Global Thin Wall Packaging Market Size, Share, Growth Analysis By Product Type (Jars, Cups, Trays, Containers, Lids, Tubs, Pots), By Material Type, By Production Process, By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135653

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Thin Wall Packaging Market Key Takeaways

- Thin Wall Packaging Business Environment Analysis

- Type Analysis

- Material Type Analysis

- Production Process Analysis

- Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis of Thin Wall Packaging Market

- Competitive Landscape of Thin Wall Packaging Market

- Recent Advancements of Thin Wall Packaging Market

- Report Scope

Report Overview

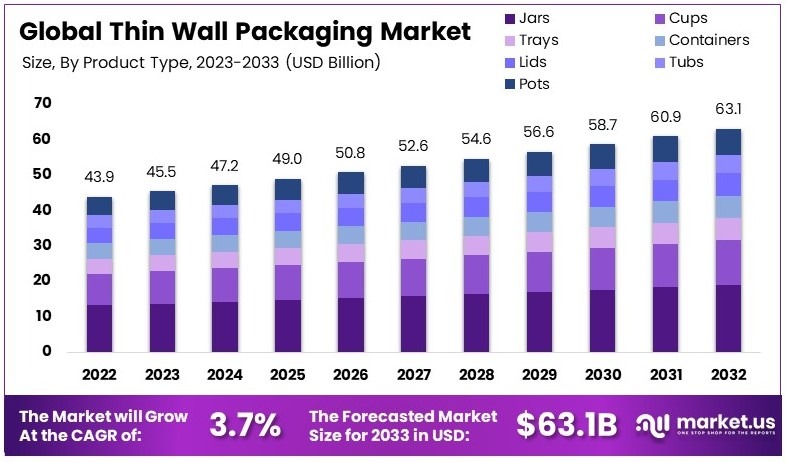

The Global Thin Wall Packaging Market size is expected to be worth around USD 63.1 Billion by 2033, from USD 43.9 Billion in 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2033.

Thin wall packaging refers to lightweight containers made from minimal material thickness, typically plastics like polyethylene terephthalate (PET). These packages are designed to be cost-effective, reduce material usage, and offer sufficient protection for products. They are commonly used in food, beverages, and consumer goods industries.

The Thin Wall Packaging Market encompasses the global industry involved in the production and distribution of thin wall packaging solutions. It includes various materials, types, and applications used across sectors such as food and beverages, healthcare, and personal care.

Thin wall packaging, characterized by its lightweight and minimal material use, is increasingly favored across various industries for its cost efficiency and environmental benefits. As consumer preferences lean towards sustainable yet convenient packaging options, the market for thin wall packaging is experiencing robust growth.

Furthermore, the demand for ready-to-cook foods and compact packaging continues to drive market expansion. Innovations in packaging that meet stringent standards are a significant growth factor.

For instance, according to the Zero Waste Week, the beauty industry annually contributes over 120 billion units of plastic packaging waste, highlighting the critical need for sustainable solutions.

Consequently, governments worldwide are implementing regulations to promote sustainable packaging practices. California’s Assembly Bill 793 mandates that plastic beverage containers contain 15% recycled content by 2022 and 50% by 2030, directly influencing local packaging strategies.

On a broader scale, the packaging machinery industry, with a turnover of €9.2 billion in 2023 and exports totaling €7.2 billion, illustrates the sector’s expansive reach and pivotal role in supporting sustainability. Moreover, according to the Consumer Brands Association, 20 of the largest FMCG manufacturers are committed to achieving 100% recycled packaging by 2030, signaling a significant shift towards sustainable packaging across global markets.

Thin Wall Packaging Market Key Takeaways

- Thin Wall Packaging Market was valued at USD 43.9 Billion in 2023, projected to reach USD 63.1 Billion by 2033, with a CAGR of 3.7%.

- In 2023, Polyethylene Terephthalate (PET) dominates the material segment, essential due to its recyclability and food safety properties.

- In 2023, Jars lead the type segment, favored for their versatility in packaging across industries.

- In 2023, Injection Molding dominates the production process, preferred for its efficiency and material versatility.

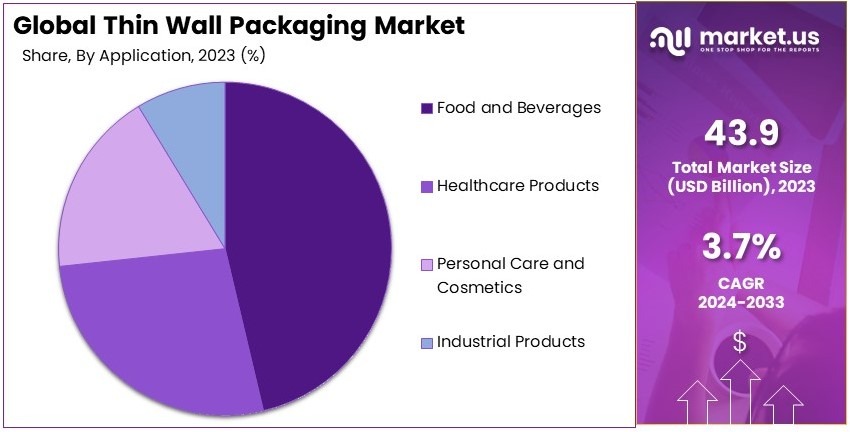

- In 2023, Food & Beverages dominate the application segment, driven by demand for convenient, safe food packaging solutions.

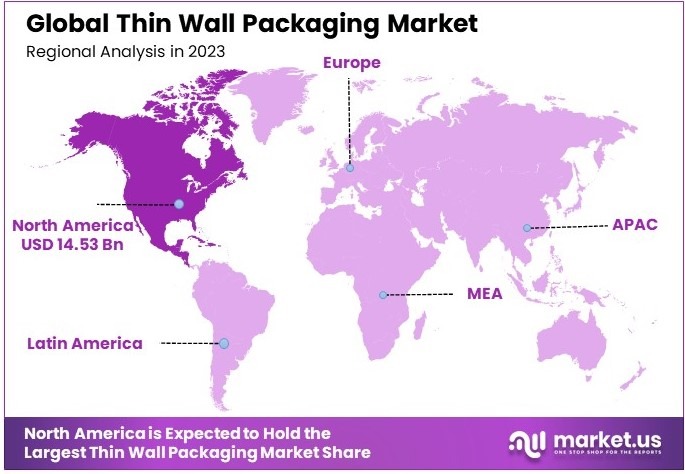

- In 2023, North America dominates with 33.1% market share, attributing to high consumption and advanced manufacturing technologies.

Thin Wall Packaging Business Environment Analysis

The thin wall packaging market is approaching saturation, but there remain untapped niches and geographic regions where growth is still possible. Over 80% of consumers purchase frozen food products, driven by motivations to reduce food waste and save money, pinpointing a significant target demographic that values durable and efficient protective packaging.

Furthermore, the differentiation in this market hinges on material innovations and design improvements that enhance product preservation and user convenience. This has been crucial in maintaining a competitive edge. The value chain is evolving, with advancements in recycling technologies and sustainable materials gaining prominence, enhancing both product lifecycle and environmental impact.

Moreover, investment opportunities abound, particularly in the areas of sustainability and automation. The global trade dynamics underscore the importance of thin wall packaging in international commerce. In 2022, the total trade value of plastics and related articles reached $864 billion, with China and the U.S. playing major roles as the top exporter and importer, respectively.

Additionally, the export-import dynamics of the market reflect significant activity, with China exporting plastics worth $156 billion and the U.S. importing goods valued at $96.2 billion in 2022. This interplay underscores the global reliance on efficient, cost-effective packaging solutions.

Type Analysis

Jars dominate the Thin Wall Packaging Market with significant market share due to their versatility and widespread use across various industries.

The Thin Wall Packaging Market has seen considerable growth in its Type segment, with Jars emerging as the dominant sub-segment. Jars, often used for their robustness and reusability, cater to a wide range of applications from food storage to cosmetics, making them a versatile choice in the thin wall packaging arena. This sub-segment benefits from technological advancements in material science that allow for lighter, more durable jars that maintain product integrity and extend shelf life.

Cups, another important sub-segment, play a crucial role in both the food service and retail sectors due to their convenience and cost-effectiveness. Trays, essential for ready-to-eat meals and fresh produce, have been integral in driving market growth by offering innovative solutions for safe and hygienic product delivery.

Containers and Lids follow, with their usage primarily driven by the food and beverages sector, where the demand for secure packaging solutions continues to rise. Tubs and Pots, typically used in the dairy and delicatessen sectors, have also seen growth, albeit more modest, driven by consumer preferences for portable and convenient packaging formats.

Material Type Analysis

Polyethylene Terephthalate (PET) leads the market with a dominant percentage, attributed to its recyclability and clarity.

In the Material Type segment of the Thin Wall Packaging Market, Polyethylene Terephthalate (PET) stands out as the leading material. PET’s popularity is due to its clear properties, robustness, and superior recyclability, which align with the global shift towards sustainable packaging solutions. Its ability to be used in various forms of packaging, including bottles and containers, enhances its appeal across multiple sectors.

Polypropylene (PP) is valued for its flexibility and resistance to chemicals, making it a preferred choice for packaging a wide array of products. Polyethylene (PE) is essential for its durability and is extensively used in the production of lids and tubs. Polystyrene (PS), while facing scrutiny due to environmental concerns, remains vital in the production of disposable cups and trays.

Other Plastics, including PVC, continue to hold a smaller portion of the market due to their specific applications in niche markets where their unique properties are required.

Production Process Analysis

Injection Molding dominates the production process segment due to its efficiency and high-quality output.

Injection Molding has emerged as the dominant production process in the Thin Wall Packaging Market. This technique is favored for its precision in producing high-quality products that require intricate designs and superior strength. The efficiency of injection molding, combined with its ability to scale production to meet high demand, underpins its leading position in the market.

Thermoforming and Extrusion are other critical processes in the production of thin wall packaging. Thermoforming is particularly prevalent in the manufacture of trays and containers due to its cost-effectiveness and speed in large-scale operations. Extrusion, while less common, is instrumental in creating multilayer structures that enhance the barrier properties of packaging, which is crucial for food safety and extending shelf life.

Application Analysis

Food and Beverages application leads the market leveraging the necessity of efficient, safe packaging in the sector.

The Application segment is dominated by Food and Beverages, which utilizes thin wall packaging extensively to meet the stringent requirements for food safety and quality. This segment’s dominance is driven by the increasing consumer demand for convenience foods and ready-to-eat meals, which require reliable and durable packaging solutions.

In this segment, Dairy Products utilize thin wall packaging for its superior barrier properties that extend the shelf life of products. Bakery and Confectionery industries rely on visually appealing yet protective packaging to attract consumers while ensuring product freshness. The Ready-to-Eat Meals market has particularly benefited from advancements in packaging technology that accommodate the thermal treatments needed for preservation.

Fruits and Vegetables also depend heavily on thin wall packaging to prevent contamination and extend freshness, whereas Beverages use these solutions for their lightweight and durable characteristics, essential for reducing transportation costs and environmental impact.

Key Market Segments

By Product Type

- Jars

- Cups

- Trays

- Containers

- Lids

- Tubs

- Pots

By Material Type

- Polypropylene (PP)

- Polyethylene (PE)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Other Plastics (e.g., PVC)

By Production Process

- Injection Molding

- Thermoforming

- Extrusion

By Application

- Food and Beverages

- Dairy Products

- Bakery and Confectionery

- Ready-to-Eat Meals

- Fruits and Vegetables

- Beverages

- Healthcare Products

- Personal Care and Cosmetics

- Industrial Products

Driving Factors

Lightweight and Technology Drives Market Growth

The Thin Wall Packaging Market is significantly driven by the increasing demand for lightweight packaging solutions, supported by growth in the food and beverage industry and advancements in packaging technology.

Lightweight packaging is becoming increasingly popular due to its cost-effectiveness in transportation and ease of handling. Additionally, the food and beverage sector, which requires reliable, durable packaging for extended shelf life and freshness, heavily relies on thin wall packaging solutions.

These packaging innovations offer significant benefits, including improved sustainability and operational efficiencies, which are crucial in today’s market. This drive towards innovative, lightweight designs is further supported by rising consumer preferences for convenient, user-friendly packaging, influencing product development and market expansion strategies.

Restraining Factors

Material Costs and Regulations Restraints Market Growth

The growth of the Thin Wall Packaging Market faces notable challenges due to the high costs of raw materials and stringent environmental regulations. The cost of premium materials necessary for producing thin wall packaging can be prohibitive, affecting profitability for manufacturers.

Furthermore, the industry must navigate a complex regulatory landscape that governs the use and disposal of plastics, particularly in regions with strict environmental protection policies. These factors complicate production processes and increase operational costs.

Additionally, the difficulty in recycling composite materials used in thin wall packaging poses further challenges, as it impedes sustainability efforts and compliance with recycling mandates, potentially restraining market growth in environmentally conscious markets.

Growth Opportunities

Emerging Markets Provides Opportunities

Emerging markets present significant growth opportunities for the Thin Wall Packaging Market, driven by innovations in biodegradable materials and the increasing adoption of these solutions in the healthcare industry.

As economies in Asia, Africa, and South America continue to grow, the demand for efficient and sustainable packaging solutions rises. Innovations such as biodegradable packaging and improved barrier properties enhance product appeal in these regions, where environmental concerns and rapid urbanization drive consumer and regulatory expectations.

Moreover, the healthcare sector’s need for high-quality, reliable packaging for medical products promotes further adoption of thin wall packaging, capitalizing on opportunities to expand market presence and meet diverse customer needs.

Emerging Trends

Sustainability Is the Latest Trending Factor

Sustainability is a leading trending factor in the Thin Wall Packaging Market, influencing shifts towards sustainable packaging materials and practices. This trend is propelled by growing consumer awareness and regulatory pressures, which demand environmentally friendly packaging solutions.

Companies are increasingly adopting sustainable practices, including the use of recycled materials and the development of recyclable thin wall products.

The shift towards eco-friendly options is not only a response to consumer preferences but also aligns with global sustainability goals. This trend towards sustainability is reshaping the market, encouraging innovation, and setting new standards for the packaging industry’s future.

Regional Analysis of Thin Wall Packaging Market

North America Dominates with 33.1% Market Share

North America commands the Thin Wall Packaging Market with a 33.1% share, totaling USD 14.53 billion. This significant market presence is underpinned by high consumer demand for sustainable and convenient packaging solutions, coupled with robust manufacturing capabilities.

The region benefits from advanced production technologies and a strong focus on sustainability, driving the adoption of thin wall packaging. The presence of major players and a highly integrated supply chain further strengthen North America’s market position.

The prominence of North America in the Thin Wall Packaging Market is poised to continue, driven by innovations in recyclable and biodegradable materials. The increasing emphasis on eco-friendly packaging solutions is likely to bolster the demand, potentially enhancing the region’s market dominance.

Regional Mentions:

- Europe: Europe maintains a pivotal role in the Thin Wall Packaging Market, with a focus on reducing plastic use and enhancing recycling processes. The region’s stringent environmental regulations and advanced waste management systems support its steady market position.

- Asia Pacific: Asia Pacific is witnessing rapid growth in the Thin Wall Packaging Market, spurred by escalating consumer goods demand and expanding retail sectors. Economies like China and India are key contributors, driving regional market expansion through increased production capacities.

- Middle East & Africa: The Middle East and Africa are gradually increasing their market share in Thin Wall Packaging, focusing on infrastructure development and economic diversification. Investments in modernizing packaging standards and improving supply chain efficiencies are central to the region’s growth.

- Latin America: Latin America shows promising growth in the Thin Wall Packaging Market, driven by urbanization and industrialization. The region is focusing on enhancing food packaging standards and supply chain innovations, which are critical for its market development.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape of Thin Wall Packaging Market

In the Thin Wall Packaging Market, the competitive landscape is predominantly shaped by four major entities: Amcor Plc, Berry Global Group, Inc., Sonoco Products Company, and RPC Group Plc. These companies hold pivotal roles due to their extensive market reach, innovative product offerings, and strategic global presence.

Amcor Plc stands out as a leader with its robust commitment to sustainability and innovation. The company’s focus on producing recyclable and reusable thin wall packaging solutions positions it as a key player driving eco-friendly initiatives within the industry. Amcor’s global footprint allows it to serve a diverse client base, thereby enhancing its market stability and growth potential.

Berry Global Group, Inc. follows closely, distinguished by its vast product portfolio and strong emphasis on technological advancements. Berry Global not only offers a wide range of thin wall packaging solutions but also invests in new technologies to improve product quality and manufacturing efficiency. This approach ensures it remains competitive and capable of meeting evolving market demands.

Sonoco Products Company, known for its customer-centric approach, tailors solutions to meet specific industry needs, which range from food and beverage to pharmaceuticals. Sonoco’s commitment to customizing products enhances its reputation for flexibility and customer service, further solidifying its market position.

RPC Group Plc, before its acquisition by Berry Global, was recognized for its expansive reach across multiple markets and its ability to deliver high-quality, cost-effective packaging solutions. The integration of RPC into Berry Global has further strengthened the latter’s market capabilities, leveraging RPC’s innovative processes and extensive material knowledge.

These top companies drive the competitive landscape through a combination of innovation, customer focus, and strategic market expansion. Their efforts not only cater to current demands but also strategically position them for future growth opportunities in the evolving thin wall packaging sector. Their roles are critical in shaping industry standards and driving forward the sustainability agenda.

Major Companies in the Market

- Amcor Plc

- Berry Global Group, Inc.

- Sonoco Products Company

- RPC Group Plc

- Paccor Packaging GmbH

- Greiner Packaging International GmbH

- Silgan Holdings Inc.

- Mold-Tek Packaging Limited

- Huhtamäki Oyj

- Reynolds Group Holdings Limited

- Alpla Group

- Double H Plastics, Inc.

Recent Advancements of Thin Wall Packaging Market

- Amcor plc and Berry Global Group, Inc.: In November 2024, Amcor plc announced an agreement to acquire Berry Global Group, Inc. in an all-stock transaction valued at approximately $8.4 billion. Berry shareholders will receive 7.25 Amcor shares for each Berry share, resulting in Amcor and Berry shareholders owning about 63% and 37% of the combined company, respectively. The merger is expected to create a leading global packaging entity with annual revenues of $24 billion.

- Sonoco Products Company: In June 2024, Sonoco Products Company announced the acquisition of Eviosys, a European metal packaging manufacturer, for $3.9 billion. This strategic move aims to prioritize metal packaging within Sonoco’s portfolio, aligning with its growth objectives in the consumer goods sector.

- Skanem AS: In October 2023, Skanem AS completed the acquisition of 100% shares in Bergen Plastics AS and Heger AS. Bergen Plastics specializes in thin-wall plastic packaging products such as containers, lids, and closures, primarily serving the home care and food markets. This acquisition enhances Skanem’s market presence and product offerings in the packaging industry.

Report Scope

Report Features Description Market Value (2023) USD 43.9 Billion Forecast Revenue (2033) USD 63.1 Billion CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Jars, Cups, Trays, Containers, Lids, Tubs, Pots), By Material Type (Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Polyethylene Terephthalate (PET), Other Plastics (e.g., PVC)), By Production Process (Injection Molding, Thermoforming, Extrusion), By Application (Food and Beverages: Dairy Products, Bakery and Confectionery, Ready-to-Eat Meals, Fruits and Vegetables, Beverages; Healthcare Products, Personal Care and Cosmetics, Industrial Products) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor Plc, Berry Global Group, Inc., Sonoco Products Company, RPC Group Plc, Paccor Packaging GmbH, Greiner Packaging International GmbH, Silgan Holdings Inc., Mold-Tek Packaging Limited, Huhtamäki Oyj, Reynolds Group Holdings Limited, Alpla Group, Double H Plastics, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor Plc

- Berry Global Group, Inc.

- Sonoco Products Company

- RPC Group Plc

- Paccor Packaging GmbH

- Greiner Packaging International GmbH

- Silgan Holdings Inc.

- Mold-Tek Packaging Limited

- Huhtamäki Oyj

- Reynolds Group Holdings Limited

- Alpla Group

- Double H Plastics, Inc.