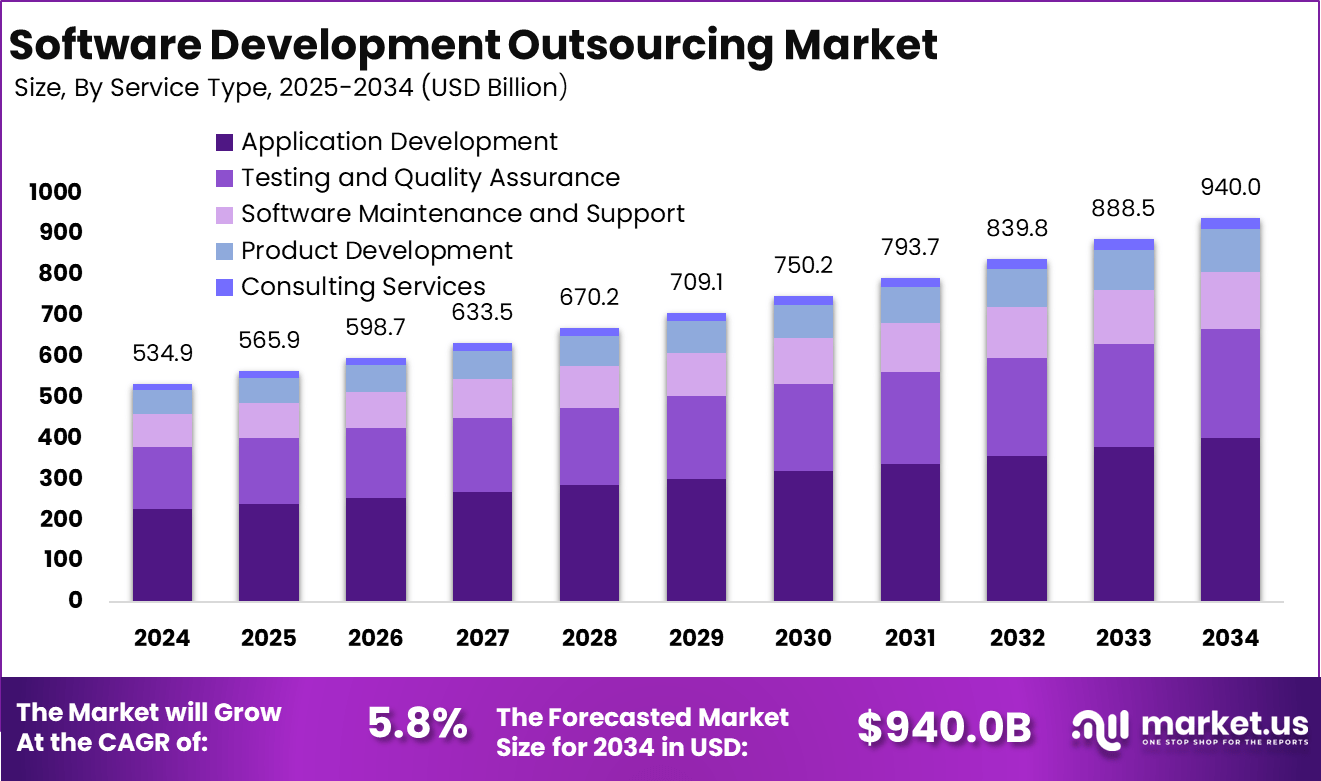

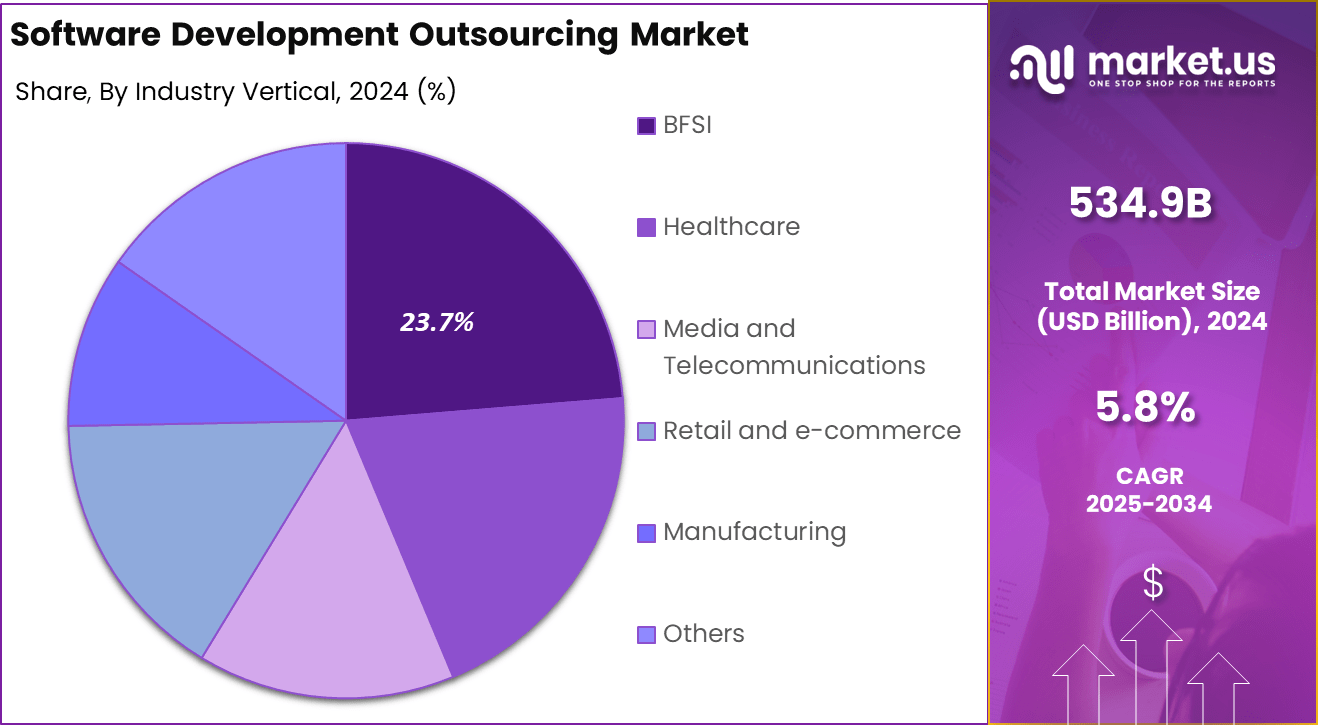

Global Software Development Outsourcing Market Size, Share Analysis Report By Service Type (Application Development, Testing and Quality Assurance, Software Maintenance and Support, Product Development, Consulting Services), By Deployment Model (Cloud-based, On-premise), By Organisation Type (SMEs, Large Enterprises), By Industry Vertical (BFSI, Healthcare, Media and Telecommunications, Retail and e-commerce, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152502

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Data-Driven Insights

- Role of AI

- U.S. Market Size

- Service Type Analysis

- Deployment Model Analysis

- Organisation Type Analysis

- Industry Vertical Analysis

- Key Market Segments

- Emerging Trend

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

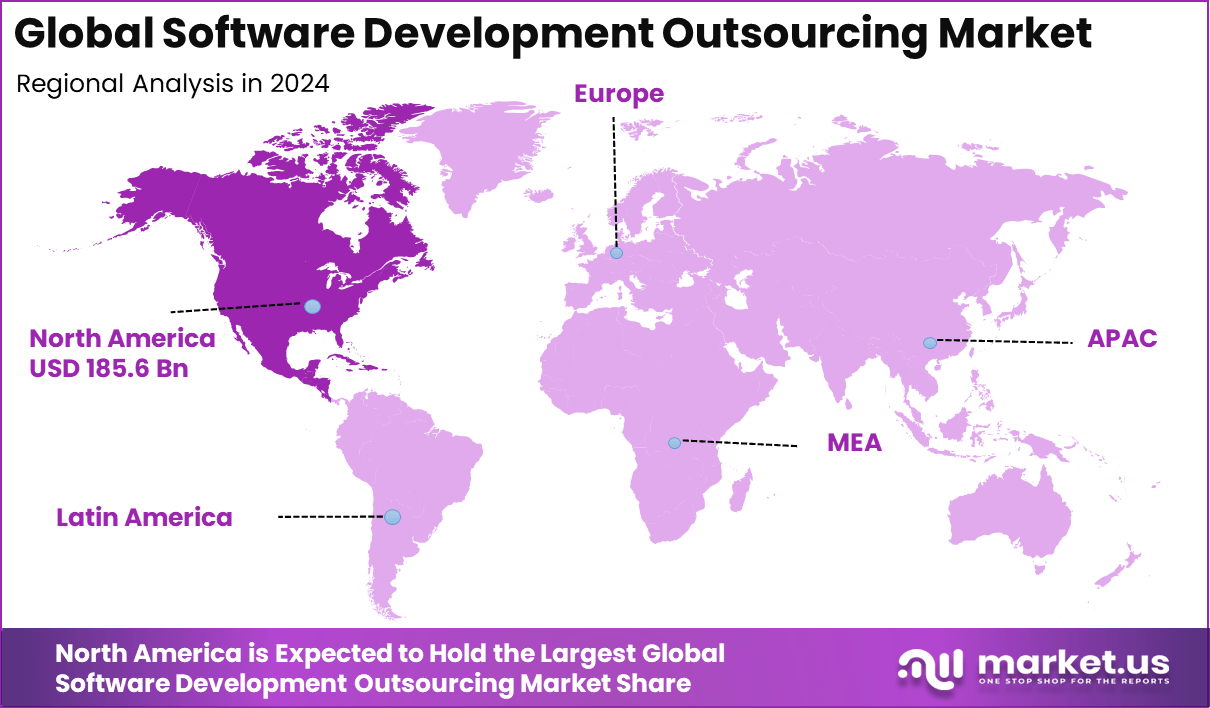

The Global Software Development Outsourcing Market size is expected to be worth around USD 940.0 billion by 2034, from USD 534.9 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.7% share, holding USD 185.6 billion in revenue.

The Software Development Outsourcing Market is defined by the increasing reliance of global businesses on external vendors to build, manage, and maintain software systems. Organizations are turning to outsourcing not only for basic coding but also for specialized services in AI, cloud integration, and cybersecurity. The industry is shaped by the need for rapid scalability, flexibility, and access to global talent pools.

Top Driving Factors include the persistent shortage of skilled developers, especially in emerging technologies, and the pressure to reduce operational expenses. Organizations are opting for outsourcing to meet tight deadlines and increase innovation without compromising cost control. The growing complexity of enterprise applications and demand for platform-agnostic solutions are also contributing to outsourcing growth.

For instance, In October 2024, EPAM Systems reported that over 76.5% of its lead developers surpassed global productivity and quality benchmarks set by BlueOptima, showcasing its strong engineering capabilities and commitment to excellence in the enterprise IT outsourcing sector.

Market Scope and Forecast

Report Features Description Market Value (2024) USD 534.9 Bn Forecast Revenue (2034) USD 940 Bn CAGR (2025-2034) 5.8% Largest market in 2024 North America [34.7% market share] The majority of demand is driven by small and medium enterprises, although large enterprises remain key contributors. Outsourcing is being used to meet custom software needs in areas such as fintech, healthcare IT, logistics management, and eCommerce platforms. The demand has been amplified by the shift toward digital-first operations. Over 70% of organizations that outsourced reported faster software delivery timelines and enhanced focus on core business functions.

Increasing Adoption Technologies include artificial intelligence, machine learning, edge computing, DevOps, and blockchain integration. The demand for cloud-native applications and scalable SaaS platforms is also rising rapidly. Outsourcing providers are incorporating these technologies into their service portfolios, allowing clients to accelerate innovation without steep internal investments.

Key Reasons for Adopting These Technologies stem from the need to enhance automation, data analytics, and real-time decision-making. Companies are outsourcing to integrate AI for predictive modeling or blockchain for improved security. Cloud technologies are enabling real-time collaboration and version control. More than 55% of enterprises cited innovation and future-readiness as key motivations for outsourcing adoption.

Key Insight Summary

- The market is projected to grow from USD 534.9 billion in 2024 to approximately USD 940.0 billion by 2034, registering a steady CAGR of 5.8%, driven by rising demand for cost-efficient, scalable, and specialized software solutions.

- North America led the global market in 2024, accounting for over 34.7% share and generating about USD 185.6 billion in revenue, supported by a strong technology ecosystem and high outsourcing adoption among enterprises.

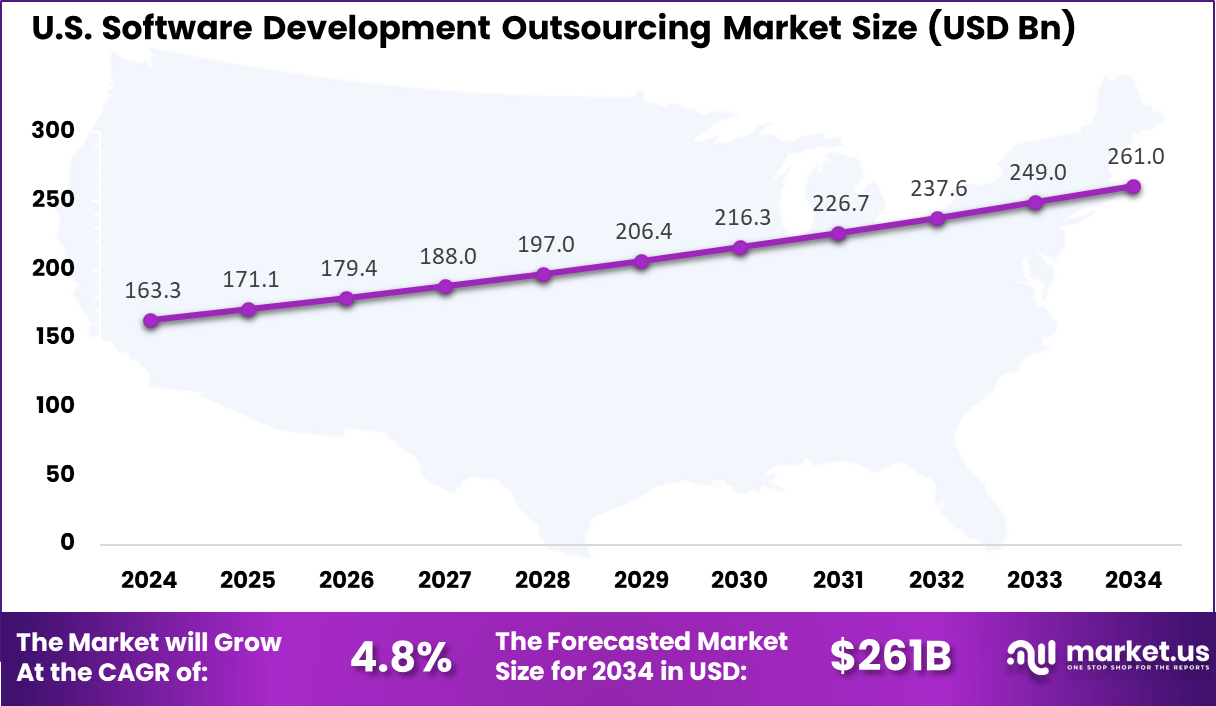

- Within North America, the U.S. market contributed approximately USD 163.3 billion, with an expected CAGR of 4.8%, reflecting ongoing demand for outsourced expertise and advanced software capabilities.

- By service type, Application Development dominated with a 42.7% share, underscoring its central role in supporting enterprise digital strategies and customer-facing innovations.

- By deployment model, On-Premise solutions held the largest share at 61.5%, reflecting preferences for greater control, security, and compliance in mission-critical applications.

- By organization type, Large Enterprises led with 68.3% share, as these organizations leverage outsourcing to manage complex, large-scale development projects effectively.

- Among industry verticals, Banking, Financial Services, and Insurance (BFSI) remained the largest segment at 23.7%, driven by growing needs for secure, compliant, and innovative financial software.

Data-Driven Insights

According to Dreamix, within the United States, about 66% of all businesses and 24% of small businesses outsource some of their IT needs. This trend shows that IT outsourcing is notably more common among larger enterprises. The reason lies in their greater demand for custom software development, IT support, and scalable solutions that align with complex operations.

Furthermore, 92% of the world’s largest 2,000 companies now rely on IT outsourcing, confirming that as companies grow, the likelihood of outsourcing their IT functions rises significantly. Deloitte has identified cloud computing as a key driver behind this outsourcing shift, with 90% of businesses acknowledging it as a core enabler. This evolution has led to increased global spending, which is projected to hit USD 731 billion in 2025.

Simultaneously, according to 10Pearls, there are approximately 28.7 million software developers globally, and 76% of executives report outsourcing at least part of their IT functions. In fact, 87% of companies worldwide now consider outsourced workers as part of their integrated workforce. In the United States, nearly 300,000 jobs are outsourced each year. The median salary for an experienced software developer is around USD 210,000, making cost optimization a major reason why 59% of businesses choose to outsource.

Demand is rising sharply, with the U.S. Bureau of Labor Statistics projecting a 22% increase in demand for software developers and QA professionals by 2030. Meanwhile, in 2025, the U.S. is expected to generate about USD 213.60 billion in IT outsourcing revenue. In Europe, the sector is projected to reach approximately USD 193.10 billion by 2025, growing steadily to nearly USD 262 billion by 2029 at a CAGR of 7.93%.

In Asia, the software development outsourcing market is also on an upward path, estimated to touch USD 126.9 billion in 2025, with growth accelerating at a CAGR of 9.04% to reach USD 179.40 billion by 2029. This global expansion reflects a strong, long-term shift toward distributed IT delivery models supported by technical talent across regions.

Role of AI

The role of AI in software development outsourcing has become increasingly central to how organizations approach outsourced digital projects. Artificial intelligence is now integrated into every stage of outsourced development, from project planning and requirement gathering to coding, testing, and deployment.

AI-driven tools enable faster code generation, automate repetitive tasks, and improve error detection during development, allowing external teams to deliver projects with greater accuracy and reduced timelines. Outsourcing partners are leveraging AI to offer predictive analytics that forecast potential risks and delays, ensuring that projects remain aligned with client expectations.

According to recent industry insights, over 70% of outsourced teams now use AI-powered testing frameworks and coding assistants, highlighting its widespread adoption. The inclusion of AI also facilitates better collaboration between in-house and external teams by enabling real-time feedback loops and intelligent documentation.

U.S. Market Size

The market for Software Development Outsourcing within the U.S. is growing tremendously and is currently valued at USD 163.3 billion, the market has a projected CAGR of 4.8%. Rising labor costs and a shortage of specialized tech talent are prompting companies to seek external expertise to maintain competitiveness.

Additionally, the increasing complexity of software projects and the need for rapid innovation are driving businesses to collaborate with outsourcing partners who can provide specialized skills and accelerate development timelines. This trend is further supported by the adoption of advanced technologies and the growing demand for scalable solutions across various industries.

For instance, in June 2025, IBN Technologies announced its expanded civil engineering outsourcing services, aiming to address the growing demands of U.S. infrastructure projects. The company offers a comprehensive suite of services, including project closeout management, cost estimation, virtual project oversight, and Building Information Modeling (BIM) consulting.

In 2024, North America held a dominant market position in the Global Software Development Outsourcing Market, capturing more than a 34.7% share, holding USD 185.6 billion in revenue. This dominance is due to the region’s technological structure, and the presence of major software firms makes it a favorable location for outsourcing activities.

Furthermore, the increasing emphasis on digital transformation in North American firms has increased demand for custom software solutions, resulting in an increase in the number of outsourcing services. The combination of technological expertise and changing business necessities ensures that North America remains at the forefront of software development outsourcing.

For instance, In April 2023, Forbes noted Latin America’s fast rise as a key source of tech talent for North America, driven by proximity, time zone alignment, and cultural compatibility. Nations like Brazil, Mexico, Argentina, and Colombia are expanding their tech industries, supported by a young, skilled workforce and growing English proficiency, making the region a strong nearshoring choice amid the global shift to remote work.

Service Type Analysis

In 2024, Application Development segment held a dominant market position, capturing a 42.7% share of the Global Software Development Outsourcing Market. This dominance can be attributed to the increasing demand for customized, scalable, and innovative software solutions across various industries.

As businesses continue to focus on enhancing their digital presence and improving customer experiences, the need for application development outsourcing has surged. Furthermore, the rapid adoption of technologies like cloud computing, AI, and mobile applications has fueled the growth of this segment, driving its continued leadership in the market.

For instance, In March 2025, Perforce Software acquired Snowtrack, a Montreal-based developer of distributed version control tools for digital artists and designers. This acquisition enabled the launch of P4 One, a user-friendly version control client integrated into the Perforce P4 Platform, aimed at simplifying collaboration across creative and technical teams.

Deployment Model Analysis

In 2024, the On-premise segment held a dominant market position, capturing a 61.5% share of the Global Software Development Outsourcing Market. The primary reason for organizations to use on-premise solutions is to gain more control over their data and IT systems.

On-premise deployment models are becoming more popular among companies in heavily regulated industries like finance and healthcare, which emphasize security and compliance. Additionally, the ability to adapt and integrate on-premise solutions with existing systems makes it a desirable option for companies seeking complete control over their software and operations.

For instance, in June 2024, Wipro announced a collaboration with Hewlett-Packard Enterprise (HPE) to launch an on-premise Generative AI (GenAI) solution at Wipro’s Customer Experience Center in Kodathi, India. This solution integrates Wipro’s Smart Operations platform with HPE’s Machine Learning Development Environment, aiming to enhance operational efficiency and customer experience.

Organisation Type Analysis

In 2024, Large Enterprises segment held a dominant market position, capturing a 68.3% share of the Global Software Development Outsourcing Market. This dominance is due to the increasing need for complex, large-scale software solutions that can support the diverse and sophisticated operations of large organizations.

These enterprises often have the resources to invest in customized software development and the scale to benefit from the cost efficiencies of outsourcing. Additionally, the demand for advanced technologies like artificial intelligence, cloud computing, and data analytics has led large companies to outsource certain functions to meet changing business needs.

For instance, In April 2025, Orion Innovation was recognized by the International Association of Outsourcing Professionals® (IAOP®) as a global outsourcing leader, earning a place on the Global Outsourcing 100® list for the ninth consecutive year. This recognition reflects the company’s consistent performance in delivering high-impact digital transformation and product development services.

Industry Vertical Analysis

In 2024, BFSI segment held a dominant market position, capturing a 23.7% share of the Global Software Development Outsourcing Market. This dominance is driven by the sector’s urgent need for digital transformation, enhanced cybersecurity, and compliance with regulations.

BFSI organizations are increasingly outsourcing software development to quickly launch secure mobile banking apps, digital payment solutions, and data analytics platforms that improve customer experiences and operational efficiency. The complexity of financial transactions, changing regulations, and rising cyber threats have made outsourcing essential for BFSI firms seeking specialized expertise and innovative solutions.

For Instance, In April 2025, Candescent, a prominent independent digital banking technology provider, opened a new office in Bangalore, India, to strengthen its software development efforts in the Banking, Financial Services, and Insurance (BFSI) sector. This expansion reflects a strategic initiative to leverage India’s highly skilled tech workforce and deepen innovation capabilities.

Key Market Segments

By Service Type

- Application Development

- Testing and Quality Assurance

- Software Maintenance and Support

- Product Development

- Consulting Services

By Deployment Model

- Cloud-based

- On-premise

By Organisation Type

- SMEs

- Large Enterprises

By Industry Vertical

- BFSI

- Healthcare

- Media and Telecommunications

- Retail and e-commerce

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

AI Driven and Hybrid Outsourcing Models

A major emerging trend in software development outsourcing is the integration of AI powered development tools into outsourced engagements. Providers are now using advanced AI platforms to automate tasks such as code generation, testing, bug fixing and documentation.

Another important trend is the adoption of hybrid engagement models that blend staff augmentation, project based contracting and managed service teams. Organizations are increasingly choosing flexible structures that adapt to different project phases, using augmented staff during planning and managed teams during implementation.

Drivers

AI Driven and Hybrid Outsourcing Models

A major emerging trend in software development outsourcing is the integration of AI powered development tools into outsourced engagements. Providers are now using advanced AI platforms to automate tasks such as code generation, testing, bug fixing and documentation. This approach improves developer productivity and accelerates delivery timelines by automating repetitive processes while enabling developers to focus on complex problems.

Another important trend is the adoption of hybrid engagement models that blend staff augmentation, project based contracting and managed service teams. Organizations are increasingly choosing flexible structures that adapt to different project phases, using augmented staff during planning and managed teams during implementation. This modular model gives companies better control over scope and resources while improving scalability to meet changing needs.

Restraint

Access to Specialized Talent and Faster Delivery

The primary driver of software development outsourcing is the ability to access specialized skills that are difficult to build internally. As enterprises pursue advanced technologies like cloud computing, artificial intelligence and DevOps, outsourcing allows them to quickly tap into global expertise without lengthy hiring and training cycles. This access to qualified talent fills critical gaps in digital transformation efforts.

Another driver is the demand for faster time to market. Distributed outsourced teams operating in multiple time zones enable around the clock development, which reduces project timelines. This continuous development model is especially valuable in competitive markets where speed and responsiveness are critical to success.

Opportunities

Technological Advancements

New opportunities are emerging in the software development outsourcing industry with the rise of technologies such as AI, cloud computing, and blockchain. These developments allow outsourcing firms to focus on more niche services such as complex analytics, automation, and decentralized applications, which helps them remain competitive while providing value to clients seeking innovative solutions.

For instance, in December 2024, IBM’s study revealed that 51% of companies utilizing open-source AI tools reported positive ROI, compared to 41% of those not using open-source solutions. The research, based on a survey of over 2,400 IT decision-makers, also indicated that 62% of organizations plan to increase their AI investments in 2025, with 48% intending to leverage open-source ecosystems to optimize their AI implementations.

Challenges

Talent Scarcity and Rising Costs

As demand for specialist technical talent rises, outsourcing firms are finding it increasingly difficult to recruit and retain top performers. The shortage of skilled workers, coupled with rising wages for proficient developers, is reducing the cost advantages that outsourcing used to provide. As a result, companies may face extended hiring periods and higher costs, which can impact project schedules and budget control.

For instance, In June 2025, Bridge Hiring expanded its remote IT talent pool to support the growing digital needs of global businesses. The company now provides access to a wider network of professionals, including software engineers, virtual assistants, and web development specialists, enabling organizations to scale efficiently.

Key Players Analysis

Accenture, IBM, and Oracle dominate the software development outsourcing market with strong global networks and advanced service offerings. Their focus on cloud, AI, and agile practices has strengthened client trust. Continued investment in talent and innovation keeps them leading choices for complex and large-scale projects.

TCS, Infosys, and HCL drive innovation with extensive offshore centers and digital-first strategies. Their expertise in DevOps, automation, and scalable solutions attracts enterprises seeking efficiency and flexibility. These firms maintain strong client relationships through consistent delivery and transformation initiatives.

ACS Technologies, Inspur, ISS, and others serve niche and mid-market segments with cost-effective, tailored solutions. Their regional strengths and client-centric models help them compete effectively. Focus on quality at lower costs has made them preferred among small and medium enterprises looking for specialized outsourcing partners.

Top Key Players in the Market

- Accenture

- HCL Technologies

- HPE

- IBM Corporation

- Tata Consultancy Services

- Oracle Corporation

- Infosys Ltd.

- ACS Technologies

- Inspur

- ISS

- Others

Recent Developments

- In August 2024, Sonata Software was appointed as the Strategic IT outsourcing partner by a U.S. based Healthcare and Wellness firm. The collaboration focuses on two key objectives: achieving cost optimization through engineering efficiencies and driving technology modernization. This transformation leverages enterprise data, AI, and hyper-automation to enhance both patient-facing applications and internal systems, aiming to boost overall operational performance.

- In July 2024, Austin-based consultancy Connect33 launched LatAm Partners, a digital marketplace focused on IT outsourcing in Latin America. The platform offers a self-guided purchasing experience, connecting global buyers with vetted software development firms across the region. It also empowers Latin American tech providers by linking them to new business opportunities, streamlining access to global markets.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Application Development, Testing and Quality Assurance, Software Maintenance and Support, Product Development, Consulting Services), By Deployment Model (Cloud-based, On-premise), By Organisation Type (SMEs, Large Enterprises), By Industry Vertical (BFSI, Healthcare, Media and Telecommunications, Retail and e-commerce, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture, HCL Technologies, HPE, IBM Corporation, Tata Consultancy Services, Oracle Corporation, Infosys Ltd., ACS Technologies, Inspur, ISS, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Software Development Outsourcing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Software Development Outsourcing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture

- HCL Technologies

- HPE

- IBM Corporation

- Tata Consultancy Services

- Oracle Corporation

- Infosys Ltd.

- ACS Technologies

- Inspur

- ISS

- Others