Global Sports Composites Market By Resin Type (Polyurethane, Epoxy, Polyamide, Polypropylene, and Others), By Fiber Type (Carbon Fiber, Glass Fiber, Boron Fiber, and Others), By Application (Golf sticks, Hockey sticks, Racquets, Bicycles, Skies and Snowboards, Windsurfing Masts and Boards, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 128912

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

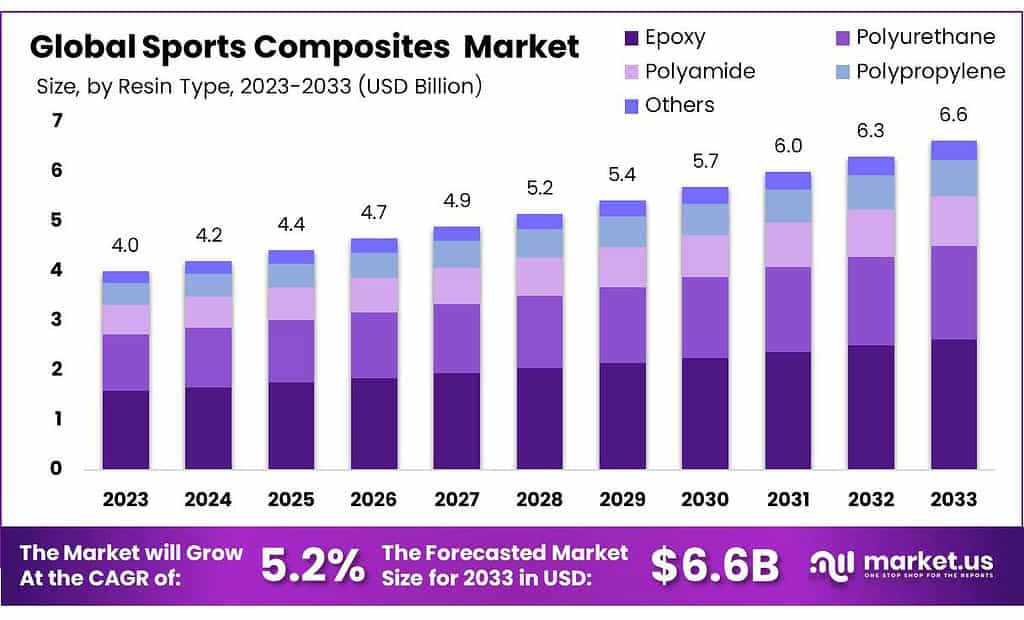

The Global Sports Composites Market size is expected to be worth around USD 6.6 billion by 2033 from USD 4.0 billion in 2023, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

The global sports composites market is rapidly growing owing to the increasing demand for high-performance, lightweight, and durable sports equipment. Sports composites are materials made from a combination of two or more substances, such as carbon fiber, glass fiber, and polymers, which offer enhanced strength, stiffness, and resistance to fatigue.

Using these materials is quintessential in modern sports equipment, including bicycles, golf clubs, tennis rackets, and athletic shoes, as they enable athletes to achieve improved performance, speed, and agility.

The demand for sports composites is expected to grow with the increasing popularity of professional and recreational sports. The advancements in material technology are another factor expected to drive the market as certain high-performance metals such as steel, super alloys, metal powders, and different additives promote better tensile strength and durability, and optimize performance for players.

The increasing global sports tourism is expected to drive the market, as consumers are traveling overseas to play, watch, or experience various sports events such as the Olympics, which is expected to drive the market. For instance, according to the news published by Forbes on July 17, 2024, millions of people traveled to watch the Paris Olympics 2024 and spent about $872 billion in the European economy on this event.

Key Takeaways

- In 2023, the global sports composites market generated a revenue of USD 4.0 billion, with a CAGR of 5.2%, and is expected to reach USD 6.6 billion by the year 2033.

- The type held a major share of the market, with carbon fiber taking the lead in 2023 with a market share of 64.4%.

- By fiber type, carbon fiber among the other sub-segments held a significant revenue share of the market with 54.5% of the global sports composites market.

- By application, golf sticks accounted for the dominant share of 29.2%.

- The North American region led the market by securing a market share of 37.9% in 2023.

- Sports composites are up to 50% lighter than traditionally used materials yet, offer a similar or improved strength and durability.

- Modern sports composites let manufacturers leave immense opportunities to their customers for customizations in terms of materials used, and other personalization parameters.

- Modern additive manufacturing (3D printing) is revolutionizing sports composites, enabling complex geometrics, reduced material waste, and rapid prototypes.

- Eco-friendly materials such as recycled carbon fiber, bio-composites, and plant-based composites are increasingly used in sports equipment.

By Resin Type Analysis

Based on resin type, the market is segmented into polyurethane, epoxy, polyamide, polypropylene, and others. Among these, the epoxy segment held a significant share of 39.6% due to its increasing applications in various sports equipment.

Epoxy’s excellent mechanical properties, chemical resistance, and adhesive capabilities make it an ideal matrix material for composites used in high-performance sports equipment. Its ability to bond well with various reinforcement materials such as carbon and glass fibers enhances its appeal.

The demand for durable and efficient sports equipment drives the adoption of epoxy resin as it provides a shiny, transparent finish to these products. Additionally, the advancements in epoxy formulations improve its impact resistance, UV resistance, and sustainability.

The growing popularity of water sports, cycling, and golf fuels the demand for epoxy-based composites in equipment in equipment such as surfboards, bicycle frames, and golf clubs. Epoxy’s versatility and performance benefits expand its applications thereby driving the segment.

By Fiber Type Analysis

The global sports composites market is segmented based on fiber type into carbon fiber, glass fiber, boron fiber, and others. The carbon fiber segment held the largest share of the market at 54.5%, owing to its exceptional strength-to-weight ratio, stiffness, and fatigue resistance.

Carbon fiber’s unique properties make it an ideal material for high-performance sports equipment, such as bicycle frames, golf clubs, tennis rackets, and athletics shoes.

As professional athletes and recreational players increasingly demand lightweight and durable equipment, carbon fiber’s popularity is expected to rise. Additionally, advancements in carbon fiber production, such as improved manufacturing processes and reduced costs, are further projected to fuel its adoption.

The growing trend of customizations and tailored equipment is also expected to boost the segment as carbon fiber enables the creation of complex geometries and precise material placement. Furthermore, the increasing focus of the players in the market, on sustainability and eco-friendliness is expected to lead to the development of recycled and bio-based carbon fibers, thereby expanding the segment’s growth.

For instance, On July 15, 2024, Toray Composite Materials America, Inc. announced its partnership with Elevated Materials to Repurpose Carbon Fiber Prepreg Waste. Elevated Materials has successfully diverted 200,000 pounds of carbon fiber waste through its innovative upcycling process. Toray aims to advance its sustainability efforts with this collaboration.

By Application Analysis

Based on application, the market is segmented into golf sticks, hockey sticks, racquets, bicycles, skis and snowboards, windsurfing masts and boards, and others. Among these, the golf sticks segment held a significant share of 29.2% due to the increasing popularity of golf globally. Sports composites such as carbon fiber and other composites are widely used in golf club shafts and heads, offering improved strength, durability, and accuracy.

Advancements in composite materials and manufacturing processes enhance performance and reduce weight. The trends of customizations and tailored clubs fuel the demand for high-end composite golf sticks. Growing participation in golf, especially among professionals and enthusiasts, drives the adoption of advanced composites by clubs.

The need for improved distance, accuracy, and control also contributes to the growth of composite golf sticks. As technology advances, composite golf sticks will continue to gain popularity, driving the segment in the coming years.

Key Market Segments

By Resin Type

- Polyurethane

- Epoxy

- Polyamide

- Polypropylene

- Others

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Boron Fiber

- Others

By Application

- Golf sticks

- Hockey sticks

- Racquets

- Bicycles

- Skies & Snowboards

- Windsurfing Masts and Boards

- Others

Drivers

Increasing global participation in high-performance sports drives the market.

This is attributed to the rapid urbanization of the global population and the growing popularity of several high-performance sports. Sports such as golf, skiing, cycling, triathlon, and others have gained more traction in recent decades owing to growing consumer perspectives toward these as recreational sports. These sports require lightweight and aerodynamic equipment to ensure an effective outlook for the players.

The growing number of amateur players and sports enthusiasts is also attributed to the rising popularity and awareness of such sports through social media. Additionally, the growing per capita income of the world population allows a greater number of end-users to purchase such equipment.

Moreover, the increasing availability of various sports clubs, guilds, and associations attracts the majority of consumers toward such sports, which ultimately increases global participation in high-performance sports thereby driving the market.

For instance, according to a news published by the International Golf Foundation, golf has reached about 123 million residents in America, with about 3.4 million people for the first time in 2023 on the course.

Restraints

Limited recycling and disposal options for disposal, are likely to hamper the market.

The disposal of sports composites has limited disposal options as they create significant environmental and sustainability concerns. Composite materials cause enormous amounts of non-biodegradable wastes when recycled, which causes landfill and ocean pollution.

This environmental impact is likely to damage the reputation of sports equipment manufacturers and lead to increased regulations and costs. As consumers become increasingly environmentally conscious, they are more likely to opt for sustainable alternatives thereby reducing the demand for composites.

Additionally, various governments have imposed strict environmental regulations on composite waste management, increasing the operational costs for manufacturers. The limited disposal options also lead to a significant amount of energy being wasted, as composites are often incinerated or landfilled. Furthermore, the industry’s inability to address the eco-friendly disposal of composites is likely to restrain the market.

Opportunities

The growing popularity of emerging sports applications and the development of new materials and advanced technologies drive the market.

The growing popularity of emerging sports applications offers a substantial opportunity for the sports composites market by driving demand for innovative materials tailored to specific athletic needs. As sports continue to evolve and diversify, there is an increasing need for composites that provide enhanced performance features such as reduced weight, increased durability, and superior strength.

The development of new materials, including advanced polymers and carbon fibers, enables the creation of equipment that meets these higher standards. Additionally, advancements in technology allow for the integration of smart features and sensors into sports gear, further boosting demand for specialized composites.

This trend extends to both traditional sports and new, niche activities, expanding market potential. Manufacturers are responding by investing in research and development to stay ahead of these evolving requirements. Overall, the intersection of emerging sports trends and technological progress in materials positions the sports composites market for significant growth.

Latest Trends

The rising global shift toward sustainable and eco-friendly materials is expected to drive the market.

The rising global shift toward sustainable and eco-friendly materials is significantly driving the sports composites market by increasing demand for greener alternatives to traditional composites. As environmental concerns grow, both consumers and manufacturers are seeking materials that minimize ecological impact while maintaining high performance.

This shift is prompting the development of composites made from renewable resources, such as bio-based fibers and recycled materials, which reduce dependency on petroleum-based products.

Innovations in these eco-friendly materials are becoming more viable for use in sports equipment, offering similar or improved performance characteristics compared to conventional composites. Regulatory pressures and consumer preferences for sustainable products are further accelerating this transition.

Consequently, companies are investing in research to create and refine these sustainable options. The embrace of eco-friendly materials not only aligns with global environmental goals but also opens new market opportunities for sports composites manufacturers.

Geopolitical Impact Analysis

The geopolitical factors significantly influence the global sports composites market, shaping its growth dynamics. Geopolitical factors significantly impact the sports composites market by influencing supply chains, trade policies, and production costs.

Trade tensions and tariffs between major economies can disrupt the availability of raw materials and components, leading to increased costs and potential shortages. A main example of this is the 2020 trade war between China and the US which benefitted the local US manufacturers of sports composites as China’s exported materials were loaded with heavy tariffs.

Additionally, political instability in key regions can affect manufacturing capabilities and logistics, causing delays and volatility in the market, such as in the case of the 2022 Russia-Ukraine conflict. Conversely, favorable trade agreements and stable political environments can facilitate smoother access to global markets and resources.

For instance, the Indian government took the initiative to facilitate sports equipment and provide a favorable environment for athletes and sports enthusiasts with the launch of ‘Khelo India’, in 2018. Geopolitical factors also drive regional shifts in production, as companies may relocate or diversify their operations to mitigate risks. These dynamics can influence pricing strategies and market competition. Overall, geopolitical conditions play a crucial role in shaping the stability and growth trajectory of the sports composites market.

Regional Analysis

North America is leading the Global Sports Composites Market.

North America dominated the market with the largest revenue 1.5 billion, commanding a share of 37.9% owing to the heightened consumer demand for advanced athletic equipment and innovations in materials.

The region saw a surge in interest in high-performance sports gear, including bicycles, golf clubs, and tennis rackets, utilizing advanced composites for enhanced durability and weight reduction. This growth was supported by increased investments in research and development by leading manufacturers focused on integrating cutting-edge technologies and sustainable materials.

The expansion of the sports industry, coupled with a growing emphasis on health and fitness, further fuelled the market’s expansion. Additionally, favorable trade policies and a robust supply chain infrastructure in North America facilitated the efficient distribution and availability of composite materials.

The market also benefited from partnerships between sports brands and technology companies, promoting innovations that attracted consumers. Overall, North America’s sports composites market in 2023 capitalized on a combination of technological advancement, consumer trends, and strategic industry developments.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period.

Asia Pacific is expected to grow with the fastest CAGR owing to a confluence of expanding economies, rising disposable incomes, and increasing interest in sports and fitness. Rapid urbanization and a growing middle class are driving demand for high-performance sports equipment, which benefits from advanced composite materials offering better strength and lightweight properties.

The region is also experiencing technological advancements in material science, fostering innovation in sports gear and equipment. Additionally, government initiatives promoting health and wellness are encouraging greater participation in sports, further boosting market demand. Increased investments in sports infrastructure and events are providing additional market opportunities.

Moreover, local manufacturers are scaling up production capabilities and forming strategic partnerships to meet the rising demand. Overall, the Asia Pacific sports composites market is expected to grow robustly, fueled by economic growth, technological progress, and a heightened focus on athletic performance and wellness.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major players in the global sports composites market are continuously investing in innovation and expansion. They implement multiple business strategies to position themselves higher on the competitive ground.

ALDILA, Inc., Amer Sports, Callaway Golf, Celanese Corporation, Dexcraft, and EPSILON Composite, are the major players known for diversified global sports composites production and supply chain network. These key players along with other industry participants collectively influence the market’s growth, supply, and demand dynamics.

Top Key Players

- ALDILA, Inc.

- Amer Sports

- Callway Golf

- Celanese Corporation

- Dexcraft

- EPSILON Composite

- Exel Composites

- Exel Composites

- Fischer Sports GmbH

- FUJIKURA COMPOSITES Inc

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Newell Brands

- Prokennex

- Rock West Composites

- Rockman

- Rossignol, Ficher Sports

- SGL Carbon

- TEIJIN LIMITED.

- Topkey

- Toray Composite Materials America, Inc.

- True Temper

- Other Key Players

Recent Developments

- On April 30, 2024, Amer Sports entered into a strategic agreement with PV3 to divest ENVE Composites. The company aims to open new growth opportunities for its sports composites brand with its new ownership.

- On March 2023 SGL Carbon unveiled its latest carbon fiber, ‘SIGRAFIL C T50-4.9/235,’ which boasts high elongation and strength. This advanced fiber is designed for use in sports, construction, and infrastructure sectors where both elongation and strength are crucial.

Report Scope

Report Features Description Market Value (2023) $ 4.0 billion Forecast Revenue (2033) $ 6.6 billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carbon Fiber, and Glass Fiber), By Resin Type (Polyurethane, Epoxy, Polyamide, Polypropylene, and Others), By Fiber Type (Carbon Fiber, Glass Fiber, Boron Fiber, and Others), By Application (Golf sticks, Hockey sticks, Racquets, Bicycles, Skies and Snowboards, Windsurfing Masts and Boards, and Others). Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ALDILA, Inc., Amer Sports, Callway Golf, Celanese Corporation, Dexcraft, EPSILON Composite, Exel Composites, Exel Composites, Fischer Sports GmbH, FUJIKURA COMPOSITES Inc, Hexcel Corporation, Mitsubishi Chemical Carbon Fiber and Composites Inc., Newell Brands, Prokennex, Rock West Composites, Rockman, Rossignol, Ficher Sports, SGL Carbon, TEIJIN LIMITED., Topkey, Toray Composite Materials America, Inc., True Temper, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ALDILA, Inc.

- Amer Sports

- Callway Golf

- Celanese Corporation

- Dexcraft

- EPSILON Composite

- Exel Composites

- Exel Composites

- Fischer Sports GmbH

- FUJIKURA COMPOSITES Inc

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Newell Brands

- Prokennex

- Rock West Composites

- Rockman

- Rossignol, Ficher Sports

- SGL Carbon

- TEIJIN LIMITED.

- Topkey

- Toray Composite Materials America, Inc.

- True Temper

- Other Key Players