Global Snacks Market By Product (Frozen and Refrigerated, Fruit, Bakery, Savory, Confectionery, Dairy, and Other Products), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 103475

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

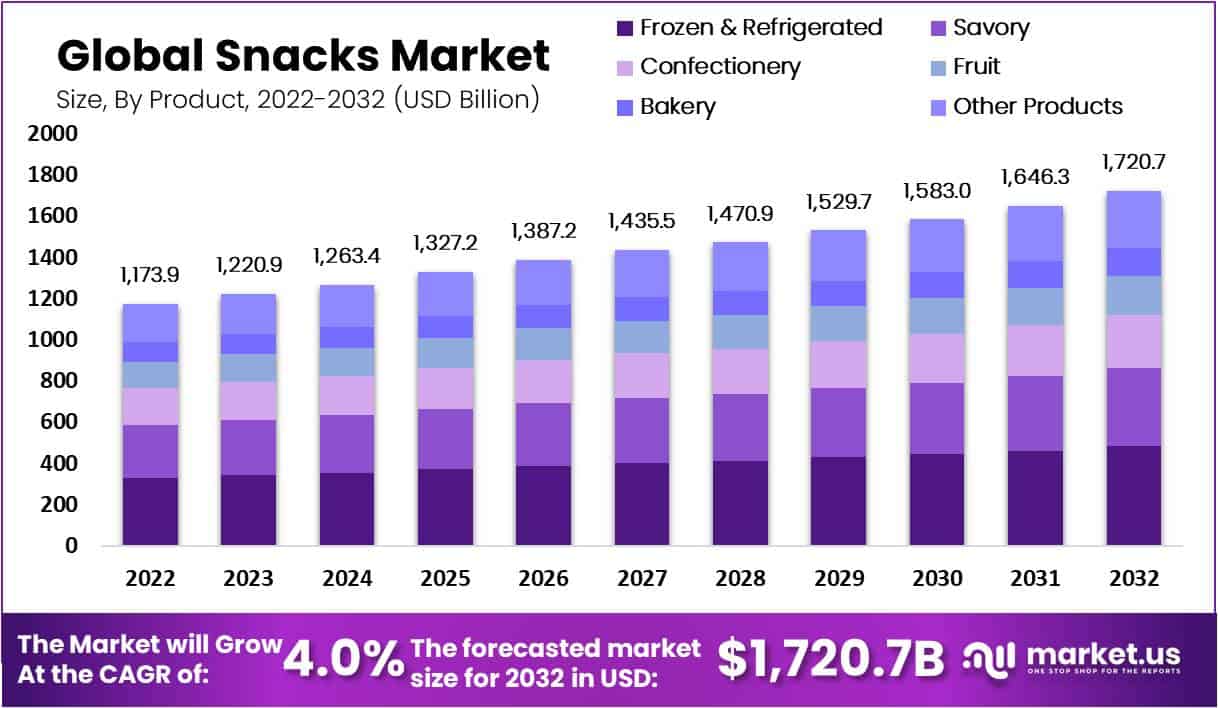

In 2022, the Global Snacks Market size was valued at USD 1,173.9 Billion and will reach USD 1,720 Billion by 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 4.0%.

Snacks can be a small part of food, which is not as filling and nutritious as regular meals. Snacks can be eaten between regular foods, and they come in many types, such as processed foods or other refined carbs. Snacks are typically made from ingredients that are easily available.

In the past two years, the market for snack products has seen an exponential rise due to pandemic-induced lockdowns and the widespread adoption of work-from-home cultures. This trend will continue during the forecast period as snack manufacturers focus on innovation and healthier products.

Increased at-home food product consumption was a result of COVID-19 lockdowns. The COVID-19 lockdown extensions and implementations have made snack products an important part of households around the world.

The desire to indulge in “on-the-go” is increasing as more people work from home. As the pandemic caused consumers to create new dining arrangements at home, the demand for packaged snacks like macaroni, chips, and noodles has increased over the past two years.

A variety of snacks are in demand due to rising health concerns and changing lifestyles. The industry is seeing a significant shift in the way people eat snacks and vegan snacks. International brands have capitalized on the increased snack demand by packaging their products in more convenient formats to increase shelf life and encourage snacking while on the go.

Key Takeaways

Market Trends: The snacks market is projected to experience compound annual growth of 4.0% between 2023-2032.

Overview of Snacks Industry: The snack industry, comprising both sweet and savory options, is well known for embracing quality taste products with diverse offerings.

Product Analysis: Frozen snacks market dominates the snacks market, particularly within the frozen and refrigerated product category. Frozen snacks can be defined as food items that can be frozen and stored at lower temperatures for extended periods.

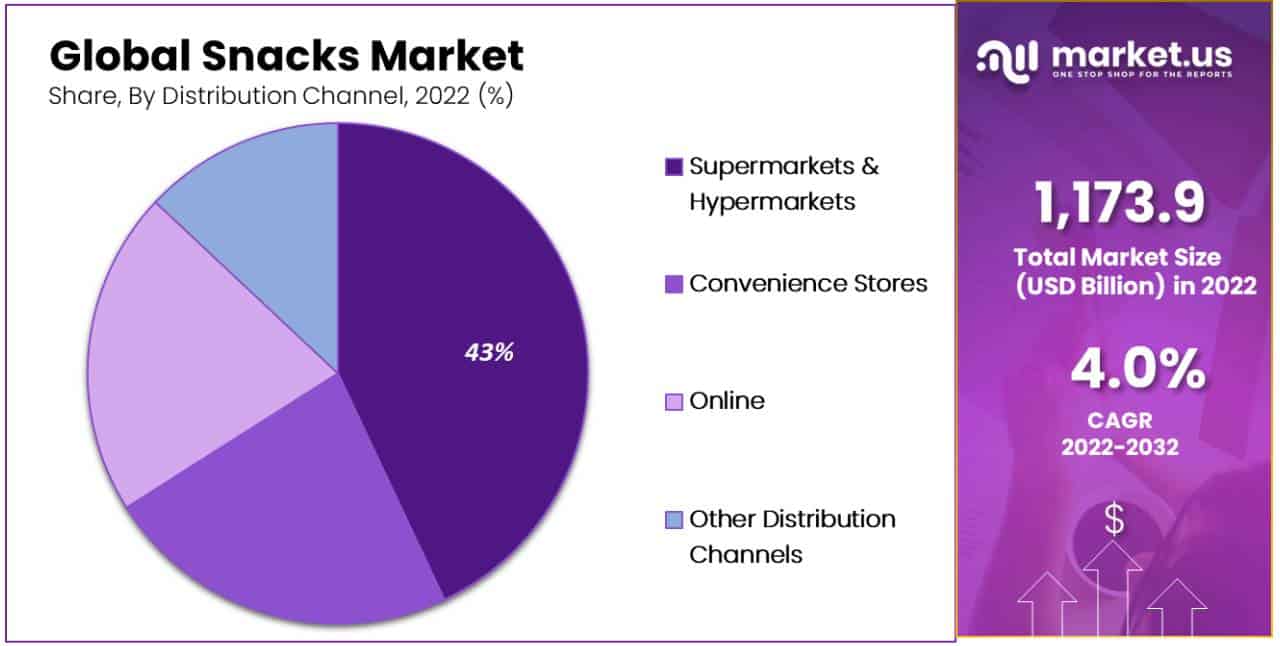

Distribution Channel Analysis: Hypermarkets and supermarkets dominate the majority of global snack sales. These retail outlets play a central role in providing snack foods in higher-income countries.

Drivers: Key factors driving growth in the snacks industry include evolving consumer tastes, busy lifestyles, and an ever-wider array of snack choices. Innovative flavors and convenient packaging also play an integral part in market expansion.

Restraints: Snack industry challenges include health concerns related to certain snack choices, market competition, and shifting consumer tastes towards healthier snack alternatives.

Recent Trends: Recent developments in the global snacks market include an upswing in demand for healthier options with organic and natural ingredients and eco-friendly packaging.

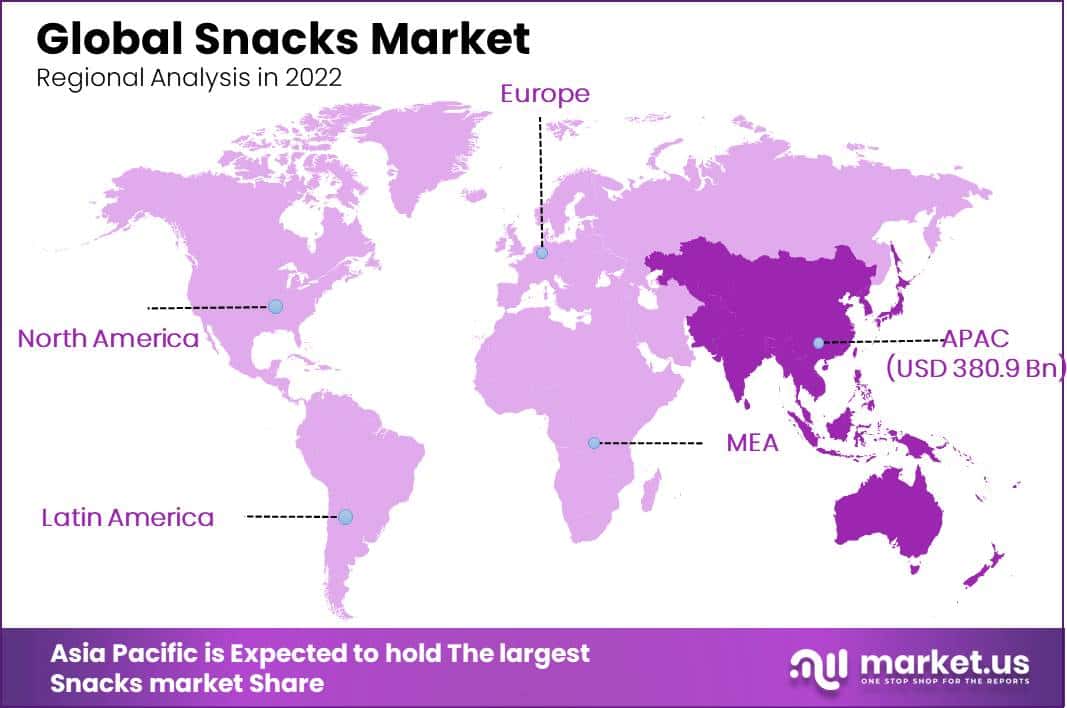

Regional Analysis: Asia Pacific held a 32.4% market share for packaged snacks globally in 2013. Their convenience and wide array of choices make packaged snacks extremely popular among snack consumers.

Key Players in the Snacks Market: Major players in the snacks industry include well-established snack manufacturing companies, brands, and distribution networks. These key players focus on collaborative endeavors such as innovation and strategic expansion to stay competitive within this ever-expanding snack marketplace.

Driving Factors

Quick Snacks and Affordable Prices are Driving the Growth of the Snacks Market.

The market expansion in healthy snacks is driven by growing consumer preference for convenient, ready-to-eat foods and quick snacking. On-the-go snacks or ready-to-eat products are a great option for those with hectic schedules, and they are a primary driver for the snacks market. They provide quick nutrition and complete feelings.

Mondelz International’s “state of snacking”, a report that examined the preferences of adults around the world, found that 59% prefer to eat smaller meals throughout the day. Customers consider snacks part of healthy eating due to the predetermined portions.

These small, lightweight packs can be carried around for an energy boost during a hectic workday which is acting as the growth factor for the snacks industry. The snack industry is evolving by offering healthy snacks that can be taken with you wherever you are.

Consumer preference for quick snacks and ready-to-eat food is driving the market growth in healthy snacks. These snacks are great for people with busy schedules. These snacks provide fast nutrition and complete emotions. Mondelz International’s report on the “state of snacking”, which examined the preferences and habits of adults worldwide, revealed that 59% prefer smaller meals throughout the day.

Because of the predetermined portions, snacks are considered healthy eating. These lightweight, portable snacks can be carried with you for energy boosts during busy work days. Healthy snacks are becoming more accessible and can be carried with you everywhere.

Restraining Factors

Processing and Technical Challenges are Hindering the Growth of the Snacks Market.

When purchasing snacks, consumers pay attention to the texture and crispiness of any product. How the product feels can be affected by how it retains moisture and its binding ability. Whole grains and fats can also have an impact on how the product tastes.

The market for fruit and vegetable snacks faces similar shelf stability and preservation problems. Clean-label snack products, such as preservative-free or additive-free, may be difficult to develop without ingredients that allow for emulsification, stability, and creamy texture. These challenges will be met by processors through technological advances and innovations.

Product Analysis

Busy Lifestyles and Long-lasting Factors are Increasing the Frozen Snacks Demand.

Frozen snacks are the leading segment in the snacks market. The most popular product category is frozen & refrigerated. Frozen snacks are food that can be frozen and kept at a low temperature for extended periods of time. There are many food options that can be frozen, such as vegetables, fruit snacks, meat poultry, seafood snacks, bakery products, and meat substitutes.

The key factor driving the growth in frozen snack usage is accommodation. The growth of frozen snacks is influenced by the busy lifestyles of consumers. The market’s growth is also due to the large spending power of consumers and economic stability.

During the pandemic, Customers panicked enough to stock their freezers with more expensive commodities at the peak of the lockdown. Although customer anxiety is decreasing as the number of COVID-19 cases decreases, frozen food sales are still strong compared with pre-pandemic levels.

The fastest expected CAGR for savory snacks is during the forecast period. The demand for meat snacks, such as jerky, dried meat, and other meat snacks, increased rapidly in North America the Middle East, and Africa.

Manufacturers and producers have responded to customers’ growing concern about their health and well-being by creating a wide range of low-fat, low-calorie, and gluten-free products. In the last few decades, we have seen a steady rise in life expectancy as well as greater quality. Consumers are more concerned about their health and pay more attention to their lifestyles.

The demand for convenience food has increased due to the growing health-consciousness of the population. This has led to an increase in sales of healthy and nutritional content snacks. In order to live healthier lives, people are spending more on value-added foods like granola bars and protein bars, which is boosting sales of healthy snacks.

People are becoming more aware of the importance of strengthening their immunity to reduce infection risk. This has led them to adopt healthy lifestyles and dietary habits.

Because of its abundance of antioxidants, macronutrients, and micronutrients, a protein-content diet can reduce the impact of the virus on those at high risk. These factors will likely increase the demand for savory snacks over the forecast period.

Fruit snacks markets are sugary, processed confectioneries that are specially designed for children. The rising demand for fruit snacks can be attributed to the growing purchasing power and increasing consumer preference towards ready-to-eat, healthy food options. Consumer preference for convenience foods is increasing due to the expanding food & beverage industry and improved economic conditions.

Fresh, unprocessed ready-to-eat foods are preferred by consumers as they are more nutritious and healthy. Convenience foods are now available in supermarkets and other retail outlets thanks to the expansion of distribution channels.

The changing working population and hectic lifestyles are also factors that have boosted the demand for convenience foods. Major companies are also coming up with better fruit snacks and more efficient distribution channels to reach a wider customer base.

Distribution Channel Analysis

Supermarkets and Hypermarkets are the Preferable Distribution Channels for Customers.

The major market share of the global snacks market is held by hypermarkets and supermarkets. Supermarkets and hypermarkets are the main suppliers of snack food in many countries with high incomes.

According to the Institute for Local Self-Reliance (a non-profit organization in the U.S.), Walmart holds more than half of all grocery sales. However, increasing retail infrastructure is driving market growth and the resulting rise in hypermarkets and supermarkets in urban areas throughout Asia, Africa, and the Middle East.

In recent years, successful e-commerce platforms, from Amazon in the U.S. and JD.com in China, have opened or acquired physical supermarkets. Internet businesses are trying new methods of automation to transfer some of their digital efficiency into brick-and-mortar stores.

Brick-and-mortar stores will need to adapt to the increasing number of people shopping online. This includes making shopping a pleasant activity rather than a transaction.

Ready-to-eat foods are preferred by consumers, especially Millennials and Generation Z. The snack food industry is also being supported by partnerships between online platform companies and manufacturers of ready-to-eat foods.

Grubhub, an American online food delivery and ordering platform, announced in February 2022 its partnership with 7-Eleven, Inc. Grubhub Goods, a delivery platform, delivers convenience products from 7-Eleven across the U.S. To meet growing demand, Grubhub Goods partners with hypermarkets around the globe.

Key Market Segments

Product

- Frozen & Refrigerated

- Fruit

- Bakery

- Savory

- Confectionery

- Dairy

- Other Products

Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Other Distribution Channels

Growth Opportunity

Substitution of Meals with Snacks is Creating Opportunities in the Snacks Market.

The industry is seeing a significant shift in the way people eat and a rise in demand for healthier snacks. International brands have capitalized on the increased snack demand by packaging their products in more convenient and convenient ways to increase shelf life and encourage snack consumption.

Kwik Lok Corp., a U.S.-based company, offers the Eco-Lok closure package solution that allows consumers to close the packaging and eat the snacks later. Innovative food products and flexible packaging solutions will help the industry to show the fastest growth in the market.

Convenience is the key to snack foods that can compete with fast-food restaurants. It contains small portions and has snacks ready to go, so there is no need for food prep. In retail settings, snacks are also easy to find. Snack delivery is a new trend that could become more prominent with companies like Amazon.

Only 5 percent of snack products are currently sold online. This could be a supplement to snack purchases. This is especially true for healthy snacks. Adults younger than 25 are more conscious of their health and seek whole-nutrition food.

This is a winning strategy in the snack food market. Premium attributes are given to nutrition bars, meat snacks, and small indulgences like cookies, ice cream, and chocolate.

Trending Factors

People are increasingly replacing meals with snacks because they don’t have the time to prepare a full meal due to their hectic work schedules. Because both parents work, many nuclear families live in large cities. This means that the children are more likely to snack than eat a full meal. Bachelors who are unable to cook at home may be able to find healthier snack options.

The report reveals that healthy snacking trends include low sugar, high-protein, new formats, and functional nutrition. The same report found that people snack because they are stressed at work or in their personal lives. To reduce frustration, 46% of British women and 26% of men eat snacks. Stress eating can reduce appetite and lead to a loss of appetite. Over the long term, snacks may replace meals.

Key trends like the increasing popularity of fusion flavors and flavor snacks are becoming more popular than traditional snacks. Many brands have begun to combine multiple flavors and switch product bases in an effort to increase novelty. Floral flavors are a big trend in the snack food industry.

Combining botanical flavors with fruit can create new products, complex tastes, or new dimensions in food, beverage, and beverages. All kinds of desserts can include blueberry, lavender, hibiscus, berry rose lemonade, blackberry, and apple hibiscus-berry rose lychee. These new floral flavors are driving increased demand for snack foods products.

Regional Analysis

Asia Pacific Covers 32.4% of Major Share in Global Snacks Market.

Asia Pacific accounted for 32.4% of the global snack market share. Packaged snacks are a top seller in convenience and flexibility when it comes to food. Because of their convenience and ready-to-eat (RTE), packaged snacks are great for quick consumption.

In China, for example, snacking is often used to quicken traditional meals. This has led to a rise in healthy snack options. Another trend in this region is clean-label snacks.

Asian consumers are looking for quick and easy food options that can be eaten on-the-go. It is expected that snack-replacing foods such as frozen and refrigerated products, along with savory snacks, will continue to be popular.

Big companies are increasingly turning to snacking categories in order to maintain their competitive edge. They are also buying smaller snacking brands. Even staples and dairy companies are trying to appeal to consumers’ snacking habits with products such as multi-compartment and easy-to-eat yogurts.

In North America, snack products are becoming more popular, particularly in prominent players in Canada and the U.S. Many snack products, such as bars, savory snacks, and burgers, are popular among millennial consumers. Snack manufacturers have begun to look at the possibilities of creating healthier, better-quality snacks for the growing market.

Europe is a major producer and consumer of snacks. Europe is a popular place to snack on the go or at social events. However, more people are choosing healthier snacks. It is a valuable addition to a healthy diet and is often consumed in between meals. Europe is the largest market in organic and natural snacks. Europe is anticipated to show immense potential growth during the forecast period.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Player Analysis

Globally, the market is fragmented, with many small and large snack food product manufacturers operating in different countries. Due to the increasing demand for snack foods, the market offers tremendous growth potential.

Snacks are constantly evolving to meet the growing demand of consumers for healthy, delicious, and sustainable snacks to help them live a more active lifestyle. Major market players are adopting strategies like merging and acquisitions for the growth of the market.

Market Key Players

- General Mills Inc.

- PepsiCo Inc.

- The Kraft Heinz Company

- Nestlé S.A

- The Kellogg Company

- Unilever

- Calbee

- Intersnack Group GmbH & Co. KG

- Conagra Brands Inc.

- ITC Limited

- Grupo Bimbo

- Danone

- Other Key Players

Recent Development

- In May 2022, General Mills purchased TNT Crust, an American company. TNT Crust makes half-baked, self-rising pizza crusts. It also produces frozen pizza crusts that can be used by regional and national pizza chains as well as grocery stores and retailers. General Mills was able to expand its frozen Bakery Snacks product line with this acquisition.

- In September 2022, The Kellogg Company partnered with Mackie Foods Corporation. The third collaboration between the snack company based in Chattanooga, Tennessee, Kellogg’s Little Debbie Nutty Buddy Cereal, is here. This new granola is available in chocolate, peanut butter, and peanut butter flavors. Granola chunks are covered with fudge. The company will be able to expand its product range in the snack market through this partnership.

- In October 2022, General Mills and Hidden Valley Ranch partnered to increase the crunch of Hidden Valley Ranch’s savory ranch products. Hidden Valley Ranch Flavours is a combination of the bright, bold flavor of Hidden Valley Ranch’s fragrant herbs and the unique shape of the products.

- In July 2021, Nestle S.A. expanded its frozen food plant operations in Cherokee County, South Carolina. The USD 100 million investment resulted in the best-frozen food for Stouffer’s brand and LEAN CUISINE brand. It also increased the production capacity by adding new production lines or expanding existing ones.

Report Scope

Report Features Description Market Value (2022) US$ 1,173.9 Bn Forecast Revenue (2032) US$ 1,720.7 Bn CAGR (2023-2032) 4.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product – Frozen and Refrigerated, Fruit, Bakery, Savory, Confectionery, Dairy, and Other Products; By Distribution Channel – Supermarkets & Hypermarkets, Convenience Stores, Online, and Other Distribution Channels. Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape General Mills Inc., PepsiCo Inc., The Kraft Heinz Company, Nestlé S.A, The Kellogg Company, Unilever, Calbee, Intersnack Group GmbH & Co. KG, Conagra Brands Inc., ITC Limited, Grupo Bimbo, Danone, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Global Snacks Market?In 2022, the Global Snacks Market was valued at US$ 1,173.9 Billion and is projected to reach USD 1,720 Billion by 2032.

What is snacks market?Snacks Market include small food items that are not as filling and nutritious as regular meals.

What are the driving factors for the growth of the Snacks Market?Quick snacks and affordable prices are driving the growth of the Snacks Market. The preference for convenient, ready-to-eat foods and quick snacking among consumers is a primary driver.

Which segment is leading the Snacks Market?Frozen snacks are the leading segment in the Snacks Market. The busy lifestyles of consumers and the demand for long-lasting snacks are driving the growth in frozen snack usage.

How are manufacturers responding to the increasing demand for healthy snacks?Manufacturers are creating a wide range of low-fat, low-calorie, and gluten-free products to cater to the growing demand for healthy snacks. They are also focusing on packaging innovations for increased shelf life and convenience.

Who are the key players in Snacks Market?Major players in the market include General Mills Inc., PepsiCo Inc., The Kraft Heinz Company, Nestlé S.A, The Kellogg Company, Unilever, Calbee, Intersnack Group GmbH & Co. KG, Conagra Brands Inc., ITC Limited, Grupo Bimbo, Danone, and other key players.

What are the popular types of snacks in the market?The popular types of snacks in the market include frozen snacks, fruit snacks, bakery snacks, savory snacks, confectionery snacks, dairy snacks, and various other snack products.

Which distribution channel holds a significant market share in the Snacks Market?Supermarkets & hypermarkets hold a significant market share in the Snacks Market.

-

-

- General Mills Inc.

- PepsiCo Inc.

- The Kraft Heinz Company

- Nestlé S.A

- The Kellogg Company

- Unilever

- Calbee

- Intersnack Group GmbH & Co. KG

- Conagra Brands Inc.

- ITC Limited

- Grupo Bimbo

- Danone