Tire Pressure Monitoring System (TPMS), Lane Departure Warning System (LDWS) Market Report By Product Type (Tire Pressure Monitoring System: Direct TPMS, Indirect TPMS; Lane Departure Warning System: Lane Departure Alert Systems, Lane Keeping Systems (LKS)), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Distribution Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 74376

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

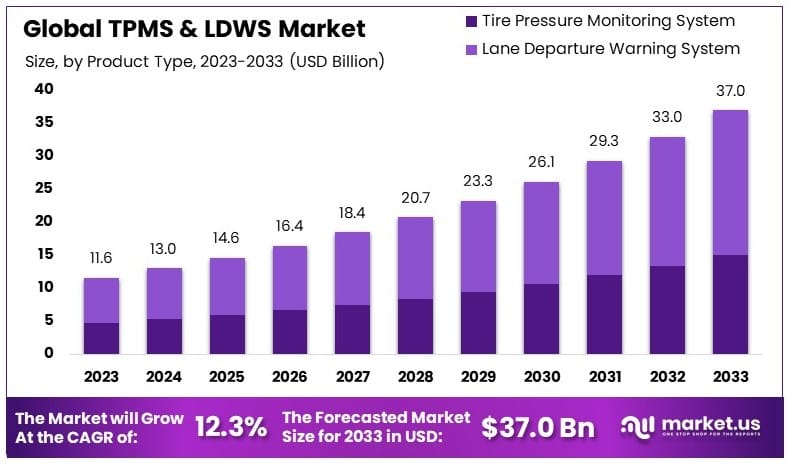

The Global Tire Pressure Monitoring System (TPMS), Lane Departure Warning System (LDWS) Market size is expected to be worth around USD 37.0 billion by 2033, from USD 11.6 billion in 2023, growing at a CAGR of 12.3% during the forecast period from 2024 to 2033.

The Tire Pressure Monitoring System (TPMS) and Lane Departure Warning System (LDWS) market focuses on advanced safety technologies in vehicles. TPMS monitors tire pressure, alerting drivers to any issues that could affect safety and performance. LDWS detects unintentional lane departures, warning drivers to prevent accidents. These systems enhance driving safety, reduce the risk of tire-related incidents, and support lane discipline.

The market is driven by increasing safety regulations, rising consumer awareness, and advancements in automotive technology. Companies in this market aim to innovate and integrate these systems into more vehicles, targeting improved safety and compliance.

The Tire Pressure Monitoring System (TPMS) and Lane Departure Warning System (LDWS) market is experiencing significant growth driven by increasing safety regulations and rising consumer awareness. TPMS ensures optimal tire pressure, reducing the risk of tire-related incidents, while LDWS prevents unintentional lane departures, enhancing overall vehicle safety.

The National Highway Traffic Safety Administration (NHTSA) reported a decline in traffic fatalities for the fifth consecutive quarter, with an estimated 19,515 fatalities in the first half of 2023, down 3.3% from 20,190 in the same period of 2022. This positive trend underscores the importance of advanced safety systems in vehicles.

NHTSA’s data highlights a decrease in fatalities in 29 states, while 21 states, Puerto Rico, and the District of Columbia saw increases. To further reduce traffic deaths, NHTSA has proposed several safety initiatives, including mandatory automatic emergency braking systems for passenger cars, light duty vehicles, and heavy vehicles. These initiatives reflect a broader regulatory push towards enhancing vehicle safety features, which directly benefits the TPMS and LDWS market.

The market’s growth prospects are bolstered by these regulatory developments and the continuous advancements in automotive technology. Companies in this sector are focusing on innovation, aiming to integrate TPMS and LDWS into more vehicle models to meet safety standards and consumer demand. As these systems become standard in vehicles, the market is expected to expand, driven by the need for improved safety and compliance with evolving regulations. Overall, the TPMS and LDWS market is poised for steady growth, supported by regulatory momentum and technological advancements.

Key Takeaways

- Market Value: The global Tire Pressure Monitoring System (TPMS) and Lane Departure Warning System (LDWS) market is projected to grow from USD 11.6 billion in 2023 to approximately USD 37.0 billion by 2033, with a compound annual growth rate (CAGR) of 12.3%.

- TPMS Analysis: Direct TPMS dominates due to its superior accuracy and reliability, critical for vehicle safety and performance.

- LDWS Analysis: Lane Departure Alert Systems command a significant 59.4% market share, playing a crucial role in preventing unintentional lane departures and enhancing road safety.

- Passenger Vehicle Analysis: Passenger Vehicles hold the dominant market share at 57.5%, driven by increasing urbanization, rising disposable incomes, and the prioritization of vehicle safety features.

- OEM Analysis: The OEM segment leads with a substantial 67.4% market share, driven by stringent safety regulations mandating the inclusion of TPMS and LDWS in new vehicles.

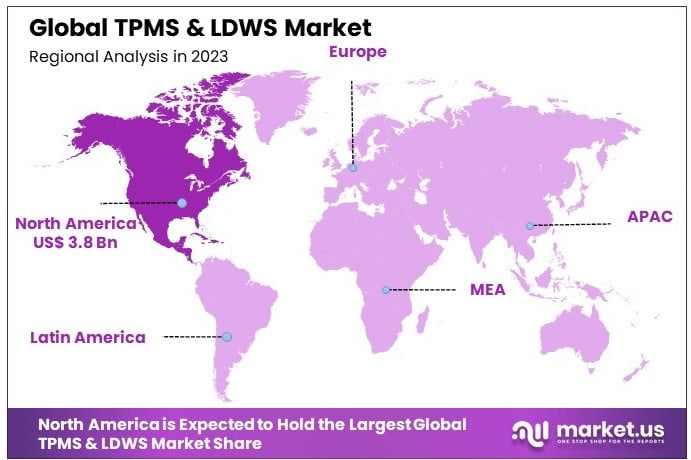

- North America Dominates: North America dominates the market with a leading market share of 33.4%, followed by Europe with 29.5%.

- Analyst Viewpoint: The market exhibits robust growth fueled by safety regulations and growing safety awareness. Competition is intense with ample opportunities for innovation and market expansion.

- Growth Opportunities: Key players can capitalize on the increasing demand for advanced safety features in passenger and commercial vehicles to strengthen their market presence and profitability.

Driving Factors

Stringent Safety Regulations Drive Market Growth

Governments globally are tightening safety regulations to decrease road accidents and fatalities. These regulations are making Tire Pressure Monitoring Systems (TPMS) and Lane Departure Warning Systems (LDWS) mandatory in many regions. For instance, the European Union has mandated TPMS in all new passenger cars since 2014. By 2024, LDWS is also expected to become compulsory in the EU. These mandates are leading to a significant increase in the adoption of these safety systems.

As a result, vehicle manufacturers are incorporating TPMS and LDWS to comply with regulations and enhance vehicle safety standards. This regulatory push not only ensures higher safety levels but also boosts market demand for these systems. The interaction between stringent safety regulations and the increasing focus on vehicle safety standards is propelling market growth. Furthermore, the regulatory landscape is expected to expand, covering more vehicle categories and regions, further driving the market forward.

Increasing Demand for Advanced Driver Assistance Systems (ADAS) Drives Market Growth

The rising focus on vehicle safety and driver convenience is significantly boosting the demand for Advanced Driver Assistance Systems (ADAS), including TPMS and LDWS. Automakers are increasingly integrating these systems to enhance their safety features and maintain a competitive edge. The global ADAS market is growing rapidly, driven by technological advancements and the increasing adoption of these systems in vehicles.

This trend is contributing to the growth of the TPMS and LDWS market as these systems are integral components of ADAS. The synergy between the growing demand for ADAS and the need for improved vehicle safety is fueling market expansion. As automakers continue to innovate and enhance their safety offerings, the adoption of TPMS and LDWS is expected to rise, supporting overall market growth. This trend is further reinforced by consumer demand for safer and more technologically advanced vehicles.

Rising Awareness about Vehicle Safety Drives Market Growth

Consumers are becoming increasingly aware of the safety benefits offered by TPMS and LDWS, thanks to educational campaigns and marketing efforts by automakers and regulatory bodies. This growing awareness is driving the adoption of these systems in both new and existing vehicles. As a result, there is a notable increase in the installation of TPMS and LDWS, contributing to market growth. The interaction between heightened consumer awareness and the promotion of vehicle safety features is creating a favorable environment for market expansion.

Additionally, as consumers prioritize safety in their vehicle purchasing decisions, the demand for TPMS and LDWS is expected to rise. This trend is further supported by advancements in technology and the availability of these systems in a wider range of vehicle models. The combined impact of increased awareness and technological innovation is driving the growth of the TPMS and LDWS market.

Restraining Factors

Technical Challenges Restrain Market Growth

TPMS and LDWS face significant technical challenges, including issues with sensor accuracy, false alerts, and seamless integration with other vehicle systems. These challenges can hinder market growth as they require ongoing research and development. For instance, ensuring that sensors provide accurate readings under varying conditions is complex and costly. False alerts can frustrate drivers, leading to a negative perception of these systems.

Additionally, integrating TPMS and LDWS with existing vehicle electronics and ensuring compatibility across different models can be a lengthy and expensive process for automakers and suppliers. This continuous need for technical improvement and the associated costs can slow down the widespread adoption of these systems, thereby restraining market growth.

Consumer Perception and Acceptance Restrains Market Growth

Consumer perception and acceptance are crucial for the success of TPMS and LDWS. Some consumers may view these systems as unnecessary or overly intrusive, particularly if they have experienced false alerts or reliability issues.

This skepticism can hinder market growth as it affects consumer demand. Building consumer trust and overcoming these negative perceptions is a significant challenge for automakers and suppliers. Effective marketing, education, and demonstration of the benefits of these systems are essential to change consumer attitudes. Until consumer perception shifts positively, the adoption rate of TPMS and LDWS may remain limited, restraining market expansion.

Product Type Analysis

Direct TPMS dominates with higher accuracy and reliability.

The Tire Pressure Monitoring System (TPMS) market includes two main sub-segments: Direct TPMS and Indirect TPMS. Direct TPMS is the dominant sub-segment due to its superior accuracy and reliability. Direct TPMS measures the actual air pressure in each tire using sensors mounted on the wheel. This system provides precise real-time tire pressure information, which is critical for vehicle safety and performance. As a result, Direct TPMS is widely preferred by automakers and consumers alike. Its accuracy reduces the risk of tire blowouts and enhances fuel efficiency, which are significant concerns for drivers and manufacturers.

Indirect TPMS, while less accurate, is also important in the market. It estimates tire pressure by monitoring the rotational speed of each wheel. Though it is more cost-effective and easier to integrate with existing vehicle systems, it does not provide the same level of precision as Direct TPMS. Despite this, Indirect TPMS is still popular in budget-friendly and smaller vehicle models where cost considerations are paramount. The combined impact of Direct and Indirect TPMS drives the overall growth of the TPMS market, with Direct TPMS leading the charge due to its advanced features and reliability.

Lane Departure Warning System Analysis

Lane Departure Alert Systems dominate with 59.4% due to their critical role in preventing unintentional lane departures.

The Lane Departure Warning System (LDWS) market consists of two sub-segments: Lane Departure Alert Systems and Lane Keeping Systems (LKS). Lane Departure Alert Systems dominate this segment with 59.4% of the market share. These systems are favored for their ability to alert drivers when their vehicle begins to drift out of its lane without signaling. This feature is critical in preventing accidents caused by unintentional lane departures, which are a common issue in both urban and highway driving scenarios. The alert systems typically use cameras and sensors to detect lane markings and provide audible or visual warnings to the driver, enhancing road safety and reducing collision risks.

Lane Keeping Systems (LKS), although less dominant, play a crucial role in the LDWS market. These systems take corrective actions to steer the vehicle back into its lane if the driver does not respond to the alerts. LKS is increasingly being integrated into advanced driver assistance systems (ADAS) and is becoming more prevalent in modern vehicles. The combination of Lane Departure Alert Systems and LKS ensures comprehensive lane-keeping assistance, contributing to the overall growth of the LDWS market.

Vehicle Type Analysis

Passenger Vehicles dominate with 57.5% due to high demand and focus on safety features.

In the vehicle type segment, Passenger Vehicles hold the dominant position with 57.5% market share. This dominance is attributed to the high demand for passenger cars globally, driven by increasing urbanization, rising disposable incomes, and consumer preference for personal mobility. Passenger vehicles are typically equipped with advanced safety features, including TPMS and LDWS, to enhance driver and passenger safety. The growing focus on vehicle safety regulations and consumer awareness about safety features further boosts the adoption of TPMS and LDWS in passenger vehicles.

Commercial Vehicles, while not as dominant, are an essential segment of the market. These vehicles, including trucks and buses, are increasingly adopting TPMS and LDWS to improve safety and operational efficiency. The integration of these systems in commercial vehicles helps reduce maintenance costs, enhance fuel efficiency, and minimize the risk of accidents caused by tire blowouts or lane departure incidents. The combined influence of Passenger and Commercial Vehicles contributes to the overall expansion of the TPMS and LDWS market.

Distribution Channel Analysis

OEM dominates with 67.4% due to mandatory integration in new vehicles.

The Original Equipment Manufacturer (OEM) segment leads the distribution channel with a significant 67.4% market share. OEMs are integral to the TPMS and LDWS market as they integrate these systems directly into new vehicles during the manufacturing process. This integration ensures that the safety systems are seamlessly incorporated with other vehicle electronics, providing a reliable and efficient solution for end-users. The dominance of the OEM segment is driven by stringent safety regulations, which mandate the inclusion of TPMS and LDWS in new vehicles, particularly in regions like Europe and North America.

The Aftermarket segment, although smaller, plays a crucial role in the market. It provides TPMS and LDWS solutions for existing vehicles, allowing owners to upgrade their vehicles with the latest safety features. The aftermarket segment caters to consumers who seek to enhance their vehicle’s safety beyond the standard features provided by the manufacturer. The combined efforts of OEM and Aftermarket channels ensure comprehensive market coverage, supporting the overall growth of the TPMS and LDWS market.

Key Market Segments

By Product Type

- Tire Pressure Monitoring System

- Direct TPMS

- Indirect TPMS

- Lane Departure Warning System

- Lane Departure Alert Systems

- Lane Keeping Systems (LKS)

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Distribution Channel

- OEM

- Aftermarket

Growth Opportunities

Expansion in Commercial and Fleet Vehicles Offers Growth Opportunity

The commercial and fleet vehicle segments present significant growth opportunities for TPMS and LDWS. Traditionally focused on passenger vehicles, these systems are now increasingly adopted in trucks, buses, and other commercial vehicles. TPMS and LDWS can greatly enhance safety, reduce maintenance costs, and improve overall vehicle performance for fleet operators. These benefits are driving adoption in the commercial sector.

According to industry trends, the use of these systems in commercial vehicles is expected to rise, as fleet operators seek to optimize operational efficiency and comply with stringent safety regulations. The expansion into this segment is bolstered by the increasing demand for fleet safety and performance optimization tools, creating a robust market potential for TPMS and LDWS.

Predictive Maintenance and Telematics Integration Offers Growth Opportunity

Integrating TPMS and LDWS with telematics and predictive maintenance systems offers a significant growth opportunity. This integration allows automakers and fleet operators to obtain real-time insights into vehicle performance and anticipate potential issues before they occur.

By proactively addressing maintenance needs, this approach reduces vehicle downtime, enhances safety, and improves operational efficiency. The value proposition of such integration is compelling, as it supports better fleet management and vehicle upkeep. Recent trends indicate a growing interest in telematics solutions, which is expected to drive the adoption of integrated TPMS and LDWS systems. This synergy creates a strong potential for market expansion, as it aligns with the increasing focus on smart vehicle technologies and predictive maintenance strategies.

Trending Factors

Internet of Things (IoT) and Connectivity Are Trending Factors

The rise of IoT and connectivity is transforming TPMS and LDWS. These systems are increasingly integrated with cloud-based platforms, allowing real-time data sharing, over-the-air updates, and enhanced diagnostics. This connectivity trend drives innovation, enabling new service offerings and revenue streams for automakers and service providers.

According to recent trends, connected vehicles are becoming the norm, with IoT integration expected to grow significantly. This trend enhances the functionality and value of TPMS and LDWS, making them more appealing to consumers and fleet operators. The ability to remotely monitor and update these systems ensures they remain efficient and up-to-date, driving their adoption in the automotive market.

Artificial Intelligence (AI) and Machine Learning Are Trending Factors

AI and machine learning are significantly enhancing TPMS and LDWS. These technologies improve the accuracy, reliability, and functionality of these systems. For example, machine learning algorithms can analyze historical data to identify potential tire pressure issues or lane departure patterns, enabling proactive maintenance and safer driving. This trend is driving the adoption of smarter, more responsive TPMS and LDWS solutions.

Current trends indicate a growing integration of AI in automotive safety systems, enhancing their predictive capabilities and overall performance. The use of AI and machine learning in TPMS and LDWS is creating safer and more reliable driving experiences, making these systems more attractive to consumers and manufacturers alike.

Regional Analysis

North America Dominates with 33.4% Market Share

North America leads the TPMS and LDWS market with a 33.4% share due to stringent safety regulations and high consumer awareness. The U.S. mandates TPMS for all vehicles, driving significant adoption. Advanced automotive technology and high vehicle ownership rates further support this dominance. Strong demand for vehicle safety and technological advancements are key contributors to this leadership position.

The region’s focus on vehicle safety, robust automotive industry, and consumer preference for advanced safety features bolster market performance. The presence of major automotive manufacturers and tech companies accelerates innovation and integration of TPMS and LDWS.

North America is expected to maintain its lead, driven by continuous technological advancements and regulatory support. The region’s focus on enhancing vehicle safety standards will likely spur further adoption of TPMS and LDWS, sustaining its dominant market position.

Europe Holds 29.5% Market Share

Europe follows with a 29.5% market share due to stringent EU regulations mandating TPMS in all new cars since 2014. The focus on road safety and advanced driver assistance systems (ADAS) adoption drives this market.

Asia Pacific Grows with 25.8% Market Share

Asia Pacific holds a 25.8% market share, driven by rapid automotive industry growth and increasing vehicle safety awareness. China and Japan lead in adopting advanced safety features.

Middle East & Africa at 6.2% Market Share

The Middle East & Africa hold a 6.2% market share, supported by growing automotive markets and increasing safety awareness.

Latin America at 5.1% Market Share

Latin America has a 5.1% market share, driven by growing automotive markets and increasing adoption of safety features. Latin America is expected to see moderate growth as safety feature adoption increases, gradually enhancing its market share.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the markets for Tire Pressure Monitoring Systems (TPMS) and Lane Departure Warning Systems (LDWS), several leading companies shape the industry with their technological innovations, strategic collaborations, and market positioning. At the forefront, Continental AG and ZF Friedrichshafen AG stand out for their comprehensive automotive safety solutions and significant investment in research and development, which ensure their leadership in both European and global markets.

DENSO Corporation and Mobileye are also key players, with DENSO known for its robust manufacturing capabilities and Mobileye leading in vision-based system technologies. Mobileye, in particular, has revolutionized LDWS with its advanced camera-based algorithms, making it a critical player in driving forward autonomous vehicle technologies.

Companies like Aptiv Plc, Veoneer Inc., and Autoliv Inc. specialize in integrating sophisticated sensor technologies and software to enhance vehicle safety and automation features, positioning themselves strongly in North America and Europe. Valeo SA and Magna International further contribute with their diversified automotive components, including TPMS and LDWS, focusing on innovation and adaptability to new vehicle technologies.

In Asia, Aisin Seiki Co., Ltd., and Panasonic Corporation leverage their extensive electronics expertise to advance both TPMS and LDWS, focusing on energy efficiency and system integration. Semiconductor giants such as Texas Instruments Incorporated, NVIDIA Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, and Intel Corporation play crucial roles by providing the essential chips and processors that power these systems, underscoring the critical interdependence of hardware performance and software capabilities in this sector.

Together, these companies drive the TPMS and LDWS market, each leveraging their unique strengths to address safety concerns and regulatory requirements while fostering the move towards fully autonomous vehicles. Their strategic positioning not only reflects their current technological prowess but also their capacity to shape future developments in vehicle safety systems.

Market Key Players

- Continental AG

- ZF Friedrichshafen AG

- DENSO Corporation

- Mobileye

- Aptiv Plc

- Veoneer Inc.

- Autoliv Inc.

- Valeo SA

- Magna International

- Aisin Seiki Co., Ltd.

- Panasonic Corporation

- Texas Instruments Incorporated

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Intel Corporation

Recent Developments

- On May 2024, Ranger, a company specializing in automotive tools and equipment, introduced the TruSensor Universal TPMS Diagnostic and Programming Kit. This kit allows technicians to diagnose and program TPMS sensors, making it easier to maintain and repair these systems.

- On April 2024, new legislation regarding tire pressure monitoring systems (TPMS) will be implemented in the European Union. Goodyear, a leading tire manufacturer, has welcomed this incoming legislation, which aims to improve vehicle safety and efficiency by ensuring proper tire inflation.

- On September 2024, Infineon, a semiconductor manufacturer, launched the Xensiv SP49 tire pressure sensor for advanced TPMS applications. This sensor is designed to provide accurate and reliable tire pressure data, contributing to the development of more sophisticated TPMS technologies.

Report Scope

Report Features Description Market Value (2023) USD 11.6 Billion Forecast Revenue (2033) USD 37.0 Billion CAGR (2024-2033) 12.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tire Pressure Monitoring System: Direct TPMS, Indirect TPMS; Lane Departure Warning System: Lane Departure Alert Systems, Lane Keeping Systems (LKS)), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Distribution Channel (OEM, Aftermarket) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Continental AG, ZF Friedrichshafen AG, DENSO Corporation, Mobileye, Aptiv Plc, Veoneer Inc., Autoliv Inc., Valeo SA, Magna International, Aisin Seiki Co., Ltd., Panasonic Corporation, Texas Instruments Incorporated, NVIDIA Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, Intel Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the TPMS and LDWS Market Size in the Year 2023?The Global TPMS and LDWS Market size was USD 11.6 Billion by 2023, growing at a CAGR of 12.30%.

What is the Estimated CAGR of TPMS and LDWS Market During the Forecast Period?The Global TPMS and LDWS Market size is expected to grow at a CAGR of 12.30% during the forecast period from 2024 to 2033.

What is the Estimated TPMS and LDWS Market Size During the Forecast Period?The Global TPMS and LDWS Market size is expected to be worth around USD 37 Billion during the forecast period from 2024 to 2033.

Tire Pressure Monitoring System (TPMS), Lane Departure Warning System (LDWS) MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Tire Pressure Monitoring System (TPMS), Lane Departure Warning System (LDWS) MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Continental AG

- ZF Friedrichshafen AG

- DENSO Corporation

- Mobileye

- Aptiv Plc

- Veoneer Inc.

- Autoliv Inc.

- Valeo SA

- Magna International

- Aisin Seiki Co., Ltd.

- Panasonic Corporation

- Texas Instruments Incorporated

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Intel Corporation