Global Shooting Games Market Size, Share, Upcoming Investments Report By Game Type (First-Person Shooter [FPS], Third-Person Shooter [TPS], Shoot ’em up [shmup], Battle Royale, Tactical Shooter), By Platform (PC [Personal Computer], Console, Mobile, Other Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2025

- Report ID: 128778

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

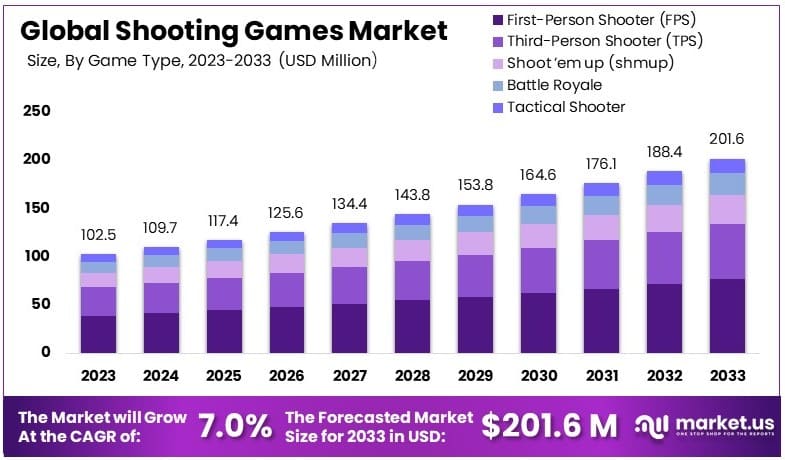

The Global Shooting Games Market size is expected to be worth around USD 201.6 Million by 2033, from USD 102.5 Million in 2023, growing at a CAGR of 7.0% during the forecast period from 2024 to 2033. The North America leads the Shooting Games Market with a 31% share, totaling USD 31.78 million.

The Shooting Games Market comprises video games in which players use firearms or ranged weapons to engage targets, opponents, or environments. This includes subgenres such as first-person shooters (FPS), third-person shooters, tactical shooters, battle royale, shooting gallery and hybrid shooter types. Platforms include PC, consoles, and mobile devices. The market also includes in-game purchases, downloadable content (DLC), weapon skins, seasonal passes, and esports monetization.

One major factor is continued consumer interest in competitive multiplayer gameplay. Shooter games often provide strong social and esports elements, which drive engagement and replay. Advances in graphics, network infrastructure, and latency reduction make immersive shooter experiences more accessible. The growth of free-to-play models lowers the barrier to entry, allowing more players to adopt shooter games and then spend on cosmetic or gameplay enhancements.

The shooting games sector continues to thrive, driven by the popularity of first-person shooter (FPS) games among global audiences. FPS games like Counter-Strike 2, with over 88,000 daily active players, and Call of Duty, which peaked at 491,000 players, highlight the sustained engagement in this genre. The appeal of shooting games stems from their competitive nature, immersive gameplay, and strong community support.

As a result, both casual and professional gamers are highly invested in these titles, boosting their market performance. The growing popularity of esports further amplifies the demand for these games, with the global esports audience expected to reach 544 million by 2024 and exceed 640 million by 2025, according to DemandSage.

Several factors are driving growth in the shooting games sector. The rise of esports as a global entertainment phenomenon is a major contributor, as FPS games form a significant part of competitive gaming events. Tournaments such as the League of Legends World Championship 2023, which saw 6.4 million peak viewers, underline the growing audience and commercial potential of these games.

Furthermore, the Free Fire World Series 2021 attracted 5.41 million viewers, showcasing the vast audience for shooting-based games. The combination of high viewer numbers and substantial prize pools—like the $40 million prize in The International 2021—creates lucrative opportunities for developers, advertisers, and investors.

Demand is further bolstered by technological advancements in game development, particularly in graphics and multiplayer capabilities. The increased use of cloud gaming and streaming services is making shooting games more accessible to a wider audience, while mobile versions of popular titles are also expanding the player base. The Asia-Pacific region leads in terms of audience size, contributing 57% of the total global esports viewers, with North America and Europe accounting for 12% and 16%, respectively.

Key Takeaways

- The Shooting Games Market was valued at USD 102.5 million in 2023, and is expected to reach USD 201.6 million by 2033, with a CAGR of 7.0%.

- In 2023, First-Person Shooter (FPS) dominates the game type segment with 38%, due to its immersive gameplay experience.

- In 2023, Console leads the platform segment with 40%, driven by its strong user base and advanced gaming features.

- In 2023, North America leads the market with 31%, valued at USD 31.78 million, due to the popularity of gaming and high consumer spending.

Analysts’ Viewpoint

Demand for shooting games is also elevated by significant advances in gaming technology. Improved graphics, sophisticated physics, and the integration of cloud gaming, 5G connectivity, and mobile platforms have enhanced accessibility and gameplay quality. The segment has also benefited from the adoption of VR and AR.

These technologies deliver more immersive experiences and realistic simulations, helping the genre remain innovative and attractive across different age groups and regions. Increasingly, players expect cross-platform compatibility and the ability to personalize their in-game avatars and environments, driving up engagement and recurring spending.

A key motivation for both players and industry stakeholders is the social and community-building potential found in shooter games. Features like in-game chat, team-based play, and streaming appeal powerfully to users seeking shared experiences, driving strong user retention.

For businesses, shooting games deliver repeat revenue via in-game purchases, season passes, and customizations, with streaming and esports sponsorships also providing lucrative opportunities. Player numbers regularly swell, reflecting both the stickiness of game communities and the growing appeal for startups and regional developers to enter the space.

Role of Generative AI

Generative AI now plays a much larger role in shaping shooting games, with over 37% of studios using generative AI tools for tasks like creating complex game content, more realistic dialogue, and smarter NPCs. These technologies boost player engagement by enabling advanced behaviors and dynamic level design, so shooting games feel fresh each time.

This shift is making shooting games increasingly adaptive, with AI-driven experiences enhancing storytelling, visuals, and interactions – innovations that would have been unimaginable a few years ago. Surveys show that nearly 78% of players spend more time on games that feature AI-powered NPCs, and more than 70% are more likely to buy expansions or sequels when those elements are present.

Investment and Business Benefits

Investment opportunities continue to appear in new game development, regional expansion (especially Asia-Pacific and Latin America), and advanced software like VR, AR, and AI-powered enemy behaviors. Notably, the audience for esports is expected to exceed 640 million in the near term, and mobile shooter games are opening new markets among previously underserved user bases.

Business benefits of the shooting games market are substantial. High user engagement and competitive loyalty translate into steady streams of revenue and repeat sales of enhancements. The exposure gained from high-profile tournaments and live streaming helps bolster brand value and community support. The sector continues to grow thanks to innovation, community engagement, and the evergreen appeal of fast-paced competition.

On the regulatory side, more stringent standards are being adopted internationally, especially to address online safety, age verification, and content moderation. In the European Union, for example, companies must disclose moderation policies, quickly remove flagged illegal content, and step up child protection efforts. As these games are popular among younger people, local and international policies increasingly focus on responsible content, user safety, and limiting negative health outcomes such as addiction.

Game Type Analysis

First-Person Shooter (FPS) dominates with 38% due to immersive gameplay and strong multiplayer communities.

In the shooting games market, the Game Type segment is diverse, including First-Person Shooter (FPS), Third-Person Shooter (TPS), Shoot ’em up (shmup), Battle Royale, and Tactical Shooter. FPS games lead this segment with a 38% market share, primarily because of their immersive reality technology that offers a first-person perspective, enhancing the player’s engagement with the game environment.

Other sub-segments, while not as dominant, contribute significantly to the market’s dynamics. TPS games provide a different perspective and gameplay style, often focusing on strategy and cover mechanics, appealing to players who enjoy a mix of action and tactical play.

Shoot ’em up games, known for their fast-paced action and retro appeal, cater to niche audiences. Battle Royale games have seen a surge in popularity due to their competitive nature and large-scale survival gameplay, often supporting large numbers of players in a single match.

Tactical shooters appeal to those who prefer team-based strategy and realism in their gaming experience. Each of these sub-segments addresses different player preferences, which helps in maintaining a vibrant market ecosystem.

Platform Analysis

Console dominates with 40% due to high-performance gaming and exclusive titles.

The Platform segment of the shooting games market includes PC (Personal Computer), Console, Mobile, and Other Platforms. Gaming consoles hold the largest share at 40%, driven by their ability to deliver high-performance gaming experiences, ease of use, and access to exclusive game titles that are not available on other platforms.

PC gaming, while slightly trailing, is favored for its high degree of customization, superior controls, and graphic settings that enhance shooting games’ performance and visual fidelity. Mobile gaming has expanded rapidly, attributed to the increasing smartphone penetration and the rising trend of mobile gaming among casual gamers, making it a significant growth area within the segment.

Mobile platforms offer unique accessibility that the other platforms cannot match, enabling gaming on the go. Other platforms, including handheld devices and virtual reality, offer unique gaming experiences that, while niche, are important for the overall growth and innovation in the shooting games market.

Each platform plays a crucial role in the distribution and accessibility of different shooting game types, catering to a broad audience with varying preferences and gaming habits.

Key Market Segments

By Game Type

- First-Person Shooter (FPS)

- Third-Person Shooter (TPS)

- Shoot ’em up (shmup)

- Battle Royale

- Tactical Shooter

By Platform

- PC (Personal Computer)

- Console

- Mobile

- Other Platforms

Driver

Advances in Graphics and Multiplayer Platforms Drive Market Growth

Several driving factors are contributing to the rapid growth of the Shooting Games Market. First, advances in graphics and game development technologies have significantly improved the quality of shooting games. Enhanced visual effects and realistic environments attract more players, boosting the demand for these games.

The rising popularity of online multiplayer platforms is accelerating market growth. Players enjoy the interactive, competitive nature of multiplayer modes, leading to higher engagement and recurring revenues for game developers.

Moreover, the growing esports industry plays a vital role in the shooting games segment. Esports tournaments featuring shooting games offer visibility and monetization opportunities, further fueling market expansion.

Lastly, the increasing demand for mobile-based shooting games is creating a more accessible market. Mobile gaming allows users to play from anywhere, expanding the audience base and driving revenues. Together, these factors drive the continued growth of the shooting games market.

Restraint

Regulatory Restrictions and High Costs Restraints Market Growth

Several restraining factors limit the growth of the Shooting Games Market. Regulatory restrictions on violent content are a significant challenge. Many countries impose strict regulations on games that feature intense violence, limiting the availability of such games in certain markets.

High development costs for AAA games also restrain growth. Creating high-quality, immersive shooting games requires substantial investment, making it difficult for smaller studios to compete.

In addition, limited access to high-performance gaming hardware in emerging markets restricts the potential for growth. Many players in these regions lack the necessary technology to experience advanced shooting games. Lastly, growing concerns over gaming addiction and health risks associated with excessive gaming negatively affect market adoption in some regions.

Opportunity

Expansion in VR and Monetization Opportunities Provide Opportunities

The Shooting Games Market presents several growth opportunities that market players can capitalize on. The expansion of virtual reality (VR) and augmented reality (AR) in gaming offers exciting possibilities. These technologies provide immersive experiences, enhancing player engagement and offering premium game modes for increased revenue.

Additionally, monetization opportunities through in-game purchases are growing. Developers can introduce paid skins, weapons, and other customizations, tapping into a highly lucrative revenue stream.

The rise of indie game developers is another opportunity. Smaller studios are creating innovative shooting games that attract niche audiences, opening new market segments. Furthermore, the expansion into untapped regions with high gaming potential, such as Asia-Pacific and Latin America, presents additional growth avenues for market players.

Challenge

Competition and Security Issues Challenge Market Growth

The Shooting Games Market faces several challenges that hinder growth. High competition among game publishers is a major challenge. Large publishers dominate the market, making it difficult for smaller companies to gain visibility.

Maintaining player engagement over time also proves challenging. With a vast array of games available, developers must continuously release new content to keep players interested.

Moreover, cybersecurity in gaming challenges such as cheating and hacking in online games undermine the player experience. Developers must invest in anti-cheat systems, which increases costs and affects player retention. Finally, the fragmentation of gaming platforms and devices poses difficulties in offering consistent user experiences, as developers must optimize games for multiple platforms.

Emerging Trends

For emerging trends, battle royale modes remain dominant, and cross-platform play is now a standard expectation. The appetite for realism is higher than ever, with technologies like ray tracing and advanced physics engines transforming gameplay environments into detailed, immersive worlds.

Cloud gaming, VR, and AR adoption in shooting games are on the rise, opening the door for fresh formats and experiences. Fast-paced action titles are expanding on mobile as well, where user demand for easy accessibility grew sharply, making it the leading segment of the market.

Globally, competitive gaming and esports are responsible for a significant spike in both participation and new game launches; about 54% of players aged 13 to 25 spend more on non-toxic gaming environments – another emerging focus for studios trying to win over new audiences.

Growth Factors

Several factors are driving growth for shooting games. Mobile gaming has been the greatest catalyst, supported by rising smartphone use and affordable internet. Tech advancements have led to visually richer, immersive games, and social features are helping build huge, loyal communities.

The esports boom remains a powerful attraction, as live events and streaming continue to draw millions of new players into the genre. Active innovation in mechanics, improved AI, and the push for responsible and inclusive play environments keep users engaged for longer and attract a more diverse demographic.

The introduction of cloud gaming has also made high-quality shooting games accessible to those without expensive hardware, further broadening the market base. In Asia-Pacific, rapidly rising adoption rates and growing mobile user bases have turned the region into a key growth engine for the category.

Regional Analysis

North America Dominates with 31% Market Share

North America leads the Shooting Games Market with a 31% share, totaling USD 31.78 million. This substantial market presence stems from the region’s strong gaming culture and advanced technological infrastructure. High levels of disposable income among consumers and the widespread popularity of eSports significantly contribute to the region’s dominance.

The market dynamics in North America are influenced by the presence of major gaming studios and a tech-savvy consumer base that is keen on adopting the latest gaming technologies. This region is also home to some of the largest gaming conventions and competitions, which promote shooting games and drive their popularity.

The forecast for North America suggests that its influence in the global shooting games market will likely increase. With advancements in gaming technology and the growing trend of competitive gaming, the demand for more sophisticated and engaging shooting games is expected to rise, potentially boosting the region’s market share further.

Regional Mentions:

- Europe: Europe holds a significant position in the shooting games market, supported by its strong gaming communities and the presence of several key game developers. The region’s high engagement rates in gaming conventions and eSports events contribute to its steady market growth.

- Asia Pacific: Asia Pacific is rapidly expanding in the shooting games market, driven by the rising popularity of mobile gaming and competitive eSports. Countries like South Korea and China lead with innovations in gaming technology and strong governmental support for the gaming industry.

- Middle East & Africa: The Middle East and Africa are seeing growth in the shooting games market, fueled by increasing internet penetration and a growing young population interested in gaming. Investments in digital infrastructure are also supporting this trend.

- Latin America: Latin America is witnessing an increase in the shooting games market, with a focus on mobile gaming due to widespread mobile penetration. The region’s enthusiasm for gaming is supported by a young demographic and an increasing number of local gaming events.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Shooting Games Market, the top companies such as Ubisoft, Valve Corporation, and Activision Blizzard significantly shape market dynamics with their strategic innovations, broad user base, and influential game titles.

Ubisoft is renowned for creating immersive, story-driven shooting games that boast large, open-world environments and a strong focus on narrative and character development. Their strategic releases and consistent updates help maintain high engagement levels, thereby securing their market share and expanding their audience reach.

Valve Corporation has cemented its position in the market through the iconic game, Counter-Strike, among other titles. Their platform, Steam, not only serves as a major distribution channel but also as a community hub, which enhances player engagement and loyalty. Valve’s influence extends through esports, significantly impacting shooting game trends and player expectations.

Activision Blizzard is a powerhouse in the market, with blockbuster titles like Call of Duty. Their approach to frequent, high-quality releases, combined with a strong multiplayer focus, ensures a persistent engagement in their gaming community. Activision Blizzard’s strategic use of seasonal content and integration of esports has effectively maximized retention and expanded their global footprint.

These key players dominate through innovative gameplay, strategic marketing, and by leveraging advanced technologies to enhance user experience. Their roles are critical in defining the evolutionary path of the shooting games genre, influencing both market growth and the direction of content development.

Top Key Players in the Market

- Ubisoft

- Gameloft (Vivendi)

- Valve Corporation

- Krafton

- Nexon

- Activision Blizzard

- Rockstar Games

- Other Key Players

Recent Developments

- Yang Chao: In September 2024, Chinese shooter Yang Chao set a new Paralympic Games record by winning gold in the P3 mixed 25m pistol SH1 event at the Paris 2024 Paralympics. This marked his third career gold, with a score of 30 points, surpassing the previous record by three points. The event also saw the first-ever U.S. silver medal in shooting para sport, earned by Yan Xiao Gong.

- For the Win (FTW): In January 2023, the mobile shooter game “For the Win” launched on the Solana blockchain, integrating decentralized finance (DeFi) elements. The game blends mobile gaming with non-fungible tokens (NFTs) and play-to-earn mechanics, allowing players to earn in-game assets that can be traded or sold.

- Sony: In January 2022, Sony acquired Bungie, the developer of the “Destiny” franchise, for $3.6 billion. The acquisition strengthens Sony’s position in live-service gaming and cross-platform content. Bungie will maintain creative independence, but the move positions Sony to expand its future gaming projects, with a focus on community-driven and online multiplayer experiences.

- 343 Industries and Activision Blizzard: In September 2023, following Microsoft’s potential acquisition of Activision Blizzard, Xbox Game Studios hinted that 343 Industries, the developers behind Halo, could co-develop future Halo titles with Activision.

Report Scope

Report Features Description Market Value (2023) USD 102.5 Million Forecast Revenue (2033) USD 201.6 Million CAGR (2024-2033) 7.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Game Type (First-Person Shooter [FPS], Third-Person Shooter [TPS], Shoot ’em up [shmup], Battle Royale, Tactical Shooter), By Platform (PC [Personal Computer], Console, Mobile, Other Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ubisoft, Gameloft (Vivendi), Valve Corporation, Krafton, Nexon, Activision Blizzard, Rockstar Games, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Shooting Games MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Shooting Games MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ubisoft

- Gameloft (Vivendi)

- Valve Corporation

- Krafton

- Nexon

- Activision Blizzard

- Rockstar Games

- Other Key Players