Global Triathlon Clothing Market By Type (Tri Tops, Tri Shorts, Tri Suits), By Application (Men, Women), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 100181

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

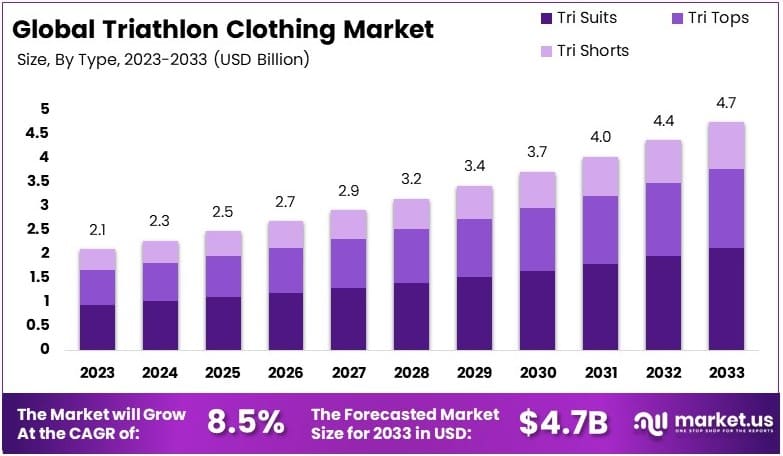

The Global Triathlon Clothing Market size is expected to be worth around USD 4.7 Billion by 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

Triathlon clothing is specialized athletic wear designed for the three stages of a triathlon: swimming, cycling, and running. These garments use lightweight, quick-drying materials to enhance performance and comfort across transitions. Triathlon suits, shorts, and tops are engineered for endurance, reducing drag in water and providing flexibility on land.

The triathlon clothing market includes brands and manufacturers producing gear tailored for triathlon athletes. This market caters to competitive and recreational participants, offering performance-focused designs. With the sport’s global appeal, companies innovate to meet demands for durability, comfort, and speed, supporting athletes across varied weather and race conditions.

Globally, triathlon events draw considerable attention. The Ironman World Championship, for instance, attracts over 2,000 athletes annually, underscoring international interest. In the United States, about 2.5 million people participate in triathlons, showing a steady base for triathlon gear demand, particularly in performance-oriented clothing.

Government funding also supports participation. In the United Kingdom, Sport England invests over £250 million from National Lottery and government funds to promote physical activity, including triathlons. Such investments strengthen the triathlon community, encouraging growth in demand for high-quality clothing designed specifically for this sport.

The market faces competition, with sportswear brands focused on creating innovative, high-performance fabrics. As demand increases, companies strive to balance functionality with affordability, aiming to capture both elite athletes and hobbyists. Saturation remains low, offering opportunities for expansion and market differentiation through specialized products.

This industry benefits from the rising popularity of endurance sports and active lifestyles. With continuous growth in participation, the triathlon clothing market shows strong potential, driven by consumer demand for quality gear that enhances comfort and performance in multi-sport events.

Key Takeaways

- The Triathlon Clothing Market was valued at USD 2.1 Billion in 2023 and is projected to reach USD 4.7 Billion by 2033, with a CAGR of 8.5%.

- In 2023, Tri Suits dominate the type segment with 44.6%, being essential for triathletes.

- In 2023, Men lead the application segment with 64%, aligning with sports demographics.

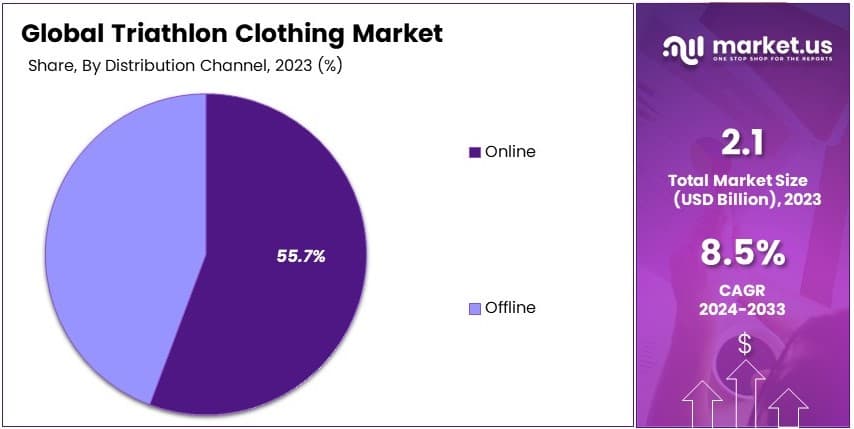

- In 2023, Online sales lead distribution channels with 55.7%, with growing trend of e-commerce.

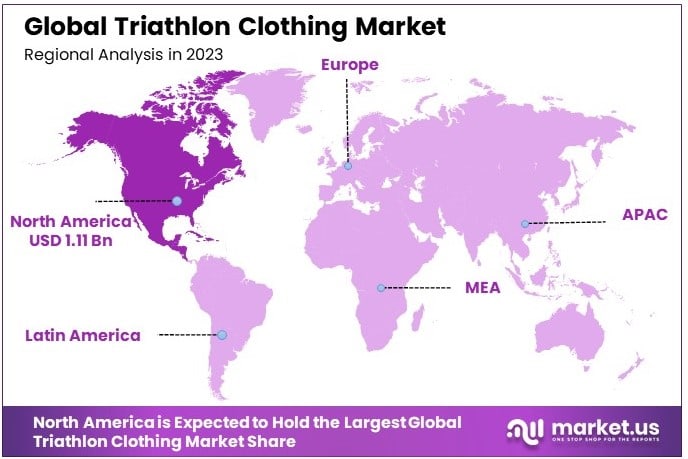

- In 2023, North America dominates with 52.7%, supported by a strong sports culture.

Type Analysis

Tri Suits dominate with 44.6% due to their comprehensive functionality and versatility.

The triathlon clothing market is segmented by type into tri tops, tri shorts, and tri suits. Tri suits hold the largest market share at 44.6%, primarily because they offer athletes a versatile and comprehensive solution for all stages of a triathlon. These suits are designed for swimming, cycling, and running without the need for change, optimizing transition times and enhancing performance.

Tri tops and tri shorts, although not as dominant as tri suits, have significant roles in the market. Tri tops are tailored for comfort and aerodynamics, typically used in warmer races where a full suit might be excessively warm.

Tri shorts are engineered with seat padding ideal for cycling and are flexible enough for running, showing a notable growth rate of 8.2% CAGR due to their specific appeal to athletes looking for specialized gear for training and shorter events.

Application Analysis

Men dominate the market with 64% due to higher participation rates in triathlon events.

Men’s triathlon clothing leads the market with a 64% share, attributed to historically higher participation rates in triathlons and a strong demand for men’s specific triathlon wear. This segment benefits from a wide range of products tailored to men’s physiques, enhancing performance and comfort.

Women’s triathlon clothing, while smaller in market share, is the fastest-growing segment, advancing at a CAGR of 9.6%. This growth is driven by an increasing number of women participating in triathlons and a rising demand for women-specific triathlon gear that offers appropriate fit and support, highlighting the market’s response to diversifying its consumer base and encouraging broader participation across genders.

Distribution Channel Analysis

Online sales lead with 55.7% due to convenience and the growing trend of e-commerce.

The distribution channels for triathlon clothing are categorized into online and offline outlets. The online segment dominates the market, accounting for 55.7% of sales. This dominance is fueled by the convenience of online shopping, the ability to compare prices, and the wider selection of products available.

The e-commerce platform’s growth is also supported by detailed product descriptions and reviews, which are invaluable to consumers making informed purchasing decisions.

The offline segment, though growing at a slower rate of 7.7% CAGR, remains crucial for providing consumers with the opportunity to try on apparel before purchasing, which is particularly important for fit-sensitive items like triathlon clothing. Physical stores also offer the benefit of immediate product availability and personalized customer service, essential for building consumer trust and enhancing shopping experiences.

Key Market Segments

By Type

- Tri Tops

- Tri Shorts

- Tri Suits

By Application

- Men

- Women

By Distribution Channel

- Online

- Offline

Drivers

Increased Event Participation and Health Awareness Drive Market Growth

The Triathlon Clothing Market is expanding as a result of increased participation in triathlon events, a rising awareness of fitness and health, advancements in fabric technology, and growth in retail channels for sports apparel.

As triathlon events become more popular globally, more individuals are investing in specialized clothing that enhances performance and comfort. Health awareness also plays a significant role, as more consumers are motivated to engage in physical activities, including triathlons, leading to higher demand for quality gear.

Moreover, technological advancements have led to the development of performance-enhancing fabrics, including materials that are lightweight, breathable, and moisture-wicking, which have transformed the clothing options for triathletes.

This focus on advanced materials enhances comfort and endurance, making triathlon-specific apparel highly sought after. The growth in sports apparel retail channels, both online and offline, further aids market expansion by providing consumers with easy access to a variety of products.

Restraints

High Costs and Seasonal Demand Restrain Market Growth

The Triathlon Clothing Market faces several restraints, including the high cost of premium clothing, limited awareness in emerging markets, the seasonal nature of demand, and competition from generic sports apparel.

High-quality triathlon apparel often comes with a premium price tag, which may discourage some consumers, especially beginners, from investing in these products. Limited awareness in developing regions also poses a challenge, as these markets are less familiar with triathlon sports and specific apparel needs.

The demand for triathlon clothing tends to be seasonal, peaking during event periods and warmer months, which can lead to fluctuating sales. Additionally, many consumers opt for generic sportswear, which is often cheaper and more versatile, rather than investing in specialized triathlon gear.

Opportunity

Emerging Markets and Wearable Technology Provide Opportunities

Growth opportunities in the Triathlon Clothing Market are driven by expansion into emerging markets, integration with smart wearable technology, the rise of e-commerce platforms, and customization trends. Emerging markets hold potential as increasing income levels and urbanization raise interest in health and fitness activities.

The integration of smart wearable technology, such as clothing with built-in sensors to monitor performance, adds a layer of innovation that appeals to tech-savvy consumers seeking enhanced training tools.

The expansion of e-commerce platforms allows brands to reach a global audience, offering convenience and a broader selection for consumers. Customization trends, including options for personalized designs and fit, allow brands to meet individual preferences, enhancing customer loyalty.

Challenges

Competitive Pressures and Supply Chain Issues Challenge Market Growth

The Triathlon Clothing Market faces significant challenges, including intense competition, rapidly changing consumer preferences, supply chain disruptions, and sustainability concerns.

Competition is fierce, with brands constantly innovating to offer quality at competitive prices, placing pressure on smaller players to keep up. Consumer preferences are also evolving rapidly, requiring companies to adapt quickly to shifting trends, which can be costly and time-consuming.

Supply chain challenges, such as delays and increased production costs, further complicate operations, especially for brands focused on high-quality materials. Additionally, growing environmental concerns require companies to adopt sustainable practices, which may require considerable investment.

Growth Factors

Growing Middle-Class and Fitness Focus Are Growth Factors

Growth in the Triathlon Clothing Market is further supported by a growing middle-class population, rising disposable income, an expanding focus on fitness, and demand for specialized apparel. The rise of the middle class, particularly in emerging economies, has increased spending on sports and fitness-related products, including triathlon clothing.

With more disposable income, consumers are more likely to invest in quality clothing that supports their fitness goals. The expanding focus on personal fitness has also boosted the market, as more individuals adopt healthy lifestyles and look for apparel that meets specific training needs.

Demand for specialized sports apparel, designed for maximum comfort and performance, further supports market growth by catering to both amateur and professional triathletes. Together, these factors underscore a growing market for triathlon clothing that aligns with global health and wellness trends.

Emerging Trends

Demand for Eco-Friendly Materials and Athleisure Are Latest Trending Factors

Several trends are influencing the Triathlon Clothing Market, including the demand for sustainable materials, increased female participation in triathlons, the rise of athleisure, and advancements in breathable fabrics.

Consumers are increasingly conscious of sustainability, leading brands to adopt eco-friendly materials to align with these values. The growing number of women participating in triathlons has created demand for female-specific apparel, reflecting gender-specific needs and preferences.

The athleisure trend, which combines athletic and casual wear, has driven demand for versatile triathlon clothing that can be worn beyond sporting events. Advances in breathable, moisture-wicking fabrics have also gained popularity, as they enhance comfort and performance, making them desirable for both training and competition.

Regional Analysis

North America Dominates with 52.7% Market Share

North America leads the Triathlon Clothing Market with a 52.7% share, totaling USD 1.11 billion. This dominance is driven by high participation rates in triathlons, a strong fitness culture, and widespread adoption of premium sportswear. The U.S. is the largest contributor, supported by well-organized triathlon events and extensive training facilities.

The region benefits from advanced sports apparel R&D, a preference for performance-enhancing materials, and a focus on athlete comfort. Strong e-commerce platforms and brand loyalty also drive sales. Moreover, a growing trend of triathlons as a popular fitness choice contributes to consistent demand for specialized clothing.

North America’s presence in the triathlon clothing market is expected to remain strong. Future growth will be driven by product innovations, expanding online sales, and rising interest in endurance sports.

Regional Mentions:

- Europe: Europe shows steady growth, supported by a strong triathlon culture, advanced sports infrastructure, and a focus on eco-friendly apparel materials.

- Asia Pacific: Asia Pacific experiences rapid growth, driven by increasing fitness awareness, rising disposable income, and government initiatives promoting sports events in countries like Japan and Australia.

- Middle East & Africa: The region sees moderate growth, supported by a growing interest in fitness activities and investments in sports tourism, especially in the UAE and South Africa.

- Latin America: Latin America shows potential, driven by expanding fitness communities, growing awareness of triathlons, and increasing sales of sportswear in countries like Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The triathlon clothing market is growing, driven by rising interest in triathlons and demand for high-performance apparel. The top four players in this market are Zone3 Ltd., Zoot Sports, 2XU, and De Soto Sport. These companies maintain strong positions through innovative designs, high-quality materials, and targeted marketing strategies.

Zone3 Ltd. leads with a wide range of triathlon apparel, including wetsuits, tri suits, and accessories. The company emphasizes comfort, speed, and buoyancy, making it popular among athletes at all levels. Zone3’s focus on R&D and collaborations with professional athletes strengthens its brand image and market presence.

Zoot Sports is known for its lightweight and breathable triathlon gear, catering to both beginners and professionals. The company’s products focus on enhancing performance and reducing drag. Zoot’s commitment to advanced fabrics and customized fits supports its competitiveness in the market.

2XU offers a range of compression-based triathlon clothing that enhances blood flow and muscle recovery. It targets both training and race day apparel, focusing on reducing fatigue and improving endurance. 2XU’s strong global distribution and athlete endorsements contribute to its market growth.

De Soto Sport stands out for its innovative designs and use of high-performance materials like quick-drying fabrics and UV protection. The brand targets serious triathletes with technical gear that improves speed and comfort. De Soto’s emphasis on customer feedback and product evolution drives its strong position.

These companies drive growth by focusing on technological advancements, athlete feedback, and expanding distribution channels, making them leaders in the triathlon clothing market.

Top Key Players in the Market

- Zone3 Ltd.

- Zoot Sports

- De Soto Sport

- Louis Garneau Sports

- Fanatics Inc.

- 2XU

- PEARL iZUMi

- Kiwami Triathlon

- TYR SPORT. INC.

- Other Key Players

Recent Developments

- Brownlee Brothers: On July 4, 2024, British triathletes Alistair and Jonny Brownlee launched Brownlee Racing, a new triathlon team competing in the Supertri global series. Jonny Brownlee will serve as team manager, with Alex Yee and Beth Potter leading the team, aiming to foster British talent in Olympic triathlon.

- Tri-Fit: In March 2022, Australian triathlon apparel brand Tri-Fit announced its international expansion. Founded in 2013, the brand specializes in high-quality triathlon clothing, aiming to reach a global audience of endurance athletes.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 4.7 Billion CAGR (2024-2033) 8.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Tri Tops, Tri Shorts, Tri Suits), By Application (Men, Women), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zone3 Ltd., Zoot Sports, De Soto Sport, Louis Garneau Sports, Fanatics Inc., 2XU, PEARL iZUMi, Kiwami Triathlon, TYR SPORT. INC., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zone3 Ltd.

- Zoot Sports

- De Soto Sport

- Louis Garneau Sports

- Fanatics Inc.

- 2XU

- PEARL iZUMi

- Kiwami Triathlon

- TYR SPORT. INC.

- Other Key Players