Global Smart Security Market By Solution Type (Video Surveillance Systems, Access Control Systems, Intrusion Detection Systems, Other Solution Types), By Application (Residential, Commercial, Industrial, Government & Public Sector), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 119189

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

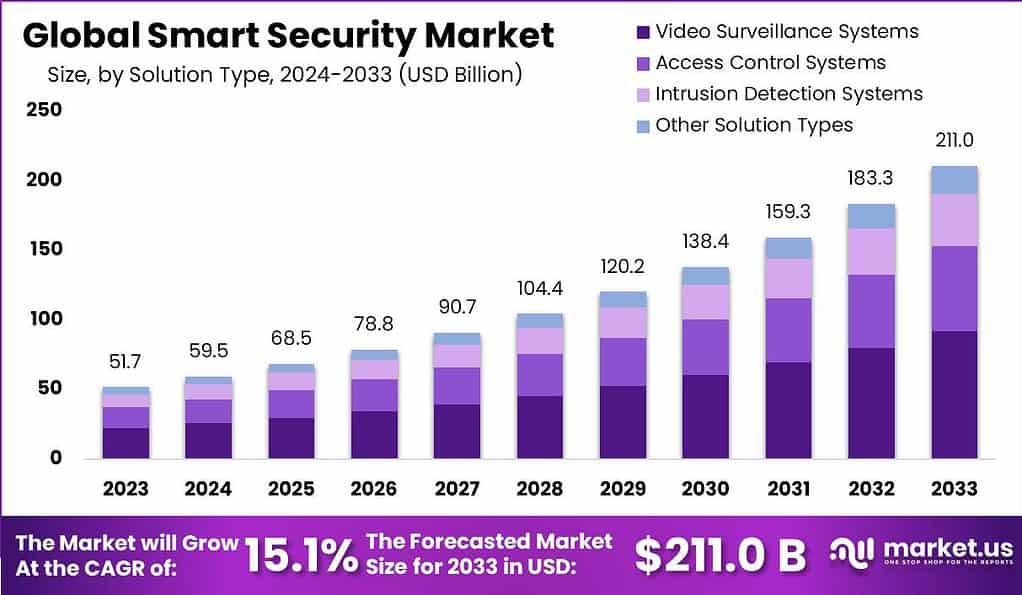

The Global Smart Security Market size is expected to be worth around USD 211.0 Billion by 2033, from USD 51.7 Billion in 2023, growing at a CAGR of 15.1% during the forecast period from 2024 to 2033.

Smart security refers to the integration of advanced technologies and intelligent systems designed to enhance the security and safety of individuals, properties, and assets. It encompasses various interconnected devices, sensors, and software applications that work together to provide comprehensive security solutions. The smart security market has seen significant growth in recent years, driven by the increasing need for advanced security measures in residential, commercial, and industrial sectors.

The smart security market is characterized by a rapid expansion driven primarily by heightened security concerns and technological advancements. This sector encompasses a variety of technologies designed to enhance the security of both physical and digital spaces. Key components include intelligent surveillance systems, automated access controls, and sophisticated cybersecurity solutions.

The proliferation of Internet of Things (IoT) devices has further propelled the demand for integrated security systems, capable of providing real-time alerts and predictive analytics to preempt potential threats. One of the key drivers for the growth of the smart security market is the rising concern for safety and security among individuals and businesses.

With the increasing instances of theft, vandalism, and security breaches, there is a growing demand for advanced security solutions that provide round-the-clock protection. Smart security systems offer enhanced capabilities such as video analytics, facial recognition, and intelligent alerts, which help in preventing and mitigating security risks.

The adoption of the Internet of Things (IoT) has played a significant role in the growth of the smart security market. IoT-enabled devices and sensors can be seamlessly integrated into security systems, allowing for real-time data collection and analysis. This enables smarter decision-making, predictive analytics, and the automation of security processes. For example, IoT sensors can detect unusual activities or unauthorized access and trigger automated responses or alerts.

Furthermore, advancements in artificial intelligence (AI) and machine learning have revolutionized the capabilities of smart security systems. AI algorithms can analyze vast amounts of data, identify patterns, and detect anomalies with higher accuracy. This enables proactive threat detection, predictive maintenance, and adaptive security measures. AI-powered video analytics, for instance, can automatically detect suspicious behavior or identify specific objects, improving situational awareness and response times.

The smart security market is witnessing a wide range of applications across various sectors. In residential settings, smart security systems offer homeowners remote access, video monitoring, and smart doorbell features. In the commercial sector, businesses utilize advanced access control systems, video surveillance, and alarm systems to protect their premises and assets. Industrial facilities employ smart security solutions for perimeter protection, asset tracking, and employee safety.

Key Takeaways

- The smart security market size is expected to reach USD 211.0 billion by 2033, projected at a CAGR of 15.1% during forecast period.

- In 2023, the Video Surveillance Systems segment held a dominant position in the smart security market, capturing more than a 43.5% share.

- In 2023, the Commercial segment held a dominant market position in the smart security market, capturing more than a 38.4% share.

- In 2023, Asia-Pacific held a dominant market position in the smart security market, capturing more than a 39.7% share.

Solution Type Analysis

In 2023, the Video Surveillance Systems segment held a dominant position in the smart security market, capturing more than a 43.5% share. This substantial market share can be attributed to the increasing need for enhanced security and surveillance solutions across various sectors, including residential, commercial, and government. The surge in demand is primarily driven by the growing awareness of security vulnerabilities and the advancements in technology that allow for more comprehensive monitoring and real-time analysis.

Video Surveillance Systems lead the smart security segments due to their extensive deployment capabilities and integration with artificial intelligence and machine learning technologies. These systems provide not only live surveillance but also sophisticated data analysis, facial recognition, and motion detection, enhancing security measures and operational efficiency. The integration of cloud-based technologies has further propelled their adoption, enabling remote access and storage of surveillance data, which adds flexibility and scalability to security operations.

Furthermore, the market is witnessing a shift towards more innovative solutions like IP-based video surveillance systems, which offer higher resolution and better scalability compared to traditional analog systems. The push for smarter and more connected cities is also a significant factor contributing to the growth of this segment. With urban areas expanding and becoming more technology-oriented, the reliance on video surveillance systems to ensure public safety and manage city infrastructures continues to rise, supporting the segment’s leading position in the smart security market

Application Analysis

In 2023, the Commercial segment held a dominant market position in the smart security market, capturing more than a 38.4% share. This leadership is primarily attributed to the escalating need for enhanced security solutions in commercial environments, such as retail spaces, office buildings, and hospitality venues.

The growing incidence of security breaches and the heightened emphasis on safeguarding assets and personnel have driven businesses to invest significantly in smart security systems. The Commercial segment’s predominance in the smart security market is further bolstered by the adoption of advanced technologies like AI-powered surveillance cameras, access control systems, and intrusion detection systems.

These technologies not only provide robust security but also offer operational efficiencies through integration with other building management systems. For instance, smart access controls can manage both security and energy efficiency by regulating access based on time or employee status and adjusting lighting and HVAC systems accordingly.

For instance, In November 2023, TerraMaster, headquartered in China, unveiled its latest product, Surveillance Manager. This software is specifically designed to enhance the capabilities of businesses in managing and monitoring video surveillance. The software integrates various functionalities such as live video monitoring, video recording capabilities utilizing TerraMaster NAS (Network Attached Storage) systems, and motion detection features equipped with alarm triggers. Furthermore, it simplifies event management tasks, providing a user-friendly interface.

Moreover, the trend towards smarter, data-driven business operations supports the extensive implementation of smart security solutions in the commercial sector. The ability to monitor and analyze data from video feeds and access patterns provides valuable insights into consumer behavior and operational bottlenecks, thus enhancing business intelligence. This integration of security with analytics is expected to propel further growth in the Commercial segment, maintaining its lead in the market.

Key Market Segments

By Solution Type

- Video Surveillance Systems

- Access Control Systems

- Intrusion Detection Systems

- Other Solution Types

By Application

- Residential

- Commercial

- Industrial

- Government & Public Sector

Driver

Increasing Urbanization and Smart City Initiatives

The ongoing global trend of urbanization acts as a major driver for the smart security market. As cities become more densely populated, the demand for sophisticated security systems to ensure public safety and infrastructure protection escalates. Concurrently, the rise of smart city initiatives worldwide supports the integration of advanced technologies, including IoT-enabled devices, for enhanced security operations.

These initiatives promote the adoption of smart security solutions, such as real-time surveillance and automated emergency response systems, to create safer and more efficient urban environments. The necessity to manage and secure an ever-growing urban population and its assets encourages continuous advancements and investments in smart security technologies, thereby fueling the growth of this market.

Restraint

Privacy Concerns and Regulatory Challenges

Privacy concerns and stringent regulatory landscapes pose significant restraints to the growth of the smart security market. As smart security systems often collect and analyze vast amounts of personal data, they raise substantial privacy issues, leading to public skepticism and resistance. This is particularly pronounced in regions with strict privacy laws and regulations, such as the European Union’s General Data Protection Regulation (GDPR), which impose rigorous compliance requirements on data handling and security.

These regulations not only increase the operational costs for smart security providers but also limit the scope of data utilization, thus hindering the deployment and scalability of smart security solutions. The balance between enhancing security measures and protecting individual privacy remains a critical challenge for the industry.

Opportunity

Advancements in Artificial Intelligence and Machine Learning

The smart security market stands to benefit enormously from advancements in artificial intelligence (AI) and machine learning (ML). These technologies enhance the capabilities of smart security systems, enabling more accurate threat detection, predictive analytics, and automated decision-making processes. AI-powered facial recognition and anomaly detection algorithms improve surveillance accuracy and reduce false alarms, enhancing overall security efficiency.

Furthermore, AI and ML can be leveraged to develop adaptive security measures that evolve in response to emerging threats, thus offering sophisticated, context-aware security solutions. The integration of these technologies presents a significant opportunity for market players to innovate and deliver more effective, intelligent security solutions to a broad range of industries.

Challenge

Integration and Compatibility Issues

One of the main challenges in the smart security market is the integration and compatibility of various security technologies into a cohesive system. Many existing infrastructures are equipped with legacy systems that are not readily compatible with newer, more advanced technologies. This incompatibility can lead to significant challenges in system integration, resulting in increased costs and operational complexities.

Furthermore, the lack of standardization across different devices and platforms can exacerbate these integration issues, leading to inefficiencies and vulnerabilities in security networks. Overcoming these technical barriers requires robust interoperability standards and significant investments in system upgrades and modifications, posing a substantial challenge for market stakeholders.

Growth Factors

- Advancements in Technology: The smart security market is propelled by continuous technological advancements, including sophisticated video surveillance systems and access control technologies. These innovations enhance real-time threat detection and response capabilities, making security solutions more effective.

- Increase in Smart Cities: The proliferation of smart cities globally significantly drives the market. Smart cities integrate various advanced security technologies, boosting the demand for smart security solutions across urban environments.

- Rising Urbanization: With growing urbanization, particularly in the Asia Pacific region, there’s an increasing need for sophisticated security solutions. This regional demand contributes substantially to the overall market growth.

- Integration with IoT: The integration of Internet of Things (IoT) devices with smart security systems is becoming more common, allowing for more comprehensive and interconnected security solutions. This integration helps in monitoring and managing security systems more efficiently.

- Government and Regulatory Initiatives: Government policies and regulatory frameworks are also significant drivers. These regulations often require the adoption of advanced security systems, further stimulating market growth.

Emerging Trends

- AI and Machine Learning: The adoption of artificial intelligence (AI) and machine learning in smart security systems is increasing. These technologies enhance the capabilities of security systems in threat detection and behavioral analytics, providing more precise and predictive security measures.

- Cloud-based Security Services: There’s a growing trend towards cloud-based security services, which offer scalable and cost-effective security solutions. These services facilitate easier access and management of security systems for both businesses and consumers.

- Mobile Connectivity: The rise of mobile connectivity enhances the functionality of smart security devices, allowing for remote monitoring and control. This trend is particularly important for residential and commercial security systems, providing users the flexibility to manage their security from anywhere.

- Biometric Technologies: The use of biometric technologies, such as facial recognition and fingerprint scanning, is increasing in smart security systems. These technologies provide a higher level of security and are becoming integral components of access control systems.

- Smart Home Integration: There is an increasing integration of security systems with smart home devices. This trend not only enhances home security but also contributes to the overall automation and efficiency of home management systems.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the smart security market, capturing more than a 39.7% share. This prominence is largely due to rapid urbanization, significant investments in smart city projects, and an expanding need for advanced security technologies across several rapidly growing economies, such as China, India, and Japan. The region’s commitment to enhancing public and private security infrastructures has led to increased deployment of smart security solutions.

The leading position of Asia-Pacific in the smart security market is also reinforced by the region’s strong focus on technological innovation and manufacturing capabilities. Countries like South Korea and China are at the forefront of producing and implementing cutting-edge security technologies, which include facial recognition systems, biometrics, and integrated security systems. These technologies are not only used domestically but are also exported globally, further strengthening the region’s market dominance.

Furthermore, the Asia-Pacific region’s increasing digital connectivity and mobile penetration have facilitated the rapid adoption of smart security solutions in both residential and commercial sectors. With more businesses and homeowners adopting smart technologies for enhanced safety and operational efficiency, the demand for intelligent security systems continues to grow. This trend is expected to maintain the Asia-Pacific region’s leading position in the global smart security market well into the future.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the smart security market, both established companies and startups have opportunities to gain a competitive edge. Established players can take organic approaches, such as expanding their product offerings, investing in technology advancements, innovating smart security system applications, and exploring new markets. On the other hand, inorganic strategies like mergers, acquisitions, and partnerships allow companies to quickly enter new segments and access innovative technologies.

For example, in August 2023, Quantum Corporation and Tiger Technology announced a strategic partnership. This collaboration aims to provide end-to-end solutions for the long-term storage of video surveillance data. By integrating Quantum’s storage solutions, such as the Smart NVR, VS-HCI hyper-converged infrastructure appliance, and USP storage platform, with Tiger Surveillance’s data management software, they aim to address the growing data management needs of video surveillance.

Top Key Players in the Market

- Honeywell International Inc.

- ASSA ABLOY Group

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Siemens AG

- Axis Communications AB

- Robert Bosch GmbH

- Teledyne FLIR LLC

- Panasonic Corporation

- Johnson Controls

- ADT Inc.

- Dahua Technology

- Vivint Smart Home Inc.

- Other Key Players

Recent Developments

- Honeywell International Inc.: In August 2023, Honeywell launched a new line of smart security solutions tailored for residential use, enhancing home protection and automation. The system incorporates advanced sensors and AI algorithms for heightened security.

- ASSA ABLOY Group: In January 2024, ASSA ABLOY announced the acquisition of a leading provider of biometric access control solutions, expanding its portfolio of smart security offerings. This move strengthens ASSA ABLOY’s position in the growing market for biometric authentication technologies.

- Hangzhou Hikvision Digital Technology Co. Ltd.: In March 2024, Hikvision introduced a series of high-definition smart cameras equipped with advanced video analytics capabilities. These cameras enable more precise surveillance and threat detection in various environments, bolstering security measures for businesses and public spaces.

- Siemens AG: In May 2023, Siemens unveiled a new integrated smart security platform designed for industrial applications. The platform integrates with existing infrastructure to provide comprehensive monitoring and control, enhancing operational efficiency and safety in industrial environments.

Report Scope

Report Features Description Market Value (2023) USD 51.7 Bn Forecast Revenue (2033) USD 211.0 Bn CAGR (2024-2033) 15.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution Type (Video Surveillance Systems, Access Control Systems, Intrusion Detection Systems, Other Solution Types), By Application (Residential, Commercial, Industrial, Government & Public Sector) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Honeywell International Inc., ASSA ABLOY Group, Hangzhou Hikvision Digital Technology Co. Ltd., Siemens AG, Axis Communications AB, Robert Bosch GmbH, Teledyne FLIR LLC, Panasonic Corporation, Johnson Controls, ADT Inc., Dahua Technology, Vivint Smart Home Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Smart Security Market?The Smart Security Market refers to the industry focused on the development and deployment of advanced security solutions that leverage technologies such as artificial intelligence, Internet of Things (IoT), cloud computing, and biometrics to enhance safety and protection in various environments.

How big is Smart Security Market?The Global Smart Security Market size is expected to be worth around USD 211.0 Billion by 2033, from USD 51.7 Billion in 2023, growing at a CAGR of 15.1% during the forecast period from 2024 to 2033.

What are the main drivers behind the growth of the Smart Security Market?Drivers include the growing demand for smart home and smart city solutions, the need for improved security measures in commercial and industrial sectors, advancements in sensor and communication technologies, increasing adoption of cloud-based security services, and regulatory requirements for enhanced safety standards.

What are some challenges facing the adoption of Smart Security solutions?Challenges include concerns about data privacy and cybersecurity risks associated with interconnected devices, interoperability issues between different smart security products and platforms, the complexity of integrating legacy security systems with new technologies, and the need for skilled professionals to manage and maintain smart security infrastructure.

What role does artificial intelligence play in Smart Security?Artificial intelligence enables Smart Security systems to analyze vast amounts of data from various sources, identify patterns and anomalies indicative of security threats, make real-time decisions and predictions, and continuously learn and adapt to evolving threats and environments.

What are some emerging trends in the Smart Security Market?Emerging trends include the convergence of physical and cybersecurity solutions, the use of machine learning and predictive analytics for proactive threat prevention, the integration of blockchain technology for secure data storage and authentication, the proliferation of edge computing for faster and more efficient processing of security data, and the development of standards and regulations to address ethical and legal considerations in Smart Security deployments.

Who are the key players in the smart security market?Honeywell International Inc., ASSA ABLOY Group, Hangzhou Hikvision Digital Technology Co. Ltd., Siemens AG, Axis Communications AB, Robert Bosch GmbH, Teledyne FLIR LLC, Panasonic Corporation, Johnson Controls, ADT Inc., Dahua Technology, Vivint Smart Home Inc., Other Key Players

-

-

- Honeywell International Inc.

- ASSA ABLOY Group

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Siemens AG

- Axis Communications AB

- Robert Bosch GmbH

- Teledyne FLIR LLC

- Panasonic Corporation

- Johnson Controls

- ADT Inc.

- Dahua Technology

- Vivint Smart Home Inc.

- Other Key Players