Global Peppermint Oil Market By Source (Organic, Natural), By Form (Absolute/Concentrate, Blends), By Method of Extraction ( Distillation, Carbon Dioxide Extraction, Cold Press Extraction, Solvent Extraction, Others), By Application (Therapeutics, Aromatherapy, Toiletries, Fragrances, Cleaning and Home, Others), By End-use ( Cosmetics and Personal Care, Food and Beverage, Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134455

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

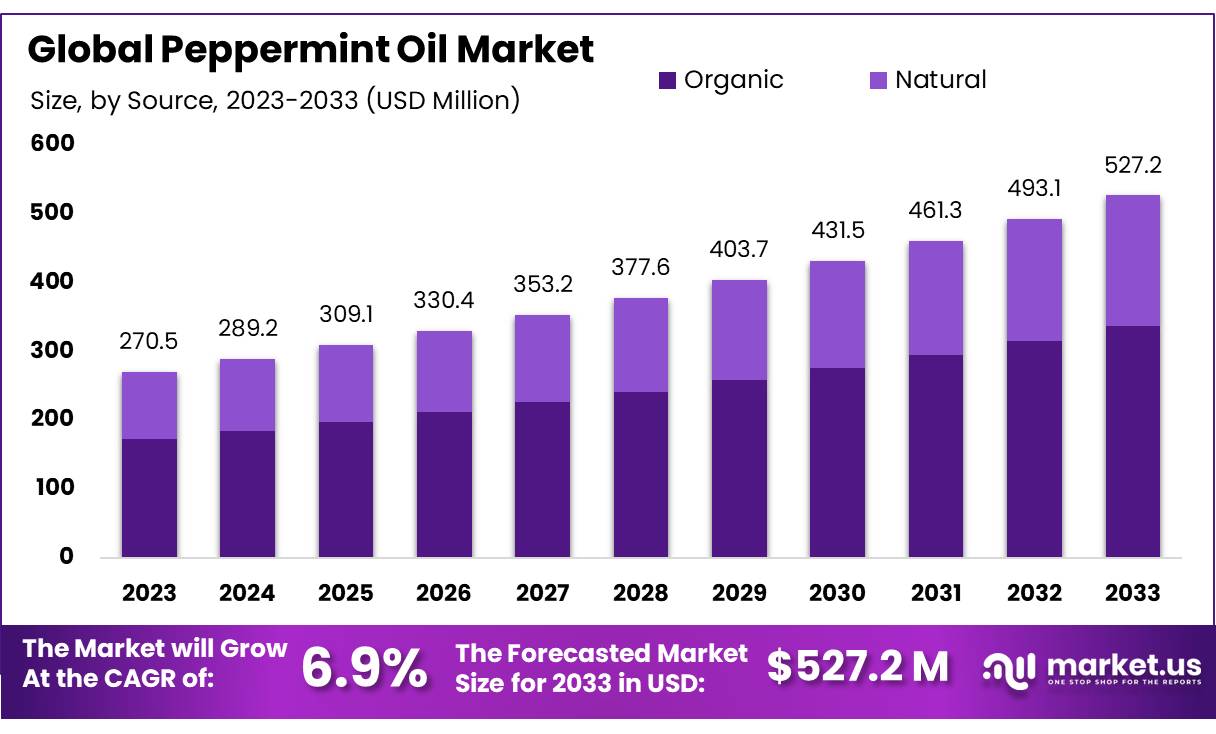

The Global Peppermint Oil Market size is expected to be worth around USD 527.2 Mn by 2033, from USD 270.5 Mn in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

Peppermint oil, derived from the peppermint plant (Mentha × piperita), is widely used across various industries, including food and beverages, pharmaceuticals, cosmetics, and personal care products. Known for its strong aroma and cooling effects, peppermint oil contains menthol, which gives it its distinctive flavor.

It is commonly found in mint-flavored candies, chewing gum, toothpaste, and medicinal products due to its soothing properties. Additionally, peppermint oil is valued for its therapeutic uses, such as relieving headaches, indigestion, and muscle pain, and is a popular choice in aromatherapy for stress relief and relaxation. The oil is extracted using steam distillation to capture the plant’s volatile compounds.

In the food and beverage sector, peppermint oil is primarily used in confectionery, chewing gum, flavored syrups, and beverages. The growing demand for natural flavors has significantly increased its popularity in this market.

In 2023, North America was the largest market, accounting for 40% of global demand, with the United States importing over 20,000 tons of peppermint oil annually. Europe follows closely, with key importers like Germany, France, and the United Kingdom.

Government regulations have a significant impact on the peppermint oil market. In Europe, the European Food Safety Authority (EFSA) enforces strict guidelines on the allowable concentrations of essential oils, including peppermint, in food products.

In 2023, new safety standards were introduced, which are expected to affect production and supply chains. Meanwhile, in India, the government has supported the peppermint oil industry through the National Medicinal Plants Board (NMPB), investing USD 15 million over two years to improve mint cultivation and processing, aiming to boost India’s global market share.

India is the world’s largest exporter of peppermint oil, accounting for more than 60% of global exports. In 2023, Indian exports of peppermint oil increased by 8%, reaching a value of USD 35 million. The primary export destinations include the United States, Germany, and Japan. North American exports are also growing, with a projected annual increase of 5%, driven by rising demand for natural flavoring agents in food and beverage production.

Innovation and investment in the peppermint oil market are evident in major corporate moves. For example, Cargill invested USD 10 million in developing peppermint oil derivatives for the cosmetic industry in 2023. Similarly, BASF expanded its essential oils portfolio by acquiring a significant stake in a peppermint oil extraction company.

Furthermore, The Essential Oil Company invested USD 5 million in expanding its distillation facilities in Oregon, USA, increasing production capacity by 30% to meet growing demand from the health, wellness, and food industries.

Key Takeaways

- Peppermint Oil Market size is expected to be worth around USD 527.2 Mn by 2033, from USD 270.5 Mn in 2023, growing at a CAGR of 6.9%.

- Absolute/Concentrate held a dominant market position, capturing more than a 68.1% share

- Distillation held a dominant market position, capturing more than a 54.2% share of the global Peppermint Oil Market.

- Therapeutics held a dominant market position, capturing more than a 37.5% share of the global Peppermint Oil Market.

- Natural held a dominant market position, capturing more than a 64.4% share of the global Peppermint Oil Market.

- North America dominated the global peppermint oil market, capturing more than 35.4% of the market share, valued at approximately USD 1.6 billion.

By Source

In 2023, Natural held a dominant market position, capturing more than a 64.4% share of the global Peppermint Oil Market. This segment’s strong performance can be attributed to the growing demand for natural products across industries such as food and beverages, personal care, and pharmaceuticals. Consumers are increasingly inclined toward natural and chemical-free ingredients, driving the preference for natural peppermint oil.

Natural peppermint oil is sourced directly from peppermint plants, ensuring authenticity and quality. Its versatility in applications, from flavoring to aromatherapy, has contributed significantly to its widespread use. Additionally, the increasing awareness of the benefits of natural oils for health and wellness has further solidified its market dominance.

The Organic segment, although smaller, is expected to witness steady growth in the coming years. Organic peppermint oil, grown without synthetic pesticides or fertilizers, appeals to a niche but growing group of eco-conscious consumers.

With rising interest in sustainable and environmentally friendly products, the organic segment is expected to gain traction, especially in premium product lines. However, it still accounts for a smaller share compared to its natural counterpart, which remains the preferred choice for the majority of consumers.

By Form

In 2023, Absolute/Concentrate held a dominant market position, capturing more than a 68.1% share of the global Peppermint Oil Market. This segment’s dominance is driven by the high demand for concentrated forms of peppermint oil in various industries, particularly in the food and beverage, cosmetics, and aromatherapy sectors. Absolute and concentrated peppermint oils are preferred for their strong aroma and potency, making them ideal for use in small quantities to create high-impact products.

The versatility of Absolute/Concentrate oils, with their ability to be diluted or blended for specific formulations, adds to their appeal. Additionally, their high concentration of active compounds makes them highly effective in therapeutic applications, driving further market growth.

The Blends segment, while smaller, is seeing increasing demand, particularly in the wellness and personal care industries. Blended peppermint oil, often mixed with other essential oils, is popular for its customized applications, offering specific benefits like relaxation or pain relief. This segment is growing as consumers seek more targeted solutions for their health and cosmetic needs. However, it still lags behind Absolute/Concentrate in terms of overall market share, reflecting the preference for the pure and potent form of peppermint oil in most applications.

By Method of Extraction

In 2023, Distillation held a dominant market position, capturing more than a 54.2% share of the global Peppermint Oil Market. This method is preferred due to its efficiency in extracting high-quality peppermint oil. Distillation involves steam, which helps preserve the oil’s purity and therapeutic properties. It is widely used across various industries, including food and beverages, personal care, and aromatherapy, for its ability to produce large quantities of peppermint oil with consistent quality.

Carbon Dioxide Extraction, while a smaller segment, is gaining popularity for its clean, eco-friendly process. This method uses carbon dioxide in a supercritical state to extract the oil without the use of harmful chemicals. It preserves the natural aroma and chemical profile of peppermint oil, making it attractive to premium product lines, especially in health and wellness markets.

Cold Press Extraction is less commonly used for peppermint oil but remains a viable option, particularly in the food and cosmetic industries. This method involves mechanically pressing the peppermint leaves to release the oil. While it is a gentler process, it typically yields a smaller amount of oil compared to distillation and may result in lower concentrations of active compounds.

Solvent Extraction, which involves using chemical solvents to extract the oil, holds a minor share in the market. This method is generally used for extracting oils from plants with lower oil content. While it can produce large volumes of peppermint oil, it may leave trace chemicals in the final product, limiting its appeal for high-quality or organic products.

By Application

In 2023, Therapeutics held a dominant market position, capturing more than a 37.5% share of the global Peppermint Oil Market. This segment’s strong performance is driven by the growing demand for peppermint oil in the healthcare industry, where it is used for its natural pain-relieving, anti-inflammatory, and digestive benefits. Peppermint oil is commonly used in topical creams, balms, and oral formulations for its soothing effects on headaches, muscle pain, and digestive discomfort.

Aromatherapy, another significant application, accounted for a substantial portion of the market. Peppermint oil is widely used in aromatherapy for its refreshing and invigorating scent, which is believed to promote mental clarity and reduce stress. The increasing popularity of essential oils in wellness practices has contributed to the growth of this segment, particularly in the personal care and relaxation sectors.

Toiletries also represent a growing application for peppermint oil. With its cooling and refreshing properties, peppermint oil is commonly added to products like shampoos, soaps, toothpaste, and deodorants. The demand for natural ingredients in personal care products is fueling the growth of this segment, as consumers seek chemical-free alternatives for daily hygiene.

Fragrances is another key segment for peppermint oil, primarily in the production of perfumes and scented products. The oil’s strong, fresh aroma is valued for its ability to enhance fragrance formulations, making it a popular choice in both premium and mass-market scent products.

Cleaning & Home products are increasingly incorporating peppermint oil due to its natural antibacterial properties. Peppermint oil is used in eco-friendly cleaning products and air fresheners, appealing to consumers seeking sustainable and non-toxic household solutions.

By End-use

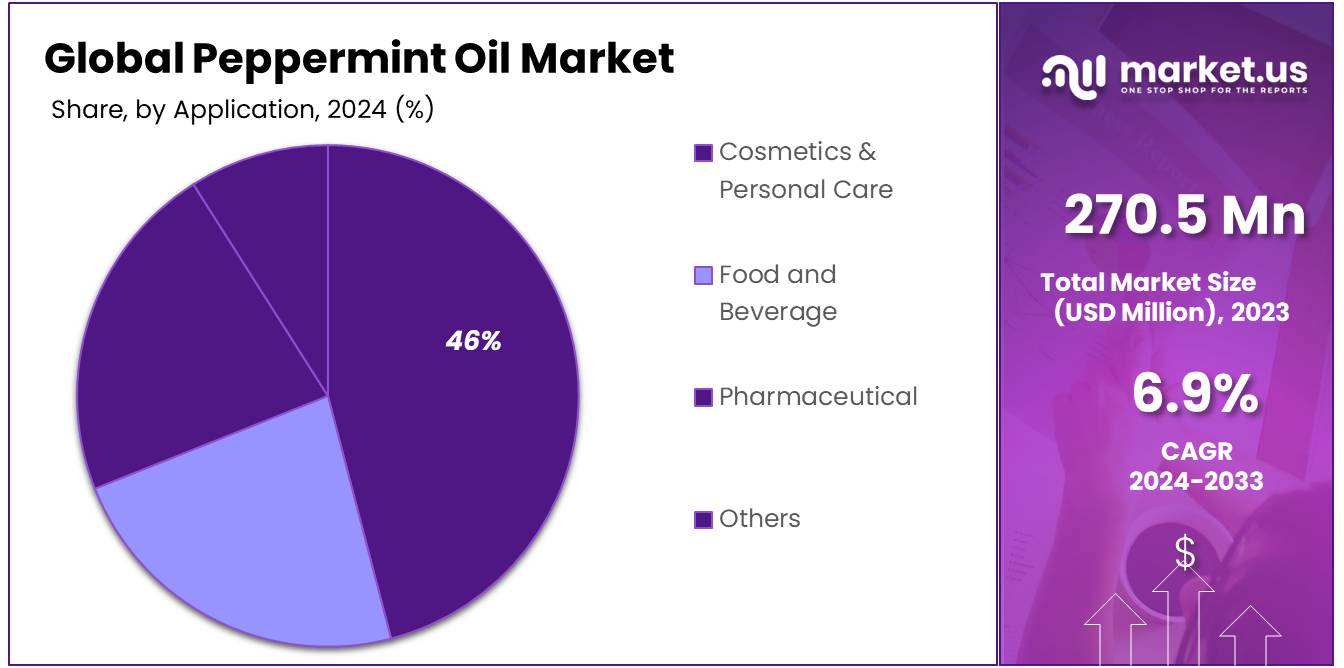

In 2023, Cosmetics & Personal Care held a dominant market position, capturing more than a 45.4% share of the global Peppermint Oil Market. This segment’s growth is driven by the rising demand for natural and organic ingredients in personal care products. Peppermint oil is highly valued for its cooling, soothing, and refreshing properties, making it a popular choice in skincare, haircare, and oral care products. Its use in products such as shampoos, soaps, lotions, and toothpaste is especially popular due to its therapeutic benefits and refreshing scent.

Food and Beverage also represents a significant portion of the market. Peppermint oil is widely used as a flavoring agent in products like candies, gums, teas, and baked goods. The growing trend towards natural flavors and health-conscious consumption is contributing to the demand for peppermint oil in this sector. Additionally, its natural antimicrobial properties make it a desirable ingredient for preserving and enhancing the taste of various food and drink products.

The Pharmaceutical sector holds a notable share of the market, with peppermint oil being used in the production of over-the-counter medicines and therapeutic formulations. It is commonly found in products aimed at relieving digestive issues, headaches, and muscle pain. The increasing preference for natural and plant-based treatments is expected to drive further growth in this segment.

Key Market Segments

By Source

- Organic

- Natural

By Form

- Absolute/Concentrate

- Blends

By Method of Extraction

- Distillation

- Carbon Dioxide Extraction

- Cold Press Extraction

- Solvent Extraction

- Others

By Application

- Therapeutics

- Aromatherapy

- Toiletries

- Fragrances

- Cleaning & Home

- Others

By End-use

- Cosmetics & Personal Care

- Food and Beverage

- Pharmaceutical

- Others

Drivers

Growing Demand for Natural and Organic Products in Food & Beverage Industry

The rising consumer preference for natural and organic ingredients in food products is a significant driver for the growth of the Peppermint Oil Market. According to a report from the Organic Trade Association (OTA), U.S. sales of organic food and beverages reached $61.9 billion in 2021, reflecting a steady increase in consumer demand for organic and natural products.

Furthermore, the global food and beverage market is increasingly adopting plant-based, clean-label, and organic ingredients, which makes peppermint oil a preferred choice for manufacturers aiming to meet the demand for clean and functional foods.

According to the International Food Information Council (IFIC), 61% of consumers reported that they prefer products with no artificial ingredients, which has fueled the growth of natural oils like peppermint oil in food products. This trend is expected to continue as both demand for healthier options and consumer awareness of the benefits of natural ingredients rise.

Health and Wellness Trends Supporting Increased Use of Peppermint Oil

Health and wellness trends are a key factor propelling the demand for peppermint oil, particularly in the pharmaceutical and personal care industries. In recent years, consumers have increasingly turned to natural remedies for health issues such as indigestion, headaches, and muscle pain. The use of peppermint oil in essential oils and topical applications has grown due to its perceived benefits in promoting relaxation, aiding digestion, and relieving pain.

According to the National Center for Complementary and Integrative Health (NCCIH), peppermint oil has been found to be an effective treatment for irritable bowel syndrome (IBS) and digestive issues. Additionally, a study published by the U.S. National Library of Medicine found that peppermint oil has analgesic properties that help alleviate tension headaches. The global health and wellness market is projected to reach $4.2 trillion by 2025, according to the Global Wellness Institute, with increasing attention on natural ingredients, including peppermint oil.

As more consumers turn toward natural solutions to improve their well-being, the use of peppermint oil in pharmaceutical and personal care products is likely to continue its upward trajectory. The increasing adoption of peppermint oil as a natural, multifunctional solution for various health concerns highlights its growing importance in health-conscious consumer markets.

Government Support and Sustainability Initiatives for Essential Oils

Government initiatives and sustainability efforts play a crucial role in supporting the growth of the peppermint oil market. In many countries, governments are promoting the use of essential oils and natural products as part of broader sustainability and green economy initiatives. For instance, the U.S. Department of Agriculture (USDA) has established programs that support organic farming and the production of natural ingredients like peppermint oil.

The USDA’s Organic Certification program has seen significant growth, with organic acreage in the United States increasing by 2.1% in 2021, according to the Organic Trade Association. This shift towards organic farming is a key enabler for the peppermint oil market, as consumers increasingly demand organic-certified products for their health benefits and environmental impact. Furthermore, in the European Union, there are strict regulations on the use of pesticides and chemicals in agricultural practices, leading to greater reliance on organic farming and natural ingredients like peppermint oil.

Restraints

Fluctuating Supply and Price Volatility of Raw Materials

According to the Food and Agriculture Organization (FAO), peppermint is a crop that is highly sensitive to environmental conditions, making it vulnerable to climatic changes. In 2022, poor weather conditions, including droughts in key peppermint-producing regions such as the United States and India, led to reduced yields and higher prices. The global supply of peppermint oil can also be affected by issues such as pests, diseases, and labor shortages, which further increase production costs.

In the U.S., the value of peppermint oil production has fluctuated in recent years, reaching a peak of $100 million in 2020 before dropping by approximately 10% in 2021, according to the United States Department of Agriculture (USDA). As a result, manufacturers are faced with rising costs, which can be passed on to consumers in the form of higher prices, limiting the overall market growth for peppermint oil-based products.

Competition from Synthetic Alternatives and Essential Oils

The availability of synthetic peppermint oil and cheaper alternatives also presents a challenge for the natural peppermint oil market. Synthetic or imitation peppermint oils, which are often produced using artificial chemicals or petrochemical derivatives, can be sold at lower prices compared to natural peppermint oil.

According to the U.S. Food and Drug Administration (FDA), synthetic flavors and fragrances are used widely in the food, cosmetics, and pharmaceutical industries due to their cost-effectiveness and consistency. While synthetic peppermint oil may not offer the same therapeutic benefits as natural peppermint oil, it is often seen as a more affordable option by manufacturers. This price difference has led some companies to opt for synthetic peppermint oil or peppermint oil blends, which are cheaper to produce.

Supply Chain Disruptions and Global Trade Barriers

Global supply chain disruptions, including trade barriers and transportation issues, continue to present a major restraint for the peppermint oil market. The COVID-19 pandemic highlighted the vulnerability of global supply chains, leading to delays in raw material procurement, production, and shipping. For instance, in 2021, the U.S. peppermint oil market saw significant shipping delays, which disrupted the timely delivery of peppermint oil to international markets.

According to the World Trade Organization (WTO), global trade volumes declined by 5.3% in 2020 due to the pandemic, and while trade has rebounded, challenges such as port congestion, labor shortages, and rising transportation costs continue to affect global supply chains. These disruptions not only increase costs but also lead to price instability for peppermint oil. Furthermore, trade barriers between countries, such as tariffs on essential oils or agricultural products, can impact the cost and availability of peppermint oil in international markets.

For example, the U.S.-China trade war in 2018-2019 led to the imposition of tariffs on agricultural products, including essential oils, which made peppermint oil more expensive for international buyers. These ongoing logistical and geopolitical challenges can hinder market growth and make it more difficult for manufacturers to maintain consistent supply levels at competitive prices.

Opportunity

Increasing Demand for Natural and Organic Products

A major growth opportunity for the peppermint oil market lies in the growing global demand for natural and organic products, particularly in the food and beverage, cosmetics, and personal care industries. According to the Organic Trade Association (OTA), the U.S. organic food industry alone saw $61.9 billion in sales in 2021, with continued growth expected. This increasing preference for organic and clean-label products is driving the adoption of natural ingredients like peppermint oil.

As consumers become more health-conscious and aware of the negative impacts of synthetic chemicals, there is a clear shift toward natural, plant-based ingredients in a wide range of products, including food, skincare, and household items. Peppermint oil, known for its refreshing aroma, cooling properties, and potential health benefits, is becoming a popular choice for manufacturers seeking to meet this growing demand.

In food products, peppermint oil is used for flavoring in candies, teas, gums, and desserts. In personal care, it is incorporated into shampoos, toothpaste, lotions, and soaps. This trend towards organic and natural products is expected to continue, offering significant growth potential for the peppermint oil market.

Rising Popularity of Essential Oils in Wellness and Aromatherapy

The increasing focus on wellness, particularly the growing popularity of aromatherapy and holistic health practices, represents another key growth opportunity for the peppermint oil market. Essential oils, including peppermint oil, are becoming widely used in the wellness industry for their therapeutic benefits, such as stress relief, improved mental clarity, and physical relaxation.

According to the National Center for Complementary and Integrative Health (NCCIH), the aromatherapy market, a major driver of essential oil demand, has seen a surge in interest in recent years. As of 2020, the global market for aromatherapy is estimated to be worth $2.9 billion, with significant growth projected through 2027. Peppermint oil is one of the most popular essential oils used in aromatherapy for its invigorating and refreshing scent, which is believed to alleviate headaches, enhance mood, and reduce fatigue.

Government Support for Organic Farming and Sustainable Practices

Government support for organic farming and sustainable agriculture practices offers a significant growth opportunity for the peppermint oil market. In many countries, governments are incentivizing the production of organic products through subsidies, certification programs, and research funding.

For example, the U.S. Department of Agriculture (USDA) has supported the organic sector through its Organic Certification program, which saw a 2.1% increase in organic acreage in 2021. This growth in organic farming is crucial for the peppermint oil market, as it ensures a steady and sustainable supply of high-quality, chemical-free peppermint leaves. The USDA reports that organic farming now represents 5.7% of total U.S. agricultural sales, demonstrating the growing market for organic and natural products.

In the European Union, the EU Organic Farming policy has led to a 56% increase in organic farmland since 2000, with a target to reach 25% of all agricultural land under organic farming by 2030. These initiatives not only boost the supply of organic peppermint oil but also promote sustainable agricultural practices, such as reduced pesticide use and water conservation, aligning with the increasing consumer preference for eco-friendly and sustainable products.

Expanding Applications in the Pharmaceutical Industry

According to the National Institutes of Health (NIH), peppermint oil has been recognized for its effectiveness in managing symptoms of irritable bowel syndrome (IBS), a condition affecting approximately 10-15% of the global population. Additionally, peppermint oil is commonly included in topical products for pain relief and muscle relaxation, as well as in inhalers for respiratory health. The increasing focus on plant-based and natural treatments has led to a rise in the demand for peppermint oil in both over-the-counter medicines and prescription formulations.

The global herbal medicine market, which includes peppermint oil-based products, is projected to reach $117.6 billion by 2027, according to the World Health Organization (WHO). As consumers seek alternatives to synthetic pharmaceuticals, the demand for natural remedies like peppermint oil is expected to grow, creating significant opportunities for expansion in the pharmaceutical sector. Furthermore, research into the health benefits of peppermint oil, including its antibacterial and antiviral properties, could open up new avenues for its use in pharmaceutical applications.

Trends

Rising Demand for Clean Label Products and Natural Ingredients

A major trend in the peppermint oil market is the growing demand for clean-label products that are free from artificial additives and preservatives. This trend is particularly evident in the food and beverage industry, where consumers are becoming increasingly health-conscious and are actively seeking natural and organic alternatives. The Clean Label Project, a non-profit organization dedicated to promoting transparency in food labeling, reports that 72% of consumers prefer products that have simple, recognizable ingredients.

In 2021, the U.S. organic food market alone reached $61.9 billion in sales, according to the Organic Trade Association (OTA), highlighting the strong consumer preference for organic and natural ingredients. Peppermint oil, with its distinct flavor and health benefits, fits into this trend perfectly. It is used in a wide range of food products such as candies, chocolates, teas, and confectioneries.

Increasing Adoption of Peppermint Oil in Pharmaceutical Applications

Another key trend driving growth in the peppermint oil market is its increasing adoption in pharmaceutical applications, particularly for digestive health. Peppermint oil has long been known for its therapeutic properties, such as its ability to alleviate symptoms of irritable bowel syndrome (IBS), reduce digestive discomfort, and act as a natural remedy for headaches.

According to the National Institutes of Health (NIH), peppermint oil has been found to be highly effective in treating IBS, which affects approximately 10-15% of the global population. As a result, the demand for peppermint oil-based products in both over-the-counter and prescription formulations is expected to rise.

The health benefits of peppermint oil, including its antimicrobial and anti-inflammatory properties, are also expanding its use in other pharmaceutical applications, such as topical creams for pain relief and respiratory treatments. As consumers increasingly seek natural remedies for various ailments, the pharmaceutical industry’s adoption of peppermint oil-based formulations is poised to grow, further driving the market for this essential oil.

Government Support for Organic Agriculture and Sustainable Practices

Government initiatives supporting organic agriculture and sustainable farming practices are fueling growth in the peppermint oil market. In the United States, the U.S. Department of Agriculture (USDA) has been promoting organic farming through subsidies, research grants, and certification programs. The organic sector in the U.S. has seen consistent growth, with the USDA reporting that organic agricultural land increased by 2.1% in 2021, contributing to the availability of high-quality, organic peppermint oil.

Additionally, the European Union has set ambitious goals to increase the share of organic farmland to 25% by 2030 as part of its Farm to Fork strategy, which aims to make food systems fair, healthy, and environmentally-friendly. This initiative is expected to boost the production of organic peppermint, which aligns with the growing consumer preference for sustainable and eco-friendly products.

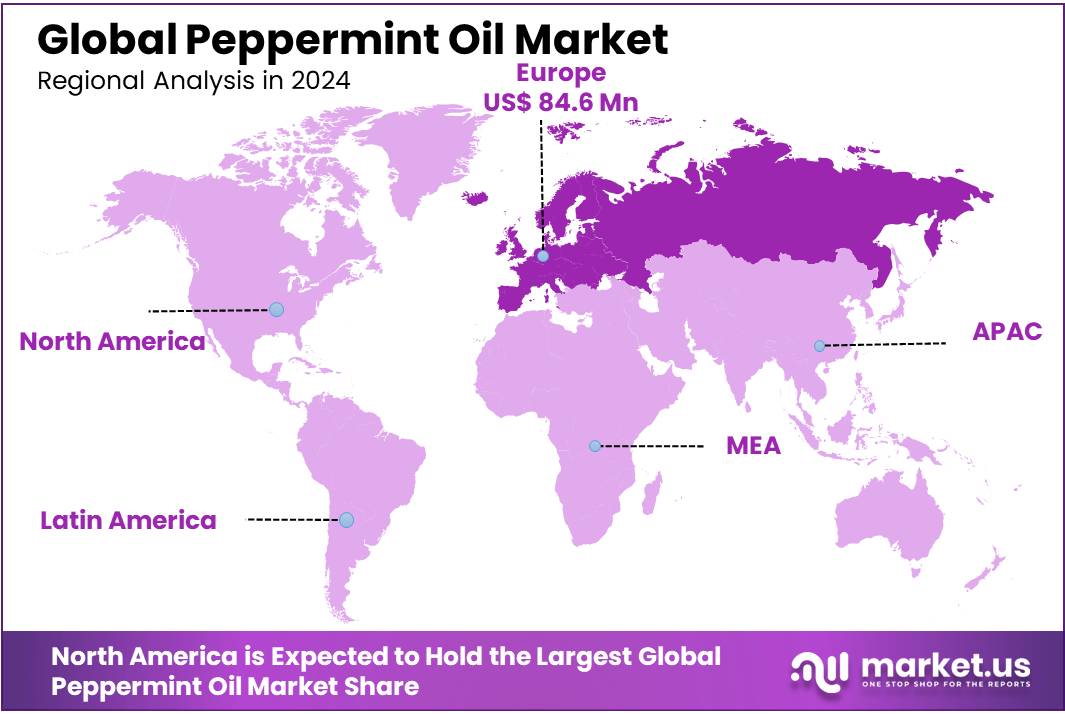

Regional Analysis

In 2023, North America dominated the global peppermint oil market, capturing more than 35.4% of the market share, valued at approximately USD 1.6 billion. This strong market position is driven by the increasing demand for peppermint oil in diverse sectors, including food and beverages, pharmaceuticals, and personal care products.

The United States, in particular, is the largest consumer, fueled by a growing consumer preference for natural ingredients in wellness products, food flavoring, and aromatherapy. According to the Organic Trade Association (OTA), the U.S. organic food industry reached USD 61.9 billion in 2021, further underscoring the growing demand for natural, organic peppermint oil in food and health products.

Europe follows as a significant market for peppermint oil, accounting for around 28.7% of the global share in 2023. The region’s demand is largely driven by its expanding use in the cosmetics and personal care industries. In particular, countries like Germany, France, and the UK have strong manufacturing bases that incorporate peppermint oil into skincare, oral care, and fragrance products. The European Union’s sustainability initiatives and organic farming policies are expected to further support the growth of organic peppermint oil production.

Asia Pacific is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.2% through 2027. The growing adoption of essential oils in wellness and personal care sectors, particularly in China, India, and Japan, is fueling this growth. Latin America and the Middle East & Africa also hold emerging potential, with the Middle East showing increasing demand for peppermint oil in personal care and health products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The peppermint oil market is characterized by the presence of several key players who offer a wide range of peppermint oil products, catering to various industries such as food and beverages, cosmetics, personal care, and pharmaceuticals. Aksuvital, AOS Products Pvt. Ltd., and Aromaaz International are some of the prominent companies that have established themselves as significant suppliers in the market.

These companies focus on providing high-quality essential oils and organic products, leveraging advanced extraction methods to meet the growing demand for natural ingredients. Arora Aromatics Pvt. Ltd., Bhagat Aromatics Limited, and Bio Extracts (Pvt.) Ltd. are also noteworthy players, with extensive product portfolios that include peppermint oil for use in food flavoring, medicinal applications, and aromatherapy.

Leading companies like Biolandes, De Monchy Aromatics, and doTERRA are focusing on sustainable farming practices and sourcing high-quality peppermint from certified organic farms. Essex Laboratories LLC and Foodchem International Corporation are key players supplying peppermint oil primarily for the food and beverage industry, where demand for clean-label and organic ingredients is rising.

Greenleaf Extractions Pvt. Ltd., Hindustan Mint & Agro Products, and IL Health & Beauty Natural Oils Co. Inc. also contribute to the market, providing peppermint oil for use in personal care products such as shampoos, lotions, and oral care items.

Additionally, Young Living Essential Oils LLC, Shaanxi Guanjie Technology Co., and The Lebermuth Company continue to dominate the global market, expanding their reach through international distribution channels and offering innovative peppermint oil-based products.

Synthite Industries Ltd. and Vinayak Ingredients (India) Private Limited play a vital role in ensuring a steady supply of high-quality peppermint oil while maintaining industry standards in production. These players are actively focusing on expansion, sustainability, and meeting the evolving consumer demand for natural and organic peppermint oil products across multiple applications.

Top Key Players in the Market

- Aksuvital

- AOS Products Pvt., Ltd.

- Aromaaz International

- Aromatic and Allied Chemicals.

- Arora Aromatics Pvt. Ltd.

- Bhagat Aromatics Limited

- Bio Extracts (Pvt.) Ltd.

- Biolandes

- De Monchy Aromatics

- do Terra

- Elixarome Limited

- Essex Laboratories LLC

- Foodchem International Corporation

- Green Fields Oil Factory

- Greenleaf Extractions Pvt. Ltd.

- Hindustan Mint & Agro Products

- IL Health & Beauty Natural Oils Co. Inc.

- Lionel Hitchen Essential Oils

- Natures Natural India

- Paras Perfumers

- Shaanxi Guanjie Technology Co.

- Shanti Chemicals

- The Lebermuth Company Synthite Industries Ltd.

- The Lebermuth Company, Inc.

- Vinayak Ingredients (India) Private Limited

- Young Living Essential Oils LLC

Recent Developments

In 2023, Aksuvital’s annual production of peppermint oil reached 500,000 kg, supporting both domestic and international markets.

In 2023, Aromaaz International reported a 15% increase in its overall peppermint oil production compared to the previous year, driven by rising global demand in industries like cosmetics,

Report Scope

Report Features Description Market Value (2023) USD 270.5 Mn Forecast Revenue (2033) USD 527.2 Mn CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Natural), By Form (Absolute/Concentrate, Blends), By Method of Extraction ( Distillation, Carbon Dioxide Extraction, Cold Press Extraction, Solvent Extraction, Others), By Application (Therapeutics, Aromatherapy, Toiletries, Fragrances, Cleaning and Home, Others), By End-use ( Cosmetics and Personal Care, Food and Beverage, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aksuvital, AOS Products Pvt., Ltd., Aromaaz International, Aromatic and Allied Chemicals., Arora Aromatics Pvt. Ltd., Bhagat Aromatics Limited, Bio Extracts (Pvt.) Ltd., Biolandes, De Monchy Aromatics, do Terra, Elixarome Limited, Essex Laboratories LLC, Foodchem International Corporation, Green Fields Oil Factory, Greenleaf Extractions Pvt. Ltd., Hindustan Mint & Agro Products, IL Health & Beauty Natural Oils Co. Inc., Lionel Hitchen Essential Oils, Natures Natural India, Paras Perfumers, Shaanxi Guanjie Technology Co., Shanti Chemicals, The Lebermuth Company Synthite Industries Ltd., The Lebermuth Company, Inc., Vinayak Ingredients (India) Private Limited, Young Living Essential Oils LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aksuvital

- AOS Products Pvt., Ltd.

- Aromaaz International

- Aromatic and Allied Chemicals.

- Arora Aromatics Pvt. Ltd.

- Bhagat Aromatics Limited

- Bio Extracts (Pvt.) Ltd.

- Biolandes

- De Monchy Aromatics

- do Terra

- Elixarome Limited

- Essex Laboratories LLC

- Foodchem International Corporation

- Green Fields Oil Factory

- Greenleaf Extractions Pvt. Ltd.

- Hindustan Mint & Agro Products

- IL Health & Beauty Natural Oils Co. Inc.

- Lionel Hitchen Essential Oils

- Natures Natural India

- Paras Perfumers

- Shaanxi Guanjie Technology Co.

- Shanti Chemicals

- The Lebermuth Company Synthite Industries Ltd.

- The Lebermuth Company, Inc.

- Vinayak Ingredients (India) Private Limited

- Young Living Essential Oils LLC