Global Extreme Ultraviolet Lithography (EUVL) Market by Equipment (Light Source, Masks, Optics, Others), by End User (Integrated Device Manufacturers, Foundries), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 138184

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- China Extreme Ultraviolet Lithography (EUVL) Market Size

- Equipment Segment Analysis

- End User Segment Analysis

- Key Market Segments:

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Latest Trends

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

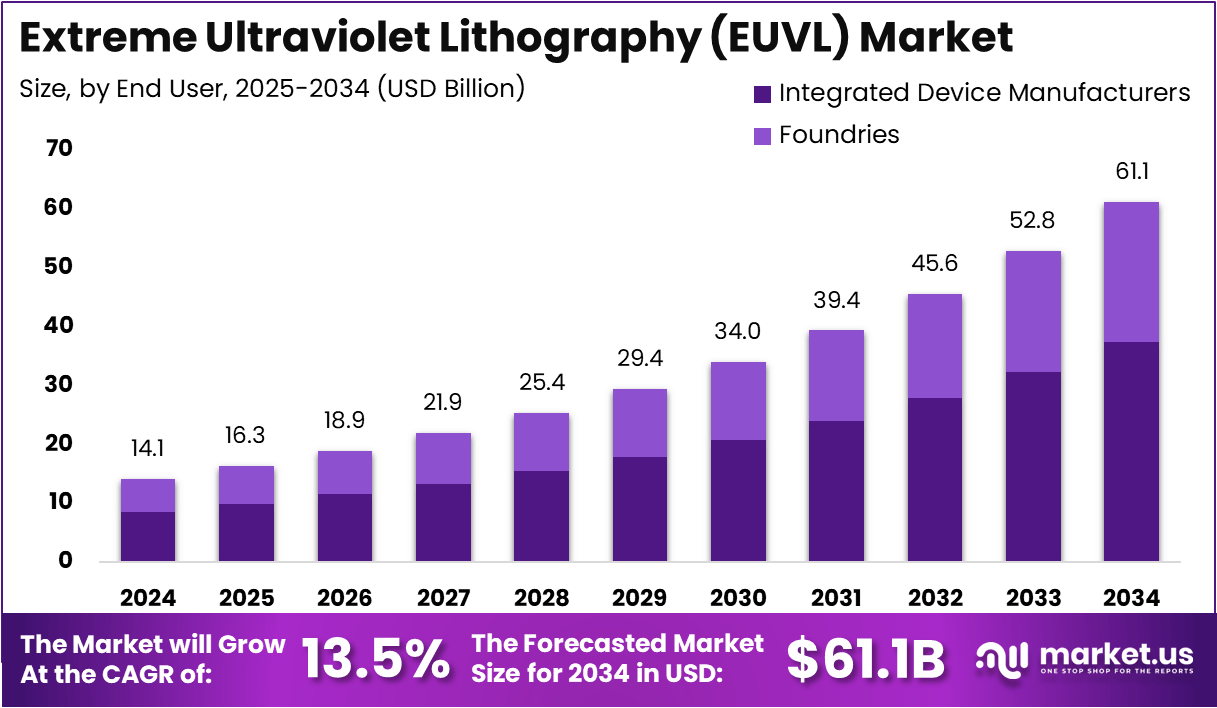

The Global Extreme Ultraviolet Lithography (EUVL) market size is expected to be worth around USD 61.1 Billion by 2034, from USD 14.1 Billion in 2024, growing at a CAGR of 15.8% during the forecast period from 2024 to 2033.

The extreme ultraviolet lithography system is an advanced optical lithography technology. This is a soft X-ray method with a wavelength of 13.5nm, which is transforming semiconductor manufacturing by enabling the production of more powerful, smaller, and energy-efficient chips.

The market for EUVL is growing rapidly due to the advancements in semiconductor manufacturing technologies and the continued growth of EY lithography light source technology. The increasing demand for higher performance in electronic devices, particularly, ly in energy-efficient cutting-edge processors for applications such as AI and 5G. Various companies such as ASML are leading the way with the cutting-edge EUV systems that are being adopted by various semiconductor manufacturers including Samsung and TSMC.

Moreover, the growth of electric vehicles and the Internet of Things are also pushing the demand for various advanced semiconductors, fuelling the EUVL market. As manufacturers tend to scale up production, investment in EUVL technology is expected to continue rising thus contributing to the overall growth and efficiency of the market.

Key Takeaways

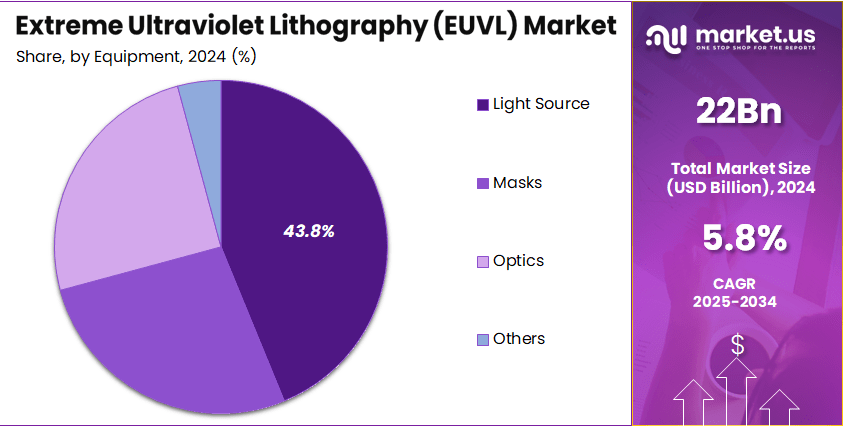

- In 2024, the Light Source segment held a dominant market position, capturing more than a 43.8% share of the Global Extreme Ultraviolet Lithography (EUVL) market.

- In 2024, the Integrated Device Manufacturers segment held a dominant market position, capturing more than a 61.1% share of the Global Extreme Ultraviolet Lithography (EUVL) market.

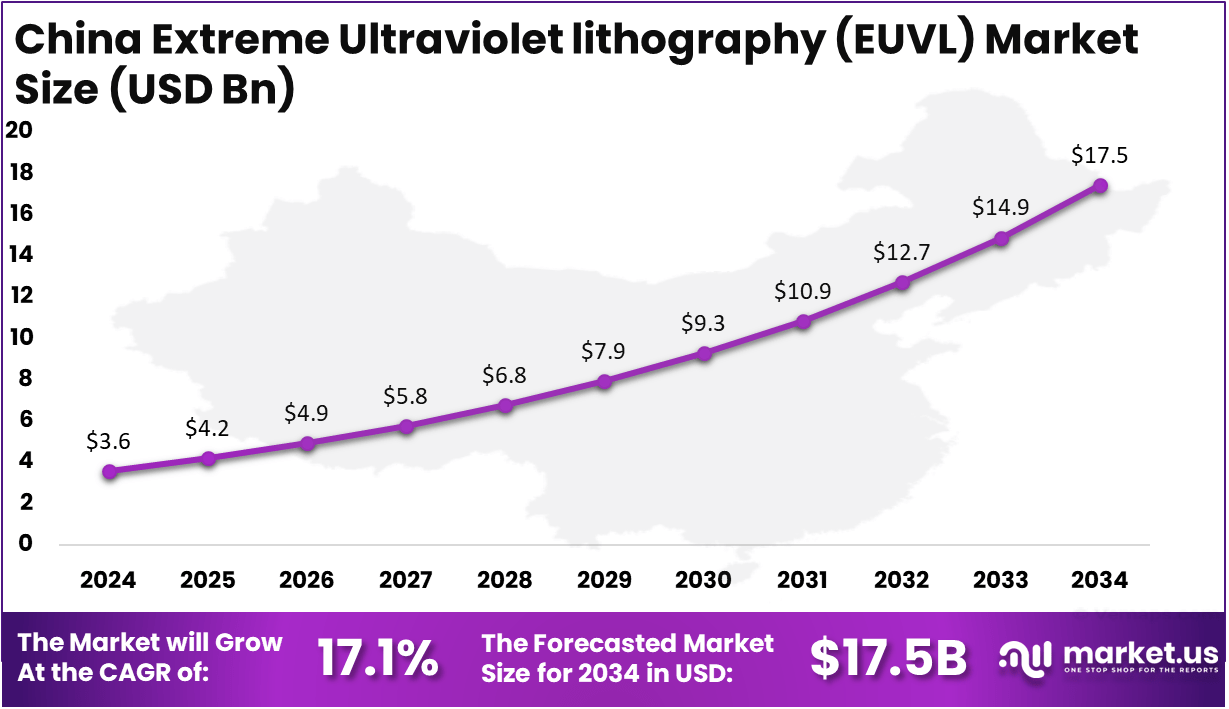

- The China Extreme Ultraviolet Lithography (EUVL) market was valued at USD 3.6 billion in 2024, with a robust CAGR of 1%.

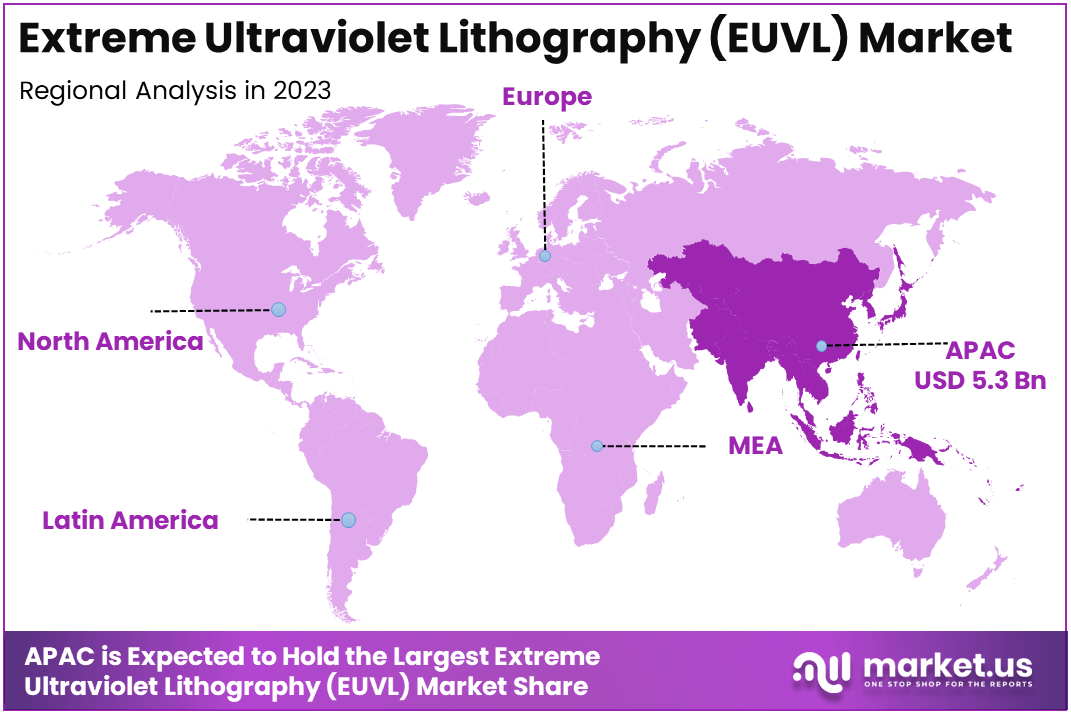

- In 2023, APAC held a dominant market position in the global Extreme Ultraviolet Lithography (EUVL) market, capturing more than a 37.5% share.

- According to NIST, EThe China allows for smaller features to be built into a semiconductor and currently costs a reported $150 Billion.

- According to SIA, global semiconductor sales hit USD 57.8 billion during November 2024, an increase of 20.7% compared to the November 2023 total of USD 47.9 billion and 1.6% more than October 2024. This depicts the increasing demand for EUVL technology.

China Extreme Ultraviolet Lithography (EUVL) Market Size

The China Extreme Ultraviolet Lithography (EUVL) market was valued at USD 3.6 billion in 2024, with a robust CAGR of 17.1%. This is due to the rapidly developed semiconductor ecosystem including the advanced manufacturing facilities, research institutions,s, and a skilled workforce. This ecosystem supports the growth and innovation of EUVL technology thus, enabling China to produce cutting-edge microchips with unprecedented precision and efficiency.

Furthermore, China has made significant investments in EUVL technology including the e, including advancements in light sources, optics, and mask technology. For instance, Shanghai Micro Electronics Equipment (SMEE) has a recent cutting-edge patent for extreme ultraviolet (EUV) radiation generators and lithography equipment. These investments have augmented the capabilities and efficiency of EUVL systems, driving market growth.

In 2023, APAC held a dominant market position in the global Extreme Ultraviolet Lithography (EUVL) market, capturing more than a 37.5% share. This is majorly due to the presence of various key players in the region including TSMC and Samsung. There is also a high demand for advanced semiconductor devices, booming the consumer electronics automotive, AI, and 5G.

Furthermore, governments in countries like South Korea, Taiwan, and China provide substantial financial incentives, tax benefits, and subsidies to boost domestic semiconductor manufacturing. For instance, the South Korean government has unveiled a $10 billion plan, to support its semiconductor industry. This includes expanding tax incentives for private research and development, as well as investments in semiconductor infrastructure.

Equipment Segment Analysis

In 2024, the Light Source segment held a dominant market position, capturing more than a 43.8% share of the Global Extreme Ultraviolet Lithography (EUVL) market. This is attributed to the demand for smaller and more powerful electronic devices including smartphones, and gaming consoles. This drives the need for advanced EUVL techniques as it allows the production of intricate microchip layers at a small scale.

Moreover, EUVL light sources, particularly those using laser-driven plasma are highly efficient in converting laser energy into EUV light. This efficiency is crucial for the mass production of advanced microchips, leading to the dominance of the segment.

EUVL Light Source also produces photons with very high energy, which is needed for achieving the fine resolution needed in advanced semiconductor manufacturing. This need further enhances the dominance of the segment in the market.

End User Segment Analysis

In 2024, the Integrated Device Manufacturers segment held a dominant market position, capturing more than a 61.1% share of the Global Extreme Ultraviolet Lithography (EUVL) market. Integrated Device Manufacturers control the semiconductor manufacturing process from design to production. This allows for optimization of the use of EUVL technology and achieves a higher efficiency and cost-effectiveness, thus contributing towards the dominance of the segment.

Moreover, Integrated device manufacturers also develop and manufacture their proprietary semiconductor products such as memory chips, microprocessors, and sensors. This could give them a competitive edge in utilizing advanced EUVL systems to produce cutting-edge devices.

These manufacturers typically have substantial financial resources, thus enabling them to invest heavily in the latest EUVL equipment and technology. This investment capacity allows for staying ahead in the evolving industry.

Key Market Segments:

By Equipment

- Light Source

- Masks

- Optics

- Others

By End User

- Integrated Device Manufacturers

- Foundries

Driving Factors

Increasing demand for miniaturization

The increasing demand for miniaturization has been a driver for the EUVL market. As consumers and industries demand smaller and more powerful electronic devices, including wearables, tablets,s and smartphones, the demand for advanced semiconductor manufacturing technologies such as EUV becomes crucial.

EUVL enables the production of devices with sizes below 10nm. For instance, the Apple A14 Bionic chip used in the iPhone 12 series, is manufactured using TSMC’s 5nm process, which relies on EUV lithography to achieve its incredibly small and precise features. This precession is highly essential for creating miniature composites for advanced applications such as AI, 5G communication, and autonomous vehicles.

Restraining Factors

Higher initial costs

EUVL systems need sophisticated and costly equipment such as light sources, mirrors, and masks. This pricing point could prohibitively hamper the market growth, especially for smaller semiconductor manufacturers or new entrants.

Furthermore, setting up an EUVL facility includes substantial investment in sophisticated and costly equipment specialized tools, and high price,sion manufacturing equipment. These costs could also add up to the barrier, making it challenging for market growth.

Growth Opportunities

Growing demand for advanced semiconductors

The growing demand for advanced semiconductors presents a significant opportunity for the market. Various advanced applications such as machine learning, 5G communication, and AI need a high-performance semiconductor with higher speed and lower power consumption. Thus, EUVL enables the production of such advanced chips by meeting the performance demands.

Furthermore, the proliferation of consumer electronics also drives the need for smaller and more efficient semiconductors. In addition to this, the expansion of IoT applications ranging from smart homes to industrial automation has also enhanced the opportunities for market growth.

Challenging Factors

Complex Manufacturing Processes

EUVL needs higher precision in the alignment and calibration of optical components including lenses, s and mirrors. This could be challenging and time-consuming for the manufacturers.

Furthermore, the manufacturing of EUVL systems needs to be conducted in cleanroom environments to prevent the contamination of optical components. Thus, maintenance of such environments is costly and needs a strict protocol, adding to the complexities of the market.

Growth Factors

The EUVL market is growing rapidly due to various factors including the growing demand for data centers and cloud computing. The increasing demand for data storage and processing power drives the need for advanced semiconductors. This in turn leads to an increased demand for the EUVL system.

Furthermore, modern vehicles that incorporate advanced driver assistance systems (ADAS), autonomous driving technology, and infotainment systems need sophisticated semicondrivesr. Hence, EUVL technolsemiconductorshe production of such chips, leading to the market growth.

Latest Trends

Various trends are reshaping the global extreme ultraviolet lithography market. The demand for high-performance computing has provided a huge opportunity for market growth as it needs powerful processors with high processing speeds and low power consumption.

Moreover, emerging technologies such as machine learning, 5G, and AI are enhancing the demand for These systems. Businesses are collaborating to leverage the expertise and resources of various stakeholders to advance the EUVL technology. For instance, IMEC, a leading research and innovation hub, collaborates with GlobalFoundries to develop and optimize EUV lithography processes. This partnership focuses on improving the efficiency and performance of EUV technology for semiconductor manufacturing.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in the market is ASML, a Netherlands-based company, that is a leading supplier of semiconductor manufacturing equipment. They are renowned for their advanced lithography machines, which are essential for producing microchips.

Another prominent firm operating in the market is ZEISS Group, a German company, that is a global leader in optics and optoelectronics. Their Semiconductor Manufacturing Technology (SMT) division collaborates closely with ASML to develop the optical systems used in EUVL machines.

Top Key Players in the Market

- ASML

- ZEISS Group

- Ushio Inc.

- Energetic

- Applied Materials, Inc.

- HOYA Corporation

- AGC Electronics America

- Advantest Corporation

- SUSS MicroTec SE

- NTT Advanced Technology Corporation

- Other Key Players

Recent Developments

- In January 2024, ZEISS Group introduced its High-NA (Numerical Aperture) Extreme Ultraviolet (EUV) lithography system. This cutting-edge system represents a monumental leap in semiconductor manufacturing, enabling the creation of microchips with incredibly fine features, compared to existing EUV systems.

- In December 2023, Dai Nippon Printing Co., Ltd. (DNP) developed a photomask manufacturing process capable of accommodating the 3-nanometer (10-9 meter) lithography process that supports Extreme Ultra-Violet (EUV) lithography, the cutting-edge process for semiconductor manufacturing.

- In August 2023, China is set to launch its first home-grown 28-nanometre lithography machine by the end of this year. The breakthrough will be a significant boost to Beijing’s quest for technological self-sufficiency in the entire chipmaking value chain amid US-led chip equipment export sanctions.

Report Scope

Report Features Description Market Value (2024) USD 14.1 billion Forecast Revenue (2034) USD 61.1 billion CAGR (2025-2034) 15.8% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment (Light Source, Masks, Optics, Others), by End User (Integrated Device Manufacturers, Foundries), Region Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape ASML, ZEISS Group, Ushio Inc., Energetic, Applied Materials, Inc., HOYA Corporation, AGC Electronics America, Advantest Corporation, SUSS MicroTec SE, NTT Advanced Technology Corporation, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Extreme Ultraviolet Lithography (EUVL) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Extreme Ultraviolet Lithography (EUVL) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ASML

- ZEISS Group

- Ushio Inc.

- Energetic

- Applied Materials, Inc.

- HOYA Corporation

- AGC Electronics America

- Advantest Corporation

- SUSS MicroTec SE

- NTT Advanced Technology Corporation

- Other Key Players