Global Smart Agriculture Market by Hardware (HVAC system,LED grow lights, Valves & pumps, Sensors & control systems, Others), By Sensing Devices (Soil sensor, Water sensors, Climate sensors and Others), By Software( Web-based, Cloud-based), By Services (Data services, Analytics services, Farm operation services, Supply chain management services, Climate information services, System integration & consulting, Maintenance & support, Managed services, Others), By Farm Size (Small, Medium, Large), By Application (Precision Farming, Livestock Monitoring, Precision Aquaculture, Precision Forestry, Smart Greenhouse, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov. 2023

- Report ID: 16886

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Hardware Analysis

- Sensing Devices Analysis

- Software Analysis

- Services Analysis

- By Farm Size Analysis

- By Application Analysis

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Geopolitical and Recession Impact Analysis Impact

- Kеу Маrkеt Ѕеgmеntѕ

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

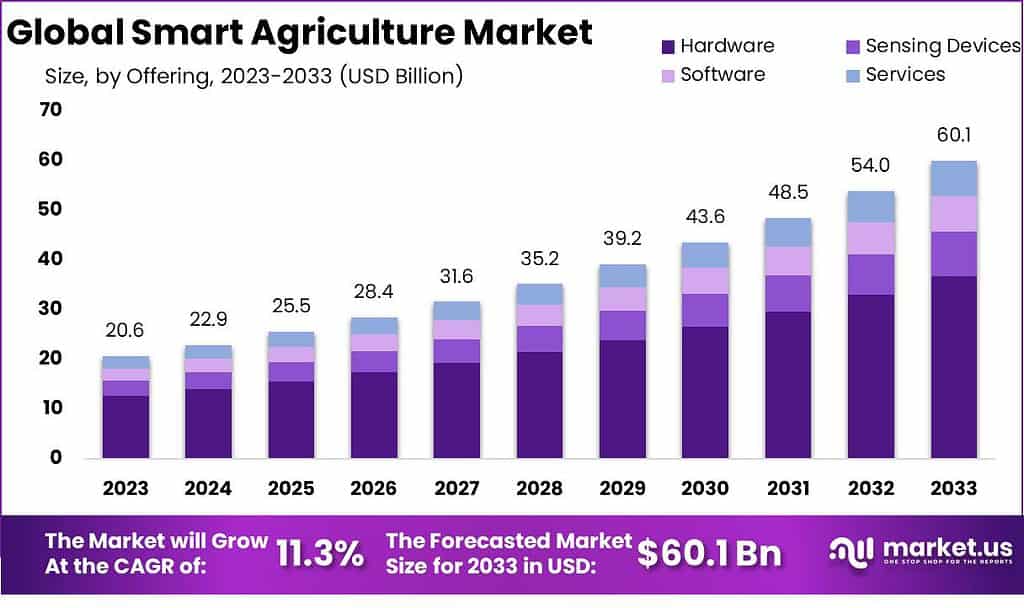

The Global Smart Agriculture Market is anticipated to be USD 60.1 billion by 2033. It is estimated to record a steady CAGR of 11.3% in the Forecast period 2023 to 2033. It is likely to total USD 20.6 billion in 2023.

Smart agriculture (also referred to as precision or digital farming) refers to the utilization of advanced technologies and data analytics in agricultural practices. This involves the integration of various digital tools, such as sensors, drones, GPS trackers, robotics and data analytics into farming operations in order to enhance crop yield, efficiency and sustainability.

Smart agriculture refers to a method for gathering and analyzing real-time data from agricultural fields, which allows farmers to make informed decisions regarding irrigation, fertilization, pest management and overall crop health. By harnessing technology for smart agriculture applications, this strategy strives to maximize resource usage while decreasing environmental impact, costs reduction and productivity gains.

Note: Actual Numbers Might Vary In The Final Report

Smart agriculture markets have seen exponential growth due to increased global food demands, sustainable farming practices and digital innovations. IoT (Internet of Things) plays a central role in smart agriculture by connecting various devices and sensors that monitor soil moisture, temperature, humidity, crop health and other parameters to provide farmers with valuable insights for efficient decision-making.

Precision farming techniques enabled by GPS and satellite imaging enable farmers to precisely manage their fields using targeted applications of fertilizers and pesticides, variable rate seeding, site-specific crop management practices that optimize resource use while minimizing waste.

Agriculture robots and automation systems are being deployed for tasks such as planting, harvesting and crop monitoring to increase operational efficiency while simultaneously decreasing labor costs and increasing productivity.

Advanced data analytics and artificial intelligence (AI) algorithms assist smart agriculture by processing the vast amounts of collected information. AI-powered systems can offer actionable insights, predict crop diseases, optimize irrigation schedules, or suggest personalized farming practices to provide actionable intelligence for decision makers.

Key Takeaways

- Market Growth and Size: The Global Smart Agriculture Market is expected to reach USD 60.1 billion by 2033. It will experience a steady Compound Annual Growth Rate (CAGR) of 11.3% during the forecast period from 2023 to 2033.

- Definition of Smart Agriculture: Smart agriculture, also known as precision or digital farming, integrates advanced technologies and data analytics into agricultural practices.

- IoT’s Role in Smart Agriculture: The Internet of Things (IoT) plays a central role in smart agriculture by connecting devices and sensors to monitor various parameters such as soil moisture, temperature, and crop health.

- Hardware Analysis: Sensors and Control Systems are crucial in facilitating precision agriculture and data-driven decision-making.

- Sensing Devices Analysis: Soil sensors, water sensors, and climate sensors provide real-time data on environmental conditions and crop health, aiding resource utilization and increasing crop yield.

- Software Analysis: Cloud-based software is popular due to its accessibility, scalability, and data management capabilities.

- Services Analysis: Data services, analytics services, and farm operation services play a significant role in data-driven decision-making and resource utilization.

- By Farm Size Analysis: Large farms dominate the adoption of smart agriculture solutions due to scalability.

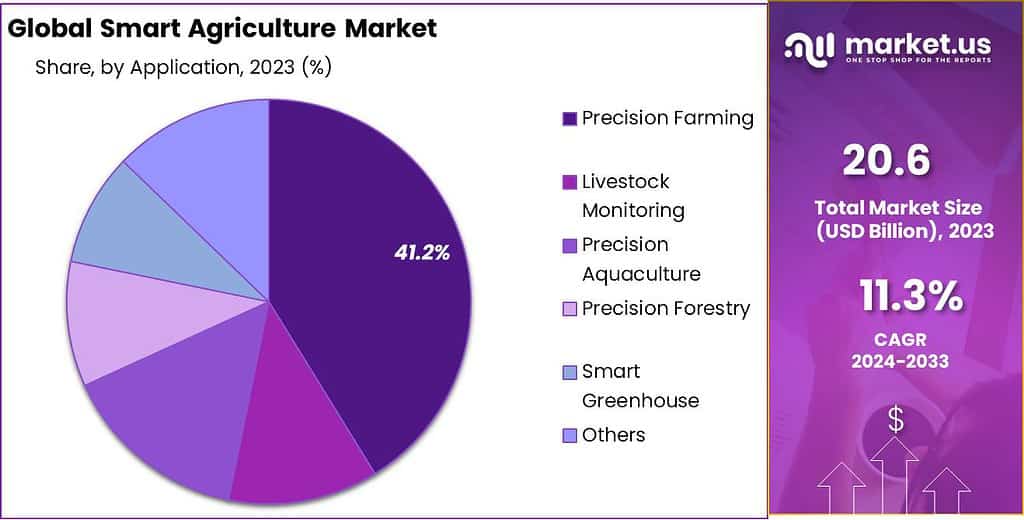

- By Application Analysis: Precision farming is the leading application, driven by technologies like GPS, sensors, and drones.

- Driving Factors: Precision farming advancements, rising global food demand, government support, and environmental concerns are driving the smart agriculture market.

- Restraining Factors: High initial costs, data privacy and security concerns, limited connectivity in rural areas, and the need for technical skills are challenges faced by the industry.

- Growth Opportunities: IoT integration, blockchain for supply chain transparency, collaboration with AgriTech startups, and global expansion present growth prospects.

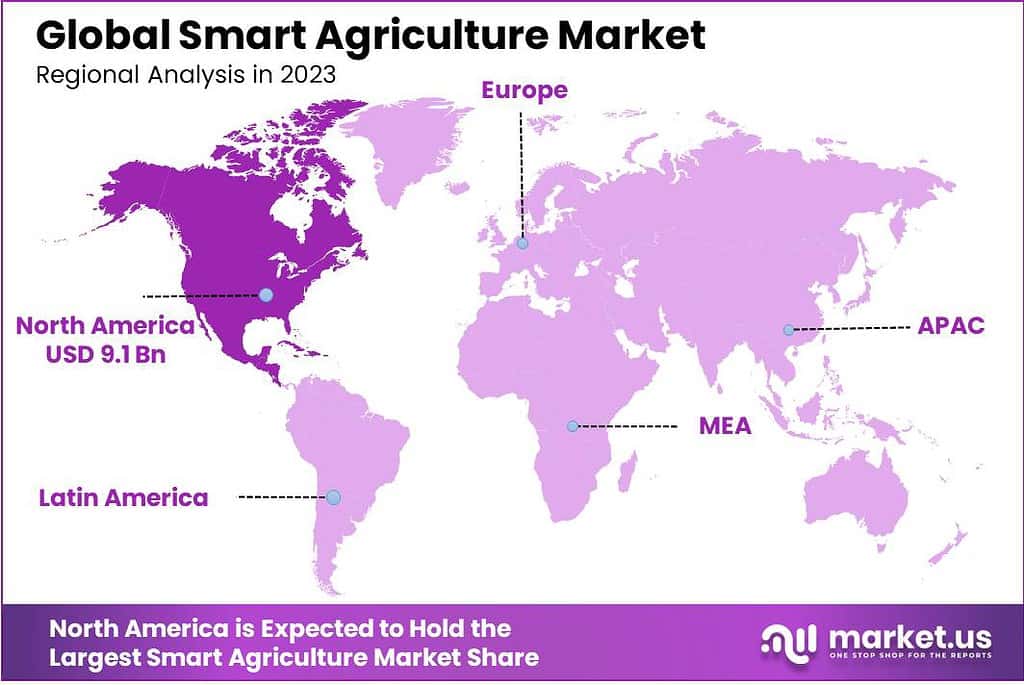

- Regional Analysis: North America leads the market due to technological advancements and adoption of precision farming.

- Key Players: Major companies in the smart agriculture market include Autonomous Solutions, Inc., GEA Group Aktiengesellschaft, Deere & Company, and more.

Hardware Analysis

In 2023, the Smart Agriculture market witnessed a dynamic landscape characterized by an array of hardware components crucial for modern farming practices. Among these hardware elements, the Sensors & Control Systems segment emerged as the dominant player, holding a prominent market position. This segment’s prominence can be attributed to its crucial role in facilitating precision agriculture and data-driven decision-making on farms.

Sensors like soil moisture sensors, weather sensors and crop health sensors offer real-time data on environmental conditions and crop health status. Coupled with sophisticated control systems, these sensors enable farmers to maximize resource utilization, increase crop yield, and minimize wastage. As agriculture embraces IoT (Internet of Things) technologies, demand for sensors and control systems has surged to meet its growing needs for innovation and efficiency. Thanks to advances in sensor technology and AI machine learning integration, this sector promises further expansion – promising the promise of smart agriculture practices for years to come.

HVAC (Heating, Ventilation and Air Conditioning) systems are an integral component of Smart Agriculture market, playing an essential role in optimizing controlled environment agriculture. HVAC systems play a pivotal role in maintaining ideal temperature and humidity levels inside farms and greenhouses that promote crop growth year-round. Their popularity has steadily grown with indoor farming techniques becoming more resource-efficient. Farmers are increasingly recognizing the benefits of year-round cultivation, reduced water usage, and protection against adverse weather conditions offered by HVAC systems, which are driving the growth of this segment.

LED grow lights, an essential hardware component in modern agriculture, have also experienced substantial demand in 2023. These energy-efficient lighting solutions offer tailored light spectra to promote plant growth, leading to increased yields and faster crop cycles. LED grow lights are favored for their longevity and low energy consumption compared to traditional lighting methods. As sustainability becomes a central focus in agriculture, LED grow lights are poised to play an even more significant role in future farming practices, contributing to energy savings and environmentally conscious farming.

Valves and pumps, while not as prominent as sensors or LED grow lights, remain indispensable in the irrigation and water management aspects of smart agriculture. These components ensure precise control of water distribution, reducing wastage and optimizing resource utilization. With the increasing emphasis on water conservation in agriculture, the demand for efficient valves and pumps is expected to grow steadily.

Sensing Devices Analysis

In 2023, the Smart Agriculture market saw a significant division when it comes to Sensing Devices, with the Soil sensor Segment taking the lead and holding a dominant market position. This achievement can be attributed to crucial role sensors for soil have in modern farming. Sensors for soil give farmers real-time information about the soil’s moisture level, temperatures and the amount of nutrients. The information is crucial for making accurate irrigation decisions, maximizing fertilization and ensuring that crops get the right conditions to grow. The ability to monitor and manage soil health efficiently has led to increased crop yields and resource conservation. As a result, the Soil sensor Segment garnered substantial market share, reflecting the industry’s recognition of their importance.

Water sensors, another vital component of Smart Agriculture, also played a pivotal role in 2023. These sensors enable farmers to monitor water quality and usage, ensuring that crops receive the right amount of irrigation while preventing water wastage. With water scarcity concerns on the rise, the demand for water sensors is expected to grow steadily as farmers seek sustainable solutions for their irrigation needs. The data-driven approach offered by water sensors aligns perfectly with the industry’s drive towards efficient water management.

Climate sensors, encompassing temperature, humidity, and weather sensors, had their own share of the market in 2023. These sensors provide crucial insights into environmental conditions that directly impact crop health and growth. Climate sensors allow farmers to respond proactively to changing weather patterns and protect their crops from adverse conditions. The demand for climate sensors is driven by the need for precision agriculture and resilience against climate change, making them an integral part of the Smart Agriculture landscape.

Software Analysis

Cloud-based solutions took the lead in this dynamic market, firmly holding a dominant market position. Cloud-based software is a huge hit. Its popularity is due in part to its capacity to provide farmers with unbeatable accessibility, scalability, and the ability to manage data. Cloud-based platforms allow agricultural stakeholders to store, collect and analyze massive amounts of data gathered from sensors IoT equipment, or other devices in real time.

This data-driven approach provides farmers with actionable information and allows them to make educated decisions about the management of their crops, allocation of resources and optimization of yield. As the agriculture industry continues to embrace digital transformation, the Cloud-based segment is poised for further growth, driving efficiency, sustainability, and productivity in farming practices.

Web-based platforms typically require more localized processing of data and do not offer the real-time capabilities provided by cloud-based solutions. However, they are an alternative for farmers who want affordable and user-friendly tools for managing their business, particularly in areas with weak internet connectivity, or where cloud infrastructure isn’t readily available.

Web-based platforms often require more localized data processing and may lack the real-time capabilities offered by cloud solutions. Nevertheless, they remain a viable option for farmers seeking cost-effective and user-friendly tools for managing their operations, particularly in regions with limited internet connectivity or where cloud infrastructure is not readily accessible.

Services Analysis

In 2023, the Smart Agriculture market underwent a comprehensive transformation, driven by a spectrum of services that played pivotal roles in revolutionizing farming practices. Among these services, the Data Services segment emerged as the dominant force, reshaping the agricultural landscape. The emergence of this sector can be explained by its central role within modern agricultural practices, in which data-driven decision-making is a must. Data services include the gathering, analysis, and distribution of crucial information about soil quality and conditions of the weather and crop health, and many more. Farmers depend on this information to make informed decisions regarding planting, irrigation, as well as protection of crops, which results in higher yields and better resource utilization.

The emergence of IoT (Internet of Things) devices and sensors in farms has produced a wealth of information, and data services are the primary means of making this data practical data. With data continuing to be the cornerstone of smart agriculture, the Data Services segment is poised for sustained growth, promising a future of data-driven farming practices.

Analytics Services form another crucial component in the Smart Agriculture market, offering advanced tools and algorithms to extract valuable insights from the vast pool of data generated on farms. These services provide predictive analytics, helping farmers anticipate crop diseases, optimize fertilization, and even forecast market demand. Analytics services leverage machine learning and AI to make sense of complex agricultural data, enabling precision farming and cost-effective decision-making. As the adoption of big data analytics in agriculture becomes more widespread, the Analytics Services segment is expected to witness significant expansion.

Farm Operation Services have gained prominence in 2023 as they streamline day-to-day agricultural activities. These services encompass a wide range of functions, including farm management software, equipment rental, and labor optimization. By digitizing and automating routine tasks, farm operation services enhance efficiency and reduce operational costs. Farmers are more often turning to these services in order to simplify their operations and boost efficiency.

Supply Chain Management Services are crucial to ensure a seamless movement of agricultural goods from the farm to the market. These services involve inventory management, logistics optimization, and quality control, ensuring that produce reaches consumers in the best possible condition. In an era of global supply chains and increasing consumer demand for transparency, supply chain management services are essential for modern agriculture.

Climate Information Services offer real-time weather data and forecasts, helping farmers make informed decisions regarding planting and harvesting times. As climate variability becomes a growing concern, these services play a crucial role in mitigating risks associated with adverse weather events.

System Integration & Consulting services assist farmers in adopting and integrating various smart agriculture technologies into their existing operations. They provide guidance on selecting the right solutions and ensure a seamless transition to modern farming practices.

Maintenance & Support services ensure the smooth operation of smart agriculture systems and equipment, reducing downtime and disruptions on the farm. These services are indispensable for farmers relying on technology for their day-to-day activities.

Managed Services encompass a range of offerings, including remote monitoring and management of farm equipment and data. These services provide farmers with peace of mind and efficient solutions to tackle operational challenges.

By Farm Size Analysis

In 2023, the Smart Agriculture market showed distinct preferences across different farm sizes. The Large segment took the lead, commanding a dominant market position. This dominance is attributed to the scalability of smart agriculture solutions, making them particularly appealing to large-scale farming operations. Large farms leverage technology to optimize production, streamline operations, and increase efficiency.

Medium-sized farms, while adopting smart agriculture, held a substantial market share as well, benefiting from cost-effective solutions that enhance crop management. Small farms, although gradually adopting smart agriculture practices, accounted for a smaller portion of the market due to budget constraints and limited scalability. As the agriculture industry continues to embrace technology, each farm size segment offers unique opportunities for growth and innovation, contributing to the overall advancement of smart agriculture.

By Application Analysis

In 2023, the Precision Farming segment lead the impressive market share exceeding 41% in the Smart Agriculture market. Precision farming involves using advanced technologies like GPS, sensors, and drones to optimize crop management. Its dominance is driven by the need for increased crop yields and resource efficiency in agriculture. Additionally, it allows farmers to make data-driven decisions, reducing waste and environmental impact.

Livestock Monitoring is another significant application, gaining traction in 2023. It involves tracking the health and behavior of animals using IoT devices. This segment is crucial for ensuring animal welfare, enhancing productivity, and preventing disease outbreaks, all of which are top priorities in modern farming.

Precision Aquaculture is on the rise, with advancements in technology enabling precise control of water quality and feeding in fish farming. This segment caters to the growing demand for seafood and sustainable aquaculture practices.

Precision Forestry is emerging as a key player, utilizing technology to optimize tree harvesting, manage forest resources, and reduce deforestation rates. It addresses the growing concern for sustainable forestry practices and conservation efforts.

Smart Greenhouses are gaining popularity for controlled environment agriculture. They offer year-round crop cultivation, reduced resource usage, and protection against adverse weather conditions, aligning with the demand for sustainable food production.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Precision Farming Advancements: Precision farming techniques, enabled by smart agriculture technologies, are driving the market’s growth. These technologies allow farmers to maximize crop management by using real-time information regarding climate conditions and soil health, as well as forecasts of weather and the health of their crops that result in increased yields as well as resource efficiency.

- Rising Global Food Demand: With the population of the world steadily increasing, there’s an ever-growing need of food products. Smart agriculture solutions provide an opportunity to meet this need by increasing productivity, reducing waste and ensuring sustainable farming methods.

- Government Support and Initiatives: Governments worldwide are increasingly recognizing the importance of smart agriculture for food security and sustainability. Subsidies, incentives, and policy support for adopting smart farming practices are incentivizing farmers to invest in these technologies.

- Environmental Concerns: Smart agriculture aligns with the growing awareness of environmental sustainability. It allows for reduced pesticide and fertilizer use, precise irrigation, and minimized greenhouse gas emissions, addressing concerns related to agriculture’s impact on the environment.

Restraining Factors

- High Initial Costs: The adoption of smart agriculture technologies often requires significant initial investments in sensors, drones, and data analytics systems. This cost can be a barrier for small-scale farmers or those in developing regions.

- Data Privacy and Security Concerns: The collection and sharing of sensitive agricultural data raise concerns about data privacy and cybersecurity. Protecting data from breaches and misuse is crucial to maintaining farmer trust in smart agriculture solutions.

- Limited Connectivity in Rural Areas: In many agricultural regions, access to high-speed internet and reliable connectivity is limited. This digital divide can hinder the widespread adoption and effectiveness of smart agriculture technologies.

- Technical Knowledge and Skills: The successful implementation of smart agriculture requires farmers and agricultural workers to acquire new technical skills. The learning curve can be steep for some, and education and training are essential to overcome this challenge.

Growth Opportunities

- IoT Integration: The integration of the Internet of Things (IoT) into smart agriculture offers vast growth potential. IoT sensors and devices can provide real-time data on crop conditions, equipment performance, and weather, enabling more precise decision-making.

- Blockchain for Supply Chain Transparency: Utilizing blockchain technology to track and verify the origin of agricultural products can enhance supply chain transparency and improve trust among consumers. This presents an opportunity for smart agriculture to add value beyond the farm gate.

- Collaboration with AgriTech Startups: Partnerships and collaborations with innovative AgriTech startups can drive market growth. These startups often develop niche solutions that can complement established smart agriculture technologies.

- Global Expansion: The adoption of smart agriculture is not limited to developed countries. Emerging markets present significant growth opportunities as they seek to modernize their agricultural practices and improve food security.

Geopolitical and Recession Impact Analysis Impact

Geopolitical factors can have a significant impact on the smart agriculture market. Here’s an analysis of how geopolitical events and dynamics may affect the industry:

- Trade Policies and Tariffs: Geopolitical tensions, trade disputes, and the imposition of tariffs can disrupt the global supply chain for agricultural technology and equipment. This can lead to increased costs for smart agriculture solutions, affecting both manufacturers and farmers. Companies may need to adapt their sourcing strategies and pricing structures in response to changing trade dynamics.

- Regulatory Environment: Geopolitical shifts can influence the regulatory environment for smart agriculture technologies. Changes in regulations related to data privacy, intellectual property, and international standards can impact the development and adoption of these technologies. Companies operating in multiple countries may face varying regulatory challenges and compliance requirements.

- Global Market Access: Geopolitical instability can affect market access in certain regions. Political conflicts, sanctions, or trade restrictions can limit the ability of smart agriculture companies to expand into new markets or maintain existing operations. Market diversification strategies may be necessary to mitigate geopolitical risks.

- Research Collaboration: Geopolitical tensions can hinder international research collaboration in agriculture and technology development. Joint research projects and knowledge-sharing initiatives may be disrupted, potentially slowing down innovation in the smart agriculture sector. Companies and research institutions may need to adapt by seeking alternative partnerships and funding sources.

Recession Impact on Smart Agriculture Market:

A recession can also significantly impact the smart agriculture market. Here’s an analysis of how economic downturns may affect the industry:

- Farmers’ Budget Constraints: During a recession, farmers often face budget constraints, which can lead to reduced investments in technology and equipment. The adoption of smart agriculture solutions, which may require initial capital expenditures, could slow down as farmers prioritize cost-cutting measures.

- Credit Availability: Economic downturns can affect the availability of credit for agricultural investments. Farmers may find it more challenging to secure loans or financing for purchasing smart agriculture technology. This can impede the adoption of advanced farming solutions.

- Supply Chain Disruptions: Recession-induced supply chain disruptions can impact the availability of components and equipment needed for smart agriculture. Delays in manufacturing and logistics can lead to delays in the delivery of technology to farmers, affecting their ability to implement time-sensitive practices.

- Government Support: During a recession, governments may allocate resources differently, potentially affecting subsidies, incentives, and support programs for agriculture. Smart agriculture initiatives may experience shifts in funding priorities, influencing the pace of technology adoption.

Kеу Маrkеt Ѕеgmеntѕ

Hardware

- HVAC system

- LED grow lights

- Valves & pumps

- Sensors & control systems

- Others

Sensing Devices

- Soil sensor

- Water sensors

- Climate sensors

- Others

Software

- Web-based

- Cloud-based

Services

- Data services

- Analytics services

- Farm operation services

- Supply chain management services

- Climate information services

- System integration & consulting

- Maintenance & support

- Managed services

- Others

By Farm Size

- Small

- Medium

- Large

By Application

- Precision farming application

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Others

- Livestock monitoring application

- Milk harvesting

- Breeding management

- Feeding management

- Others

- Smart greenhouse application

- Water & fertilizer management

- HVAC management

- Others

- Precision Aquaculture

- Precision Forestry

- Others

Regional Analysis

In 2023, North America held a dominant market position in the smart agriculture sector, capturing more than a 44% share. The dominance of the region can be attributed to the advancement of technology, a wide-spread adoption of techniques for precision farming and the presence of important industry players. It is true that the United States and Canada, specifically are in the forefront of innovative smart agriculture, making use of the power of data analysis, IoT, and AI to boost agricultural productivity and sustainability. Additionally, the government’s policies and initiatives that aim to modernize agriculture have helped accelerate the development of the smart farming market within North America.

In contrast, Europe also played a significant role, maintaining a competitive stance in 2023. The European Union’s focus on sustainable agriculture and environmental conservation has propelled the adoption of smart farming practices. Stringent regulations related to food safety and traceability have driven the demand for technologies that enable transparent and efficient supply chains. As a result, Europe held a substantial share of the smart agriculture market, with countries like Germany and France leading the way in technological integration.

The Asia-Pacific (APAC) region has emerged as a major player in the smart agricultural market by 2023, with an impressive share. Rapid urbanization, a growing population and the need to maximize the use of agricultural resources in highly urbanized areas have led to the development of smart agriculture solutions in nations like China as well as India. Additionally, initiatives by governments to modernize agriculture as well as improve food security have boosted the growth of the market across the APAC region.

Latin America exhibited its influence, with a focus on sustainable farming practices and precision agriculture. Brazil, in particular, stood out as a key player, leveraging smart agriculture technologies to boost its agricultural productivity. The region’s vast agricultural landscapes and the adoption of precision techniques contributed to its presence in the global smart agriculture market.

Lastly, the Middle East and Africa, while holding a smaller share, showcased potential growth opportunities in 2023. Water scarcity challenges in arid regions have driven the adoption of smart irrigation systems and efficient resource management. As these regions seek to enhance food production and agricultural sustainability, the smart agriculture market is expected to gain traction.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key Players Analysis refers to the evaluation and examination of the major companies operating in a specific market or industry. It involves identifying the prominent players, assessing their market presence, understanding their strategies, and analyzing their contributions to the market’s growth and dynamics.

Top Key Рlауеrѕ:

- Autonomous Solutions, Inc.

- GEA Group Aktiengesellschaft

- CropMetrics LLC

- Ag Leader Technology

- BouMatic Robotic B.V.

- Raven Industries

- Argus Control Systems Ltd

- Grownetics, Inc.

- DeLaval Inc

- DICKEY-john

- AgJunction, Inc.

- Farmers Edge Inc

- Gamaya

- Deere & Company

- CropZilla

- Topcon Positioning Systems

- DroneDeploy

- Granular, Inc.

- Trimble Inc.

- CLAAS KGaA mbH

Recent Development

- In the month of October, 2022, Trimble Inc. launched new displays, GFX-1060 and 1260 to be used in precision agriculture applications. Farmers are able to complete tasks in the field quickly and efficiently by using these new displays that allow them to track and monitor field data in real-time precisely.

- On September 2022, Deere & Company launched three self-propelled harvesters for forage to complement its existing line-up. They are designed to meet the needs of livestock and dairy producers as well as contractors and harvesters to tackle issues like shorter harvesting times as well as a lower workforce of skilled workers and the rising operating cost.

Report Scope

Report Features Description Market Value (2023) US$ 20.6 Bn Forecast Revenue (2032) US$ 60.1 Bn CAGR (2023-2032) 11.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered by Hardware (HVAC system,LED grow lights, Valves & pumps, Sensors & control systems, Others), By Sensing Devices (Soil sensor, Water sensors, Climate sensors and Others), By Software( Web-based, Cloud-based), By Services (Data services, Analytics services, Farm operation services, Supply chain management services, Climate information services, System integration & consulting, Maintenance & support, Managed services, Others), By Farm Size (Small, Medium, Large), By Application (Precision Farming, Livestock Monitoring, Precision Aquaculture, Precision Forestry, Smart Greenhouse, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Autonomous Solutions, Inc., GEA Group Aktiengesellschaft, CropMetrics LLC, Ag Leader Technology, BouMatic Robotic B.V., Raven Industries, Argus Control Systems Ltd, Grownetics, Inc., DeLaval Inc, DICKEY-john, AgJunction, Inc., Farmers Edge Inc, Gamaya, Deere & Company, CropZilla, Topcon Positioning Systems, DroneDeploy, Granular, Inc., Trimble Inc., CLAAS KGaA mbH Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Smart Agriculture?Smart Agriculture involves the use of technology, data, and automation to enhance various aspects of farming, such as crop monitoring, precision farming, and livestock management.

What technologies are considered part of Smart Agriculture?Smart Agriculture encompasses technologies like Internet of Things (IoT), sensors, drones, satellite imagery, machine learning, and data analytics for optimizing farming operations.

What is the market potential of smart agriculture?The market potential of smart agriculture is significant and is expected to grow rapidly. With the increasing global population, the need for efficient and sustainable agricultural practices is rising. The smart agriculture market encompasses a range of technologies that aim to enhance productivity, reduce resource wastage, and address challenges in the agriculture sector. As technology continues to advance, the market for smart agriculture is likely to expand further.

How big is the smart agriculture market?The Global Smart Agriculture Market is anticipated to be USD 60.1 billion by 2033. It is estimated to record a steady CAGR of 11.3% in the Forecast period 2023 to 2033. It is likely to total USD 20.6 billion in 2023.

What is the main objective of smart agriculture?The main objective of smart agriculture is to enhance the efficiency and sustainability of agricultural practices. This includes optimizing resource use, improving crop yields, reducing environmental impact, and utilizing data-driven insights to make informed decisions. Smart agriculture aims to address challenges such as climate change, resource scarcity, and the need for increased food production.

What role do drones play in Smart Agriculture?Drones are used in Smart Agriculture for various tasks, including crop monitoring, mapping, and spraying. They provide a bird's-eye view of the fields, enabling farmers to make informed decisions about crop health and resource management.

What is the future scope of smart farming?The future scope of smart farming is promising, with ongoing advancements in technology. The integration of artificial intelligence, machine learning, and the expansion of IoT applications in agriculture will likely play a significant role. The future of smart farming involves more comprehensive and interconnected systems that enable farmers to monitor, analyze, and manage their operations with greater precision, leading to increased productivity and sustainability.

-

-

- Autonomous Solutions, Inc.

- GEA Group Aktiengesellschaft

- CropMetrics LLC

- Ag Leader Technology

- BouMatic Robotic B.V.

- Raven Industries

- Argus Control Systems Ltd

- Grownetics, Inc.

- DeLaval Inc

- DICKEY-john

- AgJunction, Inc.

- Farmers Edge Inc

- Gamaya

- Deere & Company

- CropZilla

- Topcon Positioning Systems

- DroneDeploy

- Granular, Inc.

- Trimble Inc.

- CLAAS KGaA mbH