household members, pet owners are more likely to spend more time and money on their pets’ wellbeing. This lifestyle trend is pushing up spending on grooming products that keep pets looking and feeling healthy.

Urban centers are seeing an increase in mobile grooming services. These mobile units offer convenience and personalized care, making them highly appealing to busy pet parents. This trend also supports grooming product sales, as mobile groomers often recommend or sell specialized items.

Awareness about pet skin health is also on the rise. Consumers now seek grooming solutions that are allergen-free, pH-balanced, and suited for specific coat types. This has encouraged manufacturers to launch targeted products backed by dermatological research, further enhancing product demand.

Restraints

High Cost of Imported Grooming Products Post-Brexit Limits Market Accessibility

Since Brexit, importing grooming products from Europe has become more expensive due to new tariffs and supply chain barriers. These additional costs often get passed on to consumers, making premium grooming products less accessible for budget-conscious pet owners.

Rural areas in the UK often lack well-stocked pet retail outlets. This leads to a limited variety of grooming products available in local stores, forcing pet owners to rely on online platforms or travel long distances to access quality items, thereby restricting overall market penetration.

Another restraint is the low level of grooming service adoption for exotic pets such as reptiles, birds, or small mammals. These animals require specialized care, and few salons or product manufacturers cater to their grooming needs, leaving a gap in the market.

Lastly, the market suffers from a lack of standardization in product labeling and effectiveness claims. Pet owners often feel overwhelmed or confused by the wide range of choices, especially when product safety, ingredients, or usage instructions are not clearly defined. This creates hesitation and slows down purchase decisions.

Growth Factors

Launch of Subscription-Based Pet Grooming Kits Unlocks New Revenue Streams

Subscription-based grooming kits are becoming a popular solution for busy pet owners. These services deliver essential grooming products such as shampoo, brushes, and nail clippers on a regular schedule, providing convenience and fostering brand loyalty. This model also encourages recurring sales and strengthens customer engagement.

Strategic collaborations with veterinary clinics are opening up new cross-selling opportunities. By bundling grooming services with regular vet visits, clinics can offer value-added care packages. This approach not only boosts product sales but also reinforces trust among pet owners seeking holistic pet care.

Sustainability is gaining traction in the UK pet grooming sector. More consumers are demanding grooming products with biodegradable ingredients and packaging. The launch of refillable bottles and recyclable containers is creating new branding opportunities for eco-conscious businesses and helping reduce plastic waste.

There is also a rising interest in grooming products tailored for senior pets. As the UK’s pet population ages, owners are actively seeking gentle, condition-specific solutions. Formulations that address thinning fur, sensitive skin, or joint stiffness are expected to witness increased demand in the coming years.

Emerging Trends

Surge in Demand for Hypoallergenic and Fragrance-Free Products Shapes Consumer Preferences

There is a growing preference for hypoallergenic and fragrance-free grooming products as pet owners become more conscious of their pets’ skin sensitivities. Ingredients that once seemed harmless are now under scrutiny, prompting brands to offer gentler, dermatologically tested solutions.

The concept of pet luxury is evolving, with spas and grooming boutiques gaining popularity in metropolitan regions. These facilities offer tailored experiences including massages, facials, and fur treatments, contributing to rising demand for premium grooming products used in such services.

Technology is also transforming pet grooming routines. AI-enabled grooming brushes and IoT-connected dryers are emerging in the market. These tools track grooming habits, monitor skin health, and enhance grooming safety, catering to tech-savvy consumers seeking innovative pet care solutions.

Social media has become a powerful tool for product promotion. Influencer-led campaigns, particularly on Instagram and TikTok, are accelerating the popularity of new grooming brands. Pet influencers often showcase product use through visually appealing content, directly impacting purchasing decisions and brand visibility.

Key UK Pet Grooming Products Company Insights

In 2024, the UK pet grooming products market experienced growing competition and innovation, with several key players enhancing their brand presence through tailored product portfolios and sustainability-led strategies.

Petco Animal Supplies, Inc. strengthened its foothold by leveraging its strong omni-channel network and expanding eco-conscious product lines to meet increasing consumer demand for natural and cruelty-free grooming solutions. The brand also capitalized on private-label offerings tailored to UK consumer preferences.

Spectrum Brands continued to dominate the mid-range segment through its diverse product mix, offering everything from shampoos to deshedding tools. The company focused on premiumization by introducing advanced grooming kits and hypoallergenic formulations that appeal to pet owners with sensitive or high-maintenance breeds.

4-Legger made significant strides by targeting the organic and vegan grooming niche. With its USDA-certified organic ingredients and minimalist formulations, the brand earned trust among health-conscious pet owners. Their strategic marketing emphasized ingredient transparency, helping them build a loyal UK customer base.

Groomer’s Choice focused on professional-grade grooming products, particularly for salons and mobile grooming services. Their expansion strategy revolved around distributor partnerships and training-based marketing, positioning the brand as a reliable choice among grooming professionals seeking specialized tools and high-performance formulas.

Overall, the competitive dynamics in the UK pet grooming market reflect a shift toward personalization, clean ingredients, and multi-channel distribution strategies. Leading players are prioritizing transparency, performance, and trust to appeal to a pet-owning demographic increasingly concerned with animal wellness and ethical consumption.

Top Key Players in the Market

- Petco Animal Supplies, Inc.

- Spectrum Brands

- 4-Legger

- Groomer’s Choice

- SynergyLabs

- Vet’s Best

- Earthbath

- Coastal Pet Products

- Himalaya Herbal Healthcare

- Resco

Recent Developments

- In February 2025, Goose raised US$13.4 million in seed funding to enhance operational tools and workflow automation for pet care businesses. The company aims to modernize backend systems, making daily operations more efficient for clinics, groomers, and boarders.

- In January 2025, CareSix advanced pet health technology innovation with fresh funding and global partnerships. This move supports its expansion into new international markets and strengthens its AI-driven health monitoring tools.

- In March 2025, OurPetsLife secured a £300K investment to support its global expansion strategy. The funding will be used to scale its pet wellness platform and enter new markets across Europe and North America.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 1.9 CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Shampoo & Conditioner, Shear & Trimming Tools, Comb & Brush, Others), By Distribution Channel (Offline, Online) Competitive Landscape Petco Animal Supplies, Inc., Spectrum Brands, 4-Legger, Groomer’s Choice, SynergyLabs, Vet’s Best, Earthbath, Coastal Pet Products, Himalaya Herbal Healthcare, Resco Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  UK Pet Grooming Products MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

UK Pet Grooming Products MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Petco Animal Supplies, Inc.

- Spectrum Brands

- 4-Legger

- Groomer's Choice

- SynergyLabs

- Vet's Best

- Earthbath

- Coastal Pet Products

- Himalaya Herbal Healthcare

- Resco