Global Transparent Barrier Packaging Films Market By Material (Polyethylene, Ethylene Vinyl Alcohol, Polypropylene, Polyethylene Terephthalate, Polyamide, Polyvinylidene Chloride, Biaxially Oriented Polypropylene), By Application (Food and Beverages, Pharmaceutical Packaging, Personal Care Product Packaging, Household Care Product Packaging, Consumer Goods, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134380

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

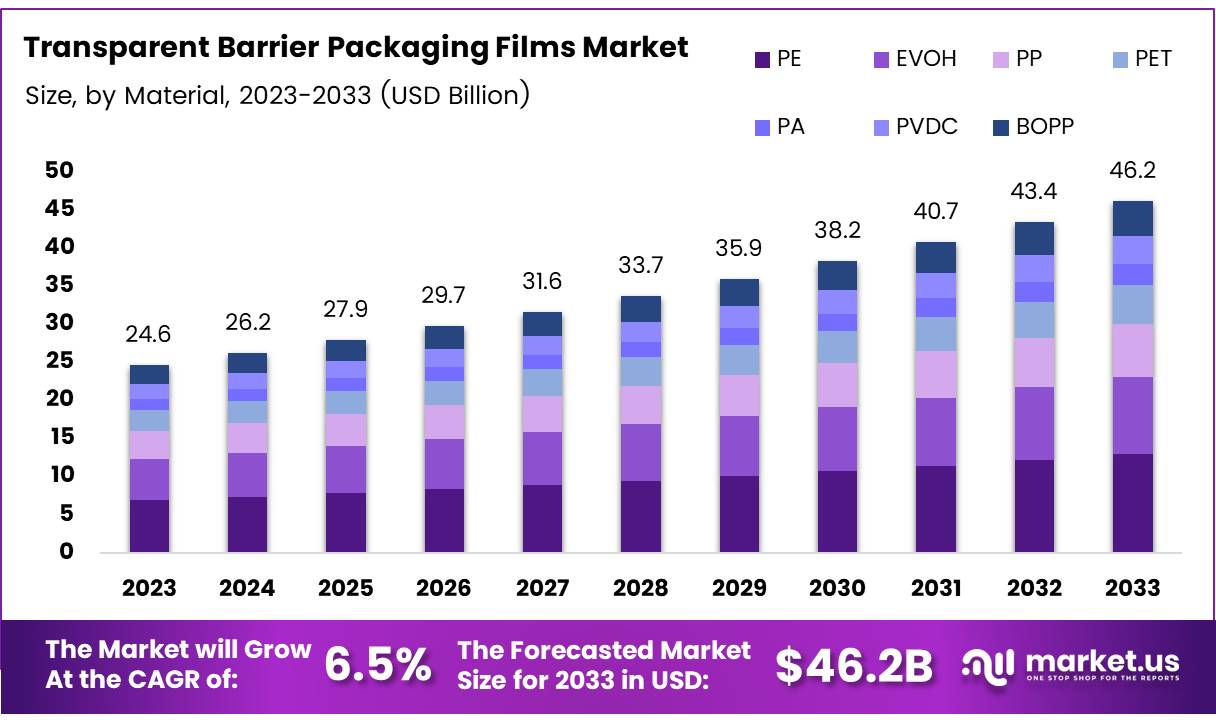

The Global Transparent Barrier Packaging Films Market size is expected to be worth around USD 46.2 Billion by 2033, from USD 24.6 Billion in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

Transparent barrier packaging films are specialized materials used for packaging a variety of consumer products, particularly in the food and beverage, pharmaceutical, and personal care industries. These films combine high transparency with exceptional barrier properties, such as resistance to oxygen, moisture, and contaminants. This ensures that the packaged product remains fresh, stable, and visually appealing throughout its shelf life.

The primary function of transparent barrier films is to provide protection without compromising on the clarity and visibility of the product inside, thereby offering an aesthetic advantage. As a result, these films are widely used for packaging products such as snacks, beverages, and high-end cosmetics, where both functionality and visual appeal are paramount.

The transparent barrier packaging films market refers to the industry involved in the production, distribution, and usage of these films. This market encompasses a broad spectrum of applications, including flexible packaging, stand-up pouches, shrink films, and more. The market is driven by consumer demand for packaging that not only offers functional benefits such as protection from environmental factors but also enhances product presentation.

The growth of the transparent barrier packaging films market is primarily driven by increasing demand across various sectors, particularly the food and beverage industry. Transparent films offer consumers clear visibility into the product, enhancing their buying experience and influencing their purchasing decisions.

For example, research indicates that consumers tend to purchase significantly more when the product is packaged in transparent films, particularly when it is a visually appealing snack food (ScienceDirect). This heightened preference for transparent packaging presents substantial growth opportunities for manufacturers to cater to this demand.

Another key driver for market growth is the rise in demand for convenience foods and ready meals, where extended shelf life and the ability to maintain product integrity are critical. Transparent barrier films provide an optimal solution by offering superior protection against moisture, oxygen, and contamination, thereby increasing the shelf life of products without the need for preservatives.

Additionally, the global annual demand for high-barrier packaging films is estimated to reach 4 million tons, highlighting the significant and growing market for such solutions.

Government regulations play a vital role in shaping the market, particularly concerning food safety, packaging standards, and environmental considerations. Governments worldwide are increasingly enforcing regulations aimed at improving sustainability in packaging. This includes pushing for the reduction of plastic waste, encouraging the use of recyclable materials, and mandating better labeling standards.

In addition to regulatory pressures, there is a growing consumer preference for brands that offer transparency not only in their products but also in their packaging.

According to a study by AltroLabels, 94% of consumers are more likely to remain loyal to brands that use consistent and transparent packaging. This trend underscores the importance of packaging design in establishing brand trust and loyalty. Brands that utilize transparent barrier packaging films are likely to benefit from a competitive edge, as consumers increasingly demand visibility and authenticity in the products they purchase.

The ability to clearly see the product inside its packaging is crucial for consumers in a variety of product categories. Transparent films help communicate the quality and authenticity of the product, which is particularly important in the food sector. As the demand for transparency in packaging grows, brands that adopt such packaging solutions are not only aligning with consumer preferences but also enhancing their market positioning.

Key Takeaways

- The global Transparent Barrier Packaging Films Market is projected to reach USD 46.2 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

- Polyethylene (PE) dominated the By Material Analysis segment in 2023, holding a 37.6% market share due to its flexibility, cost-effectiveness, and ease of processing.

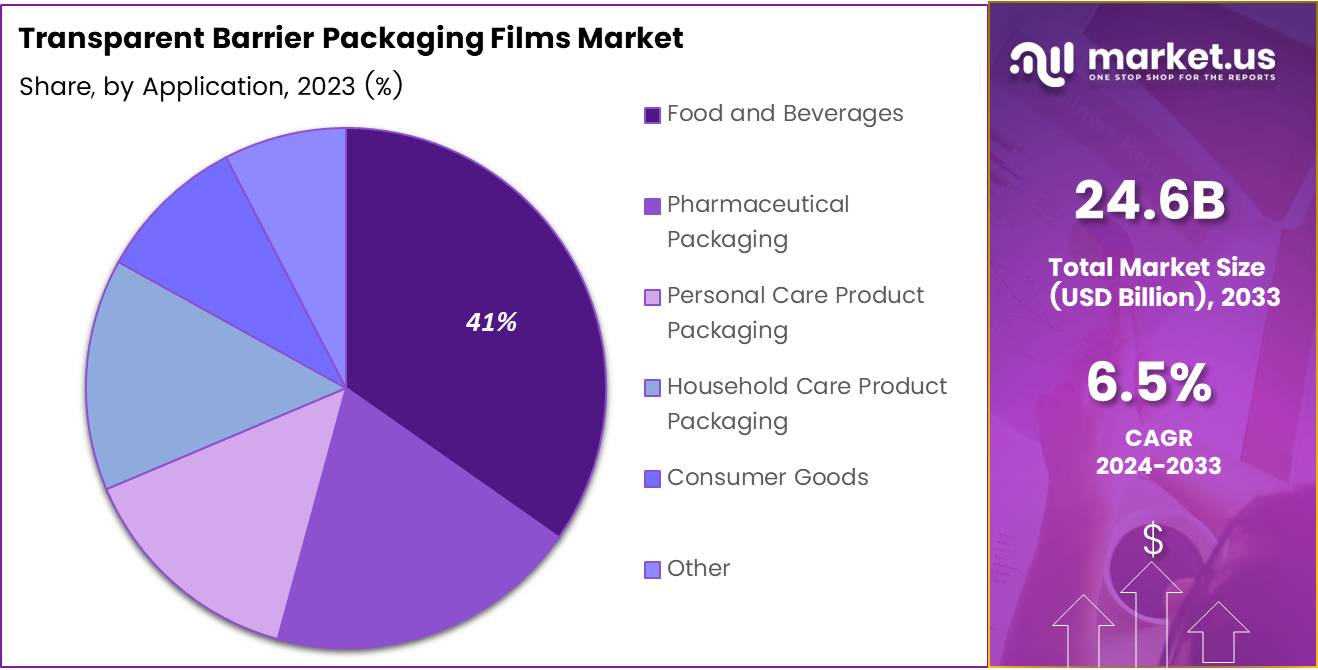

- The Food and Beverages sector led the By Application Analysis segment in 2023, with a 41.6% market share, driven by demand for moisture-resistant packaging solutions.

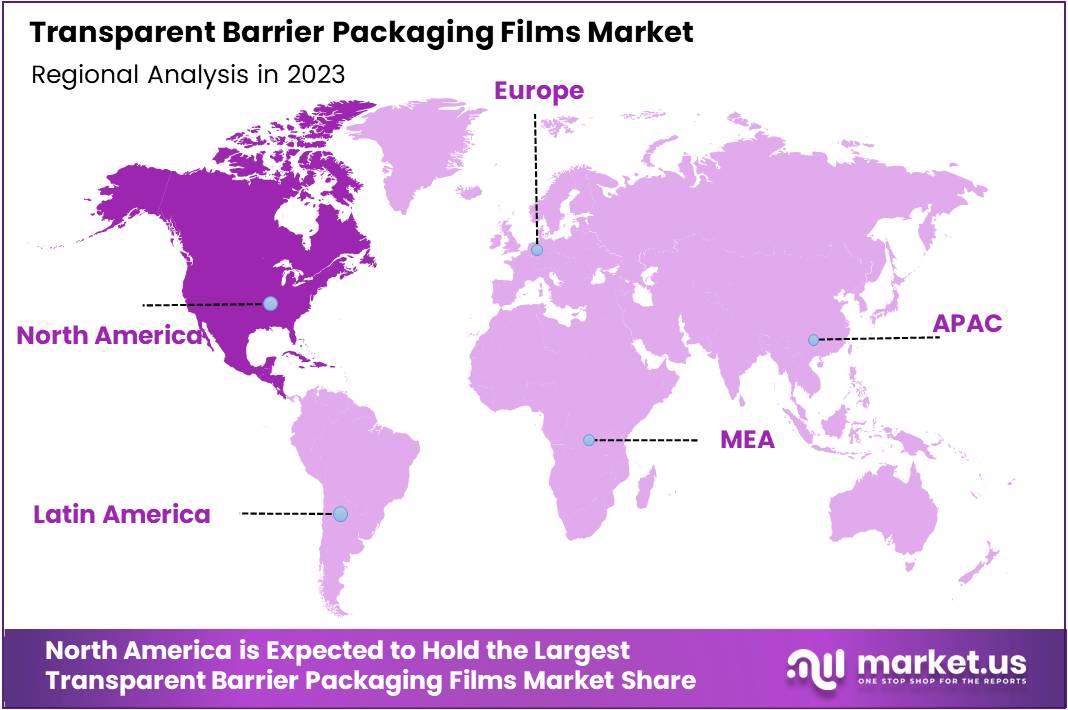

- North America holds a significant share of the transparent barrier packaging films market, supported by strong demand from food & beverage, pharmaceuticals, and personal care industries.

Material Analysis

In 2023, Polyethylene (PE) Dominated the Transparent Barrier Packaging Films Market with a 37.6% Share by Material

In 2023, Polyethylene (PE) held a dominant market position in the By Material Analysis segment of the Transparent Barrier Packaging Films Market, accounting for 37.6% of the total share. PE’s widespread adoption is largely attributed to its superior flexibility, cost-effectiveness, and ease of processing, which make it a preferred material for a range of packaging applications, especially in food and beverage industries.

Ethylene Vinyl Alcohol (EVOH) followed closely, valued for its exceptional barrier properties against oxygen and other gases, contributing to its significant presence in the market. It is often used in packaging where extended shelf-life is critical. Polypropylene (PP) also holds a notable market share due to its excellent moisture resistance and transparency, which are desirable for packaging food items and consumer goods.

Polyethylene Terephthalate (PET), known for its strength and high-temperature resistance, remains a popular material in the packaging of beverages and personal care products. Meanwhile, Polyamide (PA) is gaining traction due to its robust mechanical properties and resistance to chemicals, offering superior performance in industrial applications.

Other materials, such as Polyvinylidene Chloride (PVDC) and Biaxially Oriented Polypropylene (BOPP), are also growing in popularity, though they maintain smaller shares of the market. Together, these materials drive innovation and meet the diverse needs of the transparent barrier packaging films industry.

Application Analysis

Food and Beverages Lead Transparent Barrier Packaging Films Market in 2023 with 41% Share

In 2023, the Food and Beverages segment held a dominant market position in the By Application Analysis category of the Transparent Barrier Packaging Films Market, accounting for 41% of the overall share. This significant market share can be attributed to the growing demand for high-quality, durable, and moisture-resistant packaging solutions to preserve food products’ freshness and extend shelf life.

As the demand for convenience foods, ready-to-eat meals, and packaged snacks continues to rise, food manufacturers are increasingly relying on transparent barrier films to provide an effective solution that maintains product integrity while offering a visually appealing presentation.

The Pharmaceutical Packaging segment followed closely, driven by the rising need for secure and tamper-evident packaging to ensure the safety and efficacy of medications. Personal Care Product Packaging and Household Care Product Packaging also contributed to the market’s expansion, as consumers seek sustainable and efficient packaging options for cosmetics, toiletries, and household cleaners.

Furthermore, the Consumer Goods segment has seen a steady increase in demand for transparent barrier films, as manufacturers of various goods focus on enhancing product visibility and quality. The Other segment, though smaller, also represents niche applications across multiple industries.

Key Market Segments

By Material

- Polyethylene (PE)

- Ethylene Vinyl Alcohol (EVOH)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyamide (PA)

- Polyvinylidene Chloride (PVDC)

- Biaxially Oriented Polypropylene (BOPP)

By Application

- Food and Beverages

- Pharmaceutical Packaging

- Personal Care Product Packaging

- Household Care Product Packaging

- Consumer Goods

- Other

Drivers

Key Drivers of Transparent Barrier Packaging Films Market Growth

The growing demand for sustainable packaging is a major factor driving the expansion of the transparent barrier packaging films market. Consumers increasingly prefer eco-friendly, recyclable, and sustainable packaging solutions, which has led to a shift in the packaging industry. Transparent barrier films align with this trend by offering durable protection for products while minimizing their environmental impact.

In addition, the food and beverage industry is witnessing significant growth, particularly in the demand for packaged foods with longer shelf lives. Transparent barrier films are essential in preserving the freshness and extending the shelf life of perishable items, making them highly sought after in this sector.

As the demand for packaged food continues to rise, the need for packaging solutions that maintain product quality becomes even more critical. Moreover, advancements in technology have played a crucial role in enhancing the performance of transparent barrier films. Innovations in film coatings, barrier properties, and production techniques have improved their effectiveness, making them more attractive to a wider range of industries.

These technological developments have not only increased the films’ protective capabilities but also expanded their applications, offering superior performance for various packaging needs. These factors combined—consumer demand for sustainability, growth in food and beverage packaging, and technological advancements—are driving the transparent barrier packaging films market toward significant growth.

Restraints

Challenges Impacting the Growth of Transparent Barrier Packaging Films Market

One of the key restraints facing the transparent barrier packaging films market is the competition from alternative materials such as glass and metal. These materials often offer similar protective properties, like preventing moisture, oxygen, and light from affecting the contents, while also providing a more durable and tamper-proof packaging solution. This presents a challenge for transparent barrier films, particularly in sectors where product protection is critical, such as in food and beverages or pharmaceuticals.

Additionally, environmental concerns are increasingly influencing consumer and regulatory decisions. Although transparent barrier films made from plastic are recyclable, their production, disposal, and accumulation in landfills or oceans raise significant environmental concerns. Growing consumer awareness about plastic waste and the push for more sustainable packaging solutions have led to resistance, particularly from eco-conscious consumers and regulators.

As a result, companies in the packaging industry face increasing pressure to find more sustainable alternatives or to develop films with a reduced environmental footprint, which can slow down the adoption and growth of transparent barrier films in the market. These factors combined—competition from alternative materials and environmental concerns—represent significant challenges that could limit the market’s expansion in the coming years.

Growth Factors

Expansion in Emerging Markets Drives Growth in Transparent Barrier Packaging Films Market

The transparent barrier packaging films market is poised for significant growth driven by multiple factors. One of the primary opportunities lies in the expansion of emerging markets, where the rising middle class and increasing disposable incomes present a substantial demand for innovative packaging solutions, particularly in the food, beverage, and healthcare sectors. These regions are experiencing an elevated need for high-quality, protective packaging that maintains product integrity while offering consumer appeal.

Another key growth avenue is the development of bio-based and biodegradable barrier films. With consumers and businesses becoming increasingly eco-conscious, there is growing demand for sustainable packaging options that reduce environmental impact. Transparent barrier films made from renewable materials can attract environmentally aware consumers and align with regulations promoting sustainability.

Additionally, the integration of smart technologies into transparent barrier films presents a promising opportunity. Packaging solutions that incorporate features such as RFID tags or QR codes can enhance customer engagement, product traceability, and inventory management. These innovations can appeal to industries looking to improve operational efficiency while providing added value to consumers. As such, the transparent barrier packaging films market stands to benefit from both technological advances and changing consumer preferences, creating a fertile ground for growth across multiple industries.

Emerging Trends

Growth in E-commerce and Demand for Shelf Life Extension

The transparent barrier packaging films market is currently experiencing significant growth due to several emerging trends. One major factor is the rise in e-commerce, where the demand for durable and cost-effective packaging is at an all-time high. With the increase in online shopping, there is a greater need for protective, transparent films that preserve the product’s quality and offer visual appeal during transit. This has driven manufacturers to adopt transparent barrier films that not only protect goods but also allow for brand visibility.

Another key trend is the growing emphasis on food safety and extended shelf life. As consumers continue to prioritize fresh and long-lasting food, packaging solutions that can extend the shelf life of perishable products are increasingly sought after. Transparent barrier films, which provide a protective layer against moisture, oxygen, and other external factors, are becoming crucial in maintaining food quality.

Additionally, the integration of Internet of Things (IoT) technology with transparent films is emerging as a game changer. This technology enables smart packaging, which allows real-time tracking of product conditions, providing consumers and manufacturers with valuable data on the product’s status. This trend highlights the growing need for packaging solutions that not only preserve products but also offer enhanced functionality, making transparent barrier films increasingly important across various sectors, particularly in food and e-commerce packaging.

Regional Analysis

North America Dominant Transparent Barrier Packaging Films Market

North America holds a significant share of the global transparent barrier packaging films market, driven by robust demand across various industries, including food & beverage, pharmaceuticals, and personal care.

The region benefits from an advanced packaging infrastructure, with a strong emphasis on technological innovation and sustainability. In particular, the growing trend towards eco-friendly and sustainable packaging solutions is expected to fuel market expansion in the coming years.

Regional Mentions:

Europe is one of the prominent regions in the global transparent barrier packaging films market, driven by strong demand in the food & beverage, pharmaceutical, and cosmetic industries. The European market is particularly focused on sustainability, with an increasing emphasis on the use of recyclable and biodegradable films in packaging solutions.

Asia Pacific is expected to witness the highest growth rate in the transparent barrier packaging films market over the forecast period. This can be attributed to the rapidly expanding consumer markets in countries like China, India, Japan, and South Korea, coupled with the increasing demand for packaged food, beverages, and pharmaceuticals. The region is undergoing significant industrialization, with increased production of packaged goods and a growing emphasis on improving packaging quality and product protection.

The Middle East and Africa region is seeing gradual growth in the transparent barrier packaging films market, driven by the growing demand for packaged food and beverages, particularly in the Gulf Cooperation Council (GCC) countries. Rapid urbanization, changing consumer habits, and an increase in disposable income are contributing to the rise in packaged goods consumption.

In Latin America, the transparent barrier packaging films market is characterized by moderate growth, driven by increasing demand from the food & beverage sector, particularly for ready-to-eat and convenience foods. Brazil and Mexico are the leading markets in the region, with a growing preference for packaged goods due to urbanization, changing consumer lifestyles, and a rising middle class.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Transparent Barrier Packaging Films Market is characterized by the strong presence of several leading players, each contributing significantly to the industry’s development.

Amcor plc, a global packaging leader, continues to leverage its expertise in sustainable packaging solutions, positioning itself as a prominent force in the transparent barrier films segment. The company’s emphasis on innovation and sustainability aligns with the growing consumer demand for eco-friendly packaging solutions, a trend that is becoming central to the market’s trajectory.

Klöckner Pentaplast and Bemis Manufacturing Company (now part of Amcor) remain influential through their extensive portfolios of high-performance films used in diverse industries such as food, pharmaceuticals, and electronics. These companies benefit from their ability to cater to customized needs, ensuring a strong foothold in the market’s premium segments.

Berry Global Inc. and Sealed Air are also key players, emphasizing their capabilities in providing durable, lightweight, and cost-effective barrier films. These companies are expanding their product offerings to meet the evolving requirements of industries demanding higher barrier protection, particularly in food and beverage packaging.

Meanwhile, regional players such as DS Smith, 3M, and Cosmo Films Ltd. are strengthening their market positions through technological advancements and manufacturing excellence. DS Smith’s focus on circular packaging solutions and 3M’s innovations in barrier technology provide significant growth opportunities.

Top Key Players in the Market

- Amcor plc

- Klöckner Pentaplast

- Bemis Manufacturing Company

- Berry Global Inc.

- Sealed Air

- Sonoco Products Company

- DS Smith

- 3M

- OIKE & Co., Ltd.

- Mitsubishi Chemical Advanced Materials

- Innovia Films

- TOPPAN INC.

- Daibochi Berhad

- Cosmo Films Ltd.

- UFlex Limited

- WINPAK LTD

- Mondi

- DuPont

- Celplast Metallized Products

Recent Developments

- In December 2023, Polymateria secured £20M in Series B funding to accelerate the development and deployment of its innovative biodegradable plastic technology, aiming to reduce plastic pollution globally.

- In February 2024, Sway introduced its first scalable seaweed-based plastic packaging alternative, following the successful closure of a $5M seed round to further develop its sustainable materials.

- In July 2024, Vytal, based in Cologne, raised €6.2 million to expand its tech platform for circular reusable packaging, with a focus on enhancing its digital solutions for sustainable packaging.

- In June 2024, Kelpi, a seaweed packaging innovator, secured £4.35 million in new funding to advance the production of its biodegradable seaweed-based packaging solutions.

- In January 2024, Packmatic, a Berlin-based digital packaging platform, raised €15 million to scale its B2B solutions across Europe, further transforming the packaging supply chain with smart, sustainable technology.

Report Scope

Report Features Description Market Value (2023) USD 24.6 Billion Forecast Revenue (2033) USD 46.2 Billion CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polyethylene, Ethylene Vinyl Alcohol, Polypropylene, Polyethylene Terephthalate, Polyamide, Polyvinylidene Chloride, Biaxially Oriented Polypropylene), By Application (Food and Beverages, Pharmaceutical Packaging, Personal Care Product Packaging, Household Care Product Packaging, Consumer Goods, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor plc, Klöckner Pentaplast, Bemis Manufacturing Company, Berry Global Inc., Sealed Air, Sonoco Products Company, DS Smith, 3M, OIKE & Co., Ltd., Mitsubishi Chemical Advanced Materials, Innovia Films, TOPPAN INC., Daibochi Berhad, Cosmo Films Ltd., UFlex Limited, WINPAK LTD, Mondi, DuPont, Celplast Metallized Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transparent Barrier Packaging Films MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Transparent Barrier Packaging Films MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Klöckner Pentaplast

- Bemis Manufacturing Company

- Berry Global Inc.

- Sealed Air

- Sonoco Products Company

- DS Smith

- 3M

- OIKE & Co., Ltd.

- Mitsubishi Chemical Advanced Materials

- Innovia Films

- TOPPAN INC.

- Daibochi Berhad

- Cosmo Films Ltd.

- UFlex Limited

- WINPAK LTD

- Mondi

- DuPont

- Celplast Metallized Products