Global Transient Protection Device Market By Type(AC Transient Protection System, DC Transient Protection System), By End-user Verticals (Industrial, Commercial, Residential), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166090

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

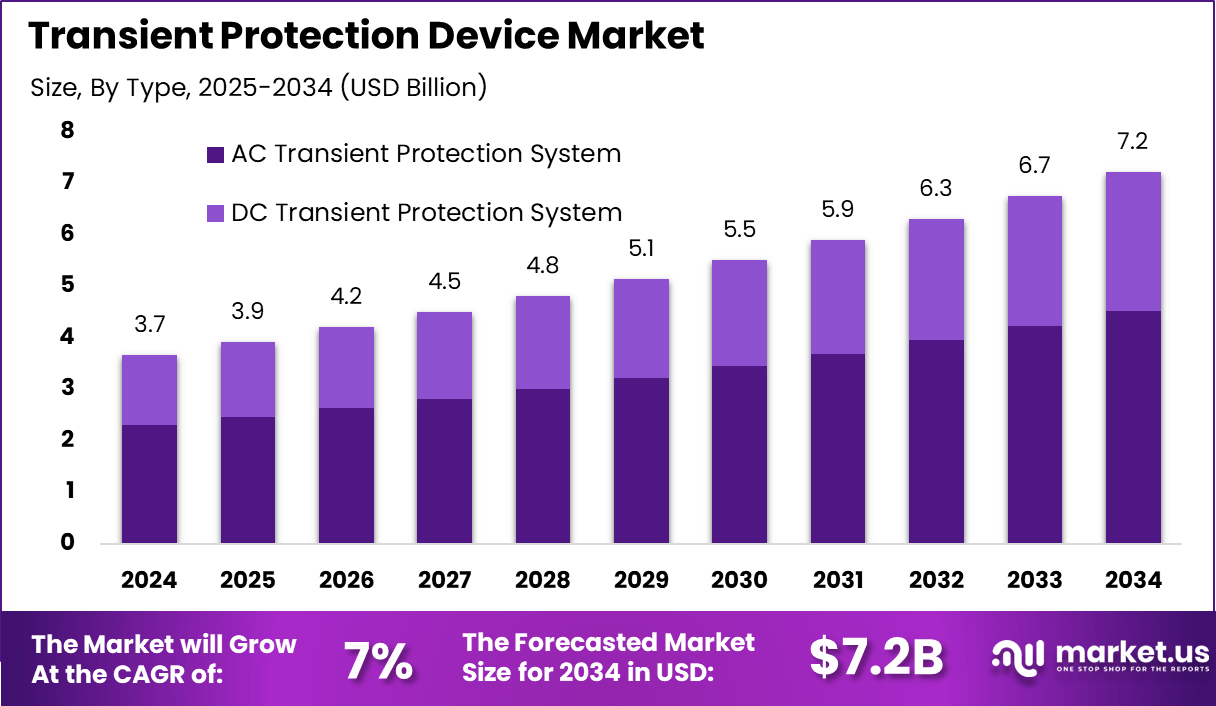

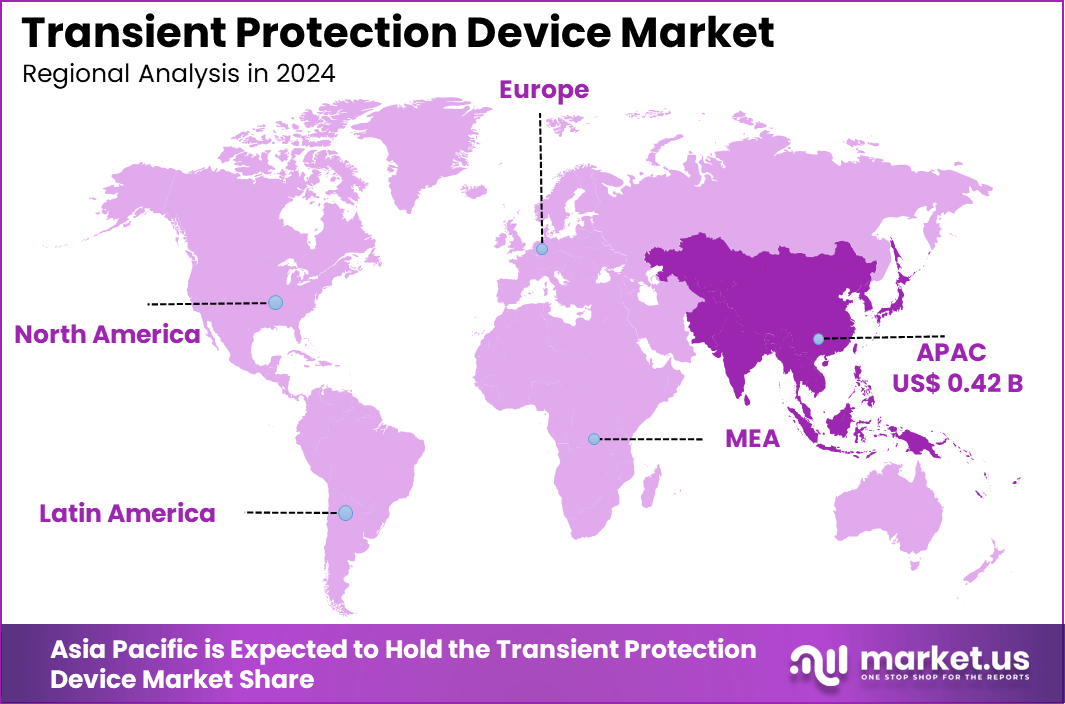

The Global Transient Protection Device Market generated USD 3.7 billion in 2024 and is predicted to register growth from USD 3.9 billion in 2025 to about USD 7.2 billion by 2034, recording a CAGR of 7% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 36.6% share, holding USD 0.42 Billion revenue.

The transient protection device market has grown as industries, utilities and commercial facilities strengthen their electrical safety systems to protect equipment from voltage spikes and power disturbances. These devices safeguard sensitive electronics against surges caused by lightning, switching operations and grid instability. Growth reflects rising dependence on digital equipment, automation systems and mission critical electronic assets across sectors.

The growth of the market can be attributed to increasing vulnerability of modern electronics to power fluctuations, expansion of industrial automation and rising installation of renewable energy systems that introduce variability into electrical networks. Greater awareness of equipment downtime costs and stronger compliance requirements for electrical safety also contribute to market expansion. Urban infrastructure development and digital transformation further support long term demand.

Top Market Takeaways

- By type, AC Transient Protection Systems dominate with 62.7% market share, driven by their critical role in protecting electrical systems from transient surges caused by switching and lightning events in AC power networks.

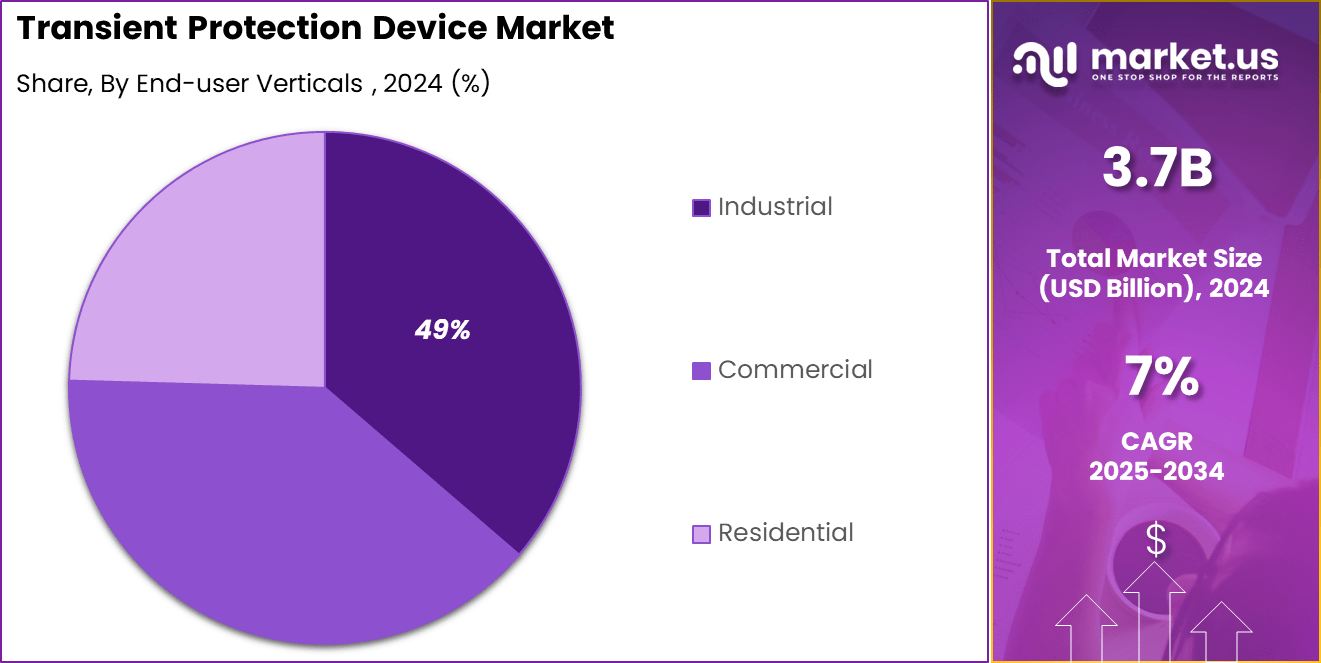

- By end-user verticals, the industrial segment holds 48.8% share due to the high demand from manufacturing plants, automated factories, and heavy industries where electrical equipment reliability is paramount.

- Regionally, Asia Pacific accounts for approximately 36.6% of the global market, marking it as a significant and fastest-growing region due to rapid industrialization, expanding smart city projects, and extensive infrastructure development.

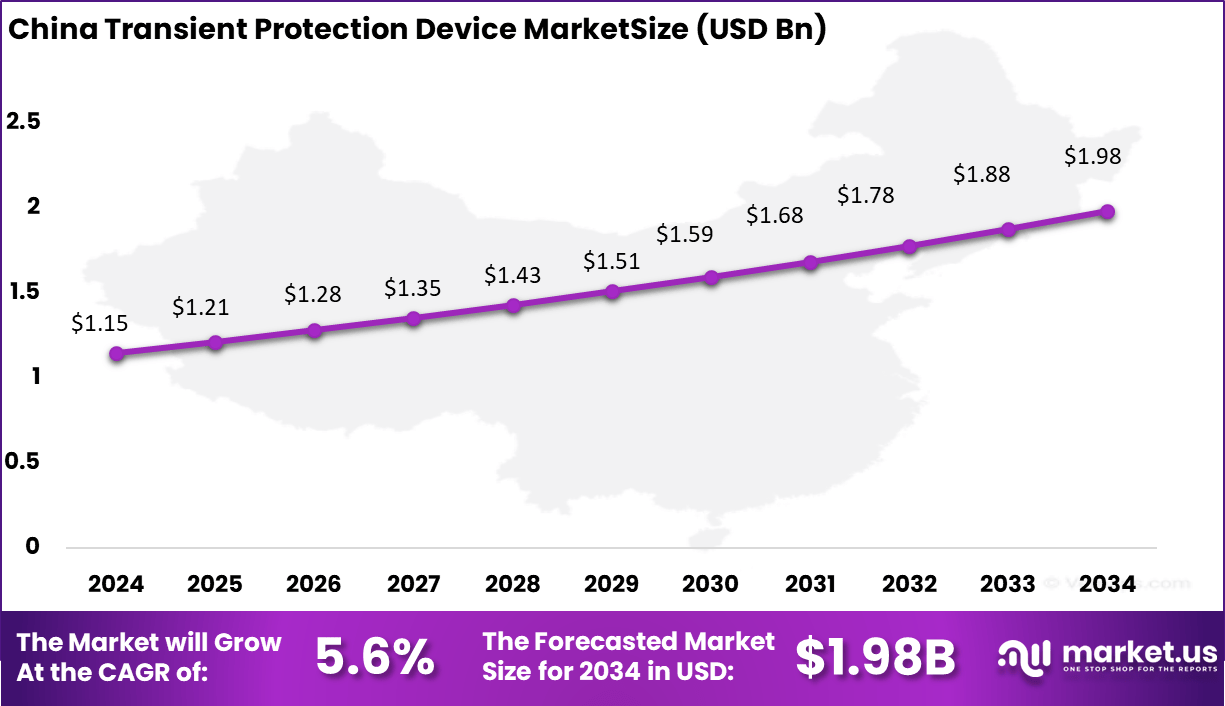

- The China market is valued at around USD 1.15 billion in 2025 and contributes notably to the regional growth, supported by government initiatives in infrastructure modernization and stringent electrical safety regulations.

- The market is projected to grow at a CAGR of approximately 5.6%, driven by rising investments in renewable energy, expanding telecommunication infrastructure, and increasing adoption of smart grids and automation technologies.

- Key growth factors include rising demand for surge protection in consumer electronics, telecommunications, industrial automation, and energy sectors, combined with increasing regulatory focus on electrical safety and system reliability.

- Leading companies in this market include Eaton Corporation, ABB, Schneider Electric, and General Electric, who are innovating in smart transient protection devices integrated with IoT and AI capabilities.

By Type

The AC transient protection system dominates the market with a significant 62.7% share. These systems are crucial for protecting electrical and electronic equipment from transient overvoltages caused by events like lightning strikes or switching surges.

AC transient protection devices help prevent equipment damage, reduce downtime, and extend the lifespan of industrial machinery and electrical infrastructure. They are widely adopted in areas where stable and uninterrupted power supply is critical, including manufacturing plants and heavy industries.

Growing demand for enhanced power quality and increasing investments in smart grids and industrial automation continue to drive the adoption of AC transient protection devices. Their effectiveness in mitigating power disturbances ensures operational reliability across many sectors.

By End-User Verticals

The industrial vertical makes up 49% of the transient protection device market. The manufacturing and industrial sectors rely heavily on these devices to safeguard sensitive machinery and electronic control systems that are vulnerable to transient voltage spikes. In highly automated plants where precision and uptime are vital, transient protection devices mitigate risks associated with electrical faults, ensuring safety and operational efficiency.

As industries modernize and integrate advanced technologies like IoT and robotics, the need for sophisticated transient protection solutions grows. This vertical’s expansive and complex infrastructure makes it the largest and most critical consumer of transient protection devices.

Key Market Segments

By Type

- AC Transient Protection System

- DC Transient Protection System

By End-user Verticals

- Industrial

- Commercial

- Residential

Emerging Trends

- Integration of smart technologies and AI is advancing the design and efficiency of transient protection devices.

- Rising adoption of IoT and smart infrastructure is increasing demand for reliable surge and transient protection.

- Growth in renewable energy systems fuels the need for advanced protection in solar and wind power installations.

- Increasing use of compact, high-performance transient protection units in consumer electronics and industrial automation.

- Expansion in regulated markets, with stricter electrical safety standards driving innovation and adoption.

Growth Factors

- Rising government regulations and standards for electrical safety across industries.

- Growing use of consumer electronics and telecommunications infrastructure requiring robust protection.

- Expansion in industrial automation and manufacturing technologies demands reliable transient protection.

- Increasing investments in renewable energy infrastructure including solar, wind, and smart grids.

- Strong market growth in Asia-Pacific driven by rapid industrialization and urban infrastructure development.

Regional Analysis

Asia Pacific led the transient protection device market with a significant 36.6% share, driven by rapid industrialization and technological advancements in countries like China, India, Japan, and South Korea. The region’s expanding industrial base, increasing adoption of smart and connected devices, and large-scale infrastructure projects create strong demand for advanced surge protection and transient voltage suppression solutions.

Growth is further accelerated by increasing investments in renewable energy, smart grids, and the telecommunications sector, which require reliable protection against voltage surges to maintain system stability. Additionally, the proliferation of consumer electronics and automotive manufacturing in Asia Pacific supports the robust market expansion, making it a crucial hub for transient protection devices.

China stands out as the dominant market within Asia Pacific, valued at approximately USD 1.15 billion in 2024. The Chinese market benefits from extensive government initiatives encouraging semiconductor manufacturing and the domestic production of protective electronic components. Growing deployment of smart grids, data centers, and electric vehicles increases the need for transient protection devices in the country’s rapidly evolving industrial and consumer sectors.

Moreover, expanding urban infrastructure and rising adoption of Industry 4.0 technologies reinforce the demand for reliable surge protection solutions in manufacturing and energy management. This strong industrial and technological foundation positions China at the forefront of the Asia Pacific transient protection device market, driving regional growth and innovation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Electronic Device Protection

The transient protection device market is driven primarily by the increasing demand to protect sensitive electronic devices from electrical surges and transient voltage spikes. Rapid adoption of consumer electronics, telecommunications infrastructure, and smart devices has heightened the need for effective surge protection to prevent costly equipment failures and operational downtime.

This demand extends to emerging industries such as renewable energy and electric vehicles, where reliable circuit protection is critical. Governments and regulatory bodies worldwide are tightening safety standards requiring the integration of transient protection devices, which further propels market growth. Innovations in compact, high-performance devices tailored for modern electronic designs contribute to the expanding market footprint.

Restraint

High Cost and Complex Integration

Despite strong growth prospects, the market faces restraints due to the high cost of advanced transient protection technologies, particularly those based on sophisticated diode materials and manufacturing processes. These costs can present affordability challenges for small and medium enterprises and limit widespread adoption in cost-sensitive segments.

Additionally, integrating transient protection devices effectively into highly miniaturized and complex electronic circuits requires specialized design expertise. The need to maintain high protection levels without compromising device performance adds a layer of engineering complexity that some manufacturers struggle to overcome.

Opportunity

Expansion in Smart Grid and Electric Vehicle Sectors

The surge in smart grid deployments and the electrification of transport systems represent significant opportunities for the transient protection device market. Smart grids require robust protection solutions to manage power quality and prevent equipment damage amid variable and distributed energy sources.

Similarly, the rapid growth of electric vehicles with sophisticated onboard electronics creates demand for durable transient protection devices. Technological integration with IoT and industrial automation further expands use cases, driving innovation in multifunctional and remotely monitored protection devices. These trends open new markets and promote long-term sustainable growth.

Challenge

Supply Chain Disruptions and Technological Advancements

A persistent challenge in the market is managing supply chain disruptions, particularly for semiconductor components critical to transient protection diodes. Geopolitical tensions and global semiconductor shortages lead to production delays and cost fluctuations, impacting device availability and pricing.

Moreover, keeping pace with rapid advancements in electronic designs and emerging threats such as electrostatic discharge (ESD) and electrical fast transients (EFT) requires continuous R&D investments. Manufacturers must balance innovation speed with regulatory compliance and cost efficiency to maintain competitiveness.

Competitive Analysis

ABB, General Electric, and Schneider Electric hold a strong position in the transient protection device market. Their solutions focus on ensuring stable power quality, protecting sensitive equipment, and reducing downtime in industrial and commercial facilities. These companies invest in advanced surge suppression technologies and reliable circuit protection designs.

Eaton, Legrand, Siemens, and Emerson strengthen the competitive landscape with high-performance protection devices tailored for utilities, manufacturing plants, data centers, and residential systems. Their products offer improved response speed, enhanced safety compliance, and robust durability in fluctuating electrical conditions. These suppliers focus on expanding product lines that support modern automation, smart grids, and energy-efficient systems.

CG Power, Littelfuse, and other participants contribute to market depth with cost-efficient surge protection components that support diverse end-use applications. Their offerings emphasize reliability, compact design, and compatibility with a wide range of electrical installations. These companies benefit from rising demand for equipment safeguarding across telecom, renewable energy, and commercial buildings.

Top Key Players in the Market

- ABB Ltd

- General Electric Company

- Schneider Electric SE

- Eaton Corporation

- Legrand S.A.

- Siemens AG

- Emerson Electric Co.

- CG Power and Industrial Solutions

- Littelfuse

- Others

Recent Developments

- September, 2025, ABB announced a $110 million investment in US manufacturing to support growth driven by AI in data centers and grid modernization. In October 2025, ABB restructured its organization into three main business areas, discontinuing Robotics reporting [Sep 2025, Oct 2025].

- October 2025: Schneider Electric launched an industry-first plug-and-play surge protection device (SPD) in the UK. This device is compact, cost-effective, and designed for quick installation directly into distribution boards without additional kits or tools, helping electrical contractors simplify their work and meet growing regulatory demands safely and reliably.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Bn Forecast Revenue (2034) USD 7.2 Bn CAGR(2025-2034) 7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type(AC Transient Protection System, DC Transient Protection System), By End-user Verticals(Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd, General Electric Company, Schneider Electric SE, Eaton Corporation, Legrand S.A., Siemens AG, Emerson Electric Co., CG Power and Industrial Solutions, Littelfuse, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transient Protection Device MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Transient Protection Device MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd

- General Electric Company

- Schneider Electric SE

- Eaton Corporation

- Legrand S.A.

- Siemens AG

- Emerson Electric Co.

- CG Power and Industrial Solutions

- Littelfuse

- Others