Global Telehealth Kiosk Market Analysis By Type (Standalone Kiosks, Mobile Kiosks, Wall-Mounted Units, Countertop Kiosks), By Component (Hardware, Software, Services), By Application (Teleconsultation, Vital Signs Monitoring, Pharmaceutical Dispensing & Counseling, Behavioral & Mental Health Assessment, Occupational Health & Preventive Screening), By End-User (Hospitals & Specialty Clinics, Community Health Centers, Pharmacies & Retail Clinics, Corporate Offices & Industrial Worksites, Educational Institutions & Government Facilities, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164810

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

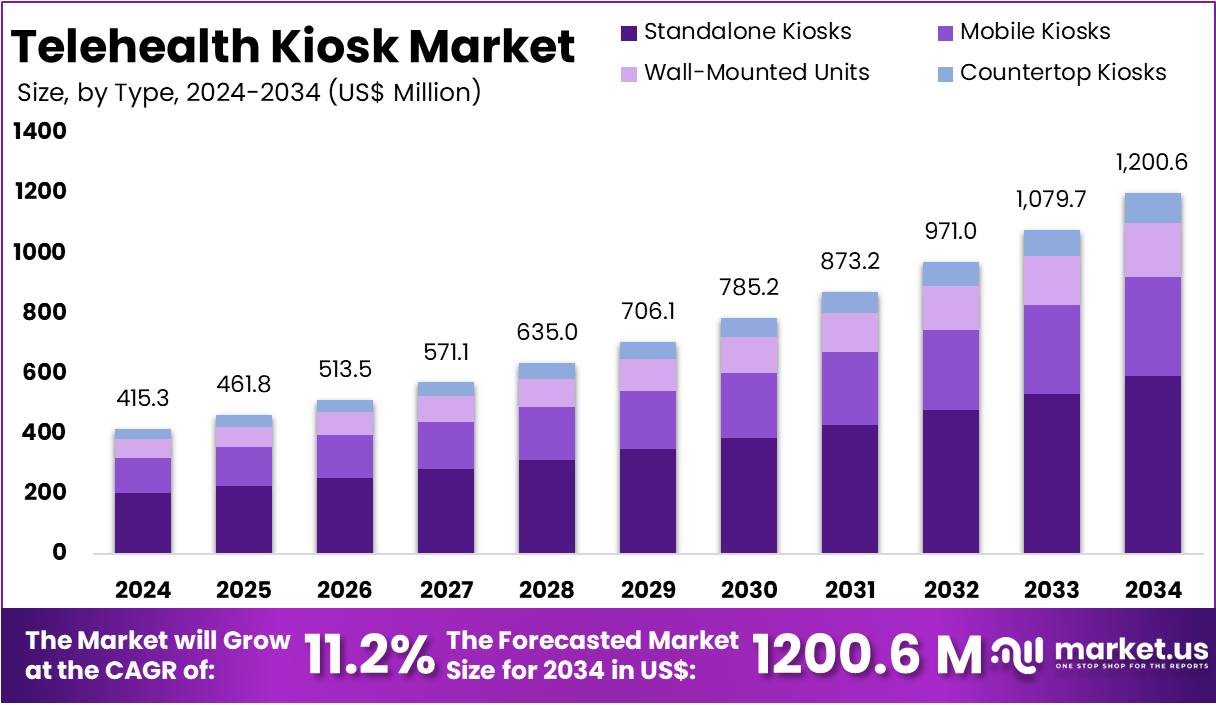

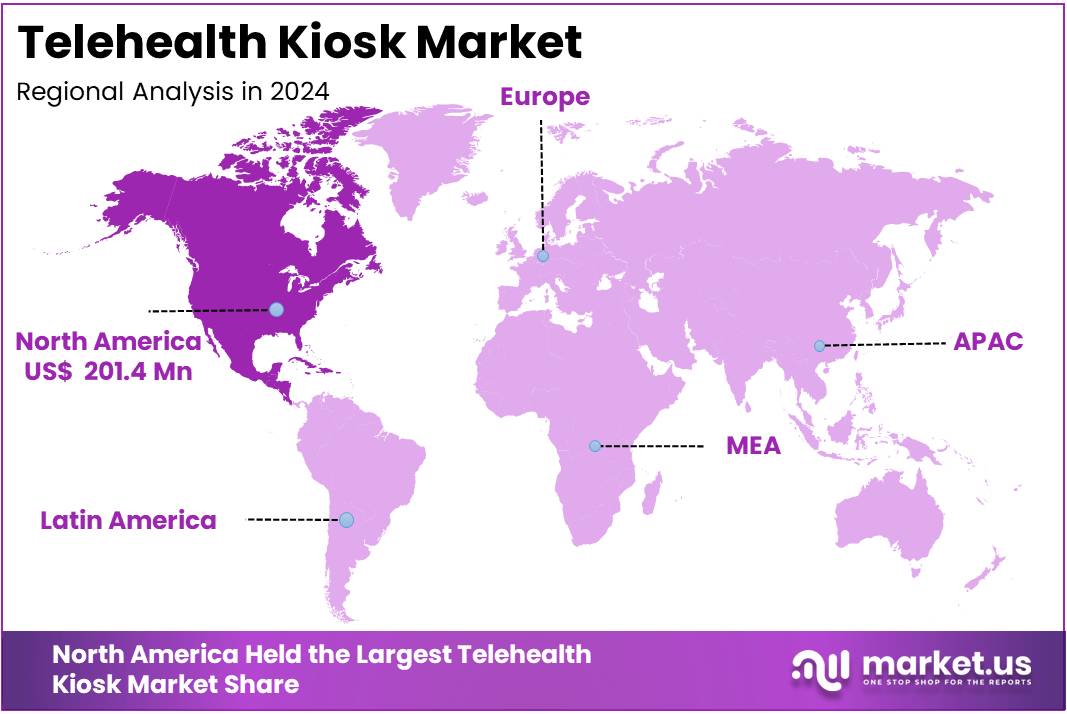

The Global Telehealth Kiosk Market Size is expected to be worth around US$ 1200.6 Million by 2034, from US$ 415.3 Million in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 48.5% share and holds US$ 201.4 Million market value for the year.

Telehealth kiosks have emerged as structured access points that support consistent delivery of remote medical services. Their design provides a controlled environment for consultations, digital diagnostics and secure data transfer. This model has become important as healthcare systems move toward hybrid and virtual care. According to recent assessments, these kiosks are now positioned in pharmacies, workplaces, schools and rural clinics to widen basic healthcare access.

The need for these stations has increased because many regions continue to face physician shortages and limited facility availability. Their placement helps stabilize primary care access where clinic density remains low. According to federal data, about 66.5% of primary care shortages in 2024 were located in rural Health Professional Shortage Areas. It was also reported that 7.8% of U.S. counties had no primary care physicians in 2022, strengthening the case for fixed access points.

Connectivity limitations have further shaped demand for kiosk-based models. Many rural residents continue to struggle with stable home broadband, making virtual visits difficult to complete from home. According to global connectivity monitoring, only 48% of rural residents used the internet in 2024 compared with 83% in urban areas. An estimated 1.8 billion rural residents worldwide also remained offline. For instance, rural libraries in Oklahoma added supported telehealth rooms in March 2024 to offset long-distance travel for care.

Evidence from field programs continues to confirm the value of these deployments. Many community-based initiatives show that travel time is reduced and basic services become easier to reach. A study by Indian Health and Wellness Centers documented travel savings ranging from 15 to 37 kilometers per visit due to telemedicine-supported centers. For example, the U.S. Department of Veterans Affairs’ ATLAS program also reported meaningful reductions in travel burden by offering designated, closer consultation sites.

Technology, Market Catalysts and Retail-Sector Signals

Technology improvements have strengthened operational reliability and diagnostic capability within kiosk systems. These upgrades have encouraged healthcare organizations to integrate kiosks into broader virtual care strategies. According to 2024 provider surveys, about 86% of health system respondents reported already using AI. This trend supports automated triage in kiosks. In addition, Medicare payments for Remote Patient Monitoring exceeded 500 million USD in 2024, confirming payer acceptance of connected vital-sign data.

Validated diagnostic accuracy has also reinforced trust in automated measurements inside kiosks. Many healthcare settings aim to replace manual capture with reliable automated systems. A peer-reviewed study using the ISO 81060-2:2018/AMD 1:2020 protocol in 2023 showed that several automated blood-pressure monitors met accuracy standards. A 2023 review by AHA Journals also confirmed strong global validation performance, demonstrating that kiosk-equipped devices can achieve dependable clinical-quality results.

Digital readiness among the general population has improved the market’s addressable user base. More individuals now use online tools to navigate health concerns, enabling easier adoption of kiosk-based encounters. According to OECD reporting across 32 countries, about 60% of people aged 16 to 74 sought health information online in 2022, up from 40% in 2012. For example, CDC data from 2023 to 2024 confirmed stable telemedicine use among physicians, indicating an environment open to expanded diagnostic endpoints.

Retail-sector activity has also influenced kiosk positioning. Many large retailers adjusted their clinic strategies due to rising costs and reimbursement challenges, creating opportunities for lower-overhead kiosk formats. In April 2024, Walmart closed 51 Walmart Health centers and its virtual care service. Walgreens also recorded a 5.8 billion USD impairment charge and began closing over 160 VillageMD clinics. For instance, about 1,100 CVS MinuteClinic sites continued operating in 2024, while supermarkets and campuses expanded kiosk-based services.

Key Takeaways

- The global telehealth kiosk market is projected to reach about US$ 1200.6 million by 2034, rising from US$ 415.3 million in 2024 at an 11.2% CAGR.

- Standalone kiosks were reported to lead the type category in 2024, accounting for over 49.3% of total market participation.

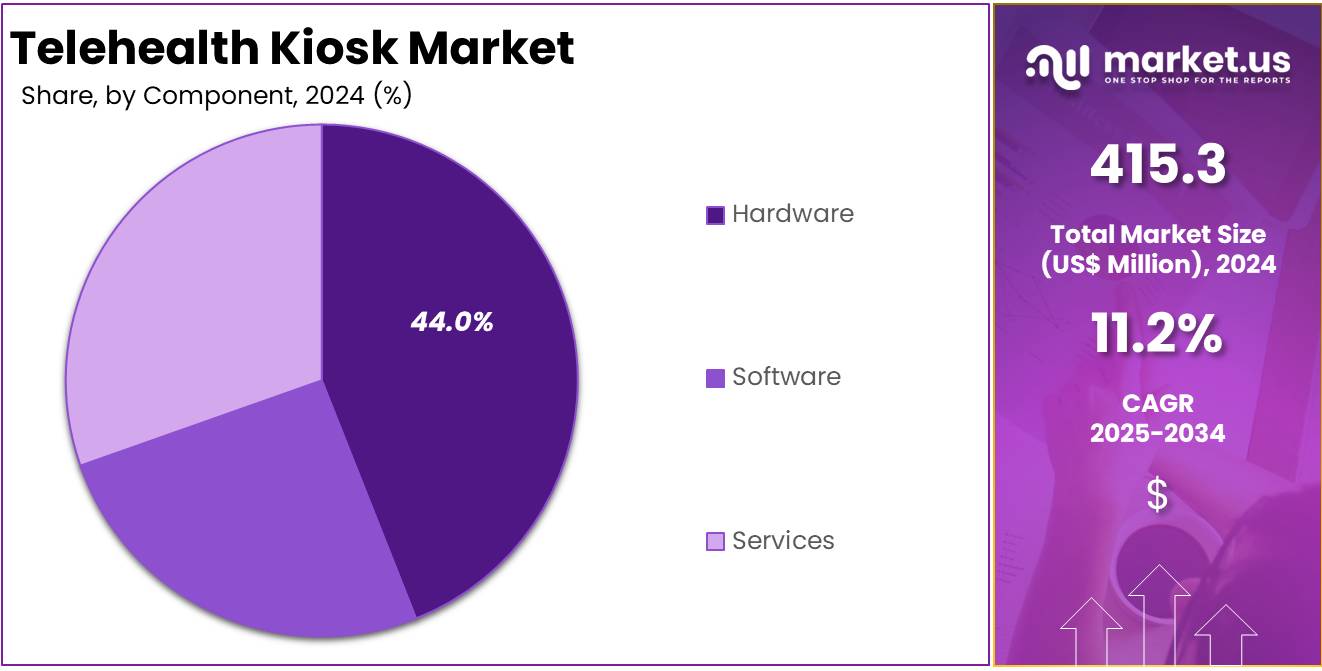

- Hardware solutions dominated the component segment in 2024, securing more than 44.0% of the overall market contribution.

- Teleconsultation applications were identified as the leading use case in 2024, representing more than 47% of total market utilization.

- Hospitals and specialty clinics held the largest end-user share in 2024, capturing over 43.5% of global demand.

- North America recorded the highest regional share in 2024, holding more than 48.5% and generating approximately US$ 201.4 million in value.

Type Analysis

In 2024, the Standalone Kiosks section held a dominant market position in the Type segment of the Telehealth Kiosk Market, and captured more than a 49.3% share. This performance was viewed as a result of broad use in hospitals and clinics. Strong diagnostic functions were noted as key benefits. Stable designs were also recognized for supporting high patient volumes. The segment was described as a preferred option for providers seeking reliable teleconsultation systems across diverse care settings.

The Mobile Kiosks category was described as gaining attention because of rising demand for flexible care tools. Their use in community sites and corporate facilities was highlighted as a major driver. Portability was viewed as improving access in remote regions. The Wall-Mounted Units segment was observed to grow at a steady pace. Space-saving layouts were valued. Installation needs were reported as lower, which supported increased use in retail clinics and pharmacy settings.

The Countertop Kiosks segment was presented as holding moderate reach. These units were selected for simple teleconsultation tasks. Their compact forms were identified as suitable for small clinics and workplace health points. Lower costs were cited as a support factor. Overall market activity was explained as shifting toward flexible and space-efficient telehealth tools. Expanding patient use of digital services was recognized as a key influence, along with continued investment in modern telemedicine infrastructure.

Component Analysis

In 2024, the Hardware Section held a dominant market position in the Component Segment of the Telehealth Kiosk Market, and captured more than a 44.0% share. It was noted that this segment grew due to high demand for reliable diagnostic tools. Strong adoption of integrated sensors also supported growth. Hospitals preferred durable kiosk structures. Clinics relied on accurate monitoring units. These trends strengthened hardware usage. Overall, hardware demand increased as providers expanded remote care services.

The Software Section was described as maintaining stable growth. It advanced through continuous improvements in telemedicine platforms. Real-time connectivity also increased adoption. Cloud-based management tools supported patient monitoring. AI-driven analytics enhanced clinical decisions. Smooth integration with health records further improved performance. Subscription models created steady revenue. These combined factors ensured that software played a central role in telehealth kiosk operations. Its adaptability supported wider digital health expansion.

The Services Section was viewed as gaining momentum. Growth was influenced by rising demand for installation support. Regular maintenance also drove adoption. Healthcare providers relied on technical assistance. Staff training improved system usage. Remote troubleshooting reduced downtime. Continuous system optimization increased operational reliability. These service features supported long-term kiosk performance. As telehealth usage expanded, service needs increased. This strengthened the importance of service offerings within the overall component landscape.

Application Analysis

In 2024, the Teleconsultation Section held a dominant market position in the Application Segment of the Telehealth Kiosk Market, and captured more than a 47.7% share. It was observed that this section expanded due to higher demand for remote medical support. Healthcare facilities used teleconsultation to reduce waiting times and improve clinical access. Analysts indicated that digital diagnostics supported stronger adoption. Wider acceptance in primary care settings also reinforced the section’s leadership during the year.

The Vital Signs Monitoring Section was noted for its steady rise. Its growth was supported by the shift toward automated health assessment systems. Many providers used these kiosks to record pulse, temperature, and blood pressure with improved accuracy. The Pharmaceutical Dispensing and Counseling Section also advanced. Its progress was linked to the need for better medication management. Automated dispensing features reduced errors. Remote counseling functions improved patient guidance across various care environments.

The Behavioral and Mental Health Assessment Section showed clear potential. Analysts linked its expansion to higher awareness of digital mental health services. Secure kiosk platforms enabled screening and therapy access. The Occupational Health and Preventive Screening Section also gained traction. Its adoption increased as employers focused on workforce wellness and early risk detection. Routine screenings became easier through automated systems. Overall, observers noted balanced growth across application areas, supported by ongoing digital transformation in healthcare services.

End-User Analysis

In 2024, the Hospitals & Specialty Clinics Section held a dominant market position in the End-User Segment of the Telehealth Kiosk Market, and captured more than a 43.5% share. This leading role was credited to broad use in diagnosis, triage, and specialist care. Demand was elevated by the need for fast patient handling and improved service flow. Community health centers also showed strong uptake. Their growth was supported by rising interest in low-cost and accessible primary care services across underserved regions.

Pharmacies and retail clinics were noted for steady expansion. Adoption was encouraged by the growth of walk-in care models that required convenient digital touchpoints. Telehealth kiosks supported medication guidance and routine assessments. Corporate offices and industrial worksites also advanced in deployment. Their usage was shaped by wider employee wellness goals. These installations helped reduce productivity losses and strengthened on-site health monitoring. Overall interest reflected broader workplace health expectations.

Educational institutions and government facilities contributed to additional market activity. Their usage was guided by rising emphasis on preventive care access. Schools used kiosks for student health evaluations. Government locations applied these systems to improve public outreach. Other settings, including long-term care centers and transportation hubs, showed gradual progress. Adoption in these environments was influenced by the need for secure and convenient remote consultations. These uses indicated expanding interest in telehealth support across controlled and mobile areas.

Key Market Segments

By Type

- Standalone Kiosks

- Mobile Kiosks

- Wall-Mounted Units

- Countertop Kiosks

By Component

- Hardware

- Software

- Services

By Application

- Teleconsultation

- Vital Signs Monitoring

- Pharmaceutical Dispensing & Counseling

- Behavioral & Mental Health Assessment

- Occupational Health & Preventive Screening

By End-User

- Hospitals & Specialty Clinics

- Community Health Centers

- Pharmacies & Retail Clinics

- Corporate Offices & Industrial Worksites

- Educational Institutions & Government Facilities

- Others

Drivers

Increasing Demand For Remote Clinical Access In Underserved Areas

The growing need for remote clinical access in underserved regions has been recognized as a major driver for telehealth kiosk deployment. The demand has been supported by persistent shortages in primary care availability and limited connectivity for home-based telehealth. The growth of the market can be attributed to the role kiosks play in enabling timely consultations, reducing travel burdens, and improving first-level triage in areas where healthcare access remains constrained.

Rising access gaps have reinforced this requirement. According to recent assessments, 7.8% of U.S. counties lacked primary care physicians in 2022. Study findings also indicated that 7,501 primary care Health Professional Shortage Areas existed by mid-2024, affecting nearly 75 million people. For instance, almost two-thirds of these shortage areas were located in rural communities. These structural disparities continue to generate demand for standardized, kiosk-based telehealth solutions.

Connectivity limitations have added further momentum to kiosk adoption. According to global digital inclusion data for 2024, internet use reached 83% in urban regions but only 48% in rural regions. For example, of the 2.6 billion people who remained offline, nearly 1.8 billion lived in rural areas. These constraints have strengthened interest in public access points such as kiosks, libraries, and community hubs where reliable telehealth connectivity can be ensured.

Sustained telehealth utilization also supports wider kiosk deployment. For example, the United States reported that 30.1% of adults used telemedicine in 2022. According to India’s national telemedicine platform, eSanjeevani, cumulative consultations reached 30 million in early 2022 and rose to 216 million by March 2024. A later statement confirmed 318.6 million by December 2024. These usage patterns demonstrate stable demand, encouraging broader installation of telehealth kiosks to serve populations with limited home access.

Restraints

High Upfront Installation And Integration Costs

The growth of the telehealth kiosk market has been restricted by the high initial expenditure required for installation and integration. Significant capital is absorbed by hardware acquisition, diagnostic peripherals, networking upgrades, and EHR connectivity. Smaller healthcare facilities often postpone deployment because annual capital envelopes are limited. The overall result is slower penetration, as budget-constrained providers prioritize essential clinical assets over new digital infrastructure. This financial barrier continues to shape adoption patterns across both public and private healthcare environments.

The burden is intensified by procurement models that front-load payments. According to a U.S. cooperative contract, the OnMed CareStation requires an upfront payment equal to six months of lease fees at the time of signing. This occurs even before full operations begin. Connectivity needs add further costs. A dedicated 50 Mbps symmetric connection, static IPs, and Ethernet runs are mandated before go-live. Facilities lacking business-grade circuits must invest in new services, which increases the initial financial commitment.

Bandwidth pricing has also pressured operating budgets. A study by the Technology Policy Institute in August 2024 reported that prices for 50 Mbps business internet plans increased in 2023 and continued to rise faster than inflation through 2024. These trends raise both startup and recurring costs for kiosk sites that must meet minimum connectivity standards. For instance, clinics adopting telehealth kiosks must secure stable ISP services before installation, which adds unavoidable expenditure in addition to hardware procurement and site preparation.

Hardware and diagnostic peripherals further elevate capital needs. For example, TradeIndia listings in 2024 show health kiosk units priced at about ₹2.5–5.0 lakh, excluding site works and networking. Government programs indicate even higher all-in costs. The Times of India reported that Maharashtra sanctioned ₹25 crore for 45 health ATMs, implying ~₹55–56 lakh per installation. Peripheral devices also add to costs. TytoCare’s exam kit, priced at US$299 for consumers, illustrates how enterprise-grade clinical bundles raise total investment per endpoint.

Opportunities

Integration Of Advanced Diagnostic Peripherals And Ai-Enabled Assessment Tools

The opportunity for telehealth kiosks is strengthened by the integration of connected diagnostics and AI-supported assessment tools. The enhancement of clinical accuracy is expected to expand use cases across primary care, urgent care, and workplace health stations. The addition of automated monitoring and device-verified measurements is projected to increase the clinical value of each encounter. This opportunity is driven by the need for faster evaluations, improved triage, and consistent data capture across high-traffic environments.

Demand is further reinforced by sustained consumer adoption of virtual care. According to recent utilization data, telemedicine use reached 30.1% among U.S. adults in 2022. This reflects a large base of users who can be transitioned from basic video visits to higher-acuity, kiosk-enabled assessments. For instance, the steady use of remote services has created an environment in which embedded diagnostics can upgrade routine consultations to more medically robust encounters.

Care-delivery trends also support this shift. Study by national outpatient data indicated that telemedicine accounted for 4% of outpatient consultations by March 2023, while mental health maintained a high virtual share at 29% in the same period. For example, these volumes highlight areas where kiosks can introduce structured diagnostic workflows. The opportunity is created by the need for consistent evaluations in behavioral health, primary care follow-ups, and chronic disease monitoring.

The technology landscape also expands the potential of kiosk-based care. According to the FDA’s updated list of AI and machine-learning medical devices, 1,016 authorizations were recorded as of December 20, 2024. This demonstrates rapid growth in tools that can support automated triage and on-site interpretation. For instance, AI-enabled peripherals can guide symptom assessment, flag risk indicators, and support clinical decision pathways. This growing inventory of approved technologies strengthens the viability of advanced, self-serve diagnostic kiosks.

Trends

Deployment In Non-Traditional Settings Such As Workplaces, Pharmacies, And Retail Locations

The expansion of telehealth kiosks into non-traditional environments has been observed as a defining market trend. Their placement in workplaces, retail stores, educational institutions, and community sites has increased. This shift has been driven by demand for convenient care access for large populations. The growth of these distributed access points indicates a broader transition toward hybrid care delivery. The trend also reflects rising acceptance of virtual consultations and the need for cost-efficient coverage in high-traffic public locations.

The adoption of kiosks in retail settings has expanded steadily. Pharmacies and supermarkets have integrated kiosk or virtual-care stations to support minor illness management and preventive care. According to a study by the American Hospital Association, the presence of retail-based clinics remained extensive in 2024. It was reported that CVS operated about 1,100 MinuteClinic locations. For instance, Hartford HealthCare and OnMed placed a CareStation in a Stop & Shop store in January 2024. This confirmed retailer participation in telehealth delivery.

The placement of kiosks in community and academic locations has followed a similar pattern. University-led initiatives have extended coverage to student populations and rural counties. For example, a study by the Carle Illinois College of Medicine described a planned network of kiosks for preventive care access. Additional guidance has been issued for public telehealth access points. According to national resource centers, Telehealth Access Points were defined in 2024 as private rooms or kiosks in libraries or banks. The standards formalized a repeatable community model.

Employer campuses have also adopted kiosk-based care. The demand for on-site health support for employees has driven vendors to introduce portable pods. According to market positioning by health system partners, kiosk models such as the OnMed CareStation are promoted for high-traffic worksites. For instance, the unit deployed in the Stop & Shop supermarket in 2024 has been marketed for corporate environments. This confirmed the suitability of telehealth kiosks for workplace integration and expanded hybrid care adoption.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 48.5% share and holds US$ 201.4 Million market value for the year. The region’s leadership was described as a result of strong demand, supportive policies, and mature infrastructure. Analysts noted that telehealth use rose sharply during the pandemic in the United States, with federal data showing a major increase in Medicare telehealth visits. This continued use created a stable base for telehealth kiosks in clinics, pharmacies, and community sites.

It was reported that federal programs in the United States supported the digital and physical groundwork needed for kiosk deployment. The FCC’s Rural Health Care initiatives helped reduce broadband expenses for providers in remote areas. These programs were fully funded and promoted nationwide. Stable payment rules also encouraged adoption. Medicare maintained expanded telehealth coverage and continued the originating-site facility fee, which helped providers recover operational costs linked to kiosk-based telehealth visits.

Observers highlighted that government-backed kiosk models have shown clear feasibility. The U.S. Department of Veterans Affairs expanded its ATLAS network, placing private telehealth rooms in community locations. These sites offered secure video capability, diagnostic tools, and structured workflows. Analysts stated that these examples reduced uncertainty about scale and performance. Federal health agencies also strengthened digital readiness. High EHR adoption and better interoperability allowed kiosk encounters to connect smoothly with clinical records, orders, and follow-up processes.

Canada’s activity reinforced regional strength. National data indicated that virtual physician services rose steeply in 2020 and 2021, with continued use in urgent-care settings. Provincial programs targeted remote communities, where private kiosk rooms and reliable devices created value. Public funding and technical support from agencies such as HRSA assisted U.S. health centers as well. These supports lowered operational barriers for providers planning kiosk networks. As a result, North America sustained a stable and well-funded environment for telehealth kiosk expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of telehealth kiosks is shaped by companies that focus on hardware engineering, integrated diagnostics, and virtual care workflows. KIOSK Information Systems, Olea Kiosks, and REDYREF are expanding their roles through advanced enclosure design and improved component integration. Their capabilities support large deployments in clinical and retail environments. Their manufacturing scale strengthens supply stability. These firms are gaining traction because strong hardware platforms remain essential for consistent telehealth delivery across diverse access points.

Clinical device specialists are also influencing the market. Sonka Medical, CSI Health, and AMD Global Telemedicine are improving diagnostic accuracy and expanding device interoperability. Their portfolios include clinically validated sensors and integrated measurement modules. These solutions support remote consultations and point-of-care assessments. Their growing presence is driven by the demand for reliable vital-sign acquisition. Their focus on regulatory compliance and device quality increases adoption among health systems and employer health programs.

Software-centric vendors are shaping the telehealth workflow ecosystem. American Well strengthens kiosk performance through mature telehealth platforms, scheduling frameworks, and provider networks. Its software tools support seamless patient flow. UniDoc Health and OnMed are building combined hardware and software systems to improve consultation quality. These firms are gaining interest due to integrated workflows and improved exam capabilities. Their solutions meet rising demand for structured digital visits supported by remote clinicians.

Additional players are widening market access. Higi, Clinics On Cloud, PharmaSmart, and MedAvail Technologies support retail and community-based deployments. Their solutions focus on preventive care, pharmacy services, and public health screening. Elo Touch and Howard Medical contribute through component manufacturing and healthcare-grade hardware systems. Their involvement strengthens the ecosystem by improving reliability and availability. Their presence supports broader telehealth adoption, especially in high-traffic locations and population health programs.

Market Key Players

- KIOSK Information Systems

- Olea Kiosks

- REDYREF

- Sonka Medical

- American Well

- CSI Health

- AMD Global Telemedicine

- Clinics On Cloud

- Elo Touch

- Versicles Technologies

- OnMed

- Howard Medical

- MedAvail Technologies

- PharmaSmart

- UniDoc Health

- Higi

Recent Developments

- In October 2024: Amwell announced that Hello Heart would partner with the Amwell Converge™ platform, enabling employers and health-plan clients to offer Hello Heart’s digital cardiovascular and blood-pressure monitoring program as part of the Amwell ecosystem.

- In August 2024: CSI Health announced that its QuickCheck kiosk was deployed at the pharmacy of the Community Health Center of Cape Cod (a Federally Qualified Health Centre). The initiative enables public access to vital-sign screening (blood pressure, SpO₂) and links biometric data to the patient’s provider via MyChart.

- In December 2023: REDYREF Interactive Kiosks acquired Livewire Digital, a provider of interactive kiosk software and services. This acquisition strengthens REDYREF’s end-to-end offering by combining its kiosk hardware capabilities with Livewire’s software expertise.

- In July 2023: Launch of HYPERMODULAR™ kiosk technology. The platform enables faster pilot-to-production timelines and flexible configurations, supporting healthcare and telehealth use cases where rapid customization and deployment are required.

- In May 2023: Sonka Medical participated in the China International Medical Equipment Fair (CMEF), positioning its full-lifecycle health management and telemedicine kiosk portfolio for international distributors and healthcare institutions.

Report Scope

Report Features Description Market Value (2024) US$ 415.3 Million Forecast Revenue (2034) US$ 1200.6 Billion CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Standalone Kiosks, Mobile Kiosks, Wall-Mounted Units, Countertop Kiosks), By Component (Hardware, Software, Services), By Application (Teleconsultation, Vital Signs Monitoring, Pharmaceutical Dispensing & Counseling, Behavioral & Mental Health Assessment, Occupational Health & Preventive Screening), By End-User (Hospitals & Specialty Clinics, Community Health Centers, Pharmacies & Retail Clinics, Corporate Offices & Industrial Worksites, Educational Institutions & Government Facilities, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape KIOSK Information Systems, Olea Kiosks, REDYREF, Sonka Medical, American Well, CSI Health, AMD Global Telemedicine, Clinics On Cloud, Elo Touch, Versicles Technologies, OnMed, Howard Medical, MedAvail Technologies, PharmaSmart, UniDoc Health, Higi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- KIOSK Information Systems

- Olea Kiosks

- REDYREF

- Sonka Medical

- American Well

- CSI Health

- AMD Global Telemedicine

- Clinics On Cloud

- Elo Touch

- Versicles Technologies

- OnMed

- Howard Medical

- MedAvail Technologies

- PharmaSmart

- UniDoc Health

- Higi