Global Sustainable Aviation Fuel Market Size, Share Analysis Report By Technology (HEFA-SPK, FT-SPK, ATJ-SPK, And PtL), By Blending Capacity (Up to 20%, 20 to 40%, And Above 40%), By Aircraft Type (Fixed-wing And Rotary-wing) By End-use (General Aviation, Commercial Aviation And Military Aviation) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 153290

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

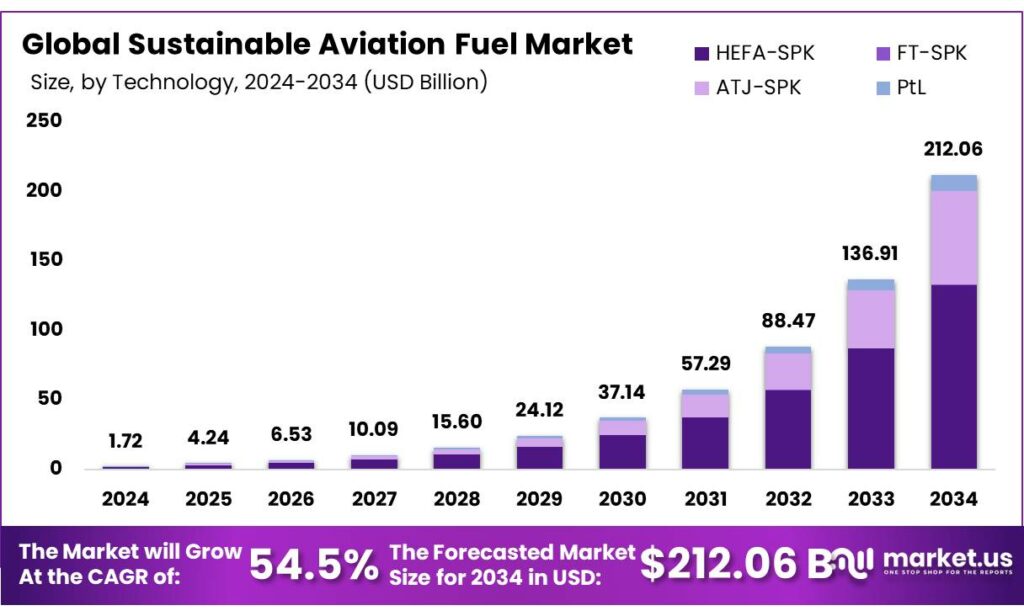

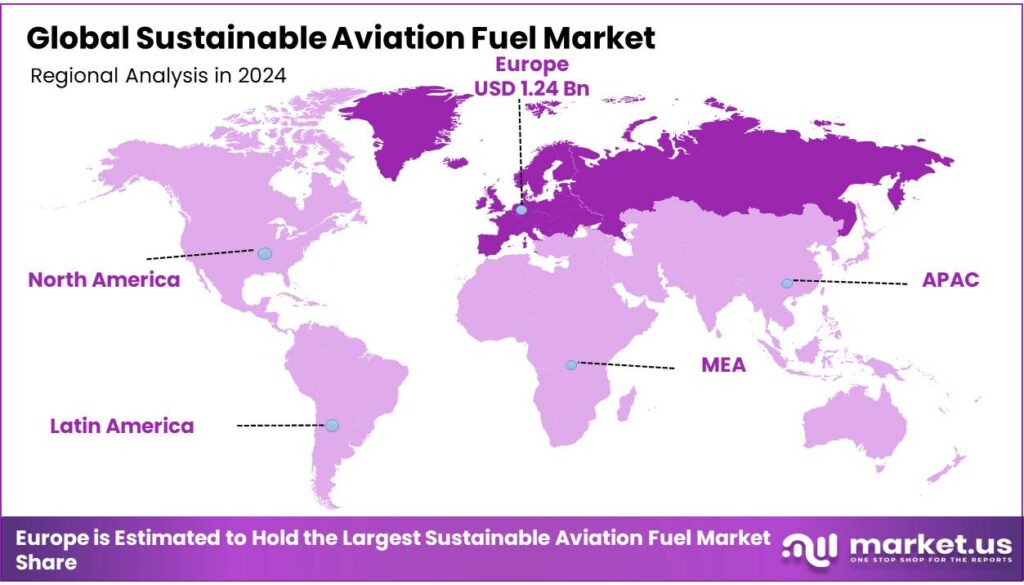

The Global Sustainable Aviation Fuel Market size is expected to be worth around USD 212.06 Billion by 2034, from USD 1.72 Billion in 2024, growing at a CAGR of 54.5% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 72.25% share, holding USD 1.24 Billion revenue.

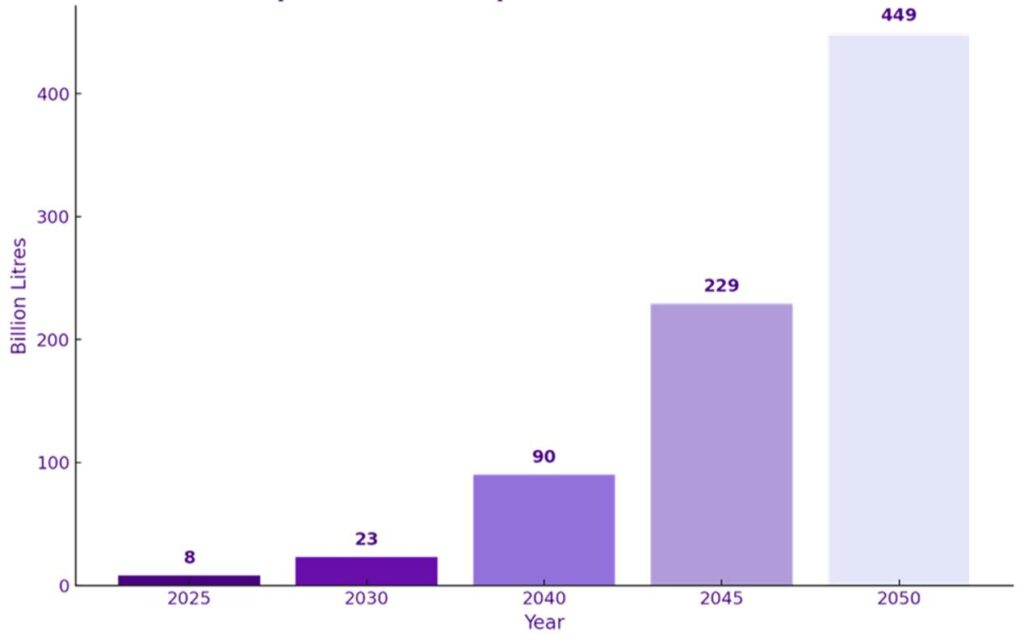

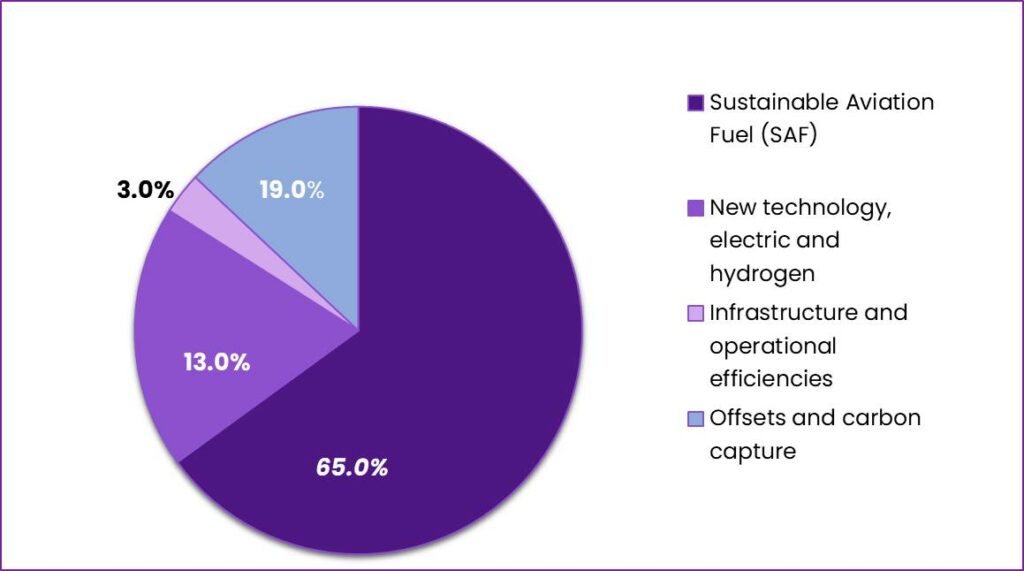

The Global Sustainable Aviation Fuel (SAF) Market in 2024 is experiencing rapid evolution, propelled by strong decarbonization commitments, supportive regulatory frameworks, and growing private sector investment. The market’s primary driver is the global push toward net-zero aviation by 2050, reinforced by IATA’s target to cut 1.8 gigatons of CO₂ annually and ICAO’s Long-Term Global Aspirational Goal (LTAG). SAF is projected to deliver about 65% of the required emission reductions, supported by mandates such as the EU’s ReFuelEU Aviation Regulation, the U.S. Inflation Reduction Act (IRA), and national blending targets across Japan, India, and the UAE.

However, infrastructure and supply chain limitations remain major restraints, as less than 1% of the required global SAF production infrastructure is currently operational. Massive capital investment—estimated at USD 2.4 trillion—is needed to develop biorefineries, feedstock logistics, and distribution systems. On the opportunity front, Power-to-Liquid (PtL) and carbon capture–based synthetic fuel technologies promise to overcome feedstock constraints and achieve near-complete carbon neutrality, especially as green hydrogen production scales up. Meanwhile, airline offtake agreements and vertical integration models are reshaping the industry by ensuring demand certainty and financing new projects.

Expected SAF Required For Net Zero 2050

Source: International Air Transport Association

Key Takeaways

- The global sustainable aviation fuel market was valued at USD 1.72 billion in 2024.

- The global sustainable aviation fuel market is projected to grow at a CAGR of 54.5% and is estimated to reach USD 212.06 billion by 2034.

- Between technologies, HEFA-SPK accounted for the largest market share of 99.64%.

- Among blending capacities, Up to 20% accounted for the majority of the market share at 96.22%.

- Fixed-wing Aircrafts domianated the market with a market share of 98.55%.

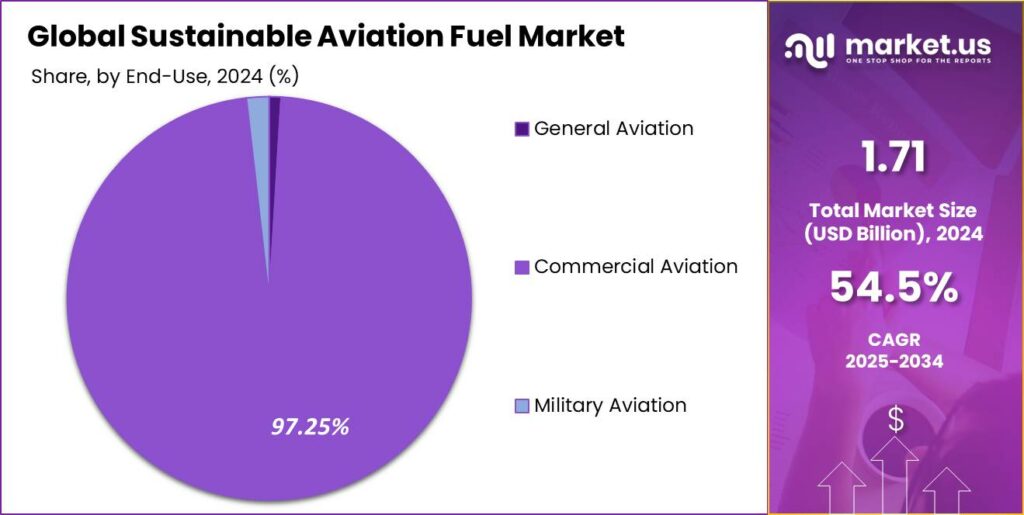

- Based on end-uses, commercial aviation dominated the global sustainable aviation fuel market with a 97.25% market share

- Europe is estimated as the largest market for sustainable aviation fuel with a share of 72.25% of the market share.

- North America was estimated second largest market with a CAGR of 58.2%.

Technology Analysis

The SAF Market Was Dominated By HEFA-SPK Owing To Its Technological Maturity

Based on technology, the market is categorized into HEFA-SPK, FT-SPK, ATJ-SPK, & PtL. As of 2024, HEFA-SPK (Hydroprocessed Esters and Fatty Acids–Synthetic Paraffinic Kerosene) dominates the sustainable aviation fuel market, accounting for 99.64% of total SAF production due to its technological maturity, commercial scalability, and regulatory approval.

HEFA-SPK is produced from readily available lipid feedstocks such as used cooking oil, animal fats, and vegetable oils through hydroprocessing, a well-established refinery technology that integrates easily with existing fuel infrastructure.Unlike other emerging SAF pathways—such as FT-SPK (Fischer–Tropsch), ATJ-SPK (Alcohol-to-Jet), and PtL (Power-to-Liquid)—HEFA-SPK has been fully certified by ASTM International (D7566 Annex 2) and is approved for blending up to 50% with conventional jet fuel.

Its production plants are already operational globally, supported by established supply chains and lower capital intensity compared with other routes. Additionally, airlines and fuel suppliers favor HEFA-SPK because it provides drop-in compatibility, meaning it requires no modifications to existing aircraft or engines. Policy incentives in the U.S., Europe, and Asia, including blending mandates and tax credits for bio-based feedstocks, further encourage HEFA-SPK deployment. In contrast, alternative technologies remain in pilot or demonstration phases, making HEFA-SPK the only commercially viable SAF pathway driving near-term market dominance.

Blending Capacity Analysis

To Ensure Compatibility, Sustainable Aviation Fuel With up to 20% Blending Capacity are Widely Utilized

Based on the blending capacity, the market is segmented into Up to 20%, 20 to 40%, & Above 40%. As of 2024, sustainable aviation fuel with a blending capacity of up to 20% holds a dominant 96.22% market share, primarily because it aligns with current industry standards, operational safety requirements, and the limited global supply of certified SAF. Most commercial aircraft engines and fueling systems are presently certified to operate on blends of up to 50% SAF under ASTM D7566 specifications, but airlines and fuel suppliers typically utilize lower blends—most commonly 10% to 20%—to ensure compatibility and minimize logistical challenges.

The limited availability and higher production cost of SAF compared to conventional Jet A fuel also constrain airlines from adopting higher blend ratios on a large scale. Moreover, refineries and airports have optimized existing infrastructure for low-level blending to maintain efficiency and reduce the need for system modifications. Lower blending percentages also help meet emission reduction targets while allowing gradual integration into existing supply chains without disrupting operations or flight certifications.

Aircraft Type Analysis

Based on the aircraft type, the market is further divided into fixed-wing & rotary-wing. Fixed-wing aircraft dominated the global sustainable aviation fuel market with a commanding 98.55% market share, primarily due to their extensive use in commercial aviation, defense, and cargo transport. Fixed-wing aircraft—including commercial airliners, business jets, and military planes—account for the vast majority of global aviation fuel consumption because they operate on long-haul routes and high-frequency flight schedules that demand large volumes of jet fuel.

Airlines are under growing regulatory and environmental pressure to decarbonize operations, making them the principal adopters of SAF for carbon reduction and compliance with international emission targets set by ICAO’s CORSIA program and regional initiatives like the EU’s ReFuelEU Aviation regulation. In contrast, rotary-wing aircraft such as helicopters represent a smaller portion of global aviation activity, being mainly used for specialized operations like emergency services, offshore transport, and surveillance, which consume significantly less fuel overall. Additionally, the existing SAF supply chains and refueling infrastructure are optimized for fixed-wing aircraft at commercial airports, facilitating large-scale adoption.

End-Use Analysis

The Agility Of Commercial Aviation Operators and Their Willingness To Pay A Premium For Sustainability Driven Their Dominant Share

Based on the end-use, the market is further divided into general aviation, commercial aviation, & military aviation. commercial aviation dominated the global sustainable aviation fuel market with a 97.25% market share, driven by its extensive operational scale, regulatory pressure, and ambitious decarbonization commitments. The commercial aviation sector—encompassing passenger airlines and air cargo—consumes the vast majority of global jet fuel, making it the primary target for SAF adoption to achieve carbon reduction goals.

Major international carriers such as Delta, Lufthansa, Emirates, and Air France-KLM have established long-term offtake agreements and partnerships with SAF producers to secure fuel supply and meet emission compliance under global frameworks like CORSIA and the EU ETS. Government policies, including the ReFuelEU Aviation Regulation and U.S. Inflation Reduction Act, further incentivize commercial airlines to integrate SAF into regular operations.

The use of SAF offers up to an 80% reduction in lifecycle carbon emissions, allowing airlines to offset part of their environmental footprint without modifying existing engines or infrastructure. Additionally, airports in key regions—Europe, North America, and Asia-Pacific—have expanded fueling capabilities to accommodate SAF blends, enhancing logistical feasibility.

Key Market Segments

By Technology

- HEFA-SPK

- FT-SPK

- ATJ-SPK

- PtL

By Blending Capacity

- Up to 20%

- 20 to 40%

- Above 40%

By Aircraft Type

- Fixed-wing

- Rotary-wing

By End-use

- General Aviation

- Commercial Aviation

- Military Aviation

Drivers

Global Net-Zero and Decarbonization Commitments Is Driving The Market Growth.

The global net-zero and decarbonization commitments have become the most important factor driving the Sustainable Aviation Fuel (SAF) market worldwide. Aviation currently accounts for nearly 3% of total global CO₂ emissions, and according to the International Air Transport Association (IATA), the sector must cut emissions by more than 1.8 gigatons annually by 2050 to achieve its Net Zero Carbon by 2050 target. Within this roadmap, SAF is projected to deliver around 65% of the total emission reductions required, underscoring its central role in aviation’s climate transition.

The International Civil Aviation Organization (ICAO) reinforced this trajectory through its Long-Term Global Aspirational Goal (LTAG), adopted in October 2022, committing member states to decarbonize aviation by 2050. It also introduced a near-term milestone: achieving a 5% reduction in international aviation’s carbon intensity by 2030 through SAF adoption. In parallel, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), initiated in 2021, mandates carbon-neutral growth from international flights, thereby creating a direct compliance-driven demand for SAF. This policy environment is further strengthened by binding regional mandates.

- The European Union’s ReFuelEU Aviation Regulation (2023) sets a minimum 2% SAF blend by 2025, 6% by 2030, and 70% by 2050, including synthetic fuels. Similarly, the U.S. Inflation Reduction Act (IRA) provides $1.25–$1.75 per gallon in SAF tax credits, while the UK targets 10% SAF use by 2030 through its Renewable Transport Fuel Obligation. Japan, Singapore, and India have introduced blending mandates ranging between 1–10% by 2030, and the UAE aims to produce 0.5 million tones of SAF annually by 2030. The market response to these commitments is tangible. Over 11 SAF pathways are now certified by ASTM, allowing flexibility in feedstock and technology selection—from waste oils and residues to power-to-liquid synthetic fuels.

Source: International Air Transport Association

Restraints

Infrastructure and Supply Chain Limitations May Hamper The Growth Of The Market to a Certain Extent

Infrastructure and supply chain limitations represent one of the most significant restraints on the global sustainable aviation fuel market, impeding its scalability and commercial viability. SAF production requires a sophisticated and integrated network of facilities — including bio refineries, feedstock collection systems, hydrogen and carbon capture units, storage tanks, blending terminals, and airport distribution pipelines most of which are either insufficiently developed or completely absent.

According to an analysis, less than 1% of the required global infrastructure for SAF production and distribution is currently in place, while the investment needed for upstream infrastructure alone is estimated at nearly USD 2.4 trillion by 2050. This vast capital requirement and the lack of established logistics networks create high entry barriers and deter investors, particularly given the uncertainty surrounding long-term policy incentives and price parity with conventional jet fuel.

The supply chain for SAF is further constrained by limited access to sustainable feedstocks and inefficient logistics. Collecting, transporting, and processing feedstocks such as used cooking oil, municipal waste, or agricultural residues demand specialized infrastructure and regional coordination.

Opportunity

Public-Private Partnerships (PPP) and Investment Mobilization

Public-private partnerships (PPPs) and innovative investment mobilization mechanisms are emerging as critical enablers for scaling the global Sustainable Aviation Fuel (SAF) market, bridging the gap between policy ambition and commercial execution. SAF production remains highly capital-intensive, with new biorefineries, carbon capture systems, and hydrogen electrolysis facilities requiring billions in upfront investment before becoming profitable. Through PPPs, governments, private enterprises, and research institutions can collectively mitigate these risks and accelerate deployment.

Governments play a pivotal role by establishing long-term regulatory certainty, providing subsidies or tax incentives, and funding early-stage R&D. Private sector partners, including airlines, fuel producers, and investors, contribute operational expertise, technological innovation, and market access, while academia and research institutions drive continuous improvement in fuel conversion efficiency and sustainability assessment. This collaborative structure ensures that financial, technical, and policy resources are aligned toward achieving large-scale decarbonization goals in aviation.

Trends

Airline-Offtake Agreements and Vertical Integration

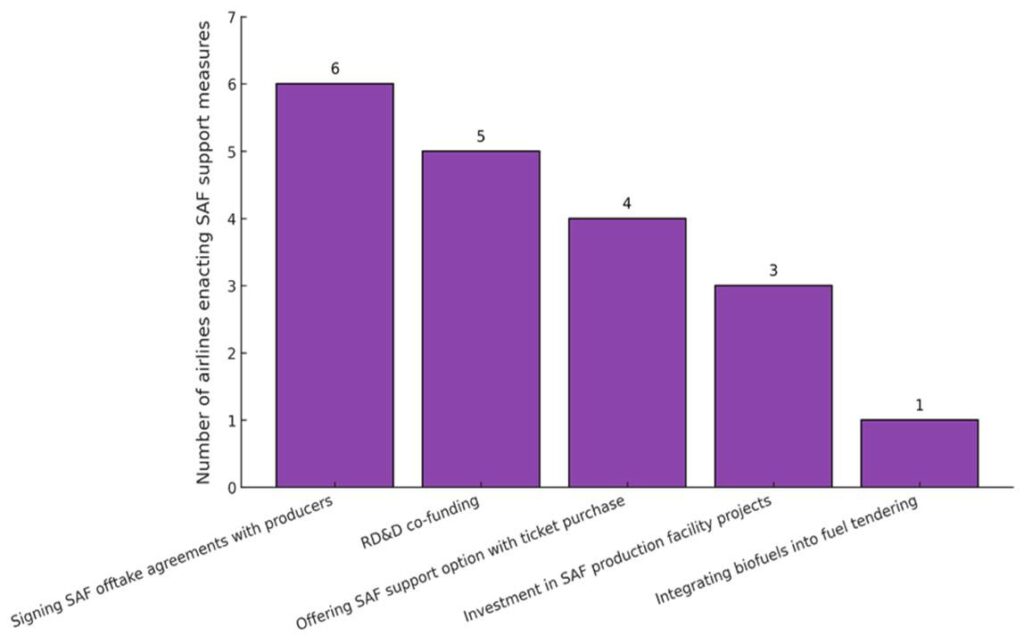

Airline offtake agreements—where carriers commit in advance to purchasing defined volumes of sustainable aviation fuel (SAF)—together with vertical integration strategies are increasingly shaping the SAF market by providing demand certainty, enabling investment in production, and integrating value-chains for performance and scale.

The International Civil Aviation Organization (ICAO) maintains a public dashboard listing SAF offtake agreements globally, underlining that airlines are now anchoring supply chains with producers and fuel suppliers. By committing to multi-year contracts, airlines reduce market risk for SAF producers, improving project financeability and encouraging the development of larger facilities and new feedstock pathways. Much of these contracts also incorporate vertical integration structures—carriers, fuel-refiners and airports forming joint ventures or equity partnerships—to align upstream production, logistics and airport delivery.

In practice, these agreements act as a counter‐cyclical signal against volatile fossil kerosene markets and help stabilize the business case for SAF. For instance, airlines that secure offtake volumes can negotiate favorable terms or guarantee off-take behaviors that underpin plant financing. According to industry guidance, structuring of offtake contracts, including ‘take-or-pay’ clauses and volume escalation schedules, is now standard practice in SAF development.

SAF Initiatives by Assessed Airlines 2020

Geopolitical Impact Analysis

Geopolitical Challeges In The Sustainable Aviation Fuel Market.

The Sustainable Aviation Fuel (SAF) market is increasingly shaped by geopolitical developments, which have become one of the most critical non-environmental challenges affecting aviation decarbonization progress. The withdrawal of the United States from the Paris Agreement in early 2025, coupled with its “America First” trade policy, has disrupted global climate cooperation frameworks and weakened momentum toward unified decarbonization goals. Increased protectionism and the imposition of tariffs are raising costs and uncertainty for SAF producers dependent on international collaboration.

For instance, both the U.S. and European Union have introduced tariffs and anti-dumping duties targeting Chinese renewable technologies such as solar panels, EVs, and biofuels, which could indirectly affect feedstock supply chains and SAF exports. Geopolitical tensions have destabilized global feedstock trade flows, especially for used cooking oil (UCO), agricultural residues, and waste oils—key inputs for SAF production.

Several Asian countries, including Japan, face shortages due to increased exports of UCO to Europe and North America, highlighting the vulnerabilities of cross-border feedstock dependency. Such constraints have intensified calls for domestic energy security and the development of localized SAF feedstock ecosystems. Geopolitical realignment is also driving regional collaboration among emerging economies.

- For instance, Brazil’s “Fuels of the Future” bill (2024) established a national SAF program mandating emission reductions of 1% by 2027, rising to 10% by 2037, and dedicated $1 billion for SAF R&D and biorefineries. Similarly, Chile’s SAF Roadmap 2030 and its partnership with Brazil aim to share best practices and accelerate SAF technology transfer across Latin America.

Regional Analysis

Europe Held the Largest Share of the Global Sustainable Aviation Fuel Market

In 2024, Europe dominated the global sustainable aviation fuel (SAF) market with a 72.25% share owing to its strong policy framework, technological leadership, and rapidly expanding production capacity. The region’s dominance is anchored in its comprehensive regulatory ecosystem, notably the ReFuelEU Aviation Regulation, the EU Emissions Trading System (EU ETS) revision, and the Renewable Energy Directive III (RED III), all of which collectively mandate and incentivize SAF integration across European airports.

These measures have created a clear demand signal, ensuring stable market growth and investment security. Europe’s early commercialization of HEFA-based SAF, coupled with a growing network of certified biorefineries—primarily in the Netherlands, Finland, France, and Spain—has positioned it as a global hub for SAF production and distribution.

Additionally, the Central Europe Pipeline System (CEPS) integration of SAF blends has enhanced logistical efficiency and supply reliability across NATO and EU airports. Major airlines and fuel producers in Europe, such as Neste, TotalEnergies, and BP, have accelerated deployment through long-term offtake agreements. Despite higher production costs, Europe’s policy-driven market ensures consistent SAF adoption, aligning with its 2050 net-zero target. Hence, strong regulation, advanced infrastructure, and industrial readiness underpin Europe’s leading role in the global SAF market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

product innovation and robust research & development are the key strategies of major players of Sustainable Aviation Fuel market.

Major players in the Sustainable Aviation Fuel (SAF) market are pursuing strategies focused on capacity expansion, technology diversification, and strategic partnerships to secure market leadership. Companies are scaling up production through new biorefineries and upgrading existing facilities to produce HEFA, Fischer–Tropsch, and Power-to-Liquid fuels. They are forming long-term offtake agreements with airlines to ensure steady demand and financial stability.

Collaboration across the value chain—linking feedstock suppliers, refiners, and airports—is enhancing supply chain efficiency. Firms are also investing in research and innovation to develop next-generation feedstocks, improve conversion efficiency, and achieve cost parity with conventional jet fuel while meeting global sustainability standards.

The Major Players in The Industry

- Neste Corporation

- GEVO, INC.

- World Energy, LLC

- TotalEnergies SE

- Montana Renewables, LLC

- Eni SpA

- Valero Energy Corporation

- LanzaTech

- SkyNRG BV

- OMV Aktiengesellschaft

- BP p.l.c.

- Synhelion AG

- Exxon Mobil Corporation

- Repsol S.A.

- Moeve

- Other Key Players

Key Development

June 2025: Neste announced an agreement to supply 7,500 metric tons (2.5 million gallons) of Neste MY Sustainable Aviation Fuel (SAF) to Amazon Air for operations at San Francisco International Airport and Ontario International Airport, making Amazon the first SAF user at Ontario. The fuel, produced from renewable waste and residues, cuts GHG emissions by up to 80% and is delivered via pipelines and renewable diesel-powered trucks. This partnership builds on Neste and Amazon’s collaboration since 2021 and showcases Neste’s expanding SAF infrastructure across the U.S. West Coast.

October 2025: Gevo Inc. received an extension from the U.S. Department of Energy (DOE) on its conditional commitment to guarantee a $1.46 billion loan for its sustainable aviation fuel (SAF) project in Lake Preston, South Dakota. The deadline has been moved to April 16, 2026, allowing evaluation of potential scope changes, including a proposed 30-million-gallon-per-year jet fuel facility (ATJ-30) in North Dakota.

May 2024: World Energy entered a five-year agreement with Boston Consulting Group (BCG) to supply Sustainable Aviation Fuel certificates (SAFc), marking BCG’s largest SAF purchase to date. The contract aims to reduce 100,000 metric tons of CO₂ emissions—over half of BCG’s 2023 air travel footprint—through 2028. Produced using HEFA technology from waste fats and oils, the SAF will be certified under strict sustainability standards. The partnership reinforces BCG’s net-zero by 2030 goal and underscores World Energy’s leadership in decarbonizing aviation by scaling sustainable fuel production and fostering corporate collaboration in the green aviation transition.

Report Scope

Report Features Description Market Value (2024) USD 1.72 Bn Forecast Revenue (2034) USD 212.06 Bn CAGR (2025-2034) 54.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (HEFA-SPK, FT-SPK, ATJ-SPK, & PtL), By Blending Capacity (Up to 20%, 20 to 40%, & Above 40%), By Aircraft Type (Fixed-wing & Rotary-wing) By End-use (General Aviation, Commercial Aviation & Military Aviation) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Neste Corporation, GEVO, INC., World Energy, LLC, TotalEnergies SE, Montana Renewables, LLC, Eni SpA, Valero Energy Corporation, LanzaTech, SkyNRG BV, OMV Aktiengesellschaft, BP plc, Synhelion AG, Exxon Mobil Corporation, Repsol S.A., Moeve, & Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Sustainable Aviation Fuel MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Sustainable Aviation Fuel MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Neste Corporation

- GEVO, INC.

- World Energy, LLC

- TotalEnergies SE

- Montana Renewables, LLC

- Eni SpA

- Valero Energy Corporation

- LanzaTech

- SkyNRG BV

- OMV Aktiengesellschaft

- BP p.l.c.

- Synhelion AG

- Exxon Mobil Corporation

- Repsol S.A.

- Moeve

- Other Key Players