Global Tackifier Market Size, Share Analysis Report By Product (Synthetic, Natural), By Form (Solid, Liquid, Resin Dispersion), By Application (Packaging, Bookbinding, Non-woven, Construction, Automotive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160757

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

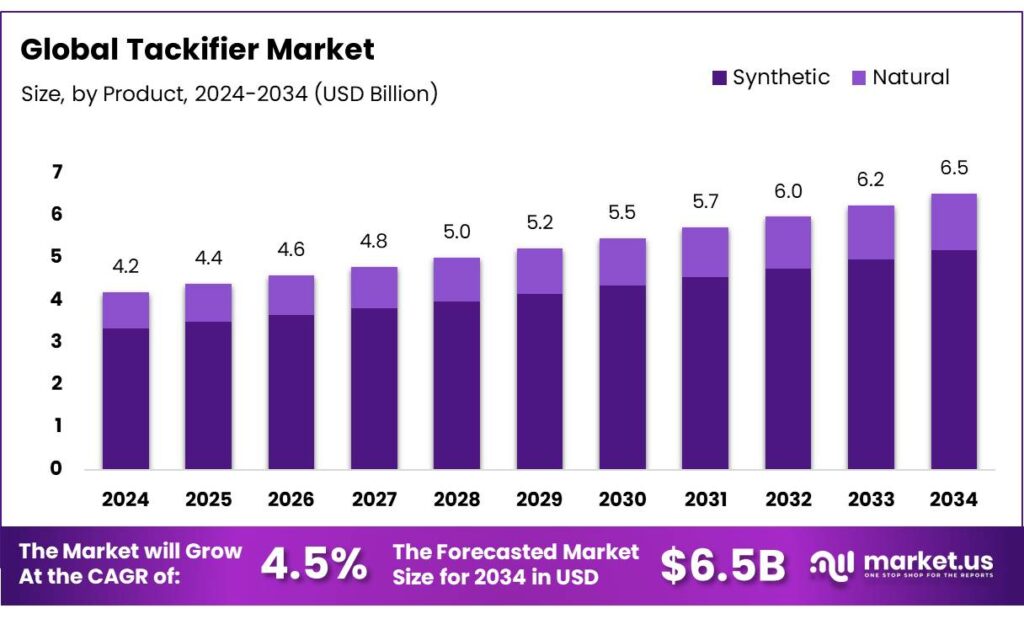

The Global Tackifier Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 4.2 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

Tackifiers are chemical compounds added to adhesives to increase their stickiness, improving properties such as tack, peel strength, and shear strength. They are crucial in the formulation of pressure-sensitive adhesives (PSAs) and hot-melt adhesives (HMAs), which are widely used in applications like tapes, labels, packaging, and construction materials. The demand for tackifiers is closely linked to the growth of these end-use industries.

Key driving factors have been identified as sustained expansion of adhesive-intensive industries (packaging and hygiene), accelerated renewable-energy installations that use composite adhesives (wind and solar), and regulatory and customer preference shifts toward lower-emissions and higher-performance tackifiers.

The renewable energy transition is material to demand from energy equipment manufacturers: global renewable power capacity additions were forecast to be ~666 GW in 2024 and are projected to rise toward ~935 GW by 2030 in the IEA main case, with solar PV and wind accounting for the majority of additions — a structural driver for composite adhesives used in turbine and module manufacture.

Government and policy actions have underpinned demand visibility and investment. The U.S. Department of Energy reported that combined infrastructure and IRA-related investments were expected to enable >35 GW of additional renewable energy online and build out >600 miles of new transmission lines via federal funding programs and related initiatives, supporting industrial activity across supply chains.

- The European Union has set a binding renewable target of at least 42.5% by 2030 under RED III, which is expected to sustain demand for equipment and materials used in renewables deployment.

Key Takeaways

- Tackifier Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 4.2 Billion in 2024, growing at a CAGR of 4.5%.

- Synthetic tackifiers held a dominant market position, capturing more than a 79.5% share.

- Solid tackifiers held a dominant market position, capturing more than an 81.56% share.

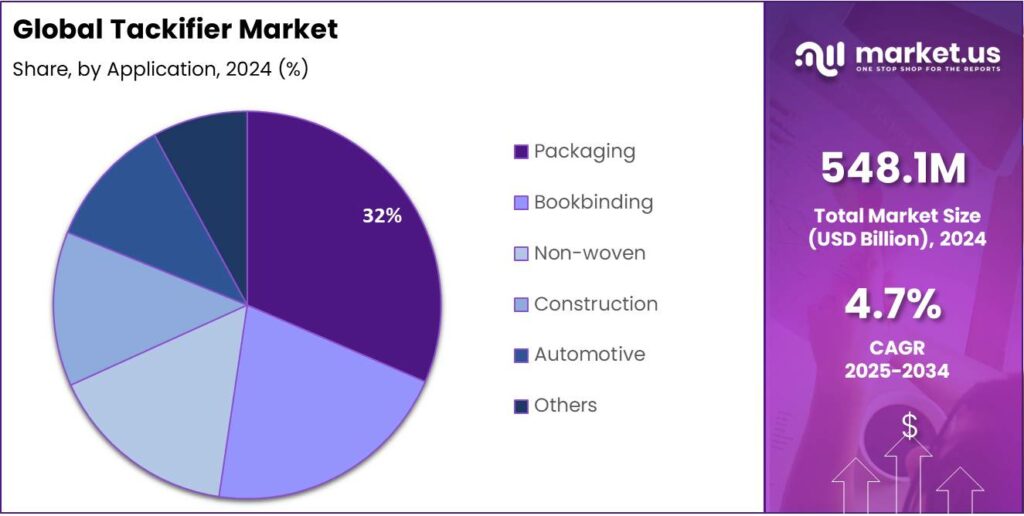

- Packaging held a dominant market position, capturing more than a 31.7% share.

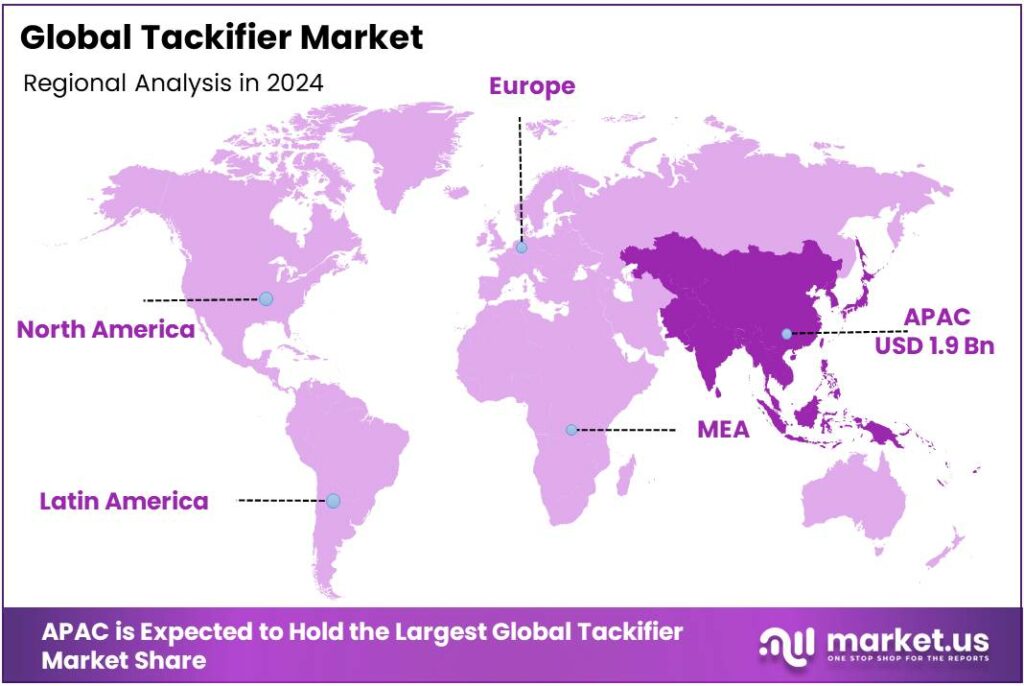

- Asia Pacific region held a dominant market position in the global tackifier industry, capturing more than 45.80% of the market share, equating to approximately USD 1.9 billion.

By Product Analysis

Synthetic Tackifiers Lead Market with 66.13% Share in 2024

In 2024, synthetic tackifiers held a dominant market position, capturing more than a 79.5% share. This segment’s growth is primarily attributed to their superior performance characteristics, including excellent thermal stability, adhesion properties, and compatibility with a wide range of adhesives. Synthetic tackifiers, primarily derived from petroleum-based sources such as C9 aromatics, aliphatic hydrocarbons, and synthetic polyterpenes, are highly favored in industries like packaging, automotive, and construction, where durability and high performance are crucial.

Their versatility in supporting advanced adhesive technologies, such as hot-melt and pressure-sensitive adhesives, further strengthens their market position. Cost-effectiveness and consistent quality compared to natural alternatives make synthetic tackifiers a preferred choice for manufacturers. Despite growing interest in bio-based tackifiers, the established infrastructure and widespread availability of synthetic variants ensure their continued dominance in the market.

By Form Analysis

Solid Tackifiers Lead with 81.56% Market Share in 2024

In 2024, solid tackifiers held a dominant market position, capturing more than an 81.56% share. This segment’s growth is primarily attributed to their superior performance characteristics, including excellent thermal stability, adhesion properties, and compatibility with a wide range of adhesives. Solid tackifiers, primarily derived from petroleum-based sources such as C9 aromatics, aliphatic hydrocarbons, and synthetic polyterpenes, are highly favored in industries like packaging, automotive, and construction, where durability and high performance are crucial.

Their versatility in supporting advanced adhesive technologies, such as hot-melt and pressure-sensitive adhesives, further strengthens their market position. Cost-effectiveness and consistent quality compared to natural alternatives make solid tackifiers a preferred choice for manufacturers. Despite growing interest in bio-based tackifiers, the established infrastructure and widespread availability of solid variants ensure their continued dominance in the market.

By Application Analysis

Packaging Application Leads Tackifier Market with 31.7% Share in 2024

In 2024, packaging held a dominant market position, capturing more than a 31.7% share. This growth is primarily driven by the increasing demand for adhesive-intensive packaging solutions across food, beverage, personal care, and e-commerce industries. Tackifiers play a crucial role in ensuring the strength, flexibility, and sealing performance of adhesive tapes, labels, cartons, and flexible packaging films. The segment benefits from the rising adoption of pressure-sensitive adhesives and hot-melt adhesives, where consistent tack and adhesion are essential for high-volume packaging operations.

In 2025, packaging is expected to maintain its leading position, reflecting continued expansion in the global packaging industry. The rise of e-commerce, which saw parcel shipments surpass 100 billion units globally in 2024, continues to support demand for adhesive solutions that provide secure and reliable packaging. The increasing focus on sustainable packaging also encourages the use of advanced tackifiers that improve recyclability without compromising performance.

Key Market Segments

By Product

- Synthetic

- Natural

By Form

- Solid

- Liquid

- Resin Dispersion

By Application

- Packaging

- Bookbinding

- Non-woven

- Construction

- Automotive

- Others

Emerging Trends

Emergence of Bio-Based Tackifiers in Food Packaging

The growing emphasis on sustainability has led to a significant shift in the food packaging industry, with a notable trend towards the adoption of bio-based tackifiers. These eco-friendly alternatives are derived from renewable resources such as natural resins, plant oils, and terpenes, offering a more sustainable option compared to traditional petroleum-based tackifiers.

Government initiatives in India are also supporting the shift towards sustainable packaging. The Ministry of Food Processing Industries (MoFPI) has been actively promoting the adoption of eco-friendly materials in the food processing sector. Additionally, the Food Safety and Standards Authority of India (FSSAI) has been revising regulations to encourage the use of materials that are both safe for food contact and environmentally friendly. These regulatory frameworks are facilitating the integration of bio-based tackifiers into food packaging applications.

The adoption of bio-based tackifiers is not only beneficial for the environment but also aligns with consumer preferences for sustainable products. As awareness about environmental issues grows, consumers are increasingly favoring products with eco-friendly packaging. This trend is prompting manufacturers to invest in research and development to create innovative adhesive solutions that incorporate bio-based tackifiers, thereby enhancing the sustainability of their packaging materials.

Drivers

Increasing Demand for Eco-Friendly Packaging Solutions

One of the most significant drivers propelling the growth of the tackifier market is the escalating demand for eco-friendly packaging solutions. As consumers and regulatory bodies increasingly prioritize sustainability, industries are shifting towards biodegradable and recyclable materials. Tackifiers, essential components in adhesives, play a pivotal role in enhancing the performance of these sustainable packaging materials.

Tackifiers enhance the performance of adhesives by improving their tack, peel strength, and shear strength, which are crucial for the effectiveness of packaging materials. In the context of food packaging, these properties are vital to maintain product freshness, prevent contamination, and ensure compliance with stringent health and safety regulations.

For instance, Kraton Corporation offers a range of pine-based and polymer tackifiers designed for adhesives, providing high cohesion, thermal stability, and versatility for consumer and industrial products . These bio-based tackifiers are particularly suitable for applications in food packaging, where low odor, hot melt stability, and biobased content are essential.

Furthermore, the adoption of hot-melt adhesives in packaging applications is on the rise due to their efficiency and environmental benefits. These adhesives, which often utilize tackifiers, are favored for their ability to bond substrates without the need for solvents, thereby reducing volatile organic compound (VOC) emissions and enhancing workplace safety.

Restraints

Regulatory Challenges in Tackifier Use for Food Packaging

A significant challenge facing the tackifier market, particularly in the food packaging sector, is the stringent regulatory landscape governing food contact materials (FCMs). These regulations are designed to ensure consumer safety by limiting the migration of potentially harmful substances from packaging into food products.

In regions like the European Union and the United States, FCMs are subject to rigorous safety assessments. For instance, the European Union’s Regulation (EC) No 1935/2004 mandates that materials in contact with food must not transfer substances to food in quantities that could endanger human health or change the composition, taste, or odor of the food. Similarly, in the United States, the Food and Drug Administration (FDA) regulates FCMs under the Federal Food, Drug, and Cosmetic Act, requiring manufacturers to demonstrate that their products are safe for intended uses.

Tackifiers, often derived from petroleum-based resins or natural sources like rosin, can pose challenges in this context. Certain synthetic tackifiers may contain residual monomers or additives that could migrate into food, raising health concerns. For example, some hydrocarbon resins used as tackifiers have been scrutinized for their potential to leach volatile organic compounds (VOCs) into food products. This necessitates comprehensive testing and certification to ensure compliance with safety standards.

Opportunity

Growth Opportunities in Tackifiers Driven by India’s Expanding Food Processing Sector

The expansion of the food processing industry is directly influencing the demand for packaging materials, which in turn drives the need for high-performance adhesives. Tackifiers, essential components in adhesives, enhance properties like tack, peel strength, and shear strength, making them crucial in the formulation of adhesives used in food packaging. With the rise in packaged food consumption, the demand for adhesives incorporating tackifiers is expected to increase correspondingly.

Government initiatives such as the Production Linked Incentive Scheme for Food Processing Industries (PLISFPI) and the Pradhan Mantri Kisan Sampada Yojana (PMKSY) have been instrumental in promoting the growth of the food processing sector. In the fiscal year 2025-26, the Ministry of Food Processing Industries (MoFPI) was allocated a budget of INR 4,364 crore (approximately USD 505.7 million), with significant portions directed towards these schemes. These initiatives aim to enhance processing capacities, improve infrastructure, and encourage innovation, all of which contribute to the increased demand for packaging solutions and, consequently, tackifiers.

Moreover, the trend towards sustainable and eco-friendly packaging is gaining momentum. Consumers are increasingly favoring products with minimal environmental impact, prompting manufacturers to adopt biodegradable and recyclable materials. Tackifiers derived from renewable resources, such as natural resins, are becoming more prevalent in adhesive formulations for sustainable packaging applications. This shift aligns with global sustainability goals and offers a growth avenue for the tackifier market.

Regional Insights

Asia Pacific Dominates Tackifier Market with 45.80% Share in 2024

In 2024, the Asia Pacific region held a dominant market position in the global tackifier industry, capturing more than 45.80% of the market share, equating to approximately USD 1.9 billion in revenue. This substantial share underscores the region’s pivotal role in the production and consumption of tackifiers, driven by robust industrial activities and a burgeoning demand across various sectors.

The dominance of Asia Pacific is primarily attributed to the rapid industrialization and urbanization in key markets such as China, India, and Southeast Asia. China, in particular, stands out as the largest market within the region, contributing over USD 1.6 billion to the global tackifier market. This is facilitated by China’s expansive manufacturing base, significant automotive and packaging industries, and substantial construction activities. The country’s position as a global manufacturing hub further amplifies its demand for high-performance adhesives, thereby propelling the need for efficient tackifiers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Henkel AG & Co. KGaA is a global leader in adhesives, sealants, and functional coatings. The company focuses on innovation and sustainability, offering advanced adhesive solutions across various industries, including automotive, electronics, and packaging. Henkel’s commitment to research and development ensures the delivery of high-performance products that meet the evolving needs of its customers. The company’s global presence and technical expertise position it as a key player in the tackifier market.

ZEON CORPORATION specializes in the production of synthetic rubbers, resins, and other specialty chemicals. The company’s tackifier resins are widely used in pressure-sensitive adhesives, hot-melt adhesives, and sealants. ZEON’s commitment to quality and innovation has established it as a trusted supplier in the global tackifier market. The company’s products are recognized for their excellent adhesion properties and compatibility with various substrates.

Kolon Industries, Inc. is a South Korean company that produces a wide range of products, including tackifier resins. The company’s tackifiers are used in adhesives for applications such as hygiene products, automotive, and packaging. Kolon’s commitment to quality and innovation has established it as a key player in the global tackifier market. The company’s products are recognized for their excellent adhesion properties and compatibility with various substrates.

Top Key Players Outlook

- Henkel AG & Co. Kga

- ZEON CORPORATION

- Eastman Chemical Company

- Arkema

- Kolon Industries, Inc.

- H.B. Fuller Company

- Exxon Mobil Corporation

- BASF SE

- SI Group, Inc.

- KRATON CORPORATION

Recent Industry Developments

In 2024, Eastman reported annual sales of approximately $9.4 billion, with a net income of $905 million and an adjusted EBIT of $1.3 billion.

In 2024, Arkema reported sales of €654 million in this segment, reflecting a 1.9% increase compared to the fourth quarter of 2023.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Bn Forecast Revenue (2034) USD 6.5 Bn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Synthetic, Natural), By Form (Solid, Liquid, Resin Dispersion), By Application (Packaging, Bookbinding, Non-woven, Construction, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Henkel AG & Co. Kga, ZEON CORPORATION, Eastman Chemical Company, Arkema, Kolon Industries, Inc., H.B. Fuller Company, Exxon Mobil Corporation, BASF SE, SI Group, Inc., KRATON CORPORATION Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Henkel AG & Co. Kga

- ZEON CORPORATION

- Eastman Chemical Company

- Arkema

- Kolon Industries, Inc.

- H.B. Fuller Company

- Exxon Mobil Corporation

- BASF SE

- SI Group, Inc.

- KRATON CORPORATION