Global Single-use Bioprocessing Market Analysis By Product [Simple & Peripheral Elements (Tubing, Filters, Connectors, & Transfer Systems, Bags, Sampling Systems, Probes & Sensors (pH Sensor, Oxygen Sensor, Pressure Sensors, Temperature Sensors, Conductivity Sensors, Flow Sensors, Others), Others), Apparatus & Plants (Bioreactors, Mixing, Storage, & Filling Systems, Filtration System, Chromatography Systems, Pumps, Others), Work Equipment (Cell Culture System, Syringes, Others)]; By Workflow (Upstream Bioprocessing, Fermentation, Downstream Bioprocessing); By End-use (Biopharmaceutical Manufacturers, CMOs & CROs, In-house Manufacturers, Academic & Clinical Research Institutes), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 32532

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

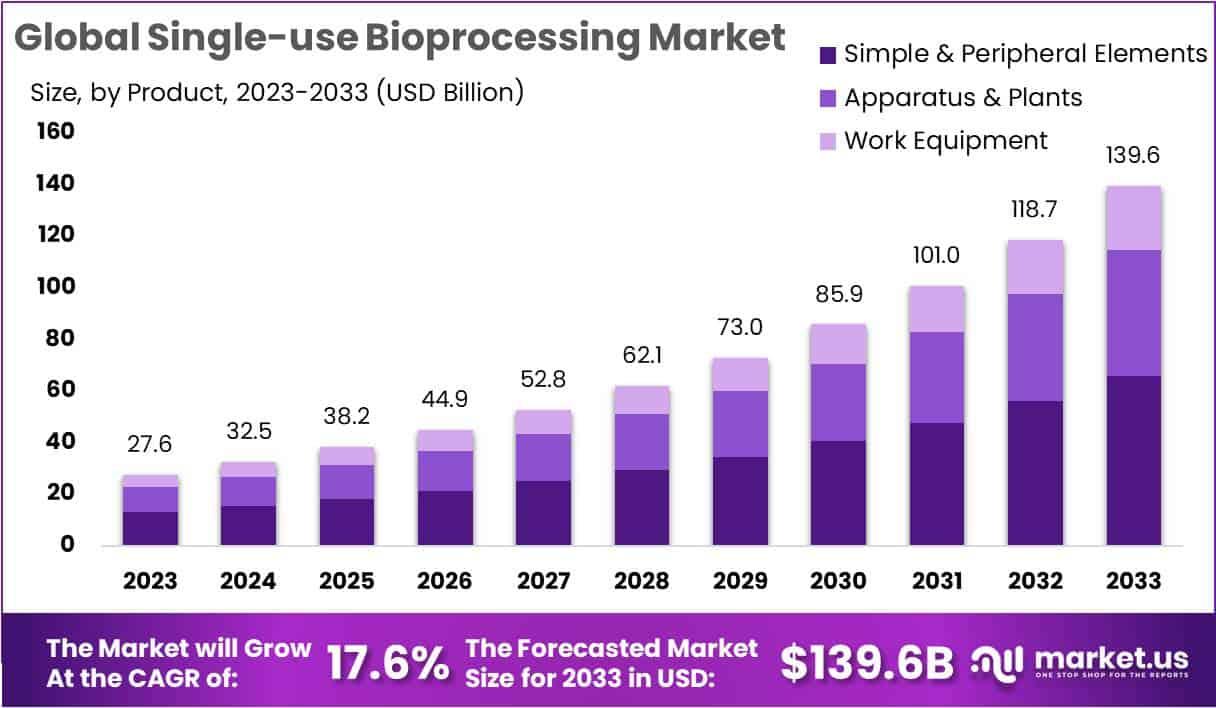

The Single-use Bioprocessing Market Size is anticipated to reach approximately USD 139.6 Billion by 2033, exhibiting substantial growth from its estimated value of USD 27.6 Billion in 2023. This remarkable expansion is forecasted to occur at a Compound Annual Growth Rate (CAGR) of 17.6% throughout the forecast period spanning from 2024 to 2033.

Single-use bioprocessing has transformed how biopharmaceuticals are made, using disposable technologies like single-use bioreactors, tubing, and containers. Unlike the traditional stainless steel equipment requiring extensive cleaning, these components are used once and then discarded. This shift brings remarkable flexibility to the industry, allowing manufacturers to easily adjust processes for different products without the hassle of reconfiguring fixed equipment.

The key advantage lies in reducing the risk of cross-contamination between batches, crucial for maintaining the purity of sensitive biologics. Moreover, it brings about significant cost and time savings by eliminating the need for time-consuming validation processes, making operations more efficient and reducing turnaround times.

Beyond flexibility, the adoption of single-use systems also makes facilities more adaptable, requiring less space and infrastructure compared to traditional setups. This not only allows for more flexible facility designs but also reduces the need for large cleanroom spaces. This adaptability enables manufacturing operations in locations that wouldn’t be suitable for permanent stainless steel facilities.

Additionally, single-use bioprocessing helps mitigate risks by minimizing the likelihood of product recalls due to contamination events. Since disposable components are used only once and then discarded, the risk of product contact with potential contaminants is significantly lowered. Widely embraced in the biopharmaceutical industry, especially in producing vaccines, monoclonal antibodies, and cell and gene therapies, single-use bioprocessing is a game-changer, offering increased efficiency, improved product quality, and operational flexibility for biomanufacturers.

Key Takeaways

- Market Size and Growth: Market value in 2023 is USD 27.6 billion, with a forecasted revenue of USD 139.6 billion by 2033, indicating a robust CAGR of 17.6%.

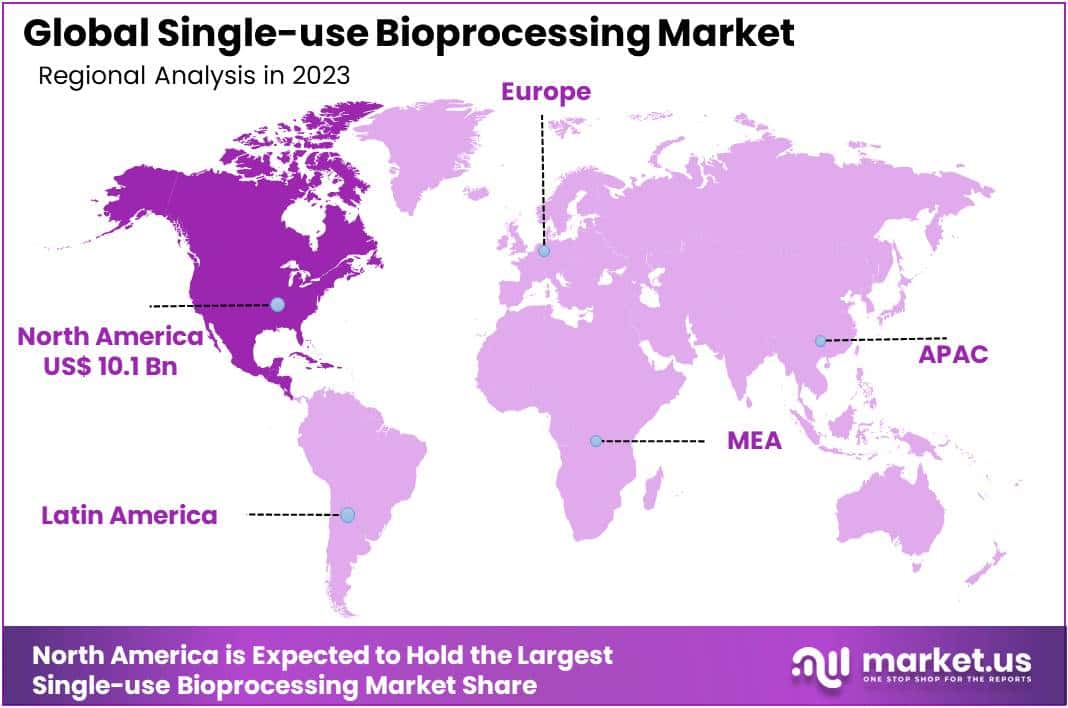

- Market Dominance: North America leads with 36.8% market share, valued at USD 10.15 billion, showcasing robust adoption of single-use bioprocessing technologies.

- Product Leadership: Simple & Peripheral Elements claim a dominant market position with over 47.2%, emphasizing their pivotal role in driving industry advancements.

- Workflow Performance: Upstream Bioprocessing leads with a substantial 55.9% market share, reflecting its critical role in establishing the foundation for successful bioproduction.

- End-use Significance: Biopharmaceutical Manufacturers secure a commanding 56.9% market share, highlighting the critical role of single-use technologies in manufacturing processes.

- Regional Analysis: North America stands tall in the Single-use Bioprocessing Market, grabbing over 36.8% of the market share and boasting a market value of USD 10.1 billion.

Product Analysis

In 2023, Simple & Peripheral Elements segment dominant market position in Single-use Bioprocessing Market, snagging a solid market share of over 47.2%. These basic components played a crucial role in driving the industry forward, proving their importance in bioprocessing applications. People were really into using them, and it made a big impact on the market.

Apparatus & Plants also had their moment, holding a significant position in the market. These important components were in demand, adding variety to the Single-use Bioprocessing Market. Thanks to their cool features and tech advancements, Apparatus & Plants became key players in pushing the industry ahead.

On the other hand, Work Equipment made its mark, too, showing it was a big deal in the market. In 2023, Work Equipment contributed to the changing scene of single-use bioprocessing, offering solutions customized to the industry’s needs. It gained more influence, proving how flexible and effective these crucial tools were.

Workflow Analysis

In 2023, the Single-use Bioprocessing market witnessed Upstream Bioprocessing emerging as the frontrunner, securing a dominant market position with an impressive share of more than 55.9%. This segment’s robust performance reflects its pivotal role in the bioproduction workflow.

Upstream Bioprocessing involves the initial stages of biomanufacturing, encompassing cell culture, media preparation, and inoculum development. The noteworthy market share can be attributed to the critical nature of these processes in ensuring the optimal growth and health of cells, setting the foundation for successful bioproduction.

Following closely behind is the Fermentation segment, contributing significantly to the single-use bioprocessing landscape. Fermentation plays a vital role in the production of various biologics, leveraging microbial or cell-based systems to achieve desired yields. As of 2023, it holds a substantial market share, reflecting the widespread adoption of single-use technologies in fermentation processes.

Downstream Bioprocessing, another integral component of the bioproduction workflow, also commands a noteworthy share in the single-use bioprocessing market. Responsible for purification and isolation of the final bioproduct, the Downstream Bioprocessing segment’s significance is underscored by its role in ensuring the quality and safety of the end product.

These market dynamics underscore the industry’s recognition of the advantages offered by single-use technologies across diverse bioprocessing workflows. The dominance of Upstream Bioprocessing, coupled with the significant contributions from Fermentation and Downstream Bioprocessing, underscores the comprehensive adoption of single-use bioprocessing solutions in the pursuit of efficient, flexible, and cost-effective biomanufacturing processes.

End-use Analysis

In 2023, the single-use bioprocessing market witnessed a significant stronghold by Biopharmaceutical Manufacturers, securing a commanding position with a market share exceeding 56.9%. This indicates a substantial reliance on single-use technologies within the biopharmaceutical sector, showcasing their pivotal role in manufacturing processes.

CMOs & CROs, comprising Contract Manufacturing Organizations and Contract Research Organizations, also played a notable role, contributing to the market with their diverse services. In the same period, they accounted for a considerable share, emphasizing the widespread adoption of single-use bioprocessing technologies in outsourced manufacturing and research activities.

Meanwhile, In-house Manufacturers asserted their presence in the market, holding a substantial share as well. This segment includes companies that produce their biopharmaceutical products internally. The adoption of single-use bioprocessing technologies by in-house manufacturers reflects a strategic approach to enhance efficiency and flexibility in their production processes.

Academic & Clinical Research Institutes, though holding a comparatively smaller share, demonstrated a growing interest in the utilization of single-use bioprocessing technologies. This emphasizes the broader applicability of these technologies beyond traditional manufacturing, extending their footprint into research and academic settings.

Overall, the diverse landscape of the single-use bioprocessing market in 2023 is marked by the dominance of Biopharmaceutical Manufacturers, supported by significant contributions from CMOs & CROs, In-house Manufacturers, and the evolving presence of Academic & Clinical Research Institutes. This dynamic scenario underlines the widespread acceptance and integration of single-use bioprocessing solutions across various segments of the biopharmaceutical industry.

Key Market Segments

Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Work Equipment

- Cell Culture System

- Syringes

- Others

Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

Drivers

Cost Efficiency and Lower Initial Investment

Single-use bioprocessing technologies cut costs significantly by doing away with the need for extensive cleaning and validation processes linked to traditional stainless-steel equipment. The lower upfront capital investment is appealing to both established and emerging biopharmaceutical companies, as single-use systems require less infrastructure.

Flexibility and Scalability

Single-use bioprocessing allows for quick adjustments in production scale, catering to varying demands effectively. This adaptability is especially beneficial for companies dealing with multiple biologics or those facing unpredictable production volumes.

Time Efficiency and Faster Time-to-Market

Streamlined workflows of single-use bioprocessing systems result in reduced setup times and overall processing durations. This efficiency contributes to faster time-to-market for biopharmaceutical products, a crucial factor in the highly competitive pharmaceutical industry.

Restraints

Limited Product Compatibility

Single-use systems may not be suitable for all bioprocessing applications, as certain products and processes may demand specific materials or conditions not easily accommodated by disposable components. This limitation can hinder the adoption of single-use bioprocessing in some specialized or complex biopharmaceutical manufacturing processes.

Environmental Concerns and Waste Management

The increased use of disposable plastic components raises environmental concerns, especially regarding plastic waste. Proper disposal and recycling of single-use bioprocessing materials present challenges, with companies potentially facing scrutiny for their environmental impact.

Quality and Standardization Concerns

Some industries express concerns about the consistency and quality of single-use components compared to traditional stainless-steel equipment. The lack of standardization across the industry may pose challenges in ensuring uniformity and reliability.

Risk of Supply Chain Disruptions

Dependence on a limited number of suppliers for single-use components exposes companies to the risk of supply chain disruptions. Shortages or quality issues in the supply chain could impact production schedules and pose challenges in maintaining a steady and reliable manufacturing process.

Opportunities

Biopharmaceutical Industry Expansion

The biopharmaceutical industry has been rapidly growing with the emergence of innovative biologics, biosimilars, and advanced therapies. This has created significant demand for efficient and flexible bioprocessing solutions like single-use systems. With benefits like reduced cross-contamination risks, lower capital costs, and faster start-up times, single-use technologies are being widely adopted in biomanufacturing facilities. The expanding biopharma pipeline and continuing investments in new facilities will be a key driver for single-use equipment and accessories.

Increased R&D Activities in Bioprocessing

Intensifying R&D activities for developing novel biologics and improving bioprocess efficiency has also augmented the uptake of single-use technologies. The flexibility and scalability provided by single-use bioreactors, mixers, filters etc. allows companies to improve process development and pilot-scale manufacturing. Moreover, single-use systems enable increased batch turnover frequency and make R&D scale-up less capital intensive.

Customization of Single-Use Technologies

With the maturity of the single-use industry, suppliers are increasingly providing customized single-use equipment to meet specific process needs. Tailored single-use bioreactor and storage systems, pre-assembled tubing sets, and purpose-built accessories help end users in reducing implementation risks and costs. The customization capabilities are further supporting the adoption of single-use technologies.

Rising Adoption in Emerging Markets

Many developing regions like China, India, Brazil, and Southeast Asia are undertaking bioprocessing investments driven by growing domestic drug demands. Single-use technologies are gaining traction in these markets owing to lower upfront infrastructure investments, reduced complexity, and lower water/energy usage. With improving regulatory and manufacturing capabilities, emerging markets offer significant expansion potential for single-use suppliers.

Trends

Continued adoption of single-use technologies

Single-use systems are rapidly replacing traditional stainless steel equipment in bioprocessing due to benefits like flexibility, reduced contamination risks, and lower capital costs. Their utilization continues to grow across all scales of bioproduction.

Advances in polymer science

Suppliers are developing innovative polymers, films, and new plastic formulations to improve the performance capabilities of single-use equipment. This allows accommodation of more aggressive processing conditions.

Smart sensors integration

Incorporating smart sensors in single-use bioreactors, mixers, and other equipment provides advanced process monitoring capabilities and data to improve automation.

Supply chain strengthening

Companies are establishing robust supply chains with increased production capacities and strategic sourcing to ensure component availability and mitigate shortages. This also enables customization as per user requirements.

Design innovations

Next-generation single-use equipment are incorporating improved ergonomic features, expanded connectivity options, non-invasive sensing technologies like wireless pH sensors, and modular configurations.

Upstream intensification

Single-use technologies like perfusion bioreactors and advanced cell retention devices are enabling continuous manufacturing and higher productivity in upstream processes.

Adoption in emerging applications

Besides biologics manufacturing, single-use systems are expanding into new areas like cell and gene therapies, microbial fermentation, and vaccines.

Shift towards capsules and pods

All-inclusive, pre-assembled and pre-sterilized capsules and pods built using single-use technologies are gaining interest for their plug-and-play usability.

Focus on sustainability

Companies are adopting eco-friendly manufacturing of single-use components using recyclable/reusable materials and reducing packaging waste to improve sustainability.

Regional Analysis

In 2023, North America stands tall in the Single-use Bioprocessing Market, grabbing over 36.8% of the market share and boasting a market value of USD 10.1 billion. This dominant position reflects the region’s robust adoption and investment in single-use bioprocessing technologies. The impressive market presence is indicative of North America’s strong commitment to advancements in bioprocessing, making it a key player in shaping the industry landscape.

The region’s dominance is primarily due to its large-scale biopharmaceutical manufacturing capabilities in the U.S. and expanding biopharmaceutical R&D. Additionally, many contract manufacturing firms in North America are engaged in integrating disposables into their processes. This has resulted in increased investment in this market.

Fujifilm Diosynth spent USD 2 billion on its U.S. facility to create large cell cultures. This site will have eight 20,000-liter bioreactors. With its growing biopharmaceutical manufacturing sector, China has been a promising market for single-use technology in recent years.

Wuxi Biologics is a critical CDMO in China. The company started GMP-compliant operation at its China facility in February 2021. This facility has nine single-use bioreactors with a 4,000-liter capacity. This region is expected to record the fastest CAGR over the forecast period, with India and China leading the charge.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Danaher Corp. operates in the single-use space through its bioprocessing brand Pall. Pall provides filtration, separation, clarification, and cell culture products for biomanufacturing. The company offers a wide selection of single-use bioreactors, mixers, tubing, connectors, sensors, and assemblies. Danaher is investing significantly to expand production of single-use products and enhance R&D. The company aims to provide complete solutions to drive greater adoption across processes. Pall’s market expertise and customization abilities make it a leading single-use technology supplier.

Thermo Fisher Scientific Inc. provides single-use storage bags, mixing systems, tubing sets, bioreactors, and other equipment. It has a diverse bioprocessing portfolio including advanced single-use sensors and automation equipment. Strategic partnerships and a strong distribution network provide Thermo Fisher a competitive edge in the market. It is focused on developing innovative single-use technologies to optimize biopharma manufacturing. Thermo Fisher’s global scale and comprehensive offerings position it as a top player in this domain.

Merck KGaA operates its single-use business through the BioContinuum brand. The comprehensive single-use portfolio includes customized pre-sterilized assemblies, bioreactors, fermenters, bags, and filters. The key strengths of Merck’s single-use technologies are flexibility, scalability, and process efficiency. Merck focuses on delivering fully integrated single-use solutions tailored to specific customer needs. Its expertise helps Merck provide high-quality offerings to gain increased single-use market share.

Avantor Inc. provides a wide range of single-use products for upstream and downstream bioprocessing. Key offerings include bioreactor bags, assemblies, tubes, connectors, and buffers. Avantor aims to enhance single-use product quality through scientific expertise and focus on compliance standards. The company adopts both organic and inorganic strategies to expand its single-use capabilities and production capacities. Avantor’s ability to offer reliable single-use components makes it an important industry supplier.

Market Key Players

- Sartorius AG

- Danaher Corp.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Avantor Inc.

- Eppendorf SE

- Corning Inc.

- Boehringer Ingelheim International GmbH

- Lonza

- Infors AG

- PBS Biotech Inc.

Recent Developments

- Sartorius AG: Sartorius AG has expanded its single-use bioprocessing portfolio by introducing innovative single-use solutions for cell culture and purification processes, catering to the growing demand for flexible biomanufacturing.

- Danaher Corp.: Danaher Corp. has made strategic acquisitions to enhance its single-use bioprocessing capabilities, further strengthening its position as a leading provider of integrated bioprocessing solutions.

- Thermo Fisher Scientific Inc.: Thermo Fisher Scientific Inc. has launched advanced single-use bioreactors and mixing systems that offer precise control over bioprocessing operations, contributing to improved biomanufacturing efficiency.

- Merck KGaA: Merck KGaA has collaborated with biopharmaceutical companies to develop customized single-use solutions, ensuring compatibility with specific bioprocessing needs and regulatory requirements.

- Avantor Inc.: Avantor Inc. has invested in research and development to create high-performance single-use technologies, addressing the demand for scalable and cost-effective bioprocessing solutions.

Report Scope

Report Features Description Market Value (2023) USD 27.6 Bn Forecast Revenue (2033) USD 139.6 Bn CAGR (2024-2033) 17.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product [Simple & Peripheral Elements (Tubing, Filters, Connectors, & Transfer Systems, Bags, Sampling Systems, Probes & Sensors (pH Sensor, Oxygen Sensor, Pressure Sensors, Temperature Sensors, Conductivity Sensors, Flow Sensors, Others), Others), Apparatus & Plants (Bioreactors, Mixing, Storage, & Filling Systems, Filtration System, Chromatography Systems, Pumps, Others), Work Equipment (Cell Culture System, Syringes, Others)]; Workflow (Upstream Bioprocessing, Fermentation, Downstream Bioprocessing); End-use (Biopharmaceutical Manufacturers, CMOs & CROs, In-house Manufacturers, Academic & Clinical Research Institutes) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sartorius AG, Danaher Corp., Thermo Fisher Scientific Inc., Merck KGaA, Avantor Inc., Eppendorf SE, Corning Inc., Boehringer Ingelheim International GmbH, Lonza, Infors AG, PBS Biotech Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the single-use bioprocessing market in 2023?The Single-use Bioprocessing market size is USD 27.6 Billion in 2023.

What is the projected CAGR at which the single-use bioprocessing market is expected to grow at?The single-use bioprocessing market is expected to grow at a CAGR of 17.6% (2024-2033).

List the segments encompassed in this report on the single-use bioprocessing market?Market.US has segmented the Single-use Bioprocessing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into simple & peripheral elements, apparatus & plants, and work equipment; by workflow, demand has been segmented into upstream, fermentation, and downstream; by the end-use market has been segmented into biopharmaceutical manufacturer and academic & clinical research institutes.

List the key industry players of the single-use bioprocessing market?Sartorius AG, Corning Incorporated, Pall Corporation, General Electric Company, Eppendorf AG, Rentschler Biopharma SE, Thermo Fisher Scientific, Inc., PBS Biotech, Inc., Other Key Players are the key vendors in the single-use bioprocessing market.

Which region is more appealing for vendors employed in the single-use bioprocessing market?North America accounted for the highest revenue share of 34.6%. Therefore, the Single-use Bioprocessing industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the single-use bioprocessing market?The US, Mexico, Canada, China, Japan, Germany, France, UK, etc., are key areas of operation for the single-use bioprocessing market.

Which segment accounts for the greatest market share in the single-use bioprocessing industry?With respect to the single-use bioprocessing industry, vendors can expect to leverage greater prospective business opportunities through the simple and peripheral elements segment, as this area of interest accounts for the largest market share.

Single-use Bioprocessing MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Single-use Bioprocessing MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sartorius AG

- Danaher Corp.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Avantor Inc.

- Eppendorf SE

- Corning Inc.

- Boehringer Ingelheim International GmbH

- Lonza

- Infors AG

- PBS Biotech Inc.