Global Steel Rebar Market Size, Share and Future Trends Analysis Report By Product (Deformed, Mild), By Process (Basic Oxygen Steelmaking, Electric Arc Furnace), By Application (Construction, Infrastructure, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148438

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

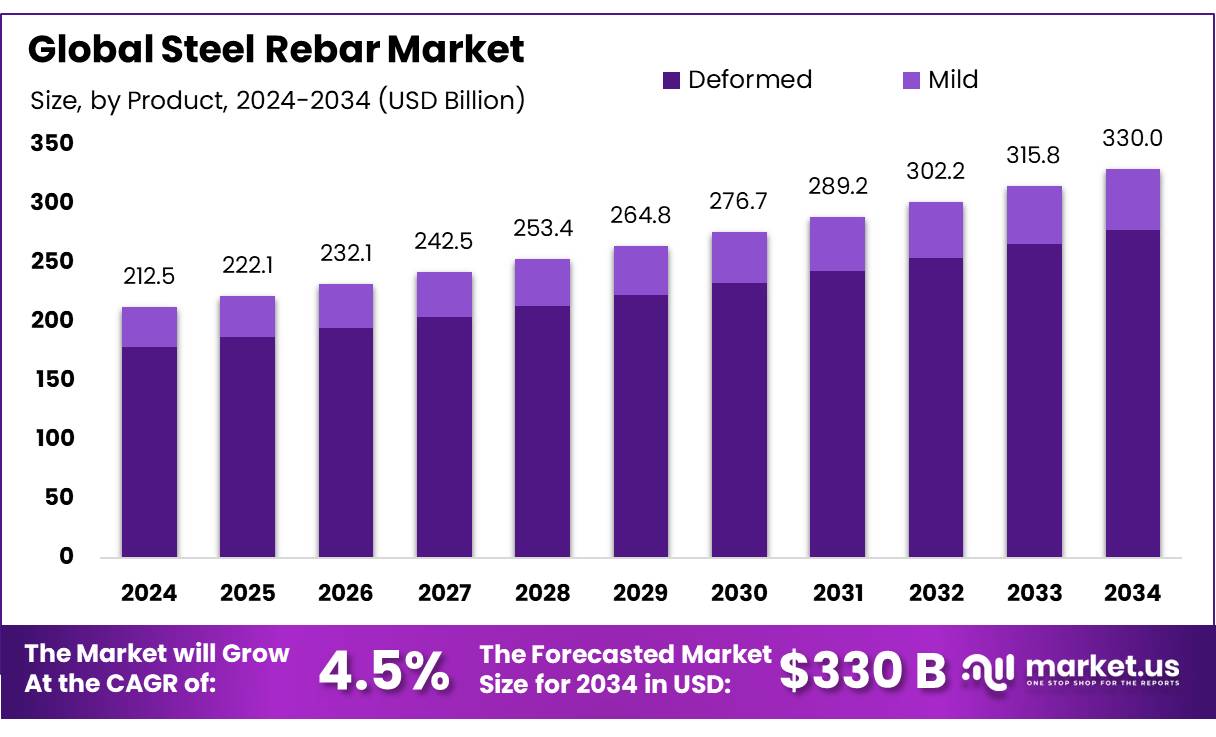

The Global Steel Rebar Market size is expected to be worth around USD 330.0 Billion by 2034, from USD 212.5 Bn in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The steel rebar industry in India is experiencing robust growth, underpinned by the nation’s expansive infrastructure development and urbanization efforts. Steel rebars, essential for reinforcing concrete structures, are integral to the construction of buildings, bridges, roads, and other infrastructural projects.

The Indian government’s commitment to infrastructure is evident in its allocation of ₹11.11 trillion (approximately $132.85 billion) for infrastructure spending in the financial year ending March 2025. This investment, representing 3.4% of the nation’s GDP, aims to stimulate economic growth and job creation, thereby driving demand for construction materials like steel rebars.

Technological advancements in steel manufacturing, such as the adoption of Thermo-Mechanically Treated (TMT) bars, have improved the quality and strength of steel rebars, making them more suitable for modern construction requirements. Additionally, the government’s Production-Linked Incentive (PLI) scheme for specialty steel aims to attract investments worth ₹40,000 crore, which is likely to add 25 million tonnes of capacity by 2026-27.

The steel rebar industry in India is poised for sustained growth, driven by continuous infrastructure development, supportive government policies, and technological innovations. As the country progresses towards its goal of becoming a $5 trillion economy, the demand for steel rebars is expected to remain strong, offering significant opportunities for stakeholders in the sector.

Key Takeaways

- Steel Rebar Market size is expected to be worth around USD 330.0 Billion by 2034, from USD 212.5 Bn in 2024, growing at a CAGR of 4.5%.

- Deformed steel rebar held a dominant market position, capturing more than an 84.2% share of the steel rebar market.

- Basic Oxygen Steelmaking held a dominant market position, capturing more than a 68.1% share of the steel rebar market.

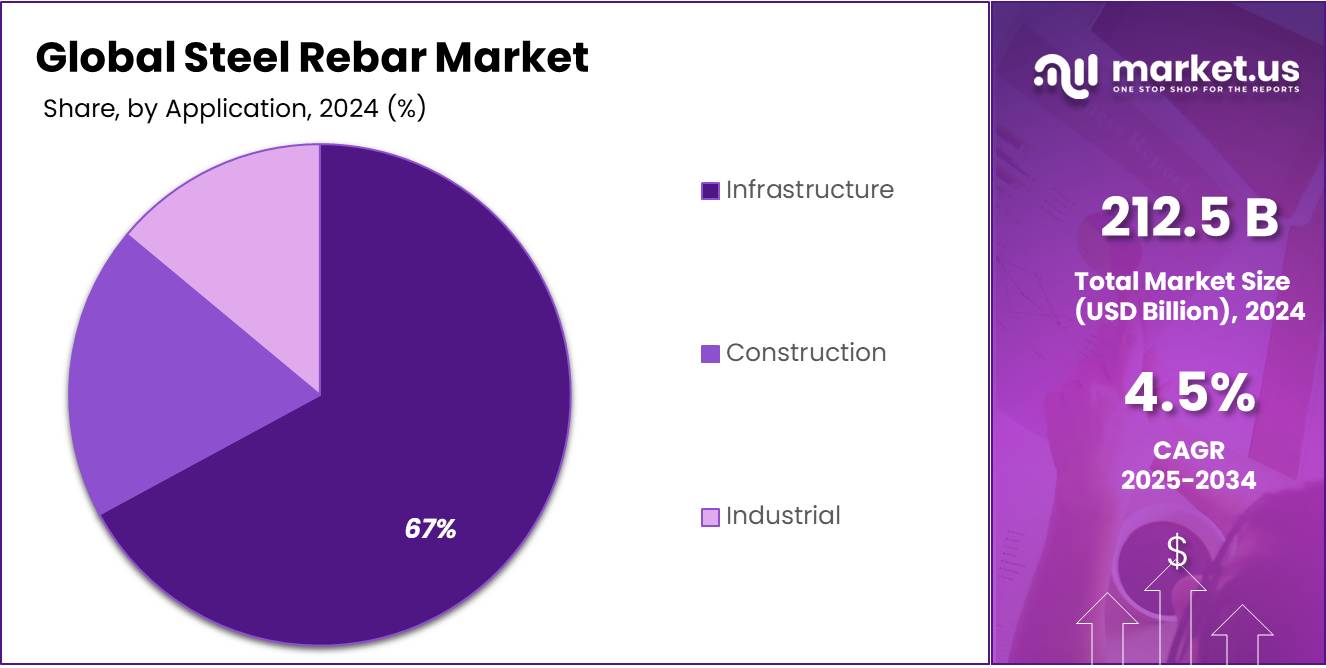

- Infrastructure held a dominant market position, capturing more than a 67.3% share of the steel rebar market by application.

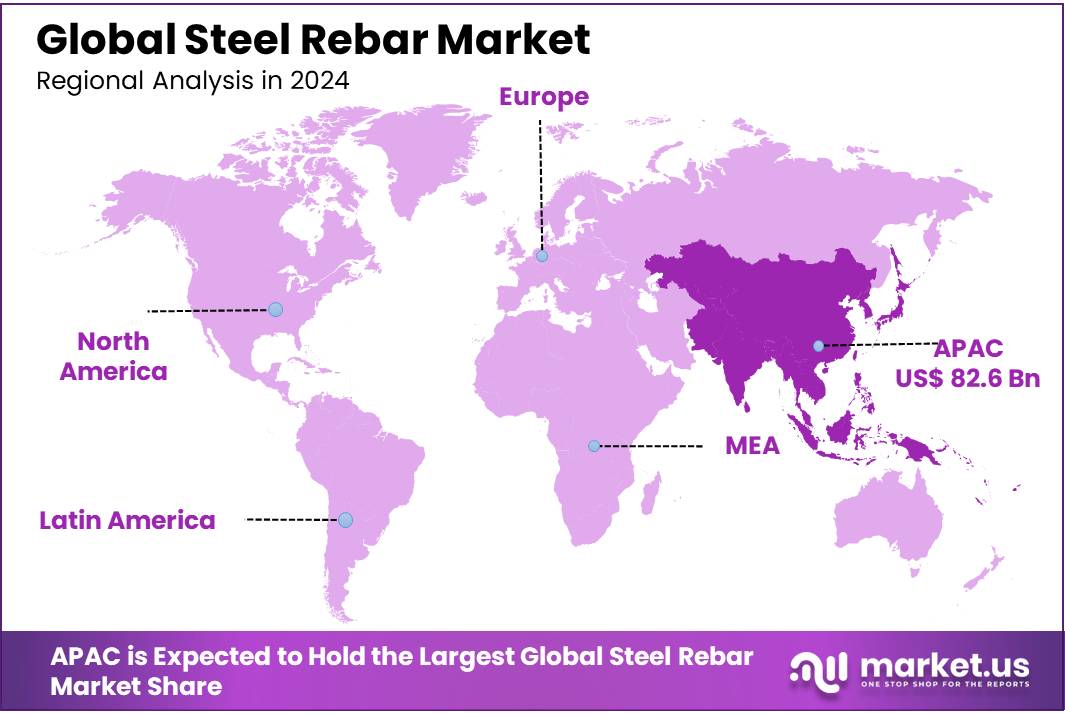

- Asia Pacific (APAC) region led the global steel rebar market, capturing a dominant share of 38.9%, valued at approximately USD 82.6 billion.

By Product

Deformed Steel Rebar Dominates with 84.2% Share in 2024

In 2024, Deformed steel rebar held a dominant market position, capturing more than an 84.2% share of the steel rebar market. The significant market share of Deformed rebar is attributed to its widespread use in construction due to its superior strength and durability. This product is widely favored for use in large-scale infrastructure projects, such as bridges, highways, and high-rise buildings, where structural integrity is critical. Its ability to resist bending and twisting under pressure makes it the preferred choice for engineers and contractors. With growing urbanization and infrastructure development globally, the demand for Deformed steel rebar is expected to maintain its strong position in the market through 2025.

By Process

Basic Oxygen Steelmaking Dominates with 68.1% Share in 2024

In 2024, Basic Oxygen Steelmaking held a dominant market position, capturing more than a 68.1% share of the steel rebar market by process. This process is widely favored due to its efficiency and cost-effectiveness in producing high-quality steel rebar. The Basic Oxygen Steelmaking process involves blowing oxygen through molten iron to produce steel, which is ideal for producing large quantities of steel rebar used in construction and infrastructure projects.

With its ability to handle large-scale production volumes and meet the growing demand for steel in the construction sector, Basic Oxygen Steelmaking is expected to maintain its leading position in the market throughout 2025. The process continues to benefit from technological advancements that improve production efficiency and reduce emissions, further solidifying its market dominance.

By Application

Infrastructure Dominates with 67.3% Share in 2024

In 2024, Infrastructure held a dominant market position, capturing more than a 67.3% share of the steel rebar market by application. The increasing demand for infrastructure development, including roads, bridges, and tunnels, has significantly contributed to the rise in steel rebar usage in this sector. Steel rebar is essential in providing strength and durability to these large-scale construction projects.

As governments and private sector players continue to invest in infrastructure development worldwide, the demand for steel rebar for infrastructure applications is projected to remain strong through 2025. This trend is driven by urbanization, rising populations, and the need for upgraded transportation networks, further bolstering the market’s dominance in infrastructure applications.

Key Market Segments

By Product

- Deformed

- Mild

By Process

- Basic Oxygen Steelmaking

- Electric Arc Furnace

By Application

- Construction

- Infrastructure

- Industrial

Drivers

Increased Demand for Infrastructure Development Drives Steel Rebar Market Growth

One major driving factor for the growth of the steel rebar market is the increasing demand for infrastructure development worldwide. As countries focus on upgrading and expanding their infrastructure, the need for high-strength, durable materials like steel rebar is growing. This trend is particularly strong in emerging economies where rapid urbanization and infrastructure projects are accelerating at a fast pace.

According to the World Bank, global infrastructure investment needs are expected to reach around US$ 94 trillion by 2040 to meet the growing demands of developing nations. This investment will require massive amounts of construction materials, with steel rebar playing a crucial role in ensuring the stability and longevity of infrastructure projects.

Governments around the world are prioritizing large-scale infrastructure projects, including roads, bridges, airports, and residential complexes, which directly contribute to the rising demand for steel rebar. For example, the U.S. government allocated US$1.2 trillion for infrastructure development under the 2021 Infrastructure Investment and Jobs Act, underscoring the need for reliable construction materials like steel rebar.

This focus on infrastructure development is expected to continue through 2025, driving a steady increase in the consumption of steel rebar. Additionally, technological advancements in construction techniques and government-backed initiatives to boost the construction sector further contribute to this demand. As nations work towards enhancing urban infrastructure to meet the needs of growing populations, the steel rebar market will continue to benefit from these long-term growth drivers. The integration of sustainable construction practices, such as the use of recycled steel, is also contributing to the market’s expansion, meeting both environmental and structural demands in modern construction projects.

Restraints

Fluctuating Raw Material Prices Challenge Steel Rebar Market Stability

One significant restraint on the steel rebar market is the volatility in raw material prices, particularly iron ore, scrap steel, and coal. These fluctuations can lead to unpredictable production costs for manufacturers, affecting pricing strategies and profit margins. For instance, between May 2024 and January 2025, India’s Hot Rolled Coil (HRC) prices declined by over 13%, indicating pressure on the domestic steel industry .

Such price volatility can create uncertainty in the marketplace, making it challenging for manufacturers to maintain consistent pricing and profitability. This unpredictability may also deter investment in the sector, as stakeholders seek more stable and reliable markets. Moreover, continuous high prices may make steel rebar unaffordable for sectors reliant on cost-effective materials, potentially reducing demand from construction and infrastructure projects .

Additionally, the steel rebar production process is energy-intensive, consuming significant amounts of electricity and fuel. Rising energy prices further increase operational costs for manufacturers, impacting their profit margins. The pressure to adopt greener energy sources to meet environmental regulations adds complexity and expense to the production process .

Opportunity

Government Infrastructure Investments Propel Steel Rebar Demand

India’s steel rebar market is poised for significant growth, driven by substantial government infrastructure investments. The Indian government has committed approximately ₹102 lakh crore (USD 1.4 trillion) to infrastructure projects between FY2020 and FY2025, encompassing sectors such as roads, railways, energy, and urban development . This extensive investment is expected to boost steel demand, with projections indicating an annual growth rate of 8% in steel consumption for 2024 and 2025 .

Key initiatives contributing to this demand include the Bharatmala scheme, which aims to develop 35 multi-modal logistics parks, and the Sagarmala project, focusing on port and coastal infrastructure modernization with an investment exceeding USD 80 billion . Additionally, the government’s Urban Infrastructure Development Fund, with an annual outlay of ₹10,000 crore, is facilitating the development of urban infrastructure in tier 2 and 3 cities .

These initiatives are expected to drive a robust demand for steel rebar, particularly in construction and infrastructure sectors, thereby presenting significant growth opportunities for stakeholders in the steel rebar market

Trends

Surge in Infrastructure Investments Driving Steel Rebar Demand

In 2024, the steel rebar market is witnessing significant growth, primarily fueled by substantial infrastructure investments worldwide. Governments are allocating considerable funds to develop and upgrade transportation networks, urban infrastructure, and public facilities, leading to an increased demand for steel rebar, a critical component in reinforced concrete structures.

For instance, the United States has committed approximately $1.2 trillion under the Infrastructure Investment and Jobs Act to modernize roads, bridges, and public transit systems. This massive investment is expected to boost the demand for construction materials, including steel rebar, across the country.

Similarly, in India, the government’s ambitious Bharatmala Pariyojana aims to enhance road connectivity by expanding the national highway network. The initiative includes the development of 35 multi-modal logistics parks, further stimulating the demand for steel rebar in infrastructure projects.

In the Asia-Pacific region, countries like China are also investing heavily in infrastructure. The Chinese government’s allocation of over $573 billion to local governments for infrastructure projects underscores the region’s commitment to urban development, thereby increasing the consumption of steel rebar.

Regional Analysis

Asia Pacific Steel Rebar Market: Dominating with 38.9% Share in 2024

In 2024, the Asia Pacific (APAC) region led the global steel rebar market, capturing a dominant share of 38.9%, valued at approximately USD 82.6 billion. This robust performance is primarily driven by rapid urbanization, substantial infrastructure investments, and a burgeoning construction sector across key economies such as China, India, and Vietnam.

India’s steel rebar market is also experiencing significant growth, propelled by government initiatives such as the Smart Cities Mission and Housing for All by 2022. These programs aim to address urban housing shortages and modernize infrastructure, leading to increased demand for steel rebar. The Indian government’s decision to raise its capital expenditure allocation to USD 133.86 billion in the 2024 Budget further amplifies investments in transportation networks, urban development, and public utilities, thereby stimulating the steel rebar market .

Vietnam is emerging as the fastest-growing market within the region, with a projected compound annual growth rate (CAGR) of over 18% through 2030. This growth is attributed to rapid urbanization and industrialization, necessitating substantial infrastructure development and, consequently, a higher demand for steel rebar.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Abbott Laboratories, primarily known for its healthcare solutions, has ventured into providing high-quality steel rebar materials for construction and infrastructure. The company has adopted advanced manufacturing techniques, ensuring the durability and strength of their steel products. Their steel rebar solutions cater to projects in urban development and large-scale infrastructure, contributing significantly to the steel rebar market in North America and Europe.

BASF SE, a global leader in chemical manufacturing, has integrated sustainable practices into the steel rebar market. Known for producing construction chemicals, BASF supplies additives that enhance the performance of steel rebar, increasing corrosion resistance and lifespan. Their innovations, like the development of high-strength steel solutions, are transforming the construction industry, supporting large infrastructure projects globally, particularly in Europe and Asia.

Biosynth Carbosynth is known for its precision manufacturing and high-performance steel rebar products, focusing on the precision engineering of materials for critical infrastructure. The company is making inroads into the construction sector by providing advanced steel rebar that meets specific environmental and durability standards. They cater primarily to large-scale, government-backed infrastructure projects in North America, with a strong emphasis on sustainable construction practices.

Top Key Players in the Market

- ArcelorMittal

- Nucor

- Nippon Steel Corporation

- NLMK

- Tata Steel

- JSW

- Shagang Group Inc

- Steel Authority of India Limited (SAIL)

- POSCO

- HBIS Group

- Gerdau S/A

- Commercial Metals Company (CMC)

- Acerinox S.A

- Daido Steel Co Ltd

- Steel Dynamics, Inc

Recent Developments

In 2024, BASF’s innovations contributed to the development of high-performance steel rebar products, addressing the growing demand for durable and sustainable construction materials.

Biosynth Carbosynth, a global leader in life sciences reagents and custom synthesis services, does not appear to be involved in the steel rebar market.

Report Scope

Report Features Description Market Value (2024) USD 212.5 Bn Forecast Revenue (2034) USD 330.0 Bn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Deformed, Mild), By Process (Basic Oxygen Steelmaking, Electric Arc Furnace), By Application (Construction, Infrastructure, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ArcelorMittal, Nucor, Nippon Steel Corporation, NLMK, Tata Steel, JSW, Shagang Group Inc, Steel Authority of India Limited (SAIL), POSCO, HBIS Group, Gerdau S/A, Commercial Metals Company (CMC), Acerinox S.A, Daido Steel Co Ltd, Steel Dynamics, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ArcelorMittal

- Nucor

- Nippon Steel Corporation

- NLMK

- Tata Steel

- JSW

- Shagang Group Inc

- Steel Authority of India Limited (SAIL)

- POSCO

- HBIS Group

- Gerdau S/A

- Commercial Metals Company (CMC)

- Acerinox S.A

- Daido Steel Co Ltd

- Steel Dynamics, Inc