Global Siding Market Size, Share, And Business Benefits By Product (Vinyl, Fiber Cement, Wood, Others), By End-use (Residential, Non-residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148474

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

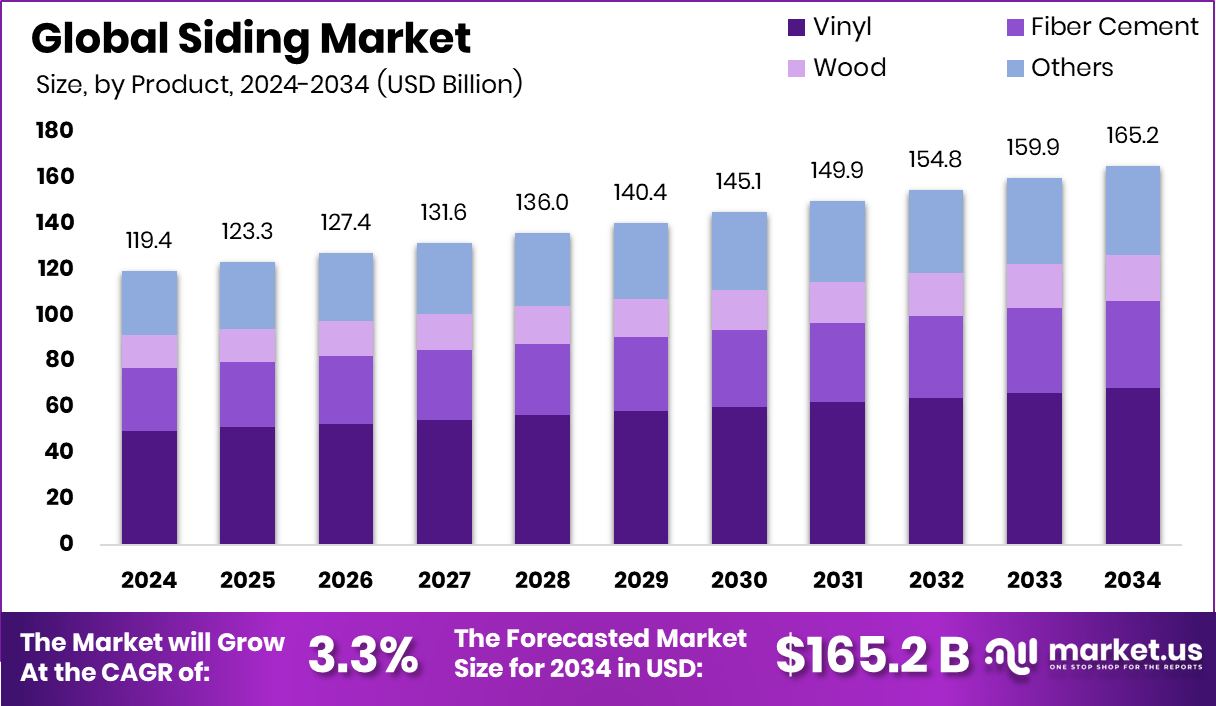

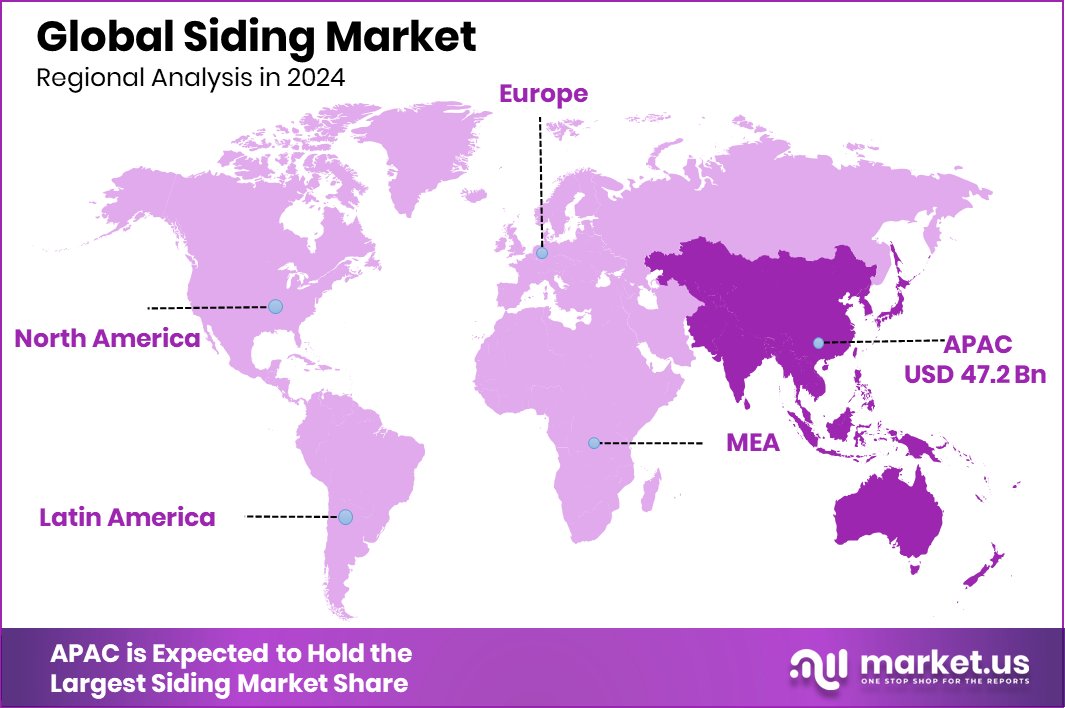

Global Siding Market is expected to be worth around USD 165.2 billion by 2034, up from USD 119.4 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034. With a 9.6% share, Asia-Pacific’s Siding Market generated USD 47.2 Bn in revenue.

Siding refers to the material applied to the exterior of a building to protect it from weather elements, enhance its aesthetic appeal, and provide insulation. It can be made from a variety of materials, including wood, vinyl, fiber cement, and metal, each offering distinct durability, cost, and maintenance characteristics.

The siding market encompasses the production, distribution, and installation of siding materials for residential, commercial, and industrial buildings. The market is influenced by factors like construction activities, architectural trends, and consumer preferences for sustainable and energy-efficient solutions. Siding materials are categorized based on type, installation technique, and application, with regional markets exhibiting varied demand patterns driven by climatic conditions and regulatory norms.

Increasing urbanization and the growing focus on infrastructure development are significant growth drivers for the siding market. Governments and private sectors are investing in residential and commercial projects, fueling demand for durable and weather-resistant siding materials. Additionally, the rise in sustainable construction practices has led to higher adoption of eco-friendly and energy-efficient siding solutions.

Rising demand for aesthetic exteriors in residential properties is propelling the siding market. Consumers are opting for visually appealing, low-maintenance siding options that can withstand extreme weather conditions. The surge in renovation and remodeling activities, particularly in developed economies, further contributes to the steady demand for siding products.

Key Takeaways

- Global Siding Market is expected to be worth around USD 165.2 billion by 2034, up from USD 119.4 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034.

- In the Siding Market, Vinyl accounted for a 41.5% share, driven by its cost-effectiveness.

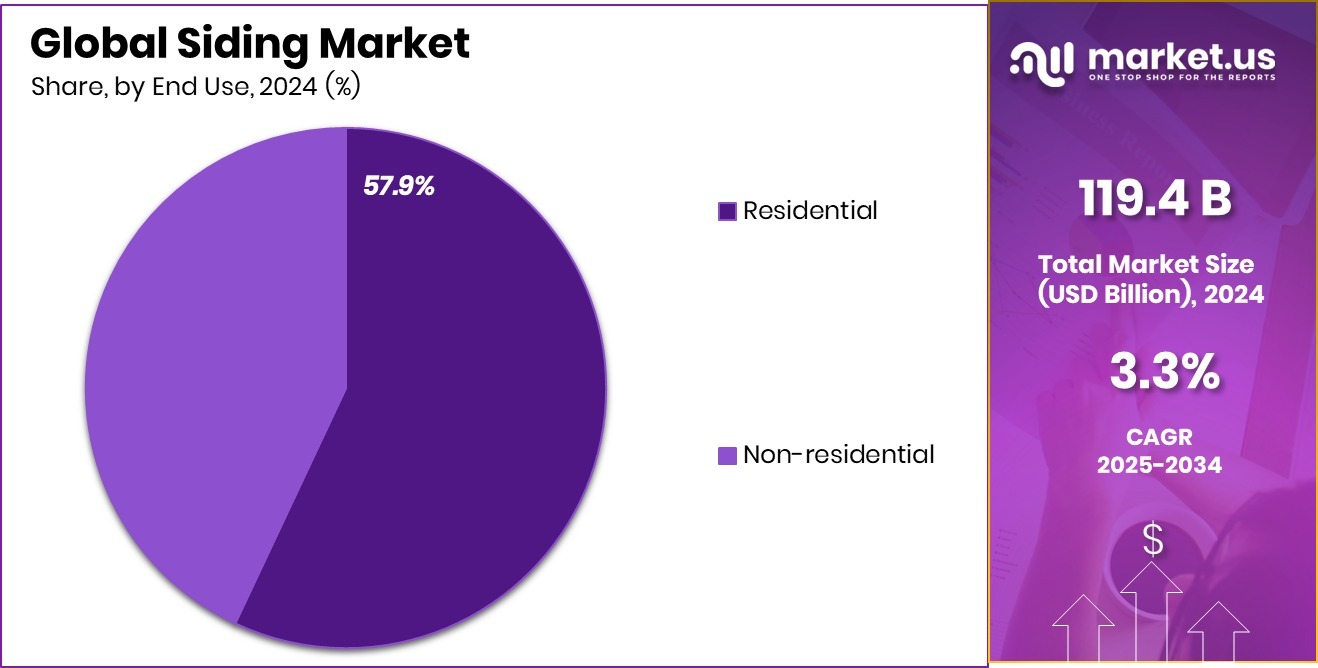

- The residential sector led the Siding Market with a 57.9% share, fueled by renovation projects.

- Asia-Pacific’s siding sector recorded USD 47.2 Bn, capturing a 9.6% market share.

By Product Analysis

In the Siding Market, Vinyl held a commanding 41.5% product share.

In 2024, Vinyl held a dominant market position in the By Product segment of the Siding Market, with a 41.5% share. The material’s popularity is primarily attributed to its cost-effectiveness, durability, and low maintenance requirements, making it a preferred choice among residential and commercial property owners.

Furthermore, the growing trend of energy-efficient building solutions has driven the adoption of insulated vinyl siding, contributing significantly to the segment’s growth. The increased focus on curb appeal and aesthetic enhancements has further bolstered the demand for vinyl siding, particularly in the residential sector.

Additionally, advancements in manufacturing processes have enabled the development of enhanced vinyl siding products that offer improved weather resistance and longevity, solidifying its market position. This strong market presence is also supported by the availability of a wide range of colors, textures, and finishes, catering to diverse consumer preferences.

As the construction and renovation activities continue to rise, particularly in regions with extreme weather conditions, the demand for vinyl siding is expected to maintain its growth trajectory, further consolidating its dominant position in the Siding Market.

By End-use Analysis

Residential end-use dominated the Siding Market, capturing a substantial 57.9% share.

In 2024, Residential held a dominant market position in the By End-use segment of the Siding Market, with a 57.9% share. The segment’s leading position is driven by the increasing demand for renovation and remodeling projects in the housing sector, especially in developed economies. Additionally, rising investments in new housing construction, fueled by urbanization and favorable mortgage rates, have significantly contributed to the segment’s growth.

The growing awareness of the benefits of energy-efficient and weather-resistant siding materials has further propelled the adoption of siding solutions in the residential sector. Furthermore, homeowners are increasingly opting for aesthetically appealing siding options to enhance property value, thereby augmenting market demand.

The availability of a wide variety of siding materials, including vinyl, fiber cement, and wood, has provided consumers with diverse options to choose from, boosting the segment’s market penetration. With ongoing urban development projects and government initiatives aimed at promoting affordable housing, the residential segment is anticipated to maintain its stronghold in the Siding Market, further solidifying its market share in the coming years.

Key Market Segments

By Product

- Vinyl

- Fiber Cement

- Wood

- Others

By End-use

- Residential

- Non-residential

Driving Factors

Energy-Efficient Siding Solutions Drive Market Growth

The Siding Market is experiencing significant growth due to the rising demand for energy-efficient building solutions. Homeowners and builders are increasingly opting for insulated siding materials that help reduce energy consumption and lower utility costs. Additionally, government incentives and energy efficiency standards are pushing property owners to upgrade to more sustainable siding options.

Vinyl and fiber cement siding have gained popularity for their thermal insulation properties, contributing to reduced heating and cooling expenses. This trend is further supported by technological advancements in siding materials that offer enhanced weather resistance and durability, making them ideal for both residential and commercial applications.

Restraining Factors

High Installation Costs Limit Siding Market Expansion

The Siding Market faces a significant challenge due to the high installation costs associated with premium siding materials like fiber cement and engineered wood. These materials, while offering excellent durability and aesthetic appeal, require specialized labor for proper installation, increasing overall project expenses. Additionally, homeowners often need to invest in additional weatherproofing and insulation, further driving up costs.

This cost barrier is particularly pronounced in developing regions where budget constraints limit the adoption of advanced siding options. Moreover, the rising prices of raw materials and supply chain disruptions have contributed to increased production costs, making siding products less affordable for budget-conscious consumers.

Growth Opportunity

Sustainable Siding Materials Gain Market Momentum

The growing focus on sustainable construction practices presents a significant growth opportunity for the Siding Market. Consumers and builders are increasingly seeking eco-friendly siding materials like recycled wood, fiber cement, and metal siding. These materials not only reduce environmental impact but also offer enhanced durability and energy efficiency. Additionally, government incentives for green building projects are encouraging the adoption of sustainable siding solutions.

Manufacturers are investing in innovative products with low carbon footprints, aiming to attract environmentally conscious consumers. As the demand for green buildings rises, sustainable siding materials are positioned to capture a larger market share, making them a lucrative segment for future growth in the siding industry.

Latest Trends

Rising Demand for Insulated Siding Solutions

Insulated siding solutions are gaining traction as homeowners prioritize energy efficiency and cost savings. These siding materials feature a built-in layer of insulation that helps regulate indoor temperatures, reducing heating and cooling expenses. As utility costs continue to rise, more consumers are opting for insulated siding to lower energy consumption. Additionally, these products provide added protection against extreme weather, enhancing the building’s structural integrity.

Manufacturers are developing advanced insulated siding options with improved thermal resistance, moisture control, and aesthetic appeal, making them attractive for both residential and commercial applications. With the growing focus on sustainable and energy-efficient building materials, insulated siding solutions are expected to witness substantial market growth in the coming years.

Regional Analysis

In the Siding Market, Asia-Pacific secured a 9.6% share, reaching USD 47.2 Bn.

In the Siding Market, North America maintained a strong market presence driven by advanced construction activities and growing renovation projects, contributing significantly to overall market revenue. Europe followed closely, capitalizing on increasing demand for energy-efficient siding materials in residential and commercial structures.

In Asia-Pacific, the siding market generated USD 47.2 Bn in 2024, holding a 9.6% share, driven by rapid urbanization and rising infrastructure investments across emerging economies. The region’s expanding construction sector, coupled with increasing adoption of weather-resistant siding materials, further bolstered its market share.

The Middle East & Africa market exhibited moderate growth, supported by infrastructural development and demand for durable siding solutions in extreme climates. Meanwhile, Latin America witnessed steady growth as the adoption of siding materials increased in residential and commercial applications, supported by construction sector recovery and rising consumer awareness of sustainable building materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Alside, Boral Limited S.A., and CertainTeed demonstrated strategic market positioning within the global Siding Market through targeted product offerings and regional expansions.

Alside maintained a strong foothold by emphasizing innovative siding solutions that combine aesthetic appeal with enhanced energy efficiency. The company continued to expand its product range, catering to both residential and commercial applications, with a focus on insulated siding products designed to reduce energy consumption.

Boral Limited S.A. capitalized on its established presence in the construction sector by promoting sustainable siding materials, leveraging its expertise in engineered wood and fiber cement siding. The company focused on expanding its product portfolio to address the growing demand for durable, weather-resistant siding options, particularly in regions with extreme climatic conditions.

CertainTeed, a key player in the siding market, leveraged its extensive distribution network and diverse product line to capture a significant share in both residential and commercial segments. The company emphasized eco-friendly siding solutions, incorporating recycled materials and advanced manufacturing processes to align with the increasing consumer preference for sustainable building products.

Top Key Players in the Market

- Alside

- Boral Limited S.A.

- CertainTeed

- Cornerstone Building Brands, Inc.

- Docke Extrusion Co. Ltd

- Etex Group

- Gentek Canada

- Georgia-Pacific

- James Hardie Building Products Inc.

- Kingspan Group

- Louisiana Pacific Corporation

- Nichiha Corporation

- Norandex

- Saint-Gobain SA

- Westlake Royal Building Products

Recent Developments

- In March 2024, CertainTeed achieved a 96% reduction in manufacturing-related emissions at three of its U.S. facilities. This was accomplished through the electrification of processes and the use of renewable energy sources.

- In November 2023, Alside added four new colors—Cottage Yellow, Sand Bar, Dune Grass, and Sea Mist—to its Coventry vinyl siding and Architectural Classics vinyl shake lines. These colors are inspired by coastal aesthetics and cater to homeowners looking for vibrant, beach-inspired finishes.

- In October 2021, Boral Limited sold its North American building products business, which included siding, trim, shutters, decorative stone, and windows, to Westlake Chemical Corporation for $2.15 billion.

Report Scope

Report Features Description Market Value (2024) USD 119.4 Billion Forecast Revenue (2034) USD 165.2 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Vinyl, Fiber Cement, Wood, Others), By End-use (Residential, Non-residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alside, Boral Limited S.A., CertainTeed, Cornerstone Building Brands, Inc., Docke Extrusion Co. Ltd, Etex Group, Gentek Canada, Georgia-Pacific, James Hardie Building Products Inc., Kingspan Group, Louisiana Pacific Corporation, Nichiha Corporation, Norandex, Saint-Gobain SA, Westlake Royal Building Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alside

- Boral Limited S.A.

- CertainTeed

- Cornerstone Building Brands, Inc.

- Docke Extrusion Co. Ltd

- Etex Group

- Gentek Canada

- Georgia-Pacific

- James Hardie Building Products Inc.

- Kingspan Group

- Louisiana Pacific Corporation

- Nichiha Corporation

- Norandex

- Saint-Gobain SA

- Westlake Royal Building Products