Global Smart Medical Devices Market By Product Type (Diagnostic & Monitoring Devices, Therapeutic Devices, Injury Prevention, and Rehabilitation Devices), By End-Users (Hospitals, Clinics, Home Care Settings, and Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: July 2024

- Report ID: 34955

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

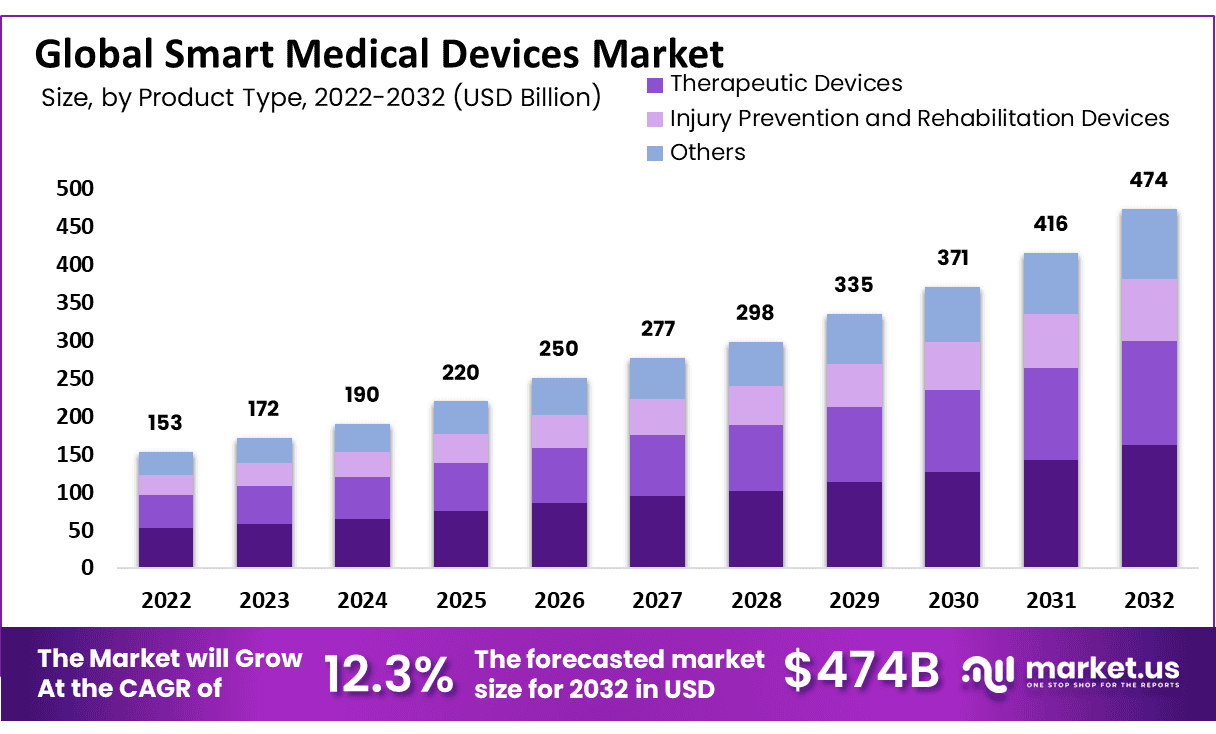

Global Smart Medical Devices Market size is expected to be worth around USD 474 Billion by 2032 from USD 172 Billion in 2023, growing at a CAGR of 12.3% during the forecast period from 2023 to 2032.

Smart medical devices help connect patients with doctors. They transmit critical medical information in real-time from hospitals and private homes and mobile equipment used at emergency sites or in transport vehicles. Although patient data has been recorded since long before the advent of smart technology, smart medical devices have enabled healthcare providers to collect patient data.

Wireless devices embedded in the body allow patients to be monitored continuously to alert healthcare providers to any changes that might need to be made. Patients can have unprecedented mobility, and the devices provide real-time information to their doctors. This allows them to give patients the best care possible. Smart medical devices must adhere to strict regulations. They must be certified and tested according to the Radio Equipment Directive (RED) for Europe and the Federal Communications Commission (FCC).

Smart innovation is also possible in the diabetes industry, where many startups and established medical device companies are pushing medical technology boundaries. They offer wireless glucose monitoring solutions that increase patient comfort and improve outcomes.

Key Takeaways

- Market Size: Smart Medical Devices Market size is expected to be worth around USD 474 Billion by 2032 from USD 172 Billion in 2023.

- Market Growth: The market growing at a CAGR of 12.3% during the forecast period from 2023 to 2032.

- Regional Analysis: North America held the largest market share, with 42%, and it is expected to continue this trend in the future.

- Rapid Expansion: The smart medical devices market has experienced rapid expansion due to advances in technology and rising consumer interest for personalized healthcare solutions.

- Remote Patient Monitoring: Smart medical devices allow healthcare providers to remotely track vital signs and health metrics of patients in real time using remote monitoring solutions.

- Wearable Health Tech: Wearable health devices such as smartwatches and fitness trackers form part of the smart medical devices ecosystem that promotes proactive healthcare management.

- AI and Data Analytics: AI and data analytics technologies can now be integrated into smart devices to analyze health data quickly, helping with early disease detection and treatment planning.

- Personalized Medicine: These devices contribute to a growing trend of personalized medicine by adapting treatments and interventions based on an individual’s health data.

- Market Diversity: This market features various smart devices, such as glucose monitors, ECG monitors, insulin pumps and smart inhalers.

Product Type Analysis

Diagnostics and Monitoring Devices Dominate The Market

Based on product, the market for smart medical devices is segmented into Diagnostics and Monitoring, Therapeutics, and Others. Among these types, diagnostics and monitoring devices are more lucrative in the global smart medical devices market. This can be attributed to an increase in the prevalence of cardiovascular disease and an increase in government spending support.

In addition, the market has seen significant growth due to recent advances in smart medical technology. Due to the expected increase in usage and the launch of pipeline products, the market for diagnostic and monitoring equipment is expected to grow fastest. Furthermore, the diagnostic and monitoring device segment can be sub-classified into wearable and nonwearable.

Due to the expected increase in device usage and the launch of new pipeline products, the demand for diagnostic and monitor devices will experience the fastest market growth over the forecast period.

The largest growth in the cardiovascular segment is expected to be by application over the forecast period. This can be attributed to increased cardiovascular diseases, such as diabetes, and research expenditures on medical devices. The market is also growing due to the increased use of smart medical devices. The fastest market growth is expected in the cardiovascular segment during the forecast period.

This is due to the increase in the geriatric population, technological advances, and the increased efficacy of smart medical devices. Due to the increase in the geriatric population and technological advances, the demand for the cardiovascular segment will experience the fastest market growth over the forecast period. Smart medical devices are also expected to be more effective.

According to data from the United Nations Department of Economic and Social Affairs (UNDESA), there were 703,000,000 people 65 and over in 2019. The projected increase in older people to 1.5 billion by 2050 results from this projection. In 2019, the percentage of people 65 and over grew from 6.0% in 1990 to 9.0% in 2019. This proportion is expected to increase to 16.0% in 2050, meaning that one-in-six people will be 65 or older by 2050.

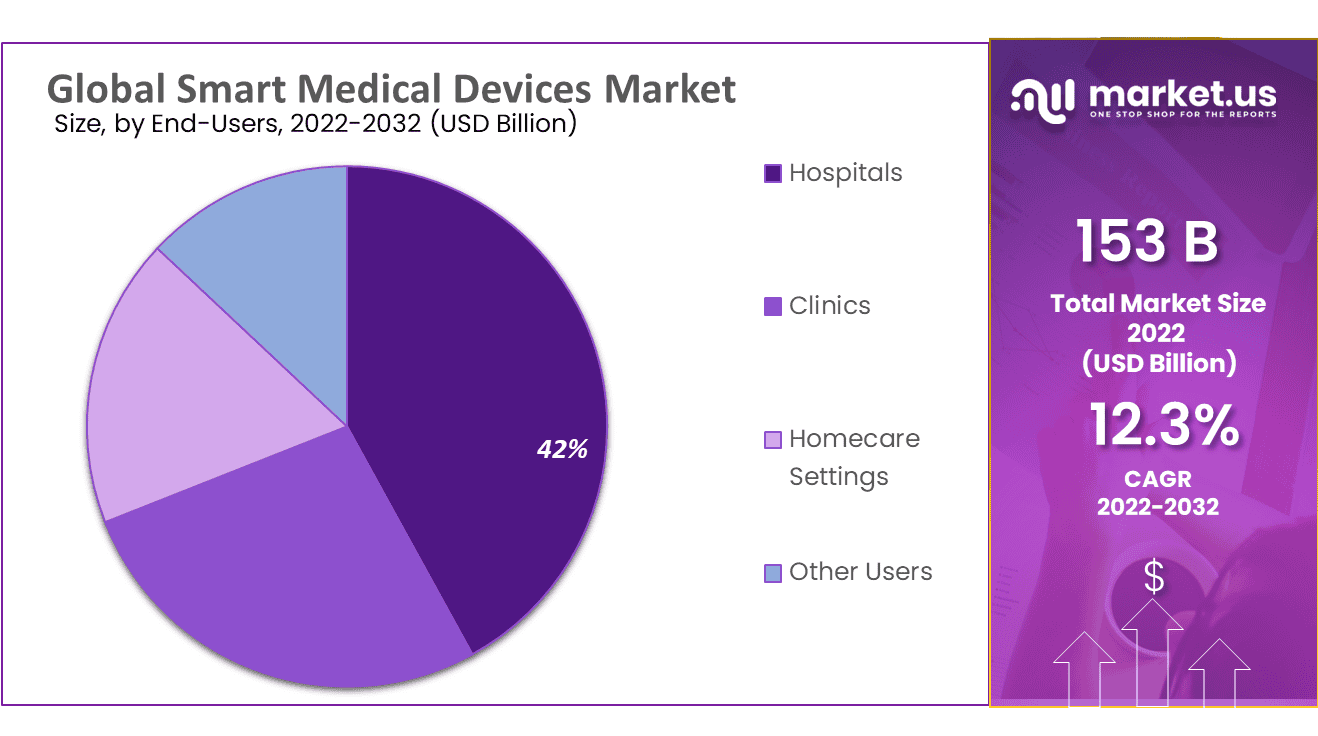

End-User Analysis

Segment Growth Is Expected To Be Driven By The Growing Aging Population Worldwide And Rising Patient Demand For Quality-Based Healthcare At Home

The smart medical device market is segmented into hospitals and homecare settings. From 2023 to 2032, the homecare setting segment will experience an 8.5% CAGR. The segment growth is expected to be driven by the growing aging population worldwide and rising patient demand for quality-based healthcare at home.

According to WHO, the number of people over 60 will reach 1.4 billion in 2030. This will increase demand for patient-centered healthcare services, particularly in-home care.

Key Market Segments

Based on Product Type

- Diagnostics and Monitoring Devices

- Therapeutic Devices

- Injury Prevention and Rehabilitation Devices

- Others

Based on End-User

- Hospitals

- Clinics

- Homecare Settings

- Others

Drivers

The Smart Medical Device Sector Is Thriving Due To New Innovations In Smart Medical Devices

The Smart medical device market is growing due to the increasing prevalence of chronic diseases like diabetes, hypertension, and other chronic conditions. A growing number of chronic illnesses has increased the demand for smart gadgets and wearables to provide management tools and services.

The Smart medical device sector thrives due to innovations in smart medical devices like glucose monitors and wearables. Patients can connect to their smartphones to share their situation with doctors, which aids in managing and controlling their symptoms. These smart medical devices are a great way to expand the market.

Restraints

Rising Equipment Costs Are Seen As A Constraint To The Market For Smart Medical Devices

The current limitations to the growth of smart medical devices are inaccuracy, errors in medical parameters, and technological issues. An experiment was conducted to determine the accuracy of continuous glucose monitors. The results showed significant errors when compared with blood glucose meters. An error in the results could result in an incorrect prescription, leading to life-threatening conditions.

In addition, rising equipment costs are seen as a constraint to the market for smart medical devices. These devices are not readily available in developing countries or countries with economic difficulties.

Opportunity

The Growth Of Smart Medical Devices Is Being Influenced By The Expansion Of Distribution Channels, E-Commerce, Digital Marketing, As Well As Other Factors

The market for smart medical devices has grown significantly due to the increasing use of the Internet of Things across various industries. There has been a rise in demand for medical devices such as smartwatches and pulse oximeters. This market will see significant growth in smart medical devices, with the demand expected to increase over the forecast period.

Smart medical device market outlook optimistically promising with projected annual compounded compound growth of 12.3% projected for upcoming years. These innovative devices, equipped with cutting edge technologies such as artificial intelligence and remote monitoring have significantly transformed healthcare institutions globaly.

The expansion of distribution channels, e-commerce, digital marketing, and other factors is influencing the growth of smart medical devices. The market has attractive growth opportunities due to incorporating new technologies such as the Internet of Things, digital counseling, big-data management, and increased R&D.

Trends

Insulin Pumps are Expected to Witness Good Growth in the Market Over the Forecast Period

An insulin pump is a medical device that administers insulin to diabetic patients. An insulin pump comprises a pump, a disposable reservoir, and a disposable infusion set. The pump’s control section includes a processing module and batteries. The insulin is stored in the disposable reservoir.

The disposable infusion kit includes a cannula, a tubing system connecting the insulin reservoir, and an insulin reservoir. Insulin pumps are easy to use and can accurately measure insulin doses. This reduces wastage and ensures proper insulin delivery. In addition, insulin pumps are a smart device that is a boon for diabetes patients.

Smart medical device market trends have been rapidly shifting over the past several years. Devices utilizing cutting-edge technology to track and manage patient health conditions, have quickly grown increasingly popular due to providing real-time data for better patient outcomes. From wearable devices that track heart rate and blood pressure levels to inhalers designed specifically to address respiratory ailments – smart medical devices now cover an expansive variety of uses across various healthcare conditions.

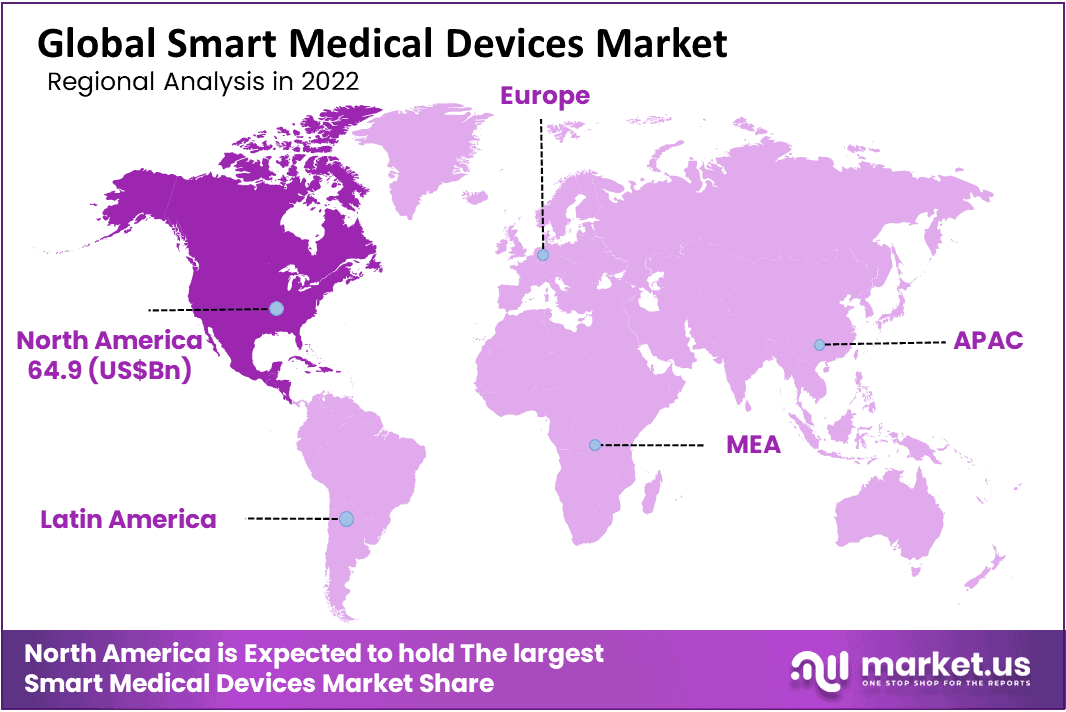

Regional Analysis

North America held the largest market share, with 42%, and it is expected to continue this trend in the future. Because of the favorable policies that make healthcare affordable for many, or even all, the healthcare facilities in North America meet the highest standards. This allows for a greater selling rate throughout the country.

In addition, this region’s smart device market has seen significant growth due to technological advances and the early adoption of advanced medical equipment. According to the American Heart Association 2021 Heart Disease and Stroke Statistics Update fact sheet, Coronary Heart Disease (CHD) was the leading cause of death in the United States (42.1%) due to cardiovascular disease.

The study shows that chronic diseases in the American population drive market growth. Smart medical devices and home-based monitoring devices are essential to patient health.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on various strategic policies to develop their respective businesses in foreign markets. As a result, the smart medical devices market is moderately competitive, and few companies hold most of the market share. However, new players are coming up in the market due to the technological advancements in the healthcare industry and the rising R&D expenditure of the companies.

Some of the companies which are currently dominating the market are Abbott Laboratories, apple inc, Bio-beat, Dexcom Inc, F. Hoffmann la Roche Ltd, Fitbit Inc, Medtronic plc, Neurometric Inc, Omron Corporation, Otsuka Holdings Co., Ltd, Koninklijke Philips N.V., Vital Connect, Samsung and others.

The following are some of the major players in the Global Acne Treatment industry

- Abbott Laboratories

- Apple Inc.

- Dexcom, Inc.

- Fitbit, Inc.

- Hoffmann La-Roche Ltd.

- Johnson & Johnson Pvt Ltd.

- Medtronic plc.

- NeuroMetrix, Inc.

- Samsung Electronics Co., Ltd.

- Sonova

- Other Key Players

Recent Developments

- Abbott Laboratories (May 2024): Abbott Laboratories introduced the FreeStyle Libre 4, a continuous glucose monitoring system with advanced sensor technology, offering real-time glucose readings and enhanced connectivity features, providing users with more accurate and actionable health insights.

- Apple Inc. (June 2024): Apple Inc. acquired Cardiogram, a company specializing in heart health monitoring, to integrate advanced cardiac health features into their wearable devices, enhancing their health tracking capabilities and expanding their portfolio of smart medical devices.

- Fitbit, Inc. (March 2024): Fitbit, Inc. merged with AliveCor, a leader in personal ECG technology, to offer comprehensive heart health monitoring solutions through their wearable devices, combining fitness tracking with advanced cardiac health insights.

- Hoffmann-La Roche Ltd. (February 2024): Hoffmann-La Roche Ltd. acquired mySugr, a diabetes management platform, to enhance their digital health offerings and provide integrated solutions for diabetes patients, improving their overall health management and outcomes.

- Johnson & Johnson Pvt Ltd. (January 2024): Johnson & Johnson Pvt Ltd. launched a smart medication adherence device, designed to remind patients to take their medications on time, track their adherence, and provide real-time feedback to healthcare providers, improving treatment outcomes.

- Medtronic plc (July 2024): Medtronic plc introduced the MiniMed 780G, an advanced insulin pump system with automated insulin delivery and continuous glucose monitoring capabilities, offering improved glucose control and convenience for diabetes patients.

Report Scope

Report Features Description Market Value (2022) USD 172 Bn Forecast Revenue (2032) USD 474 Bn CAGR (2023-2032) 12.3% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Diagnostic & Monitoring Devices, Therapeutic Devices, Injury Prevention, and Rehabilitation Devices), By End-Users (Hospitals, Clinics, Home Care Settings, and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott Laboratories, Apple Inc., Dexcom, Inc, Fitbit, Inc, F.Hoffmann La-Roche Ltd., Johnson & Johnson Pvt Ltd., Medtronic plc., NeuroMetrix, Inc., Samsung Electronics Co., Ltd., Sonova, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are smart medical devices?Smart medical devices are electronic devices designed to collect and transmit health data, enabling remote monitoring and improved healthcare management.

How big is the Smart Medical Devices Market?The global Smart Medical Devices Market size was estimated at USD 153 billion in 2022 and is expected to reach USD 474 billion in 2032.

What is the Smart Medical Devices Market growth?The global Smart Medical Devices Market is expected to grow at a compound annual growth rate of 12.3%. From 2023 To 2032

Who are the key companies/players in the Smart Medical Devices Market?Some of the key players in the Smart Medical Devices Markets are Abbott Laboratories, Apple Inc., Dexcom, Inc., Fitbit, Inc., Hoffmann La-Roche Ltd., Johnson & Johnson Pvt Ltd., Medtronic plc., NeuroMetrix, Inc., Samsung Electronics Co., Ltd., Sonova, Other Key Players

How do smart medical devices benefit patients?They help patients by providing real-time health data, promoting early disease detection, and enabling better management of chronic conditions.

What types of smart medical devices are available?Smart medical devices include wearable fitness trackers, blood glucose monitors, ECG monitors, smart inhalers, and more.

Do smart medical devices enhance telemedicine?Yes, they play a crucial role in telemedicine by transmitting patient data to healthcare providers, facilitating virtual consultations.

How do smart devices ensure data security and privacy?Smart medical devices incorporate encryption and strict privacy measures to protect patient health data.

Smart Medical Devices MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Smart Medical Devices MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Apple Inc.

- Dexcom, Inc.

- Fitbit, Inc.

- Hoffmann La-Roche Ltd.

- Johnson & Johnson Pvt Ltd.

- Medtronic plc.

- NeuroMetrix, Inc.

- Samsung Electronics Co., Ltd.

- Sonova

- Other Key Players