Global Smart Stethoscopes Market Analysis By Product Type (Wireless Stethoscopes, Wired Stethoscopes), By Application (Cardiovascular, Pediatric, Neonatal, Other Applications), By End-use (Hospitals, Clinics, Ambulatory Surgical Centers (ASCs)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 31250

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

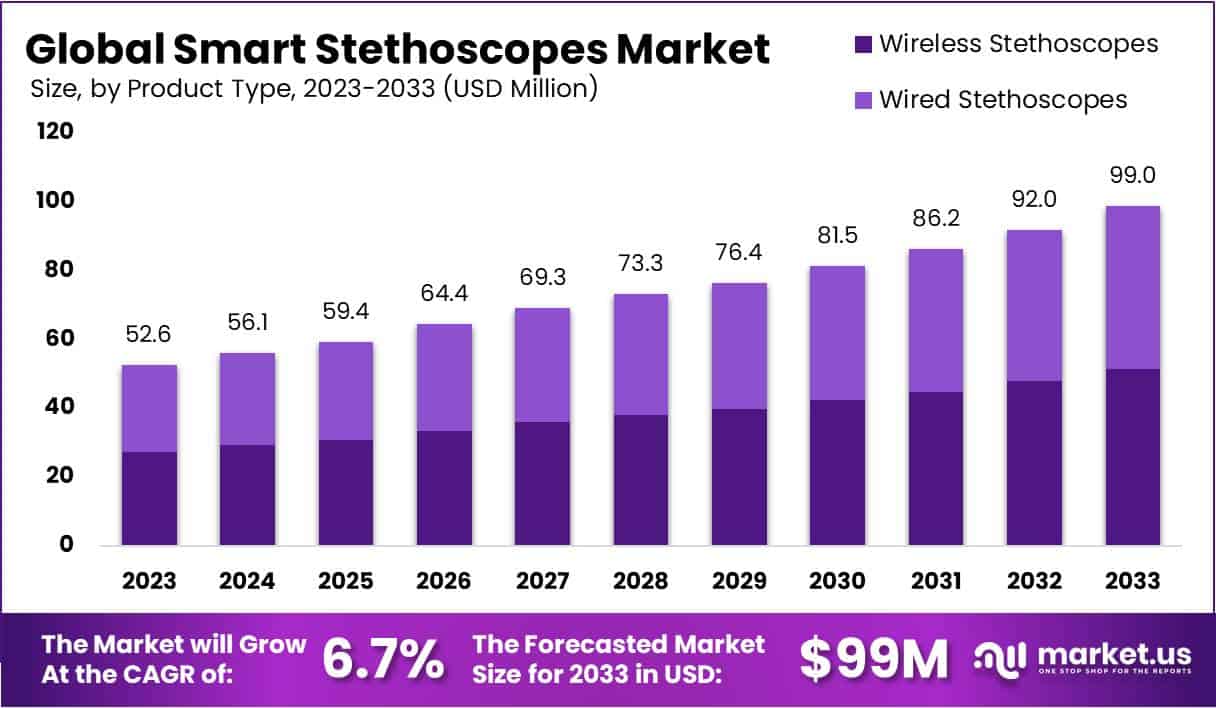

The Smart Stethoscopes Market Size is projected to experience substantial growth, with an anticipated value of approximately USD 99 million by 2033, compared to its estimated worth of USD 52.6 million in 2023. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 6.7% throughout the forecast period spanning from 2024 to 2033.

A smart stethoscope represents a technological leap in auscultation, elevating the traditional diagnostic tool with digital features. These advanced devices integrate Bluetooth connectivity, noise cancellation, and recording capabilities. Health professionals benefit from wireless transmission of audio signals to compatible devices, facilitating seamless data recording and sharing. Equipped with noise reduction technology, smart stethoscopes deliver clearer and more precise sounds for accurate diagnoses.

Some models include visualization tools for a comprehensive understanding, allowing healthcare providers to visualize sound wave representations. Additionally, these devices store and analyze auscultation data, enabling tracking of changes over time and identification of patterns. The integration of smart stethoscopes with telemedicine platforms further enhances remote patient consultations.

The smart stethoscope market encompasses the dynamic industry involved in developing, manufacturing, and selling these innovative diagnostic tools. Fueled by the increasing adoption of digital health technologies, the market responds to the demand for efficient remote patient monitoring solutions. It comprises a diverse range of players, from established medical device manufacturers to agile startups focused on pioneering healthcare technology. As technology evolves, smart stethoscopes offer a promising avenue for improving diagnostic accuracy. The market is shaped by factors such as the integration of digital solutions into healthcare practices, reflecting a broader trend toward enhancing traditional tools with cutting-edge advancements.

Key Takeaways

- Market Growth: Smart Stethoscopes Market to reach USD 99 million by 2033, with a 6.7% CAGR from 2024-2033, compared to USD 52.6 million in 2023.

- Product Dominance: Wireless Stethoscopes claimed over 52% market share in 2023, indicating a preference for cord-free convenience among healthcare professionals.

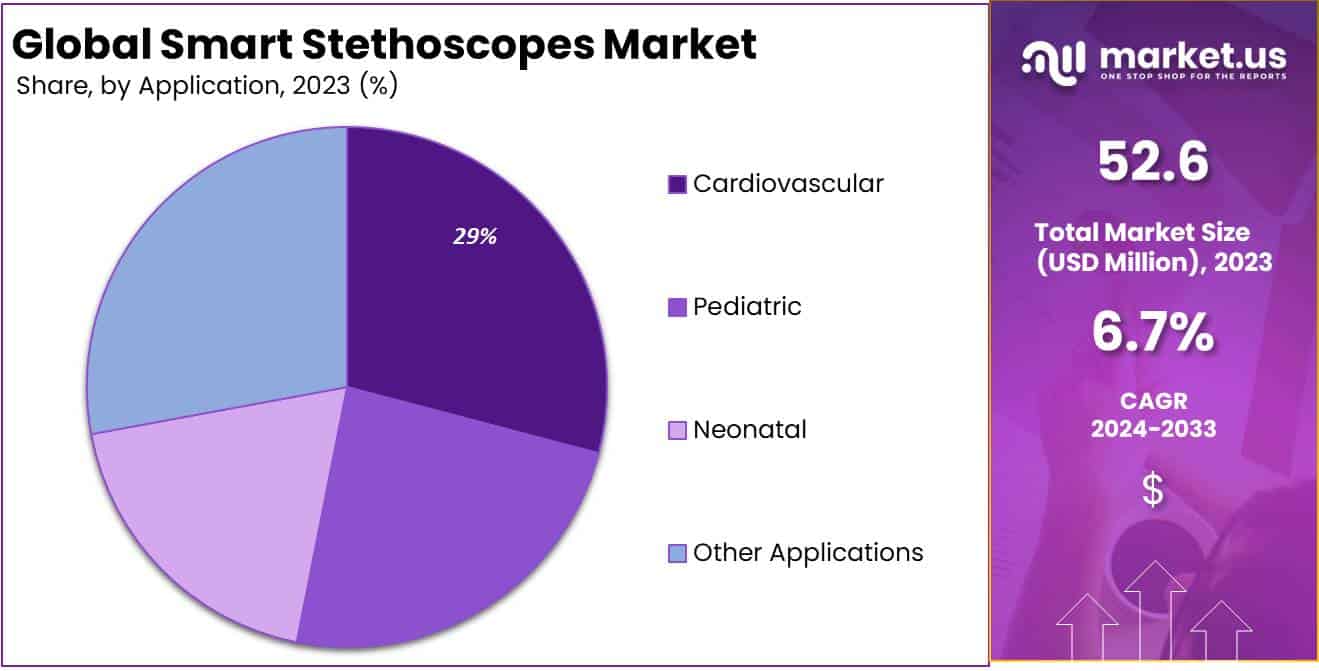

- Application Dominance: Cardiovascular segment led with over 29.1% market share in 2023, addressing the demand for advanced diagnostic tools in cardiovascular disease assessment.

- End-Use Dominance: Hospitals dominated as the primary end-user, capturing over 61% of the market share in 2023, showcasing the crucial role of smart stethoscopes in critical care.

- Technological Drivers: Integration of AI, Bluetooth, and mobile apps propels market growth, enhancing diagnostic capabilities for improved patient care.

- Chronic Disease Impact: Rising prevalence of chronic diseases globally drives demand, positioning smart stethoscopes as essential tools for early detection and continuous monitoring.

- Remote Monitoring Opportunity: Growing emphasis on remote patient monitoring provides a significant growth opportunity, aligning with the market’s evolution.

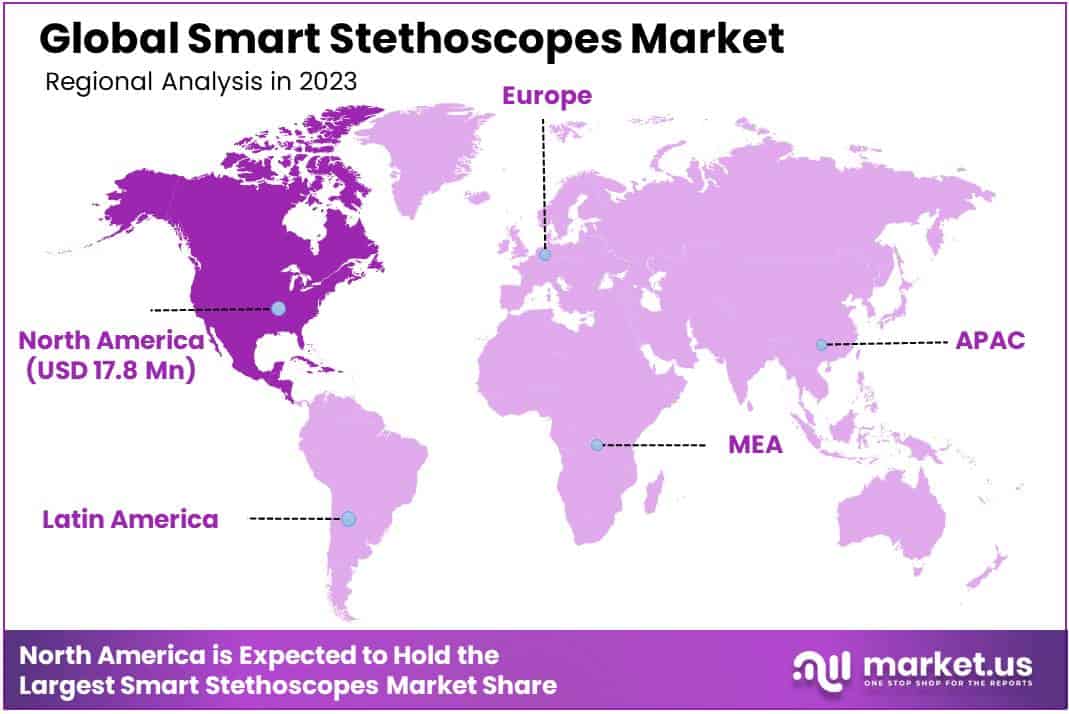

- North America’s Dominance: In 2023, North America secured a commanding market position with a share exceeding 34%, driven by technological innovation and a well-established healthcare infrastructure.

Product Type Analysis

In 2023, the Smart Stethoscopes market showcased a notable trend, with the Wireless Stethoscopes segment securing a leading market position, claiming a substantial share of over 52%. This signifies a growing preference among healthcare professionals for the wireless variant, a shift that is poised to influence the market landscape.

Wireless Stethoscopes, with their cord-free convenience, gained significant traction due to enhanced mobility and ease of use. Healthcare practitioners increasingly embraced this technology, appreciating the flexibility it offers during patient examinations. The segment’s dominance can be attributed to its ability to provide real-time data transmission and compatibility with digital platforms, fostering efficient patient care and diagnosis.

In contrast, the Wired Stethoscopes segment, while maintaining a presence in the market, faced a relative decline in market share. These traditional stethoscopes, though trusted for their reliability, are gradually giving way to the advanced capabilities offered by their wireless counterparts. However, wired stethoscopes still find utility in specific healthcare settings, where the emphasis lies on simplicity and cost-effectiveness.

As the Smart Stethoscopes market evolves, the Wireless Stethoscopes segment is anticipated to continue its ascendancy, driven by ongoing technological advancements and the increasing demand for seamless healthcare solutions. Healthcare professionals’ inclination toward wireless innovations is expected to sustain and potentially expand the market share of this segment in the coming years.

Application Analysis

In 2023, the Smart Stethoscopes Market exhibited a noteworthy presence, with the Cardiovascular segment taking the lead by securing a dominant market position, capturing more than a 29.1% share. This segment’s robust performance can be attributed to the increasing prevalence of cardiovascular diseases globally, prompting a growing demand for advanced diagnostic tools.

The Cardiovascular application of smart stethoscopes addresses the specific needs of healthcare professionals in assessing and monitoring heart-related conditions. With an emphasis on accuracy and efficiency, these smart devices enable practitioners to detect and analyze cardiac abnormalities with greater precision, ultimately contributing to improved patient outcomes.

The Pediatric segment also played a pivotal role in the market landscape, showcasing a substantial growth trajectory in 2023. This growth is indicative of the rising adoption of smart stethoscopes in pediatric healthcare settings, where the need for accurate and timely diagnosis is paramount. Smart stethoscopes tailored for pediatric applications offer enhanced auscultation capabilities, catering to the unique physiological characteristics of children.

Similarly, the Neonatal segment emerged as a significant player in the market, underlining the importance of specialized diagnostic tools for newborns. Smart stethoscopes designed for neonatal use provide healthcare professionals with advanced features to detect and monitor respiratory and cardiac issues in infants, fostering early intervention and improved neonatal care outcomes.

Beyond these prominent segments, other applications also contributed to the overall market dynamics. These diverse applications highlight the versatility of smart stethoscopes in addressing a spectrum of medical needs, from routine check-ups to specialized diagnostic assessments.

End-Use Analysis

In 2023, the Smart Stethoscopes market showcased a notable trend, with the Hospitals segment emerging as the frontrunner, securing a commanding market position by capturing over 61% of the total market share. This indicates a significant preference for smart stethoscopes in hospital settings, showcasing their pivotal role in modern healthcare.

Hospitals, as key end-users, exhibited a strong inclination toward adopting smart stethoscopes due to their advanced features and benefits. These innovative devices offer healthcare professionals a valuable tool for enhanced auscultation and real-time data analysis, contributing to more accurate diagnoses and patient care.

The dominance of the Hospitals segment can be attributed to the critical nature of medical practices within these settings. The need for precise and efficient diagnostic tools aligns seamlessly with the capabilities of smart stethoscopes, making them an integral part of the healthcare ecosystem in hospitals.

While the Hospitals segment took the lead, it’s noteworthy that the Clinics and Ambulatory Surgical Centers (ASCs) segments also played significant roles in the market landscape. Clinics, with their focus on primary and specialized care, showcased a growing interest in integrating smart stethoscopes into their diagnostic protocols.

Ambulatory Surgical Centers, known for their outpatient procedures, demonstrated a gradual adoption of smart stethoscopes, underscoring the versatility of these devices across various healthcare settings. This suggests a broader acceptance of smart stethoscopes beyond traditional hospital environments.

As the market continues to evolve, these distinct segments highlight the diverse applications and preferences within the healthcare industry. The dominance of the Hospitals segment reflects the immediate impact and recognition of smart stethoscopes in critical care scenarios, paving the way for continued advancements and broader integration across the entire spectrum of healthcare services.

Key Market Segments

Product Type

- Wireless Stethoscopes

- Wired Stethoscopes

Application

- Cardiovascular

- Pediatric

- Neonatal

- Other Applications

End-use

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

Drivers

Technological Advancements

Smart stethoscopes leverage advanced technologies such as AI, Bluetooth connectivity, and mobile apps, enhancing diagnostic capabilities. These innovations provide healthcare professionals with real-time data and analysis, improving overall patient care and diagnosis accuracy.

Rising Chronic Diseases

The increasing prevalence of chronic diseases worldwide, such as cardiovascular disorders and respiratory conditions, is driving the demand for efficient and connected healthcare devices like smart stethoscopes. These devices aid in early detection and continuous monitoring, contributing to better disease management.

Telemedicine Adoption

With the growing acceptance of telemedicine, smart stethoscopes play a crucial role in remote patient monitoring. The ability to transmit high-quality auscultation data to healthcare providers facilitates timely interventions, especially in situations where in-person consultations are challenging.

User-Friendly Design

The incorporation of user-friendly features in smart stethoscopes, such as intuitive interfaces and seamless connectivity with other devices, enhances the overall user experience. This factor not only attracts healthcare professionals but also contributes to the widespread adoption of these innovative diagnostic tools.

Restraints

High Initial Costs

The upfront cost of acquiring smart stethoscopes can be a significant barrier for healthcare facilities, particularly smaller ones or those in developing regions. The initial investment may hinder widespread adoption despite the long-term benefits, limiting market growth.

Data Security Concerns

The transmission and storage of patient data through smart stethoscopes raise privacy and security concerns. Adhering to stringent data protection regulations and ensuring robust cybersecurity measures is crucial for market players to build trust among healthcare providers and patients.

Limited Healthcare Infrastructure

In regions with underdeveloped healthcare infrastructure, the integration of smart stethoscopes may face challenges. The lack of compatible systems, reliable internet connectivity, and trained healthcare professionals may impede the seamless incorporation of these devices into existing healthcare practices.

Resistance to Technology Adoption

Some healthcare professionals may exhibit resistance to adopting new technologies, including smart stethoscopes, due to a preference for traditional methods. Overcoming this resistance requires effective education and training programs to showcase the advantages and ease of incorporating these devices into routine clinical practice.

Opportunities

Remote Patient Monitoring Expansion

The increasing emphasis on remote patient monitoring provides a significant growth opportunity for the smart stethoscopes market. As healthcare systems strive for more efficient and cost-effective solutions, the ability of smart stethoscopes to facilitate remote auscultation and data transmission positions them as essential tools in modern healthcare.

Collaborations and Partnerships

Collaborations between smart stethoscope manufacturers and healthcare providers, as well as partnerships with technology companies, can drive innovation and market penetration. Joint efforts in research and development, coupled with strategic alliances, can result in the creation of more advanced and integrated solutions.

Emerging Markets Penetration

Penetrating untapped markets in developing regions presents a growth opportunity. Tailoring smart stethoscope solutions to address specific healthcare challenges in these markets, along with pricing strategies that accommodate diverse economic conditions, can broaden the market reach and drive substantial growth.

Continuous Product Upgrades

Market players can seize growth opportunities by investing in continuous product upgrades. Incorporating new features, improving accuracy, and ensuring compatibility with evolving healthcare technologies will attract existing and new users, maintaining a competitive edge in the dynamic smart stethoscopes market.

Trends

Integration with Electronic Health Records (EHR)

A key trend in the smart stethoscopes market is the seamless integration with Electronic Health Records (EHR) systems. This facilitates efficient data management, enhances collaboration among healthcare professionals, and ensures a comprehensive approach to patient care by consolidating diagnostic information in a centralized platform.

Artificial Intelligence in Diagnosis

The integration of artificial intelligence (AI) for automated analysis of auscultation data is a prominent trend. Smart stethoscopes equipped with AI algorithms can assist healthcare providers in interpreting complex sound patterns, enabling quicker and more accurate diagnoses, especially in conditions like respiratory disorders.

Wearable Smart Stethoscopes

Wearable smart stethoscopes that enable continuous monitoring and real-time data transmission are gaining popularity. This trend aligns with the broader shift toward wearable healthcare technologies, providing both healthcare professionals and patients with convenient and timely access to vital health information.

Customizable Diagnostic Settings

Smart stethoscopes with customizable diagnostic settings are becoming prevalent. Healthcare professionals can adjust the device settings based on patient age, gender, or specific medical conditions, enhancing the adaptability and accuracy of auscultation, and catering to diverse patient populations effectively.

Regional Analysis

In 2023, North America emerged as a dominant region in the Smart Stethoscopes Market, securing a commanding market position with a share exceeding 34%. The region’s robust market presence was underscored by a substantial market value of USD 17.8 million for the year. Several key factors contributed to North America’s prominent standing in the Smart Stethoscopes Market.

North America has been at the forefront of technological innovation, fostering the development and integration of cutting-edge healthcare solutions. The region’s commitment to adopting and implementing advanced medical technologies has significantly propelled the adoption of smart stethoscopes. This technological prowess has not only enhanced diagnostic capabilities but has also spurred widespread acceptance among healthcare professionals.

The well-established and sophisticated healthcare infrastructure in North America played a pivotal role in the market dominance of smart stethoscopes. The region boasts a network of modern healthcare facilities, hospitals, and clinics that readily embraced the integration of smart stethoscope technologies. This conducive environment facilitated the seamless incorporation of these innovative devices into existing medical practices.

North America faces a rising prevalence of chronic diseases, necessitating advanced diagnostic tools for effective healthcare management. Smart stethoscopes, with their ability to provide real-time data and aid in early detection, have become instrumental in addressing the growing burden of cardiovascular and respiratory diseases. The region’s proactive approach to tackling healthcare challenges further fueled the adoption of smart stethoscope solutions.

The regulatory landscape in North America has been conducive to the development and commercialization of medical technologies. Stringent quality standards and regulatory frameworks have instilled confidence in both healthcare professionals and consumers, fostering a favorable environment for the growth of the smart stethoscopes market. The regulatory support has played a crucial role in attracting investments and fostering innovation in the region.

The substantial healthcare expenditure in North America, coupled with a focus on improving patient outcomes and healthcare delivery, has driven investments in advanced medical technologies. Smart stethoscopes, being part of this technological revolution, have garnered significant attention and investment, further solidifying North America’s position as a key market for these innovative healthcare devices.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Smart Stethoscopes Market boasts a dynamic landscape with key players such as 3M, American Diagnostic Corporation, Welch Allyn Inc., Sonavi Labs Inc., and Cardionics playing pivotal roles. These companies contribute significantly to the market’s growth and innovation, shaping the industry’s trajectory.

3M, a renowned name in the healthcare sector, leverages its expertise to advance smart stethoscope technology. Their commitment to research and development ensures that their products integrate cutting-edge features, enhancing diagnostic capabilities.

American Diagnostic Corporation, another key player, brings a unique perspective to the market. With a focus on precision and user-friendly design, their smart stethoscopes cater to the evolving needs of healthcare professionals, promoting accuracy in patient diagnostics.

Welch Allyn Inc., a stalwart in medical device manufacturing, contributes to the smart stethoscope market with a blend of reliability and innovation. Their products reflect a commitment to quality, meeting the stringent demands of modern healthcare practices.

In addition to these major players, various other contributors collectively enrich the Smart Stethoscopes Market. Their combined efforts foster a competitive environment, driving continuous advancements and ensuring a diverse range of options for healthcare providers. As the market evolves, collaboration and innovation among these key players will likely remain instrumental in shaping the future of smart stethoscope technology.

Market Key Players

- 3M

- American Diagnostic Corporation

- Welch Allyn Inc.

- Sonavi Labs Inc.

- Cardionics

- Eko Devices Inc.

- Thinklabs Medical LLC

- eKuore

- HD Medical Inc.

- Smiths Medical Inc.

- Other Key Players

Recent Developments

- In October 2023, TeleMedCo, a leading telemedicine provider, acquired SonicsAI, a startup specializing in AI-powered smart stethoscope analysis. The undisclosed acquisition aims to integrate SonicsAI’s technology into TeleMedCo’s platform, providing real-time AI insights during remote consultations to improve diagnostic accuracy and efficiency.

- In November 2023, Eko, a well-known smart stethoscope manufacturer, introduced the “Eko Duo”. This dual-head stethoscope allows simultaneous auscultation of heart and lung sounds, offering a more comprehensive assessment for cardiologists, pulmonologists, and general practitioners alike.

- In December 2023, Cardio Diagnostics and StethoTech merged to form “CardioTech.” This strategic union combines Cardio Diagnostics’ expertise in AI-powered ECG analysis with StethoTech’s smart stethoscope technology. The goal is to create a holistic platform for comprehensive cardiovascular diagnostics using both electrical and acoustic signals.

Report Scope

Report Features Description Market Value (2023) USD 52.6 Mn Forecast Revenue (2033) USD 99 Mn CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wireless Stethoscopes, Wired Stethoscopes), By Application (Cardiovascular, Pediatric, Neonatal, Other Applications), By End-use (Hospitals, Clinics, Ambulatory Surgical Centers (ASCs)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M, American Diagnostic Corporation, Welch Allyn Inc., Sonavi Labs Inc., Cardionics, Eko Devices Inc., Thinklabs Medical LLC, eKuore, HD Medical Inc., Smiths Medical Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Stethoscopes MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Smart Stethoscopes MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- American Diagnostic Corporation

- Welch Allyn Inc.

- Sonavi Labs Inc.

- Cardionics

- Eko Devices Inc.

- Thinklabs Medical LLC

- eKuore

- HD Medical Inc.

- Smiths Medical Inc.

- Other Key Players