Global Substrate Like PCB Market Size, Share, Statistics Analysis Report By Line/Space (25/25 & 30/30 ìm, Less than 25/25 ìm), By Application (Consumer Electronics, IT & Telecommunications, Automotive, Healthcare, Industrial, Military, Defense, & Aerospace, Others), By Inspection Technologies (Automated Optical Inspection, Direct Imaging, Automated Optical Shaping), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143978

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- China Substrate Like Pcb Market

- Line/Space Analysis

- Application Analysis

- Inspection Technologies Analysis

- Key Growth Factors

- Key Advantages

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities For Players

- Recent Developments

- Report Scope

Report Overview

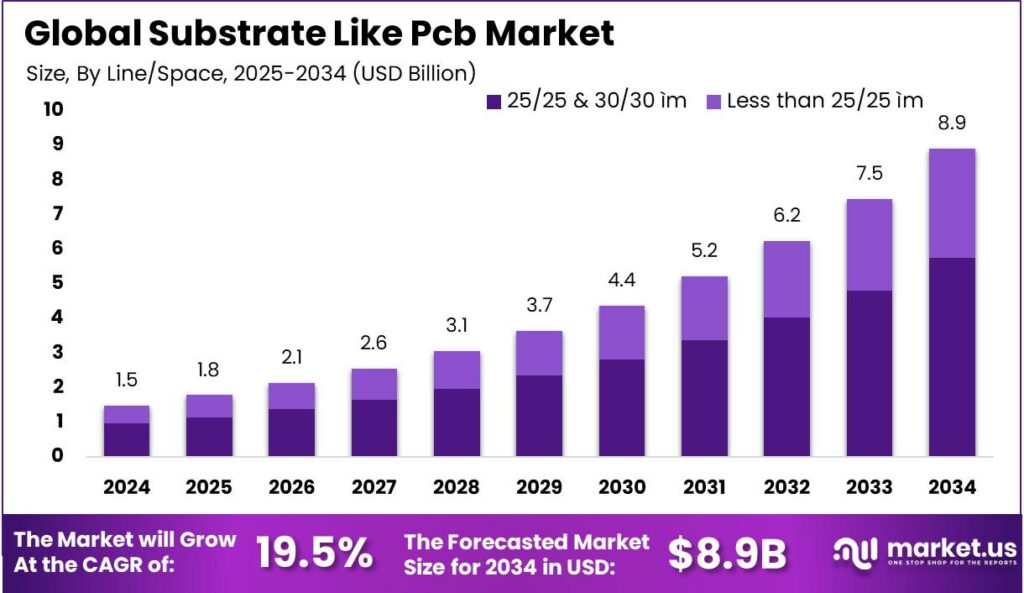

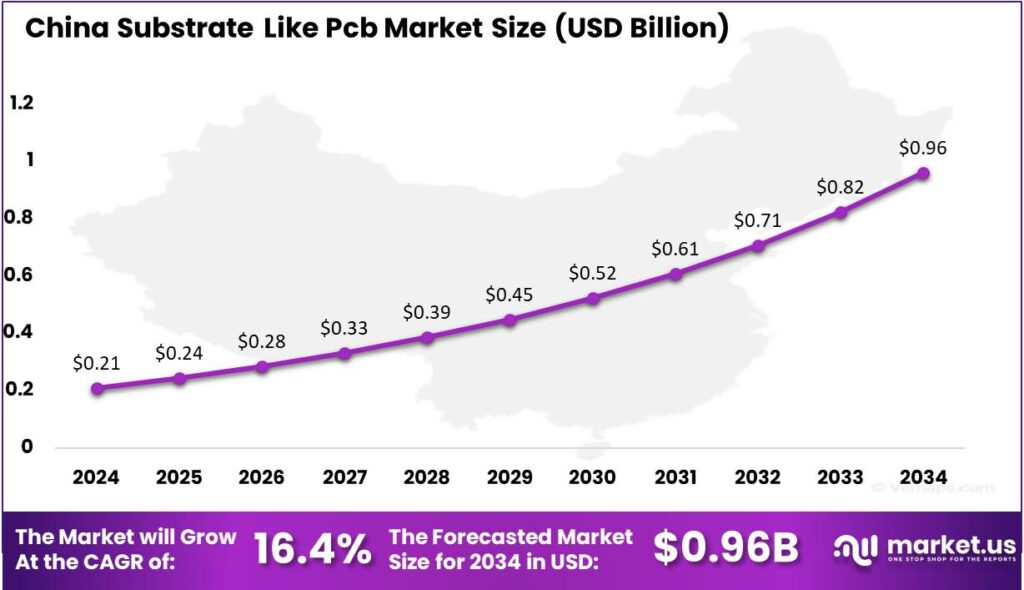

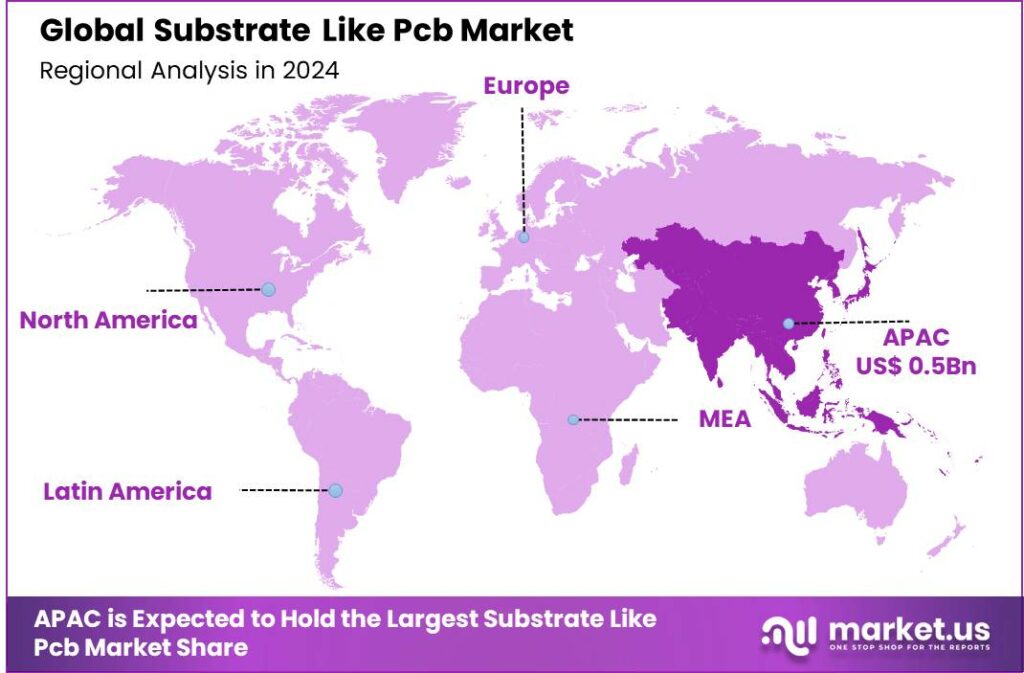

The Global Substrate Like Pcb Market size is expected to be worth around USD 8.9 Billion By 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 19.50% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region led the market with 36.4% share and USD 0.5 billion in revenues. The Substrate Like PCB market in China was valued at USD 0.21 billion, with a projected CAGR of 16.4%.

The market for Substrate Like PCBs is rapidly expanding, driven by the demand for more powerful and compact electronics across various industries. As devices become smaller and more feature-packed, SLP technology allows manufacturers to integrate more components into tighter spaces without compromising performance.

This is particularly advantageous in sectors such as smartphones, wearable technology, and medical devices, where space optimization and device integration are critical. The primary driving factors for the Substrate Like PCB market include the ongoing miniaturization of electronic devices, increasing complexity of electronic components, and the need for efficient heat management in compact devices.

Additionally, the rise in applications requiring high-frequency and high-speed circuitry contributes to the demand for SLPs, as they are capable of supporting these requirements with greater reliability and performance. Demand for Substrate Like PCBs is particularly strong in high-tech industries, including consumer electronics, automotive, aerospace, and medical technology.

These industries benefit from the high density and reliability of SLPs, which are essential for supporting the advanced functionalities of modern electronic products. As electronic devices continue to evolve, the demand for SLPs is expected to grow, driven by their ability to meet stringent performance and size specifications.

The strong demand for substrate-like PCBs is driven by advancements in consumer electronics like smartphones, wearables, and IoT devices. The automotive industry’s focus on advanced electronics for safety, navigation, and performance also boosts demand. Additionally, emerging technologies like 5G require highly reliable, dense circuit boards, further propelling the market.

Implementing Substrate Like PCB technology provides significant business benefits such as enhanced performance due to higher component density and improved reliability from better thermal management. These boards are designed to handle high power and high-speed conditions, which are increasingly prevalent in modern electronic applications.

Key Takeaways

- The Global Substrate Like PCB Market is projected to reach USD 8.9 billion by 2034, growing from USD 1.5 billion in 2024, with a CAGR of 19.50% during the forecast period from 2025 to 2034.

- In 2024, the 25/25 & 30/30 μm segment held a dominant position in the substrate-like PCB market, capturing more than 64.6% of the market share.

- The Consumer Electronics segment also led the substrate-like PCB market in 2024, accounting for over 38.4% of the total market share.

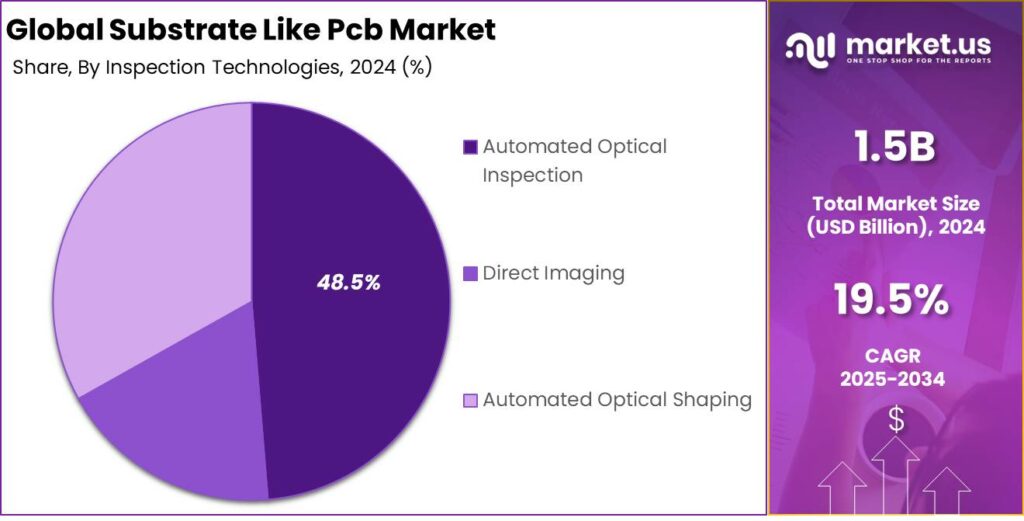

- The Automated Optical Inspection (AOI) segment had a dominant market position in 2024, holding more than 48.5% of the share in the Substrate Like PCB market.

- The Asia-Pacific region was the leading market in 2024, commanding more than 36.4% of the market share, with revenues amounting to USD 0.5 billion.

- In 2024, the market for Substrate Like PCBs in China was valued at USD 0.21 billion, with a projected CAGR of 16.4% for future growth.

Analysts’ Viewpoint

From an investment perspective, Substrate Like PCB technology presents significant opportunities due to its critical role in enabling next-generation electronic devices. Analysts suggest that investments in SLP technology are likely to yield substantial returns as the demand for miniaturized, high-performance electronic devices continues to rise.

Technological advancements and a stringent regulatory environment that favors high reliability and performance are further driving the SLP market. Partnerships with experienced manufacturers equipped to handle the intricate requirements of SLP fabrication are recommended to fully capitalize on these market opportunities.

China Substrate Like Pcb Market

The market for Substrate Like PCBs in China was estimated to be valued at $0.21 billion in the year 2024. It is anticipated to grow at a compound annual growth rate (CAGR) of 16.4%. This substantial growth can be attributed to several factors, including the increasing demand for more sophisticated electronics that require advanced PCB solutions.

Substrate Like PCBs (SLPs) provide finer line and space widths for higher-density interconnections, essential for meeting the demands of high-performance devices in industries like smartphones, wearables, and automotive electronics.

Moreover, the expansion of this market is likely to be supported by the advancements in technology within the region’s manufacturing sector. China’s focus on enhancing industrial capabilities and investing in tech infrastructure creates a favorable environment for the growth of advanced PCB technologies like SLPs. This trend is expected to persist, fueled by domestic demand and the export of electronics to global markets.

In 2024, the Asia-Pacific region held a dominant position in the Substrate Like PCB market, capturing more than a 36.4% share, with revenues amounting to USD 0.5 billion. The region’s leading stance is driven by its strong electronics manufacturing sector, with China, South Korea, and Taiwan as key hubs for PCB production.

Asia-Pacific’s dominance in this market stems from several key factors. The presence of major electronics manufacturers in the region creates strong demand for advanced PCBs, including Substrate Like PCBs (SLPs). These manufacturers continuously push the limits of device miniaturization and functionality, driving the need for SLPs that offer higher circuit density and enhanced performance.

The region also benefits from a strong supply chain and infrastructure for electronics production, including access to raw materials, components, and advanced manufacturing technologies for high-density PCBs. Supportive government policies, such as investments in tech parks and subsidies for tech companies, further contribute to the growth of the SLP market in Asia-Pacific.

Increasing investment in R&D for electronics and PCB technologies in Asia-Pacific drives continuous innovation and improvements in SLP offerings. This commitment to development is essential for meeting the evolving needs of global electronics markets and preserving the region’s leadership in the Substrate Like PCB industry.

Line/Space Analysis

In 2024, the 25/25 & 30/30 μm segment held a dominant market position in the substrate-like PCB market, capturing more than a 64.6% share. This substantial market share can be attributed to the segment’s optimal balance between performance and manufacturability.

The 25/25 & 30/30 μm segment is preferred in mainstream electronics like smartphones, tablets, and wearables due to its balance of high-density interconnectivity and efficient miniaturization. These widths offer reliability and cost-effectiveness, making them a popular choice for top electronics brands.

Furthermore, the 25/25 & 30/30 μm segment’s leadership in the market is supported by the established infrastructure of suppliers and technological maturity. The production techniques for this range have been refined over the years, enhancing yield rates and reducing defects, which in turn supports higher profitability margins for PCB manufacturers.

The 25/25 & 30/30 μm technology’s compliance with regulatory and environmental standards enhances its market dominance. Aligning with global directives on electronic waste and energy use, it offers manufacturers a sustainable, high-performance solution, reinforcing its preference among PCB buyers and manufacturers.

Application Analysis

In 2024, the Consumer Electronics segment held a dominant position in the substrate-like PCB market, capturing more than a 38.4% share. This segment’s leadership can be attributed to the exponential growth in the consumption of personal devices such as smartphones, tablets, and wearable technology.

Consumer electronics manufacturers continually push for thinner, more flexible, and highly durable PCBs to meet the increasing demands for sleeker and more robust devices. Substrate-like PCBs fulfill these requirements by offering enhanced circuitry integration with greater reliability and higher density, which are critical for modern consumer electronics.

Moreover, this segment’s prominence is bolstered by rapid innovations and product launches, which frequently incorporate advanced technologies necessitating sophisticated PCB solutions. The fast replacement cycle of consumer electronics also fuels continual demand for substrate-like PCBs, as new devices need updated or entirely new PCB designs to support enhanced functionalities.

The rise of smart home devices and IoT products increases the demand for substrate-like PCBs. These applications require PCBs that offer durability, enhanced connectivity, and efficient operation in a connected environment. Substrate-like PCBs are ideal for supporting the complex, miniaturized assemblies common in IoT devices.

Inspection Technologies Analysis

In 2024, the Automated Optical Inspection (AOI) segment held a dominant market position in the Substrate Like PCB market, capturing more than a 48.5% share. This leading role is primarily attributed to AOI’s critical function in enhancing the quality and reliability of PCBs during manufacturing, which is essential for meeting the high standards required in electronics production.

Automated Optical Inspection systems are favored in the PCB industry due to their ability to detect a wide range of surface defects and irregularities that can affect the functionality of the final product. This includes minute flaws such as scratches, stains, and uneven surfaces, which are particularly significant in the production of high-density Substrate Like PCBs.

Moreover, the integration of AOI systems into PCB production lines has become more feasible due to advancements in imaging technologies and software algorithms. These improvements have enhanced the speed and accuracy of inspections, allowing for real-time quality control without impeding the overall production speed.

The miniaturization of electronic devices requires more complex and compact PCBs, and Automated Optical Inspection (AOI) technology effectively addresses this need. AOI ensures reliable quality control as designs evolve and its scalability across different PCB sizes and types strengthens its dominant position in the market.

Key Growth Factors

- Miniaturization of Electronics: The trend towards smaller, more powerful devices necessitates compact circuit boards. SLPs enable higher component density, supporting this miniaturization without compromising performance.

- Advancements in Manufacturing Techniques: Innovations like the modified semi-additive process (mSAP) allow for finer circuit patterns in SLPs, enhancing their functionality and reliability in complex electronic applications.

- Demand in Consumer Electronics: The proliferation of smartphones and wearable devices drives the need for SLPs, as they offer the high-density interconnects required for advanced features in limited spaces.

- Automotive Electronics Growth: Modern vehicles incorporate sophisticated electronics for safety and infotainment systems. SLPs provide the necessary reliability and performance to meet these automotive industry demands.

- Emergence of 5G Technology: The rollout of 5G networks requires electronic components capable of handling higher frequencies. SLPs are designed to meet these requirements, making them integral to 5G infrastructure development.

Key Advantages

- Enhanced Density and Miniaturization: SLP technology allows for a reduction in line width and pitch, enabling manufacturers to fit more components into the same area. For instance, it can reduce line width from 40/50μm to as low as 20/35μm, effectively doubling the component density compared to traditional HDI boards.

- Size and Weight Reduction: Utilizing SLPs can decrease the thickness of PCB boards by about 30% and their area by approximately 50% as per ELEPCB report. This reduction not only saves space but also allows for increased battery capacity in devices like smartphones.

- Improved Thermal Management: SLPs provide better thermal conductivity, which is crucial for high-performance applications, ensuring devices operate efficiently without overheating.

- Higher Reliability and Signal Integrity: The advanced manufacturing processes used in SLPs enhance signal integrity, making them ideal for high-speed applications such as 5G devices and automotive electronics.

Key Market Segments

By Line/Space

- 25/25 & 30/30 ìm

- Less than 25/25 ìm

By Application

- Consumer Electronics

- IT & Telecommunications

- Automotive

- Healthcare

- Industrial

- Military, Defense, & Aerospace

- Others

By Inspection Technologies

- Automated Optical Inspection

- Direct Imaging

- Automated Optical Shaping

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Miniaturized and High-Performance Electronic Devices

The relentless pursuit of compact and multifunctional electronic devices has significantly propelled the demand for substrate-like PCBs. As consumers seek slimmer smartphones, wearable gadgets, and other portable electronics, manufacturers are compelled to adopt advanced PCB technologies that support high-density interconnections and reduced form factors.

SLPs, with their finer lines and spaces, enable the integration of complex circuits within limited spaces, thereby enhancing device performance without compromising size. This trend is particularly evident in the consumer electronics sector, where the emphasis on sleek design and enhanced functionality drives the adoption of SLPs. The ability of SLPs to facilitate miniaturization while maintaining high performance positions them as a critical component in the evolution of modern electronic devices.

Restraint

High Manufacturing Costs and Complex Production Processes

Despite the advantages offered by substrate-like PCBs, their widespread adoption is hindered by the high costs associated with their manufacturing. The production of SLPs involves advanced materials and intricate fabrication techniques, such as the modified semi-additive process (mSAP), which require significant investment in specialized equipment and skilled labor.

Additionally, the complexity of the manufacturing process increases the likelihood of production challenges, leading to higher defect rates and reduced yields. These factors contribute to elevated production costs, making SLPs less accessible for cost-sensitive applications and markets. Manufacturers must navigate these economic challenges to balance the benefits of SLPs with the financial implications of their production.

Opportunity

Expansion in Automotive Electronics

The automotive industry’s rapid advancement towards electrification and enhanced connectivity presents a significant opportunity for the substrate-like PCB market. SLPs offer the necessary attributes, such as high-density interconnects and improved signal integrity, to meet requirements.

Modern vehicles are increasingly outfitted with advanced electronic systems, such as ADAS, infotainment, and electric powertrains, which require high-performance PCBs to support complex functions and high-speed data transmission. As automotive manufacturers continue to integrate more electronic features into vehicles, the demand for SLPs is expected to rise, opening new avenues for market growth in the automotive sector.

Challenge

Shortage of Skilled Labor and Standardization Issues

The substrate-like PCB industry faces challenges related to the shortage of skilled professionals adept at handling the sophisticated design and manufacturing processes inherent to SLP production. The intricate nature of SLP fabrication necessitates a workforce with specialized knowledge and expertise, which is currently in limited supply.

Furthermore, the absence of standardized protocols and industry-wide benchmarks for SLP design and production complicates the manufacturing landscape. This lack of standardization can lead to inconsistencies in product quality and performance, hindering the scalability and broader adoption of SLPs across various applications. Addressing these challenges requires focused workforce development and the establishment of industry standards to ensure consistency and reliability in SLP production.

Emerging Trends

One notable trend is the shift from traditional high-density interconnect (HDI) PCBs to SLPs, characterized by finer line widths and spaces, typically 30/30 micrometers or smaller. This advancement allows for increased component integration within limited spaces, catering to the growing demand for miniaturized electronic devices.

The adoption of modified semi-additive processes (mSAP) in manufacturing is another significant development. mSAP enhances precision in circuit patterning, facilitating the production of intricate designs required for modern electronics. This method has become essential in meeting the stringent requirements of next-generation devices.

SLPs are also gaining traction in various applications beyond consumer electronics. In the automotive sector, SLPs enhance advanced driver-assistance systems and electric vehicle technologies, boosting performance and safety. The growth of wearable devices and IoT also drives demand for compact, efficient PCBs, making SLPs essential for these innovations.

Business Benefits

The use of substrate-like PCBs provides business advantages by improving product performance and competitiveness. The high wiring density of SLPs allows for the creation of smaller, lighter devices without sacrificing functionality, which is especially beneficial in consumer electronics that prioritize sleek, portable designs.

SLPs contribute to improved electrical performance due to shorter interconnects and reduced signal loss. This enhancement is crucial for devices requiring high-speed data transmission, such as smartphones and communication equipment, ensuring reliable and efficient operation.

Moreover, the use of advanced materials in SLPs leads to better thermal management, effectively dissipating heat and prolonging device lifespan. SLP technology ensures reliability in automotive and industrial applications, where durability is crucial. From a manufacturing standpoint, mSAP’s precision reduces material waste, and modularization simplifies assembly, leading to cost savings.

Key Player Analysis

A few key players dominate the SLP market, driving innovation and influencing market trends.

Kinsus Interconnect Technology Corp. is a leading player in the SLP market, known for its expertise in advanced packaging solutions. The company has a strong presence in the global electronics industry, specializing in the production of high-quality SLPs used in consumer electronics and telecommunications.

Ibiden Co., Ltd. is another major player in the SLP market, recognized for its advanced materials and technology solutions. The company produces high-end SLPs for use in smartphones, laptops, and various other electronic devices. Ibiden’s strength lies in its ability to create high-performance, miniaturized solutions that meet the growing demands of the electronics sector.

Compeq Manufacturing Co. Ltd. is a prominent supplier of PCBs and SLPs, known for its precision manufacturing and high-quality products. With years of industry experience, Compeq is a leader in producing SLPs for consumer electronics and telecommunications, known for high-density interconnect solutions that meet modern performance standards.

Top Key Players in the Market

- Kinsus Interconnect Technology Corp.

- Ibiden Co., Ltd.

- Compeq Manufacturing Co. Ltd.

- Unimicron

- AT&S

- TTM Technologies, Inc.

- Samsung Electro-Mechanics

- Korea Circuit

- Zhen Ding Tech. Group

- DAEDUCKGDS

- ISU Petasys Co., Ltd.

- Tripod Technology Corp.

- Others

Top Opportunities For Players

- Expansion into Emerging Markets: The Asia-Pacific region, particularly Taiwan, Japan, and China, is seeing strong growth in the Substrate Like PCB industry due to high demand from smartphone makers and investments in telecom infrastructure. The Middle East and Africa are also experiencing increased demand driven by investments in telecom and urban electronics.

- Innovations in Automotive Applications: There is a significant opportunity for growth in the automotive sector, especially with the increasing integration of electronics in vehicles. This includes applications in safety systems, infotainment, and particularly in electric vehicles, which require advanced PCB solutions for effective performance.

- Technological Advancements in PCB Manufacturing: The market is experiencing technological innovations, including the use of advanced materials like ceramic substrates and new manufacturing technologies such as Laser Direct Imaging and Automated Optical Inspection. These advancements enhance efficiency and precision, essential for meeting the complex demands of modern electronic devices.

- Growing Demand in Consumer Electronics: The continuous evolution and demand for smaller, more efficient electronic devices in the consumer electronics sector provide a substantial market for substrate-like PCBs. This is driven by the proliferation of smart devices and the IoT, where compact and efficient PCB designs are crucial.

- Focus on Sustainable and High-Performance Materials: There is an increasing emphasis on environmental compliance and sustainability in manufacturing. This trend is driving the market toward eco-friendly substrates and processes that minimize environmental impact without sacrificing performance. This shift not only complies with regulatory standards but also caters to a market that is increasingly aware of ecological concerns.

Recent Developments

- In December 2024, Ibiden announced plans to accelerate its production expansion to meet the growing demand for AI chips. The company is constructing a new substrate factory in Gifu, Japan, which will begin operations at partial capacity by late 2025.

- In March 2024, a leading manufacturer introduced a new high-density substrate-like PCB tailored for 5G applications. This innovation aims to meet the growing demand for high-frequency, high-speed data transmission in telecommunications.

- In September 2024, a major electronics company unveiled a new flexible substrate-like PCB designed specifically for wearable electronics. This development addresses the increasing need for durable and adaptable components in the wearable technology market.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 8.9 Bn CAGR (2025-2034) 19.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Line/Space (25/25 & 30/30 ìm, Less than 25/25 ìm), By Application (Consumer Electronics, IT & Telecommunications, Automotive, Healthcare, Industrial, Military, Defense, & Aerospace, Others), By Inspection Technologies (Automated Optical Inspection, Direct Imaging, Automated Optical Shaping) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kinsus Interconnect Technology Corp., Ibiden Co., Ltd., Compeq Manufacturing Co. Ltd., Unimicron, AT&S, TTM Technologies, Inc., Samsung Electro-Mechanics, Korea Circuit, Zhen Ding Tech. Group, DAEDUCKGDS, ISU Petasys Co., Ltd. , Tripod Technology Corp., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Substrate Like PCB MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Substrate Like PCB MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kinsus Interconnect Technology Corp.

- Ibiden Co., Ltd.

- Compeq Manufacturing Co. Ltd.

- Unimicron

- AT&S

- TTM Technologies, Inc.

- Samsung Electro-Mechanics

- Korea Circuit

- Zhen Ding Tech. Group

- DAEDUCKGDS

- ISU Petasys Co., Ltd.

- Tripod Technology Corp.

- Others