Global Truck-As-A-Service (TaaS) Market Size, Share, Growth Analysis By Service Type (Leasing and Rental Services, Maintenance and Repair Services, Fleet Management Services, Digital Freight Brokerage Services, Connectivity Solutions, Insurance Services), By Truck Type (Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks), By Deployment Type (On-Premises, Cloud-Based), By End-User Industry (Retail and E-commerce, Manufacturing, Logistics and Transportation, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137818

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

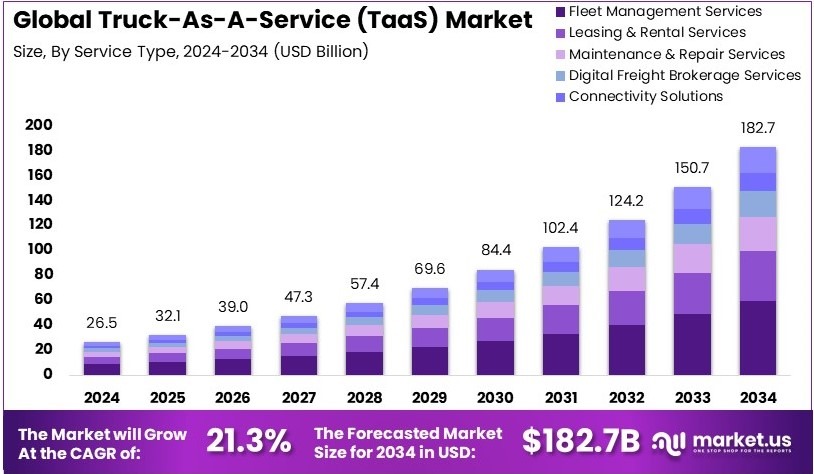

The Global Truck-As-A-Service (TaaS) Market size is expected to be worth around USD 182.7 Billion by 2034, from USD 26.5 Billion in 2024, growing at a CAGR of 21.3% during the forecast period from 2025 to 2034.

Truck-As-A-Service (TaaS) is a business model that offers on-demand transportation services through a digital platform. It combines technology like telematics and real-time data analytics to optimize truck routes, maintenance, and fleet management.

The Truck-As-A-Service (TaaS) market comprises companies that provide technology-driven services to optimize the use of trucks in logistics. These services improve the efficiency and scalability of transport operations for businesses across various industries.

Truck-As-A-Service (TaaS) is revolutionizing the logistics and transportation industry by integrating digital technology with traditional trucking services. According to the American Trucking Associations, in 2022, trucks were responsible for hauling 11.46 billion tons of freight, accounting for 72.6% of all domestic freight tonnage.

This significant share demonstrates the critical role of trucking in the economy and highlights the potential for TaaS to enhance operational efficiencies. TaaS solutions, such as real-time fleet management, automated scheduling, and route optimization, not only streamline operations but also offer substantial cost savings and improved service reliability.

The TaaS market is growing, driven by the increasing demand for logistic services that are both efficient and environmentally sustainable. The sector is marked by intense competition as companies strive to innovate and provide superior technology solutions.

On a broader scale, the adoption of TaaS technologies has substantial implications for the overall transportation sector. These technologies help reduce operational costs and greenhouse gas emissions, aligning with global efforts towards sustainability.

Furthermore, government regulations and incentives play a pivotal role in shaping the TaaS market. Policies aimed at reducing emissions and improving road safety encourage the adoption of TaaS solutions, fostering a shift towards more sustainable and efficient transportation management systems.

Key Takeaways

- The Truck-As-A-Service (TaaS) Market was valued at USD 26.5 Billion in 2024, and is expected to reach USD 182.7 Billion by 2034, with a CAGR of 21.3%.

- In 2024, Fleet Management Services dominate the service type segment with 32.5% due to efficiency and data-driven operations.

- In 2024, Heavy Duty Trucks dominate the truck type segment with 40.8%, crucial for freight and logistics operations.

- In 2024, Cloud-Based deployments dominate with 58.3%, reflecting a shift to scalable and flexible IT solutions.

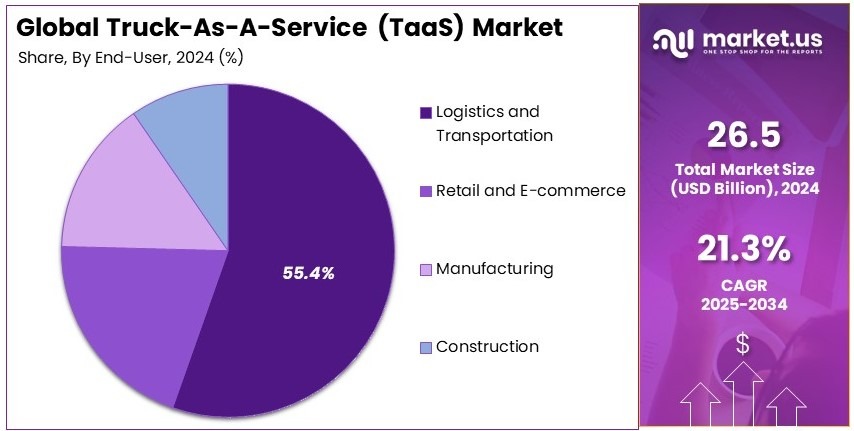

- In 2024, Logistics and Transportation dominate the end-user industry with 55.4%, underlining the sector’s pivotal role in TaaS growth.

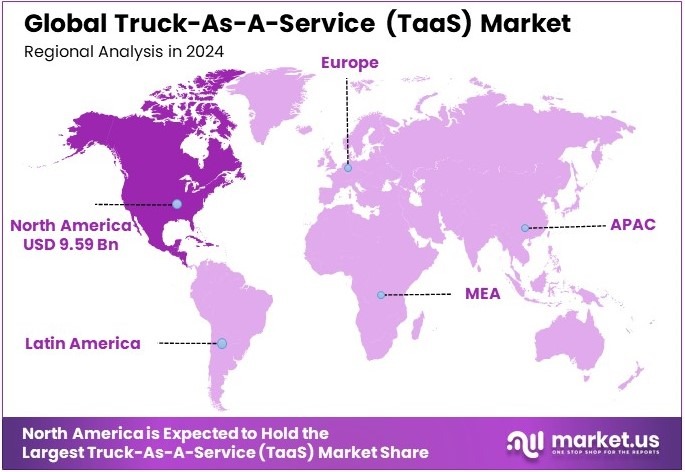

- In 2024, North America leads the region with 36.2% share and USD 9.59 Bn revenue, bolstering market expansion.

Service Type Analysis

Fleet Management Services dominate with 32.5% due to their critical role in optimizing operations and reducing costs.

In the Truck-As-A-Service (TaaS) market, the “Service Type Analysis” shows that Fleet Management Services are the leading sub-segment, holding a 32.5% market share. This dominance is attributed to the increasing demand for operational efficiency and cost reduction in logistics and transportation industries.

Fleet management services provide comprehensive solutions that include vehicle tracking, fuel management, maintenance scheduling, and compliance management. These services are essential for companies looking to enhance the utilization of their assets and improve their overall operational efficiencies.

Leasing and Rental Services also play a significant role in the TaaS market, offering flexibility and scalability to businesses that need to adjust their fleet sizes based on seasonal demand without committing to long-term investments. Maintenance and Repair Services ensure that fleets are always in optimal condition, minimizing downtime and extending the lifecycle of vehicles, which is crucial for maintaining profitability in competitive markets.

Truck Type Analysis

Heavy Duty Trucks lead with 40.8% due to their essential capacity for transporting large volumes over long distances.

The “Truck Type Analysis” within the TaaS market highlights Heavy Duty Trucks as the most significant sub-segment, capturing a 40.8% market share. This segment’s prominence is driven by the heavy-duty trucks’ capability to transport large volumes of goods over long distances, making them indispensable in sectors such as manufacturing, construction, and logistics.

Their robustness and reliability underpin the core logistics operations, ensuring the efficient movement of goods across extensive supply chains.

Medium Duty Trucks and Light Duty Trucks serve specific market niches. Medium Duty Trucks are suited for regional deliveries and specialized logistics such as waste collection, dump trucks or utility services, providing a balance between maneuverability and capacity. Light Duty Trucks are preferred for urban logistics, where smaller size and better fuel efficiency are beneficial for navigating through city traffic and completing short delivery routes.

Deployment Type Analysis

Cloud-Based solutions dominate with 58.3% due to their scalability and advanced data analytics capabilities.

In the “Deployment Type Analysis,” Cloud-Based deployment leads the market with a 58.3% share. The adoption of cloud-based solutions in the TaaS market is primarily due to their ability to provide scalable, flexible, and efficient data management solutions.

These systems facilitate real-time data access and advanced analytics, which are critical for optimizing routes, managing fleets in real-time, and making data-driven decisions that enhance operational efficiencies.

On-Premises solutions, while important, are increasingly being overshadowed by the benefits of cloud technology. However, they still play a vital role for organizations that require local data control for security reasons or have specific regulatory compliance requirements.

End-User Industry Analysis

The Logistics and Transportation sector leads with 55.4% due to the critical need for efficient goods movement.

The “End-User Industry Analysis” identifies the Logistics and Transportation sector as the largest market segment, holding a 55.4% share. This sector’s dominance is driven by the escalating need for efficient and reliable goods transportation in the wake of globalizing trade and increasing e-commerce activities.

TaaS solutions provide pivotal benefits such as route optimization, load management, and real-time tracking, which are essential for logistics companies to improve delivery times and reduce operational costs.

Other sectors like Manufacturing and Construction also benefit from TaaS solutions but focus more on the specific utility of trucks to support operations like material supply and large equipment transportation. Retail and E-commerce use TaaS solutions to manage delivery fleets that are vital for customer satisfaction and competitive advantage in fast-paced consumer markets.

Key Market Segments

By Service Type

- Leasing and Rental Services

- Maintenance and Repair Services

- Fleet Management Services

- Digital Freight Brokerage Services

- Connectivity Solutions

- Insurance Services

By Truck Type

- Light Duty Trucks

- Medium Duty Trucks

- Heavy Duty Trucks

By Deployment Type

- On-Premises

- Cloud-Based

By End-User Industry

- Retail and E-commerce

- Manufacturing

- Logistics and Transportation

- Construction

- Others

Driving Factors

Subscription Models and Smart Technology Drive Market Growth

The Truck-as-a-Service (TaaS) market is growing rapidly due to the demand for efficient freight management solutions. Businesses increasingly require streamlined logistics to optimize costs and improve delivery times. TaaS platforms provide advanced solutions, including route optimization and real-time tracking, which enhance operational efficiency.

Subscription-based and pay-per-use models are gaining traction in the market. These flexible options reduce upfront costs for businesses, enabling access to modern fleets without the burden of ownership. For example, companies can scale their operations based on seasonal demand, ensuring cost-effectiveness.

Investments in autonomous truck technology further propel market growth. Self-driving trucks offer reduced labor costs and improved safety, addressing key industry challenges. As these technologies become more reliable, they integrate seamlessly with TaaS platforms, offering fully automated solutions.

Additionally, smart fleet management and telematics solutions contribute to growth. These systems provide real-time data on vehicle health, driver performance, and fuel consumption. By leveraging this information, companies can minimize downtime and improve asset utilization.

Restraining Factors

Infrastructure and Cost Challenges Restrain Market Growth

The limited adoption of TaaS in developing markets poses a significant challenge. Cost constraints in these regions make it difficult for businesses to transition from traditional fleet ownership to subscription-based models. Smaller companies, in particular, may struggle to afford advanced TaaS solutions.

Infrastructure dependency for electric and autonomous trucks further hampers growth. These technologies require robust charging networks and well-maintained road systems, which are often lacking in emerging economies. Without adequate infrastructure, the adoption of advanced TaaS services is limited.

Concerns about data privacy and cybersecurity in telematics systems also restrain market growth. TaaS platforms rely heavily on data collection and analysis, raising questions about the security of sensitive information. Breaches or misuse of data can erode customer trust and hinder adoption.

Another challenge is the lack of standardization across TaaS platforms and services. Variations in service offerings, pricing models, and technology compatibility create inconsistencies in user experience. These disparities discourage businesses from adopting TaaS solutions on a large scale.

Growth Opportunities

Tailored Services and Partnerships Offer Opportunities

The expansion of subscription-based truck leasing in emerging markets presents a significant growth opportunity. Flexible leasing options allow businesses to access modern fleets without heavy upfront investments, making it feasible for small and medium enterprises (SMEs) to upgrade their logistics capabilities.

The development of modular services tailored to customer needs also creates room for innovation. For example, TaaS providers can offer customizable packages that include fleet management, maintenance, and insurance. This flexibility helps businesses optimize costs while meeting specific operational requirements.

Integration with renewable energy solutions supports sustainable operations. Companies adopting electric or hydrogen-powered trucks can align with environmental goals while reducing fuel expenses. Renewable energy-based fleets appeal to eco-conscious customers and align with regulatory frameworks promoting sustainability.

Collaborations with retail and e-commerce giants are another key opportunity. These partnerships allow TaaS providers to cater to large-scale logistics needs, leveraging their extensive networks and resources. For instance, last-mile delivery solutions for online retailers drive demand for versatile and efficient fleet options.

Emerging Trends

Sustainability and AI Trends Are Shaping the Market

The rising popularity of electric trucks in fleet services is a significant trend. Businesses increasingly prioritize sustainable logistics, making electric vehicles an attractive option. These trucks offer reduced emissions and lower operating costs, aligning with environmental and economic goals.

AI-powered predictive maintenance systems are also transforming the market. These technologies analyze real-time data to predict potential vehicle issues before they occur. This proactive approach minimizes downtime, reduces repair costs, and ensures uninterrupted operations, making fleets more reliable.

The adoption of real-time freight optimization technologies is another emerging trend. These systems leverage data analytics and machine learning to plan efficient routes, reduce fuel consumption, and improve delivery timelines. For example, dynamic routing adjusts paths based on traffic and weather conditions, ensuring timely deliveries.

Additionally, there is a growing focus on carbon-neutral fleet operations. Companies aim to offset their emissions through green initiatives such as carbon credits or renewable energy investments. This approach not only enhances brand reputation but also meets regulatory demands for sustainability.

Regional Analysis

North America Dominates with 36.2% Market Share

North America leads the Truck-As-A-Service (TaaS) Market with a 36.2% share, valued at USD 9.59 billion. This dominance is driven by the region’s advanced logistics infrastructure, high fleet adoption rates, and increasing demand for efficient and scalable trucking solutions across industries.

Key factors include the strong presence of key TaaS providers and significant investments in digital platforms that enhance fleet management, connectivity, and operational efficiency. The region also benefits from robust e-commerce growth, which requires efficient transportation and last-mile delivery systems. Policies promoting sustainability and smart logistics further drive demand for innovative TaaS solutions.

Market dynamics highlight the role of North America’s tech-driven logistics ecosystem, which leverages IoT, AI, and cloud-based services to optimize truck operations. For example, leading players in the U.S. offer predictive maintenance and real-time fleet tracking, reducing downtime and improving operational efficiency. Additionally, the region’s focus on electrification of commercial fleets opens new opportunities for TaaS providers.

Regional Mentions:

- Europe: Europe maintains a strong position in the TaaS market with its emphasis on sustainable logistics and stringent emission standards. Smart transportation initiatives across the EU drive the adoption of advanced TaaS solutions.

- Asia Pacific: Asia Pacific is rapidly expanding in the TaaS market, fueled by growing industrialization and e-commerce. Countries like China and India are investing heavily in logistics infrastructure to support this growth.

- Middle East & Africa: The Middle East and Africa are emerging as important players in the TaaS market, focusing on logistics to support infrastructure projects and economic diversification efforts.

- Latin America: Latin America sees gradual growth in the TaaS market, driven by increased trade and the need for efficient fleet solutions to support agricultural and manufacturing exports.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Truck-As-A-Service (TaaS) Market is led by key players offering advanced fleet solutions and innovative technologies. Among these, Daimler AG, Volvo Group, Scania AB, and Tesla Inc. dominate the market.

Daimler AG is a leader in TaaS, providing integrated fleet management solutions through its subsidiary, Fleetboard. Daimler’s focus on connected vehicles, predictive maintenance, and electric truck technology positions it as a frontrunner in the market.

Volvo Group stands out for its comprehensive TaaS offerings, including leasing, maintenance, and connected services. Volvo’s emphasis on sustainability and autonomous truck development strengthens its presence in the global market.

Scania AB specializes in delivering tailored TaaS solutions for logistics and transportation. With advanced telematics and eco-friendly vehicle technologies, Scania supports customers in optimizing operations and reducing environmental impact.

Tesla Inc. disrupts the market with its electric semi-trucks and integrated fleet management systems. Tesla’s focus on clean energy and autonomous driving technology aligns with the growing demand for sustainable TaaS solutions.

These top players are reshaping the TaaS market by offering innovative, efficient, and sustainable solutions. Their contributions drive the adoption of advanced trucking services, ensuring continued growth and transformation in the industry.

Major Companies in the Market

- Daimler AG

- Volvo Group

- Scania AB

- MAN Truck & Bus

- PACCAR Inc.

- Navistar International Corporation

- Hino Motors Ltd.

- Isuzu Motors Limited

- Tata Motors Limited

- Ashok Leyland

- BYD Company Limited

- Nikola Corporation

- Tesla Inc.

Recent Developments

- Nissan & Vehicle-to-Grid (V2G) Technology: On October 2024, Nissan announced plans to launch affordable V2G technology in select electric vehicles by 2026. This system will allow EV owners to use stored electricity in car batteries to power homes or sell energy back to the grid, aiming to reduce annual EV charging costs by up to 50% and decrease net CO2 emissions from charging by 30% per year for the average UK household.

- Nissan & ChargeScape: On October 2024, Nissan became an equal investor in ChargeScape, a V2G integration company, joining BMW, Ford, and Honda. ChargeScape’s platform manages home EV charging and enables energy transfer back to the grid during peak demand. This collaboration is designed to reduce energy costs for EV owners and enhance grid stability.

Report Scope

Report Features Description Market Value (2024) USD 26.5 Billion Forecast Revenue (2034) USD 182.7 Billion CAGR (2025-2034) 21.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Leasing and Rental Services, Maintenance and Repair Services, Fleet Management Services, Digital Freight Brokerage Services, Connectivity Solutions, Insurance Services), By Truck Type (Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks), By Deployment Type (On-Premises, Cloud-Based), By End-User Industry (Retail and E-commerce, Manufacturing, Logistics and Transportation, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Daimler AG, Volvo Group, Scania AB, PACCAR Inc., Navistar International Corporation, MAN SE, Hino Motors, Ltd., Isuzu Motors Limited, Tata Motors, Ashok Leyland, BYD Auto Co., Ltd., Nikola Corporation, Rivian Automotive, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Truck-As-A-Service (TaaS) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Truck-As-A-Service (TaaS) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Daimler AG

- Volvo Group

- Scania AB

- MAN Truck & Bus

- PACCAR Inc.

- Navistar International Corporation

- Hino Motors Ltd.

- Isuzu Motors Limited

- Tata Motors Limited

- Ashok Leyland

- BYD Company Limited

- Nikola Corporation

- Tesla Inc.