Global Starter Culture Market Size, Share, And Business Benefits By Type (Bacteria, Yeast, Molds), By Form (Dried, Frozen, Liquid), By Application (Dairy Products, Alcoholic Beverages, Non-Alcoholic Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165348

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

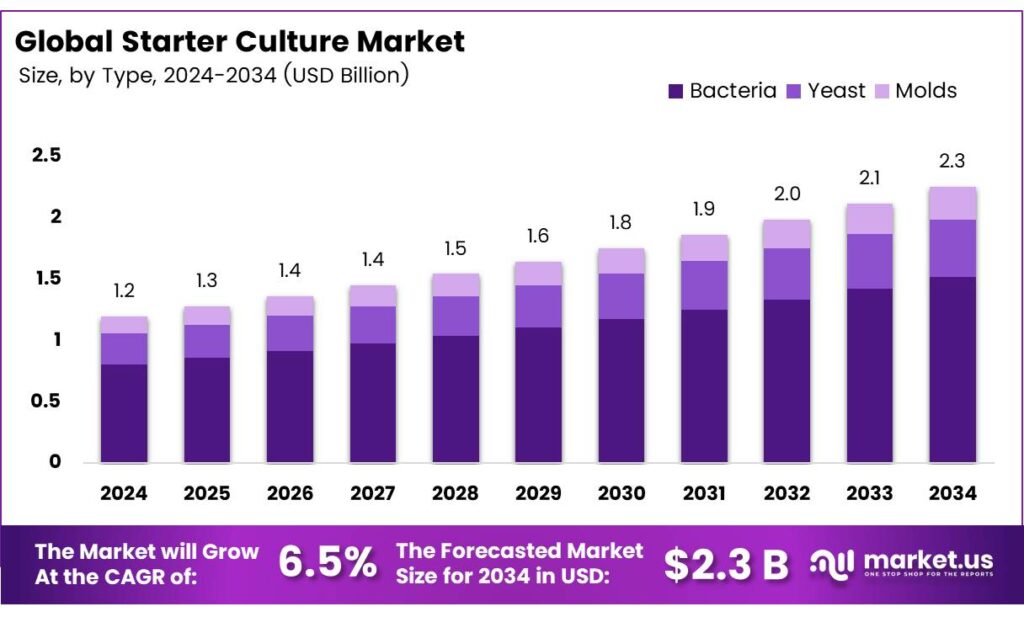

The Global Starter Culture Market size is expected to be worth around USD 2.3 billion by 2034, from USD 1.2 billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

Starter cultures are mixed fermentations that combine selected yeast strains, including non-Saccharomyces yeasts and Saccharomyces cerevisiae, to modulate the production of target metabolites in food processes. By leveraging the unique metabolic traits of different yeast species, these cultures enhance overall fermentation outcomes. They are a vital element in nearly all commercially produced fermented foods.

In simple terms, starter cultures consist of microorganisms deliberately inoculated into food materials to drive predictable and desirable transformations in the final product, such as improved preservation, enhanced nutritional value, altered sensory properties, and greater economic worth. While many fermented foods can be produced without them, adding concentrated microorganisms via starter cultures ensures consistent manufacturing schedules and uniform product quality.

Lactococcus lactis ssp. Cremoris and Leuconostoc species can be sub-cultured up to 50 times without risk of mutation. These cultures are incubated either at 22°C for 16–18 hours or at 30°C for 8–10 hours, using a 1% inoculum. Yogurt cultures, in contrast, can be sub-cultured 15–20 times. They are incubated at 42°C for 3–4 hours with a 1–2% inoculum and can be stored for one week without loss of activity.

- For long-term preservation, cultures are frozen in liquid nitrogen at –196°C using sterile reconstituted skim milk powder (SMP) at 16% solids. Single-strain cultures are inoculated at 2% (v/v), dispensed in 4 ml aliquots into sterile polypropylene screw-top tubes, and rapidly frozen at –196°C. This cryogenic method prevents the formation of large ice crystals, halting all biochemical processes and placing the cells in a state of suspended animation.

Liquid starter cultures are the most common form, preserved in small amounts and maintained by weekly or daily sub-culturing in reconstituted skim milk or litmus milk. Prepare antibiotic-free non-fat dry milk to 10–12% solids, autoclave at 10–15 psi, and confirm sterility by incubating at 30°C for one week. Fermented foods rely on back-slopping, natural microbes on raw materials, or porous containers to carry cultures. These methods create unique varieties and persist in small-scale, developing, or home settings.

Key Takeaways

- The Global Starter Culture Market is projected to grow from USD 1.2 billion in 2024 to USD 2.3 billion by 2034 at a CAGR of 6.5%.

- Bacteria dominated the By Type segment in 2024 with a 67.3% share due to efficient lactic acid production and industrial scalability.

- Dried form led the By Form segment in 2024 with 59.7% share, offering preserved viability, easy transport, and sustainability benefits.

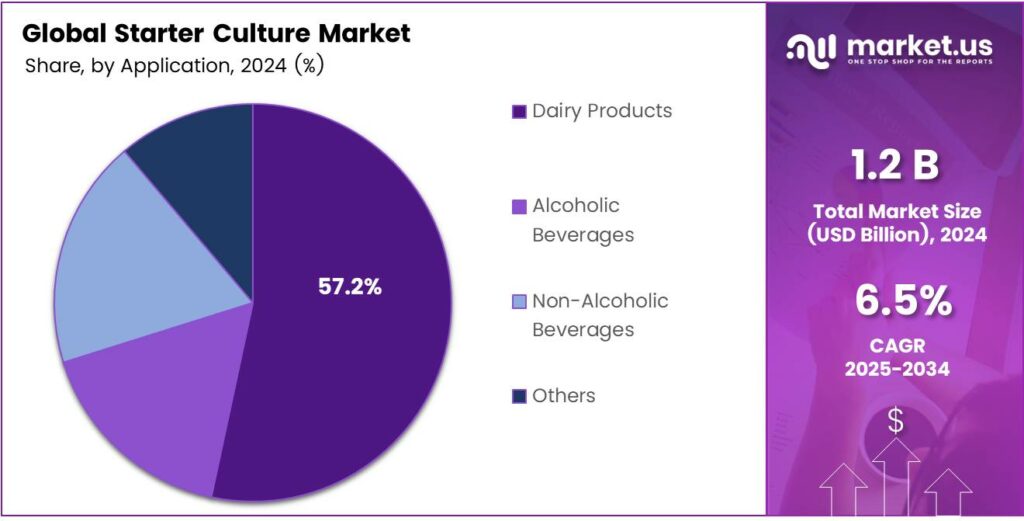

- Dairy Products held the largest share in the By Application segment in 2024 at 57.2%, driven by demand for yogurt, cheese, and probiotic products.

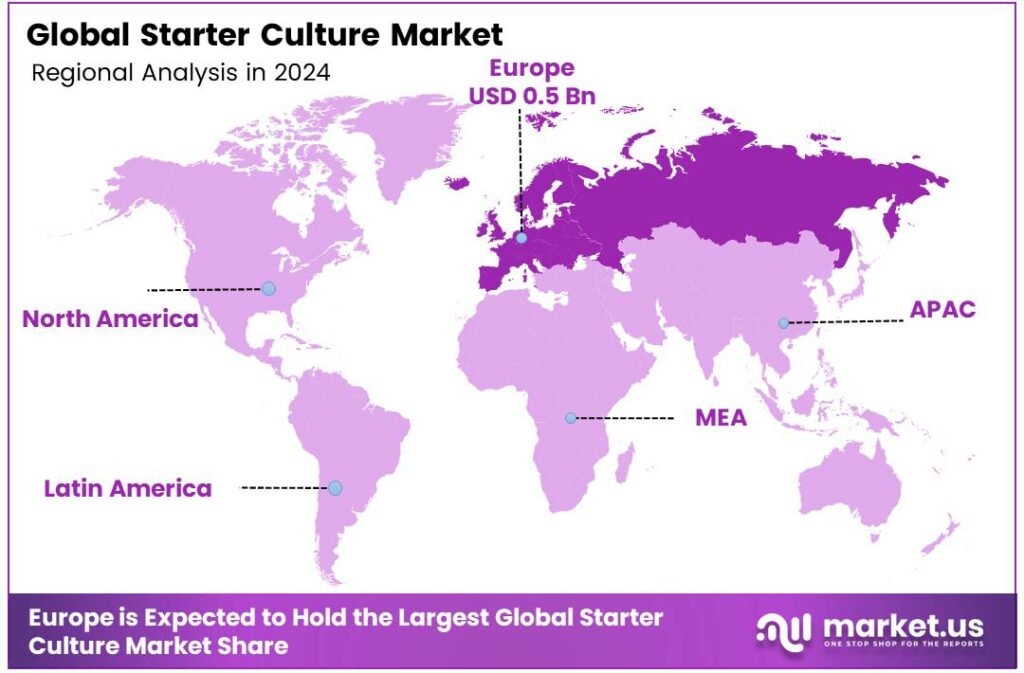

- Europe commanded 45.8% of the global market in 2024, valued at USD 0.5 billion, fueled by strong dairy traditions and fermented product demand.

By Type Analysis

Bacteria dominate with 67.3% due to their essential role in fermentation processes.

In 2024, Bacteria held a dominant market position in the By Type Analysis segment of the Starter Culture Market, with a 67.3% share. This sub-segment thrives because bacteria efficiently initiate lactic acid production, enhancing flavor in various foods. Manufacturers prefer it for its reliability and scalability in industrial settings.

Yeast plays a vital role in the Starter Culture Market, particularly in baking and brewing. It ferments sugars into alcohol and carbon dioxide, creating light textures and aromas. While not dominating, yeast supports diverse applications, from bread rising to beer production. Its natural occurrence in environments aids easy integration.

Molds contribute uniquely to cheese and soy product ripening in the Starter Culture Market. They develop complex flavors and textures through enzymatic breakdown. Though smaller in share, molds enable specialty items like blue cheese. Researchers enhance mold strains for better safety and efficiency. This sub-segment grows steadily, fueled by gourmet food trends and global cuisine exploration.

By Form Analysis

Dried dominates with 59.7% due to its long shelf life and ease of storage.

In 2024, Dried held a dominant market position in the By Form Analysis segment of the Starter Culture Market, with a 59.7% share. This form preserves microbial viability during transport, reducing spoilage risks. It suits large-scale operations, allowing quick rehydration. As sustainability rises, dried cultures minimize waste and energy use.

Frozen starter cultures maintain high potency in the market, ideal for sensitive strains. Freezing halts metabolic activity, preserving activity levels over time. Commonly used in premium dairy, it ensures consistent results. While handling requires cold chains, frozen forms support batch flexibility. Advancements in cryoprotectants enhance viability, meeting needs in high-quality fermentation.

Liquid cultures provide immediate usability in the Starter Culture Market, skipping rehydration steps. They deliver uniform distribution in small-scale productions. Though prone to shorter shelf life, liquids excel in fresh applications like yogurt making. Innovations in stabilization extend usability. This form appeals to artisanal makers seeking rapid activation and natural processes.

By Application Analysis

Dairy Products dominate with 57.2% due to the high global consumption of fermented dairy.

In 2024, Dairy Products held a dominant market position in the By Application Analysis segment of the Starter Culture Market, with a 57.2% share. These cultures transform milk into yogurt, cheese, and kefir, enhancing nutrition and taste. Rising health awareness boosts probiotic-rich dairy demand. Producers leverage them for texture control and shelf extension.

Alcoholic Beverages rely on starter cultures for consistent fermentation in wines, beers, and spirits. Yeasts convert sugars efficiently, defining flavor profiles. The craft boom accelerates the adoption of specialized strains. While seasonal, this application grows with premiumization trends. Cultures ensure quality, reducing off-flavors and supporting global exports.

Non-Alcoholic Beverages incorporate starter cultures for kombucha and fermented teas, promoting wellness. They generate fizz and tang without alcohol. Emerging as health drinks, these products attract younger consumers. Cultures aid natural preservation, aligning with clean-label demands. This sub-segment expands rapidly, fueled by functional beverage innovations.

Key Market Segments

By Type

- Bacteria

- Yeast

- Molds

By Form

- Dried

- Frozen

- Liquid

By Application

- Dairy Products

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Others

Emerging Trends

Growing Demand for Clean-Label & Functional Fermented Foods

One major emerging trend in starter cultures is the surge in clean-label and functional fermented food products, driven by consumers seeking more natural, health-oriented options. The core of this trend lies in how starter cultures, microbial preparations used to initiate fermentation, are no longer just about making cheese or yogurt.

In the dairy and fermented-plant sectors, consumers are increasingly looking for minimally processed items, probiotic-rich products, and transparent production practices. Traditional fermented milks made using defined starter cultures are described by the Food and Agriculture Organization (FAO) materials as a milk product. prepared by the action of specific microorganisms known as starter cultures.

In India, the Department of Biotechnology (DBT) issued a call for proposals focused on Traditional Fermented Foods of the North Eastern Region that explicitly targets the commercialisation of starter cultures, scale-up, and functional-food development. This shows government recognition of starter culture development as part of food innovation, rural value-chains, and nutrition strategy.

Drivers

Health-led surge in fermented foods (esp. dairy)

A single, powerful force is pushing starter cultures into the mainstream: people are choosing fermented foods, yogurt, kefir, cultured buttermilk, and fresh cheeses for everyday wellness. The base is huge and still growing. The FAO notes that more than 6 billion people consume milk and milk products, a ready canvas for cultures that turn milk into safe, tasty, longer-lasting foods.

The OECD-FAO Outlook projects world per-capita consumption of fresh dairy products to rise by about 1.0% per year, powered by income gains and urban grocery habits. Each extra bowl of dahi or glass of cultured milk means more dependable demand for starter strains that deliver consistent acidification, texture, and flavor.

- Public policy is also nudging cultures from niche to necessity. In India, the national Eat Right School initiative is embedding safe, nutritious food habits in classrooms. Over 142,000 schools are registered and more than 212,000 activities completed, which reinforces everyday acceptance of curd, lassi, and other fermented staples that rely on robust starters.

Restraints

Fragile cold chains and unreliable power

Starter cultures are living cells. They need tight temperature control from the factory to the dairy plant to survive and perform. In many places, that basic condition still breaks down. The World Health Organization reminds us why this matters: unsafe food sickens about 600 million people and causes 420,000 deaths each year, so processors become extra-cautious, and any lapse in refrigeration or hygiene can force them to discard entire batches rather than risk illness.

Dairy and fermented foods are especially sensitive to temperature swings; when cooling is patchy, cultures lose activity, fermentation becomes unpredictable, and products can taste off or fail micro tests—costly outcomes that make some producers hesitate to scale culture-based lines.

- First, access to cooling is still not universal: over 1 billion people are at high risk from lack of adequate cooling, which includes food cold chains, limiting reliable storage and transport for perishables. Second, electricity access remains uneven; the IEA estimates 730–750 million people lack electricity, making continuous refrigeration and controlled incubation harder for small dairies and village collection centers.

Opportunity

Sugar-reduction reformulation needs smarter starter cultures

Starter cultures do exactly that: they create clean acidity, fuller mouthfeel, and gentle sweetness notes from fermentation so yogurts, cultured milks, and fresh cheeses can meet new limits without tasting thin. The World Health Organization recommends keeping free sugars below 10% of daily energy, with a further cut to 5% as a sensible goal.

- In the United States, Added Sugars must appear on the Nutrition Facts label, and FDA education materials spell out the 10% limit of about 50 g/day on a 2,000-kcal diet. These changes make high-sugar options more visible on the shelf—and make culture-enabled, lower-sugar recipes more valuable to brands.

The UK’s program asked industry to cut sugar by 20% across key categories, including yogurt; independent analyses later observed real movement in the yogurt aisle, with median sugar down 13% over two years, evidence that policy pressure catalyzes reformulation. Cultures that deliver faster acidification, better water binding, and balanced flavor help reach those targets without artificial sweeteners.

Regional Analysis

Europe leads with a 45.8% share and a USD 0.5 Billion market value.

Europe dominates the global starter culture market, accounting for a 45.8% share valued at around USD 0.5 billion in 2024. The region’s leadership stems from its deeply rooted dairy tradition and growing demand for fermented products such as cheese, yogurt, kefir, and probiotic drinks.

Government initiatives encouraging sustainable and clean-label production are another growth pillar. The European Commission’s Farm to Fork strategy promotes sustainable food processing methods and stricter microbial quality standards, which have accelerated investments in microbial fermentation and biotechnology.

Several EU-based biotech firms are developing next-generation cultures for plant-based dairy alternatives, supporting the shift toward vegan and lactose-free products. Additionally, ongoing research programs like Horizon Europe fund microbiome-based innovations for functional foods, further advancing the regional ecosystem.

Europe’s combination of strong dairy heritage, modern fermentation technology, and proactive sustainability policies positions it as the dominant regional hub for starter culture innovation and production, with continued expansion expected across health-oriented and alternative food categories.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dohler provides integrated ingredient systems and solutions, including starter cultures for dairy, meat, and bakery products. Their strength lies in a comprehensive portfolio and strong application expertise, enabling customized solutions for industrial food production. By leveraging their extensive global presence and focus on natural ingredients, they cater to the demand for clean-label products.

Lesaffre is a dominant force in yeast and fermentation. Through its extensive portfolio, including baking yeast and probiotics, the company possesses deep expertise in microbial strains. This knowledge is directly applied to its high-performance starter cultures for dairy, bakery, and health & nutrition markets. Their global manufacturing and R&D network ensures consistent quality and drives innovation in fermentation processes.

Angel Yeast leverages its core expertise in yeast extraction to be a key supplier in the starter culture market. They provide a diverse range of microbial ingredients for baking, dairy, and savory applications. Their competitive advantage stems from strong vertical integration, cost-effectiveness, and a vast production scale. By focusing on biotechnology and expanding its international footprint.

Top Key Players in the Market

- Dohler Group

- Lesaffre Group

- Angel Yeast Co., Ltd.

- Wyeast Laboratories Inc.

- Lallemand Inc

- Lactina Limited.

- Others

Recent Developments

- In 2024, Dohler Ventures marked a decade of investments in emerging consumer packaged goods (CPG), including fermentation technologies for beverages. This includes backing for brands using microbial cultures to enhance flavor and sustainability in fermented drinks. Sebastian Dreher, head of the North American Venture Team.

- In 2024, Lesaffre is a Brazilian yeast producer from Zilor, establishing control of a joint venture for yeast-based ingredients in food and animal feed. This strengthens Lesaffre’s savory fermentation portfolio, including starter cultures for enhanced microbial solutions in dairy and plant-based products.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bacteria, Yeast, Molds), By Form (Dried, Frozen, Liquid), By Application (Dairy Products, Alcoholic Beverages, Non-Alcoholic Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dohler Group, Lesaffre Group, Angel Yeast CO., Limited, Wyeast Laboratories Inc., Lallemand Inc., Lactina Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Starter Culture MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Starter Culture MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dohler Group

- Lesaffre Group

- Angel Yeast Co., Ltd.

- Wyeast Laboratories Inc.

- Lallemand Inc

- Lactina Limited.

- Others