Global Seam Tapes Market By Material (PU, PVC, TPU), By Application (Waterproofing, Woven Fabrics, Non-Woven Fabrics, Others), By End Use (Apparel & Footwear, Healthcare, Automotive, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136530

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

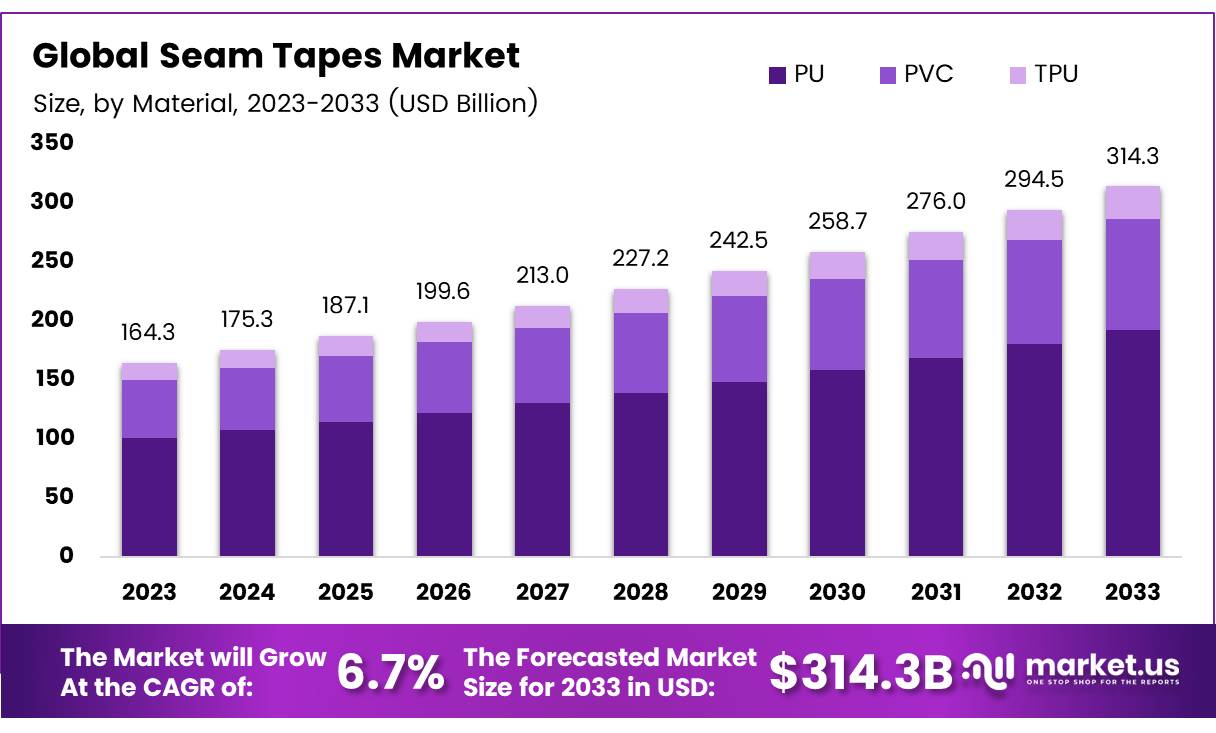

The Global Seam Tapes Market size is expected to be worth around USD 314.3 Billion by 2033, from USD 164.3 Billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

Seam tapes are adhesive strips used in various industries, including textiles, apparel, construction, and automotive, to bond and seal seams. These tapes ensure water resistance, airtightness, and enhanced durability by preventing water, air, or dust from penetrating the seams of materials like fabrics or plastic.

Common applications of seam tapes include waterproof clothing, tents, outdoor gear, and protective suits. Seam tapes are typically made from high-performance materials such as polyurethane (PU), polyvinyl chloride (PVC), and thermoplastic elastomers (TPE), designed to withstand harsh environmental conditions.

The seam tapes market refers to the industry that produces and distributes these adhesive strips for various applications. This market has seen notable growth due to the increasing demand for waterproofing and sealing products in several end-use industries. The expanding global textile and garment industry, combined with rising demand for personal protective equipment (PPE), is a significant driver for this market.

The seam tapes market is poised for sustained growth in the coming years, driven by factors such as rising demand for waterproof and airtight materials, especially in industries like textiles, construction, and automotive.

According to the market trends, the increasing adoption of protective clothing, particularly in hazardous environments, is a key growth driver. This surge in demand is further supported by the growing awareness of safety standards, particularly in industrial settings.

Another significant factor contributing to the market’s expansion is the growing trend towards outdoor recreational activities. As consumers increasingly engage in outdoor sports and adventures, the need for durable, water-resistant clothing and gear has risen. Seam tapes are crucial in ensuring the performance and longevity of these products.

Government investment and regulations play a critical role in shaping the seam tapes market. For instance, many countries have introduced regulations on the use of sustainable materials and environmentally friendly products, pushing manufacturers to align with these standards. The investment in infrastructure, particularly in construction and automotive sectors, has also created demand for advanced seam tapes.

According to a survey by the U.S. National Center for Biotechnology Information (NCBI), 60% of participants reported increasing their cleaning and disinfecting practices since the onset of the COVID-19 pandemic, indicating a growing emphasis on hygiene and safety products.

Furthermore, the U.S. Environmental Protection Agency (EPA) reports that 75% of U.S. households used at least one pesticide product indoors during the past year, highlighting the growing consumer focus on safety, which extends to the use of high-performance materials in other industries as well.

Recent Statistics reports that, in 2024, drugstores in Germany held the largest share of household cleaning products revenue, with around 35% of the market, underlining the growing emphasis on cleanliness and the associated demand for specialized materials like seam tapes.

Key Takeaways

- The global Seam Tapes Market size is projected to reach USD 314.3 billion by 2033, growing at a CAGR of 6.7%.

- PU (Polyurethane) led the market in 2023, capturing 64.3% share due to its superior adhesive properties and flexibility.

- Waterproofing dominated the application segment in 2023, accounting for 50.3% of the market share.

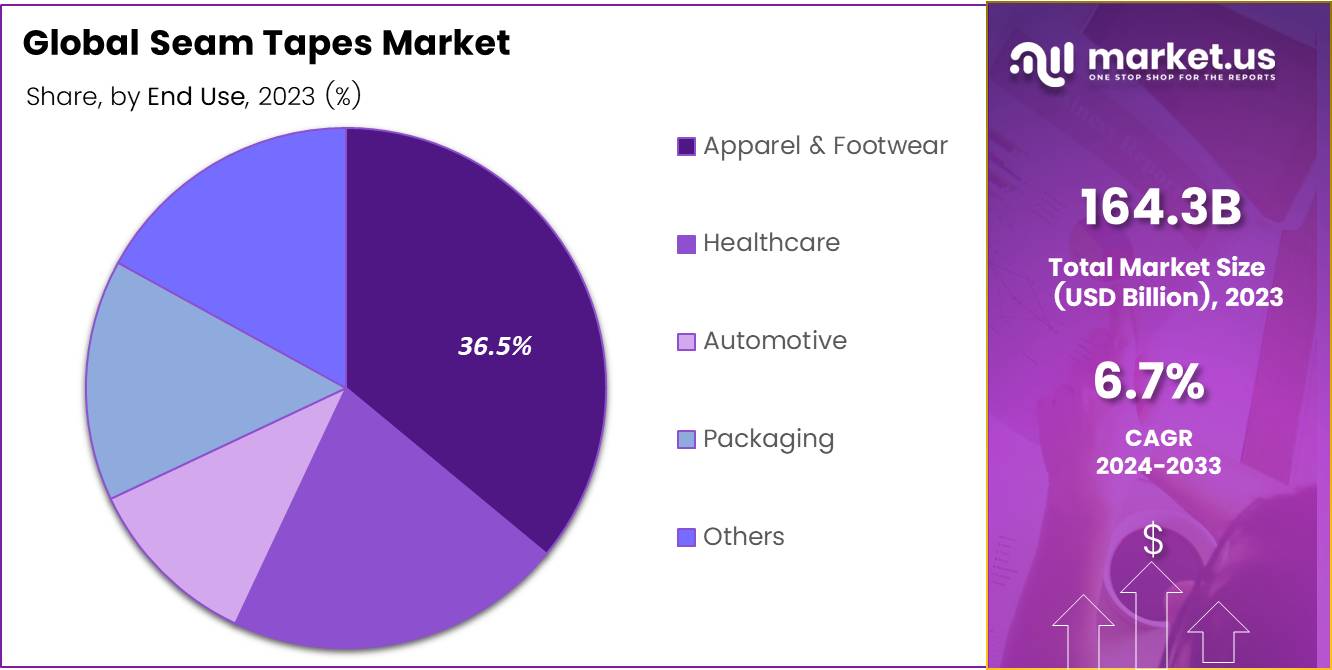

- Apparel & Footwear held the largest end-use share in 2023, with a 36.5% share, driven by demand for durable, waterproof garments and footwear.

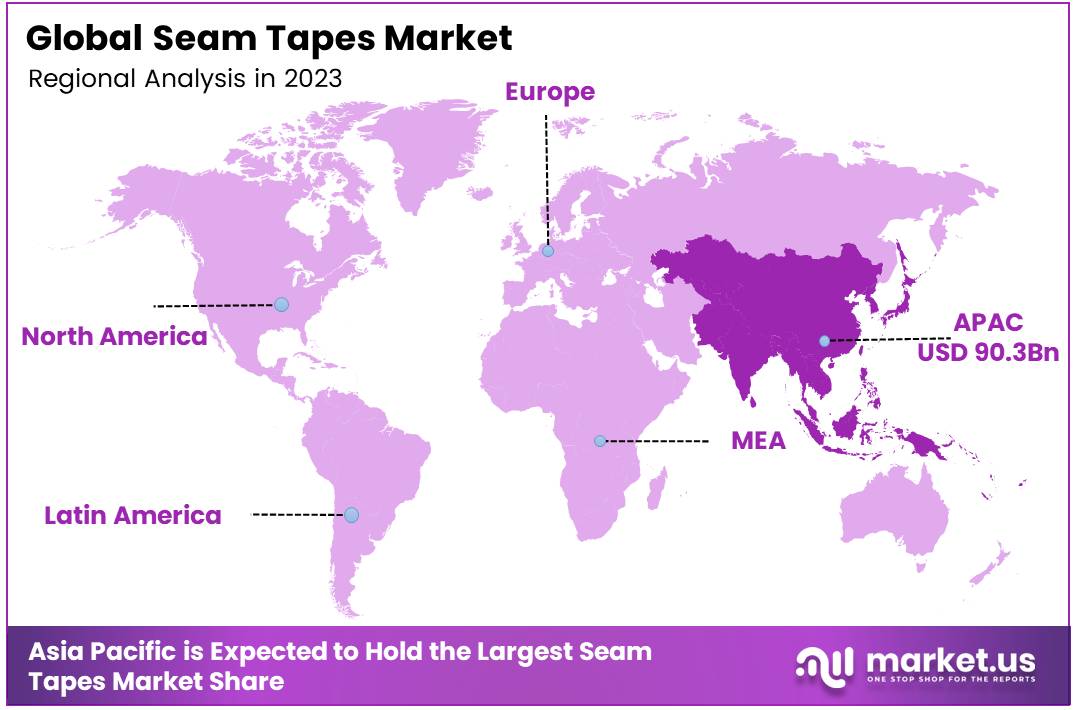

- Asia Pacific holds a dominant regional share of 55.4%, valued at USD 90.3 billion in 2023.

Material Analysis

PU Dominates Seam Tapes Market in 2023 with 64.3% Share, Followed by PVC and TPU

In 2023, PU held a dominant market position in the By Material Analysis segment of the Seam Tapes Market, with a 64.3% share. This market leadership can be attributed to the material’s superior adhesive properties, flexibility, and resistance to harsh environmental conditions, making it the preferred choice for a wide range of applications, particularly in the automotive, textile, and sportswear industries.

PU-based seam tapes offer high durability, waterproofing, and UV resistance, which are critical for applications that require long-lasting performance in extreme conditions.

PVC, while trailing behind PU, accounted for a significant portion of the market. PVC’s cost-effectiveness, coupled with its decent durability and ease of processing, made it a viable option for industries that prioritize budget-conscious solutions. PVC is commonly used in applications where high performance is not as critical, such as in certain textile products.

TPU, though growing in popularity due to its excellent elasticity and abrasion resistance, held a smaller market share compared to PU and PVC. TPU-based seam tapes are favored in high-performance applications, especially in the footwear and medical industries, where superior strength and flexibility are essential. However, the higher cost of TPU limits its widespread adoption in more price-sensitive markets.

Application Analysis

Waterproofing Leads the Seam Tapes Market with a 50.3% Share in 2023

In 2023, Waterproofing held a dominant market position in the By Application Analysis segment of the Seam Tapes Market, with a 50.3% share. This can be attributed to the increasing demand for waterproof solutions across a variety of industries, including construction, automotive, and textiles.

Seam tapes are critical in ensuring the durability and water resistance of materials, making them indispensable in applications requiring waterproof characteristics. As consumer demand for waterproof products continues to rise, especially in outdoor gear, garments, and industrial materials, the segment is expected to maintain its leading position in the foreseeable future.

Woven fabrics, which accounted for a significant portion of the market, are also gaining traction due to their strength and versatility in industrial and consumer product applications.

These fabrics offer enhanced durability, contributing to the overall effectiveness of seam tapes in various high-performance applications. Non-woven fabrics, while a smaller segment, are increasingly being used for lightweight and breathable applications, particularly in medical and hygiene products.

The Others category, which encompasses specialized uses, represents a niche but growing segment of the market. As technology advances, the potential for innovation in these subcategories is substantial, further diversifying the seam tapes market and contributing to its overall growth.

End Use Analysis

Apparel & Footwear Dominates Seam Tapes Market by End Use in 2023, Accounting for 36.5% Share

In 2023, Apparel & Footwear held a dominant market position in the By End Use Analysis segment of the Seam Tapes Market, with a 36.5% share.

This substantial share can be attributed to the widespread application of seam tapes in the production of waterproof, breathable, and durable garments and footwear, where functionality and performance are critical. The growing demand for outdoor wear, sports apparel, and specialized footwear further bolstered the segment’s growth.

The Healthcare sector followed closely, accounting for a significant portion of the market share. Seam tapes are increasingly used in the production of medical textiles, including bandages, wound care products, and surgical garments, due to their flexibility and ability to provide sterile, waterproof seals.

The Automotive industry also contributed notably to the market, with the increasing demand for sealing applications in automotive interiors and exteriors, where seamless joints are essential for weatherproofing and durability.

Packaging, though a smaller segment, is steadily growing as the demand for adhesive solutions in packaging materials, especially in food and beverage, continues to rise. Other industries, including construction and electronics, also contribute to the market but with a more modest share.

Overall, the end-use segment of the seam tapes market remains diverse, with notable growth in both functional and aesthetic applications across industries.

Key Market Segments

By Material

- PU

- PVC

- TPU

By Application

- Waterproofing

- Woven Fabrics

- Non-Woven Fabrics

- Others

By End Use

- Apparel & Footwear

- Healthcare

- Automotive

- Packaging

- Others

Drivers

Seam Tapes Market Driven by Growing Demand for Waterproof Solutions and Technological Advancements

The growing demand for waterproofing solutions across various industries is one of the primary drivers of the seam tapes market. Consumers are increasingly seeking products that provide protection against water and harsh weather conditions, particularly in sectors like apparel, outdoor gear, and automotive.

As outdoor activities such as hiking, camping, and sports continue to gain popularity, the need for durable, waterproof clothing and gear is expanding. This trend is encouraging the widespread use of seam tapes, which are essential for ensuring that seams in garments and equipment are sealed and water-resistant.

Furthermore, there is rising awareness among consumers about the importance of protection against extreme environmental conditions, such as rain and snow. This awareness is driving a preference for high-quality seam tapes that enhance product durability and comfort. At the same time, advancements in seam tape technology, including the development of breathable, flexible, and high-performance materials, are boosting market demand.

These innovations allow manufacturers to produce more versatile products that meet the increasing consumer demand for both functionality and comfort. Together, these factors are contributing to the sustained growth of the seam tapes market, as industries seek to meet the evolving needs of consumers and improve the performance of their products.

Restraints

Seam Tape Market Faces Challenges from Durability Issues and Alternative Sealing Methods

The seam tapes market faces significant restraints, particularly related to the long-term performance of adhesives.

Adhesives used in seam tapes can degrade when exposed to environmental factors such as ultraviolet (UV) light, extreme temperatures, or moisture. This degradation may cause the adhesive bond to weaken, reducing the durability and effectiveness of the seam tape, which limits its use in applications requiring long-term reliability.

As a result, industries reliant on these tapes for waterproofing or strength may seek alternatives that offer greater stability. Additionally, the availability of substitute sealing methods, including heat-sealing or ultrasonic welding, further pressures the market for seam tapes.

These alternatives are often preferred in applications where high precision and durability are required, as they may offer superior bonding properties without the potential for adhesive breakdown.

The competition from such methods, combined with the limitations of adhesive performance, could hinder the growth of the seam tape market, especially in sectors like automotive or outdoor gear manufacturing. Therefore, the adoption of alternative sealing technologies and the inherent challenges in adhesive longevity present substantial hurdles for the market’s expansion.

Growth Factors

Growth Potential in Seam Tapes Market Driven by Rising Demand and Sustainable Innovation

The seam tapes market presents several significant growth opportunities, particularly in emerging markets where urbanization and rising disposable incomes are increasing the demand for higher-quality apparel and protective products.

As these regions experience economic development, there is an expanded market for durable, high-performance materials, including seam tapes that enhance product functionality. Furthermore, innovation in sustainable materials is creating new avenues for growth.

Eco-friendly and biodegradable seam tapes are gaining popularity as both consumers and manufacturers place greater emphasis on sustainability. This trend is expected to drive demand for greener alternatives across various industries.

Additionally, the growing adoption of smart textiles, particularly in wearable technology, offers new opportunities for the integration of seam tapes with conductive and flexible electronic components, making them an essential part of the next generation of clothing and devices.

Another promising area is the medical and healthcare sector, where seam tapes are increasingly being used in surgical gowns, bandages, and wound care products.

As the healthcare industry continues to prioritize hygiene and comfort, the demand for high-quality, specialized seam tapes is expected to grow, opening new niches in this sector. Overall, the combination of rising demand in emerging markets, technological innovation, and growing sustainability awareness offers significant growth potential for the seam tapes market.

Emerging Trends

Seam Tapes Market Growth Driven by Sustainability, Activewear Demand, and Customization Trends

The seam tapes market is experiencing notable growth driven by several key trends. One of the most prominent is the rise in eco-conscious consumerism. As sustainability becomes a priority for consumers, manufacturers are increasingly focusing on developing seam tapes made from recyclable or biodegradable materials. This aligns with the growing demand for environmentally friendly products across various industries, especially apparel.

Another significant trend is the booming popularity of activewear and athleisure. With more people embracing these clothing categories for both athletic and casual purposes, the need for durable and waterproof garments has driven the demand for high-performance seam tapes, which enhance the functionality of such products.

Additionally, there is a shift toward greater customization and personalization in outdoor gear. Consumers are now seeking outdoor products tailored to specific needs, such as waterproofing and insulation, prompting manufacturers to incorporate specialized seam tapes into their designs.

Finally, the trend toward seamless and minimalist designs in fashion and functional clothing is gaining momentum. Consumers and designers are opting for clean, smooth garment aesthetics, which has led to the development of innovative seam taping techniques that maintain both durability and a sleek, seamless appearance. These trends reflect the market’s growing emphasis on combining functionality, performance, and sustainability in seam tape solutions.

Regional Analysis

Asia Pacific Leads Seam Tapes Market with 55.4% Share valued at USD 90.3 Billion

The Seam Tapes Market is characterized by regional dynamics that contribute to its global growth trajectory. Asia Pacific dominates the market, holding a significant share of 55.4%, valued at USD 90.3 billion.

The region’s dominance is attributed to the strong manufacturing capabilities of countries like China, India, and Japan, where the demand for seam tapes is driven by industries such as textile, apparel, automotive, and construction. The increasing focus on performance-driven fabrics, particularly in the outdoor and sportswear segments, is a key factor in the market’s expansion in this region.

Regional Mentions:

In North America, steady growth is anticipated, driven by demand across various sectors, including healthcare, automotive, and sportswear. The U.S., in particular, plays a crucial role, with the growth of activewear and high-performance medical fabrics boosting the use of seam tapes. As sustainability and functional fabrics gain prominence, seam tapes are increasingly utilized to enhance the durability and performance of products.

The European market is also witnessing growth, albeit at a slower pace compared to Asia Pacific. The demand for seam tapes is driven by established textile and garment manufacturers, particularly in Germany, the UK, and Italy. The region’s emphasis on innovation in activewear and outdoor apparel is contributing to the growth of the seam tapes market, with a focus on high-quality and durable products.

Latin America and the Middle East & Africa regions are expected to see gradual growth in the coming years. While the demand for seam tapes in Latin America is more concentrated in textiles and fashion, the Middle East & Africa’s market is growing due to increasing applications in the construction and protective garment sectors.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global seam tapes market in 2023 is characterized by a diverse and competitive landscape, with several key players driving market growth through innovation, strategic collaborations, and product differentiation.

3M Company, a dominant force in the adhesive and material science sectors, continues to lead the market with its robust portfolio of high-performance seam tapes. Known for its R&D capabilities, 3M has leveraged advanced adhesive technologies to cater to industries such as automotive, textiles, and construction, offering solutions that enhance durability, water resistance, and ease of application.

Bemis Associates Inc., another prominent player, specializes in functional and high-quality seam tapes that find widespread application in the apparel, automotive, and medical industries. Their focus on sustainability, coupled with a commitment to product innovation, positions Bemis as a key driver of growth in the eco-conscious consumer segment.

GCP Applied Technologies Inc. has carved a niche for itself with its seam tapes designed for building and construction applications. The company’s solutions emphasize energy efficiency and structural integrity, making it an attractive option for the growing demand for energy-efficient construction materials.

Framis Italia S.P.A. and Koch Industries, Inc. also hold significant market shares, offering high-quality, specialized products for the textile and automotive sectors. Their advanced manufacturing processes and strong distribution networks contribute to their market competitiveness.

Meanwhile, Toray Industries Inc. and San Chemicals, Ltd. are recognized for their innovation in high-performance films and adhesive technologies, which cater to a wide range of industrial applications.

Overall, the competition in the seam tapes market remains intense, with players focusing on technological advancements, sustainability, and expanded application areas to solidify their market positions.

Top Key Players in the Market

- 3M Company

- Bemis Associates Inc.

- GCP Applied Technologies Inc.

- Framis Italia S.P.A.

- Koch Industries, Inc.

- Toray Industries Inc.

- San Chemicals, Ltd.

- Essentra PLC

- Himel Corp.

- Sealon Co., Ltd.

- Loxy AS

- Gerlinger Industries GmbH

- Adhesive Films, Inc.

- DingZing Advanced Materials Inc.

- E. Textint Corp.

Recent Developments

- In November 2023, Paterson announced a significant $1 million investment to upgrade personal protective equipment (PPE) for its Fire Department, ensuring enhanced safety and readiness for first responders.

- In November 2024, Honeywell revealed plans to sell its PPE business to PIP (Professional Industrial Products) in a landmark $1.3 billion deal, marking a major shift in the industrial safety equipment market.

- In July 2023, Coverguard, a prominent safety gear provider, announced its acquisition of Weltek, a move aimed at expanding its product offerings and strengthening its market position in personal protection.

- In July 2024, Stellar Industrial Supply completed the acquisition of PPE distributor USA Safety Supply, enhancing its portfolio and solidifying its presence in the personal protective equipment sector.

Report Scope

Report Features Description Market Value (2023) USD 164.3 Billion Forecast Revenue (2033) USD 314.3 Billion CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (PU, PVC, TPU), By Application (Waterproofing, Woven Fabrics, Non-Woven Fabrics, Others), By End Use (Apparel & Footwear, Healthcare, Automotive, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Company, Bemis Associates Inc., GCP Applied Technologies Inc., Framis Italia S.P.A., Koch Industries, Inc., Toray Industries Inc., San Chemicals, Ltd., Essentra PLC, Himel Corp., Sealon Co., Ltd., Loxy AS, Gerlinger Industries GmbH, Adhesive Films, Inc., DingZing Advanced Materials Inc., E. Textint Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- Bemis Associates Inc.

- GCP Applied Technologies Inc.

- Framis Italia S.P.A.

- Koch Industries, Inc.

- Toray Industries Inc.

- San Chemicals, Ltd.

- Essentra PLC

- Himel Corp.

- Sealon Co., Ltd.

- Loxy AS

- Gerlinger Industries GmbH

- Adhesive Films, Inc.

- DingZing Advanced Materials Inc.

- E. Textint Corp.