Global Solar Charge Controllers Market Size, Share Analysis Report By Type (PWM (Pulse Width Modulation), MPPT (Maximum Power Point Tracking), Others), By Application (Industrial, Commercial, Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170071

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

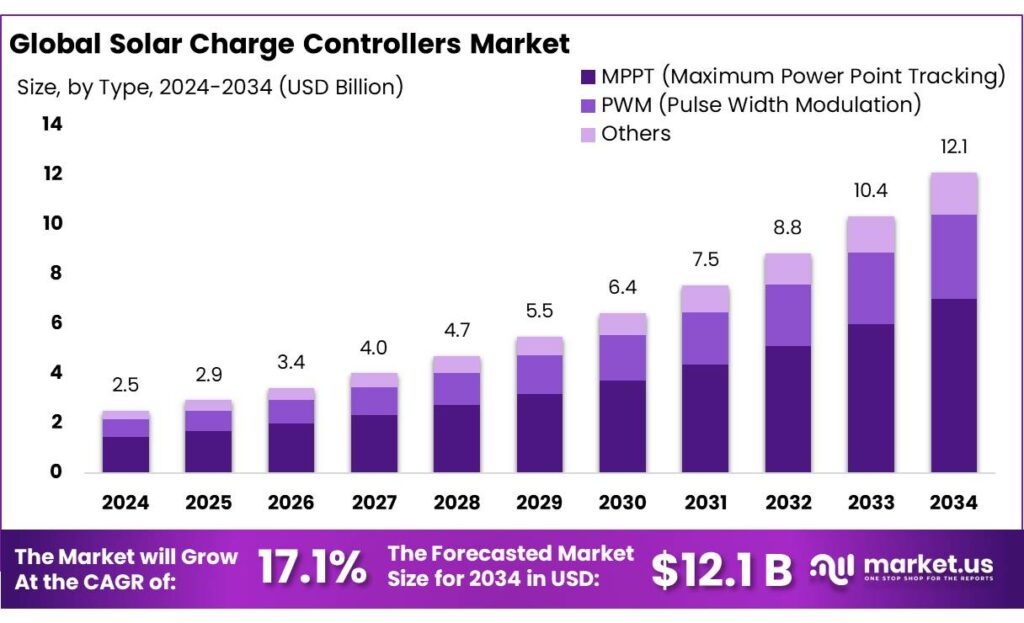

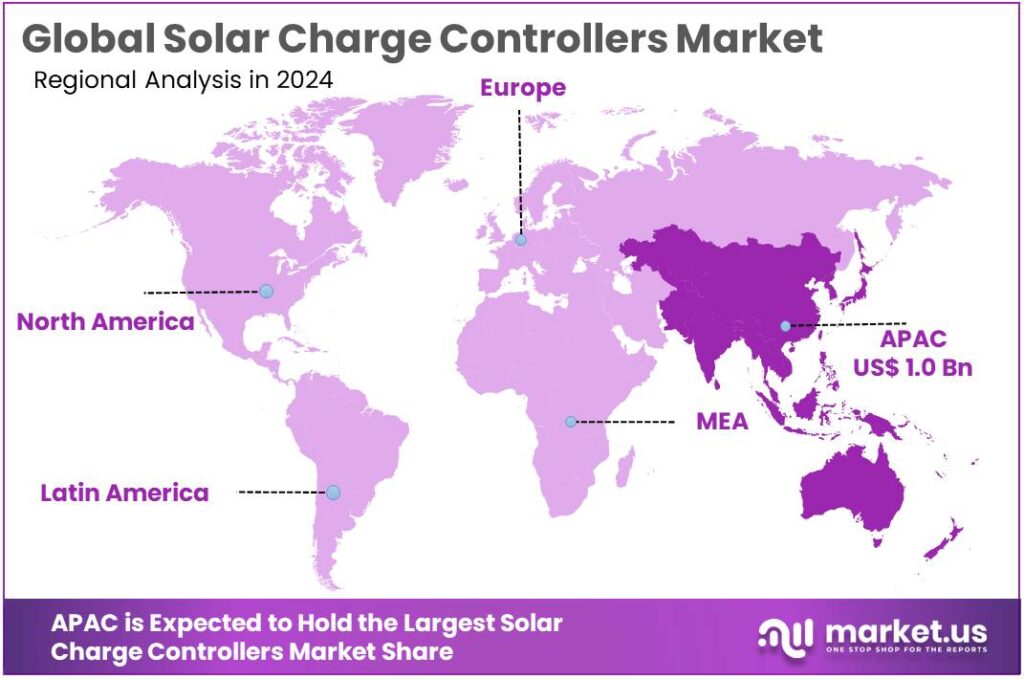

The Global Solar Charge Controllers Market size is expected to be worth around USD 12.1 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 17.1% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 41.90% share, holding USD 1.0 Billion revenue.

Solar charge controllers are critical power-electronics devices that safeguard batteries and downstream loads by regulating voltage and current from solar PV modules, preventing over-charging and deep discharge in off-grid, hybrid and small grid-tied systems. Their importance has scaled rapidly with global solar PV capacity, which reached 1,865 GW by end 2024, up from 710 GW in 2020, with around 451 GW added in 2024 alone, making solar the largest contributor to new renewable capacity additions.

The solar charge controllers is shaped by the rapid expansion of PV. Cumulative solar PV capacity climbed to around 1.6 TW in 2023, up from 1.2 TW in 2022, with roughly 407–447 GW of new PV systems added in a single year. Renewable additions overall rose nearly 50% to almost 510 GW in 2023, the fastest growth in two decades, underlining a strong, structural pipeline for balance-of-system components such as controllers. As module prices fall and distributed PV grows, the value-added functionality shifts toward power electronics, monitoring and integration.

Key demand drivers are the accelerating deployment of renewables and the need for reliable distributed power. Global annual renewable capacity additions reached nearly 510 GW in 2023, the fastest growth in two decades, with solar PV accounting for the bulk of new capacity. At the same time, around 750 million people still lacked access to electricity in 2023, with sub-Saharan Africa hosting about 80% of this population. The World Bank notes that off-grid solar is the most cost-effective solution for about 41% of those expected to gain first-time access by 2030, and the off-grid solar sector has already provided energy services to roughly 560 million people.

Emerging economies, particularly India, illustrate how policy and infrastructure needs translate into controller demand. India’s cumulative solar power has reached about 132.85 GW, including 23.16 GW of grid-connected rooftop and 5.55 GW of off-grid solar capacity, according to the Ministry of New and Renewable Energy (MNRE). Government data also show that energy generation from solar, wind, bio-power and small hydro has increased by roughly 265.9% since 2014–15, and India now ranks 4th globally in solar power generation. Each new rooftop plant, village microgrid, or off-grid asset embeds one or more charge controllers, making their market closely correlated with distributed solar roll-out.

- Government initiatives significantly shape the industrial scenario and future opportunities. Under India’s PM Surya Ghar: Muft Bijli Yojana, around 23,96,497 households had installed rooftop solar systems by December 2025, achieving about 23.96% of the one-crore household target for FY 2026-27. In parallel, the PM-KUSUM scheme aims to add 34,800 MW of solar capacity by 2026, including the installation of 14 lakh stand-alone solar agriculture pumps with substantial central financial support. Each pump and rooftop system requires controller or inverter-integrated charge management, creating a large, policy-backed demand base.

Key Takeaways

- Solar Charge Controllers Market size is expected to be worth around USD 12.1 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 17.1%.

- MPPT (Maximum Power Point Tracking) held a dominant market position, capturing more than a 57.8% share.

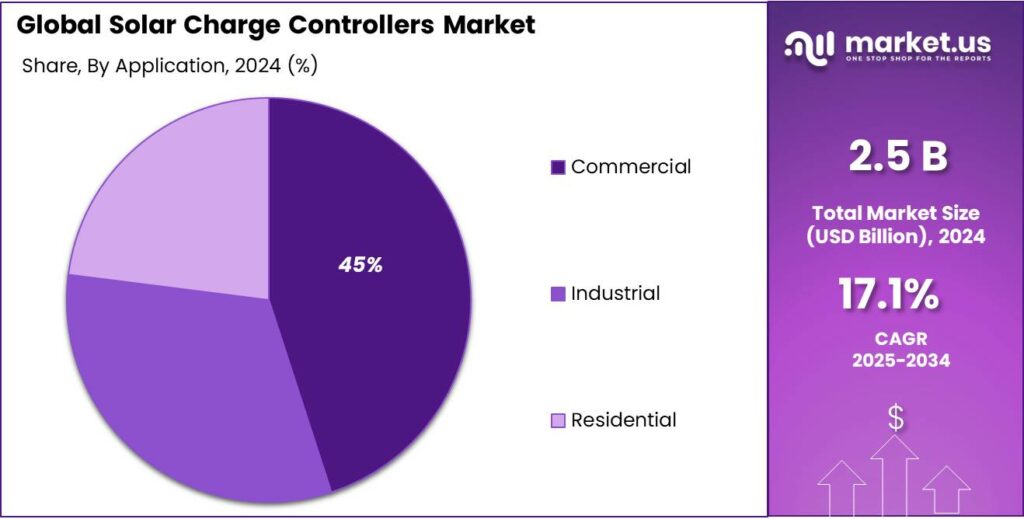

- Natural held a dominant market position, capturing more than a 45.2% share.

- Asia Pacific held a dominant regional position in the solar charge controller market, capturing 41.90% of regional share with an estimated market value of USD 1.0 billion.

By Type Analysis

MPPT leads with 57.8% due to superior efficiency and smarter energy harvest.

In 2024, MPPT (Maximum Power Point Tracking) held a dominant market position, capturing more than a 57.8% share. This leadership was driven by MPPT’s superior ability to maximise solar-array output under varying irradiance and temperature conditions, which made it the preferred choice for residential, commercial and utility-scale installations requiring higher energy yield. The technology was favoured where panel mismatch, partial shading and changing weather reduced fixed-point performance, and its adoption was supported by falling component costs and greater awareness of lifecycle energy gains.

Procurement decisions in 2024 often prioritised long-term energy return and system reliability, so MPPT units were chosen for new solar deployments and retrofits alike. Technical serviceability and compatibility with battery storage also reinforced uptake. Looking into 2025, the MPPT segment is expected to retain leadership as installers continue to prioritise efficiency and integration with smart energy systems.

By Application Analysis

Commercial applications dominate with 45.2% as business-scale installations drive controller demand.

In 2024, Natural held a dominant market position, capturing more than a 45.2% share. The commercial segment was driven by growing deployment of rooftop and ground-mounted systems for offices, retail parks and small industrial facilities where reliability and predictable energy yield were prioritized. Investments in energy cost reduction and corporate sustainability targets led to larger, centrally managed installations that favoured higher-specification controllers with monitoring and storage compatibility.

Procurement decisions in 2024 were influenced by total cost of ownership and integration with building energy management systems, which supported uptake of controllers offering remote telemetry and smart charging functions. Continued expansion of commercial solar portfolios is expected to sustain demand into 2025 as organisations pursue resilience and operational savings.

Key Market Segments

By Type

- PWM (Pulse Width Modulation)

- MPPT (Maximum Power Point Tracking)

- Others

By Application

- Industrial

- Commercial

- Residential

Emerging Trends

Smart Solar Controllers Powering Food and Cold Chains

A striking latest trend in solar charge controllers is their use in smart, food-linked applications such as cold storage, solar irrigation and rural mini-grids. Instead of only protecting batteries, new controllers are becoming the “brains” of small energy systems that keep crops fresh and water flowing. This matters because food loss remains a huge global problem: FAO estimates that over 13% of food produced is lost before retail, worth more than USD 400 billion every year.

At the same time, family and small farms dominate global food production. FAO estimates there are around 600 million farms, and family farms account for roughly 80% of the world’s food in value terms. Many of these farms are smallholdings with limited land and income. For them, every sack of grain saved and every crate of vegetables kept fresh can mean school fees paid or debts avoided. Solar-powered cooling and irrigation systems, orchestrated by advanced charge controllers, help farmers protect their harvest, time their sales better and reach more distant markets.

Off-grid solar is no longer only about lights and phone charging. A recent World Bank analysis estimates that off-grid solar could be the most cost-effective way to provide first-time electricity access to around 398 million people by 2030, requiring about USD 3.6 billion in investment every year. A growing share of this demand comes from “productive uses” such as solar water pumps and cold storage in food value chains.

Drivers

Expanding Off-Grid and Rural Electrification Needs

One of the biggest and most humane forces driving demand for solar charge controllers today is the push to bring reliable, affordable electricity to communities and households that have historically lived without it. In many rural regions across Asia, Africa, and parts of Latin America, traditional grid extension is slow, expensive, or simply not feasible due to geographical and economic barriers.

Solar power, combined with battery systems and simple power electronics like solar charge controllers, offers a practical alternative that people can depend on for everyday life—lighting homes, pumping water for farms, powering schools, health centres, and small businesses. This isn’t just about technology—it’s about real improvements in people’s lives.

- According to the World Bank, off-grid solar solutions have already helped over 560 million people gain access to electricity, and they are considered the most cost-effective option for about 41% of the world’s unelectrified population by 2030 (about 398 million people), especially in areas where grid extension won’t reach easily.

This scale of impact is huge: for millions of families, solar installations equipped with robust charge controllers mean light after sunset, mobile phones charged, and tools run without depending on costly diesel or unreliable grids. Solar charge controllers play a vital role here, making sure the energy captured by solar panels is managed safely into batteries, preventing damage and extending system life.

Government programs amplify this effect significantly. In India, the Pradhan Mantri Kisan Urja Suraksha Evam Utthan Mahabhiyan (PM-KUSUM) scheme is a flagship initiative that explicitly supports farmers in switching to solar-powered irrigation. Under PM-KUSUM, the government aims to install up to 1.75 million standalone solar pumps and solarise 1 million grid-connected pumps, ultimately supporting up to 10 GW of distributed solar capacity across rural India.

The human side of this transformation can be seen in recent achievements like Maharashtra’s record of installing 45,911 solar agricultural pumps in one month, a feat recognised by Guinness World Records and driven by both PM-KUSUM and local renewable schemes. Each of these pump installations represents families with sustained access to water for crops without paying high electricity or fuel costs—helping ensure food security, increase farm productivity, and reduce the drudgery and expense associated with traditional irrigation.

Restraints

High Upfront Cost and Limited Affordable Finance

A major restraint for solar charge controllers is simple: the people who need them most often cannot afford the full solar system that comes with them. Many smallholder farmers and low-income households still live on very tight margins. The World Bank estimates that around 685 million people were living in extreme poverty in 2022, and poverty is increasingly concentrated in rural, agriculture-dependent regions. This makes any large upfront investment in solar panels, batteries and controllers a serious risk for a family budget.

- Food production is dominated by small farms that rarely have easy access to credit. FAO reports that there are over 600 million farms worldwide, and about 90% of them are family farms, many of which operate on less than 2 hectares of land. These farms produce roughly 80% of the world’s food in value terms, but they often rely on informal finance, seasonal income and limited savings. For them, even a modest solar pump kit with a good charge controller can feel out of reach without grants or subsidised loans.

Governments and development banks have launched programmes to ease this burden, but coverage is still uneven. For instance, under India’s PM-KUSUM scheme, farmers receive up to 60% capital subsidy and 30% bank credit support for solar pumps. Yet, many smallholders still find their own contribution and loan procedures difficult, especially tenant farmers without formal land titles. As a result, the very people who could benefit most from reliable solar charge controllers are sometimes excluded.

Similar issues appear in off-grid regions of sub-Saharan Africa and South Asia. A World Bank assessment suggests that delivering off-grid solar and productive-use technologies like solar water pumps and cold storage to achieve universal access will require around USD 95 billion in investment by 2030, including USD 21 billion for basic household systems and USD 74 billion for productive uses.

Opportunity

Solar-Powered Irrigation for Smallholder Farmers

A powerful growth opportunity for solar charge controllers lies in solar-powered irrigation and on-farm energy systems for smallholder farmers. Globally, there are about 500–600 million family and smallholder farms, producing close to 80% of the world’s food in value terms. Most of these farmers are in Asia and sub-Saharan Africa, where access to reliable electricity and affordable irrigation is still limited. Solar pumps with robust charge controllers directly support their daily work and income.

Food production is deeply tied to water, and this is where solar really matters. Agriculture uses roughly 70% of global freshwater withdrawals, and in low-income countries that share can reach 90%. At the same time, food production has more than doubled in the last 30 years, putting huge pressure on land and water. Solar-powered irrigation, managed by reliable charge controllers, offers a way to use water more efficiently while freeing farmers from diesel costs and unstable grid supply.

Real-world rollouts are already pointing to strong momentum. In December 2025, Maharashtra set a Guinness World Record by installing 45,911 solar agricultural pumps in just one month, contributing to a total of over 747,000 solar pumps already deployed in the state and a goal of more than 1 million units. Behind each pump is at least one charge controller, turning a policy vision into reliable daily irrigation for farmers in drought-prone districts.

Global development agendas add another tailwind. A World Bank–led assessment estimates that off-grid solar could be the most cost-effective way to provide first-time electricity access to about 398–400 million people by 2030, and calls for around USD 21 billion in investment for off-grid access plus about USD 74 billion for productive-use technologies like solar water pumps and cold storage. Each new solar irrigation or cold-chain system requires smart charge controllers to manage batteries and protect equipment, making them central to the business case.

Regional Insights

Asia Pacific commands 41.90% (~USD 1.0 Bn) as rapid solar expansion and storage needs drive controller demand

In 2024, Asia Pacific held a dominant regional position in the solar charge controller market, capturing 41.90% of regional share with an estimated market value of USD 1.0 billion; this prominence was driven by large-scale PV additions, accelerating residential rooftop rollouts and rising investment in behind-the-meter storage that increased demand for smarter charge management. The region’s renewable market was sizable in 2024 and was characterised by rapid policy-led capacity growth and corporate procurement activity, which encouraged demand for controllers that offer MPPT capability, battery compatibility and remote telemetry.

Strong upstream supply and falling module prices supported faster project economics and wider system deployment across China, India, Japan and Southeast Asia, translating into higher controller uptake for both off-grid and grid-connected systems. The global market for charge controllers was also expanding in 2024, reinforcing a healthy addressable market for Asia Pacific suppliers and distributors. China’s export and manufacturing scale continued to shape component costs and availability across the region, while growing energy-storage deployments raised the technical bar for controllers used in hybrid systems.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SUNGROW — Sungrow is a global inverter and charge-controller leader; as of 2024 the group reported operating revenue around USD 10.2 billion (2023 reported surge) and had installed ~740 GW of power-electronics capacity by year-end, demonstrating scale in PV electronics and strong R&D/manufacturing backing for charge-controller product lines. Its global footprint supports residential, commercial and utility deployments.

Morningstar Corporation — Morningstar specialises in off-grid and remote-site controllers with a long reliability record; the company reports >4 million off-grid products deployed across 100+ countries since 1993 and maintains a compact, engineering-led organisation focused on high-reliability MPPT and PWM controllers for mission-critical sites.

Schneider Electric — Schneider is a multinational energy-management leader reporting €38.2 billion in revenues for 2024 and employing hundreds of thousands globally; its solar and storage controller offerings are positioned within broader energy-management and BMS portfolios, enabling integration with building and grid management systems.

Luminous India — Luminous Power Technologies reported operating revenue in the range of INR 3,274 crore (FY 2023/24 nine-month figure reported) and is a leading Indian supplier of solar controllers, inverters and storage solutions; its scale and distribution network support broad commercial and residential controller adoption across India.

Top Key Players Outlook

- SUNGROW

- Morningstar Corporation

- Schneider Electric

- BEIJING EPSOLAR TECHNOLOGY CO. LTD

- Wenzhou Xihe Electric Co.,LTD.

- Sunforge LLC

- Luminous India

- KATEK Memmingen GmbH

- AIRKOM

- Victron Energy B.V.

Recent Industry Developments

In 2024, Sunforge LLC’s presence in the solar charge controller sector was defined by its Genasun‑branded MPPT controllers, with products like the GV‑4 (50 W) and GV‑10 (140 W) delivering high electrical efficiency up to 99.85% and very low self‑consumption as part of rugged, compact controller lines.

In 2024, Morningstar Corporation continued its role as a specialist solar charge controller provider, with over 4 million controllers and related products sold in more than 100 countries since its foundation, reflecting sustained global adoption and quality recognition.

In 2024, Sungrow Power Supply Co., Ltd. achieved robust operational results with reported operating revenue of approximately USD 10.2 billion and net profit near USD 1.3 billion, reflecting strong demand for its renewable energy products and rapid adoption worldwide.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 12.1 Bn CAGR (2025-2034) 17.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (PWM (Pulse Width Modulation), MPPT (Maximum Power Point Tracking), Others), By Application (Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SUNGROW, Morningstar Corporation, Schneider Electric, BEIJING EPSOLAR TECHNOLOGY CO. LTD, Wenzhou Xihe Electric Co.,LTD., Sunforge LLC, Luminous India, KATEK Memmingen GmbH, AIRKOM, Victron Energy B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solar Charge Controllers MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Solar Charge Controllers MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SUNGROW

- Morningstar Corporation

- Schneider Electric

- BEIJING EPSOLAR TECHNOLOGY CO. LTD

- Wenzhou Xihe Electric Co.,LTD.

- Sunforge LLC

- Luminous India

- KATEK Memmingen GmbH

- AIRKOM

- Victron Energy B.V.