Global Chocolate Bar Packaging Market By Material (Plastic, Paper, Metal, Others), By Product Type (Wrappers, Stick Packs, Pouches, Bags, Others), By Distribution Channel (Retail, Supermarkets, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134258

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

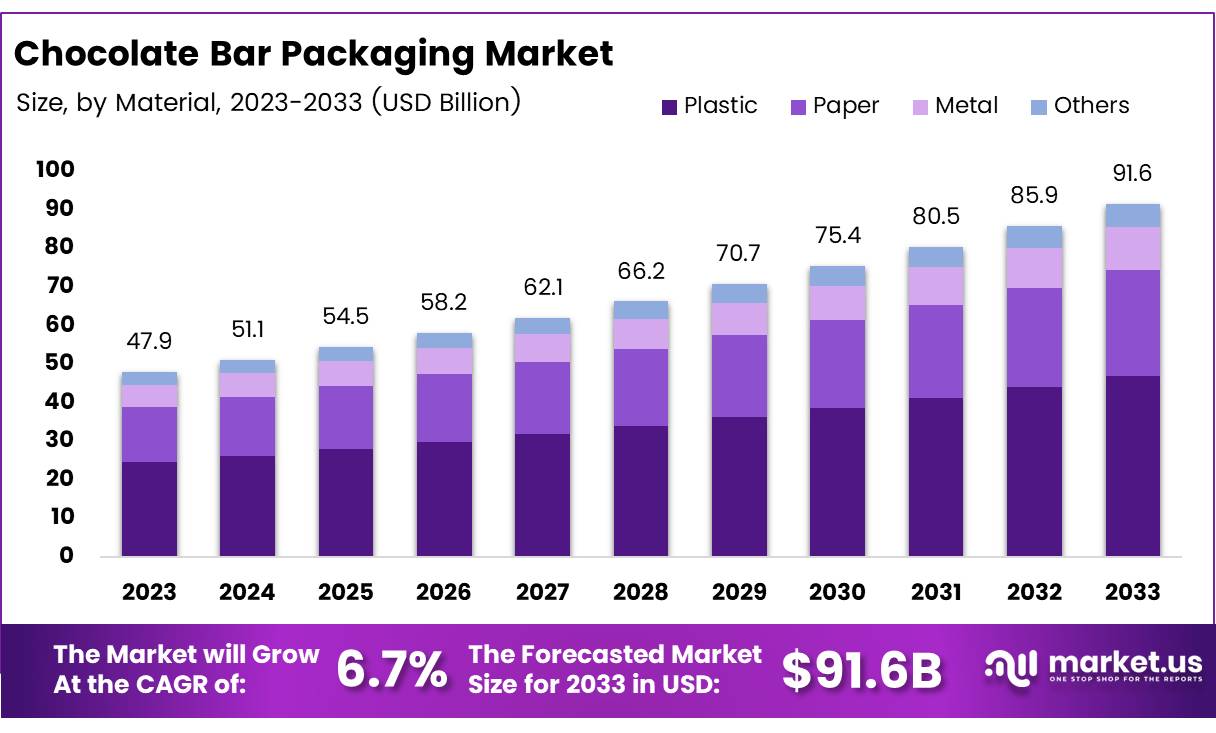

The Global Chocolate Bar Packaging Market size is expected to be worth around USD 91.6 Billion by 2033, from USD 47.9 Billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

Chocolate bar packaging refers to the materials and processes used to wrap, store, and protect chocolate bars, ensuring their quality and appealing presentation. Packaging plays a key role in preserving the taste, texture, and shelf-life of chocolate, while also influencing consumer choices and brand perception.

The growth of the packaging market is driven by the rising consumption of chocolate, innovations in packaging technology, and a growing focus on sustainability. In 2022, global chocolate consumption reached 7.5 million tons, demonstrating the ongoing popularity of chocolate worldwide.

This surge in demand has led to an increased need for packaging materials, with many companies focusing on reducing their environmental impact. As sustainability becomes a central concern, packaging companies are investing in biodegradable packaging and recyclable materials to meet consumer expectations for eco-friendly packaging.

The market is also benefiting from the growing demand for premium chocolate products. Over $5 billion worth of cacao-based materials are imported annually into the United States, highlighting the rise in demand for higher-quality chocolate. This trend offers opportunities for packaging companies to provide customized solutions for premium and organic chocolates.

Governments are further influencing the chocolate bar packaging market by introducing regulations aimed at reducing plastic waste and promoting recyclable materials. The European Union, for example, has implemented measures to curb single-use plastics, encouraging packaging companies to develop alternative solutions.

Consumer preferences are increasingly shifting toward brands that prioritize sustainability and ethical sourcing. Reports indicate that 66% of global consumers prefer brands with a positive environmental and social impact. This growing consumer awareness is driving demand for eco-friendly packaging, with companies using biodegradable or recyclable materials gaining market share. Although 70% of chocolate packaging is still made from plastic, the industry is moving toward alternatives like paper or plant-based plastics.

As sustainability becomes a priority, governments worldwide are introducing regulations that push companies to adopt more environmentally friendly packaging solutions. The shift toward biodegradable and compostable packaging is gaining momentum, though it also presents challenges such as higher production costs and the need for improved recycling infrastructure.

Fluctuating raw material prices are another factor influencing the chocolate bar packaging market. The average cost of a chocolate bar has risen by 8% in 2024, driven by inflationary pressures on raw materials and production costs, including packaging components. This increase in prices may lead chocolate manufacturers to seek more cost-efficient packaging solutions that still align with sustainability goals.

Key Takeaways

- The global chocolate bar packaging market is projected to reach USD 91.6 billion by 2033, growing at a CAGR of 6.7%.

- Plastic accounted for 51.3% of the market share in the material segment in 2023 due to its versatility and barrier properties.

- Wrappers led the product type segment in 2023, holding a 35.6% share.

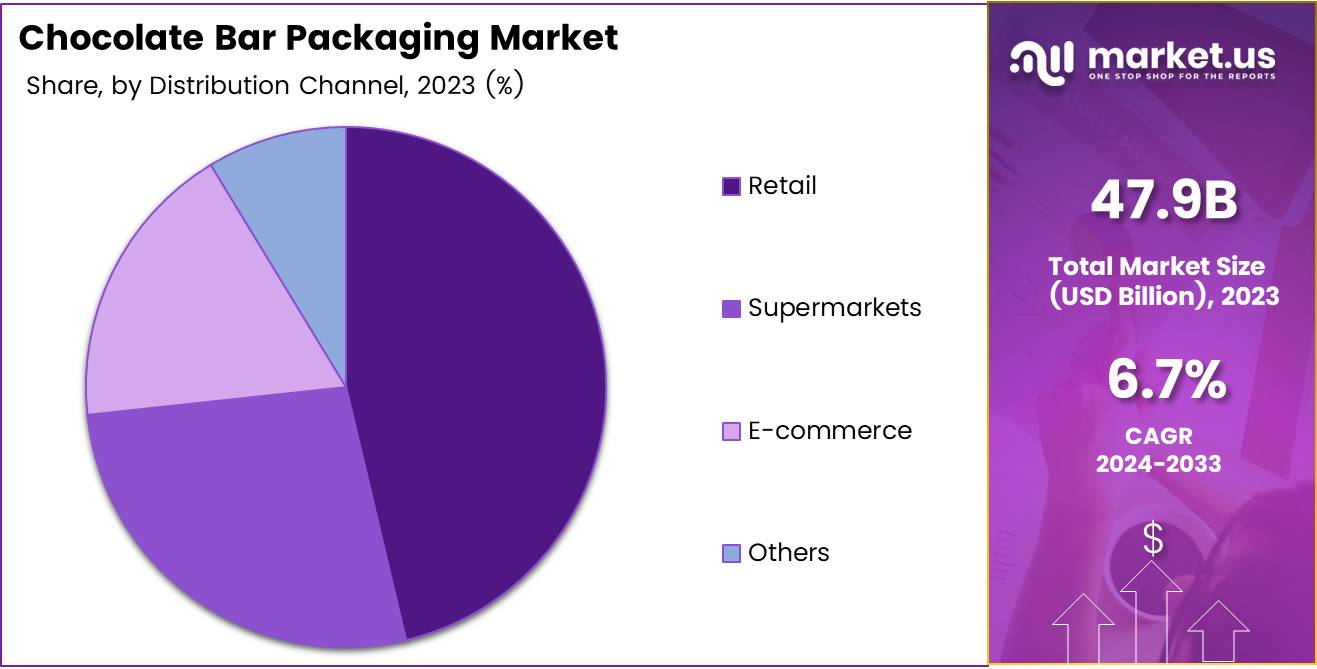

- Retail distribution channels dominated the market in 2023, with traditional stores like supermarkets and convenience stores leading the way.

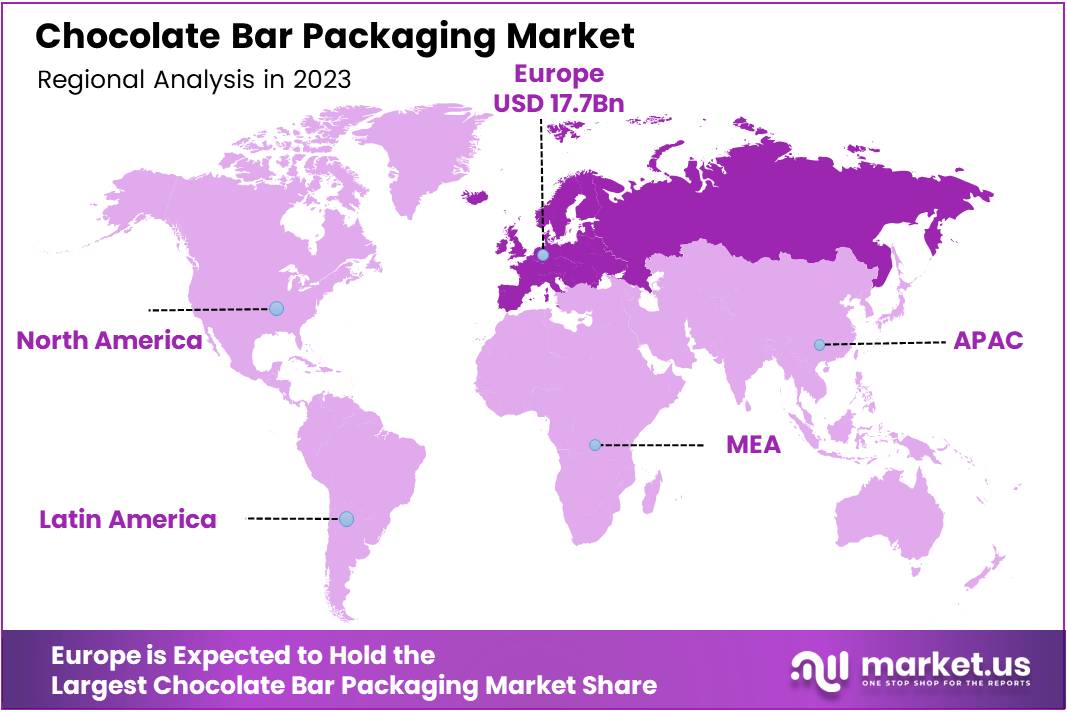

- Europe held the largest regional market share in 2023, accounting for 37% of the total market,

Material Analysis

In 2023, Plastic Dominated the Chocolate Bar Packaging Market with a 51.3% Share by Material Type

In 2023, plastic maintained a dominant market position in the By Material Analysis segment of the chocolate bar packaging market, with a substantial 51.3% share. This significant share can be attributed to plastic’s versatility, cost-effectiveness, and superior barrier properties, which ensure the preservation of the chocolate’s freshness and texture.

The material is also lightweight, reducing transportation costs, and is highly customizable in terms of design, which appeals to manufacturers seeking aesthetic appeal and branding opportunities.

Following plastic, paper-based packaging held a notable position, contributing to a growing trend towards sustainable and eco-friendly materials. With increasing consumer preference for environmentally conscious packaging, paper is expected to see gradual growth in the coming years, although it still accounted for a smaller portion compared to plastic.

Metal packaging, predominantly used for premium chocolate products, accounted for a moderate market share, valued for its premium appeal and durability. Lastly, the Others segment, including materials like glass and biodegradable plastics, represented a smaller share, with limited market penetration but notable potential in niche applications.

Overall, while plastic continues to dominate, shifting consumer preferences towards sustainability are expected to influence the market’s dynamics, gradually reshaping material choices in chocolate bar packaging.

Product Type Analysis

Wrappers Lead the Chocolate Bar Packaging Market with a 35.6% Share in 2023

In 2023, Wrappers held a dominant market position in the By Product Type Analysis segment of the Chocolate Bar Packaging Market, with a 35.6% share.

This strong market presence can be attributed to their widespread use due to cost-effectiveness, ease of handling, and versatility. Wrappers are particularly preferred in the packaging of small to medium-sized chocolate bars, providing adequate protection while also offering opportunities for branding through vibrant designs and logos.

Stick Packs followed closely behind, capturing a significant portion of the market due to their compact, convenient format that aligns with on-the-go consumer lifestyles. Stick packs are gaining popularity, particularly in snack-sized chocolate products, appealing to the demand for portability.

Pouches and Bags accounted for a smaller yet notable share, catering to larger-sized chocolate products and offering a balance between flexibility and cost. These packaging options are often favored for their ability to accommodate higher quantities and provide ample space for product information and branding.

Other packaging formats, including jars and tubs, also contribute to the market but occupy a more niche segment, primarily used for premium or bulk chocolate offerings. The packaging landscape is expected to continue evolving, with sustainability becoming an increasingly important factor in shaping consumer preferences.

Distribution Channel Analysis

Retail Dominates Chocolate Bar Packaging Market by Distribution Channel in 2023

In 2023, Retail held a dominant market position in the By Distribution Channel Analysis segment of the Chocolate Bar Packaging Market. Retail channels, including traditional brick-and-mortar stores such as supermarkets, specialty stores, and convenience stores, accounted for the largest share of the market.

This can be attributed to the continued consumer preference for in-store shopping experiences, especially for impulse purchases and premium chocolate products, which are prominently displayed in physical retail outlets. Additionally, supermarkets remained a key player within the retail segment, benefiting from their extensive product ranges, promotional offers, and strategic placement of chocolate bars.

Supermarkets were followed by the growing influence of e-commerce platforms, which have seen increased adoption due to convenience and the rise in online shopping. E-commerce’s share in the chocolate bar packaging market has been expanding steadily, driven by a shift in consumer buying behavior, particularly during the pandemic and subsequent recovery periods. However, despite e-commerce growth, retail remains the primary driver due to its longstanding dominance in consumer purchasing patterns.

The Others category, which includes distribution via vending machines and wholesale, also contributed to the market but at a smaller scale compared to retail and e-commerce channels. The shift towards more diverse packaging formats is likely to influence distribution strategies in the coming years.

Key Market Segments

By Material

- Plastic

- Paper

- Metal

- Others

By Product Type

- Wrappers

- Stick Packs

- Pouches

- Bags

- Others

By Distribution Channel

- Retail

- Supermarkets

- E-commerce

- Others

Drivers

Increased Demand for Convenient, Sustainable, and Health-Conscious Packaging

The chocolate bar packaging market is experiencing several key drivers that are shaping its evolution. First, there is a growing demand for convenient packaging.

As consumers lead increasingly busy lives, they prefer chocolate bars in packaging that is easy to carry, resealable, and portable, making it more convenient for on-the-go consumption. This trend is especially prominent among younger demographics and busy professionals who prioritize ease of use.

Additionally, sustainability has become a major factor influencing packaging design. Consumers are more environmentally conscious, which has led to an increasing demand for eco-friendly and recyclable materials. Manufacturers are responding by adopting sustainable practices, using biodegradable films, and minimizing excess packaging to reduce waste.

Another significant driver is the rising health consciousness among consumers. With more people becoming aware of health issues like sugar intake, packaging that highlights the nutritional benefits, such as low sugar or organic, is gaining popularity. This is encouraging brands to rethink their packaging to emphasize these health-conscious features, making it a crucial aspect of the product’s overall appeal.

Together, these drivers convenience, sustainability, and health awareness—are reshaping the chocolate bar packaging market, as companies strive to meet consumer expectations while aligning with broader environmental and health trends.

Restraints

Challenges in the Chocolate Bar Packaging Market

One of the key restraints in the chocolate bar packaging market is the environmental impact of non-sustainable packaging materials. While there is increasing pressure from both consumers and regulatory bodies for more eco-friendly packaging solutions, the transition from traditional packaging to sustainable alternatives is still a significant challenge.

Conventional packaging materials, such as plastic and certain types of foil, are often cost-effective and provide excellent protection for the product, but they contribute to long-term environmental issues, including waste accumulation and pollution. The development and adoption of biodegradable or recyclable packaging solutions, although progressing, face barriers related to cost, material availability, and manufacturing complexity. This can slow down the industry’s shift towards sustainability.

Additionally, regulatory compliance issues play a role in hindering packaging innovation. Fresh food packaging materials, especially those in direct contact with food products, are subject to strict regulations regarding safety, hygiene, and material use. These regulations, while essential for consumer protection, can lead to increased costs for manufacturers and restrict the development of new packaging solutions.

The need to balance regulatory compliance with innovative, cost-effective, and environmentally-friendly packaging designs creates an ongoing challenge for the chocolate bar packaging market, slowing the pace of change despite growing consumer demand for sustainability.

Growth Factors

Growth Opportunities in the Chocolate Bar Packaging Market

The chocolate bar packaging market is witnessing significant growth driven by several emerging opportunities. A major trend is the adoption of eco-friendly packaging, as the global shift toward sustainability prompts companies to focus on recyclable, biodegradable, and compostable materials. This not only helps reduce environmental impact but also appeals to environmentally-conscious consumers, offering brands a competitive edge.

Additionally, the integration of smart packaging is gaining momentum, with technologies like QR codes, NFC tags, and sensors being incorporated into packaging to enhance consumer engagement and enable better product tracking. This trend allows companies to offer a more personalized and interactive experience, helping to build stronger brand loyalty.

Moreover, the premium and luxury chocolate markets are expanding, driven by rising disposable incomes and growing demand for high-quality, artisanal chocolates. Packaging plays a crucial role in this segment, as consumers seek elegant, high-end packaging that reflects the premium nature of the product.

This presents a niche but lucrative opportunity for packaging manufacturers to develop sophisticated, premium designs tailored to this market segment. Overall, the chocolate bar packaging market is well-positioned for growth, with sustainability and innovation being central to its development, while luxury and premium segments create valuable opportunities for specialized packaging solutions.

Emerging Trends

Key Trends Shaping the Chocolate Bar Packaging Market

The chocolate bar packaging market is experiencing significant shifts driven by evolving consumer preferences and innovative design concepts. One major trend is the increasing demand for interactive and engaging designs. Chocolate brands are incorporating features like augmented reality (AR) or QR codes on their packaging, allowing consumers to interact with the product beyond traditional labeling. This not only enhances the consumer experience but also encourages brand loyalty.

Alongside this, functional packaging is gaining traction. Consumers are seeking convenience, which has led to the rise of packaging innovations like resealable wrappers and easy-to-open designs. This trend addresses the growing need for packaging that is both user-friendly and sustainable.

Furthermore, product transparency is becoming a critical factor. Shoppers are now more conscious of the origins and quality of ingredients in their food, and as a result, chocolate brands are increasingly adopting transparent packaging solutions. Clear ingredient labels and eco-friendly materials allow consumers to make more informed purchasing decisions, aligning with the broader trend towards health and sustainability.

These trends collectively reflect the chocolate bar packaging industry’s efforts to cater to a more engaged, informed, and convenience-seeking consumer base, with brands using packaging not just as a protective layer, but as a communication tool to reinforce values and enhance brand identity.

Regional Analysis

Europe remains the dominant region in the chocolate bar packaging market holding 37% of the market share

The chocolate bar packaging market is experiencing substantial growth across various global regions, with Europe being the dominant player, accounting for 37% of the total market share, valued at approximately USD 17.7 billion.

This dominance can be attributed to Europe’s established chocolate consumption culture, high demand for premium products, and growing focus on sustainable packaging solutions. With stringent environmental regulations and an increasing preference for eco-friendly packaging alternatives, European manufacturers are increasingly adopting recyclable and biodegradable materials, driving the overall market growth in the region.

Regional Mentions:

North America, particularly the United States, holds a significant share of the market. The region’s market is characterized by continuous innovation, especially in terms of packaging designs, such as resealable, single-serve, and portion-controlled formats. There is also a marked shift towards healthier chocolate options, such as organic and low-sugar variants, which is fueling demand for new packaging technologies. This trend is expected to sustain growth in the region, supported by a mature and competitive chocolate industry.

The Asia Pacific region, although currently smaller in comparison, is poised for the fastest growth. With rising disposable incomes, urbanization, and an evolving taste for chocolate products, particularly in countries like China, India, and Japan, the demand for chocolate bar packaging is expected to surge in the coming years. Consumer preferences are shifting towards more Westernized consumption patterns, which further enhances the potential for market growth in the region.

In Latin America and the Middle East & Africa, the market is comparatively smaller but is anticipated to grow steadily. These regions are experiencing a gradual increase in demand for chocolate products, particularly with the younger demographic, and are expected to show an uptick in packaged chocolate consumption driven by urbanization and changing consumer preferences.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global chocolate bar packaging market is characterized by a diverse range of key players, each leveraging innovation, sustainability, and advanced technologies to capture market share.

Companies such as Amcor Plc, Mondi Plc, and Sonoco Products Company stand out due to their global presence, established expertise, and comprehensive packaging solutions that cater to the unique requirements of chocolate manufacturers. These companies offer a wide range of packaging materials, including flexible films, pouches, and rigid packaging solutions, which are critical for preserving the quality and extending the shelf life of chocolate products.

Amcor Plc and Mondi Plc are particularly noted for their leadership in sustainable packaging, aligning with the increasing demand for eco-friendly materials. Both companies are heavily invested in developing recyclable, biodegradable, and compostable packaging solutions, which are becoming more important in the consumer goods sector, as environmental considerations drive purchasing decisions.

Huhtamaki Oyj and Packman Packaging have strengthened their market positions by offering customized packaging solutions, focusing on both functionality and aesthetics. These firms are adept at blending consumer appeal with practicality, an essential balance for chocolate packaging, which requires both attractive design and durability during transport.

Stora Enso Oyj and Swiftpak Limited are recognized for their strong focus on innovation in material science, continually developing advanced packaging technologies that ensure the freshness and protection of chocolate bars. Additionally, companies like JBM Packaging and Charpak Ltd are gaining traction through a combination of flexible, cost-effective solutions, catering to both large multinational brands and niche producers.

Top Key Players in the Market

- Amcor Plc

- Charpak Ltd

- Marber S.r.l.

- Packman Packaging

- Stora Enso Oyj

- JBM Packaging

- Packle Packaging Industries

- The Sherwood Group

- Swiftpak Limited

- Sonoco Products Company

- Mondi Plc

- Huhtamaki Oyj

Recent Developments

- In November 2024, Cadbury announced that beginning in 2025, approximately 300 million of its sharing bars sold in the UK and Ireland will be packaged in 80% certified recycled plastic, utilizing advanced recycling technology to support its sustainability goals.

- In March 2024, Love Cocoa, a UK-based chocolate brand, secured a £4.25 million investment to accelerate its growth and expand its product offerings, signaling a significant step towards becoming a major player in the premium chocolate market.

- In October 2024, Barry Callebaut, the Swiss chocolate manufacturer, revealed plans to invest $30 million in a new state-of-the-art chocolate production facility, aimed at enhancing its global manufacturing capabilities and meeting growing demand in key markets.

Report Scope

Report Features Description Market Value (2023) USD 47.9 Billion Forecast Revenue (2033) USD 91.6 Billion CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Paper, Metal, Others), By Product Type (Wrappers, Stick Packs, Pouches, Bags, Others), By Distribution Channel (Retail, Supermarkets, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor Plc, Charpak Ltd, Marber S.r.l., Packman Packaging, Stora Enso Oyj, JBM Packaging, Packle Packaging Industries , The Sherwood Group, Swiftpak Limited, Sonoco Products Company, Mondi Plc, Huhtamaki Oyj Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chocolate Bar Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Chocolate Bar Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor Plc

- Charpak Ltd

- Marber S.r.l.

- Packman Packaging

- Stora Enso Oyj

- JBM Packaging

- Packle Packaging Industries

- The Sherwood Group

- Swiftpak Limited

- Sonoco Products Company

- Mondi Plc

- Huhtamaki Oyj