Global Submucosal Injections Market By Type of Agent (Eleview and ORISE Gel, Succinylated Gelatin, Normal Saline, Hydroxypropyl Methylcellulose, Hydroxyethyl Starch, Hyaluronic Acid, Fibrinogen Mixture and Dextrose Water), By Application (Colorectal Cancer, Esophageal Cancer and Gastric Cancer), By End-User (Hospitals, Surgical Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173841

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

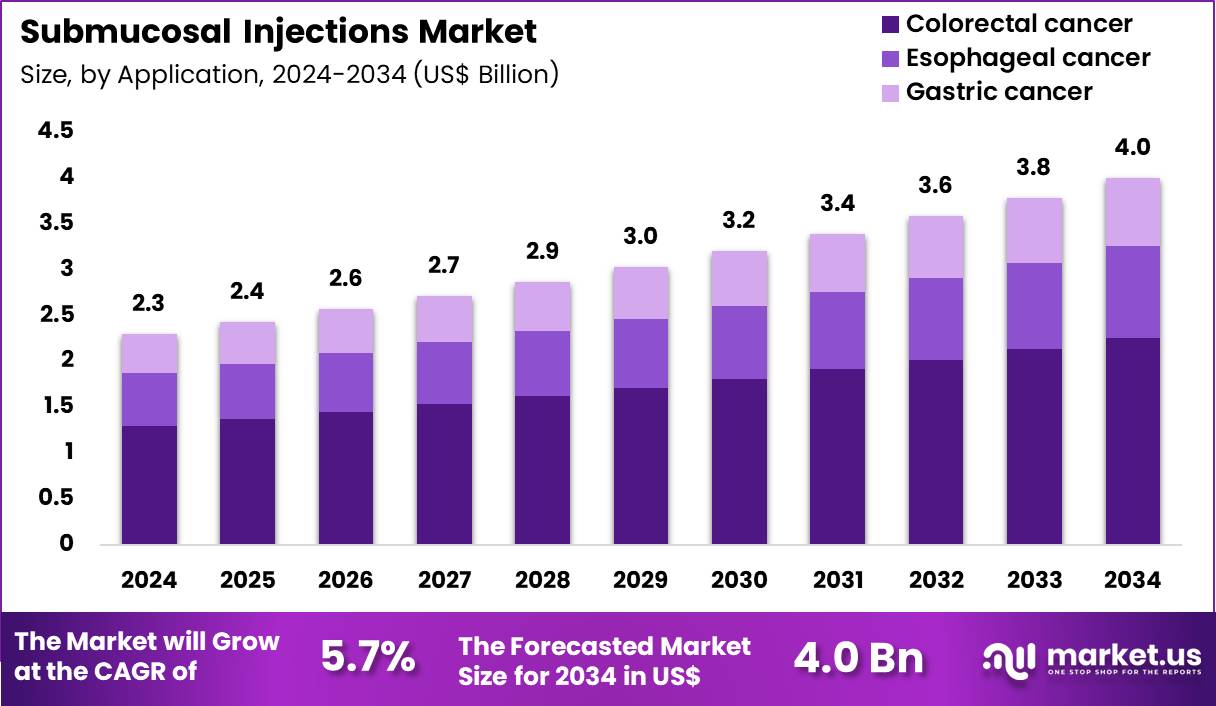

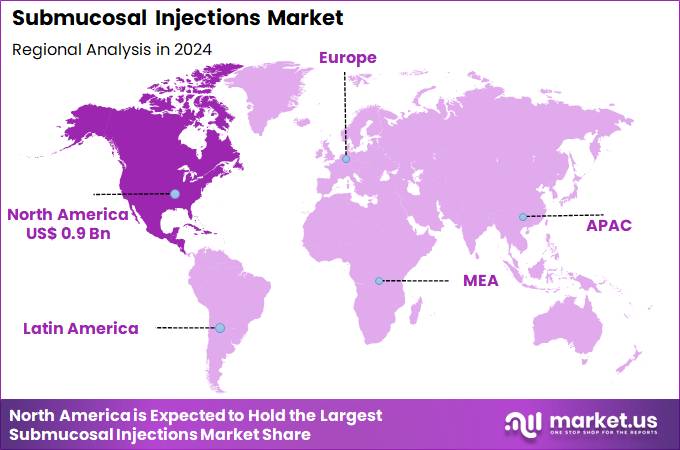

The Global Submucosal Injections Market size is expected to be worth around US$ 4.0 Billion by 2034 from US$ 2.3 Billion in 2024, growing at a CAGR of 5.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 0.9 Billion.

Growing adoption of endoscopic resection techniques drives demand for submucosal injections that create a reliable fluid cushion, separating diseased tissue from underlying muscle layers during therapeutic procedures. Gastroenterologists increasingly perform endoscopic submucosal dissection for early-stage esophageal and colorectal neoplasms, utilizing saline or viscous solutions to elevate lesions and minimize perforation risks. These injections facilitate piecemeal endoscopic mucosal resection in larger flat polyps, ensuring complete removal while preserving healthy mucosa.

Clinicians apply submucosal lifting agents in gastric neoplasia management, enhancing visualization and precision during en bloc excisions. These tools support hemostatic interventions by delivering epinephrine mixtures to control bleeding from post-polypectomy sites.

In 2025, Olympus Corporation retained an estimated 70% share of the global gastrointestinal endoscope market, reinforcing its leadership position in endoscopic technologies. This scale provides a strong installed base for the use of Olympus-compatible submucosal injection tools, supporting procedural adoption and contributing to the company’s solid financial performance for the fiscal year ending March 31, 2025.

Manufacturers pursue opportunities to develop longer-lasting submucosal lifting solutions with hyaluronic acid derivatives, extending elevation duration for complex endoscopic submucosal dissection procedures. Developers engineer dye-containing injectables that improve lesion demarcation, facilitating accurate margin identification in colorectal and esophageal resections. These advancements broaden applications in therapeutic endoscopic retrograde cholangiopancreatography, where submucosal injections aid in ampullary adenoma removal.

Opportunities emerge in creating low-viscosity agents optimized for narrow-channel endoscopes, enabling precise delivery in pediatric and small-anatomy cases. Companies advance combination formulations that integrate hemostatic agents with lifting solutions, enhancing safety during high-risk mucosal resections. Firms invest in biodegradable viscous polymers that maintain tissue separation while reducing post-procedural inflammation in gastric and duodenal interventions.

Industry leaders introduce prefilled syringes with standardized volumes to streamline workflow efficiency in high-volume endoscopy suites performing submucosal dissections. Developers refine needle designs with adjustable depth control, minimizing inadvertent muscular layer penetration during esophageal and rectal procedures. Market participants prioritize biocompatible, non-dye alternatives that avoid obscuring tissue planes in advanced imaging-assisted resections.

Innovators incorporate real-time pressure monitoring features into injection systems, optimizing fluid delivery and reducing complications in technically challenging lesions. Companies emphasize training programs that integrate submucosal injection proficiency with advanced endoscopic techniques, elevating procedural success rates across therapeutic indications. Ongoing advancements focus on cost-effective, single-use injection systems that maintain sterility and performance in routine and complex gastrointestinal endoscopic resections.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.3 Billion, with a CAGR of 5.7%, and is expected to reach US$ 4.0 Billion by the year 2034.

- The type of agent segment is divided into eleview and orise gel, succinylated gelatin, normal saline, hydroxypropyl methylcellulose, hydroxyethyl starch, hyaluronic acid, fibrinogen mixture and dextrose water, with eleview and orise gel taking the lead in 2024 with a market share of 42.8%.

- Considering application, the market is divided into colorectal cancer, esophageal cancer and gastric cancer. Among these, colorectal cancer held a significant share of 56.4%.

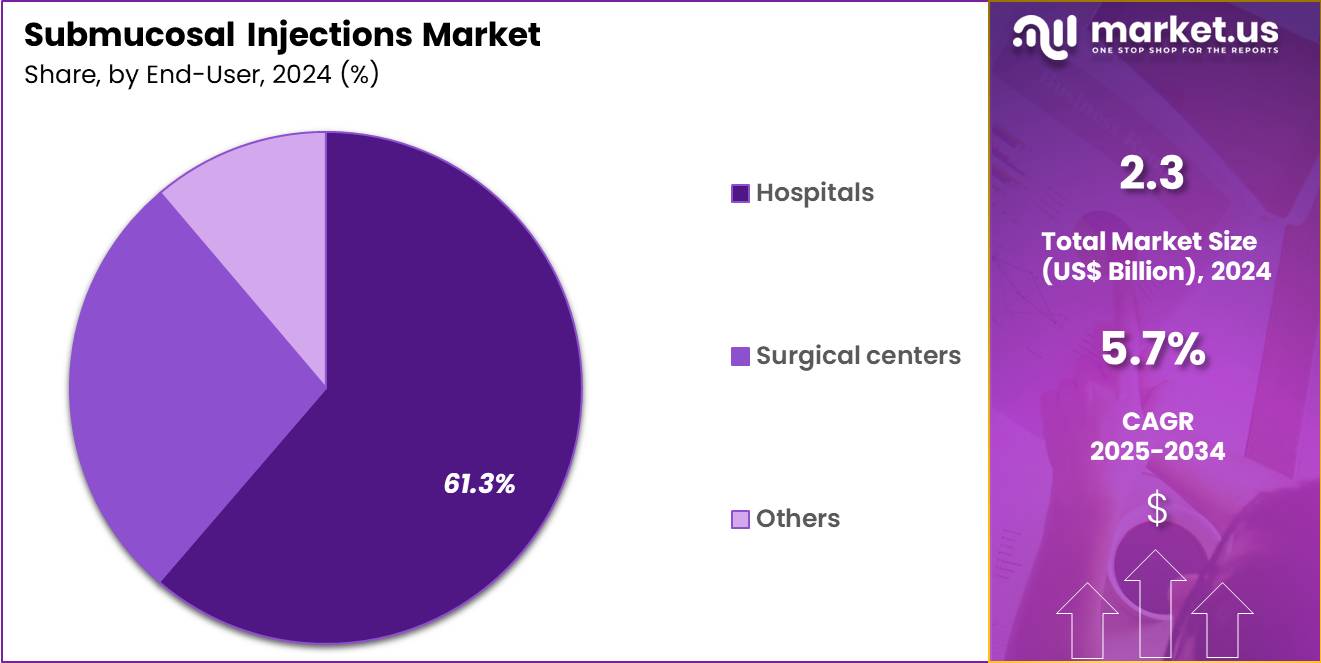

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, surgical centers and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 3% in the market.

- North America led the market by securing a market share of 38.4% in 2024.

Type of Agent Analysis

Eleview and Orise Gel accounted for 42.8% of growth within the type of agent category and form the backbone of the Submucosal Injections market. Endoscopists increasingly prefer ready-to-use viscous lifting agents during complex resections. These agents create durable submucosal cushions that support safer endoscopic mucosal resection procedures. Consistent lifting performance reduces the risk of perforation during advanced polypectomy. Clinicians value predictable injection spread and sustained elevation during lengthy procedures.

Adoption accelerates with growth in minimally invasive gastrointestinal oncology interventions. Eleview and Orise Gel support en bloc resection of large and flat lesions. Improved visualization enhances procedural precision and outcomes. Hospitals emphasize standardized products to reduce procedural variability. Training programs increasingly incorporate these agents into advanced endoscopy protocols. Reduced need for repeated injections shortens procedure time. Efficiency gains support higher case throughput in endoscopy units.

Rising screening programs increase detection of early-stage lesions requiring advanced resection. Product familiarity among gastroenterologists strengthens repeat usage. Compatibility with existing injection devices supports seamless adoption. Safety profiles reinforce clinician confidence across patient populations. Procedure reimbursement structures favor reliable lifting agents. Innovation in formulation sustains performance differentiation. The segment is projected to maintain leadership due to clinical preference. Overall growth reflects procedural efficiency and outcome reliability.

Application Analysis

Colorectal cancer captured 56.4% of growth within the application category and represents the largest clinical driver of submucosal injection demand. Screening initiatives increase early detection of colorectal lesions. Early-stage tumors frequently require endoscopic mucosal and submucosal resections. Submucosal injections support safe separation of lesions from the muscular layer. Rising incidence among aging populations expands procedural volumes.

Gastroenterologists increasingly manage colorectal neoplasia through minimally invasive approaches. Reduced hospital stay and recovery time support endoscopic treatment preference. Submucosal lifting agents improve margin control during resections. Hospitals prioritize colorectal oncology pathways due to high patient throughput. Advanced endoscopy adoption grows faster in colorectal indications. Precision resection lowers recurrence rates and follow-up interventions.

Improved patient outcomes strengthen clinician reliance on injection-assisted techniques. Colorectal procedures dominate endoscopy unit utilization. Continuous guideline updates reinforce endoscopic management of early colorectal cancer. Demand rises with expansion of population-based screening programs. Training in advanced colorectal resection increases specialist availability.

Technological integration enhances procedural success rates. Reimbursement stability supports sustained application growth. The segment is anticipated to remain dominant due to epidemiological trends. Growth reflects procedural frequency and clinical effectiveness.

End-User Analysis

Hospitals represented 61.3% of growth within the end-user category and dominate the Submucosal Injections market. Complex endoscopic oncology procedures concentrate within hospital settings. Hospitals maintain infrastructure for advanced imaging and intervention. Multidisciplinary teams support comprehensive cancer management. Endoscopy units in hospitals handle high patient volumes.

Availability of trained gastroenterologists supports advanced resection techniques. Hospitals invest in standardized consumables to ensure procedural safety. Emergency preparedness strengthens confidence in complex interventions. Centralized procurement favors consistent use of premium lifting agents. Teaching hospitals drive adoption through training and research. Integration of screening, diagnosis, and treatment improves workflow efficiency.

Hospitals manage patients with multiple comorbidities requiring monitored care. Regulatory oversight reinforces adherence to procedural standards. Expansion of ambulatory endoscopy units within hospitals increases capacity. Data-driven outcome tracking supports protocol refinement. Hospitals lead innovation adoption in minimally invasive oncology. Referral networks funnel complex cases to hospital centers.

Reimbursement models align with hospital-based procedures. The segment is projected to sustain dominance due to care complexity. Overall growth reflects infrastructure strength and procedural concentration.

Key Market Segments

By Type of Agent

- Eleview and ORISE gel

- Succinylated gelatin

- Normal saline

- Hydroxypropyl methylcellulose

- Hydroxyethyl starch

- Hyaluronic acid

- Fibrinogen mixture

- Dextrose water

By Application

- Colorectal Cancer

- Esophageal Cancer

- Gastric Cancer

By End-user

- Hospitals

- Surgical Centers

- Others

Drivers

Increasing number of gastrointestinal endoscopic procedures is driving the market

The submucosal injections market is propelled by the increasing number of gastrointestinal endoscopic procedures, which require injection agents to lift lesions for safe resection in conditions like polyps and early cancers. Healthcare providers rely on these agents to improve visibility and reduce perforation risks during endoscopy, enhancing procedural efficiency. Regulatory bodies emphasize the role of submucosal injections in minimally invasive techniques, supporting market growth through standardized guidelines.

Pharmaceutical companies invest in agent development to meet the demands of rising endoscopy volumes in oncology screening. Clinical protocols integrate injections for endoscopic mucosal resection and submucosal dissection, driving adoption in hospitals. Global health trends in digestive disease management amplify the need for reliable lifting solutions.

Academic research validates injection efficacy in improving outcomes for GI procedures. Patient care benefits from reduced complications with effective submucosal elevation. Economic factors, including cost savings from outpatient endoscopies, further justify market expansion. According to a study in the American Journal of Gastroenterology, an estimated 23.5 million GI endoscopies were performed in 2022.

Restraints

High costs of advanced submucosal injection agents are restraining the market

The submucosal injections market is restrained by the high costs of advanced agents, which include premium pricing for formulations with prolonged lifting duration and enhanced viscosity. Manufacturers face elevated production expenses for sterile, biocompatible solutions, passing these onto healthcare facilities. Regulatory compliance for agent safety adds to financial burdens, deterring widespread adoption in budget-constrained settings. Pharmaceutical distribution challenges increase costs for global supply chains.

Clinical practices in smaller clinics opt for cheaper alternatives, limiting market penetration. Global disparities in healthcare funding exacerbate affordability issues for advanced agents. Academic analyses highlight the impact of costs on procedural accessibility. Patient access is limited in regions with limited reimbursement for endoscopic tools. Economic models project slower growth without cost reductions in agent manufacturing. These factors collectively hinder market expansion by favoring basic saline injections over specialized products.

Opportunities

Growth in endoscopic submucosal dissection procedures is creating growth opportunities

The submucosal injections market offers growth opportunities through the growth in endoscopic submucosal dissection procedures, which demand precise lifting agents for en bloc resection of large lesions. Developers can innovate agents with optimized properties to support these advanced techniques in GI oncology. Regulatory advancements facilitate approvals for agents enhancing dissection safety, encouraging investment. Healthcare systems expand ESD capabilities to treat early-stage cancers, driving demand for reliable injections.

Pharmaceutical partnerships focus on agents compatible with robotic endoscopy for improved precision. Clinical research explores agent applications in esophageal and colorectal procedures for broader indications. Global adoption in emerging markets aligns with infrastructure development for minimally invasive surgery.

Academic collaborations refine agent formulations to minimize adverse events in ESD. Patient outcomes improve with agents enabling complete resection and reduced recurrence. According to Boston Scientific’s 2024 Annual Report, net sales grew 22.4% in Q4 2024, reflecting expansion in endoscopy divisions including submucosal agents.

Impact of Macroeconomic / Geopolitical Factors

Vigorous worldwide economic trends propel investments in endoscopic advancements, surging the submucosal injections market via expanded procedural volumes in advanced healthcare systems. Corporations exploit shifting demographics toward preventive care, which heightens utilization of lifting agents for gastrointestinal interventions. Even so, intensifying global inflation burdens processors with steeper energy and packaging outlays, restricting market reach in budget-strapped locales.

Rising interstate rivalries in vital commodity belts sabotage extraction timelines for gel-based compounds, testing resilience among cross-border participants. Visionaries tackle these obstacles by channeling efforts into modular production setups, which refines responsiveness and taps into untapped resource pools.

Modern US tariffs, typically assessing 10-25% on imported endoscopic aids from Asia-Pacific exporters, overburden external procurers with compliance demands. Native outfits harness this dynamic to upscale assembly lines, invigorating R&D ecosystems and community upliftment within borders. Trailblazing evolutions in viscosity-optimized formulations steadfastly catalyze the field’s trajectory, unlocking expansive opportunities and fortified profitability on a global scale.

Latest Trends

Advancement in thermosensitive in-situ gels for submucosal injections is a recent trend

In 2025, the submucosal injections market has demonstrated a prominent trend toward advancements in thermosensitive in-situ gels, which provide sustained lifting and targeted delivery for conditions like oral submucous fibrosis. Manufacturers are focusing on formulations that gel at body temperature, improving procedural control and reducing agent migration. Healthcare professionals are adopting these gels for painless management in outpatient settings, enhancing patient comfort.

Regulatory reviews are accommodating stability data for these innovative agents in endoscopic applications. Clinical trials are evaluating gel efficacy in reducing fibrosis and inflammation over extended periods. Academic studies are exploring biodegradable polymers for eco-friendly gel designs. Global research networks are standardizing gel properties for consistent performance in diverse climates.

Patient therapies benefit from reduced dosing frequency with sustained-release gels. Ethical protocols are ensuring safety in long-term use for chronic conditions. According to a 2025 study in the International Journal of Pharmaceutics, curcumin thermosensitive in-situ gels achieved effective management of oral submucous fibrosis.

Regional Analysis

North America is leading the Submucosal Injections Market

In 2024, North America held a 38.4% share of the global submucosal injections market, energized by the proliferation of advanced endoscopic techniques for early detection and removal of gastrointestinal neoplasms, where injectable lifting agents facilitate precise mucosal separation to minimize perforation risks during dissections.

Gastroenterologists ramped up utilization of hyaluronic acid and saline-based solutions in colorectal polypectomies and esophageal interventions, supported by updated clinical protocols that emphasize outpatient efficiency amid staffing optimizations.

Regulatory clearances accelerated introductions of viscous, long-lasting formulations, enabling broader applications in bariatric endoscopy for obesity-related complications. Demographic rises in metabolic syndromes heightened procedural volumes for Barrett’s esophagus management, prompting insurers to cover enhanced agents with superior tissue elevation properties.

Hospital systems invested in sterile, pre-filled syringes compliant with biosafety norms, reducing preparation times in high-throughput suites. Collaborative training programs equipped residents with injection skills for complex lesions, bridging gaps in underserved regions. Supply partnerships stabilized access to biocompatible materials, aligning with sustainability mandates. In 2022, an estimated 23.5 million GI endoscopies were performed.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders envision vigorous escalation in submucosal injection solutions across Asia Pacific during the forecast period, propelled by intensifying colorectal screening initiatives amid dietary shifts that exacerbate polyp incidences. Endoscopists incorporate viscous agents into routine mucosal resections, optimizing elevation for flat adenomas in high-prevalence gastric cancer zones.

Health ministries allocate funds for procedural kits in public facilities, equipping them to handle surges from aging urban dwellers. Biotech developers tailor saline hybrids with prolonged dwell times, suiting humid environments vulnerable to rapid dissipation. Cross-national research groups validate novel polymers through trials, enhancing safety for esophageal variceal therapies.

Pharmaceutical exporters adapt formulations to local pharmacodynamics, fostering compliance in diverse ethnic cohorts. Community clinics train technicians on injection methodologies, extending reach to peripheral areas facing diagnostic delays. In 2022, Asia accounted for 50.2% of global colorectal cancer cases, with 966.4 thousand new cases.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Submucosal Injections market drive growth by developing advanced lifting agents that improve lesion elevation, procedural visibility, and safety during endoscopic resections. Companies expand adoption by collaborating closely with gastroenterologists and endoscopy centers to embed injection solutions into standardized EMR and ESD workflows.

Commercial strategies emphasize clinical evidence, training support, and ease-of-use advantages that shorten procedure time and reduce complication risk. Innovation priorities focus on longer-lasting cushions, optimized viscosity, and compatibility with commonly used endoscopic needles.

Market expansion targets regions with rising colorectal cancer screening volumes and growing adoption of minimally invasive endoscopic techniques. Olympus strengthens its position through a comprehensive endoscopy portfolio, deep procedural expertise, and global relationships with endoscopy units that support consistent uptake of submucosal injection solutions.

Top Key Players

- GI Supply

- Cosmo Pharmaceuticals N.V.

- ERBE Elektromedizin GmbH

- Boston Scientific

- Olympus Corporation

- Taewoong Medical

- Endo-Flex GmbH

- Medtronic

- Seikagaku Corp

- Ovesco Endoscopy AG

Recent Developments

- In 2024, Boston Scientific recorded annual revenue of US$16.747 billion, reflecting a 17.61% year-on-year increase, supported by strong uptake across its endoscopy portfolio. This positive trajectory extended into the third quarter of 2025, when revenue reached US$5.065 billion, driven in part by sustained demand in the endoscopy segment that includes the ORISE submucosal gel used in advanced gastrointestinal procedures.

- In fiscal year 2025, Medtronic reported that its Surgical and Endoscopy segment delivered US$6.498 billion in revenue, underscoring the segment’s role as a consistent contributor within the company’s total revenue base of US$33.537 billion. Products such as the Eleview submucosal injectable composition continued to support procedural volumes in minimally invasive endoscopic interventions, reinforcing the segment’s stability.

Report Scope

Report Features Description Market Value (2024) US$ 2.3 Billion Forecast Revenue (2034) US$ 4.0 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Agent (Eleview and ORISE Gel, Succinylated Gelatin, Normal Saline, Hydroxypropyl Methylcellulose, Hydroxyethyl Starch, Hyaluronic Acid, Fibrinogen Mixture and Dextrose Water), By Application (Colorectal Cancer, Esophageal Cancer and Gastric Cancer), By End-User (Hospitals, Surgical Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GI Supply, Cosmo Pharmaceuticals N.V., ERBE Elektromedizin GmbH, Boston Scientific, Olympus Corporation, Taewoong Medical, Endo-Flex GmbH, Medtronic, Seikagaku Corp, Ovesco Endoscopy AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Submucosal Injections MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Submucosal Injections MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- GI Supply

- Cosmo Pharmaceuticals N.V.

- ERBE Elektromedizin GmbH

- Boston Scientific

- Olympus Corporation

- Taewoong Medical

- Endo-Flex GmbH

- Medtronic

- Seikagaku Corp

- Ovesco Endoscopy AG