Global Thaumatin Market By Source(Natural Thaumatin, Synthetic Thaumatin), By Form(Powder, Liquid), By Type(Food Grade, Pharmaceutical Grade, Others), By Application(Sweeteners, Flavoring Agents, Others), By End-user(Food And Beverage, Pharmaceutical, Cosmetics, Nutraceutical, Others), By Distribution Channel(Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132068

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

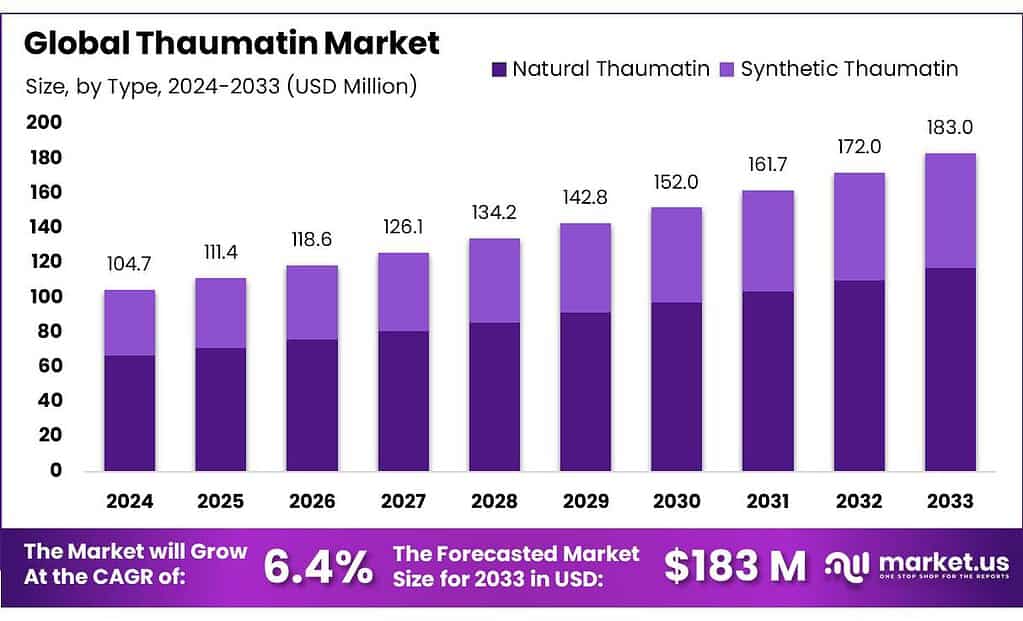

The Global Thaumatin Market size is expected to be worth around USD 183.0 Mn by 2033, from USD 104.7 Mn in 2023, growing at a CAGR of 6.4% during the forecast period from 2024 to 2033.

Thaumatin is a natural sweetener and flavor enhancer extracted from the arils of the katemfe fruit, scientifically known as Thaumatococcus daniellii, which is native to West Africa. This intensely sweet protein mixture is approximately 2000 to 3000 times sweeter than sucrose, making it an effective alternative to traditional sugars in various food products.

Thaumatin has a unique taste profile that builds slowly and leaves a lingering sweetness, often described as having a licorice-like aftertaste at higher concentrations. Unlike many other sweeteners, thaumatin is classified as a protein rather than a carbohydrate, contributing only about 4 calories per gram, which makes it particularly appealing for those managing their caloric intake or blood sugar levels.

Thaumatin is classified as Generally Recognized As Safe (GRAS) by the FDA in the United States. In the European Union, it is approved as a food additive under the designation E 957. The EFSA has established that there is no need for a numerical acceptable daily intake (ADI) due to its non-toxic nature, but a working maximum level of 1.1 mg/kg/day has been adopted, translating to approximately 77 mg per day for an average adult weighing 70 kg34.

Production Volume The global production of thaumatin was approximately 169.07 metric tons (MT) in 2016, up from 138.47 MT in 2012. This reflects an increasing trend in production, although it is limited by the availability of the T. daniellii plant, which is harvested from wild sources in West Africa.

Current Production Capacity Proposed large-scale production facilities aim for capacities around 50 MT/year, but these are not yet widely implemented due to challenges in cultivation and extraction processes.

Key Takeaways

- Thaumatin Market size is expected to be worth around USD 183.0 Mn by 2033, from USD 104.7 Mn in 2023, growing at a CAGR of 6.4%.

- Natural Thaumatin held a dominant market position, capturing more than a 64.3% share.

- Natural Powder held a dominant market position, capturing more than a 72.4% share.

- Natural Food Grade thaumatin held a dominant market position, capturing more than a 53.4% share.

- Natural Sweeteners held a dominant market position, capturing more than a 58.4% share.

- Natural Food & Beverage held a dominant market position, capturing more than a 48.5% share.

- Natural Supermarkets/Hypermarkets held a dominant market position, capturing more than a 38.5% share.

- North America is currently the leading region in the Thaumatin market, holding a dominant share of 37% and valued at approximately USD 39.06 million.

By Source

Comparative Market Share Analysis of Natural Thaumatin 64.3%

In 2023, Natural Thaumatin held a dominant market position, capturing more than a 64.3% share. This segment’s strong performance is largely attributed to consumer preferences for natural and organic ingredients in food and health products. Natural thaumatin, derived from the katemfe fruit found in West Africa, is favored for its non-synthetic origin and its compatibility with clean label trends, which prioritize ingredients that are easily recognizable and minimally processed.

On the other hand, Synthetic Thaumatin, although holding a smaller portion of the market, plays a crucial role due to its stability and consistency in production. Synthetic versions of thaumatin are important for manufacturers requiring precise sweetness levels and flavor profiles, especially in highly regulated markets where natural variability can pose challenges in standardization. The synthetic segment also benefits from advancements in biotechnological methods, which have improved its cost-effectiveness and scalability, making it a vital option for certain applications within the food and beverage industry.

By Form

In 2023, Natural Powder held a dominant market position, capturing more than a 72.4% share. This form of thaumatin is highly favored for its ease of storage and versatility in application, making it a preferred choice across a wide range of food and beverage industries. Powdered thaumatin is particularly valued for its ability to blend seamlessly into dry mixes, baking products, and sweetener packets, offering a convenient and effective way to deliver sweetness and enhance flavors without impacting texture.

Meanwhile, the Liquid form of thaumatin, while less prevalent in the market, serves important niches. Liquid thaumatin is essential for applications requiring precise dosages and rapid integration into beverages, dairy products, and liquid sweeteners. Its solubility and ease of handling make it ideal for use in industrial food production settings where liquid systems are predominant.

By Type

2023 Market Share Analysis: Natural Food Grade Thaumatin 53.4%

In 2023, Natural Food Grade thaumatin held a dominant market position, capturing more than a 53.4% share. This type is extensively used in the food and beverage industry because of its ability to enhance flavors and provide sweetness without the calories associated with traditional sugars. Food Grade thaumatin is popular in products like beverages, confectioneries, and dairy items, where it also helps in reducing sugar content while maintaining taste.

Pharmaceutical Grade thaumatin also plays a critical role, particularly in the formulation of oral care products like toothpaste and mouthwash, where it is used to mask bitterness. Its application extends to medicated confectionery and throat lozenges, leveraging its sweetening properties to improve taste profiles.

By Application

2023 Market Share Analysis: Natural Sweeteners 58.4%

In 2023, Natural Sweeteners held a dominant market position, capturing more than a 58.4% share. This segment of thaumatin is primarily used as a sugar alternative in various products, benefiting from the global shift towards healthier dietary choices.

Thaumatin sweeteners are especially popular in the food and beverage industry for their ability to provide high-intensity sweetness without the caloric impact of sugars, making them ideal for low-calorie and diabetic-friendly products.

Flavoring Agents form another significant application for thaumatin. In this role, thaumatin is utilized not just for its sweetness but also for its ability to enhance and modify flavors in foods and beverages. It helps mask undesirable tastes in high-protein shakes, pharmaceuticals, and nutraceuticals, contributing to a better sensory profile.

By End-user

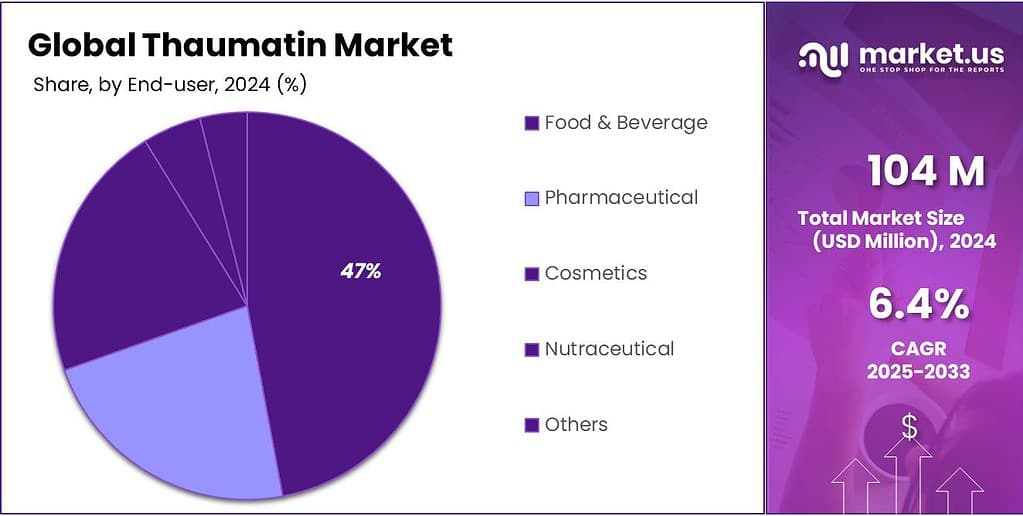

2023 Market Share Analysis: Food & Beverage 48.5%

In 2023, Natural Food & Beverage held a dominant market position, capturing more than a 48.5% share. This sector leverages thaumatin primarily for its natural sweetness and flavor-enhancing properties, appealing to consumers seeking healthier, low-calorie food options. The ingredient is widely utilized in products like soft drinks, health bars, and dairy alternatives, where it contributes to reduced sugar content while maintaining desirable tastes.

In the Pharmaceutical sector, thaumatin is valued for its ability to mask the unpleasant flavors of active pharmaceutical ingredients. It is increasingly incorporated into oral medications and syrups, enhancing patient compliance, particularly in pediatric and geriatric care.

The Cosmetics industry utilizes thaumatin in products like lip balms and oral hygiene products, where its sweetening properties can improve the consumer experience without the health risks associated with traditional sugars.

Thaumatin’s role in the Nutraceutical industry is growing, driven by the demand for dietary supplements that are both effective and enjoyable to consume. It is used in protein powders, nutritional bars, and health drinks to improve flavor without adding calories.

By Distribution Channel

2023 Market Share Analysis: Supermarkets/Hypermarkets 38.5%

In 2023, Natural Supermarkets/Hypermarkets held a dominant market position, capturing more than a 38.5% share. This channel remains a key touchpoint for consumers seeking thaumatin-based products due to its broad accessibility and the convenience of one-stop shopping for a variety of grocery and health-related items. Supermarkets and hypermarkets are preferred for their ability to offer extensive product selections alongside frequent promotions, enhancing their appeal to consumers looking for both value and variety.

Online Stores are rapidly growing as a distribution channel for thaumatin, thanks to the rise in e-commerce and consumer preferences for shopping from home. These platforms cater to a tech-savvy demographic that values the convenience of direct-to-home delivery and often provides access to a wider range of niche products not typically available in physical stores.

Specialty Stores play a crucial role in the distribution of thaumatin, especially catering to health-conscious consumers. These stores often offer high-quality, organic, or specialty products that are not easily found in larger retail outlets, providing a curated shopping experience for those seeking specific health-oriented goods.

Key Market Segments

By Source

- Natural Thaumatin

- Synthetic Thaumatin

By Form

- Powder

- Liquid

By Type

- Food Grade

- Pharmaceutical Grade

- Others

By Application

- Sweeteners

- Flavoring Agents

- Others

By End-user

- Food & Beverage

- Pharmaceutical

- Cosmetics

- Nutraceutical

- Others

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Driving Factors

Increased Health Awareness and Demand for Natural Sweeteners

The primary driving force behind the growth of the thaumatin market is the heightened global health awareness and the corresponding surge in demand for natural, low-calorie sweeteners. As the prevalence of lifestyle-related diseases like obesity and diabetes continues to rise, consumers are increasingly turning to natural sweeteners like thaumatin that offer sweetness without the health risks associated with high sugar intake. This trend is further bolstered by the ongoing efforts to reduce sugar consumption globally amidst growing health concerns.

Government Initiatives and Regulatory Support

Governmental health initiatives and regulations play a crucial role in supporting the thaumatin market. Policies aimed at reducing the consumption of artificial additives and promoting natural ingredients in food products enhance the appeal of thaumatin. Regulatory support for natural sweeteners across various regions, coupled with public health campaigns about the benefits of reducing sugar intake, significantly contribute to the market’s expansion.

Innovation and Market Expansion

Innovation in product development, particularly in the food and beverage sector, has led to the increased use of thaumatin as a flavor enhancer and sweetener. The introduction of new flavors and food products that incorporate natural ingredients is expected to continue driving the market’s growth. Additionally, companies are expanding their distribution networks and launching new lines of thaumatin-based products, which help penetrate new markets and increase consumer accessibility.

Global Economic Factors

The thaumatin market’s growth is also influenced by broader economic factors such as per capita income and urbanization, especially in emerging economies. As disposable incomes rise and urban populations grow, the demand for healthier and more sustainable food options increases, further driving the demand for natural ingredients like thaumatin.

Restraining Factors

Competition with Established Sweeteners

One of the most significant challenges facing the thaumatin market is intense competition from a wide array of established sweeteners, both natural and synthetic. These existing sweeteners have entrenched market positions, strong brand recognition, and consumer loyalty, which thaumatin, as a relatively newer entrant, struggles to match. This competition is particularly tough in segments where consumers are either accustomed to the taste profiles of traditional sweeteners or are skeptical of new ingredients

Consumer Preferences and Perceptions

Thaumatin, despite its benefits, faces hurdles due to consumer preferences for familiar tastes and concerns about new food additives. The distinct taste profile of thaumatin may not align with traditional expectations for sweetness, potentially limiting its acceptance in mainstream food products

Processing and Production Costs

The extraction and purification processes required to produce high-quality thaumatin are not only complex but also costly. These processes involve sophisticated techniques and technologies, which can increase production costs and affect pricing strategies, thereby impacting its competitiveness in the market.

Supply Chain Vulnerabilities

The sourcing of katemfe fruit, the natural source of thaumatin, is limited to specific regions, primarily in West Africa. This geographical concentration can lead to supply chain vulnerabilities, including the risk of supply disruptions due to political instability, transport restrictions, or environmental factors. Such challenges are crucial in determining the scalability and reliability of thaumatin supply

Growth Opportunity

High Production and Extraction Costs

A major restraining factor for the growth of the thaumatin market is the high cost associated with the production and extraction processes. Thaumatin is derived from the fruit of the katemfe plant (Thaumatococcus daniellii), which grows primarily in West Africa. The extraction process is not only complex but also requires specialized equipment and conditions to ensure the purity and effectiveness of the extracted sweetener. These factors significantly increase the production costs, making thaumatin more expensive compared to other more established sweeteners on the market.

Limited Raw Material Sources

The katemfe fruit, the sole source of natural thaumatin, is native only to certain parts of West Africa. This geographic limitation poses significant challenges in scaling production, especially in meeting global demand. Furthermore, the political and economic instability in some of these regions can exacerbate supply chain vulnerabilities, leading to fluctuations in availability and price

Regulatory and Approval Challenges

The use of thaumatin as a food additive is subject to regulatory approvals which vary significantly across different regions. In some markets, obtaining the necessary approvals can be a lengthy and uncertain process, thereby hindering market entry and expansion

Competition from Other Sweeteners

Thaumatin faces stiff competition from both artificial and other natural sweeteners that are already well-established in the market. These competitors often have lower production costs and more developed supply chains, which can be more appealing to food and beverage manufacturers looking to maintain cost-efficiency

Latest Trends

Diversification into Pharmaceutical Applications

Thaumatin is increasingly being recognized for its potential beyond the food and beverage sector, particularly in pharmaceutical applications. Its intense sweetness and flavor-enhancing properties make it an excellent candidate for use in oral medications and other pharmaceutical products.

This could help improve the palatability of medicines, which is crucial for patient compliance, especially in pediatric and geriatric care. The ability to mask unpleasant medicinal flavors while contributing minimal calories positions thaumatin as an ideal ingredient in this industry.

Growth in Personal Care Products

Another significant growth opportunity for thaumatin lies in the personal care industry. Thaumatin’s application in products such as toothpaste and mouthwashes, where it can improve taste without promoting tooth decay, taps into the consumer demand for more natural ingredients in personal care items. The increasing consumer preference for clean label products, which are perceived as safer and healthier, supports the expansion of thaumatin into these new categories.

Clean Label and Natural Ingredient Trend

The ongoing shift towards natural and clean label products in global markets provides a fertile ground for thaumatin’s growth. As consumers become more health-conscious and wary of synthetic additives, the demand for natural sweeteners like thaumatin is expected to rise. This trend is not only prevalent in food and beverages but extends to any consumer product that involves ingestible or topical application, highlighting a broad spectrum of potential new markets for thaumatin.

Regional Analysis

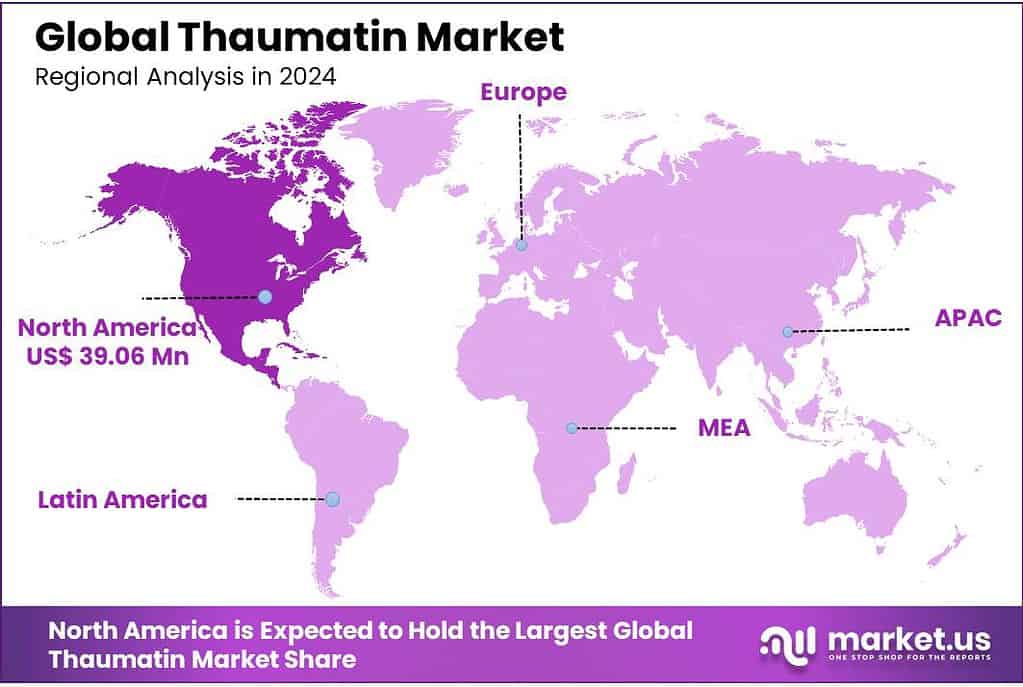

North America is currently the leading region in the Thaumatin market, holding a dominant share of 37% and valued at approximately USD 39.06 million. This region’s market dominance is primarily driven by the high prevalence of health-related issues such as obesity and diabetes, which has increased the demand for low-calorie and sugar-free food additives.

The U.S. and Canada are significant contributors to this market, leveraging advanced food processing technologies and a strong regulatory framework supporting the use of natural sweeteners.

Europe follows closely, characterized by a robust awareness of health and wellness among consumers and favorable regulations promoting the use of natural additives in the food and beverage industry. The European market is keen on clean-label products, which has facilitated the adoption of natural sweeteners like Thaumatin. Countries like Germany, France, and the UK are at the forefront of driving demand in this region.

The Asia Pacific region is projected to exhibit the fastest growth in the Thaumatin market, driven by rising disposable incomes, increasing urbanization, and growing health awareness. The market in countries such as China and India is expanding rapidly due to the rising consumer demand for healthier food ingredients and the growing prevalence of lifestyle diseases.

The Middle East & Africa region shows potential for significant market growth, fueled by a growing food and beverage industry and increasing consumer demand for natural products. The market here benefits from the natural availability of katemfe fruit, particularly in West Africa, which is a primary source of Thaumatin.

Latin America is also seeing a rise in the Thaumatin market, though it is at a nascent stage compared to other regions. The increasing influence of global health trends and the gradual shift towards healthier dietary choices are expected to propel market growth in this region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Top Key Players in the Market

- BENEO-Palatinit GmbH

- KF Specialty Ingredients Nutraceutical Group

- NateX

- Naturex Group

- Neptune Bio-Innovations

- Parchhem Fine & Specialty Chemicals

- Penta International

- Silver Fern Chemical

- Synerzine

- TCI America

Recent Developments

in 2023 BENEO-Palatinit has been exploring biotechnological advancements to improve thaumatin yields and processing.

in 2023 KF Specialty Ingredients Nutraceutical Group has been actively involved in the thaumatin market, focusing on leveraging its expertise to expand the use of thaumatin across various sectors.

Report Scope

Report Features Description Market Value (2023) USD 104.7 Mn Forecast Revenue (2033) USD 183.0 Mn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source(Natural Thaumatin, Synthetic Thaumatin), By Form(Powder, Liquid), By Type(Food Grade, Pharmaceutical Grade, Others), By Application(Sweeteners, Flavoring Agents, Others), By End-user(Food And Beverage, Pharmaceutical, Cosmetics, Nutraceutical, Others), By Distribution Channel(Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BENEO-Palatinit GmbH, KF Specialty Ingredients Nutraceutical Group, NateX, Naturex Group, Neptune Bio-Innovations, Parchhem Fine & Specialty Chemicals, Penta International, Silver Fern Chemical, Synerzine, TCI America Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BENEO-Palatinit GmbH

- KF Specialty Ingredients Nutraceutical Group

- NateX

- Naturex Group

- Neptune Bio-Innovations

- Parchhem Fine & Specialty Chemicals

- Penta International

- Silver Fern Chemical

- Synerzine

- TCI America