Global Test and Measurement Equipment Market By Product Type (Oscilloscopes, Spectrum Analyzers, Multimeters, Signal Generators, Network Analyzers, Power Meters, Electronic Counters, Other Product Types), By Technology (Analog Test Equipment, Digital Test Equipment, Wireless Test Equipment, Other Technologies), By Application (Research and Development, Manufacturing and Installation, Maintenance and Service, Quality Control and Assurance, Other Applications), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Sales Channel (Direct Sales, Distributors/Wholesalers, Online Retail, Other Sales Channels), By End-User (Telecommunications, Electronics and Semiconductor, Automotive, Aerospace and Defense, Healthcare, Industrial, Energy and Power, Other End-Users), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 29498

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Application Analysis

- Organization Size Analysis

- Sales Channel Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

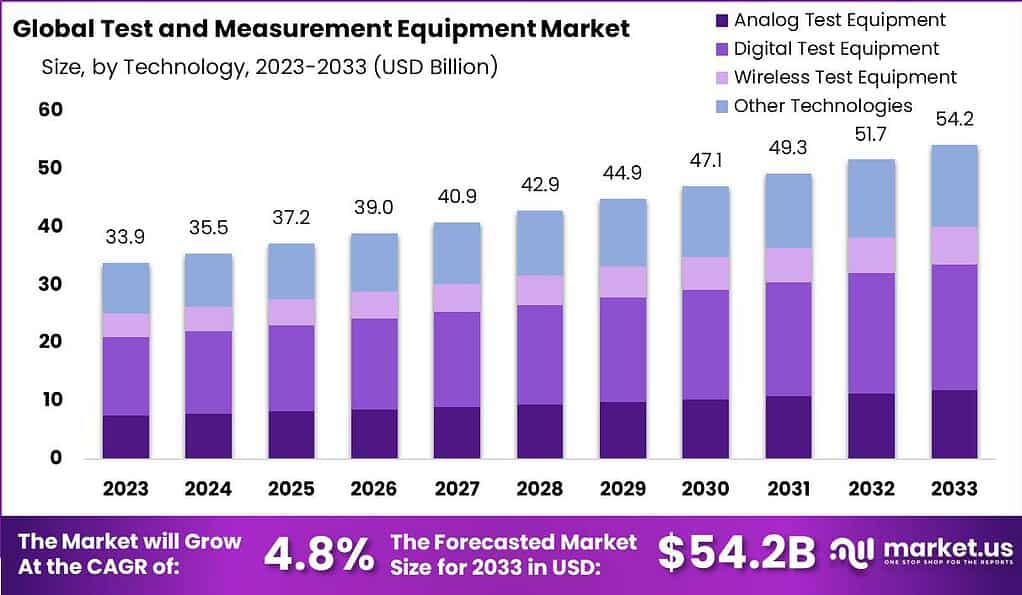

The Global Test and Measurement Equipment Market size is expected to be worth around USD 54.2 Billion by 2033, from USD 33.9 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

Test and measurement equipment refers to a wide range of tools and devices used to verify and assess the performance, functionality, and quality of various electronic, electrical, and mechanical systems. These equipment are essential in industries such as telecommunications, aerospace, automotive, manufacturing, and research and development. It includes instruments such as oscilloscopes, multimeters, spectrum analyzers, signal generators, power meters, logic analyzers, and network analyzers, among others.

The Test and Measurement Equipment market encompasses a broad array of devices and systems used for assessing, monitoring, and managing various operational and environmental parameters. These instruments play a crucial role in the lifecycle of product development, from prototyping and manufacturing to field testing and maintenance. The market is characterized by its diversity, covering equipment like oscilloscopes, multimeters, spectrum analyzers, and environmental test systems, among others.

Several factors drive the growth of the Test and Measurement Equipment market. The increasing demand for electronic devices, coupled with the need for quality assurance and compliance with regulatory standards, propels the adoption of these tools.

Furthermore, advancements in wireless technologies and the growth of data-intensive industries, such as telecommunications and automotive, necessitate robust testing to ensure system performance and safety. The integration of IoT technology into testing equipment has also enhanced the capabilities of these instruments, enabling remote monitoring and data analysis.

Key Takeaways

- The Test and Measurement Equipment market is projected to reach USD 54.2 billion by 2033, with a strong CAGR of 4.8% from 2024 to 2033.

- Oscilloscopes hold a dominant position in the market, capturing over 21% share in 2023. Their critical role in electronic device development and maintenance drives their demand across industries.

- Digital Test Equipment leads the market, holding over 40% share in 2023. Its precision and repeatability are essential for developing and maintaining modern digital systems.

- Manufacturing and Installation segment dominates, with over 30% share in 2023. Test and measurement equipment play a crucial role in ensuring precision, efficiency, and safety during manufacturing processes.

- Large Enterprises dominate the market, holding over 65% share in 2023. Their substantial resources, R&D capabilities, and global presence give them a competitive edge.

- Direct Sales lead the market, capturing over 38% share in 2023. Direct control over sales processes enables manufacturers to provide superior support and maintain closer relationships with clients.

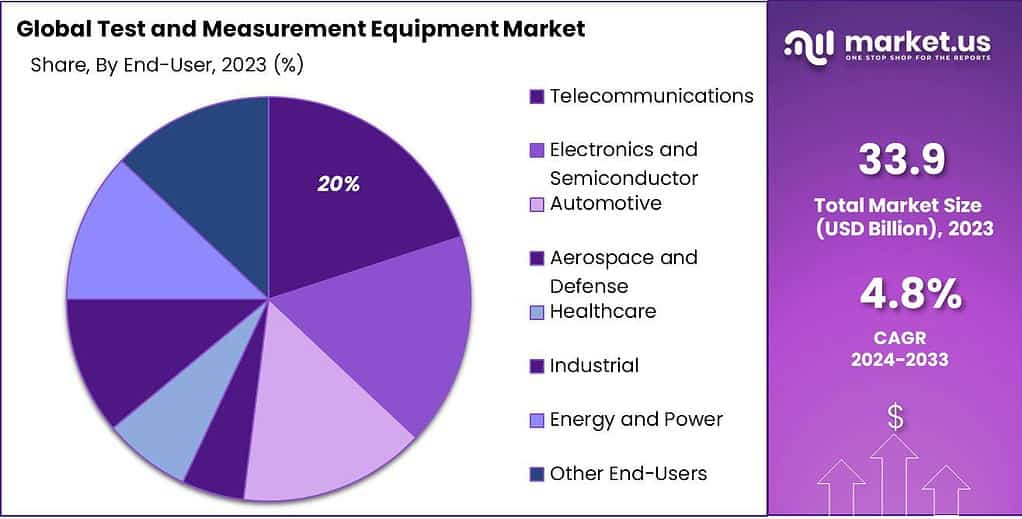

- Electronics and Semiconductor segment holds a dominant position, with over 20% share in 2023. The relentless pace of innovation and high production volumes in the electronics sector drive the demand for testing equipment.

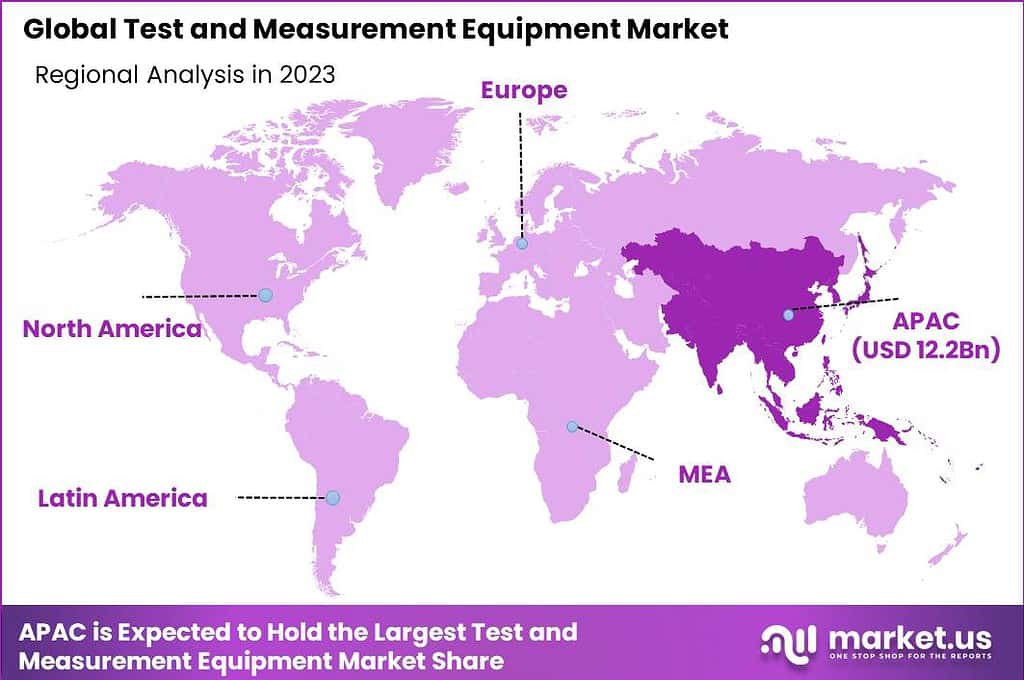

- In 2023, Asia-Pacific held a dominant market position in the Test and Measurement Equipment market, capturing more than a 36% share.

Product Type Analysis

In 2023, the Oscilloscopes segment held a dominant position in the Test and Measurement Equipment market, capturing more than a 21% share. This leading status can be attributed to the essential role oscilloscopes play in electronic device development and maintenance, allowing engineers and technicians to visualize and analyze the waveform and bandwidth of electronic signals.

The demand for oscilloscopes is driven by their critical applications across various industries, including automotive, healthcare, telecommunications, and aerospace. These industries are continually innovating and expanding their use of complex electronic systems, which require precise testing and monitoring to ensure reliability and safety.

The robust growth of the oscilloscopes segment is also fueled by technological advancements in oscilloscope functionality, such as enhanced connectivity, higher bandwidth capabilities, and digital integration. Modern oscilloscopes are equipped with sophisticated features like touchscreen displays, advanced user interfaces, and the ability to integrate with other test and measurement equipment, making them more user-friendly and efficient.

The integration of IoT technology has further expanded the capabilities of oscilloscopes, enabling remote operation and data sharing, which is increasingly valued in fast-paced, data-driven industries. Furthermore, the expansion of wireless communication and the surge in demand for consumer electronics have necessitated rigorous testing environments, where oscilloscopes play a pivotal role. As electronic devices become more intricate and the push for miniaturization continues, the precision provided by advanced oscilloscopes becomes indispensable.

Technology Analysis

In 2023, the Digital Test Equipment segment held a dominant market position within the Test and Measurement Equipment market, capturing more than a 40% share. This segment’s leadership is primarily due to the extensive adoption of digital technologies across various sectors including telecommunications, automotive, consumer electronics, and industrial manufacturing.

Digital test equipment, known for its precision and repeatability, is indispensable for developing and maintaining sophisticated digital systems and components, which are now prevalent in modern technology infrastructures. The superiority of digital test equipment stems from its ability to process and measure digital signals with high accuracy, offering clearer insights into the performance and stability of digital systems.

This type of equipment typically includes features such as higher sampling rates, greater data storage capacity, and the ability to handle complex data streams, which are crucial for thoroughly testing modern digital devices and systems. Moreover, the ongoing digital transformation across industries, characterized by the shift from analog to digital systems, bolsters the demand for digital testing solutions.

Additionally, the increasing complexity of electronic systems and the need for enhanced connectivity and functionality in devices like smartphones, IoT devices, and automotive electronics fuel the need for sophisticated digital testing.

The integration of artificial intelligence and machine learning into digital test equipment further enhances its capabilities, making it a critical tool in ensuring the efficiency and safety of digital applications. The continuous innovation and technological advancements in digital testing are expected to keep driving the growth of this segment in the foreseeable future.

Application Analysis

In 2023, the Manufacturing and Installation segment held a dominant market position in the Test and Measurement Equipment market, capturing more than a 30% share. This segment’s prominence is primarily due to the critical role that test and measurement equipment plays in ensuring the precision, efficiency, and safety of manufacturing processes.

As industries strive for higher productivity and reduced downtime, the demand for accurate and reliable equipment during the manufacturing and installation phases becomes indispensable. The Manufacturing and Installation segment benefits significantly from advancements in automation and control technologies, where precise testing and measurement ensure that equipment and systems meet stringent operational standards.

Test and measurement tools are extensively used to calibrate machines, monitor production lines, and manage installation processes, ensuring that all components function within their specified parameters. This rigorous testing is crucial in industries such as automotive, aerospace, electronics, and semiconductors, where precision is paramount.

Moreover, the drive towards Industry 4.0 and the increasing integration of IoT devices in industrial settings further bolster the demand for test and measurement equipment in this segment. These technologies require sophisticated testing to ensure that new installations are correctly configured and that existing systems can seamlessly integrate with upgraded networks and controls.

As industries continue to adopt smart manufacturing techniques, the role of test and measurement equipment in manufacturing and installation is set to grow, underscoring its importance in the modern industrial landscape.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant position in the Test and Measurement Equipment market, capturing more than a 65% share. This segment’s leadership can be attributed to several strategic advantages that large enterprises typically possess, including substantial financial resources, extensive research and development capabilities, and robust distribution networks.

These attributes enable large enterprises to invest in the latest technologies, ensuring they remain at the forefront of innovation in test and measurement solutions. Moreover, their global presence allows them to cater to a diverse customer base, further reinforcing their market dominance.

Large enterprises also benefit from economies of scale, which allow them to reduce manufacturing and operational costs more effectively than their smaller counterparts. This cost advantage is crucial in maintaining competitiveness in the high-stakes environment of test and measurement equipment, where the pressure to innovate while managing costs is constant.

Furthermore, large enterprises often engage in strategic partnerships and acquisitions to enhance their product portfolios and expand their market reach. Such moves not only consolidate their position in established markets but also provide avenues for growth in emerging markets, where there is a burgeoning demand for sophisticated testing and measurement tools.

Sales Channel Analysis

In 2023, the Direct Sales segment held a dominant market position in the Test and Measurement Equipment market, capturing more than a 38% share. This prominence is primarily due to the direct control manufacturers maintain over their sales processes, enabling them to tailor customer experiences, provide superior support, and maintain closer relationships with their clients.

Direct sales channels allow for immediate feedback from end users, which is invaluable for continuous product improvement and innovation. Additionally, bypassing intermediaries reduces operational costs, which can be redirected towards research and development, enhancing the company’s competitive edge in technology advancements.

The direct sales model also facilitates better brand control and customer loyalty as manufacturers can ensure consistent service quality and quicker response times to customer needs. In industries where the precision and reliability of equipment are crucial, such as in manufacturing and research sectors, having direct access to the provider offers customers a sense of security, fostering strong business relationships.

Furthermore, this segment’s ability to offer customized solutions tailored to specific client requirements gives it an upper hand, particularly in handling complex projects and large contracts that may be less appealing to third-party vendors.

End-User Analysis

In 2023, the Electronics and Semiconductor segment held a dominant market position in the Test and Measurement Equipment market, capturing more than a 20% share. This leading position is primarily due to the relentless pace of innovation and high production volumes in the electronics sector, which necessitates rigorous testing to ensure product reliability and compliance with international standards.

Semiconductor devices form the backbone of numerous technology products, from mobile devices to automotive electronics, making their testing critical for the overall quality and performance of final products. The precision required in semiconductor manufacturing, where even microscopic defects can lead to significant functionality issues, underlines the importance of advanced testing and measurement equipment.

Additionally, the growth of this segment is propelled by the rapid advancements in consumer electronics, particularly in areas like smartphones, wearables, and smart home devices. These developments drive demand for newer and more complex semiconductor chips, which in turn boosts the need for sophisticated testing solutions that can keep pace with the fast-evolving technological landscape.

Testing in the semiconductor industry not only involves basic functionality checks but also extends to performance analysis under various stress conditions and simulations, which are critical for ensuring device durability and operational reliability. Moreover, the push towards miniaturization of electronic components and the integration of semiconductors in emerging technologies such as IoT (Internet of Things) and Artificial Intelligence further compound the demand for precise and scalable test and measurement solutions.

This demand is expected to grow as technologies continue to advance, ensuring the Electronics and Semiconductor segment remains a crucial area of focus in the Test and Measurement Equipment market. The strategic importance of maintaining high standards in semiconductor testing underscores the segment’s continued market dominance and its pivotal role in the broader electronics industry.

Key Market Segments

Product Type

- Oscilloscopes

- Spectrum Analyzers

- Multimeters

- Signal Generators

- Network Analyzers

- Power Meters

- Electronic Counters

- Other Product Types

By Technology

- Analog Test Equipment

- Digital Test Equipment

- Wireless Test Equipment

- Other Technologies

By Application

- Research and Development

- Manufacturing and Installation

- Maintenance and Service

- Quality Control and Assurance

- Other Applications

Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Sales Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retail

- Other Sales Channels

End-User

- Telecommunications

- Electronics and Semiconductor

- Automotive

- Aerospace and Defense

- Healthcare

- Industrial

- Energy and Power

- Other End-Users

Driver

Technological Advancements in Testing Equipment

The continuous evolution in technology serves as a major driver for the Test and Measurement Equipment market. As industries such as telecommunications, automotive, and aerospace increasingly integrate complex electronic systems and components, the necessity for sophisticated testing tools that can deliver accurate and reliable data grows.

The introduction of 5G technology, for instance, demands equipment capable of handling higher frequencies and broader bandwidths, driving demand for upgraded testing solutions. This technological progression not only improves the efficiency and capabilities of testing equipment but also ensures compatibility with the latest innovations in various industries, fueling market growth.

Restraint

High Cost of Advanced Testing Equipment

One of the primary restraints in the Test and Measurement Equipment market is the high cost associated with advanced testing solutions. Developing cutting-edge equipment that meets the stringent accuracy and performance requirements of modern applications involves significant investment in research and development.

Furthermore, the sophisticated components used in such devices are expensive, which in turn increases the overall cost of the equipment. This high cost can be prohibitive for small and medium-sized enterprises (SMEs) and emerging industries, limiting the market’s growth potential by restricting access to the latest testing technologies.

Opportunity

Expansion into Emerging Markets

Emerging markets present significant opportunities for the expansion of the Test and Measurement Equipment market. Countries in regions such as Asia-Pacific, Latin America, and parts of Africa are experiencing rapid industrial growth, urbanization, and technological adoption.

This growth is accompanied by increasing investments in sectors such as telecommunications, energy, and automotive, which require extensive testing services to ensure quality and compliance. By targeting these emerging markets, companies in the test and measurement equipment sector can tap into new revenue streams and diversify their market presence, thereby reducing their dependency on saturated markets.

Challenge

Rapid Technological Changes

A major challenge in the Test and Measurement Equipment market is keeping pace with the rapid rate of technological change. Industries such as electronics, telecommunications, and automotive are advancing at an unprecedented rate, necessitating frequent updates and adaptations in testing equipment.

This dynamic environment requires manufacturers to continually invest in research and development to ensure their offerings are up-to-date and capable of handling new and evolving standards and technologies. Such a requirement for constant innovation and upgrade can strain resources and complicate strategic planning for companies in the test and measurement sector.

Growth Factors

- Increasing Regulatory Standards: As governments and regulatory bodies worldwide impose stricter quality and safety standards across various industries, the demand for testing and measurement equipment grows. These tools are essential for companies to ensure their products meet compliance standards.

- Rise of Wireless Technologies: The surge in wireless communication technologies, particularly with the rollout of 5G networks, demands more sophisticated testing tools to ensure connectivity, speed, and efficiency. This trend significantly drives the growth of the market.

- Advancements in Automotive and Aerospace: Innovations in electric vehicles (EVs) and autonomous driving systems, along with advancements in aerospace technologies, require rigorous testing of electronic systems for safety and functionality, pushing the demand for advanced testing equipment.

- Healthcare Sector Development: With increasing technological integration in medical devices, from diagnostics to therapeutic equipment, there is a growing need for precise testing equipment to ensure device safety and effectiveness, contributing to market growth.

- Growth of Consumer Electronics: The continuous innovation in consumer electronics, such as smartphones, wearable devices, and smart home technologies, requires ongoing development of testing systems that can handle new functionalities and increased complexity.

Emerging Trends

- Internet of Things (IoT) Integration: The integration of IoT technology in test and measurement equipment allows for more automated and remote monitoring systems. This connectivity enables real-time data collection and analysis, improving the efficiency and accessibility of testing operations.

- Adoption of Artificial Intelligence (AI): AI is increasingly being used to enhance the capabilities of test and measurement equipment. AI algorithms can predict equipment failures, optimize testing processes, and provide more accurate results by analyzing vast amounts of data.

- Sustainability Focus: There is a growing trend towards developing environmentally sustainable testing solutions, including energy-efficient products and systems that minimize waste. This shift is driven by global environmental concerns and regulatory pressures.

- Increased Use of Modular Instruments: Modular instruments are becoming more popular due to their flexibility and scalability, allowing users to customize their testing environments easily. This adaptability is particularly useful in research and development settings.

- Focus on Cybersecurity: As testing equipment becomes more connected, the importance of cybersecurity measures in these devices increases. Manufacturers are now embedding advanced security protocols to prevent data breaches and ensure the integrity of the testing processes.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the Test and Measurement Equipment market, capturing more than a 36% share. This leadership is largely attributed to the region’s rapid industrial growth, significant investments in telecommunications infrastructure, and robust expansion in manufacturing capabilities, particularly in electronics and automotive sectors.

Countries like China, South Korea, and Taiwan are leading producers of electronic components and devices, necessitating extensive testing to ensure quality and reliability. Additionally, the push towards developing 5G networks across the region has spurred demand for new testing technologies that can handle higher frequencies and increased data volumes.

The Asia-Pacific region is also seeing a significant increase in research and development activities, supported by government initiatives aimed at fostering innovation in technology sectors. These efforts are complemented by the presence of several key players in the test and measurement equipment industry who are investing in local manufacturing and R&D facilities to tap into local talent and lower operational costs. This strategic localization not only supports the regional market growth but also enhances the export capabilities of these countries to other high-demand regions.

Furthermore, the rise of smart cities and IoT in Asia-Pacific presents additional growth opportunities for the test and measurement equipment market. As these technologies become more integrated into everyday life and business operations across the region, the need for compatible, precise testing tools increases.

The ongoing urbanization and digital transformation in the region are expected to continue driving the demand for advanced test and measurement solutions, securing Asia-Pacific’s position as a leader in this global market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

A Key Players Analysis in the Test and Measurement Equipment market refers to a detailed examination of the major companies that dominate this sector. This analysis typically covers a range of critical factors including each company’s market share, strategic positioning, product offerings, technological innovations, geographical reach, and financial performance. The purpose of such an analysis is to provide stakeholders with a clear understanding of the competitive landscape, highlighting the strengths and weaknesses of each major player within the market.

In the Test and Measurement Equipment market, several top market leaders are recognized for their significant contributions and influence. Among these, Keysight Technologies Inc. stands out for its comprehensive range of electronic measurement instruments, playing a pivotal role in various high-tech sectors. Similarly, Rohde & Schwarz GmbH & Co. KG is renowned for its precision in developing equipment for wireless communications and RF testing, essential for advancing mobile network technologies.

Top Market Leaders

- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & Co. KG

- Tektronix Inc.

- Anritsu Corporation

- National Instruments Corporation

- Fluke Corporation

- Advantest Corporation

- EXFO Inc.

- Viavi Solutions Inc.

- Yokogawa Electric Corporation

- TestEquity LLC

- GW Instek

- Other Key Players

Recent Developments

- In January 2023, Keysight Technologies introduced the Electrical Performance Scan (EP-Scan), a novel high-speed digital simulation tool. This tool enhances signal integrity analysis for hardware engineers and printed circuit board (PCB) designers, streamlining their design processes.

- Also in January 2023, Rohde & Schwarz launched Benchmarker 3, an innovative network benchmarking solution. It is designed to help mobile network operators (MNOs) navigate the complexities of technological advances, cost constraints, and competitive pressures, optimizing their network performance.

- Furthermore, in May 2023, Tektronix, Inc announced the release of the WBG-DPT solution, a Double Pulse Test system. This solution facilitates repeated, automated, and precise measurements on wide bandgap devices, including GaN MOSFETs and SiC, thereby advancing testing capabilities in semiconductor technology.

Report Scope

Report Features Description Market Value (2023) USD 33.9 Bn Forecast Revenue (2033) USD 54.2 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oscilloscopes, Spectrum Analyzers, Multimeters, Signal Generators, Network Analyzers, Power Meters, Electronic Counters, Other Product Types), By Technology (Analog Test Equipment, Digital Test Equipment, Wireless Test Equipment, Other Technologies), By Application (Research and Development, Manufacturing and Installation, Maintenance and Service, Quality Control and Assurance, Other Applications), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Sales Channel (Direct Sales, Distributors/Wholesalers, Online Retail, Other Sales Channels), By End-User (Telecommunications, Electronics and Semiconductor, Automotive, Aerospace and Defense, Healthcare, Industrial, Energy and Power, Other End-Users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Keysight Technologies Inc., Rohde & Schwarz GmbH & Co. KG, Tektronix Inc., Anritsu Corporation, National Instruments Corporation, Fluke Corporation, Advantest Corporation, EXFO Inc., Viavi Solutions Inc., Yokogawa Electric Corporation, TestEquity LLC, GW Instek, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Test and Measurement Equipment (T&M)?Test and Measurement Equipment refers to devices or instruments used to verify, validate, and ensure the performance, quality, and compliance of various electronic and mechanical systems.

How big is Test and Measurement Equipment Market?The Global Test and Measurement Equipment Market size is expected to be worth around USD 54.2 Billion by 2033, from USD 33.9 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

Who are the major players in the market?The major companies covered by the test and measurement equipment market report are Keysight Technologies Inc., Rohde & Schwarz GmbH & Co. KG, Tektronix Inc., Anritsu Corporation, National Instruments Corporation, Fluke Corporation, Advantest Corporation, EXFO Inc., Viavi Solutions Inc., Yokogawa Electric Corporation, TestEquity LLC, GW Instek, Other Key Players

Which technology segment shows the high growth rate of this Market over the forecast period?In 2023, the Digital Test Equipment segment held a dominant market position within the Test and Measurement Equipment market, capturing more than a 40% share.

Which region dominated the Test and Measurement Equipment market in 2023?In 2023, Asia-Pacific held a dominant market position in the Test and Measurement Equipment market, capturing more than a 36% share.

Test and Measurement Equipment MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Test and Measurement Equipment MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & Co. KG

- Tektronix Inc.

- Anritsu Corporation

- National Instruments Corporation

- Fluke Corporation

- Advantest Corporation

- EXFO Inc.

- Viavi Solutions Inc.

- Yokogawa Electric Corporation

- TestEquity LLC

- GW Instek

- Other Key Players