Global Rum Market By Product Type (Light/Gold Rum, White Rum, Dark Rum, and Spiced Rum) By Nature (Plain and Flavored) By Distribution Channel (On-Trade, Off-Trade, and Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 106518

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

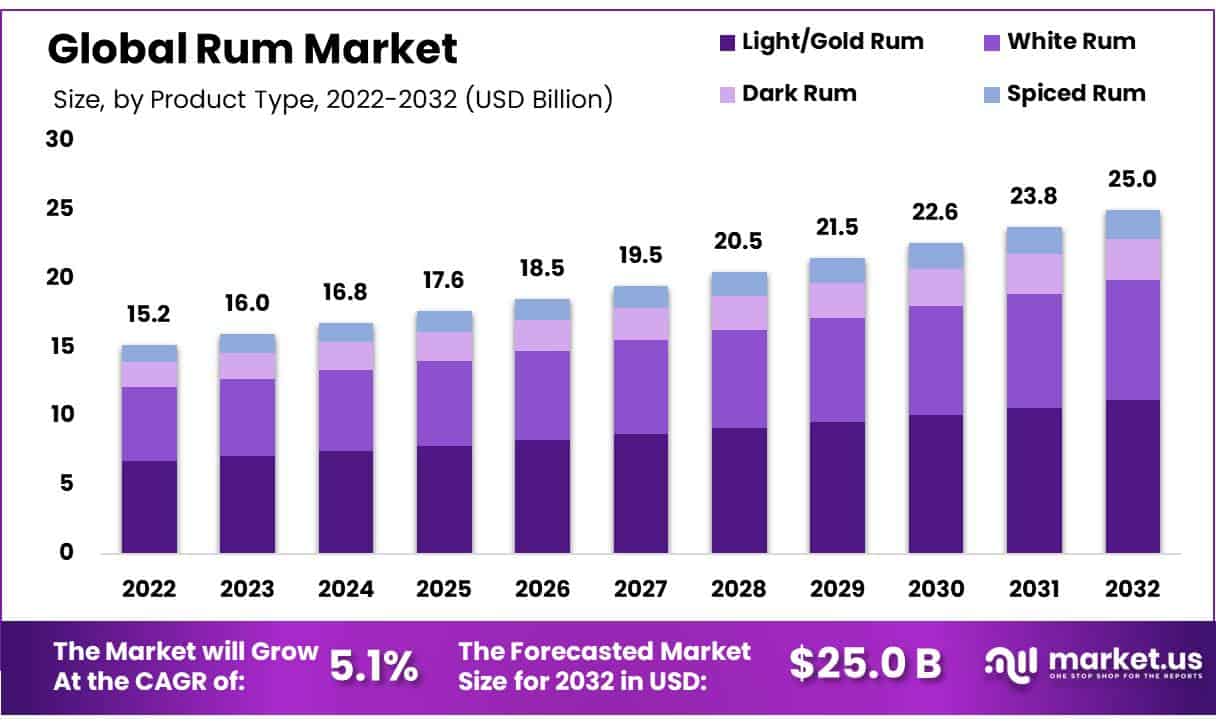

The global Rum market is valued at USD 15.2 Billion in 2022, This market is estimated to reach USD 25.0 Billion in 2032 It is expected to grow at a CAGR of 5.1% between 2023 and 2032.

Rum, a distilled alcoholic beverage made from sugarcane by-products such as molasses or sugarcane juice, has a rich history dating back to the Caribbean in the 17th century. It’s renowned for its diverse flavors, ranging from light and sweet to dark and robust, making it a versatile spirit used in various cocktails and enjoyed neat.

The global rum market is experiencing significant growth, driven by several key factors. Its popularity has surged, with more consumers exploring diverse tastes and cocktails. The global cocktail culture has also increased, with bars and restaurants offering creative rum-based concoctions, further fueling demand.

The Caribbean countries, particularly Jamaica, Puerto Rico, and the Dominican Republic, are among the world’s top rum producers.

Key Takeaways

- The global Rum market is valued at USD 15.2 Billion in 2022.

- By Product Type, the light/gold Rum segment dominates the market with a market share of 6% in 2022.

- By nature, the plain rum segment dominates the market with more than 60% market share in 2022.

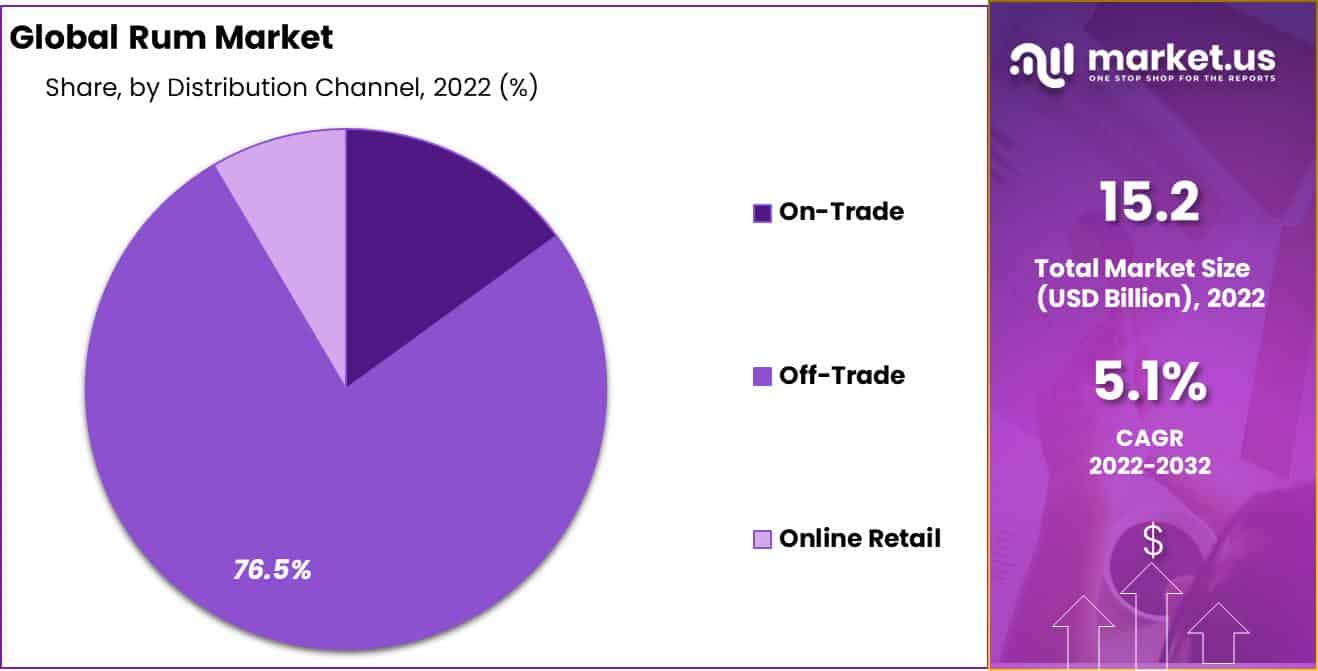

- The distribution Channel off-trade segment led the market in 2022 with a market share of 76.5%.

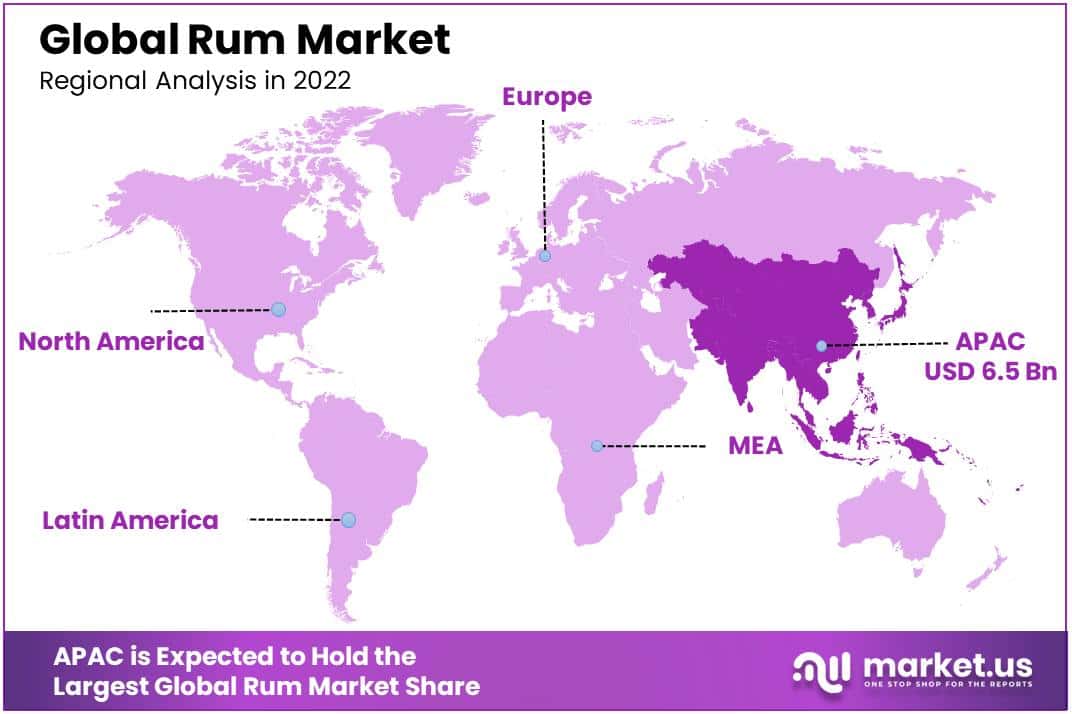

- In 2022, the APAC region will be the dominant region in the global Rum market, with a market share of 42.5% of global revenue.

- With sales of around 21.1 million 9-liter cases in the year 2022, Bacardi was the second-largest rum brand in the world.

- Alcohol intake across Europe is highest at around 15 liters per person annually.

Rum Market Analysis

By Product Type Analysis

Light/Gold Rum Led the Global Market Because of its Versatility and Premium Appeal.

By product type, the Global Rum Market is divided into light/gold Rum, white Rum, dark Rum, and spiced Rum. Among these, the light/gold Rum segment dominates the market with a market share of 44.6% and a projected CAGR of 5.2% during the forecasted period.

This dominance of light/gold rum is attributed to its versatility and appeal to a broad consumer base. Light/gold rum is a popular choice for cocktails, including Mojitos and Piña Coladas, making it a staple in the mixology world.

Additionally, light/gold rum production often involves aging in oak barrels, which imparts a smoother taste and appealing amber color. This aging process contributes to its premium image, and consumers are often willing to pay a higher price for such quality.

Spiced rum is the second most popular segment. It appeals to consumers who prefer a more flavorful and aromatic profile in their cocktails. The infusion of spices and caramelized sugar gives spiced rum a distinctive taste, making it suitable for crafting specialty cocktails like the Spiced Rum Punch and Captain Morgan & Cola.

Nature Analysis

The Plain Rum Segment Dominated the Global Rum Market.

By nature, the rum market is further divided into plain and flavored rum. Among these, the plain rum segment dominates the market with more than 60% market share in 2022. Traditional plain rum holds a timeless appeal, steeped in centuries of history and tradition, making it a trusted choice among consumers.

Moreover, plain rum is a versatile base for cocktails and mixology, giving it a broad consumer base.

The flavored rum segment has rapidly grown, driven by consumer demand for innovative and exciting flavors. Infusions of fruits, spices, and other aromatics have expanded the rum market’s appeal, attracting a younger and more diverse consumer base.

Distribution Channel Analysis

Off-trade dominates the Global Rum Market Due to Convenience and Home Enjoyment.

The global Rum market is further segmented based on distribution channels into on-trade, off-trade, and online retail. The off-trade segment dominates the market, with a more than 76.5% market share in 2022.

Off-trade channels such as liquor stores and supermarkets offer consumers convenience and abundant Rum offerings, encouraging them to explore and purchase for home consumption. COVID-19 was instrumental in this shift as lockdowns and social distancing measures limited on-trade opportunities.

Furthermore, consumers increasingly prefer enjoying rum in their home environments where they can savor and sample different offerings, further strengthening off-trade market shares.

Key Market Segments

Based on Product Type

- Light/Gold Rum

- White Rum

- Dark Rum

- Spiced Rum

Based on Nature

- Plain

- Flavored

Distribution Channel

- On-Trade

- Off-Trade

- Online Retail

Driving Factors

Rising Consumer Preference for Craft and Premium Rum Fuels Global Market Growth

One of the significant drivers in the global rum market is the rising consumer preference for craft and premium rum products. As consumers become more selective in their alcoholic beverage selections, they are willing to explore innovative and high-quality rum offerings.

Craft distilleries are becoming increasingly popular for their small-batch production methods, which emphasize premium ingredients and traditional aging techniques – this trend has created a niche market for premium and artisanal rums, resulting in exponential industry growth.

The global trend towards mixology and craft cocktails has boosted the demand for rum as a key ingredient. Bartenders and consumers are experimenting with innovative rum-based cocktail recipes, such as Mai Tais, Mojitos, and Daiquiris, contributing to increased rum consumption.

Additionally, the versatility of rum, with variations ranging from light to dark and spiced, makes it a favorite choice for crafting a wide range of cocktails, thereby driving sales in the market.

Restraining Factors

Navigating Regulatory Hurdles, Global Competition, and Taxation these are the Challenges in the Rum Industry

The rum industry faces significant challenges due to strict regulations and trade restrictions imposed by various governments. These regulations often relate to rum production, labeling, and distribution.

For instance, some countries have strict rules on the minimum aging period for rum, while others have high import tariffs or quotas, making it difficult for rum producers to access international markets. Additionally, stringent alcohol advertising and marketing regulations further limit the ability of rum brands to promote their products.

The rum market faces stiff competition from other alcoholic beverages like whiskey, vodka, and gin. Consumers have a wide range of options, and this intense competition can limit rum’s market share and growth potential.

In many countries, the production and sale of alcoholic beverages, including rum, are subject to high levels of taxation and stringent regulations. This can significantly increase the cost of production and reduce profit margins for rum producers.

Growth Opportunities

Craftsmanship and Flavor Innovation Presents Lucrative Growth Opportunities The Global Rum Industry

The global rum industry is experiencing a surge in consumer interest in craft and artisanal spirits. This trend shifts consumer preferences towards unique and top-tier offerings, allowing rum producers to stand out by focusing on small-batch, handcrafted production.

By embracing traditional methods and sourcing the best ingredients, distilleries can establish a niche in the hearts and palates of connoisseurs who value authentic craftsmanship and artisanal rum.

The global rum market can also capitalize on flavor innovation and premiumization. Offering diverse flavored rums, including exotic fruit-infused varieties or barrel-aged options, can cater to consumers seeking unique taste experiences.

Premiumization involves creating high-end rum products, often with elaborate packaging and marketing strategies, to command higher prices. By investing in flavor development and marketing efforts, rum producers can tap into the premium spirits segment, attracting consumers seeking indulgent and sophisticated drinking experiences.

Trending Factors

Aged Rum’s Surge as a Premium Spirit and Cocktail Culture is the latest Trend In the Market.

In recent years, aged rum has gained traction as a premium spirit. Discerning consumers are willing to invest in well-aged rums, similar to the appreciation seen in the whisky market.

This trend drives producers to invest in aging facilities and experiment with various cask types for maturation. As consumers develop a taste for the complex and nuanced flavors of aging, there is a growing market for vintage and limited-edition aged rums.

The rise of the cocktail culture has significantly impacted the rum market. Consumers are exploring rum-based cocktails, from classic mojitos and daiquiris to more complex concoctions. This trend drives the demand for versatile rums used in various cocktails, leading to the emergence of mixologist-friendly rum brands.

Furthermore, flavored rum has gained popularity recently, particularly among younger consumers. These products offer various flavors, from tropical fruits to spices, making them versatile for cocktails and mixology. This trend is boosting sales and expanding the consumer base for rum, as it appeals to those who may not have traditionally been rum enthusiasts.

Geopolitics and Recession Impact Analysis

Trade Disputes and Tariffs: The rum market is influenced by ongoing trade disputes and tariffs between major countries, such as the US and China. These tariffs on rum imports affect the prices and availability of rum products, making it difficult for producers to navigate international markets and maintain profitability.

Supply Chain Vulnerabilities: Rum companies in regions like the Caribbean and Central America face potential supply chain disruptions due to geopolitical instability, natural disasters, and government policy changes. To maintain a stable product flow, they must diversify their supply sources and adapt to these risks.

Regulatory Changes and Trade Agreements: The rum industry is highly regulated, and changes in government regulations and international trade agreements can significantly affect market dynamics. The Brexit agreement has altered trade relationships between the UK and Caribbean rum suppliers, affecting market access, import duties, and labeling requirements.

Market Expansion and Emerging Economies: Geopolitical shifts also play a role in expanding the rum market into emerging economies. Growing middle-class populations in countries like India and China have increased demand for premium and exotic spirits, including rum. However, entering these markets requires navigating complex regulatory environments and understanding the geopolitical factors affecting market entry and long-term success.

Regional Analysis

APAC Led The Market with Highest Revenue Share in 2022

APAC is the dominant region in the global Rum market, with a market share of 42.5% of global revenue. The APAC region’s dominance in the global rum market is attributed to its cultural significance in countries like India, Thailand, and the Philippines and its ideal environment for sugarcane cultivation.

The growing middle class and changing consumer tastes have driven demand for premium and craft rums in APAC. Additionally, the vast population of the APAC region, including emerging markets like China and Southeast Asia, provides a substantial consumer base.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global rum market is dominated by Bacardi Limited, Davide Campari-Milano N.V., Demerara Distillers Ltd., Diageo Plc, LT Group, Inc., Nova Scotia Spirit Co., Pernod Ricard SA, Suntory Holdings Ltd, and William Grant & Sons Ltd., Tanduay Distillers, United Spirits, Demerara Distillers, Stock Spirits, and Amrut Distilleries among other key players, creating a dynamic and evolving industry landscape.

Market Key Players

- Bacardi Limited

- Davide Campari-Milano N.V.

- Demerara Distillers Ltd.

- Diageo Plc

- LT Group, Inc.

- Nova Scotia Spirit Co.

- Pernod Ricard SA

- Suntory Holdings Ltd

- William Grant & Sons Ltd

- Tanduay Distillers

- United Spirits

- Demerara Distillers

- Stock Spirits

- Amrut Distilleries

- Brown–Forman

- Other Key Players

Recent Developments

- In March 2023, The Bacardi brand’s first premium spiced aged product, the Bacardi Caribbean Spiced, which is made with pineapple, coconut, vanilla, and cinnamon, was introduced by Bacardi Rum.

- In January 2023, Brown-Forman Corporation acquired the Diplomático Rum brand and related assets from Distillers United Group S.L., entering the growing super-premium+ rum category.

- In January 2023, Diageo agreed to acquire Don Papa Rum, a premium dark rum from the Philippines, for €260 million, with potential considerations of up to €177.5 million through 2028.

Report Scope

Report Features Description Market Value (2022) USD 15.2 Bn Forecast Revenue (2032) USD 25.0 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type (Light/Gold Rum, White Rum, Dark Rum, and Spiced Rum) By Nature (Plain and Flavored) By Distribution Channel (On-Trade, Off-Trade, and Online Retail) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Bacardi Limited, Davide Campari-Milano N.V., Demerara Distillers Ltd., Diageo Plc, LT Group, Inc., Nova Scotia Spirit Co., Pernod Ricard SA, Suntory Holdings Ltd, William Grant & Sons Ltd, Tanduay Distillers, United Spirits, Demerara Distillers, Stock Spirits, and Amrut Distilleries, Brown–Forman, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the market size of Rum Market?The global Rum market is valued at USD 15.2 Billion in 2022, This market is estimated to reach USD 25.0 Billion in 2032 It is expected to grow at a CAGR of 5.1% between 2023 and 2032.

Who are the leading players in the Rum market?- Bacardi Limited

- Davide Campari-Milano N.V.

- Demerara Distillers Ltd.

- Diageo Plc

- LT Group, Inc.

- Nova Scotia Spirit Co.

- Pernod Ricard SA

- Suntory Holdings Ltd

- William Grant & Sons Ltd

- Tanduay Distillers

- United Spirits

- Demerara Distillers

- Stock Spirits

- Amrut Distilleries

- Brown–Forman

- Other Key Players

What is rum, and how is it produced?Rum is a distilled alcoholic beverage made from sugarcane byproducts, such as molasses or sugarcane juice. The production involves fermentation, distillation, and aging in wooden barrels.

-

-

- Bacardi Limited

- Davide Campari-Milano N.V.

- Demerara Distillers Ltd.

- Diageo Plc

- LT Group, Inc.

- Nova Scotia Spirit Co.

- Pernod Ricard SA

- Suntory Holdings Ltd

- William Grant & Sons Ltd

- Tanduay Distillers

- United Spirits

- Demerara Distillers

- Stock Spirits

- Amrut Distilleries

- Brown–Forman

- Other Key Players