Global Smart Battery Market Size, Share, And Industry Analysis Report By Battery Type (Lithium-ion, Lead-acid, Nickel-Metal Hydride, Solid State), By Applications (Consumer Electronics, Healthcare, Aerospace and Defense, Automotive, Utilities, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 168082

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

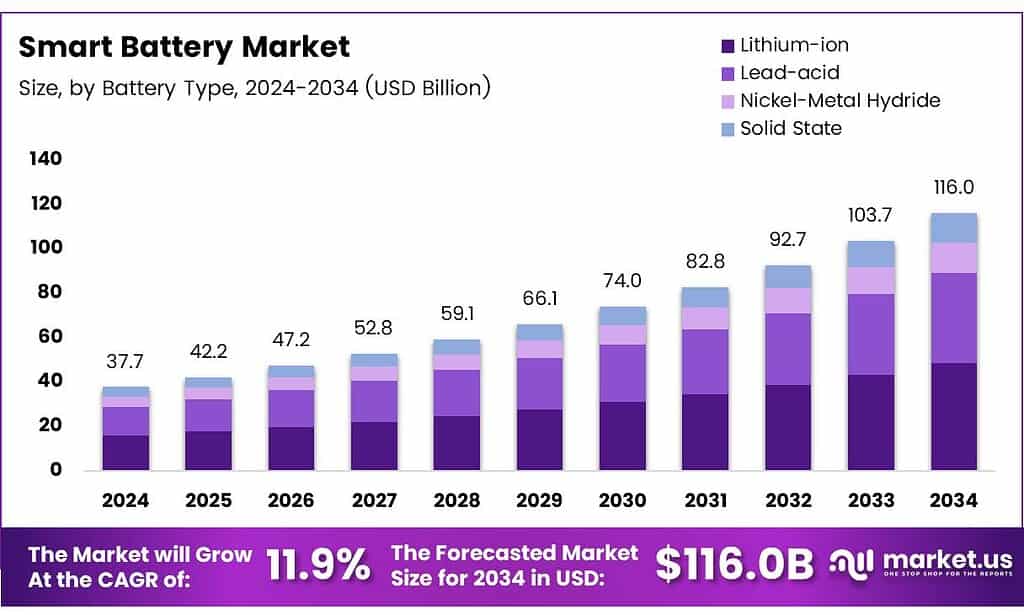

The Global Smart Battery Market size is expected to be worth around USD 116.0 billion by 2034, from USD 37.7 billion in 2024, growing at a CAGR of 11.9% during the forecast period from 2025 to 2034.

The Smart Battery Market refers to batteries integrated with electronics, software, and communication features that actively monitor, control, and optimize performance. Essentially, smart batteries measure state of charge, health, and temperature in real time. Therefore, they enable safer operation, longer life, and predictive maintenance across consumer electronics, medical devices, industrial equipment, and energy storage systems.

From a product perspective, a smart battery is not only an energy storage device but also a data source. It includes sensors, embedded firmware, and battery management systems that communicate usage conditions. As a result, users gain better reliability, optimized charging, and reduced downtime, which directly improves the total cost of ownership for business buyers.

From a technology cost standpoint, nickel metal hydride solutions remain commercially attractive for smart battery designs. Final NiMH production costs are typically less than 50% of lithium battery packs, while development costs stay below 75%. This affordability supports adoption in cost-sensitive industrial and medical segments. Performance data also supports continued NiMH relevance.

NiMH cells offer average capacities of around 2200 mAh versus 1500 mAh for comparable lithium cells. Operational challenges are increasingly managed through smart electronics. NiMH batteries self-discharge at roughly 1% per day and may face memory effect issues. However, advanced BMS implementations using controlled trickle charging below 0.025 C and moderate charging times of 2–3 hours significantly improve cycle life and system stability.

Key Takeaways

- The Global Smart Battery Market is projected to grow from USD 37.7 billion in 2024 to USD 116.0 billion by 2034, at a 11.9% CAGR.

- Lithium-ion dominates the battery type segment with a leading market share of 84.3% in 2024.

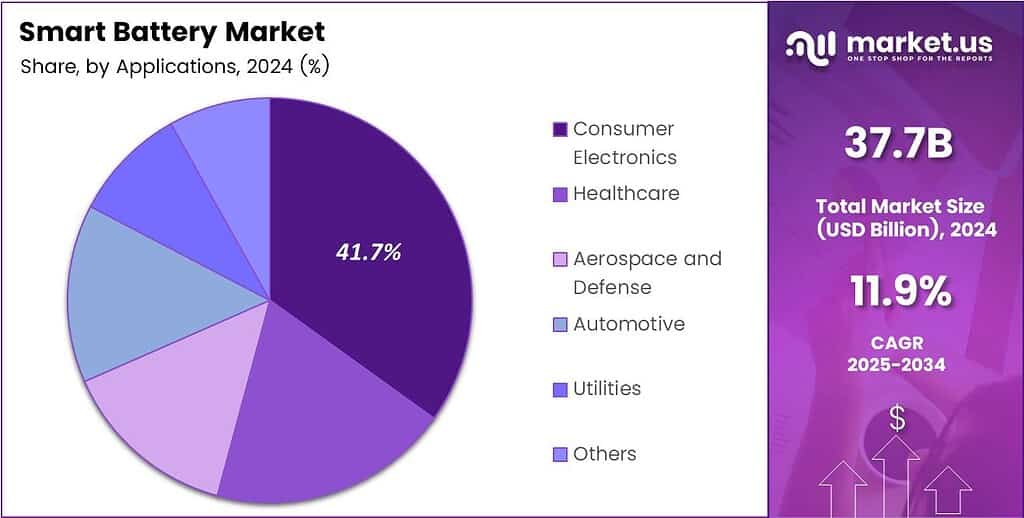

- Consumer Electronics leads application demand, accounting for a 41.7% market share in 2024.

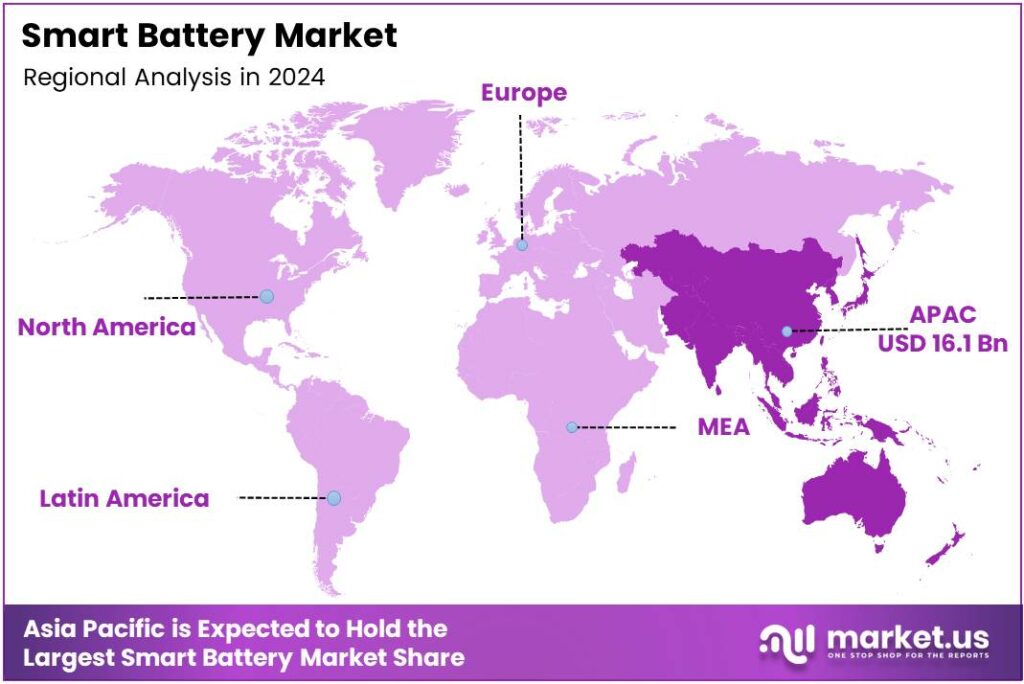

- Asia Pacific is the dominant regional market, holding a 42.9% share and valued at USD 16.1 billion.

By Battery Type Analysis

Lithium-ion dominates with an 84.3% share due to its high energy density, smart monitoring compatibility, and wide device adoption.

In 2024, Lithium-ion held a dominant market position in the Battery Type Analysis segment of the Smart Battery Market, with an 84.3% share. This leadership is supported by fast charging, lightweight design, and strong compatibility with battery management systems. As a result, it remains the preferred chemistry across connected and intelligent power solutions.

Lead-acid batteries continue to serve stable roles where cost sensitivity and reliability matter. Although heavier and less energy-dense, they are still preferred for backup systems and stationary applications. Moreover, their recyclability and mature supply chains help maintain steady demand in selected smart power installations.

Nickel-Metal Hydride batteries hold relevance in niche smart battery uses requiring durability and thermal stability. While energy density is lower than lithium-ion, they benefit from safer chemistry and longer cycle life. Consequently, they are used in specific industrial and hybrid applications where robustness outweighs size constraints.

Solid-state batteries represent an emerging sub-segment focused on safety and higher future energy potential. Although still in early stages, they attract attention for smart systems due to reduced fire risk and compact design. Over time, innovation is expected to improve scalability and integration into smart platforms.

By Applications Analysis

Consumer Electronics dominates with a 41.7% share, driven by rising demand for connected and portable smart devices.

In 2024, Consumer Electronics held a dominant market position in the By Applications Analysis segment of the Smart Battery Market, with a 41.7% share. Growth is driven by smartphones, wearables, and laptops that rely on intelligent batteries for performance tracking, safety, and longer usage cycles in daily consumer environments.

Healthcare applications are steadily expanding as smart batteries power portable medical devices and monitoring equipment. These batteries support patient safety through real-time diagnostics and power optimization. As home healthcare and remote monitoring increase, the need for reliable smart energy storage continues to rise.

Aerospace and Defense use smart batteries for mission-critical systems requiring precision and reliability. These applications value advanced monitoring and fault detection. Although volumes are lower, performance requirements are strict, making smart battery integration essential for aircraft systems, satellites, and defense electronics.

Automotive, Utilities, and Others together represent growing adoption areas. In vehicles, smart batteries support electrification and energy management. Utilities apply them in grid support systems, while other industries adopt smart batteries for industrial equipment, tools, and emerging connected applications.

Key Market Segments

By Battery Type

- Lithium-ion

- Lead-acid

- Nickel-Metal Hydride

- Solid State

By Applications

- Consumer Electronics

- Healthcare

- Aerospace and Defense

- Automotive

- Utilities

- Others

Emerging Trends

Integration of AI and Digital Battery Management Emerges as a Key Trend

One major trend in the smart battery market is the use of artificial intelligence in battery management systems. AI helps analyse usage patterns and predict battery life more accurately. This improves performance and reduces unexpected failures. Wireless communication is another growing trend. Smart batteries now send real-time data to cloud platforms or mobile apps.

- This allows users and operators to monitor battery health remotely, supporting better decision-making and maintenance planning. The world added 69 GW of new battery storage capacity — almost doubling the total installed capacity from 2023, which was 86 GW. The average price of lithium-ion battery packs fell to USD 115 per kWh in 2024 — that is 84% cheaper than a decade ago.

Fast charging optimisation is gaining attention. Smart batteries adjust charging based on temperature and usage conditions. This helps reduce degradation and supports longer battery life, which is important for electric vehicles and portable devices. Sustainability is also shaping trends. Manufacturers are designing smart batteries to support recycling and second-life use.

Restraints

High Cost and Design Complexity Restrain Smart Battery Market Growth

One major restraint for the smart battery market is the higher cost compared to traditional batteries. Smart batteries include sensors, control chips, and software, which raise manufacturing expenses. This limits adoption in price-sensitive applications where low-cost batteries are still preferred.

Design complexity is another challenge. Integrating battery management systems requires skilled engineering and testing. Small manufacturers may struggle with technical know-how, slowing wider market penetration. This complexity can also increase development time for new products.

Compatibility issues add to the restraint. Smart batteries must work smoothly with devices, chargers, and software platforms. If systems are not well matched, performance benefits can be reduced. This makes some users hesitant to shift from conventional batteries.

Drivers

Rising Adoption of Smart and Connected Devices Drives Smart Battery Market Growth

The growing use of smart and connected devices is a key driver for the smart battery market. Devices such as smartphones, laptops, wearables, and handheld tools now require batteries that can monitor health, control charging, and improve safety. Smart batteries help extend device life while maintaining stable performance.

- Electric vehicles and energy storage systems are also pushing demand. These applications need batteries that can communicate with management systems in real time. The average cost of lithium-ion battery packs dropped to about USD 115 per kWh in 2024 — a dramatic reduction compared to a decade ago, making batteries far more affordable than before. Global deployments have surged. The energy sector added 42 GW of battery storage — the fastest-growing energy technology for that year.

Industrial automation is another important factor. Factories are using smart equipment that depends on accurate power control. Smart batteries help reduce downtime by predicting failures before they happen. As industries focus on efficiency and cost control, smart batteries become a practical choice. Government support for clean energy and electrification is encouraging battery innovation.

Growth Factors

Expansion of Electric Mobility Creates New Growth Opportunities

Electric mobility presents strong growth opportunities for the smart battery market. Electric cars, bikes, and buses rely heavily on battery intelligence to improve driving range and safety. Smart batteries enable accurate State of Charge monitoring, which improves user confidence and system efficiency.

Energy storage for renewable power is another promising area. Solar and wind systems need batteries that can adapt to changing power flows. Smart batteries support efficient charging and discharging, making them suitable for grid and backup applications. Healthcare devices also offer growth potential.

Medical equipment requires reliable, safe power sources. Smart batteries help track usage, reduce failure risk, and support preventive maintenance, all of which are critical in healthcare environments. Emerging markets add further opportunity. As access to smart electronics increases in developing regions, demand for reliable battery solutions grows. Local manufacturing and cost optimisation could help smart batteries reach wider customer bases.

Regional Analysis

Asia Pacific Dominates the Smart Battery Market with a Market Share of 42.9%, Valued at USD 16.1 Billion

Asia Pacific leads the Smart Battery Market, accounting for a dominant 42.9% share and reaching a value of USD 16.1 billion. This leadership is supported by strong manufacturing capacity, rapid electrification, and large-scale adoption of smart devices and electric mobility. Supportive government policies and expanding energy storage needs further strengthen regional demand. The presence of advanced supply chains also contributes to faster commercialization.

North America represents a mature and innovation-driven market for smart batteries. The region benefits from early adoption of intelligent energy systems across consumer electronics, automotive, and grid storage. Strong regulatory focus on energy efficiency and digital power management supports stable growth. Investments in smart infrastructure also continue to enhance long-term market potential.

Europe’s smart battery market is shaped by strict environmental regulations and sustainability goals. The region emphasizes efficient battery management systems to reduce energy losses and extend battery life. Adoption is steady across electric vehicles, renewable integration, and industrial automation. Policy-backed clean energy transitions remain a key growth driver.

The U.S. market shows strong demand for smart batteries due to rising use in electric vehicles, defense, and connected devices. Advanced digital monitoring and predictive battery management are gaining traction. Federal support for energy storage modernization further supports adoption. The focus remains on performance optimization and safety compliance.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sealed Energy Systems is positioned as a specialist in advanced battery packs and power solutions, giving it a strong foothold in the smart battery value chain. The company’s focus on reliability, safety, and integration with battery management systems helps it serve demanding use cases. As smart devices and backup systems grow, their capability to customize packs supports deeper collaboration with OEM customers.

Accutronics Ltd plays an important role by offering engineered battery solutions that prioritize intelligence, monitoring, and long cycle life. Its portfolio in smart, rechargeable packs aligns well with trends like portable medical, industrial, and professional equipment that require consistent performance. By combining electronics, cells, and firmware, the company strengthens its positioning as a design partner rather than just a cell supplier.

Battery Smart adds momentum to the smart battery market through its focus on connected, service-oriented battery offerings. By emphasizing swappability, remote monitoring, and data insight, it supports new business models around batteries-as-a-service and high-utilization fleets. This approach helps unlock recurring revenue streams and improves asset utilization, which is increasingly attractive in electric mobility and shared applications.

Rose Electronics Distributing Company, Inc. supports the ecosystem by acting as a channel for smart battery packs, components, and related electronics. As a distributor, it helps bridge specialized manufacturers and end customers, ensuring availability, configuration support, and technical guidance. Its role in logistics, inventory management, and product selection enables smaller and mid-sized OEMs to adopt smart battery technologies without heavy in-house sourcing capabilities.

Top Key Players in the Market

- Sealed Energy Systems

- Accutronics Ltd

- Battery Smart

- Rose Electronics Distributing Company, Inc

- Trojan Battery Company

- Epec, LLC

- Cell-Con, Inc

- Fluor Corporation

- Cadex Electronics, Inc.

- Inspired Energy, Inc.

Recent Developments

- In 2024, Trojan introduced 48V OnePack lithium single-pack batteries for golf carts, UTVs, low-speed vehicles (LSVs), and related equipment. Available in extended-range and high-performance models, these smart batteries feature extended run times.

- In 2024, Accutronics showcased its latest innovations in off-the-shelf and custom smart batteries and chargers for medical and healthcare applications at the Medical Technology Ireland event. This highlights advancements in high-performance portable battery solutions for handheld electronic devices.

Report Scope

Report Features Description Market Value (2024) USD 37.7 billion Forecast Revenue (2034) USD 116.0 billion CAGR (2025-2034) 11.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium-ion, Lead-acid, Nickel-Metal Hydride, Solid State), By Applications (Consumer Electronics, Healthcare, Aerospace and Defense, Automotive, Utilities, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sealed Energy Systems, Accutronics Ltd, Battery Smart, Rose Electronics Distributing Company, Inc, Trojan Battery Company, Epec, LLC, Cell-Con, Inc, Fluor Corporation, Cadex Electronics, Inc., Inspired Energy, Inc. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Sealed Energy Systems

- Accutronics Ltd

- Battery Smart

- Rose Electronics Distributing Company, Inc

- Trojan Battery Company

- Epec, LLC

- Cell-Con, Inc

- Fluor Corporation

- Cadex Electronics, Inc.

- Inspired Energy, Inc.