Global Timing Gear Market Size, Share, Growth Analysis By Product Type (Camshaft Timing Gear, Crankshaft Timing Gear), By Engine Type (Inline Engines, V – Engines), By Sales Channel (OEM, Aftermarket), By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, Off-Highway Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158497

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

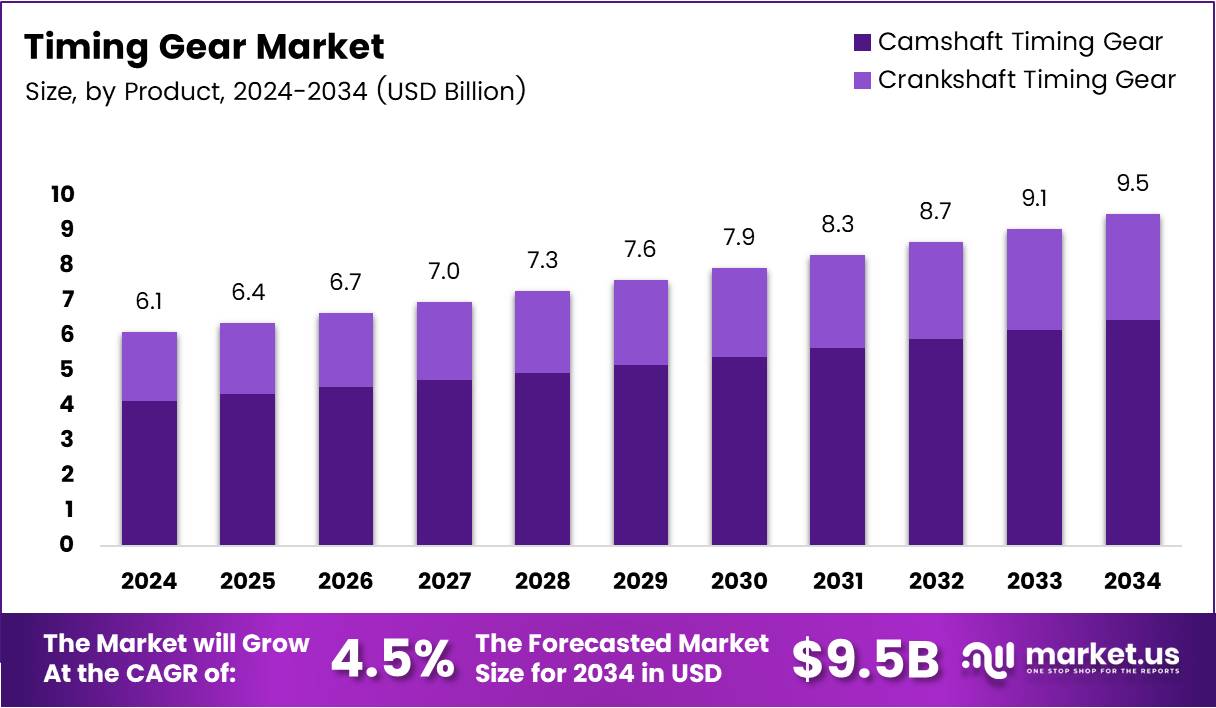

The Global Timing Gear Market size is expected to be worth around USD 9.5 Billion by 2034, from USD 6.1 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The timing gear market plays a pivotal role in ensuring synchronization within automotive engines and machinery. Timing gears are essential components used to control the timing of engine cycles. They are primarily employed in the automotive, aerospace, and industrial machinery sectors, where precise synchronization is crucial for efficiency and performance.

In recent years, the demand for timing gears has witnessed steady growth due to the expansion of the automotive industry. Increasing vehicle production, particularly in emerging economies, is expected to fuel the need for high-performance timing gears. Moreover, the automotive industry’s shift toward electric vehicles (EVs) and hybrid technologies presents new opportunities for timing gear manufacturers.

Additionally, the aerospace sector is contributing significantly to the timing gear market. Aircraft engines rely heavily on accurate timing to maintain operational efficiency. As the aviation industry rebounds post-pandemic, manufacturers are expected to increase their investment in advanced timing gear technologies to ensure better performance and reduce maintenance costs.

Government investments in infrastructure projects are also likely to drive market growth. With an emphasis on developing robust industrial machinery and upgrading manufacturing facilities, governments worldwide are focusing on initiatives that require precise timing mechanisms. This shift will likely generate higher demand for timing gears in construction, mining, and heavy-duty equipment sectors.

While the market shows promising growth, certain challenges persist. Stringent government regulations around manufacturing processes, especially in the automotive and aerospace industries, can increase the cost of production. Companies must navigate these regulatory landscapes while ensuring that their products meet the required standards for safety and performance. Additionally, the rising costs of raw materials, such as steel and alloys, could constrain profitability for some manufacturers.

The market also faces opportunities related to the rise of Industry 4.0 technologies. Automation, robotics, and smart manufacturing techniques are becoming increasingly prevalent in the timing gear sector. This shift is expected to boost efficiency and reduce production costs, creating new opportunities for manufacturers to expand their market share.

Furthermore, the growing adoption of 3D printing and additive manufacturing processes offers a cost-effective solution for producing customized timing gears. This technology could lead to faster production cycles and the ability to meet the diverse needs of industries that require unique, high-precision components.

Key Takeaways

- Global Timing Gear Market size is expected to reach USD 9.5 Billion by 2034, growing at a CAGR of 4.5% from 2025 to 2034.

- In 2024, Camshaft Timing Gear held a dominant position with a 67.1% share in the By Product Type segment.

- In 2024, Inline Engines held a dominant position with a 69.3% share in the By Engine Type segment.

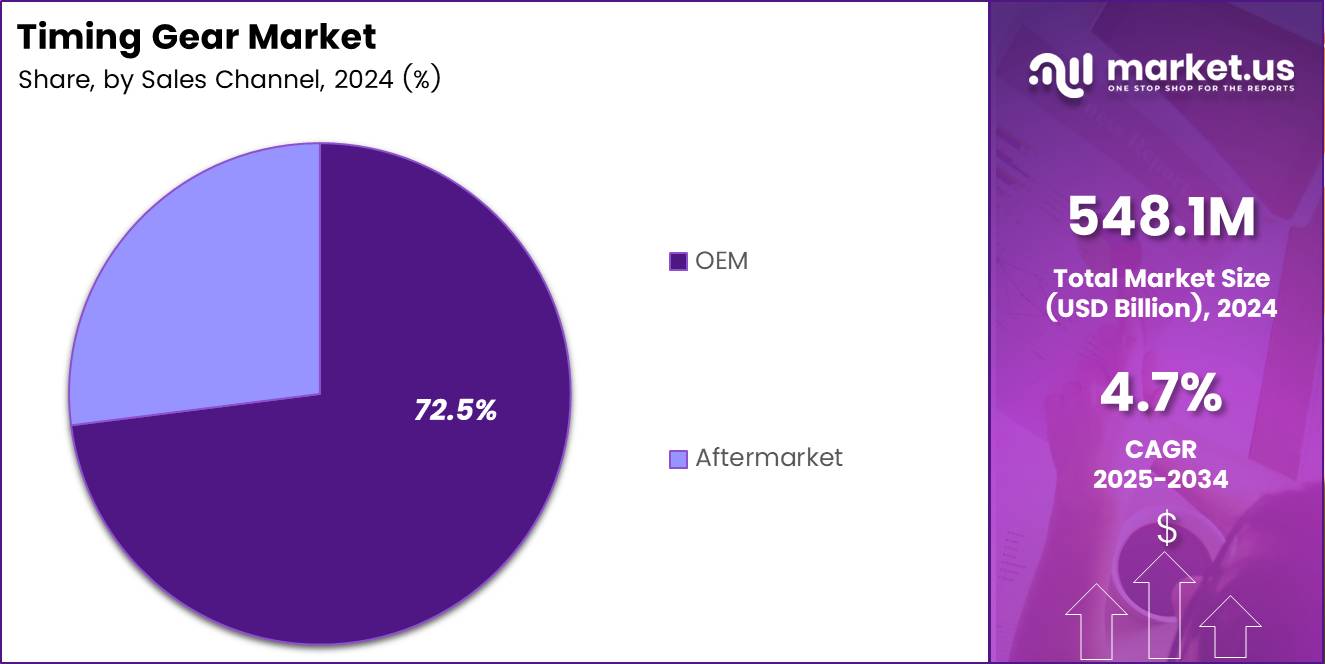

- In 2024, OEM held a dominant position with a 72.5% share in the By Sales Channel segment.

- In 2024, Passenger Vehicles held a dominant position with a 55.6% share in the By Vehicle Type segment.

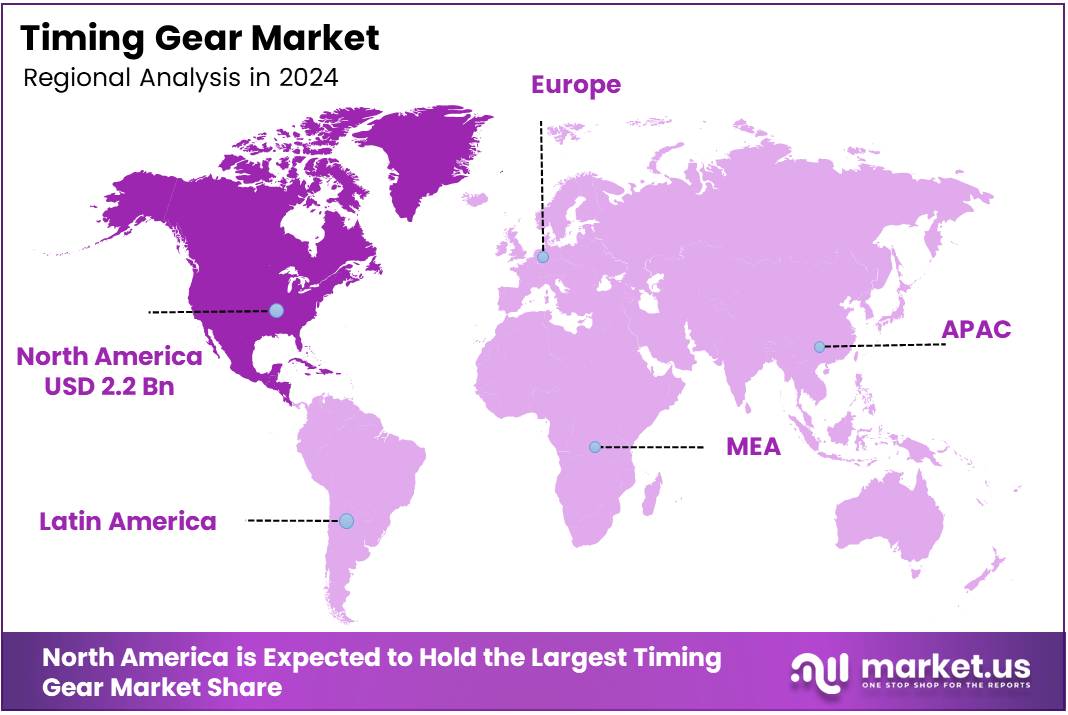

- In 2024, North America held a dominant market position with a 37.3% share, valued at USD 2.2 Billion in the Timing Gear Market.

Product Type Analysis

Camshaft Timing Gear dominates with 67.1% due to its critical role in valve operation and engine synchronization.

In 2024, Camshaft Timing Gear held a dominant market position in the By Product Type Analysis segment of Timing Gear Market, with a 67.1% share. This dominance stems from its essential function in controlling valve timing and ensuring precise engine operation.

Camshaft timing gears regulate intake and exhaust valve operations, making them indispensable components. Their widespread application across various engine configurations drives consistent demand. Additionally, these gears require regular maintenance and replacement, sustaining market growth through both OEM and aftermarket channels.

Meanwhile, crankshaft timing gears maintain steady demand but hold a smaller market share. These components synchronize crankshaft rotation with camshaft movement, ensuring optimal engine performance. However, their typically longer lifespan compared to camshaft gears results in lower replacement frequency.

Furthermore, technological advancements continue enhancing gear durability and efficiency. Manufacturers increasingly focus on precision engineering and material innovations to meet evolving automotive industry standards and performance requirements.

Engine Type Analysis

Inline Engines dominate with 69.3% due to their simpler design and widespread automotive adoption.

In 2024, Inline Engines held a dominant market position in the By Engine Type Analysis segment of Timing Gear Market, with a 69.3% share. This leadership reflects their prevalent use in passenger vehicles and commercial applications worldwide.

Inline engines offer straightforward timing gear configurations, reducing complexity and manufacturing costs. Their linear cylinder arrangement simplifies timing system design, making them particularly attractive for mass production. Consequently, automotive manufacturers favor inline engines for fuel-efficient vehicles.

Conversely, V-engines represent a significant but smaller market segment. These engines require more complex timing systems due to their dual cylinder bank configuration. Despite higher manufacturing complexity, V-engines deliver superior performance and power output for premium vehicles.

Moreover, emerging engine technologies continue influencing timing gear demand. Hybrid and electric vehicle integration creates new opportunities while traditional internal combustion engines maintain substantial market presence across global automotive markets.

Sales Channel Analysis

OEM dominates with 72.5% due to direct manufacturer relationships and bulk procurement advantages.

In 2024, OEM held a dominant market position in the By Sales Channel Analysis segment of Timing Gear Market, with a 72.5% share. This dominance reflects strong partnerships between timing gear manufacturers and automotive producers.

OEM channels benefit from long-term contracts and bulk purchasing agreements, ensuring consistent revenue streams. Vehicle manufacturers prioritize quality and reliability, establishing trusted supplier relationships. These partnerships facilitate integrated product development and customized timing solutions.

Meanwhile, aftermarket channels serve replacement and maintenance needs effectively. Independent repair shops, distributors, and retail outlets drive aftermarket demand through vehicle servicing requirements. This segment grows steadily as vehicle populations age and require component replacements.

Additionally, digital transformation enhances both channels’ efficiency. Online platforms expand aftermarket reach while OEM supply chain optimization reduces costs. These technological improvements strengthen market accessibility and customer service capabilities.

Vehicle Type Analysis

Passenger Vehicles dominate with 55.6% due to high production volumes and global automotive demand.

In 2024, Passenger Vehicles held a dominant market position in the By Vehicle Type Analysis segment of Timing Gear Market, with a 55.6% share. This leadership stems from massive global passenger car production and ownership rates.

Passenger vehicles require regular timing gear maintenance and replacement throughout their operational lifespan. Urban mobility trends and rising disposable incomes drive continuous demand for personal transportation. Consequently, this segment maintains steady growth across developed and emerging markets.

Light commercial vehicles contribute significantly to market expansion through e-commerce and delivery service growth. These vehicles experience intensive usage patterns, accelerating timing gear wear and replacement cycles. Urban logistics demands further boost this segment’s importance.

Heavy commercial vehicles and off-highway vehicles represent specialized market segments with distinct requirements. These applications demand robust timing gears capable of handling extreme operating conditions and extended service intervals, commanding premium pricing.

Off-highway vehicles encompass agricultural, mining, and construction equipment with specialized timing gear needs. These applications face harsh environmental conditions including dust, moisture, and temperature extremes. Consequently, timing gears must deliver exceptional durability and reliability for mission-critical operations.

Key Market Segments

By Product Type

- Camshaft Timing Gear

- Crankshaft Timing Gear

By Engine Type

- Inline Engines

- V – Engines

By Sales Channel

- OEM

- Aftermarket

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Off-Highway Vehicles

Drivers

Increasing Demand for Advanced Engine Technologies Drives Market Growth

The timing gear market is experiencing significant growth driven by the increasing demand for advanced engine technologies. Modern vehicles require more sophisticated timing systems to optimize engine performance and reduce emissions. Car manufacturers are investing heavily in research and development to create engines that deliver better fuel efficiency and lower environmental impact.

The rise in automotive production and sales worldwide is another major driver. As global vehicle manufacturing continues to expand, particularly in emerging markets, the demand for timing gears increases proportionally. This growth is supported by rising disposable incomes and urbanization trends in developing countries.

Electric vehicle adoption is creating new opportunities for timing gear manufacturers. While electric vehicles have different requirements than traditional combustion engines, they still need timing components for various mechanical systems. This shift is pushing manufacturers to adapt their products for electric and hybrid vehicle applications.

Advancements in material technologies are revolutionizing timing gear manufacturing. New materials offer improved durability, reduced weight, and better performance characteristics. These innovations allow manufacturers to create timing gears that last longer and operate more efficiently under various operating conditions.

Restraints

Stringent Regulatory Standards for Automotive Components Create Market Restraints

The timing gear market faces several challenges that limit its growth potential. Stringent regulatory standards for automotive components pose significant constraints on manufacturers. Government agencies worldwide are implementing stricter quality and safety requirements, forcing companies to invest heavily in compliance measures and testing procedures.

The availability of alternative materials presents another restraint. While new materials offer benefits, they also create competition for traditional timing gear materials. Manufacturers must constantly evaluate cost-effectiveness and performance trade-offs when selecting materials for their products.

Fluctuating raw material prices create uncertainty in the market. Steel, aluminum, and other essential materials experience price volatility due to global economic conditions, supply chain disruptions, and geopolitical factors. These fluctuations make it difficult for manufacturers to maintain consistent pricing and profit margins.

Quality control requirements add complexity to the manufacturing process. Companies must implement rigorous testing procedures and quality assurance measures, which increase production costs and time-to-market. These factors can limit the ability of smaller manufacturers to compete effectively in the market.

Growth Factors

Expansion of Automotive Aftermarket Services Creates Growth Opportunities

The timing gear market presents numerous growth opportunities for manufacturers and suppliers. The expansion of automotive aftermarket services is creating increased demand for replacement timing gears. As vehicles age, timing components require maintenance and replacement, providing a steady revenue stream for manufacturers.

Rising demand for fuel-efficient vehicles is driving innovation in timing gear design. Consumers are increasingly conscious of fuel costs and environmental impact, pushing manufacturers to develop timing systems that optimize engine efficiency. This trend creates opportunities for companies that can deliver superior performance products.

Technological advancements in 3D printing are revolutionizing automotive parts manufacturing. This technology enables rapid prototyping, customization, and cost-effective production of complex timing gear designs. Manufacturers can reduce development time and costs while offering more diverse product lines.

The growth of electric and hybrid vehicle segments opens new market opportunities. These vehicles require specialized timing components for their unique powertrains. Companies that can successfully adapt their products for electric vehicle applications will gain competitive advantages in this expanding market segment.

Emerging Trends

Integration of Timing Gears with Smart Automotive Systems Shapes Market Trends

Current market trends are reshaping the timing gear industry landscape. The integration of timing gears with smart automotive systems is becoming increasingly important. Modern vehicles feature sophisticated electronic control systems that require precise timing coordination, creating demand for more advanced timing gear solutions.

The adoption of lightweight materials for performance enhancement is a significant trend. Manufacturers are exploring carbon fiber, advanced alloys, and composite materials to reduce weight while maintaining strength and durability. These materials help improve overall vehicle performance and fuel efficiency.

Increased demand for high-precision timing gears in high-performance vehicles is driving market growth. Sports cars, racing vehicles, and luxury automobiles require extremely precise timing systems to achieve optimal performance. This niche market commands premium prices and high-quality standards.

The shift toward sustainable and eco-friendly manufacturing processes is influencing industry practices. Companies are adopting cleaner production methods, recycling programs, and environmentally responsible material sourcing. This trend reflects growing consumer awareness of environmental issues and regulatory pressure for sustainable manufacturing practices.

Regional Analysis

North America Dominates the Timing Gear Market with a Market Share of 37.3%, Valued at USD 2.2 Billion

In 2024, North America held a dominant market position in the Timing Gear Market, accounting for 37.3% of the total market share, valued at USD 2.2 Billion. The region’s growth is driven by advanced automotive manufacturing, stringent vehicle emission standards, and increasing adoption of fuel-efficient technologies. The presence of major automotive manufacturers and OEMs in the region further bolsters demand for timing gears, particularly in the U.S.

Europe Timing Gear Market Trends

Europe accounted for a significant share in the global Timing Gear Market, with steady demand driven by the automotive industry’s focus on engine performance and emissions regulations. Technological advancements in materials and manufacturing processes are expected to propel growth. The region is anticipated to witness increased adoption of electric vehicle components, influencing the timing gear sector positively.

Asia Pacific Timing Gear Market Insights

The Asia Pacific region is expected to see robust growth in the Timing Gear Market, driven by the rapid expansion of the automotive industry, especially in China and India. Rising demand for passenger vehicles and advancements in engine technology are key contributors to market growth. The region’s increasing automotive production, combined with a growing middle-class population, will further strengthen demand.

Middle East and Africa Timing Gear Market Overview

The Middle East and Africa market for timing gears is expected to grow at a moderate pace due to ongoing automotive development in the region. While the market is still emerging, rising automotive sales in countries like Saudi Arabia and the UAE, coupled with expanding industrial infrastructure, are expected to increase demand for automotive components, including timing gears.

Latin America Timing Gear Market Analysis

Latin America is experiencing steady growth in the Timing Gear Market, primarily driven by the automotive sector in countries like Brazil and Mexico. The region’s growing demand for fuel-efficient vehicles and an increase in automotive production are anticipated to create lucrative opportunities for timing gear manufacturers in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Timing Gear Company Insights

In 2024, ACDelco is anticipated to strengthen its position in the global Timing Gear Market, driven by its strong reputation for high-quality automotive components. ACDelco continues to leverage its extensive distribution network to cater to a growing demand for timing gears in the aftermarket automotive sector.

J.K. Fenner Limited is expected to capitalize on its innovative manufacturing processes and high-performance materials to maintain a competitive edge. The company’s focus on precision and durability is likely to support its growth in both OEM and aftermarket sectors globally.

Gates Corporation remains a major player in the timing gear market, renowned for its strong engineering expertise. With a commitment to product innovation and an expansive customer base, Gates Corporation is expected to see consistent growth, particularly in the automotive industry where timing gears are essential for engine performance.

The Carlstar Group is projected to continue its success in the timing gear market through its focus on advanced manufacturing techniques and extensive product portfolio. The company’s efforts to improve efficiency in its production lines and expand its footprint in emerging markets will likely enhance its market share in the coming years.

Top Key Players in the Market

- ACDelco

- J.K. Fenner Limited

- Gates Corporation

- The Carlstar Group

- B&B Manufacturing

- Dayco

- Ningbo Beidi Synchronous Belt

- Federal-Mogul Motorparts Corporation

- ContiTech

- Bando USA

Recent Developments

- In August 2024, BBB Industries completed the acquisition of All Star Auto Parts, significantly enhancing its electronics offerings and strengthening its position in the automotive aftermarket sector.

- In August 2025, Fenix Parts expanded its operations throughout the Midwest with the acquisition of Grade A Auto Parts, increasing its regional footprint and product portfolio in the auto parts industry.

- In August 2025, XL Parts and TPH acquired Alliance Automotive, marking a strategic move into the collision market, broadening their market reach and diversifying their service offerings.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Billion Forecast Revenue (2034) USD 9.5 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Camshaft Timing Gear, Crankshaft Timing Gear), By Engine Type (Inline Engines, V – Engines), By Sales Channel (OEM, Aftermarket), By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, Off-Highway Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ACDelco, J.K. Fenner Limited, Gates Corporation, The Carlstar Group, B&B Manufacturing, Dayco, Ningbo Beidi Synchronous Belt, Federal-Mogul Motorparts Corporation, ContiTech, Bando USA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ACDelco

- J.K. Fenner Limited

- Gates Corporation

- The Carlstar Group

- B&B Manufacturing

- Dayco

- Ningbo Beidi Synchronous Belt

- Federal-Mogul Motorparts Corporation

- ContiTech

- Bando USA