Silicon Carbide (SiC) MOSFET Market Size, Share Analysis By Device Type (Module SiC MOSFETs, Discrete SiC MOSFETs), By Technology (200mm Wafer Technology, 150mm Wafer Technology), By Voltage Range (650V-900 V, 900V-1200V, 1200V-1700V, Above 1700V), By Application (Power Supplies, Inverters, Industrial equipment, Electric vehicles (EVs), Others), By End-Use (Automotive, Telecommunications, Industrial, Consumer electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142749

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- APAC SiC MOSFET Market Size

- Analysts’ Viewpoint

- Device Type Analysis

- Technology Analysis

- Voltage Range Analysis

- Application Analysis

- End Use Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

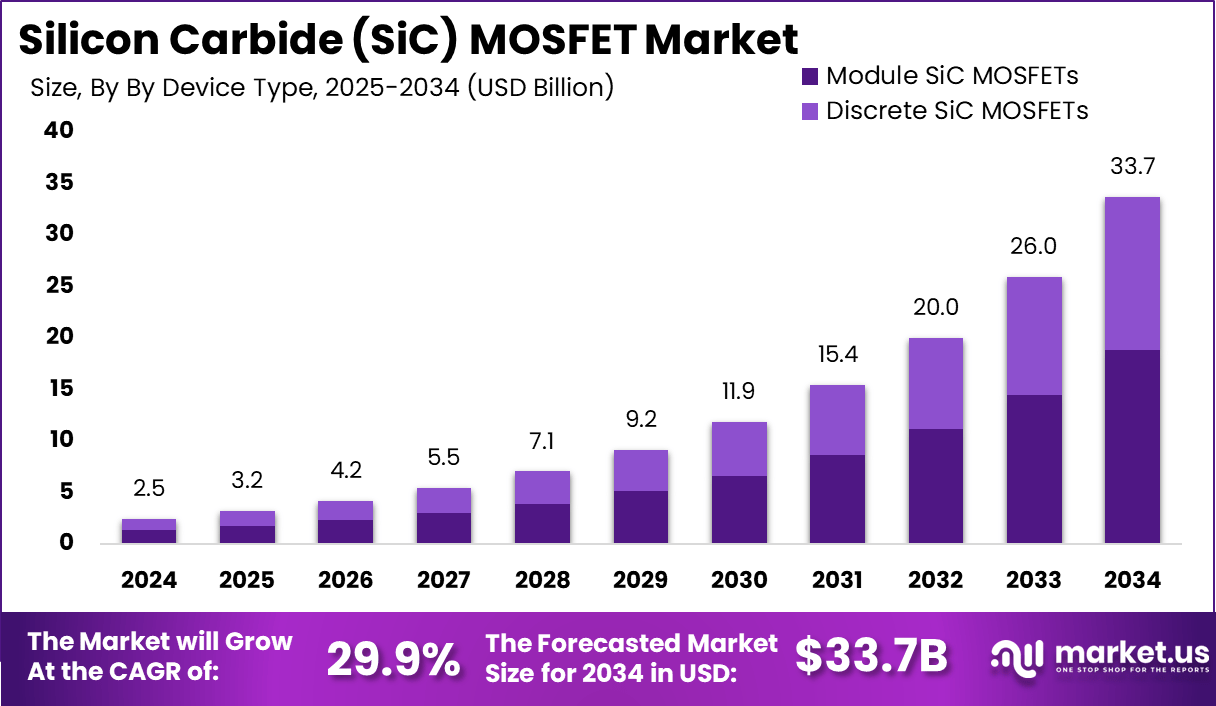

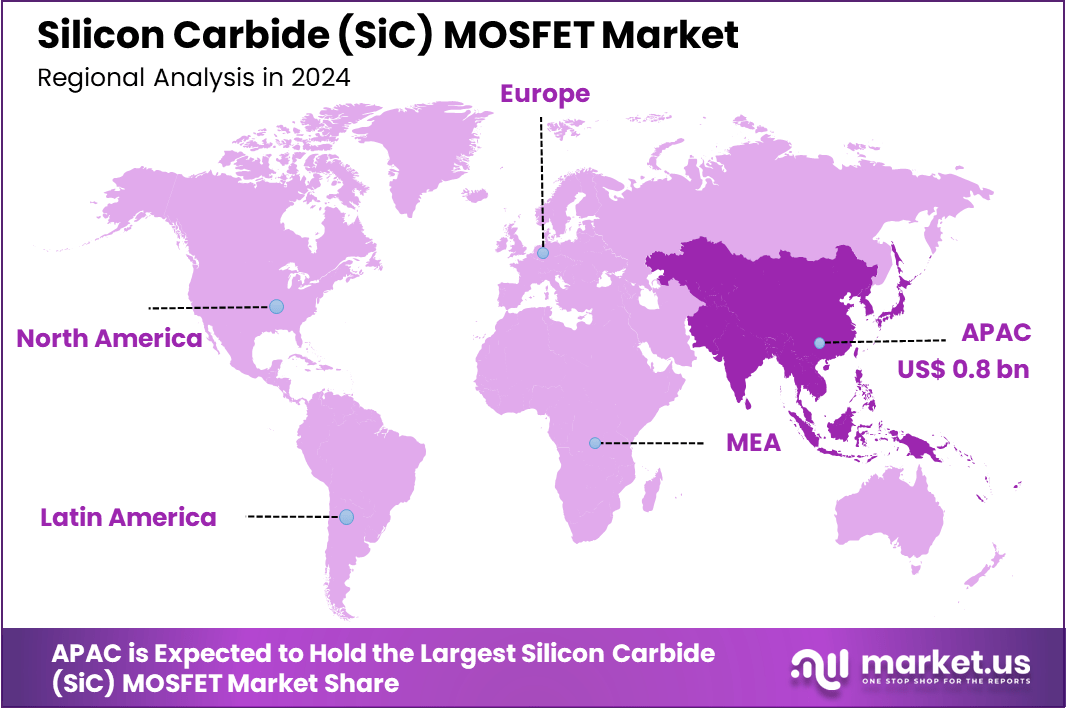

The Silicon Carbide (SiC) MOSFET Market size is expected to be worth around USD 33.7 Billion By 2034, from USD 2.5 billion in 2024, growing at a CAGR of 29.9% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 33.7% share, holding USD 0.8 Billion revenue.

Silicon Carbide (SiC) Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs) are advanced semiconductor devices that have become integral in power electronics due to their superior properties compared to traditional silicon-based transistors. SiC MOSFETs offer enhanced efficiency, faster switching times, and better thermal management, making them particularly suitable for applications in power electronics, electric vehicles, and renewable energy systems

The global market for SiC MOSFETs is experiencing significant growth, driven by the increasing adoption of these devices in sectors like automotive and renewable energy. The primary drivers of the SiC MOSFET market include the rising demand for energy-efficient power systems, the expansion of the electric vehicle (EV) market, and the increasing requirements for advanced power solutions in industrial and consumer electronics.

The superior characteristics of SiC MOSFETs, such as enhanced efficiency and higher temperature and voltage capabilities, also contribute significantly to their growing adoption. Demand for SiC MOSFETs is robust across industries that require high efficiency and reliability in power conversion. This includes applications in automotive power systems, renewable energy converters, and power supply units for data centers and telecommunications.

The ability of SiC MOSFETs to reduce energy loss and improve system performance underpins their widespread adoption. Key factors impacting the SiC MOSFET market include technological advancements that improve the performance and reduce the costs of SiC devices. However, the high cost of SiC materials and the complexity of manufacturing processes remain significant challenges that could temper market growth.

For instance, In June 2024, Vishay Intertechnology introduced its first SiC MOSFET products at PCIM Europe 2024, marking a significant milestone in its power semiconductor portfolio. The company showcased a broad range of power management solutions, addressing key trends in power electronics, including e-mobility, high-efficiency power conversion, energy storage, and grid management.

Adopting SiC MOSFETs in business operations leads to increased energy efficiency, reduced operational costs, and improved system performance across various applications. Businesses involved in manufacturing electric vehicles or renewable energy systems will particularly benefit from the enhanced efficiency and thermal properties of SiC MOSFETs.

Key Takeaways

- The Silicon Carbide (SiC) MOSFET Market is projected to grow from USD 2.5 billion in 2024 to USD 33.7 billion by 2034, registering a CAGR of 29.9% during the forecast period (2025-2034).

- The Asia-Pacific (APAC) region dominated the market in 2024, capturing 33.7% of the total market share and generating USD 0.8 billion in revenue.

- The Module SiC MOSFETs segment accounted for more than 56% of the total market share in 2024.

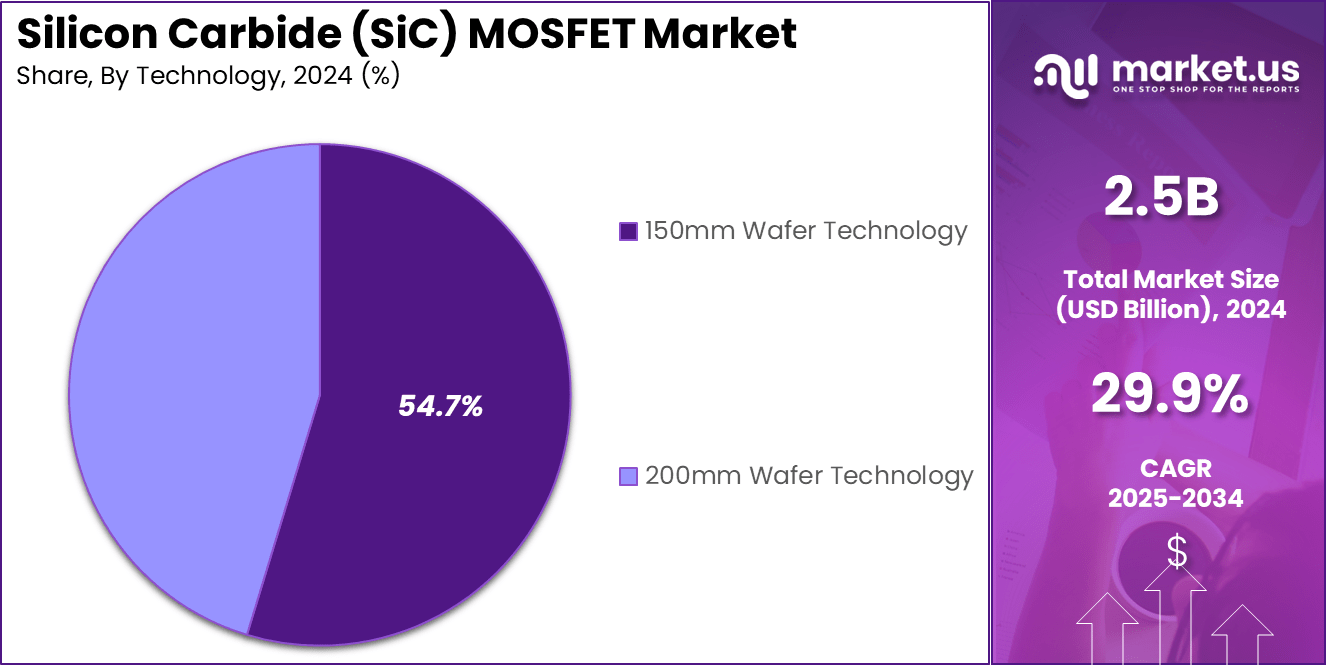

- The 150mm Wafer Technology segment held a 54.7% market share in 2024, reflecting its widespread adoption in high-power applications.

- The 1200V-1700V segment captured a dominant market position in 2024. This voltage range is crucial for applications requiring high power density and efficiency, including electric vehicles, industrial automation, and grid infrastructure.

- The inverters segment accounted for a significant market share in 2024, highlighting its importance in power conversion applications.

- The automotive sector dominated the SiC MOSFET market, holding more than a 40% share in 2024.

APAC SiC MOSFET Market Size

In 2024, the Asia Pacific (APAC) region held a dominant position in the Silicon Carbide (SiC) MOSFET market, capturing more than a 33.7% share with revenues reaching approximately USD 0.8 billion. This substantial market share can be attributed to several strategic and economic factors that underscore the region’s pivotal role in the global SiC MOSFET industry.

Firstly, APAC benefits from the presence of leading semiconductor manufacturing countries, including China, South Korea, and Japan. These countries host some of the world’s foremost manufacturers and R&D centers dedicated to advancements in SiC technology.

The strong industrial base, coupled with significant investments in semiconductor research, has propelled the development of high-performance SiC MOSFETs that cater to a growing demand across various applications. Moreover, the region’s commitment to electrification and renewable energy significantly contributes to the surge in demand for SiC MOSFETs.

Governments across APAC have implemented favorable policies and incentives that encourage the adoption of electric vehicles (EVs) and the expansion of renewable energy installations, both of which rely heavily on the efficiency gains provided by SiC MOSFETs. This policy-driven demand creates a robust market for SiC components, further establishing APAC as a leader in this sector.

Additionally, the rapid urbanization and industrialization in APAC necessitate advanced power solutions for energy management and distribution, further driving the demand for SiC MOSFETs. The integration of SiC technology in industrial and consumer electronics applications, attributed to its superior efficiency and thermal characteristics, aligns well with the region’s push towards high-tech and sustainable industrial practices.

Analysts’ Viewpoint

Investment opportunities within the SiC MOSFET market are large in areas such as the development of more cost-effective manufacturing processes, expansion of product ranges to cover a broader array of applications, and enhancements in packaging technologies to support the integration of SiC MOSFETs into various electronic devices.

The regulatory environment for SiC MOSFETs is increasingly focusing on energy efficiency and environmental sustainability. Regulations such as the European Union’s RoHS and WEEE directives impact the manufacturing and disposal of electronic components, including SiC MOSFETs, pushing manufacturers to adopt more sustainable practices.

Recent technological advancements in SiC MOSFETs include improvements in device architecture that reduce gate charge and conduction losses, and the development of more robust gate drive technologies. These innovations contribute to the overall performance and reliability of SiC-based power systems.

Device Type Analysis

In 2024, the Module SiC MOSFETs segment held a dominant market position, capturing more than a 56% share of the global SiC MOSFET market. This leadership is primarily due to the module’s ability to provide superior system-level performance in a range of demanding applications, from renewable energy systems to automotive power electronics.

The integration of multiple SiC MOSFETs into a single module facilitates higher power densities and efficiency, which are crucial for these high-performance domains. Module SiC MOSFETs are particularly favored in applications requiring robust power management solutions, such as electric vehicles and industrial motor drives.

Their ability to handle high voltages and temperatures with lower losses compared to discrete devices significantly enhances overall system reliability and performance. This advantage is compounded by the trend towards more compact and energy-efficient power systems in sectors like automotive, where space optimization and energy savings are paramount.

The market’s preference for Module SiC MOSFETs is further supported by their streamlined design and manufacturing process. By reducing the complexity involved in system assembly and ensuring higher reliability through integrated components, modules offer a more cost-effective solution over the long term.

Technology Analysis

In 2024, the 150mm Wafer Technology segment in the Silicon Carbide (SiC) MOSFET market held a commanding lead, securing more than a 54.7% share. This segment’s dominance is attributed to its established role in producing SiC MOSFETs, which are crucial for a range of applications from power electronics to automotive systems.

The 150mm wafers are particularly valued for their cost-effectiveness and flexibility in handling, making them suitable for various manufacturing requirements where high-volume production is not the primary focus. The preference for 150mm wafer technology stems from its ability to balance performance with manufacturing costs effectively.

Despite the emergence of larger wafers, 150mm wafers remain integral in settings that require precise device specifications without the necessity for extensive scaling. This includes specialized markets and applications where the transition to larger wafers does not yet present a clear cost benefit.

Moreover, the 150mm wafer technology continues to benefit from incremental improvements in manufacturing processes and material handling. These advancements have helped sustain its competitiveness by enhancing the quality and reducing the cost of the wafers, making the technology accessible for a wider range of applications.

The ongoing development in this segment indicates a robust position in the market, driven by its adaptability and the sustained demand for cost-efficient, high-performance SiC MOSFETs. Despite the pressure from newer technologies like 200mm wafers, the 150mm segment’s resilience highlights its crucial role in the SiC MOSFET market landscape, supported by its proven capabilities and ongoing optimization that align with industry needs.

Voltage Range Analysis

In 2024, the 1200V-1700V segment of the Silicon Carbide (SiC) MOSFET market held a dominant position, capturing a significant market share. This segment leads due to its pivotal role in accommodating the advanced needs of high-voltage applications across various industries.

The devices in this voltage range are especially crucial in sectors such as renewable energy, automotive, and industrial applications, where they are essential for managing higher power levels and ensuring efficient energy conversion.

The 1200V-1700V SiC MOSFETs are particularly favored in applications that require robust performance under high voltage conditions. For instance, they are integral in solar inverters, industrial motor drives, and electric vehicle powertrains.

The superior efficiency and thermal management capabilities of SiC MOSFETs make them ideal for these applications, enabling more compact designs and less energy loss compared to lower voltage ranges. Technological advancements have also propelled the growth of the 1200V – 1700V segment.

Innovations in semiconductor technology have enhanced the performance characteristics of SiC MOSFETs, improving their reliability and efficiency at higher voltages. This has made them increasingly attractive for manufacturers looking to boost the performance of power electronic systems.

Furthermore, the push towards greener technologies and electrification in the automotive sector underpins the strong demand within this voltage range. As the industry moves towards higher power applications, the ability of 1200V – 1700V SiC MOSFETs to operate efficiently at elevated voltages and temperatures becomes a key factor driving their adoption

Application Analysis

In 2024, the inverters segment held a dominant position in the Silicon Carbide (SiC) MOSFET market, capturing a substantial market share. This leading role can be primarily attributed to the critical role SiC MOSFETs play in improving the efficiency and performance of inverter systems across various applications, particularly in renewable energy and electric vehicles (EVs).

SiC MOSFETs are highly valued in inverter applications due to their superior efficiency, which significantly enhances the overall energy conversion process, reducing losses and improving output. The inverters segment benefits notably from the deployment of SiC MOSFETs in solar inverters and wind power systems, where they enable more efficient power conversion, crucial for achieving sustainable energy goals.

Their ability to operate at higher voltages and temperatures with lower losses than traditional silicon devices further cements their utility in renewable energy applications. In the automotive industry, SiC MOSFETs are increasingly used in EV inverters, contributing to better battery management and more efficient power usage, which extends vehicle range and reduces charging times.

This application has seen rapid growth due to global shifts toward electric mobility, stringent emission regulations, and government incentives promoting EV adoption. Additionally, the ongoing advancements in SiC technology, such as improvements in wafer production and packaging, continue to drive down costs and enhance the performance of SiC MOSFETs.

End Use Analysis

In 2024, the automotive segment held a dominant position in the Silicon Carbide (SiC) MOSFET market, capturing more than a 40% share. This significant market presence is primarily driven by the increasing integration of SiC MOSFETs into electric vehicles (EVs), which are essential for improving the efficiency, range, and performance of EVs.

SiC MOSFETs contribute to enhancing the power density and reducing the energy losses in automotive power electronics, particularly in traction inverters, onboard chargers, and DC-DC converters, which are crucial components in EVs.

The leadership of the automotive segment is further supported by ongoing advancements in vehicle technology, including the expansion of autonomous and connected vehicle capabilities that utilize SiC MOSFETs for efficient power management and reliable performance under the demanding conditions of automotive applications.

As the automotive industry continues to push towards electrification and more sophisticated electronic systems, the role of SiC MOSFETs is expected to grow, supported by trends towards reducing vehicle emissions and increasing the adoption of energy-efficient technologies.

Additionally, the growth in this segment is propelled by significant investments from automotive manufacturers and continuous innovations in SiC technology that reduce costs and improve the technical specifications of SiC MOSFETs. This makes them more attractive for high-power applications in modern vehicles, ensuring the automotive segment remains a key driver of the SiC MOSFET market.

Key Market Segments

By Device Type

- Module SiC MOSFETs

- Discrete SiC MOSFETs

By Technology

- 150mm Wafer Technology

- 200mm Wafer Technology

By Voltage Range

- 650V – 900V

- 900V – 1200V

- 1200V – 1700V

- Above 1700V

By Application

- Power Supplies

- Inverters

- Industrial equipment

- Electric vehicles (EVs)

- Others

By End Use

- Automotive

- Telecommunications

- Industrial

- Consumer electronics

- Others

Driver

Expanding Electric Vehicle Market

The surge in electric vehicle (EV) adoption is a significant driver for the Silicon Carbide (SiC) MOSFET market. SiC MOSFETs are integral in improving the efficiency, performance, and range of EVs. They are utilized in various components such as onboard chargers, inverters, and DC-DC converters, enhancing the vehicle’s power management systems.

The ability of SiC MOSFETs to handle high voltages and temperatures with superior efficiency makes them especially suitable for the rigorous demands of electric vehicle power electronics. This trend is bolstered by the global shift towards greener transportation options and the increasing implementation of stringent environmental regulations pushing automakers to develop more energy-efficient vehicles.

Restraint

High Production Costs

A major restraint for the SiC MOSFET market is the high initial cost associated with producing SiC-based devices. The manufacturing process for SiC MOSFETs is complex and requires high-purity SiC wafers, which are expensive and challenging to produce. This complexity leads to higher production costs compared to traditional silicon-based MOSFETs.

The cost factor significantly influences adoption rates, particularly in cost-sensitive applications where the high performance of SiC MOSFETs does not justify their premium pricing. This is compounded by the limited availability and high cost of the required raw materials, which can hinder the scalability and widespread adoption of SiC technology.

Opportunity

Advancements in Semiconductor Technology

There is a substantial opportunity for growth in the SiC MOSFET market driven by ongoing advancements in semiconductor technology. Improvements in wafer production and fabrication techniques are expected to lower costs and enhance the performance of SiC MOSFETs.

Additionally, the expansion of sectors requiring high efficiency and high power density, such as renewable energy systems and industrial automation, provides a fertile ground for the increased adoption of SiC MOSFETs. The technology’s superior characteristics are particularly advantageous for applications like solar inverters and wind turbines, where efficiency and reliability are paramount.

Challenge

Competition from Other Technologies

SiC MOSFETs face significant competition from other semiconductor technologies, such as Gallium Nitride (GaN) and traditional silicon-based devices. GaN offers similar benefits in terms of efficiency and thermal performance at potentially lower costs in certain applications, presenting a viable alternative to SiC in some market segments.

Furthermore, the well-established infrastructure and ongoing improvements in silicon technologies continue to pose competitive pressures. SiC MOSFET manufacturers must navigate these challenges by continuing to innovate and differentiate their offerings, emphasizing the unique benefits of SiC in high-temperature, high-power, and high-frequency applications.

Growth Factors

The market for Silicon Carbide (SiC) MOSFETs is experiencing rapid growth driven primarily by the increasing demand for energy-efficient solutions across various industries. SiC MOSFETs are essential in applications that require high efficiency and high power density, such as electric vehicles (EVs), renewable energy systems, and industrial automation.

Their superior properties over traditional silicon-based MOSFETs, such as higher thermal conductivity, faster switching speeds, and the ability to operate at higher temperatures, make them ideal for these applications. This transition is heavily supported by the global push towards more sustainable and efficient energy use, particularly in the automotive and energy sectors, where the shift to electric and hybrid technologies necessitates the adoption of advanced power electronics.

Emerging Trends

One of the most significant trends in the SiC MOSFET market is the adoption of wide bandgap semiconductor technologies, which allow for devices to operate at higher voltages, frequencies, and temperatures. This trend is critical for miniaturization and integration of power electronics, making devices not only smaller but also more efficient.

The ongoing electrification across various sectors, especially transportation and energy, propels the demand for SiC MOSFETs. Technological advancements are also contributing to market growth, with companies making strides in improving the device architecture, packaging, and thermal management of SiC MOSFETs. These enhancements help in reducing costs and improving the performance of the MOSFETs, thereby broadening their applications and market reach.

Business Benefits

The integration of SiC MOSFET technology brings several business benefits, particularly in terms of operational efficiency and performance enhancement in high-power applications. SiC MOSFETs contribute to significant reductions in power losses, which is crucial for industries aiming to improve energy efficiency and reduce operational costs.

For instance, in electric vehicles, SiC MOSFETs help extend the driving range and reduce the frequency of charging by enhancing the efficiency of the powertrain systems. In renewable energy applications, such as solar inverters and wind turbines, SiC MOSFETs improve power conversion efficiency, thus maximizing the output and reliability of these systems.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia

-Pacific - China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East

& Africa - South Africa

- Saudi Arabia

- United Arab Emirates

- Rest of Middle East & Africa

Key Player Analysis

The Silicon Carbide (SiC) MOSFET market is shaped by several key players, notably Wolfspeed, onsemi, and Littelfuse. These companies have actively engaged in strategic acquisitions, product innovations, and mergers to strengthen their positions in the industry.

Wolfspeed, formerly known as Cree, has a rich history in SiC technology. In October 2021, the company rebranded to Wolfspeed, reflecting its focus on SiC and GaN technologies. In February 2023, Wolfspeed announced plans to build its first European factory in Germany, aiming to expand its SiC device manufacturing capabilities.

onsemi has strategically expanded its SiC capabilities through targeted acquisitions. In August 2021, the company agreed to acquire GT Advanced Technologies, enhancing its SiC wafer production. Further strengthening its position, onsemi completed the acquisition of Qorvo’s SiC JFET business, including United Silicon Carbide, in December 2024 for $115 million.

In 2024, Infineon introduced its CoolSiC MOSFETs rated at 400 V, marking a significant advancement in power density and efficiency for AI server power supplies. This innovation aligns with Infineon’s recently unveiled power supply unit (PSU) roadmap, targeting the AC/DC conversion stage in AI servers. The new MOSFET portfolio is also designed for broader applications, including solar and energy storage systems (ESS), inverter motor control.

In 2023, Nexperia made strides in the SiC MOSFET market with the introduction of its 1,200 V MOSFETs, the NSF040120L3A0 and NSF080120L3A, in three-pin configurations. One of the key advantages of these devices is their consistent drain-to-source on-resistance (RDS (on)), ensuring stable performance across a wide temperature range.

Top Manufacturers

- STMicroelectronics

- Toshiba Corporation

- STARCHIP

- ROHM Semiconductor

- Renesas Electronics Corporation

- ON Semiconductor

- Mitsubishi Electric Corporation

- Microchip Technology Inc.

- Littelfuse, Inc.

- Infineon Technologies AG

- II-VI Incorporated (now Coherent Corp.)

- Hitachi Power Semiconductor Device, Ltd.

Recent Developments

- In November 2024, STMicroelectronics announced a partnership with Chinese foundry Hua Hong to manufacture microcontroller chips in Shenzhen by the end of 2025. This collaboration aims to strengthen STMicroelectronics’ position in the Chinese market, particularly in the electric vehicle (EV) sector, by leveraging local manufacturing capabilities.

- In November 2024, Toshiba began shipping samples of its new 1200V SiC MOSFETs in bare die format. These devices are designed for automotive traction inverters, offering low on-resistance and high reliability to enhance energy efficiency in electric vehicles.

- In April 2024, ROHM’s subsidiary, SiCrystal, expanded its partnership with STMicroelectronics to supply advanced monocrystalline SiC wafers. This agreement aims to support the increasing demand for SiC power devices in applications like electric vehicles and renewable energy systems.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 33.7 Bn CAGR (2025-2034) 29.9% Largest Market APAC (33.7% Share) Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Device Type (Module SiC MOSFETs, Discrete SiC MOSFETs), By Technology (200mm Wafer Technology, 150mm Wafer Technology), By Voltage Range (650V-900 V, 900V-1200V, 1200V-1700V, Above 1700V), By Application (Power Supplies, Inverters, Industrial equipment, Electric vehicles (EVs), Others), By End-Use (Automotive, Telecommunications, Industrial, Consumer electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape STMicroelectronics, Toshiba Corporation, STARCHIP, ROHM Semiconductor, Renesas Electronics Corporation, ON Semiconductor, Mitsubishi Electric Corporation, Microchip Technology Inc., Littelfuse Inc., Infineon Technologies AG, II-VI Incorporated (now Coherent Corp.), Hitachi Power Semiconductor Device Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Silicon Carbide (SiC) MOSFET MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Silicon Carbide (SiC) MOSFET MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- STMicroelectronics

- Toshiba Corporation

- STARCHIP

- ROHM Semiconductor

- Renesas Electronics Corporation

- ON Semiconductor

- Mitsubishi Electric Corporation

- Microchip Technology Inc.

- Littelfuse, Inc.

- Infineon Technologies AG

- II-VI Incorporated (now Coherent Corp.)

- Hitachi Power Semiconductor Device, Ltd.