Global Ruthenium Recycling Market By Purity (99.99%, 99.95% / 99.90%) By Application (Electrical & Electronics, Chemical Catalysis, Electrochemical, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 105202

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

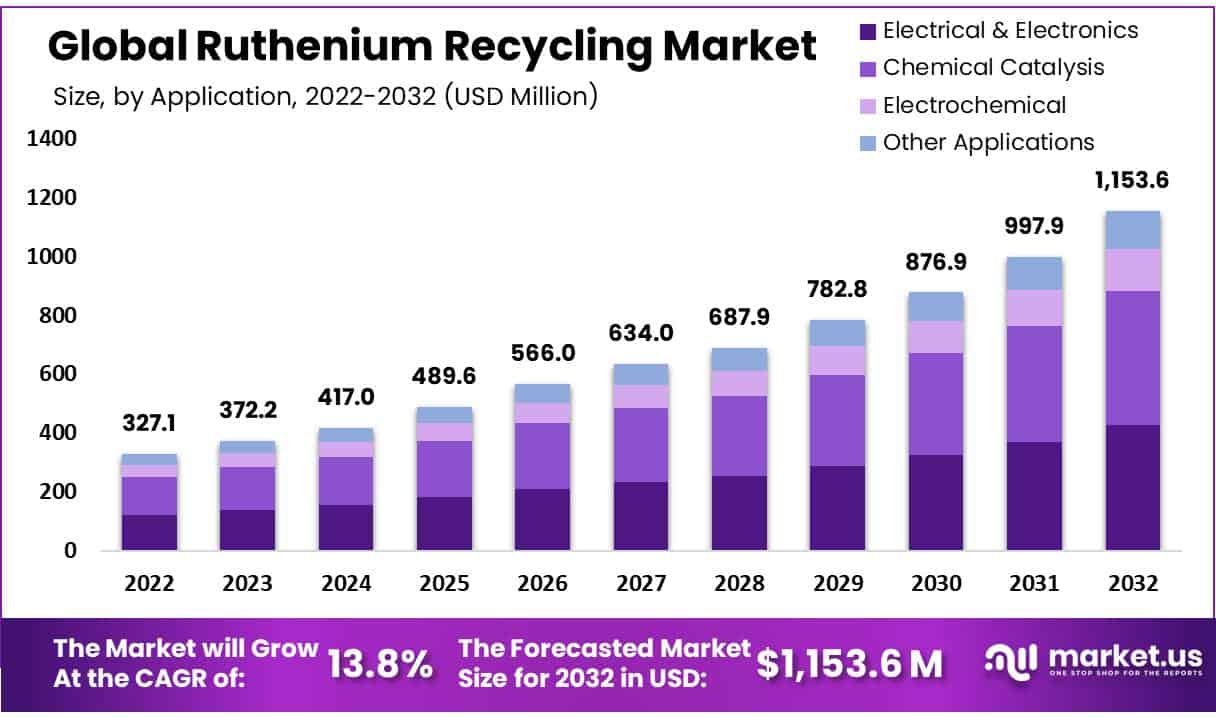

In 2022, the Global Ruthenium Recycling Market was valued at USD 327.1 Million and is expected to reach USD 1,153.6 Million in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 13.8%.

Ruthenium, a rare and shiny metal belonging to the platinum family, has gained prominence due to its exceptional heat resistance properties. The limited availability of ruthenium from conventional mining sources has led to an increased focus on alternative supply strategies. Recycling ruthenium from end-of-life products has emerged as a viable solution to supplement the constrained supply from primary sources.

Businesses increasingly recognize the advantages of recycling ruthenium, particularly in catalyst applications. This trend aligns with eco-friendly practices and presents a lucrative business opportunity for cost reduction, waste reduction, and sustainable growth. As the demand for ruthenium continues to grow, embracing recycling from discarded products becomes a sensible choice.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth: The Ruthenium Recycling Market was valued at USD 327.1 Million in 2022 and is projected to reach USD 1,153.6 Million by 2032, with a notable CAGR of 13.8% between 2023 and 2032.

- Ruthenium’s Unique Properties: Ruthenium, a rare and heat-resistant metal from the platinum family, has gained importance due to its exceptional properties, such as high electrical conductivity and catalytic activity.

- Limited Natural Resources: The market is driven by the limited availability of natural ruthenium resources. As industries like electronics, petrochemicals, and catalysis demand more ruthenium, recycling becomes an efficient alternative.

- Environmental Concerns: Increasing environmental concerns have pushed industries to seek sustainable alternatives, and recycling ruthenium aligns with these efforts by reducing the need for new mining activities and promoting responsible resource management.

- Recycling Challenges: The market faces challenges due to the lack of robust recycling infrastructure designed specifically for ruthenium. Specialized processes and technical expertise are needed for effective recycling, which can be cost-prohibitive.

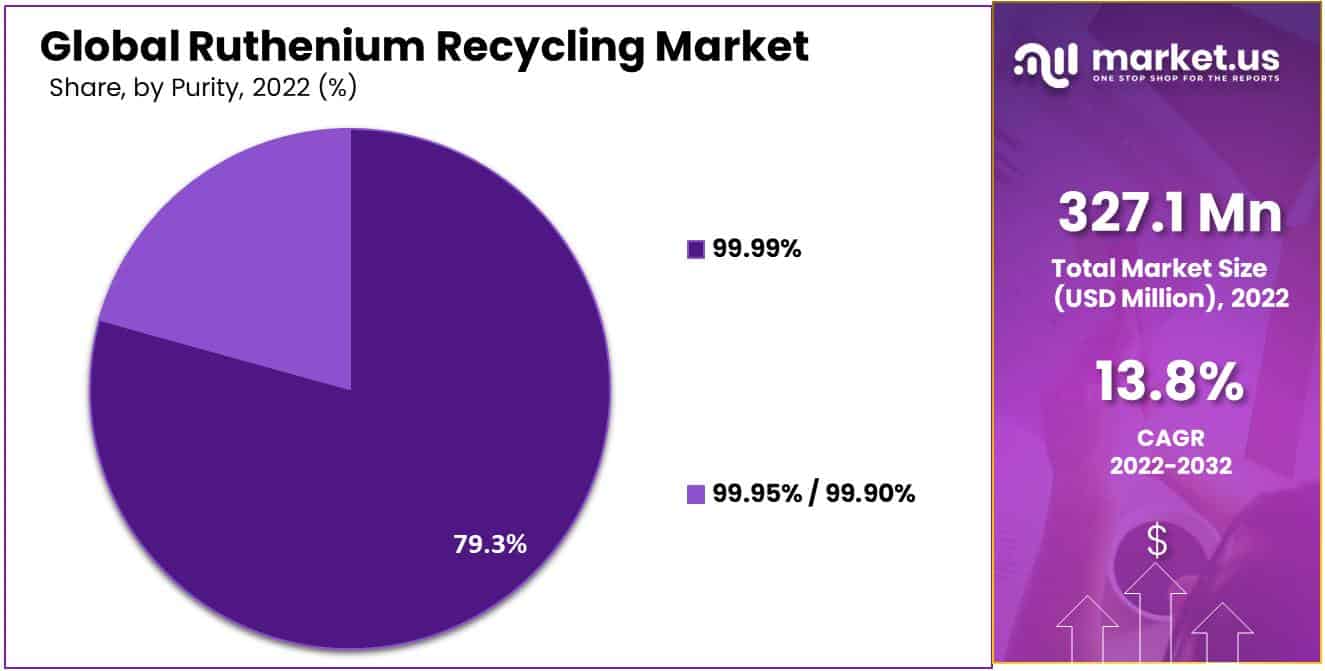

- Purity Segmentation: In 2022, the 99.99% purity segment dominated the market, driven by demand from electronics, catalyst manufacturing, and jewelry industries.

- Application Segmentation: The Chemical Catalysis segment is the dominant application in the Ruthenium Recycling Market, accounting for 39.5% of the market share in 2022. It is projected to grow at a CAGR of 16% from 2023 to 2032.

- Growth Opportunities: Growing environmental concerns and cost-effectiveness provide lucrative opportunities in the Ruthenium Recycling Market, benefiting both recyclers and end-users.

- Latest Trends: Advanced separation and extraction techniques are being adopted to enhance the recovery of ruthenium from various waste streams, minimizing environmental impact.

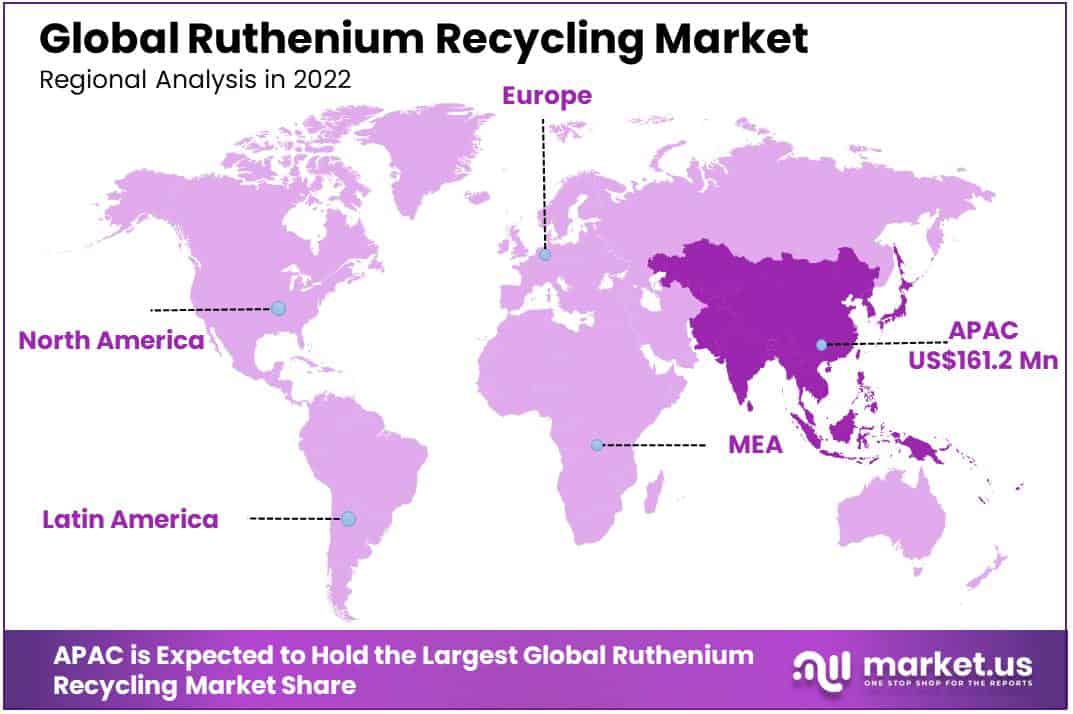

- Regional Dominance: The Asia-Pacific (APAC) region was the most dominant in the Ruthenium Recycling Market, holding a significant share of 49.3% of the total revenue. This dominance is expected to continue, with a projected CAGR of 15.1% during the forecasted period (2023 to 2032).

- Key Market Players: Major players in the market include BASF SE, Heraeus Holding GmbH, Umicore N.V., Johnson Matthey PLC, and others, who are committed to sustainable resource management in the ruthenium recycling industry.

Driving Factors

Rising Demand from Various Industries and Limited Supply Driving the Global Ruthenium Recycling Market.

One of the primary drivers of ruthenium recycling is the limited availability of natural resources. As demand from various industries such as electronics, catalysts, and renewable energy increases, the scarcity of this metal becomes more apparent. Therefore, the need for recycling ruthenium from existing sources becomes more appealing and efficient for the companies operating in this market.

Furthermore, ruthenium is used in various industries, including electronics, petrochemicals, and catalysis. Its unique properties, such as high electrical conductivity and catalytic activity, make it essential for technologies such as electronic components and fuel cells. The growing demand for these applications bolsters the need for a stable and reliable ruthenium supply through recycling.

Additionally, growing concerns over environmental impact have driven industries to seek sustainable alternatives to traditional raw materials. Ruthenium, being a rare and valuable metal, aligns with these concerns. Recycling ruthenium reduces the need for new mining activities, minimizing environmental damage and promoting responsible resource management.

Restraining Factors

The dearth of robust recycling infrastructure designed specifically for ruthenium poses a significant challenge. Unlike more common metals, ruthenium’s unique properties demand specialized processes that are not readily available. The lack of streamlined recycling techniques hinders market growth. Furthermore, Ruthenium’s presence in advanced technological applications necessitates intricate separation and extraction techniques.

As such, recycling ruthenium from complex electronic devices and catalysts requires cutting-edge methods, which can be cost-prohibitive for recycling operations. The high level of technical expertise needed limits the number of facilities capable of engaging in effective ruthenium recycling. In addition, High initial investments required for setting up recycling facilities and uncertainty about the long-term availability of ruthenium-containing waste materials can hinder the expansion of the ruthenium recycling market.

Market Scope

By Purity Analysis

The 99.99% Segment was Dominant in 2022 Due to the Demand for High Purity Ruthenium from Various Industries.

Based on purity, the market for Ruthenium Recycling is segmented into 99.99%, 99.95% / 99.90%. Among these, the 99.99% segment dominated the market with a 79.3% market share of the global market in 2022, and it is estimated to register a CAGR of 14.7% during the projected period.

This dominance is attributed to the demand for high-purity ruthenium from the electronics, catalyst manufacturing, and jewelry industries. High-purity ruthenium ensures optimal performance and quality. The 99.99% purity segment caters to these high-end industrial needs, making it a crucial market driver.

The 99.95% / 99.90% segment holds a 20.7% market share of the global market and is estimated to register a CAGR of 9% during the projected period.

By Application Analysis

The Chemical Catalysis Segment is Dominant in the Market Due to the Wide Use of Ruthenium as a Catalyst in Petrochemicals, Pharmaceuticals, and Fine Chemicals Production

By applications, the market for ruthenium recycling is further divided into electrical & electronics, chemical catalysis, electrochemical, and other applications. Among these, the chemical catalysis segment dominated the market with a market share of 39.5% in 2022 and a projected CAGR of 16% from 2023 to 2032.

This is attributed to the wide use of ruthenium as a catalyst in many industrial processes, including petrochemicals, pharmaceuticals, and fine chemicals production. Its ability to accelerate specific reactions without being consumed in the process contributes to its high demand in the chemical catalysis sector.

Ruthenium catalysts often offer high selectivity, enabling specific products to be obtained from complex reactions. Additionally, they can operate at relatively milder reaction conditions, leading to energy savings and increased process efficiency. These factors contribute to their demand in chemical catalysis applications.

The electrical & electronics segment is the second most dominant segment in the market, with a CAGR of 13.5% during the estimated period and a market share of 36.9% in 2022. The demand for electronic gadgets, appliances, and equipment is continuously increasing, as is the demand for rare metals such as ruthenium. Ruthenium plays a crucial role in the production of integrated circuits, where it contributes to the performance, reliability, and miniaturization of electronic components.

Key Market Segments

Based on Purity

- 99%

- 95% / 99.90%

Based on Application

- Electrical & Electronics

- Chemical Catalysis

- Electrochemical

- Other Applications

Growth Opportunities

Growing Environmental Concerns and Cost Effectiveness Provides Lucrative Opportunities in The Ruthenium Recycling Market

The rising demand for ruthenium and the potential for limited future supply can lead to increased market value for recycled ruthenium, benefiting both recyclers and end-users. As environmental concerns about waste materials continue to rise, more companies are turning towards recyclable materials such as ruthenium, rhodium, palladium, etc. This provides numerous opportunities for businesses looking to capitalize on this emerging industry.

Recovering and reusing ruthenium helps reduce waste associated with mining operations while providing companies access to high-quality recycled materials at a lower cost than mining new materials. Companies can also benefit from reduced environmental impact since fewer resources are required for processing recycled materials compared to those needed for new ones. The recovered material can be reused directly or further processed into other products, such as catalytic converters or electroplating solutions.

Latest Trends

One of the prominent trends in this sector is the adoption of advanced separation and extraction techniques. Innovations in metallurgical processes and refining methodologies have allowed for more efficient recovery of ruthenium from various waste streams, such as spent catalysts, electronic waste, and industrial byproducts. These advancements not only enhance the overall yield of ruthenium but also contribute to reduced environmental impact through minimized waste generation.

Moreover, the global ruthenium recycling market is rapidly growing owing to the increasingly stringent regulations on waste management. Governments across the globe are focusing on reducing carbon footprints, encouraging sustainability, and thus promoting waste recycling and reuse. This has created a demand for efficient recovery technologies that can be used to recycle valuable metals such as ruthenium.

Regional Analysis

APAC is the Dominant Region in the Global Ruthenium Recycling Market

In 2022, APAC was the most dominant region in the market, with a 49.3% share of the total revenue, and it is projected to register a CAGR of 15.1% during the forecasted period. This dominance of the region is attributed to the consistently demonstrated robust industrial growth, driven by its rapidly expanding economies and burgeoning manufacturing sectors.

This has increased demand for ruthenium, a precious metal with diverse industrial applications. Furthermore, the region’s proactive adoption of cutting-edge recycling technologies has facilitated efficient extraction and recovery of ruthenium from various waste streams, bolstering its market share.

Europe holds the second position in the ruthenium recycling market, with a 20.1% market share in 2022 and a projected CAGR of 13.5 from 2023 to 2032. European countries have invested heavily in the research and development of advanced recycling technologies. These technologies enable efficient recovery of ruthenium from various sources, including electronic waste, catalytic converters, and industrial byproducts. This technological advantage has bolstered Europe’s competitive edge in the global ruthenium recycling landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Several key players have emerged in the global ruthenium recycling market, each contributing their expertise to this dynamic market. These companies have demonstrated their commitment to sustainable resource management and are playing a crucial role in shaping the future of ruthenium recycling.

Market Key Players

- BASF SE

- Heraeus Holding GmbH

- Umicore N.V.

- Johnson Matthey PLC

- Dowa Holdings Co. Ltd.

- TANAKA Precious Metals

- Sims Ltd.

- Materion Corp.

- Furuya Metal Co., Ltd.

- Shanxi Kaida Chemical Engineering Co. Ltd

- Colonial Metals, Inc.

- Changshu Changhong Precious Metal Co. Ltd

- Other Key Players

Recent Developments

- In August 2023, the Team at TU Freiberg developed a recycling process for precious metals from electrolyzers, and the team focused on hydrometallurgical recycling methods. This involves transferring the catalyst material into an aqueous solution and recovering it as a salt or metal in a solid form that is as pure as possible.

- In May 2023, Heraeus Precious Metals, a leading supplier of precious metal products and one of the largest recyclers of platinum group metals, is expanding its recycling capacities at its headquarters in Hanau, Germany, with a 35-million-euro investment.

Report Scope

Report Features Description Market Value (2022) USD 327.1 Mn Forecast Revenue (2032) USD 1,153.6 Mn CAGR (2023-2032) 13.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Purity (99.99%, 99.95% / 99.90%) By Application (Electrical & Electronics, Chemical Catalysis, Electrochemical, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape BASF SE, Heraeus Holding GmbH, Umicore N.V., Johnson Matthey PLC, Dowa Holdings Co. Ltd., TANAKA Precious Metals, Sims Ltd., Materion Corp., Furuya Metal Co., Ltd., Shanxi Kaida Chemical Engineering Co. Ltd, Colonial Metals, Inc., Changshu Changhong Precious Metal Co. Ltd, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is ruthenium recycling market?Ruthenium recycling refers to the process of recovering ruthenium, a precious metal, from various sources, such as industrial waste, electronic scrap, and spent catalysts, in order to reuse it for manufacturing and other applications.

What is the future outlook for the ruthenium recycling market?The future of the ruthenium recycling market looks promising as the demand for precious metals increases and industries seek sustainable alternatives to traditional mining and production methods.

How does ruthenium recycling market benefit the environment?Recycling ruthenium reduces the environmental impact of mining and processing raw materials. It also minimizes the release of potentially harmful substances associated with ruthenium extraction.

-

-

- BASF SE

- Heraeus Holding GmbH

- Umicore N.V.

- Johnson Matthey PLC

- Dowa Holdings Co. Ltd.

- TANAKA Precious Metals

- Sims Ltd.

- Materion Corp.

- Furuya Metal Co., Ltd.

- Shanxi Kaida Chemical Engineering Co. Ltd

- Colonial Metals, Inc.

- Changshu Changhong Precious Metal Co. Ltd

- Other Key Players