Global Smart Refrigerator Market Size, Share, Growth Analysis By Product Type (Single-door, Double-door, Side-by-side, French-door), By Technology (Wi-Fi Enabled, Bluetooth Enabled, RFID Enabled), By End-User (Residential, Commercial), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144394

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

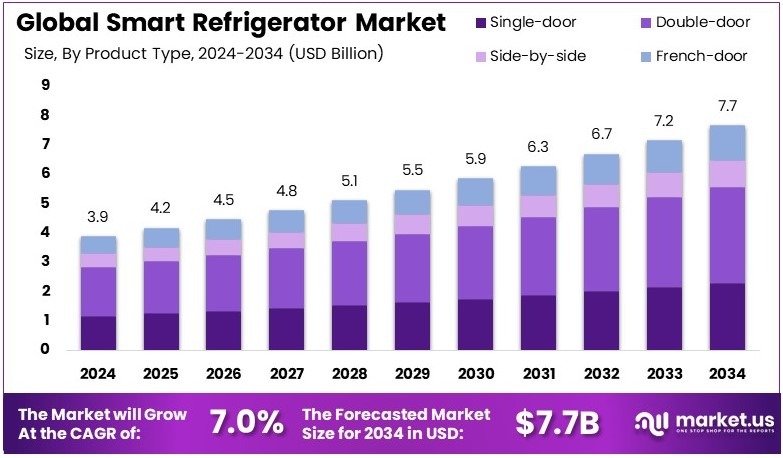

The Global Smart Refrigerator Market size is expected to be worth around USD 7.7 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034.

A smart refrigerator is a high-tech fridge connected to the internet. It can track items inside, control temperature remotely, and send alerts. Some models have touchscreens or voice assistants. These features help save energy, reduce waste, and improve convenience in managing food at home or in businesses.

The smart refrigerator market includes the sales and development of internet-connected refrigerators. It covers manufacturers, suppliers, and consumers. Market growth is driven by rising smart home trends, energy-saving features, and customer demand for convenience. The market also includes product innovation and new technologies like AI and IoT.

The smart refrigerator category is expanding as smart homes become more common. Consumers now expect appliances to connect with voice assistants and other smart devices. Amazon Alexa supports over 60,000 devices, while Google Assistant works with 30,000. This wide compatibility is driving interest in refrigerators with built-in smart features.

The smart refrigerator market is seeing steady growth, led by innovation in energy efficiency and automation. Consumers value features like inventory tracking, temperature control, and remote access. In fact, 89% say device compatibility affects their voice assistant choice. This behavior is shaping how smart appliances are bought and used.

Moreover, energy laws are pushing change. The European Union plans to cut emissions by 55% by 2030. As a result, tougher rules are being set on refrigerants and power use. In response, manufacturers are investing in smart fridges that meet both user needs and new environmental standards.

On the flip side, the market is becoming crowded. Many brands now offer similar features, like touchscreens and app control. To compete, companies must offer better design, longer warranties, or deeper integration with smart home systems. Without strong differentiation, brands may struggle to stay ahead.

On a larger scale, smart refrigerators are part of the global smart home movement. They help reduce energy waste and improve food management. Locally, cities promoting energy-saving tech—such as Amsterdam or San Jose—are seeing quicker adoption. These areas are key targets for smart appliance makers.

Government actions are also shaping growth. In Europe, rules on refrigerants are making old models less attractive. Similarly, U.S. states are offering incentives for energy-efficient appliances. These changes are pushing both demand and innovation, helping smart refrigerators become more common in everyday kitchens.

Key Takeaways

- The Smart Refrigerator Market was valued at USD 3.9 billion in 2024 and is expected to reach USD 7.7 billion by 2034, with a CAGR of 7.0%.

- In 2024, Double-door dominates the product type segment with 42.6%, driven by its spacious storage and increasing consumer preference.

- In 2024, Wi-Fi Enabled leads the technology segment with 58.2%, offering enhanced connectivity and smart home integration.

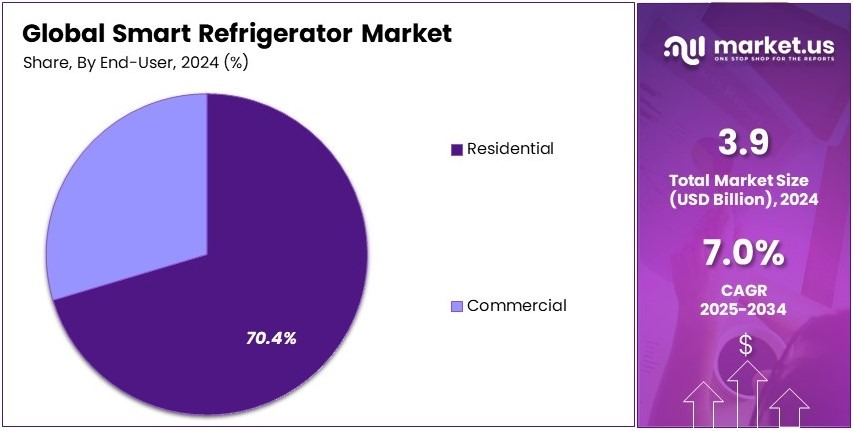

- In 2024, Residential is the dominant end-user segment with 70.4%, attributed to rising adoption of smart appliances in households.

- In 2024, Offline distribution channel holds 61.8%, as consumers prefer in-store purchases for better evaluation before buying.

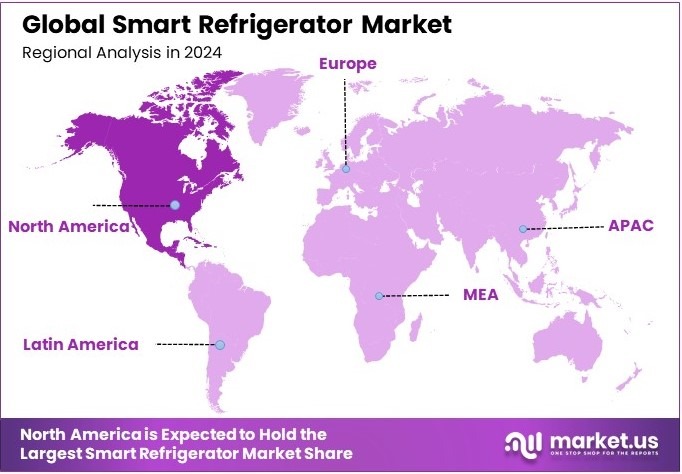

- In 2024, North America dominates the market with 34.2% and a value of USD 1.33 billion, driven by high smart home adoption.

Product Type Analysis

Double-door dominates with 42.6% due to its large storage capacity, energy efficiency, and strong demand from urban households.

In the Smart Refrigerator Market, the product type segment plays a major role in shaping consumer demand. Double-door smart refrigerators hold the largest market share because of their balanced design and features. They offer separate sections for the freezer and fresh food, which helps in better storage and organization.

Double-door models are also popular in cities, where consumers value technology and smart features. Many models come with energy-saving modes, touch panels, and mobile app connectivity, which add to their appeal. In countries like the U.S., China, and Germany, this category sees steady demand due to the rising middle class and increasing focus on food preservation and smart home integration.

Side-by-side refrigerators are growing in demand, especially among premium buyers. They provide a modern design and offer advanced features like voice control and internal cameras. French-door refrigerators, though more expensive, are preferred in luxury homes and high-end markets due to their spacious layout and modern aesthetics.

Single-door refrigerators, on the other hand, are used mostly in small homes or by individuals. Their share remains limited as they offer fewer smart features and smaller capacity, though their lower price keeps them relevant in developing regions.

Technology Analysis

Wi-Fi Enabled dominates with 58.2% due to ease of integration with smart home systems and enhanced remote access.

Wi-Fi enabled smart refrigerators lead the market by a wide margin. Their popularity is due to growing interest in connected homes and automation. These refrigerators can be controlled using smartphones, allowing users to adjust temperatures, receive alerts, and even view the contents remotely. In busy urban households, this feature saves time and improves efficiency.

In addition, Wi-Fi support makes it easier for users to update software and access new functions. Many global brands like Samsung, LG, and Whirlpool have launched Wi-Fi integrated models in various sizes, boosting adoption across markets. For instance, in U.S. households that already use smart assistants like Alexa, Wi-Fi enabled fridges easily become part of the daily routine.

Bluetooth enabled refrigerators have a smaller market share. They are mostly found in lower-cost smart models, offering short-range connectivity. Their features are more limited and suitable for users with simple needs.

RFID-enabled smart refrigerators, while promising, remain a niche. These are often used in commercial or healthcare environments where inventory tracking is important. The technology helps monitor stored items, reduce waste, and improve safety. However, the high cost and complexity have slowed adoption in the residential segment.

End-User Analysis

Residential dominates with 70.4% due to increasing household adoption of smart appliances and growing urban populations.

The residential segment leads the Smart Refrigerator Market by a significant margin. Consumers are becoming more interested in convenience and smart living. As such, the demand for connected kitchen appliances continues to grow.

Smart refrigerators make everyday tasks easier. Features like remote monitoring, automatic updates, and voice controls add comfort and reduce food waste. In cities, where working professionals seek efficiency, smart fridges are becoming a common part of modern homes. In countries like South Korea, Japan, and Germany, tech-savvy homeowners are rapidly adopting smart kitchen technologies.

The commercial segment includes restaurants, hotels, and retail stores. In these areas, smart refrigerators help manage food safety, reduce spoilage, and improve inventory control. Although the share is lower, commercial demand is growing.

Businesses are starting to see the benefits of automation and monitoring, especially in cold storage and perishable goods management. However, the higher upfront cost can be a barrier for small establishments. Even so, larger hotel chains and food service companies continue to invest in smart refrigeration systems to support operational efficiency.

Distribution Channel Analysis

Offline dominates with 61.8% due to strong consumer preference for physical inspection and after-sales support.

In the Smart Refrigerator Market, offline channels continue to hold the dominant position. Customers prefer to view large appliances in person before buying. They want to test features, examine space, and understand warranty terms directly from sales representatives.

This is especially true for expensive items like smart refrigerators, which require a higher investment. Retail stores also provide flexible financing options, free installation, and ongoing customer support. In countries like India and Brazil, trusted electronics showrooms remain the top choice for many buyers.

Online sales are rising fast, especially among younger consumers. E-commerce platforms offer more choices, quick delivery, and discounts. They are ideal for buyers who already know the product or are looking for convenience.

During the COVID-19 pandemic, online sales grew rapidly and many brands expanded their digital presence. However, because smart refrigerators are costly and complex, many customers still prefer buying them from physical stores where they can clarify doubts and compare models in person. Even so, as logistics and digital experiences improve, the share of online channels is expected to rise steadily over the next few years.

Key Market Segments

By Product Type

- Single-door

- Double-door

- Side-by-side

- French-door

By Technology

- Wi-Fi Enabled

- Bluetooth Enabled

- RFID Enabled

By End-User

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

Driving Factors

Connected Living and Smart Design Drives Market Growth

The smart refrigerator market is growing as more people adopt smart home technology. Consumers now want appliances that are connected, responsive, and easy to control. With the rise of IoT and AI, smart fridges offer helpful features like voice commands, internal cameras, and temperature control through mobile apps. These tools add convenience to daily life and attract tech-savvy buyers.

Energy efficiency is another strong driver. Smart refrigerators help reduce electricity use by adjusting cooling settings based on usage patterns. As more consumers focus on sustainability, they prefer appliances with energy-saving modes and eco-friendly refrigerants.

The growth of smart home ecosystems also plays a role. Smart fridges that connect with voice assistants like Alexa or Google Assistant make kitchen tasks easier. Users can set reminders, check groceries, or adjust settings without touching the appliance.

In addition, many buyers now look for customizable and modular designs. Some brands offer separate cooling units, convertible compartments, and flexible shelves. These options allow users to build a refrigerator that fits their lifestyle.

Altogether, rising demand for tech-friendly, energy-efficient, and customizable appliances is pushing market growth. Companies that offer seamless smart integration and user-friendly design are set to benefit the most.

Restraining Factors

Cost and Compatibility Challenges Restrain Market Growth

Despite rising demand, the smart refrigerator market faces several challenges. One of the biggest restraints is the high initial cost. Smart refrigerators are more expensive than regular ones, making them less accessible to budget-conscious buyers. Maintenance and repairs also tend to be pricier due to advanced components and software.

Data privacy is another concern. Since these fridges connect to the internet and store user data, there are growing fears about cybersecurity. Consumers worry about personal information being hacked or misused, especially if payment apps or shopping features are involved.

Compatibility is also a problem. Many older smart home systems do not work well with newer smart refrigerator models. This creates frustration for buyers who want seamless integration across their devices. Without strong cross-device support, users may hesitate to upgrade.

Finally, retrofitting traditional refrigerators with smart features is difficult. Older models lack the necessary sensors or tech support, and upgrading them is costly and limited in function.

Growth Opportunities

AI and Compact Design Provides Opportunities

New innovations are opening strong opportunities in the smart refrigerator market. AI-powered food inventory systems are one of the most exciting developments. These features track stored items, suggest meals, and alert users when products are close to expiry. This reduces food waste and improves kitchen efficiency.

Smart fridges are also expanding into commercial and industrial settings. Restaurants, cafes, and offices are adopting connected refrigeration for better food safety and inventory tracking. In large-scale storage, predictive maintenance and energy management tools offer big cost savings.

Compact smart refrigerators are gaining interest too. As more people live in smaller apartments, dorms, or shared homes, the demand for space-saving smart appliances is rising. These mini smart fridges offer the same technology benefits in a smaller size.

Another opportunity is in self-diagnosing systems. Smart fridges that can detect issues early and suggest repairs improve user experience and cut service costs. This adds reliability and peace of mind for users.

Altogether, AI tools, compact designs, commercial use, and self-monitoring tech present high-potential growth areas. Companies investing in these features will likely tap into broader consumer segments and boost adoption across both home and professional markets.

Emerging Trends

Interactive Features and Eco-Tech Are Latest Trending Factor

Several modern trends are changing how people use and view smart refrigerators. Augmented Reality (AR) is being added to offer interactive recipe suggestions. Users can scan items inside the fridge and get meal ideas based on available ingredients. This turns everyday cooking into a smart, helpful experience.

Built-in cameras are also trending. These cameras let users check fridge contents from their phones while shopping. This avoids duplicate purchases and helps users plan better. It’s especially useful for busy families and people who shop on the go.

Eco-friendly innovations are also gaining traction. Solar-powered and hybrid smart fridges are now being developed. These models aim to cut energy bills and reduce environmental impact. This appeals to customers looking for greener home solutions.

Touchless and gesture-controlled functions are another rising trend. These features help users open or adjust settings without touching the surface—ideal for clean, safe use in kitchens. It’s especially useful during cooking or in shared spaces.

Regional Analysis

North America Dominates with 34.2% Market Share

North America leads the Smart Refrigerator Market with a 34.2% share, valued at USD 1.33 billion. This strong presence is driven by high disposable income, a strong focus on smart home adoption, and early consumer tech acceptance. Brands like Whirlpool, GE, and Samsung have a strong presence, helping push innovation and market penetration.

Key factors include the rising popularity of smart kitchens and voice-controlled appliances. Many homes in the U.S. and Canada already use smart devices like Alexa or Google Assistant, making it easier to integrate smart refrigerators. Consumers prefer features like touchscreens, food inventory tracking, and energy-efficient cooling systems. The trend of meal planning, remote monitoring, and home automation has made smart fridges more than just storage units—they’re now part of daily convenience.

The region’s strong tech ecosystem, backed by leading electronics manufacturers and IoT infrastructure, supports rapid product rollouts. E-commerce platforms and large retail chains like Best Buy, Walmart, and Amazon play a key role in product accessibility. Government incentives promoting energy-efficient appliances also contribute to growing adoption.

Regional Mentions:

- Europe: Europe is steadily growing in the smart refrigerator market, driven by demand for sustainable and energy-efficient appliances. Countries like Germany and the UK are adopting smart kitchen devices due to rising environmental awareness and modern home upgrades.

- Asia Pacific: Asia Pacific is showing rapid growth in the smart refrigerator market. Countries like China, Japan, and South Korea lead with high-tech consumer electronics, growing urban middle-class, and strong domestic manufacturing capabilities.

- Middle East & Africa: The Middle East and Africa are gradually adopting smart refrigerators as urbanization rises. Countries like UAE and Saudi Arabia invest in smart homes and luxury appliances, while local adoption remains modest but expanding.

- Latin America: Latin America is seeing increased interest in smart home appliances, including smart refrigerators. Brazil and Mexico are leading adoption, with demand driven by growing internet access and rising awareness of connected living benefits.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The smart refrigerator market is expanding due to rising demand for connected home appliances. The top four companies—Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, and Haier Smart Home Co., Ltd.—lead the market with innovation and global reach.

Samsung Electronics Co., Ltd. is a global leader in smart appliances. Its smart fridges offer touch screens, voice control, and Wi-Fi connectivity. Samsung invests in AI to improve energy use and food management.

LG Electronics Inc. focuses on smart features and energy efficiency. Its refrigerators use InstaView technology and connect with mobile apps. LG combines sleek design with smart functions to appeal to tech-savvy consumers.

Whirlpool Corporation is a key player in North America. Its smart refrigerators are known for reliability and ease of use. Whirlpool offers app-based controls and integration with smart home systems like Alexa and Google Assistant.

Haier Smart Home Co., Ltd. has grown globally through strong R&D and strategic acquisitions. Its smart fridges include advanced cooling, digital displays, and cloud connectivity. Haier targets both premium and mass-market users.

These companies lead due to strong brands, product innovation, and wide distribution. They invest in energy-saving technologies and user-friendly features to meet modern lifestyle needs.

In conclusion, the top players in the smart refrigerator market stay ahead with cutting-edge tech, smart designs, and strong global presence. Their focus on energy efficiency, connectivity, and convenience helps drive the market forward.

Major Companies in the Market

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Whirlpool Corporation

- Haier Smart Home Co., Ltd.

- Panasonic Corporation

- Electrolux AB

- GE Appliances (a Haier company)

- Hisense Co., Ltd.

- Bosch (BSH Hausgeräte GmbH)

- Midea Group Co., Ltd.

- Siemens AG

- Liebherr Group

- Hitachi, Ltd.

Recent Developments

- Bosch: On January 2025, Bosch unveiled its 100 Series French Door Bottom Mount Refrigerator, its first appliance compatible with the Matter smart home standard. Priced at $2,500, the refrigerator is expected to be available in the U.S. market in spring 2025, with a firmware update scheduled for summer.

- Samsung: On January 2025, Samsung enhanced its Bespoke series of smart refrigerators by incorporating artificial intelligence and Instacart integration. The upgraded models feature internal cameras for food recognition and automatic grocery ordering, along with 32-inch screens offering access to live channels and on-demand content.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 7.7 Billion CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single-door, Double-door, Side-by-side, French-door), By Technology (Wi-Fi Enabled, Bluetooth Enabled, RFID Enabled), By End-User (Residential, Commercial), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Haier Smart Home Co., Ltd., Panasonic Corporation, Electrolux AB, GE Appliances (a Haier company), Hisense Co., Ltd., Bosch (BSH Hausgeräte GmbH), Midea Group Co., Ltd., Siemens AG, Liebherr Group, Hitachi, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Refrigerator MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Refrigerator MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Whirlpool Corporation

- Haier Smart Home Co., Ltd.

- Panasonic Corporation

- Electrolux AB

- GE Appliances (a Haier company)

- Hisense Co., Ltd.

- Bosch (BSH Hausgeräte GmbH)

- Midea Group Co., Ltd.

- Siemens AG

- Liebherr Group

- Hitachi, Ltd.