Global Shaving Market Report By Product (Razors & Blades, After-Shave Emulsion, Other Products), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 100234

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

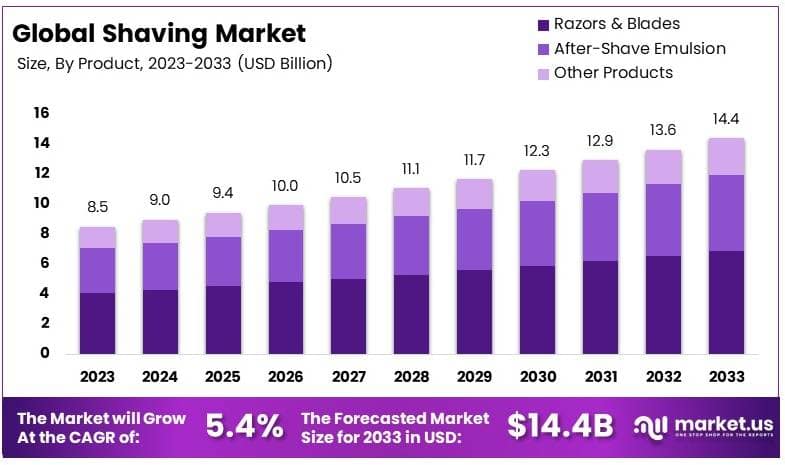

The Global Shaving Market size is expected to be worth around USD 14.4 Billion by 2033, from USD 8.5 Billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

Shaving involves the removal of body or facial hair using tools like razors, electric shavers, or trimmers. It is a common grooming practice for both men and women, often associated with maintaining hygiene and personal appearance.

The shaving market covers the production and sales of grooming products such as razors, blades, shaving creams, gels, and electric shavers. This market is driven by the demand for male grooming products and the growing popularity of personal care routines among women.

The shaving market is evolving, driven by rising disposable income, increased personal grooming trends, and innovations in product development. According to the Bureau of Economic Analysis (BEA), disposable personal income in the U.S. increased by $211.7 billion, or 4.2%, in Q4 2023.

This rise supports higher spending on grooming products, including shaving supplies, indicating strong growth potential. Moreover, the grooming industry is shifting towards sustainable and eco-friendly options, creating new demand opportunities for brands that focus on biodegradable packaging and ingredients.

China and Mexico are dominant players in the global shaving market. China, the largest exporter of shaving products, ships products valued at $1.34 billion annually. Mexico is also a significant contributor, with exports valued at $477 million, much of which goes to the U.S. market, according to the OEC. This dominance highlights these countries’ manufacturing capabilities and their importance in the global supply chain.

There is also growing demand for innovative shaving products that cater to specific skin types and preferences. While traditional razors remain popular, electric shavers and grooming kits are gaining market share, especially among younger demographics. The average beard growth rate of 0.27 mm per 24 hours suggests a consistent need for shaving products, providing steady demand for these items across diverse consumer groups.

The shaving market is moderately saturated, with established brands like Gillette, Schick, and Philips dominating the space. However, the rise of new D2C (Direct-to-Consumer) brands and startups focusing on organic, sustainable, and subscription-based models has intensified competition. This competitive environment encourages continuous innovation, especially in eco-friendly packaging and personalization options.

On a global scale, the shaving industry’s supply chain relies heavily on key exporting countries like China and Mexico. Changes in trade policies or production costs in these countries can have a significant impact on global prices and product availability. Brands that diversify their supply chains and invest in local production capabilities can mitigate these risks and gain a competitive edge.

Key Takeaways

- The Shaving Market was valued at USD 8.5 billion in 2023, and is expected to reach USD 14.4 billion by 2033, with a CAGR of 5.4%.

- In 2023, Razors and Blades held the largest revenue share due to essential grooming needs.

- In 2023, Beard Moisturizers and Pre-Shave Creams experienced the fastest growth, driven by male grooming trends.

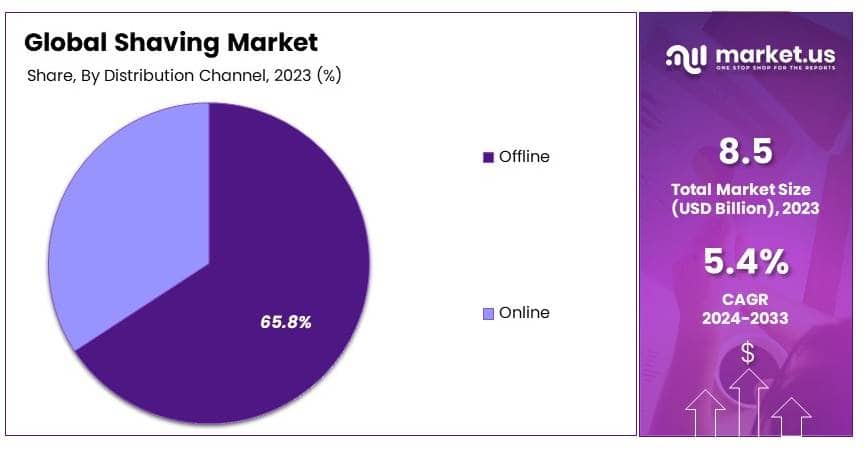

- In 2023, Offline Distribution led with 65.8% market share, favored for accessibility and immediate availability.

- In 2023, Online Distribution exhibited the fastest growth, aligning with e-commerce expansion.

- In 2023, North America dominated with 35.0% share and USD 2.98 billion, reflecting high consumer spending.

Product Analysis

Razors and Blades dominate with the largest revenue share in 2023 due to advancements in technology and increased consumer demand.

The shaving market is segmented into various products, with razors and blades holding the largest revenue share in 2023. This dominance is primarily due to continuous innovations in product design and technology that improve user experience.

Consumers today have a variety of choices ranging from disposable razors to sophisticated multi-blade systems that promise a closer and more comfortable shave. The growing male grooming trend has also significantly contributed to the sustained demand for high-quality razors and blades.

Companies in this segment have focused on enhancing the durability and sharpness of blades, which are key factors consumers consider when selecting a product. Additionally, the development of ergonomic handles and skin-sensitive features reflects the industry’s response to the increasing consumer demand for personalized and comfortable shaving solutions.

The after-shave emulsion segment, although smaller in comparison, plays a crucial role in the overall market by providing products that soothe and protect the skin post-shave, which are especially popular in markets where consumers face harsher skin conditions or are more skincare conscious.

Other products, including beard moisturizers and pre-shave creams, are experiencing the fastest growth over the forecast period. These products cater to a niche but rapidly expanding segment of consumers who prefer a comprehensive grooming regimen that includes pre and post-shave care, highlighting a shift towards holistic personal care routines.

Channel Analysis

Offline channels dominate with 65.8% in 2023 due to their established presence and consumer trust in in-person purchases.

In the distribution of shaving products, offline channels continue to hold the majority share, accounting for 65.8% of the market in 2023. This segment’s strength lies in its long-established consumer trust and the tangible shopping experience it offers, which is particularly important in personal care and grooming markets where consumers often seek to physically inspect products before purchase.

Offline distribution channels, including supermarkets, drugstores, and specialty grooming shops, provide the advantage of immediate product availability and the opportunity for consumers to receive immediate assistance and advice from store personnel. These factors are critical in maintaining consumer loyalty and driving repeat purchases.

Conversely, the online distribution channel is witnessing the fastest growth within the market, driven by the convenience of home shopping and the broadening acceptance of e-commerce. The rise of online shopping has been supported by improvements in e-commerce platforms, enhanced logistics, and the increasing comfort of consumers with making online purchases.

Online retailers have been quick to capitalize on digital marketing tools to reach a broader audience, offering detailed product descriptions, customer reviews, and interactive platforms that help reduce the uncertainty associated with buying non-tangible goods. The expansion of this channel is also facilitated by the frequent discounts and subscription services that appeal to price-sensitive consumers.

Key Market Segments

By Product

- Razors & Blades

- After-Shave Emulsion

- Other Products

By Distribution Channel

- Offline Channel

- Online Channel

Drivers

Increasing Grooming Awareness Drive Market Growth

The shaving market is witnessing substantial growth fueled by several pivotal factors. Increasing grooming awareness has led consumers to prioritize personal hygiene and appearance, thereby boosting the demand for shaving products.

Concurrently, rising disposable incomes across various regions enable consumers to allocate more funds towards premium shaving products. As individuals have greater financial flexibility, they are more inclined to purchase higher-end razors, shaving creams, and aftercare items that offer superior performance and comfort.

Additionally, the rapid expansion of e-commerce channels has revolutionized the accessibility and convenience of purchasing shaving products. Online platforms provide a vast selection of brands and products, often accompanied by personalized recommendations and competitive pricing, which attract a broader customer base.

The integration of user-friendly interfaces and efficient delivery systems further enhances the shopping experience, making it easier for consumers to explore and purchase their preferred shaving solutions. Moreover, technological advancements in shaving products, such as the development of multi-blade razors, ergonomic designs, and innovative skincare formulations, cater to the evolving needs and preferences of modern consumers.

Restraints

High Competition, Raw Material Prices, and Health Concerns Restrain Market Growth

Despite the positive growth trajectory, the shaving market faces several restraining factors that challenge its expansion. High competition among brands is a significant barrier, as numerous companies vie for market share by offering similar products.

Additionally, fluctuating raw material prices pose a threat to market stability. The costs of essential components such as steel for blades, plastics for handles, and chemicals for shaving creams can vary significantly due to supply chain disruptions, geopolitical tensions, and changes in global demand.

Furthermore, health and safety concerns related to shaving products also act as a restraining factor. Issues such as skin irritation, allergic reactions, and the risk of cuts or infections can deter consumers from using certain shaving products.

Moreover, the environmental impact of shaving products, including disposable razors and non-recyclable packaging, has garnered increasing scrutiny from environmentally conscious consumers. This heightened awareness pressures brands to adopt more sustainable practices, which can involve significant costs and operational changes.

Opportunity

Expansion into Emerging Markets, Eco-friendly Solutions, and Personalization Provide Opportunities

The shaving market is brimming with growth opportunities driven by strategic initiatives and evolving consumer preferences. One of the most promising avenues lies in the expansion into emerging markets, where rising incomes and increasing urbanization are fueling demand for personal grooming products.

Additionally, the development of eco-friendly shaving solutions offers a significant opportunity for brands to differentiate themselves in a crowded marketplace. Consumers are increasingly seeking sustainable and environmentally responsible products, prompting brands to innovate with biodegradable razors, recyclable packaging, and natural ingredients in shaving creams.

Furthermore, personalization and customization of shaving products present a unique growth opportunity. By leveraging data and advanced manufacturing technologies, companies can offer tailored shaving solutions that cater to individual preferences, such as personalized razor handles, customized blade counts, and bespoke skincare formulations.

Additionally, the integration of smart technologies into shaving products, such as razors with built-in sensors or mobile app connectivity, opens up new avenues for innovation and consumer engagement. These smart shaving tools can provide real-time feedback, usage tracking, and personalized grooming recommendations, enhancing the overall shaving experience.

Challenges

Supply Chain Disruptions, Changing Preferences, and High Return Rates Challenge Market Growth

The shaving market encounters several challenging factors that complicate its growth trajectory. Supply chain disruptions, often triggered by geopolitical tensions, natural disasters, or logistical inefficiencies, can significantly impede the production and distribution of shaving products.

Additionally, rapidly changing consumer preferences pose a substantial challenge for shaving brands. As trends in personal grooming evolve, consumers may shift their preferences towards new styles, functionalities, or types of shaving products. This necessitates continuous innovation and agility in product development to stay relevant in the market.

High return rates, particularly prevalent in online sales, also present a significant hurdle for the shaving market. Consumers often purchase shaving products online without the ability to physically test them beforehand, leading to dissatisfaction with aspects such as blade sharpness, handle ergonomics, or skin compatibility.

Moreover, regulatory compliance issues add another layer of complexity. Shaving products must adhere to various safety and quality standards across different regions, requiring brands to navigate a maze of regulations and certifications. Non-compliance can result in legal penalties, product recalls, and damage to brand reputation.

Growth Factors

Product Diversification, Strategic Collaborations, and Enhanced Customer Experience Are Growth Factors

Growth in the shaving market is supported by several key factors that enable brands to expand and strengthen their market position. Product diversification is a fundamental growth factor, allowing companies to offer a broader range of shaving solutions that cater to diverse consumer needs and preferences.

This diversification also enables brands to respond to specific market segments, such as sensitive skin, eco-conscious consumers, or those seeking premium shaving experiences.

Strategic partnerships and collaborations further drive market growth by leveraging complementary strengths and expanding brand reach. Collaborating with other brands, designers, or influencers can enhance product offerings, introduce innovative designs, and access new customer segments.

Additionally, enhancing the customer experience is crucial for fostering loyalty and encouraging repeat purchases. Investing in user-friendly online platforms, personalized shopping experiences, and exceptional customer service can significantly improve customer satisfaction and retention.

Emerging Trends

Subscription Models and Influencer Marketing Are Latest Trending Factors

Additionally, the demand for natural and organic shaving products is on the rise, reflecting a broader shift towards healthier and environmentally friendly personal care options. Consumers are increasingly seeking products free from harsh chemicals, artificial fragrances, and synthetic materials, prompting brands to develop and market organic skincare, natural razors, and eco-friendly packaging.

Furthermore, male grooming trends are significantly influencing the shaving market, with men becoming more invested in their personal appearance and grooming routines. This shift has led to an increased demand for specialized shaving products, such as precision razors, beard grooming kits, and skincare solutions designed specifically for men’s skin types and preferences.

Social media influencer marketing has also become a critical trend in the shaving industry. Influencers leverage their online presence to showcase products, provide authentic reviews, and engage with their followers, thereby enhancing brand visibility and credibility. This form of marketing is particularly effective in reaching younger, digitally savvy consumers who rely on social media for product recommendations and trends.

Regional Analysis

North America Dominates with 35.0% Market Share

North America leads the global shaving market with a 35.0% share, amounting to USD 2.98 billion. This dominance is fueled by a strong culture of grooming and personal care among both men and women. High disposable incomes and a preference for premium products, such as electric shavers and high-end grooming kits, also contribute significantly to this market share.

The region’s market benefits from an advanced retail infrastructure, including both physical stores and extensive online platforms, providing easy access to a wide range of products. Additionally, the influence of marketing campaigns that promote grooming as part of a modern lifestyle plays a crucial role in maintaining consumer interest and driving sales.

North America’s presence in the shaving market is expected to remain strong as companies continue to innovate, introducing new products that align with sustainability trends and personalized grooming needs. The shift toward eco-friendly and subscription-based models is likely to further solidify the region’s market position and possibly increase its share in the coming years.

Regional Mentions:

- Europe: Europe is a key player in the shaving market, driven by a focus on quality grooming products and sustainable practices. The region’s strong tradition of premium grooming brands, along with the influence of eco-conscious consumers, shapes its market dynamics.

- Asia Pacific: Asia Pacific shows robust growth potential, with rising disposable incomes and a growing emphasis on personal grooming among younger demographics. The expansion of e-commerce platforms and local brands enhances accessibility and product diversity in the region.

- Middle East & Africa: The Middle East & Africa region sees an increasing demand for shaving products due to a growing population and an emerging middle class. The expansion of modern retail channels and rising grooming awareness boost market development.

- Latin America: Latin America is experiencing gradual market growth, driven by a youthful population and rising urbanization. The market focuses on affordable shaving solutions, with local and international brands catering to price-sensitive consumers through diverse product offerings.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The shaving market is led by a few global giants, including Beiersdorf AG, Church & Dwight Co, Inc., Reckitt Benckiser Group Plc, and Procter & Gamble. These companies dominate with well-established brands and wide product ranges.

The top players offer a variety of shaving products such as razors, electric shavers, shaving creams, gels, and aftershaves. They cater to both men’s and women’s grooming needs, with products sold through retail stores and online platforms.

Procter & Gamble, with brands like Gillette, focuses on premium quality and performance, while Church & Dwight Co, Inc. targets affordability and accessibility. Beiersdorf AG and Reckitt Benckiser Group emphasize skin-care benefits and product safety, appealing to sensitive skin users. These companies use strategic advertising and sponsorships to increase brand awareness.

These companies have a global footprint, with strong presence in North America, Europe, and Asia-Pacific regions. They benefit from extensive distribution networks and partnerships with major retailers.

Innovation is a priority, with emphasis on developing electric shavers, multi-blade systems, and skin-care enhancements. Sustainability is also key, with efforts to produce eco-friendly and refillable products gaining traction.

The competitive advantage for these companies lies in their strong brand reputation, diversified product lines, and continuous innovation. They leverage their global reach and marketing expertise to stay ahead in the market.

Top Key Players in the Market

- Beiersdorf AG

- Church & Dwight Co, Inc.

- Reckitt Benckiser Group Plc

- Procter & Gamble

- Oriflame Holding AG

- GiGi

- Koninklijke Philips N.V.

- Syska India Ltd.

- Harry’s Inc.

- Societe BIC S.A.

- Other Market Players

Recent Developments

- OneBlade Dawn Razor Summary: On October 2024, the OneBlade Dawn Razor, designed by PENSA in collaboration with OneBlade, was crafted for sustainability and primarily targets women and body shavers. Constructed from recyclable stainless steel and aluminum, it eliminates plastic waste and has won the 2024 Green Good Design Award for its eco-friendly design.

- Dentsu X and Vi-John Partnership Summary: On September 2024, Dentsu X secured the integrated media mandate for Vi-John Healthcare India’s shaving category following a multi-agency competition. The agency will deliver media planning across various channels, aiming to drive innovative brand experiences and enhance Vi-John’s market presence using a strategic and creative approach.

- Bombay Shaving Company Funding Summary: On April 2024, Bombay Shaving Company raised INR 24 crore ($3 million) in debt funding from Alteria Capital. The funds are intended to support the brand’s growth, focusing on refining its go-to-market strategy for the razor category and expanding its offline presence from 12 to 25 cities.

- MANSCAPED® Product Launch Summary: On September 2024, MANSCAPED® introduced The Chairman™ Pro electric foil shaver, featuring SkinSafe® Technology, interchangeable blade heads, and waterproof capabilities. This advanced shaver, designed to reduce irritation, is part of a new premium face shaving kit available in the U.S. and Canada, with global expansion planned.

Report Scope

Report Features Description Market Value (2023) USD 8.5 Billion Forecast Revenue (2033) USD 14.4 Billion CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Razors & Blades, After-Shave Emulsion, Other Products), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Beiersdorf AG, Church & Dwight Co, Inc., Reckitt Benckiser Group Plc, Procter & Gamble, Oriflame Holding AG, GiGi, Koninklijke Philips N.V., Syska India Ltd., Harry’s Inc., Societe BIC S.A., Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Beiersdorf AG

- Church & Dwight Co, Inc.

- Reckitt Benckiser Group Plc

- Procter & Gramble

- Oriflame Holding AG

- GiGi

- Koninkliijke Philips N.V.

- Syska India Ltd.

- Harry's Inc.

- Societe BIC S. A.

- Other Market Players