Automotive Technologies Market By Technologies (Remote Diagnostics, 3D Automotive Printing, On-Board Internet Services, Advanced Heads-Up Display, Automotive Security Systems, Biometric Vehicle Access Systems, Vehicle Intelligence Systems, Night Vision, Blind Spot Detection Systems, Other Technologies), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), Hybrid Vehicles, Autonomous Vehicles), By Application (Passenger Safety, Driver Assistance, Navigation and Telematics, Entertainment, Fleet Management, Vehicle Maintenance, Emission Control, Energy Management, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 120565

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

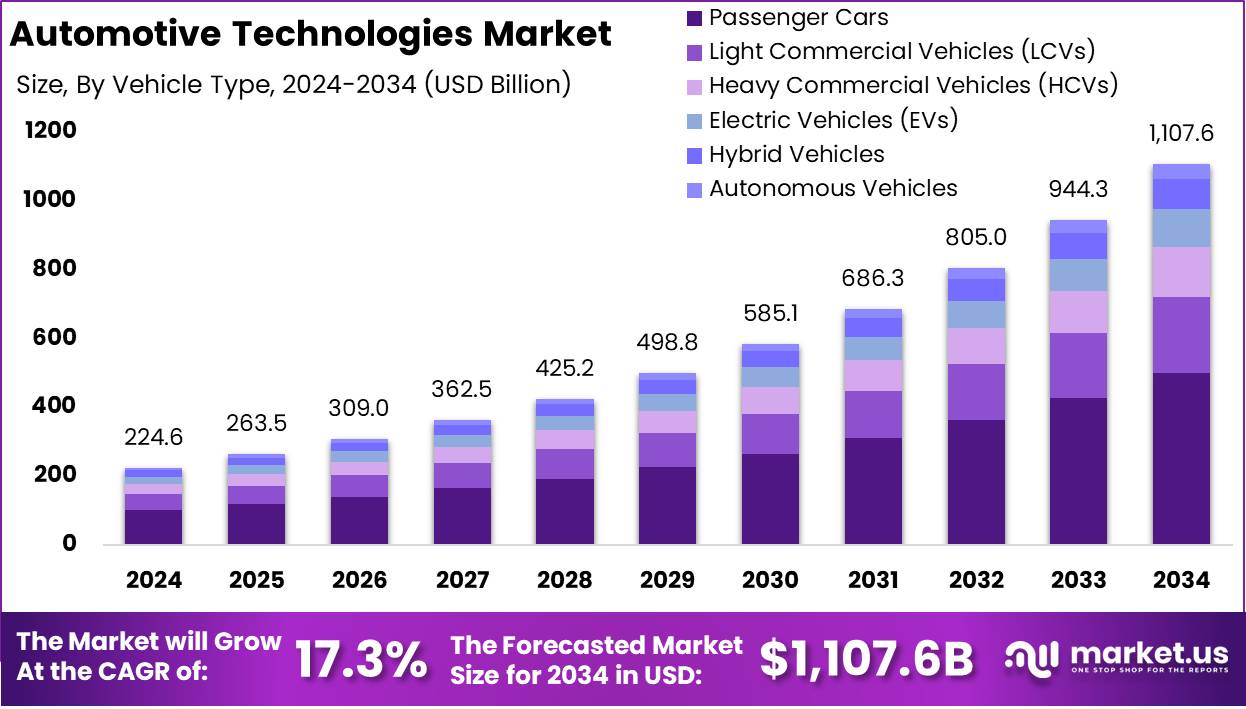

The Global Automotive Technologies Market size is expected to be worth around USD 1,107.6 Billion by 2034 from USD 224.6 Billion in 2024, growing at a CAGR of 17.3% during the forecast period from 2025 to 2034.

Automotive technologies refer to the suite of advanced systems, components, and digital innovations integrated into vehicles to enhance their performance, safety, connectivity, efficiency, and user experience. These technologies encompass a broad spectrum, including powertrain electrification, advanced driver assistance systems (ADAS), vehicle-to-everything (V2X) communication, autonomous driving software, connected infotainment platforms, and advanced materials for lightweighting.

Rapid digital transformation, combined with rising regulatory pressures and shifting consumer expectations, has catalyzed the development and adoption of cutting-edge automotive technologies. These innovations are reshaping conventional mobility paradigms, marking a transition from traditional mechanical systems to software-defined, intelligent, and electrified mobility solutions.

The automotive technologies market represents the global ecosystem of companies, products, and services involved in the research, development, production, and deployment of next-generation automotive innovations. It includes OEMs, Tier 1 suppliers, semiconductor firms, software providers, and tech startups, all contributing to various components such as electric drivetrains, autonomous systems, smart sensors, digital dashboards, and cloud-based telematics.

This market is shaped by evolving mobility trends such as electrification, autonomy, shared mobility, and connectivity. The automotive technologies market is increasingly driven by strategic investments in R&D, collaborative ventures, and regulatory incentives, making it one of the most transformative sectors in the broader mobility industry.

The growth of the automotive technologies market can be attributed to a convergence of regulatory, environmental, and technological dynamics. Stricter emission norms and fuel efficiency mandates in key regions such as Europe, North America, and China are accelerating the transition toward electric and hybrid vehicles.

Simultaneously, the proliferation of 5G, AI, and IoT technologies is enabling real-time communication and advanced automation, fostering increased integration of intelligent systems in vehicles. Additionally, growing investments in vehicle autonomy, driven by safety standards and urban mobility demands, are further contributing to the market’s expansion.

Another significant growth lever is the surge in consumer demand for connected, personalized, and safer driving experiences. Modern consumers are increasingly valuing features like predictive maintenance, in-car entertainment, adaptive cruise control, and real-time navigation. This evolving preference is prompting OEMs and suppliers to adopt modular platforms and software-first development models.

Governments’ fiscal incentives for electric vehicles and infrastructure development, including EV charging networks and smart mobility corridors, also play a vital role in supporting the growth trajectory of automotive technologies globally.

Global demand for automotive technologies is experiencing a paradigm shift, largely fueled by the electrification and digitalization of vehicles. With battery electric vehicle (BEV) and plug-in hybrid vehicle (PHEV) sales projected to grow at double-digit CAGR through 2030, the need for sophisticated battery management systems, power electronics, and energy recovery technologies is rising significantly.

Commercial vehicle fleets, ride-hailing platforms, and logistics providers are also contributing to rising demand, as they seek to leverage connected vehicle technologies for operational efficiency, remote diagnostics, and predictive analytics. In urban centers, demand is amplified by smart city initiatives and the integration of connected transport systems. The interplay between real-time data collection, vehicle-to-infrastructure (V2I) communication, and centralized traffic management is prompting cities and mobility providers to invest heavily in advanced automotive technologies.

Substantial opportunities in the automotive technologies market lie in the convergence of mobility-as-a-service (MaaS), electrification, and artificial intelligence. With urbanization and shared mobility models gaining traction, there is increasing scope for software-defined vehicles and on-demand service integration platforms. Startups and legacy automakers alike are exploring subscription-based mobility models, creating room for tailored infotainment, over-the-air (OTA) updates, and adaptive user interfaces. These advancements offer recurring revenue streams and deeper consumer engagement possibilities.

According to Fact Retrieve, the Automotive Technologies Market is advancing rapidly due to digital integration, sustainability, and safety demands. Around 165,000 cars are produced daily equaling 60 million annually supporting the growing need for smart mobility. With 1.475 billion vehicles globally, including 300 million in the U.S. and 78 million in China, technological innovation is essential.

One in four vehicles is made in China, while the U.S. faces over $160 billion in annual congestion-related losses. As each car comprises 30,000 parts and 80% are recyclable, sustainable and circular practices are becoming central. These factors collectively drive growth and transformation in automotive technologies.

According to Car Surance, the automotive industry contributes nearly 3% to global economic output and supports 14.6 million jobs in Europe, or 6.7% of total EU employment. It also accounts for 11.5% of all manufacturing roles, underscoring its importance in industrial productivity. Furthermore, the expansion of EV infrastructure, with nearly 113,600 public charging outlets in the U.S. and 14,627 in California, signals a rising demand for advanced automotive technologies, driving innovation and growth.

Key Takeaways

- The global automotive technologies market is projected to grow from USD 224.6 billion in 2024 to USD 1,107.6 billion by 2034, registering a CAGR of 17.3% from 2025 to 2034.

- Remote diagnostics accounted for over 24.3% of the technologies segment in 2024, driven by rising demand for real-time vehicle monitoring.

- Passenger cars held a 45.2% market share in 2024, supported by widespread integration of smart and safety technologies.

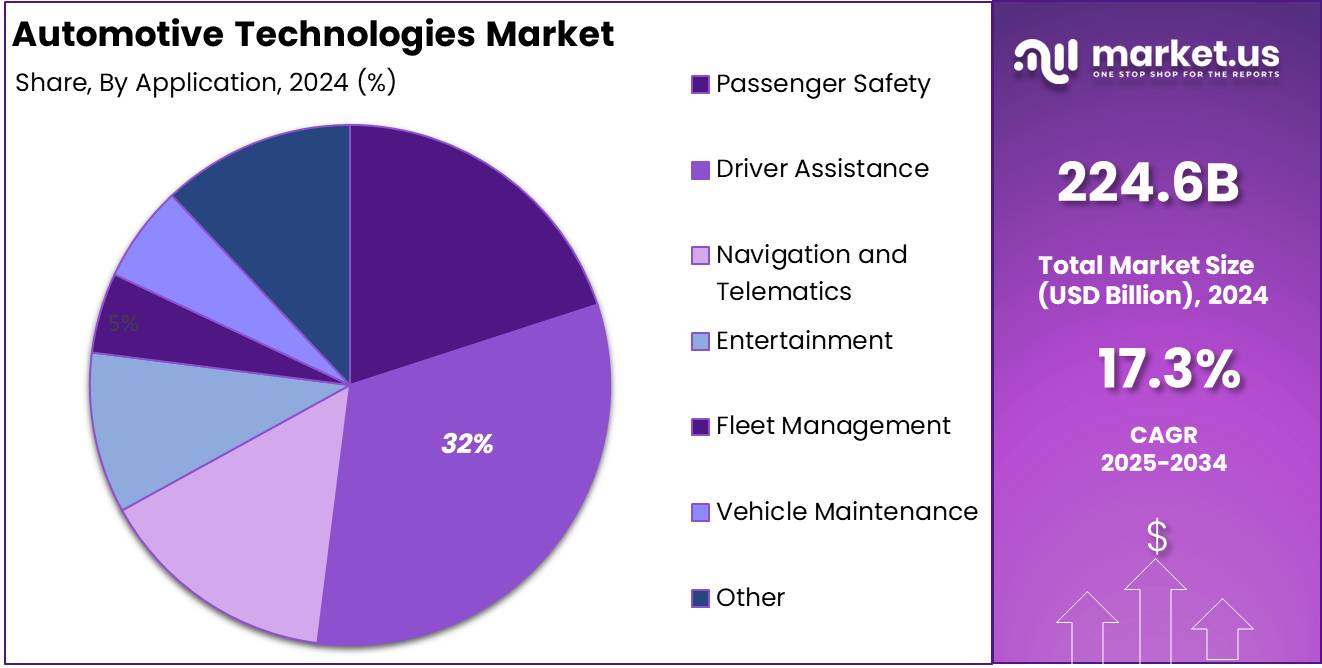

- Driver assistance applications led with 32.3% share in 2024 due to increasing focus on vehicle safety and regulatory compliance.

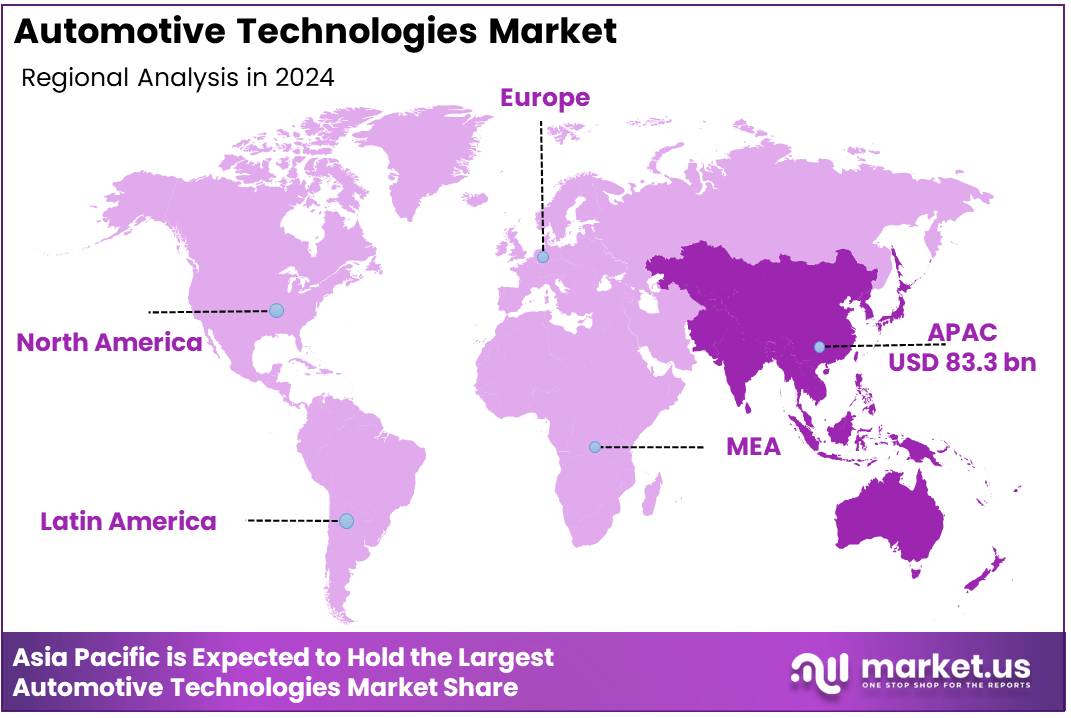

- Asia Pacific dominated the market with 37.1% share, valued at USD 83.3 billion in 2024, owing to strong manufacturing presence and policy support.

By Technologies Analysis

Remote Diagnostics Leads the Automotive Technologies Market with Over 24.3% Share in 2024

In 2024, Remote Diagnostics held a dominant market position in the By Technologies segment of the Automotive Technologies Market, capturing more than 24.3% of the total share. This growth has been driven by the rising need for real-time monitoring of vehicle health and the increasing integration of IoT-based solutions within automotive systems. The ability of remote diagnostics to enhance vehicle uptime, improve maintenance scheduling, and reduce repair costs has significantly contributed to its widespread adoption across passenger and commercial vehicles alike.

Moreover, the emphasis placed by manufacturers on predictive maintenance and customer-centric services has further accelerated the demand for remote diagnostic solutions. As automotive OEMs and fleet operators seek to enhance operational efficiency and minimize unplanned downtimes, the remote diagnostics market is expected to experience sustained growth over the forecast period.

In 2024, 3D automotive printing contributed significantly to the Automotive Technologies Market by enhancing prototyping, tooling, and lightweight component production, driven by accelerated product development and design flexibility. Material science advancements expanded its use in mass production, especially for electric and customized vehicles, supporting future market growth.

On-board internet services experienced robust growth fueled by the rising demand for connected car features like real-time navigation, infotainment, and emergency assistance. Investments in V2X communication and the rollout of 5G networks are expected to further strengthen this segment.

Advanced heads-up displays gained traction due to increasing emphasis on driver safety and convenience, with critical driving information projected directly onto windshields. The integration of augmented reality and improved display technologies has further boosted adoption across mid-range and premium vehicles.

Automotive security systems expanded in response to rising vehicle theft and cybersecurity threats, driven by the integration of immobilizers, alarm systems, and anti-theft technologies. The shift toward connected and autonomous vehicles is reinforcing the importance of robust automotive cybersecurity measures.

Biometric vehicle access systems gained popularity as demand rose for enhanced security and personalized vehicle experiences through fingerprint recognition, facial authentication, and iris scanning. OEMs are adopting these systems to offer keyless entry and customized features, supporting continued market expansion.

Vehicle intelligence systems grew steadily as they became critical for advanced driver-assistance systems and autonomous driving, enabling hazard prediction and environmental analysis. Regulations promoting vehicle safety and advancements in AI technologies are anticipated to drive future growth.

Night vision technologies advanced vehicle safety by improving visibility in low-light conditions, aiding in the detection of pedestrians and obstacles. Adoption is increasing within premium vehicle segments, supported by improvements in thermal imaging and infrared sensor capabilities.

Blind spot detection systems witnessed rising adoption driven by road safety awareness and regulatory mandates, playing a key role in accident prevention during lane changes. Integration into broader ADAS packages by OEMs continues to fuel the growth of this segment.

Other emerging automotive technologies, including in-cabin radar and gesture recognition systems, contributed modestly but hold significant future growth potential as automotive innovation and new mobility solutions continue to evolve.

By Vehicle Type Analysis

Passenger Cars Leads the Automotive Technologies Market with Over 45.2% Share in 2024

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Technologies Market, capturing approximately 45.2% share. The high adoption of advanced automotive technologies in passenger cars, such as ADAS, connected services, infotainment systems, and safety enhancements, has been a key factor behind this leadership. Increasing consumer demand for comfort, safety, and enhanced driving experiences has pushed automotive OEMs to invest heavily in integrating innovative technologies into passenger vehicles.

Additionally, the surge in production volumes, especially in emerging economies, and the growing trend toward electrification and smart mobility solutions have reinforced the dominance of passenger cars. As consumer preferences continue to evolve toward vehicles equipped with intelligent features, the Passenger Cars segment is expected to maintain its leading market share over the coming years.

In 2024, Light Commercial Vehicles gained traction in the Automotive Technologies Market due to the growing demand for efficient last-mile deliveries and the rapid expansion of the e-commerce sector. Integration of telematics, fleet tracking systems, and driver-assist technologies has been crucial in enhancing logistics operations and overall vehicle utility.

The rising use of connected technologies for improved transport safety and operational efficiency has further supported LCV adoption. As commercial operators increasingly seek smart and eco-friendly mobility solutions, the penetration of advanced technologies in this vehicle type is expected to deepen.

Heavy Commercial Vehicles witnessed increased uptake of automotive technologies driven by regulatory pressure for safety and emissions compliance. Features such as real-time diagnostics, advanced navigation, and collision avoidance are being embedded into freight and logistics fleets to optimize performance and reduce risk.

Support from government initiatives aimed at decarbonizing transport and improving freight efficiency has also played a significant role. The integration of intelligent technologies is transforming HCV operations, particularly across long-distance and industrial applications.

Electric Vehicles continued to gain momentum as the industry transitions toward sustainability. Advancements in battery technology, energy management systems, and digital connectivity have enhanced the appeal of EVs across private and commercial use cases.

Growing government incentives, along with improved charging infrastructure and range capabilities, have accelerated their integration into the market. These developments are expected to sustain the strong growth trajectory of electric vehicles over the coming years.

Hybrid Vehicles attracted attention as a transitional mobility option, offering reduced emissions without the limitations of charging infrastructure. Key technologies such as energy recovery systems and intelligent switching between power sources have supported market adoption.

Favorable policies, fuel efficiency standards, and consumer interest in low-emission alternatives are driving continued investment in hybrid technologies. Manufacturers are responding with expanded model availability across vehicle classes.

Autonomous Vehicles remained an emerging yet increasingly significant category. Advances in AI, machine learning, and sensor integration are laying the foundation for scalable autonomy in both passenger and commercial applications.

By Application Analysis

Driver Assistance Leads the Automotive Technologies Market with Over 32.3% Share in 2024

In 2024, Driver Assistance held a dominant position in the By Application segment of the Automotive Technologies Market, capturing approximately 32.3% of the market share. This growth is largely attributed to increasing consumer demand for safety features and the ongoing development of advanced driver-assistance systems (ADAS). Technologies such as lane-keeping assistance, adaptive cruise control, and collision warning are becoming standard in modern vehicles, driving the widespread adoption of driver assistance systems.

Furthermore, the continuous advancements in AI and sensor technologies are enhancing the effectiveness and precision of these systems, significantly improving driver and passenger safety. As regulatory pressure for safer vehicles increases globally, the demand for driver assistance technologies is expected to continue its upward trajectory.

In 2024, Passenger Safety captured a significant share of the Automotive Technologies Market by application. The integration of advanced safety technologies such as airbags, automatic emergency braking, and pedestrian detection systems has become crucial in reducing accidents and injuries, meeting rising consumer expectations for safety. Stringent government regulations have also pushed automakers to include these features across various vehicle segments, ensuring continued growth in this area.

Navigation and Telematics has grown substantially, driven by the increasing demand for connected vehicles and real-time traffic updates. Navigation systems now play a key role in optimizing routes and offering remote diagnostics, becoming a staple in modern vehicles. As 5G connectivity expands, these technologies are set to enhance vehicle-to-vehicle communication, further boosting the segment’s growth.

The Entertainment segment is expanding rapidly as in-car entertainment systems, including advanced infotainment, wireless connectivity, and streaming services, become standard in many vehicles. The growing demand for seamless multimedia experiences during travel is pushing automakers to innovate and offer richer entertainment options. The shift toward electric vehicles, with a focus on in-car connectivity, also supports this trend.

Fleet Management technologies are crucial for commercial operators, providing solutions for optimizing logistics, reducing costs, and improving vehicle utilization. Telematics, vehicle tracking, route optimization, and performance monitoring are integral to these systems. As fleet operators increasingly prioritize efficiency, the adoption of these technologies is expected to rise, particularly with the inclusion of electric and autonomous vehicles.

Vehicle Maintenance is becoming more vital as vehicles become more complex. Predictive maintenance technologies that monitor vehicle health and alert operators to potential issues are gaining traction. These systems help reduce downtime and prevent costly repairs, particularly in fleet operations where reliability is critical.

Emission Control technologies are becoming more prevalent as environmental regulations tighten and consumer awareness of vehicle emissions increases. Technologies such as catalytic converters and exhaust gas recirculation systems are key to reducing harmful pollutants. The drive for cleaner transportation solutions ensures the continued adoption of these technologies.

Energy Management systems, particularly in electric and hybrid vehicles, are gaining importance. These systems help optimize energy usage and improve overall vehicle efficiency by managing battery charging and discharging cycles. As the push for sustainability intensifies, energy management solutions will play a crucial role in the future of the automotive industry.

The “Others” category includes emerging technologies such as in-cabin radar, gesture recognition, and energy harvesting solutions. While currently a small part of the market, these technologies are poised for growth as automakers look for innovative ways to enhance vehicle functionality and driver experience.

Key Market Segments

By Technologies

- Remote Diagnostics

- 3D Automotive Printing

- On-Board Internet Services

- Advanced Heads-Up Display

- Automotive Security Systems

- Biometric Vehicle Access Systems

- Vehicle Intelligence Systems

- Night Vision

- Blind Spot Detection Systems

- Other Technologies

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Autonomous Vehicles

By Application

- Passenger Safety

- Driver Assistance

- Navigation and Telematics

- Entertainment

- Fleet Management

- Vehicle Maintenance

- Emission Control

- Energy Management

- Others

Driver

Rising Demand for Advanced Driver-Assistance Systems (ADAS)

The growth of the global automotive technologies market in 2024 can be attributed to the increasing demand for Advanced Driver-Assistance Systems (ADAS). ADAS technologies, such as adaptive cruise control, lane departure warning systems, and automatic emergency braking, are witnessing rapid adoption due to heightened consumer awareness regarding vehicle and occupant safety.

Government regulations mandating the integration of safety features have further accelerated this trend. For instance, it has been observed that vehicles equipped with basic ADAS functionalities are expected to account for over 60% of all new car sales in developed economies. The surge in urbanization, combined with the rising incidence of road accidents globally, has created an urgent need for technologies that enhance driving safety and comfort, thereby propelling market growth.

Furthermore, the integration of ADAS technologies is also supported by technological advancements in sensors, cameras, radar, and LiDAR systems, enabling real-time analysis and decision-making for vehicles. The push towards autonomous driving is another underlying factor, as the adoption of ADAS serves as a stepping stone towards fully autonomous vehicles.

As OEMs focus on offering enhanced user experiences through semi-autonomous capabilities, the installation of sophisticated ADAS features is becoming a critical differentiator in the highly competitive automotive sector. Consequently, the demand for intelligent, automated vehicle technologies is expected to sustain robust market growth over the forecast period.

Restraint

High Costs of Advanced Automotive Technologies

The high initial and maintenance costs associated with advanced automotive technologies are acting as a major restraint on the global market’s growth in 2024. The incorporation of next-generation systems, such as autonomous driving modules, electrified powertrains, and connected infotainment solutions, significantly increases the overall cost of vehicles.

On average, the integration of high-end ADAS can raise the price of a new car by 15–20%, making it unaffordable for many consumers, particularly in emerging economies. The lack of adequate financing options and government subsidies in some regions further limits mass adoption, creating a noticeable disparity between premium and economy vehicle segments.

Additionally, the high cost of ongoing maintenance and potential repairs for these complex systems is discouraging buyers. Technologies such as autonomous navigation and vehicle-to-everything (V2X) communication systems require specialized servicing and updates, which often result in higher lifetime ownership costs.

Small and mid-sized automotive manufacturers also face significant barriers in implementing these technologies at scale due to the substantial investment required for research, development, and production. This financial burden has slowed the diffusion of automotive innovations across all market tiers, thereby restraining the overall growth trajectory of the automotive technologies market.

Opportunity

Expansion of Vehicle Electrification Initiatives

The expansion of vehicle electrification initiatives globally is offering a significant opportunity for the growth of the automotive technologies market in 2024. With governments around the world enforcing stringent emission regulations and promoting sustainable mobility, the demand for electric vehicles (EVs) has witnessed exponential growth.

It is estimated that EV sales will account for approximately 18% of total global car sales by the end of 2024. This rising adoption is driving innovation in battery management systems, electric drivetrains, regenerative braking technologies, and lightweight material usage, all of which are crucial components of the broader automotive technologies market.

Moreover, major investments in charging infrastructure, coupled with incentives for consumers and manufacturers, are further encouraging the development of supporting technologies such as smart energy management systems and wireless charging solutions. The automotive sector is increasingly focusing on improving vehicle range, reducing charging times, and enhancing battery durability, creating numerous growth avenues for technology providers.

The shift towards electrification is not limited to passenger cars but also extends to commercial vehicles and public transportation systems, thereby broadening the scope of market opportunities. As a result, the global emphasis on vehicle electrification is set to substantially bolster demand across multiple segments of the automotive technologies ecosystem.

Trends

Integration of Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into automotive technologies represents a dominant trend shaping the market landscape in 2024. AI and ML are being extensively deployed to enhance vehicle performance, personalize user experiences, and improve predictive maintenance capabilities.

It is projected that more than 70% of new vehicles will incorporate AI-driven features such as natural language processing for voice commands, real-time traffic prediction, and personalized infotainment settings by the end of the year. These technologies are revolutionizing how vehicles interact with their environment and users, fostering a new era of smart mobility.

In addition, the application of AI and ML extends beyond consumer convenience to critical safety systems and autonomous driving. Predictive analytics, enabled through AI, allow vehicles to anticipate road conditions, identify potential hazards, and make split-second decisions, thereby reducing the risk of accidents.

The continuous learning capabilities of ML models ensure that vehicles become more efficient and intelligent over time, providing long-term value to consumers and manufacturers alike. The rising integration of AI is not only enhancing the capabilities of individual vehicles but is also enabling the development of connected ecosystems such as smart cities and intelligent transportation networks, driving sustained innovation and growth in the automotive technologies market.

Regional Analysis

Asia Pacific Leads the Automotive Technologies Market with Largest Market Share of 37.1% in 2024

The global automotive technologies market in 2024 exhibits significant regional segmentation, with Asia Pacific emerging as the leading region, commanding the largest market share of 37.1%. Valued at USD 83.3 billion, the Asia Pacific market is driven by the high concentration of vehicle production, increasing adoption of electric vehicles, and rapid advancements in automotive software and safety systems.

Countries such as China, Japan, South Korea, and India have witnessed substantial growth in automotive R&D capabilities, supported by favorable government initiatives aimed at promoting cleaner mobility and smart vehicle solutions. The widespread presence of automotive technology innovation hubs and rising disposable incomes are further contributing to the region’s dominance in this sector.

North America holds a considerable share in the automotive technologies market, supported by the increasing integration of advanced driver-assistance systems (ADAS), autonomous driving features, and connected vehicle platforms. The region demonstrates strong penetration of premium and electric vehicles, with a growing focus on vehicle-to-everything (V2X) communication technologies.

Demand for safety, emissions control, and fuel-efficient systems continues to rise across the United States and Canada, thereby propelling investments in cutting-edge automotive technologies. The market in North America remains robust, underpinned by the continuous modernization of vehicle fleets and consumer preference for technologically advanced automobiles.

Europe represents a mature market characterized by stringent environmental regulations, leading to accelerated adoption of electrified powertrains and sustainable automotive technologies. The European Union’s regulatory frameworks around carbon emissions and vehicle safety are driving innovation in autonomous mobility, battery technology, and intelligent driving systems.

Furthermore, the presence of highly developed transportation infrastructure and rising demand for zero-emission vehicles are enhancing the market for next-generation automotive technologies across key European economies.

The Middle East & Africa region is experiencing steady growth, driven by the gradual introduction of connected vehicle technologies and improvements in mobility infrastructure. Increasing urbanization and rising consumer awareness of vehicle safety features are fostering adoption across countries in the Gulf Cooperation Council (GCC) and parts of Africa. Although currently smaller in size, the market holds potential for expansion as smart city initiatives and intelligent transport systems gain momentum.

Latin America also shows a growing inclination toward automotive digitalization, particularly in urban areas. Countries such as Brazil and Mexico are witnessing increasing uptake of infotainment systems, navigation features, and vehicle diagnostics technologies. Economic development and urban mobility challenges are pushing the need for efficient automotive solutions, creating favorable ground for gradual market penetration of advanced automotive technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

Delphi Automotive PLC maintained its focus on electrification and advanced driver assistance systems (ADAS), leveraging its expertise in powertrain and electronic architectures to support the transition towards electric and autonomous vehicles.

Continental AG demonstrated resilience by enhancing its technological portfolio, particularly in sensor solutions, high-performance computing, and software-defined vehicle platforms. The company’s strategic partnerships, such as the collaboration with Aurora for autonomous trucking systems, underscored its commitment to innovation in mobility solutions. Despite industry challenges, Continental achieved its annual targets, reflecting its robust operational capabilities .

Robert Bosch GmbH faced headwinds in 2024, with a notable decline in operating profit attributed to stagnant global auto sales and a slower-than-anticipated shift to electric and software-controlled vehicles. The company announced significant job cuts, primarily affecting its advanced driver assistance and automated driving technology divisions, signaling a strategic pivot to address market dynamics . Agero Inc. continued to expand its footprint in connected vehicle services, emphasizing roadside assistance and telematics solutions that enhance driver safety and convenience.

Airbiquity Inc. sustained its role as a key player in over-the-air (OTA) software update platforms, supporting automakers in delivering remote vehicle management and infotainment services, thereby facilitating continuous vehicle improvement and customer engagement . WirelessCar AB strengthened its position in telematics services, providing scalable solutions that enable real-time vehicle data exchange, essential for fleet management and connected car ecosystems.

AT&T Inc., Verizon, and Vodafone Group Plc played pivotal roles in advancing vehicle connectivity. AT&T and Verizon focused on expanding 5G networks to support the growing demand for connected and autonomous vehicle technologies. Vodafone, through its subsidiary Vodafone Automotive, offered comprehensive telematics and vehicle tracking solutions, contributing to enhanced vehicle security and fleet management efficiency .

Top Key Players in the Market

- Delphi Automotive PLC

- Continental AG

- Robert Bosch GmbH

- Agero Inc.

- Airbiquity Inc.

- WirelessCar AB

- AT&T Inc.

- Verizon

- Vodafone Group Plc

Recent Developments

- In 2024, L&T Technology Services announced a major partnership with BlackBerry to support the development of Software Defined Vehicles (SDVs). This collaboration will use BlackBerry’s QNX software platform to create advanced digital systems for vehicle manufacturers around the world. The goal is to deliver smarter and safer automotive software solutions through this strategic alliance.

- In 2024, Arm introduced new automotive technologies aimed at speeding up the creation of AI-based vehicles. The latest Arm Automotive Enhanced processors and virtual platforms are designed to simplify software development. These tools are expected to reduce vehicle development time by as much as two years, supporting the growing demand for smart, electric, and autonomous vehicles.

- In 2024, BMW Group joined hands with Tata Technologies to build a joint venture focused on automotive software and IT services. This new venture will set up operations in Pune, Bangalore, and Chennai, with major technical activities planned for Bangalore and Pune, and business IT services based in Chennai. The agreement is currently under review by relevant authorities.

- In 2024, Applied Intuition raised $250 million in a Series E funding round, bringing its valuation to $6 billion. The funding was led by Lux Capital, Elad Gil, and Porsche Investments. This investment highlights strong support from top investors like Andreessen Horowitz and General Catalyst, positioning the company to grow further in vehicle software for several industries including automotive and agriculture.

- In 2025, American Axle & Manufacturing revealed a plan to acquire Dowlais Group in a deal worth around $1.44 billion. The agreement includes a combination of cash and shares. With this acquisition, AAM aims to expand its global presence and enhance its capabilities in the mobility and powertrain sectors.

Report Scope

Report Features Description Market Value (2024) USD 224.6 Billion Forecast Revenue (2034) USD 1,107.6 Billion CAGR (2025-2034) 17.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technologies (Remote Diagnostics, 3D Automotive Printing, On-Board Internet Services, Advanced Heads-Up Display, Automotive Security Systems, Biometric Vehicle Access Systems, Vehicle Intelligence Systems, Night Vision, Blind Spot Detection Systems, Other Technologies), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), Hybrid Vehicles, Autonomous Vehicles), By Application (Passenger Safety, Driver Assistance, Navigation and Telematics, Entertainment, Fleet Management, Vehicle Maintenance, Emission Control, Energy Management, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Delphi Automotive PLC , Continental AG , Robert Bosch GmbH , Agero Inc. , Airbiquity Inc. , and WirelessCar AB , AT&T Inc. , Verizon , Vodafone Group Plc , Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Technologies MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Technologies MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Delphi Automotive PLC

- Continental AG

- Robert Bosch GmbH

- Agero Inc.

- Airbiquity Inc.

- WirelessCar AB

- AT&T Inc.

- Verizon

- Vodafone Group Plc