U.S Medical Coding Market by Classification System (ICD, HSPCS, CPD), By Component (In-House and Outsourced), By Medical Specialty (Oncology, Anesthesia, Cardiology, Pathology, and Others), and By Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: June 2024

- Report ID: 105997

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

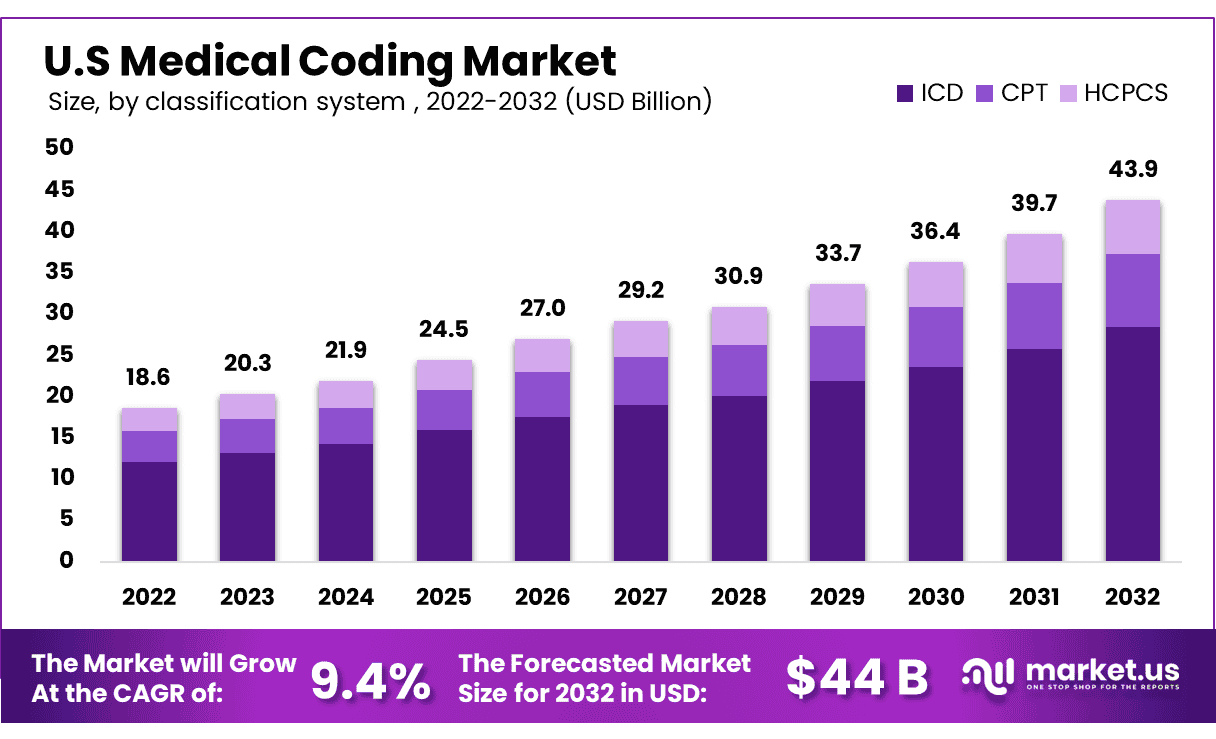

U.S. Medical Coding Market size is expected to be worth around USD 44 Billion by 2032 from USD 20.3 Billion in 2023, growing at a CAGR of 9.4 % during the forecast period from 2023 to 2032.

Medical errors, fraud, and delusion of medical documents can lead to considerable financial losses, which in turn can lead to a lack of effective revenue cycle management and medical billings. Consequently, a growing demand for revenue cycle management software and services, including medical coding software, is anticipated.

The market is further supported by the increased endorsement of digital technologies, such as Electronic Health Records (EHR), mHealth Applications, telehealth, revenue cycle management software and the growing trend of digitization of healthcare in the U.S. According to the Centers for Disease Control and Prevention (CDC), in 2021, over 88% of the physicians’ offices in the U.S used EHRs. The utilization of medical coding is increasing in the revenue cycle management process.

In addition, new revisions are added to the codes to make them more flexible and scalable. The latest version of the code, ICD 11, was launched in January 2022. This includes several new chapters and acts as a support for electronic health records (EHRs). The ICD 11 has about 55000 codes to classify disorders, diseases and injuries, as well as deaths. WHO introduced the new version of ICD 10 between April to September 2020.

Key Takeaways

- The U.S. Medical Coding Market is expected to reach a valuation of USD 44 Billion by 2032.

- The market is growing at a CAGR of 9.4% from 2023 to 2032.

- In 2022, the market size was USD 18.6 Billion.

- Over 88% of physicians in the U.S. used Electronic Health Records (EHRs) in their offices in 2021.

- The latest version of the ICD 11 code has around 55,000 codes.

- The Bureau of Labor Statistics predicts a 7% increase in employment for medical records from 2021 to 2031.

- The ICD segment had the largest revenue share of 65% in 2022.

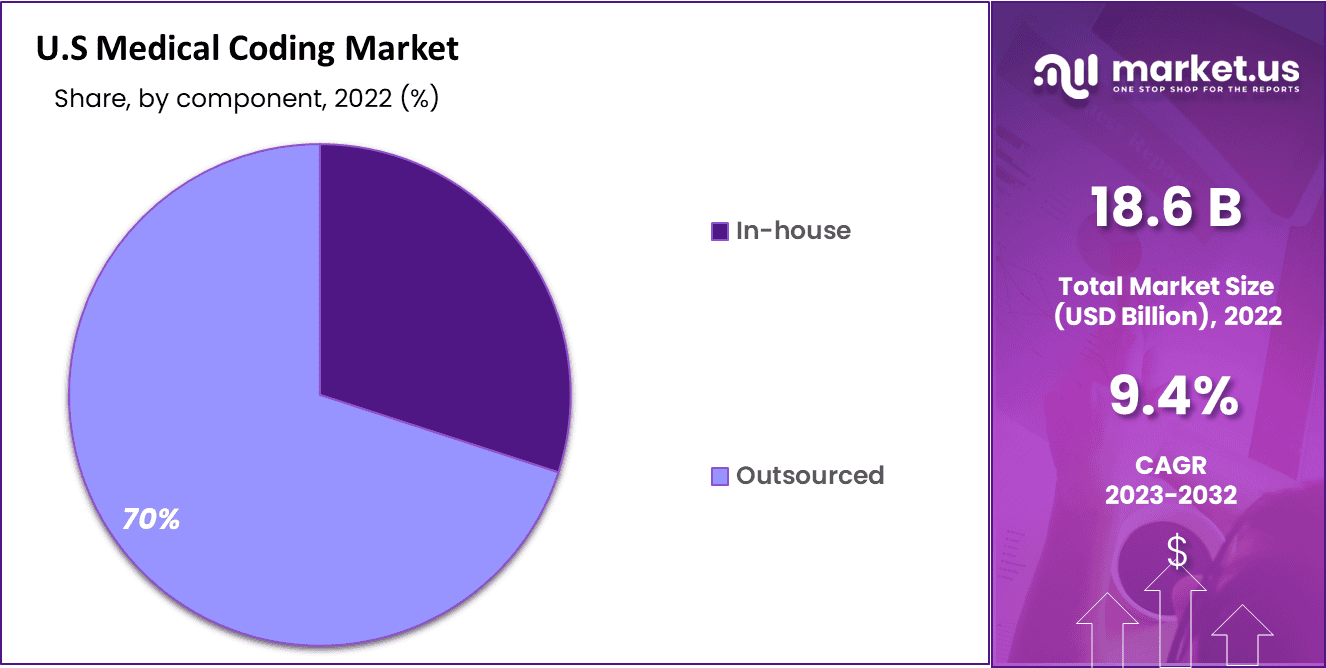

- The outsourced segment accounted for the largest revenue share of 70% in 2022.

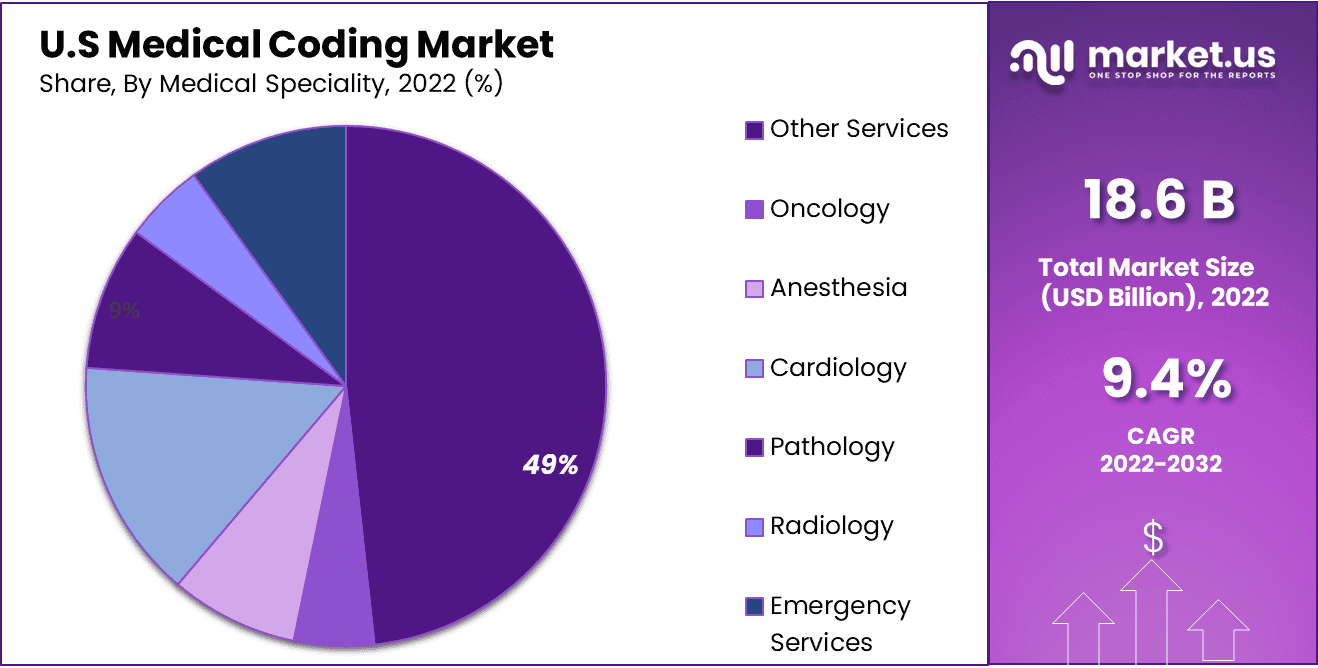

- By Medical Specialty, the other services segment accounted for the highest revenue share of 49% in 2022.

- In the U.S., the other services segment in the medical specialty insight held a 49% market share in 2022.

- The ICD segment dominated the market with 65% revenue in 2022.

- The outsourced segment in 2022 accounted for 70% of revenue with a CAGR of 8.4%.

The introduction and revision of codes have a positive impact on the market growth of medical records and health information employees. As per the Bureau of Labor Statistics, Office of Occupational Statistics and Employment Projections, employment for medical records is expected to rise by 7% from 2021 to 2031. This number is the fastest growing among all occupations. Medical coding is one of the most popular occupations in the U.S. Due to the rising demand for universal language in medical documentation, the demand for medical coders is receiving a positive response.

Classification System Analysis

ICD Segment accounted for the largest revenue share in 2022

The ICD segment dominated the market with 65% revenue share in 2022 as there is an increase in the usage of these codes among the coders. ICD 11, which entered into force on 1st January 2022, is precise and flexible. Health information can be used for multiple purposes such as improving patient outcomes, quality analysis, strategic planning, population health reporting, safety, integrated care and delivering healthcare services. The coding tool can be submerged in local digital records and IT systems. This increases user compliance and reduces cost & training time.

With multiple ICD codes and revisions to suit the fast-changing healthcare industry, CPT is expected to be the fastest-growing segment in the forecast period. CPT codes, also known as HCPCS codes, are used for describing tests, surgeries, and other procedures for medical billing. The government monitors the CPT codes to measure disease prevalence and health expenditure.

Component Analysis

The outsourced Segment of the U.S medical coding market held the largest revenue share at 70% in 2022.

In 2022, the outsourced segment had the largest revenue share of 70%. It is expected to grow at a CAGR of 8.4% over the forecast period. Outsourcing of medical coding requirements is becoming popular among healthcare providers to a great extent. This is due to the fact that outsourcing helps in reducing administrative costs, saving time, and improving workflow. By outsourcing medical coding, healthcare providers are able to focus on delivering high-quality patient care and increasing patient engagement. The increasing trend of outsourcing revenue cycle management, as well as medical coding, is also having a positive impact on the market growth.

The in-house segment is projected to be the fastest-growing segment over the forecast period. Healthcare providers are capable of regulating their entire operations through the utilization of in-house codes, medical billing and coding, as well as revenue cycle management. Furthermore, in-house coders are readily available in case of coding errors.

Medical Specialty Analysis

Other Services Segment Dominated the U.S Market in 2022

In 2022, the other services segment dominated the US market with 49% market share. Medical coding services are in high demand across the majority of specialties due to an increase in insurance coverage for a variety of diseases. Other Services include medical specialties such as obstetrics, gynecology, nephrology and many more. This makes other services the dominant segment among all the other medical specialties. Owing to rising prevalence of cardiac disorders and complicated procedures which require well-trained coders, the cardiology segment is likely to demonstrate the fastest growth.

Key Market Segments

By Classification System

- ICD

- HSPCS

- CPD

By Component

- In-House

- Outsourced

- On-shore

- Off-shore

By Medical Specialty

- Emergency Services

- Oncology

- Anesthesia

- Cardiology

- Pathology

- Radiology

- Other services

Drivers

Rising Demand for Standardized Medical Documentation

The growing demand for standardized medical documentation drives the US medical coding market. The healthcare industry depends on medical coding to make sure there is proper billing, reimbursement and communication between healthcare providers and payers. Medical coding services and solutions are in high demand as the importance of EHRs is growing and healthcare processes need to be streamlined.

The development of EHR software is driving market growth

EHRs are becoming widely popular in recent times. EHRs for medical coding and billing are reinforcing the market growth. The market players’ are focusing upon integrating voice recognition with EHRs to boost the market growth. EHRs play a major role in medical coding market as medical coders and billers are relying on them. They help the medical coders in working efficiently by cutting down the need for paperwork and by reducing the errors that occur in data entry.

Restraints

High Costs Affiliated with EHRs

High costs affiliated with EHRs tampers the growth of market. EHR costs currently range from 0$ upfront to potentially 10000$ and everything in between. The system requires on-time maintenance and updating which creates difficulty many a times. Also the maintenance cost of EHRs service is very high. Furthermore, as the demand for EHRs is rising across the globe for medical coding services, factors related to the cost of EHRs can hinder the growth of the market in the upcoming years.

Complexity and Continuous Evolution of Coding Systems and Regulations.

The continuous evolution of coding systems and regulations is one of the restraints of U.S medical coding market. Various coding systems such as the International Classification of Diseases (ICD) and Current Procedural Terminology (CPT) are involved in medical coding. These coding systems require extensive training. Furthermore, they undergo regular updates and revisions, and staying updated with the latest coding guidelines becomes a big challenge for the coders.

Opportunity

Increasing Technological Advancements

Rapid technological development offers many opportunities for market expansion. The integration of artificial intelligence (AI) into electronic health record software (EHRs) creates a positive outlook for the medical coding market. The development of EHR software contributes significantly to the growth of the medical coding market.

The rapid development of healthcare software technology is accelerating the overall growth of medical coding market, as healthcare organizations are using AI-powered tools and advanced medical coding software in order to increase productivity and streamline the coding process. Governments and private organizations are taking the initiative and investing heavily into them.

Trends

Growing demand for more simplified and convenient coding and billing solutions for hospitals.

There is currently a growing demand for more simplified and convenient coding and billing solutions for hospitals. Along with the growing demand for a universal language to reduce fraud and insurance, the fraudulent claim is one of the factors driving the market. Furthermore, there is an increase in the utilization of medical coding for uniform documentation of medical facilities in the country. Along with this, the growing healthcare industry and technological advancements across the country are fueling the growth of the market. Apart from this, the rising demand for ICD is also positively influencing the market.

Additionally, the growing need for medical coding to create accurate patient records and expedite payments to physicians offers lucrative growth opportunities for industry investors and end users. Furthermore, major market players are investing heavily in R&D and offering next-generation coding and replacement solutions, which are expected to increase their overall sales and profitability in the coming years.

Key Players Analysis

Strong Focus on Product Portfolio Expansion through Various Strategies Maintain the Dominance of Industry Leaders.

Key players in this market are adopting various strategies such as partnerships, mergers, acquisitions and investments in expanding their product portfolio, etc. Along with this, key stakeholders in the U.S are adopting the strategy of announcing new products and services to the market in order to enlarge their existence in the U.S.

Market Key Players

Due to the presence of several major players across the country, the US medical coding market is fragmented. New key players will face strong competition from major market players, especially those with strong brand awareness and large distribution networks. Moreover, companies have adopted various expansion strategies, partnerships, and the development of new research methods in order to secure a leading position in the market.

The following are some of the major players in the industry

- StarTek

- Oracle

- Maxim Healthcare Services

- Parexel International Corporation

- Aviacode Inc.

- Verisk Analytics, Inc.

- Medical Record Associates, LLC.

- Optum

- Dolbey System Inc.

Recent Development

- StarTek: In March 2024, StarTek acquired a leading healthcare BPO firm to enhance its medical coding and billing capabilities. This strategic move aims to expand its service portfolio and strengthen its market position.

- Oracle: In April 2024, Oracle launched a new AI-driven medical coding solution designed to improve accuracy and efficiency in healthcare documentation. This innovation leverages advanced machine learning algorithms to streamline coding processes.

- Maxim Healthcare Services: In May 2024, Maxim Healthcare Services announced a merger with a prominent health information management company. The merger aims to integrate their services, offering comprehensive medical coding and healthcare staffing solutions.

- Parexel International Corporation: In February 2024, Parexel International Corporation acquired a specialized medical coding firm to bolster its clinical trial data management services. This acquisition is expected to enhance Parexel’s data accuracy and regulatory compliance.

- Verisk Analytics, Inc.: In March 2024, Verisk Analytics, Inc. completed a merger with a data analytics company focusing on healthcare. This merger aims to enhance Verisk’s capabilities in providing comprehensive data-driven insights for medical coding and reimbursement.

- Medical Record Associates, LLC.: In April 2024, Medical Record Associates, LLC. acquired a regional coding service provider to expand its geographic reach and client base. The acquisition supports its growth strategy and enhances service offerings in medical coding.

Report Scope

Report Features Description Market Value (2023) USD 18.6 Billion Forecast Revenue (2032) USD 44 Billion CAGR (2023-2032) 9.4% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Classification System (ICD, HSPCS, CPD), By Component (In-House and Outsourced), By Medical Specialty (Oncology, Anesthesia, Cardiology, Pathology, Radiology, Emergency Services and Others), By Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032 Competitive Landscape StarTek, Oracle, Maxim Healthcare Services, Parexel International Corporation, Aviacode Inc., Verisk Analytics, Inc., Medical Record Associates, LLC., Materion, Optum, Exela Technologies, Dolbey System Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Medical Coding?Medical coding is the process of translating healthcare procedures and diagnoses into universally recognized codes for billing, insurance claims, and data analysis.

How big is the U.S Medical Coding Market?The U.S Medical Coding Market size was estimated at USD 18.6 billion in 2022 and is expected to reach USD 44 billion in 2032.

What is the U.S Medical Coding Market growth?The U.S Medical Coding Market is expected to grow at a compound annual growth rate of 9.4%. From 2023 To 2032

Who are the key companies/players in the U.S Medical Coding Market?Some of the key players in the U.S Medical Coding Markets are StarTek, Oracle, Maxim Healthcare Services, Parexel International Corporation, Aviacode Inc., Verisk Analytics, Inc., Medical Record Associates, LLC., Optum, Dolbey System Inc.

What are the Key Coding Systems Used in the U.S.?The primary coding systems in the U.S. are ICD-10-CM for diagnoses, CPT for procedures, and HCPCS Level II for supplies and services.

Why is Medical Coding Important?Medical coding ensures accurate billing, reimbursement, and healthcare data management, which is crucial for healthcare providers, insurers, and researchers.

What Are the Ethical Considerations in Medical Coding?Coders must adhere to ethical standards, ensuring patient confidentiality, accuracy, and compliance with healthcare regulations.

-

-

- StarTek

- Oracle

- Maxim Healthcare Services

- Parexel International Corporation

- Aviacode Inc.

- Verisk Analytics, Inc.

- Medical Record Associates, LLC.

- Optum

- Dolbey System Inc.