Global Transport Chairs Market Analysis By Product Type (Manual Transport Chairs, Powered Transport Chairs), By Material (Aluminum, Steel, Others), By End User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Home Care Settings, Rehabilitation Centers, Nursing Homes & Long-Term Care Facilities) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145594

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

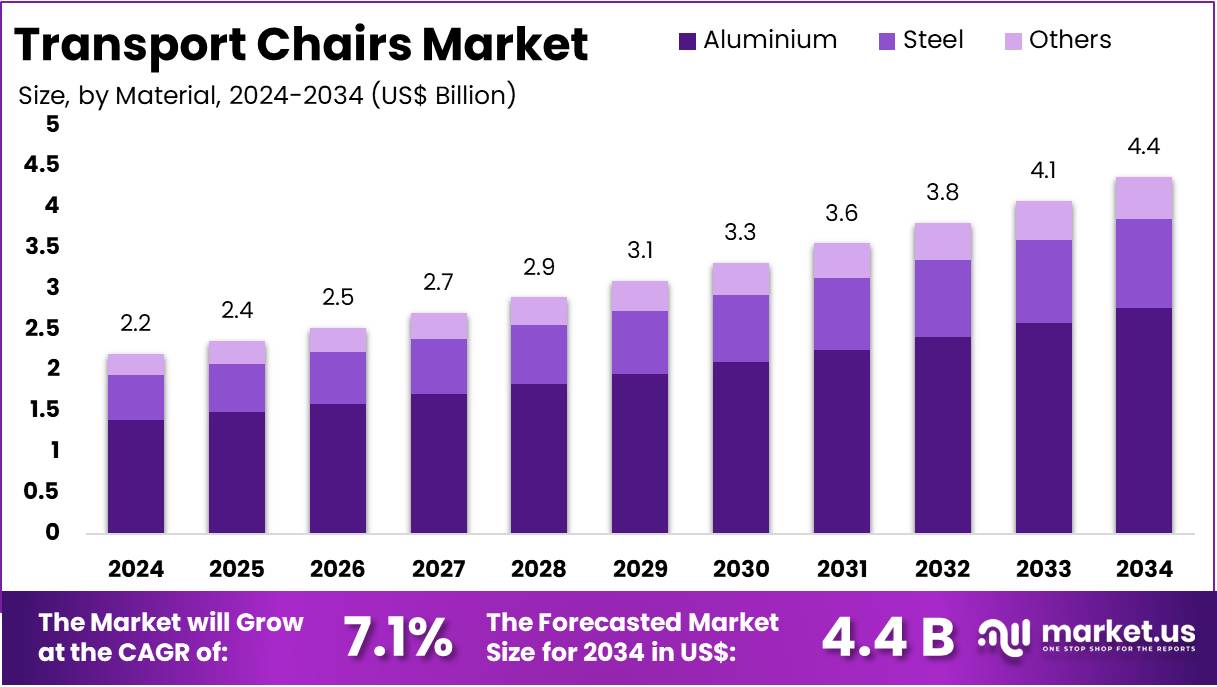

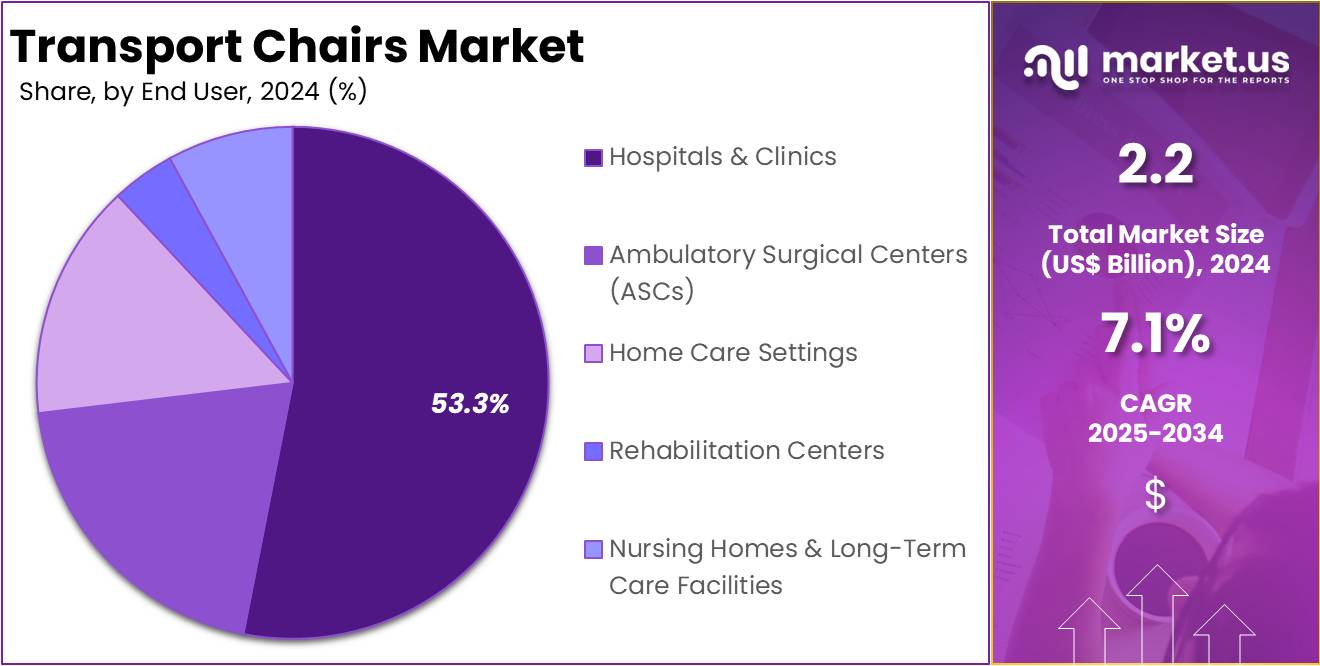

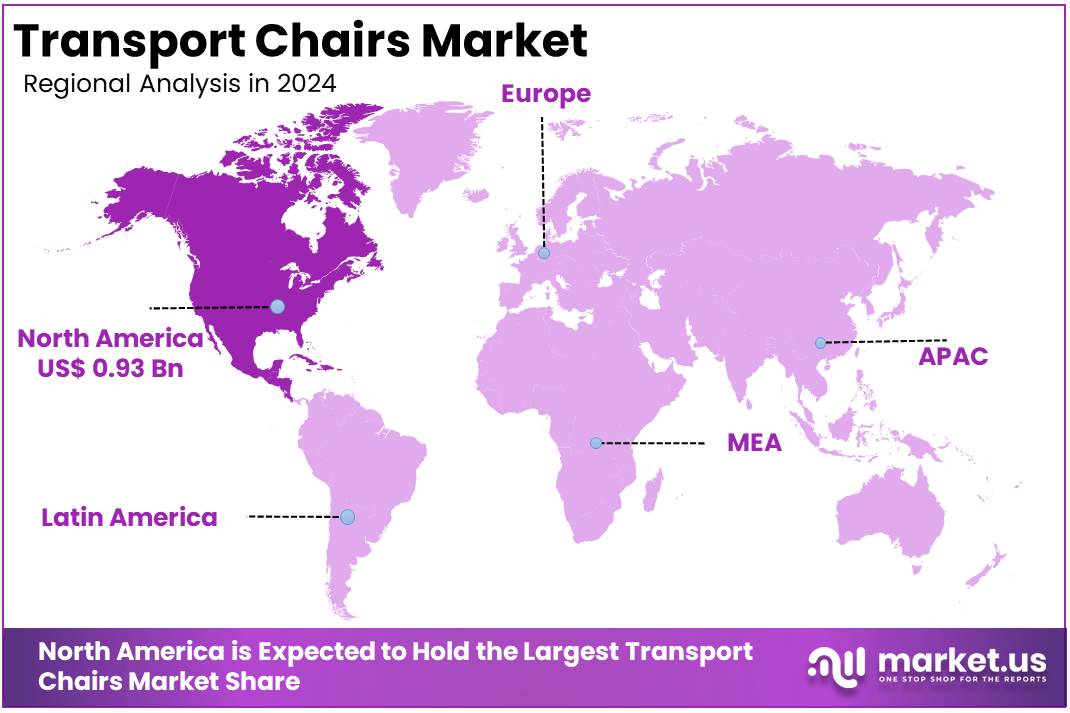

The Global Transport Chairs Market Size is expected to be worth around US$ 4.4 Billion by 2034, from US$ 2.2 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. North America dominated the regional market, accounting for over 42.5% of the total share and achieving a market value of US$ 0.93 billion.

Transport chairs are lightweight mobility devices designed for individuals with limited mobility. Unlike standard wheelchairs, these chairs cannot be self-propelled and must be pushed by a caregiver. Their compact design and ease of maneuverability make them ideal for travel, medical appointments, and short trips. These features make transport chairs especially suitable where space constraints and convenience are primary concerns, driving demand across various demographic segments.

According to the World Health Organization (WHO) and UNICEF Global Report on Assistive Technology (2022), access to assistive products remains highly unequal. In some low-income countries, only 3% of individuals have access to necessary assistive devices, compared to 90% in high-income countries. For example, out of the 80 million people worldwide who require a wheelchair, only 5% to 35% have access to one, depending on their country of residence. This highlights a significant unmet need in the mobility device segment, including transport chairs.

The growing prevalence of non-communicable diseases such as diabetes, cardiovascular disorders, and arthritis has contributed to increased mobility challenges. These conditions often result in reduced physical function, thereby increasing the demand for assistive devices. For instance, transport chairs offer a practical solution to maintain independence and improve quality of life for elderly and chronically ill individuals. Study by Heliyon shows that in the U.S., 10% of adults over 65 use canes and 4.6% use walkers.

In the United States, the U.S. Department of Transportation’s Bureau of Transportation Statistics reported that 49.3% of adults with disabilities use one or more mobility aids. Of these, 28.9% rely on canes or sticks, while 20.1% use walkers or crutches. This suggests a large potential market for mobility aids, including transport chairs, especially among the aging population.

Technological advancements are also shaping the market landscape. Modern transport chairs now include smart features such as position adjustment, transfer assistance, and improved safety mechanisms. These enhancements not only increase user comfort and convenience but also expand the usability of transport chairs to a broader group of patients. For example, newer models are more durable, lightweight, and easier to maneuver, further boosting their appeal among caregivers and healthcare providers.

Global policy and advocacy efforts have further supported market growth. For instance, the WHO’s Wheelchair Provision Guidelines aim to help countries expand access to appropriate mobility aids, including transport chairs. Additionally, increased government support, funding programs, and public health initiatives in low- and middle-income countries are enhancing access and awareness, thus driving adoption. These developments indicate a cautiously optimistic outlook for the global transport chair market.

Key Takeaways

- The global transport chairs market is projected to reach approximately US$ 4.4 billion by 2034, growing at a CAGR of 7.1% from 2025.

- In 2024, the market was valued at US$ 2.2 billion, marking a strong baseline for future expansion in the transport chairs segment.

- Manual transport chairs accounted for over 65.7% of product type sales in 2024, reflecting their widespread adoption due to simplicity and affordability.

- Aluminum emerged as the leading material in 2024, securing over 63.2% market share, favored for its lightweight, durable, and cost-effective properties.

- Clinics dominated the end-user segment in 2024 with more than 56.3% share, driven by consistent demand for mobility aids in outpatient care settings.

- North America led the regional market in 2024, capturing over 42.5% share and reaching a market value of US$ 0.93 billion that year.

Product Type Analysis

In 2024, Manual Transport Chairs held a dominant market position in the Product Type Segment of Transport Chairs, capturing more than a 65.7% share. This was mainly due to their lightweight structure and cost-effectiveness. Many hospitals and care centers prefer these chairs for short-distance patient movement. Their low maintenance needs and ease of handling further support adoption. These chairs are especially popular in low-income regions, where advanced mobility equipment is less accessible due to budget constraints.

Manual transport chairs are often used in clinics, emergency units, and rehabilitation centers. They do not rely on batteries or electric systems, which makes them suitable for facilities with limited resources. An increasing elderly population and rising demand for basic mobility aids have supported the segment’s strong position. Additionally, awareness of home healthcare solutions continues to grow. This trend supports the ongoing preference for manual chairs, particularly in regions with limited access to advanced healthcare devices.

On the other hand, powered transport chairs held a smaller share of the market in 2024. Despite this, the segment is expected to grow at a steady rate. Demand is rising among patients with limited physical strength. New product innovations, such as compact motors and long-lasting batteries, are improving usability. However, high costs and portability concerns limit wider adoption. These factors continue to challenge market growth, especially in developing areas. Yet, increasing urbanization and patient convenience may boost future demand for powered models.

Material Analysis

In 2024, Aluminum held a dominant market position in the Material Segment of Transport Chairs, capturing more than a 63.2% share. This high share was due to several advantages of aluminum. It is lightweight, strong, and resistant to rust. These features made it a preferred choice in hospitals and home care. Aluminum transport chairs are easy to move and store. They are also known for their durability and low maintenance. As a result, demand for aluminum chairs remained strong across multiple user groups.

Steel emerged as the second-largest material type in the same year. It gained popularity for its strength and cost-effectiveness. Steel chairs are widely used in medical institutions. These settings require high load capacity and robustness. However, their heavy weight made them less suitable for travel. Users seeking portability often avoided steel models. Despite this limitation, steel transport chairs continued to serve niche needs. Their presence remained steady in the overall market structure.

The Others segment includes hybrid and composite materials. These materials offer a balance between strength and weight. However, their market share remained small in 2024. Higher production costs and low consumer awareness slowed adoption. These options are still being tested in different settings. Manufacturers are working to improve cost efficiency. Interest in alternatives is rising, but progress is gradual. The material type plays a key role in buyer choice. Trends suggest aluminum will lead future growth in this category.

End User Analysis

In 2024, Clinics held a dominant market position in the End User Segment of Transport Chairs, capturing more than a 56.3% share. This strong presence was due to the rising number of outpatient visits and routine check-ups. Clinics often deal with non-emergency patients who still require mobility support. A lightweight transport chairs are ideal for such settings. Their compact design and ease of handling make them a practical solution for short-distance patient movement within clinics.

Hospitals also represented a key end user in the transport chairs market. These facilities require quick and safe patient transfer across departments. Emergency rooms and recovery wards frequently use these chairs to reduce physical strain on healthcare staff. According to industry insights, hospitals prefer durable and easy-to-clean models. Ambulatory Surgical Centers (ASCs) are also gaining traction. They carry out a growing number of day surgeries. This drives the need for efficient post-operative mobility aids like transport chairs.

Home care settings showed steady growth in demand for transport chairs. This is driven by the aging population and the increasing shift toward in-home medical care. The transport chairs suit these environments well due to their foldable and lightweight nature. Rehabilitation centers and long-term care facilities also contribute to the market. These institutions serve patients with limited mobility or undergoing therapy. As mobility support remains a daily need, the demand for transport chairs in these segments is expected to rise gradually.

Key Market Segments

By Product Type

- Manual Transport Chairs

- Powered Transport Chairs

By Material

- Aluminum

- Steel

- Others

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings

- Rehabilitation Centers

- Nursing Homes & Long-Term Care Facilities

Drivers

Rising Geriatric Population and Mobility-Related Disabilities

The global transport chairs market is being significantly driven by the growing geriatric population. Older adults often experience decreased physical mobility, requiring specialized support. As aging progresses, the need for transport chairs rises due to reduced strength and endurance. Many elderly individuals find it difficult to walk for extended periods. As a result, transport chairs are increasingly used to support daily activities. This trend is especially prominent in developed regions with high life expectancy and advanced healthcare infrastructure.

Another key factor contributing to market growth is the increasing prevalence of mobility-related disorders. Conditions such as arthritis, osteoporosis, and neurological diseases are becoming more common across all age groups. These health issues often result in temporary or permanent disability. In such cases, transport chairs play a vital role in improving patient mobility. The rising diagnosis rate of these conditions further supports demand. Early intervention and advanced mobility solutions are now prioritized in treatment plans.

In both clinical and non-clinical settings, the use of transport chairs is expanding. Hospitals, rehabilitation centers, and home care providers are investing in user-friendly mobility aids. The demand is also fueled by the desire for patient independence and comfort. Lightweight and foldable chair designs are gaining popularity. These features make transport easier for both users and caregivers. The market is expected to grow steadily, driven by a consistent rise in healthcare needs and awareness of mobility solutions.

Restraints

High Cost of Advanced Transport Chairs

The high cost of advanced transport chairs remains a key restraint in the market. These chairs often come with features such as smart technology, lightweight frames, and ergonomic designs. However, the cost of production and materials significantly increases their final price. As a result, many end users find them unaffordable. Healthcare providers, particularly in cost-sensitive regions, face challenges in adopting these high-end solutions. This limits widespread adoption and slows down market penetration, especially in developing economies.

Affordability is a major concern that restricts market growth. Although advanced transport chairs offer improved functionality and comfort, their premium pricing reduces accessibility. Budget constraints in public healthcare systems also contribute to the low uptake. In many instances, institutions and individuals opt for basic models due to cost considerations. As a result, demand for high-tech options is limited to a niche segment. This further widens the gap between technological advancement and practical implementation.

Accessibility in under-resourced regions is severely impacted by pricing. Emerging markets often lack the financial support or subsidies required to make these devices available. Additionally, awareness and training around these chairs are often lacking. Without local distributors or support infrastructure, the cost of procurement becomes even higher. Consequently, advanced transport chairs remain out of reach for many users. This cost barrier continues to hinder inclusive mobility solutions on a global scale, restricting market expansion across low-income areas.

Opportunities

Technological Advancements Driving Market Expansion

Advancements in material science are offering new opportunities for product innovation. The development of lightweight yet durable materials has enabled the creation of more efficient product designs. These improvements can lead to better portability and usability, especially in health and mobility-related devices. Lightweight frames also support user comfort and safety, which are increasingly important factors in consumer decision-making. As a result, manufacturers can improve product performance while also addressing specific customer preferences across various demographic groups.

Manufacturing process innovations are also contributing to market growth. Modern techniques such as 3D printing and automation have increased production speed and precision. These improvements help reduce manufacturing costs while maintaining quality and customization. Additionally, streamlined production supports faster time-to-market, which is essential in competitive markets. As these methods become more accessible, both established and emerging players can benefit from improved operational efficiency and scalability, leading to stronger market presence and enhanced product offerings.

The integration of smart technologies, particularly IoT, is reshaping consumer expectations. Products with features like health monitoring, real-time feedback, and remote connectivity are increasingly in demand. These innovations address the growing need for personalized healthcare and convenience. They also create opportunities for data-driven services and continuous user engagement. In emerging markets, rising smartphone penetration and digital infrastructure are further enabling adoption. As a result, companies that invest in smart and connected solutions are likely to achieve higher consumer engagement and expand their reach across new regions.

Trends

Adoption of Sustainable Materials in Transport Chairs Market

The transport chairs market is witnessing a notable shift toward sustainability. Manufacturers are actively integrating eco-friendly materials in product design and development. Recyclable plastics, aluminum, and biodegradable components are gaining traction. This transition is driven by rising environmental concerns and growing consumer awareness. The shift also aligns with government regulations promoting green manufacturing. As a result, sustainability has become a key factor influencing both product innovation and brand positioning in the transport chairs market.

Recyclable materials are being tested for their strength, weight, and durability. Manufacturers aim to balance eco-friendliness with safety and performance. Traditional materials are being replaced without compromising structural integrity. The focus remains on producing lightweight and long-lasting transport chairs. Product development now considers the full lifecycle, from sourcing to disposal. Such initiatives reduce the environmental footprint. This approach supports a circular economy, which is becoming a priority in healthcare mobility equipment production.

Eco-friendly design strategies are also being incorporated. These include modular structures for easy disassembly and repair. Minimalistic designs are used to reduce material consumption. Water-based coatings and non-toxic finishes are preferred. Brands that adopt these sustainable practices gain competitive advantage. Consumers and healthcare providers are increasingly valuing green certifications. This creates a market differentiation opportunity. Overall, sustainability is emerging as a strategic imperative, influencing design, production, and marketing within the global transport chairs segment.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 42.5% share and holds US$ 0.93 Billion market value for the year. This strong performance was supported by advanced healthcare infrastructure and a growing elderly population. The rise in age-related mobility issues led to increased demand for transport chairs. Hospitals, nursing homes, and rehabilitation centers across the region adopted these products. Improved access to healthcare services also contributed to wider usage across institutional and homecare settings.

The United States accounted for the highest share in the North American market. The country benefits from high healthcare spending and strong insurance coverage. Favorable reimbursement policies further supported product adoption. Transport chairs are widely used in post-surgical care, elderly care, and temporary mobility support. Technological developments in lightweight and foldable designs improved user convenience. This encouraged usage not only in hospitals but also among individuals seeking home-based mobility solutions.

Canada also made a significant contribution to the regional market. Government-supported healthcare and elderly care programs promoted transport chair adoption. Growing awareness about mobility aids led to higher product visibility. The rise in orthopedic surgeries and recovery-related needs created new opportunities. Many facilities focused on enhancing patient mobility and safety. This trend drove consistent demand across public and private care settings. The increase in assistive technology funding also supported product accessibility.

The market outlook remains positive due to continued innovation and strong distribution networks. Manufacturers are introducing advanced features such as ergonomic design and smart mobility functions. This is expected to further boost product appeal. The growing need for mobility support in aging populations remains a key driver. North America is likely to maintain its leading position throughout the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global transport chairs market features several established players that focus on innovation, safety, and ease of use. Carex Health Brands holds a strong position due to its affordable and user-friendly products. Its presence in retail chains supports broad market access, especially in North America. Drive Medical GmbH & Co. KG offers a wide range of lightweight, foldable models. Its reach across North America and Europe ensures consistent demand. Both companies invest in product design and distribution networks to maintain market leadership.

Stryker Corporation competes through advanced design and premium-quality products. Though known for hospital and surgical equipment, its ergonomic transport chairs are preferred in institutional settings. Strong brand reputation and strategic acquisitions support its growth. GF Health Products, Inc. manufactures durable transport chairs that meet global safety standards. The company benefits from efficient manufacturing and distribution capabilities. Its wide customer base includes hospitals and rehabilitation centers. These companies focus on safety, durability, and compliance to gain a competitive advantage.

Invacare Holdings Corporation offers high-quality, customizable transport chairs. Its global presence supports steady market share in North America and Europe. The company focuses on advanced mobility solutions and R&D investments. In addition to major players, regional manufacturers contribute to price competition and niche innovations. Products such as bariatric and pediatric transport chairs are expanding the market scope. Online platforms help smaller players reach a wider audience. This competitive landscape ensures continuous product development and enhances consumer choices across various market segments.

Market Key Players

- Carex

- Stryker

- Drive Medical GmbH & CO. KG

- GF Health Products Inc.

- Invacare Holdings Corporation

- Medline

- Sunrise Medical

- Karman Healthcare Inc.

- NOVA Medical Products

- Staxi

Recent Developments

- In October 2024: New Product Launch, Carex Health Brands introduced the updated Carex Classics Transport Chair. This product features a lightweight, foldable design for portability and ease of use. It includes a 19-inch padded seat, swing-away footrests, and 7.5-inch wheels for enhanced maneuverability. The chair is priced at $99.99, reduced from its regular price of $167.58, making it an affordable option for mobility aid users.

- In April 2023: Stryker introduced the Xpedition powered stair chair, designed to enhance patient and caregiver safety during stair transport. This innovation improves on the original stair chair by offering increased comfort and security for both patients and first responders. The product reflects Stryker’s commitment to advancing patient transport solutions in emergency care.

Report Scope

Report Features Description Market Value (2023) US$ 2.2 Billion Forecast Revenue (2033) US$ 4.4 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Manual Transport Chairs, Powered Transport Chairs), By Material (Aluminum, Steel, Others), By End User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Home Care Settings, Rehabilitation Centers, Nursing Homes & Long-Term Care Facilities) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Carex, Stryker, Drive Medical GmbH & CO. KG, GF Health Products Inc., Invacare Holdings Corporation, Medline, Sunrise Medical, Karman Healthcare Inc., NOVA Medical Products, Staxi, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Carex

- Stryker

- Drive Medical GmbH & CO. KG

- GF Health Products Inc.

- Invacare Holdings Corporation

- Medline

- Sunrise Medical

- Karman Healthcare Inc.

- NOVA Medical Products

- Staxi